Absa Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Absa Group Bundle

Absa Group's strengths lie in its strong brand recognition and diversified product offerings, while its opportunities include expanding digital banking services across Africa. However, the company faces challenges from intense competition and evolving regulatory landscapes, alongside threats from cybersecurity risks.

Want the full story behind Absa Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Absa Group's extensive pan-African footprint, spanning 16 countries, is a significant strength. This broad presence grants them a deep understanding of diverse local markets and creates multiple avenues for revenue generation. For instance, in 2023, Absa's international operations contributed a notable portion to their overall financial performance, showcasing the benefit of this diversified geographical reach.

Absa Group's robust digital transformation is a key strength, evidenced by substantial investments in modernizing its technology and digital channels. This strategic focus has driven a significant increase in digitally active customers, reaching 4.3 million in H1 2024, a 12% rise, and a 14% increase across the Group for the full year 2024.

The Group is actively employing advanced analytics and machine learning to deliver innovative and seamless customer experiences. These efforts have resulted in market-first offerings, such as card replacement at ATMs and the introduction of Chat Wallet via WhatsApp, further solidifying its position in digital banking.

Absa's strength lies in its diversified business model, functioning as a universal bank. This means it offers a wide array of financial services, from everyday banking for individuals to complex corporate and investment banking solutions, alongside wealth management and insurance. This broad spectrum allows Absa to tap into various revenue streams and serve a diverse clientele.

This comprehensive offering proved beneficial in the first half of 2024, with Absa's South African retail portfolio demonstrating robust headline earnings growth. Specifically, segments like Everyday Banking, Product Solutions, and Relationship Banking contributed positively, highlighting the resilience and broad appeal of its core banking services.

Commitment to Sustainability and ESG

Absa Group's commitment to sustainability and Environmental, Social, and Governance (ESG) principles is a significant strength, deeply integrated into its core business strategy. The Group is actively working to be a positive force, showing strong progress in non-financial performance indicators.

A key achievement is surpassing its 2025 sustainable finance target of R100 billion. By the end of 2024, Absa had already mobilized over R121 billion since 2021, channeling these funds into crucial areas like renewable energy, infrastructure development, and social upliftment projects.

- Exceeded Sustainable Finance Target: Mobilized over R121 billion since 2021, surpassing the R100 billion goal set for 2025.

- Focus on Green Initiatives: Funding directed towards renewable energy, sustainable infrastructure, and social development projects.

- Operational Emission Reduction: Actively working to lower its own carbon footprint across its operations.

- Promoting Financial Inclusion: Developing products like eco-home loans and providing sustainable finance solutions for Micro, Small, and Medium Enterprises (MSMEs).

Resilient Financial Performance and Capital Strength

Absa Group demonstrated impressive financial resilience throughout 2024, navigating a difficult economic landscape. The group achieved a notable 10% increase in earnings, largely fueled by a robust second-half performance and enhanced risk mitigation strategies. This financial strength is underscored by a solid balance sheet.

Key indicators highlight Absa's capital robustness. The Common Equity Tier 1 (CET 1) ratio stood at a healthy 12.7% by the end of the first half of 2024 and maintained 12.6% for the full year, comfortably exceeding regulatory mandates. This strong capital base provides a significant buffer against potential economic shocks.

- Resilient Earnings Growth: 10% increase in 2024 earnings despite economic headwinds.

- Strong Capital Ratios: CET 1 ratio of 12.7% (H1 2024) and 12.6% (FY 2024) exceeding regulatory requirements.

- Revenue Milestone: Revenue surpassed R100 billion, reaching R109.9 billion in 2024, a 5% increase year-on-year.

Absa's diversified business model as a universal bank is a core strength, allowing it to serve a wide range of clients with various financial needs. This broad offering, from retail to corporate banking and wealth management, proved beneficial in H1 2024, with its South African retail portfolio showing strong headline earnings growth.

The Group's commitment to sustainability and ESG principles is deeply integrated into its strategy, exceeding its 2025 sustainable finance target by mobilizing over R121 billion since 2021 by the end of 2024. This funding supports vital areas like renewable energy and social upliftment.

Absa demonstrated significant financial resilience in 2024, achieving a 10% increase in earnings and surpassing R100 billion in revenue, reaching R109.9 billion. This is supported by strong capital adequacy, with a CET 1 ratio of 12.6% at year-end 2024, well above regulatory requirements.

| Metric | H1 2024 | FY 2024 |

|---|---|---|

| Digitally Active Customers | 4.3 million (12% rise) | 14% increase across Group |

| Sustainable Finance Mobilized (Since 2021) | - | Over R121 billion |

| Revenue | - | R109.9 billion (5% YoY increase) |

| CET 1 Ratio | 12.7% | 12.6% |

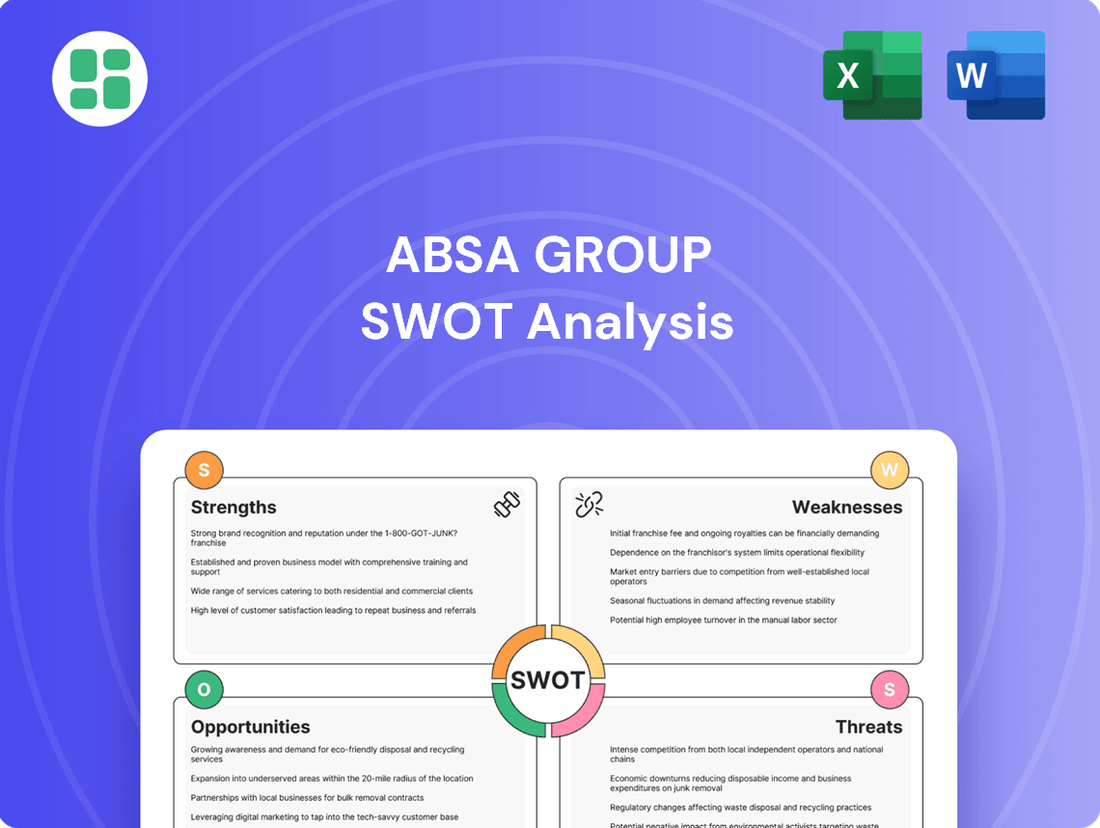

What is included in the product

Delivers a strategic overview of Absa Group’s internal and external business factors, highlighting its strengths in brand recognition and market share alongside weaknesses in digital transformation and opportunities in emerging markets, while also considering threats from fintech disruption and regulatory changes.

Identifies key competitive advantages and potential threats for proactive risk management.

Weaknesses

Absa Group faced a notable 8% surge in operating costs during the first half of 2024. This directly contributed to an uptick in their cost-to-income ratio, climbing to 52.7% from the previous period's 50.6%.

Although the cost-to-income ratio stabilized at 53.2% for the full year 2024, the persistent challenge of managing these escalating expenses continues to weigh on the group's profitability. This necessitates ongoing efforts in efficiency initiatives to preserve a competitive edge.

Absa's headline earnings experienced a 5% dip to R10.2 billion in the first half of 2024, indicating a degree of vulnerability to prevailing economic conditions. While a rebound is expected in the latter half of the year, this initial fluctuation underscores the challenge of maintaining consistent earnings growth.

Despite a projected 10% full-year earnings increase for 2024, the interim decline highlights Absa's exposure to economic headwinds. This variability in headline earnings suggests that the group's profitability can be sensitive to short-term market shifts, necessitating robust risk management strategies.

Absa Group's exposure to volatile African markets presents a significant weakness. For instance, in the first half of 2024, the Absa Regional Operations (ARO) retail and business banking cluster saw its headline earnings decrease, largely due to unfavorable exchange rate movements, even though revenue grew when measured in constant currencies.

Several macroeconomic challenges are contributing to this volatility. Drought conditions in Zambia, sovereign distress in certain nations, increased cash reserve requirements imposed by regulators, and hyperinflationary environments like the one in Ghana are all negatively impacting the performance of Absa's regional banking operations. These conditions create inherent unpredictability and elevate the risk profile for the Group's ambitions of expanding its reach across the African continent.

Elevated Credit Loss Ratio

While Absa Group's credit loss ratio (CLR) showed improvement, settling at 103 basis points for the full year 2024, it still sits just above the Group's desired range of 75 to 100 basis points. This persistent elevation suggests ongoing challenges with credit impairments, particularly impacting the South African retail segment, even with some easing observed in the latter half of 2024.

The banking sector as a whole continues to grapple with elevated levels of non-performing loans, a factor that directly contributes to the higher CLR for institutions like Absa Group.

- Elevated Credit Loss Ratio: The CLR of 103 basis points for FY2024 exceeds the target range of 75-100 basis points.

- Persistent Impairments: This indicates continued pressure from credit impairments, especially in the South African retail portfolio.

- Sector-Wide Concern: High non-performing loans remain a significant concern across the broader banking industry.

Leadership Instability and Succession

Leadership instability has been a notable weakness for Absa Group. The early 2024 retirement of CEO Arrie Rautenbach, for instance, coincided with the bank being the worst-performing stock on the Johannesburg Stock Exchange (JSE) at one point, highlighting the market's reaction to such transitions. This kind of flux can erode investor confidence and hinder the consistent execution of long-term strategies.

Ensuring smooth leadership succession and maintaining a clear strategic vision are critical to mitigating this weakness. The market closely watches how effectively Absa manages these changes to ensure stability and continued progress.

- Leadership Transition Impact: Absa's CEO Arrie Rautenbach retired in early 2024, a move that saw the bank's stock underperform relative to peers on the JSE during certain periods.

- Investor Confidence: Such leadership changes can create uncertainty, potentially impacting investor sentiment and the perceived stability of the group's strategic direction.

- Strategic Continuity: Maintaining consistent strategic execution requires robust succession planning and clear communication to stakeholders during periods of leadership transition.

Absa Group's operating costs saw an 8% increase in the first half of 2024, pushing its cost-to-income ratio to 52.7%, a slight rise from the prior period. While this ratio stabilized for the full year 2024 at 53.2%, managing these rising expenses remains a key challenge for profitability and competitive positioning.

The group's headline earnings dipped 5% to R10.2 billion in the first half of 2024, demonstrating sensitivity to economic conditions. Despite a projected 10% full-year earnings increase for 2024, this interim decline highlights Absa's exposure to economic headwinds and the need for robust risk management.

Exposure to volatile African markets presents a significant weakness, with Absa Regional Operations (ARO) retail and business banking experiencing a headline earnings decrease in H1 2024 due to unfavorable exchange rates. Macroeconomic challenges like drought in Zambia, sovereign distress, and increased cash reserve requirements in various nations further impact regional operations, creating unpredictability.

Absa's credit loss ratio (CLR) for the full year 2024 was 103 basis points, exceeding the target range of 75-100 basis points. This indicates persistent credit impairment challenges, particularly within the South African retail segment, despite some easing in the latter half of 2024.

Leadership instability, exemplified by the early 2024 retirement of CEO Arrie Rautenbach, coincided with periods of underperformance on the JSE. This leadership flux can impact investor confidence and the consistent execution of long-term strategies, underscoring the need for effective succession planning.

What You See Is What You Get

Absa Group SWOT Analysis

You’re viewing a live preview of the actual Absa Group SWOT analysis. The complete, detailed version becomes available after checkout, providing a comprehensive understanding of the company's strategic positioning.

This is the same Absa Group SWOT analysis document included in your download. The full content, covering all strengths, weaknesses, opportunities, and threats, is unlocked after payment.

The file shown below is not a sample—it’s the real Absa Group SWOT analysis you'll download post-purchase, in full detail, ready for your strategic planning needs.

Opportunities

Africa's financial markets are showing robust growth, with Absa's 2024 Africa Financial Markets Index revealing that 23 out of 29 surveyed countries improved their scores. This expansion, fueled by economic recovery and enhanced market infrastructure, creates a prime environment for Absa to strengthen its presence and capitalize on emerging opportunities across the continent.

The positive trajectory in market development across Africa, highlighted by the index, offers Absa a significant chance to deepen its penetration and expand its franchise. This is particularly true in regions demonstrating strong economic momentum and where market infrastructure is rapidly maturing, presenting attractive avenues for growth.

The expanding e-commerce landscape and widespread digital transformation offer Absa significant opportunities. By leveraging its investments in AI and payment platforms, the bank can deepen customer engagement and streamline operations, capitalizing on this digital shift.

Absa's commitment to digital innovation, exemplified by projects like Chat Wallet, positions it to capture a larger share of the growing digital economy. This focus on enhancing customer experience through technology is crucial for future growth and market competitiveness.

The accelerating global and local emphasis on climate change and sustainable development presents a prime opportunity for Absa to expand its green finance offerings and innovative sustainable financing solutions. This focus is driving demand for environmentally conscious financial products, directly aligning with Absa's strategic direction.

Absa has already demonstrated its commitment by surpassing its sustainable finance targets, a feat that positions it favorably to attract substantial impact investments. This leadership allows for the development and promotion of new eco-friendly products, such as the Eco-Home Loan, which directly caters to this growing market segment.

Untapped Market Segments and Financial Inclusion

The banking sector's increased attention on micro and township businesses, alongside a broader push for financial inclusion, presents a significant opportunity. Absa's proactive stance, demonstrated by its disbursement of KES 47 billion in sustainable finance to MSMEs and women- and youth-led enterprises, strategically positions the group to capture growth in these previously underserved markets.

Expanding financial services through innovative digital platforms and customized product offerings is a critical avenue for growth. This approach allows Absa to reach a wider customer base and deepen engagement.

- Growing focus on servicing micro and township businesses.

- Absa's KES 47 billion sustainable finance disbursement to MSMEs and women/youth-led enterprises.

- Digital and tailored financial propositions as key growth drivers.

Strategic Partnerships and Collaborations

Absa Group is actively cultivating strategic partnerships to bolster its digital capabilities and sustainability initiatives. For instance, the extension of its contract with LTIMindtree aims to deepen the integration of digitally powered financial solutions, enhancing customer experience and operational efficiency. This focus on digital transformation is critical in the evolving financial landscape, where technology adoption directly impacts market competitiveness.

Collaborations with entities like the African Development Bank underscore Absa's commitment to sustainable development, particularly in African economies. These partnerships are designed to channel investment and introduce innovative practices, fostering resilience and growth across the continent. Such alliances are instrumental in expanding Absa's footprint and diversifying its service portfolio, creating new avenues for revenue and impact.

- Digital Enhancement: Extended partnership with LTIMindtree to advance digitally powered financial solutions.

- Sustainability Focus: Collaboration with the African Development Bank for impactful sustainability projects.

- Innovation & Reach: Partnerships provide access to new technologies, practices, and funding, expanding market reach and diversifying offerings.

Absa is well-positioned to leverage the burgeoning growth across African financial markets, as evidenced by the 2024 Africa Financial Markets Index where 23 out of 29 surveyed countries showed improvement. This expansion, coupled with the increasing demand for green finance solutions, presents a significant opportunity for Absa to deepen its market penetration and introduce innovative, eco-friendly products like its Eco-Home Loan. Furthermore, the bank's strategic focus on digital transformation and financial inclusion, including its KES 47 billion sustainable finance disbursement to MSMEs and youth/women-led enterprises, allows it to capture growth in underserved markets and enhance customer engagement.

| Opportunity Area | Key Initiative/Data Point | Impact |

|---|---|---|

| African Market Growth | 23/29 countries improved scores in 2024 Africa Financial Markets Index | Strengthened presence and capitalization on emerging opportunities |

| Green Finance | Surpassed sustainable finance targets; Eco-Home Loan | Attract impact investments, cater to growing eco-conscious market |

| Financial Inclusion | KES 47 billion sustainable finance to MSMEs, women/youth-led enterprises | Capture growth in underserved markets, deepen customer engagement |

| Digital Transformation | Extended LTIMindtree partnership for digital solutions | Enhance customer experience and operational efficiency |

Threats

Absa Group faces significant threats from intense competition within South Africa's banking sector. Major players like Standard Bank, FNB, and Nedbank continue to vie for market share, while the burgeoning fintech and digital banking landscape presents a disruptive challenge, forcing Absa to constantly innovate to maintain customer loyalty and attract new clients.

The rapid growth of fintechs, offering specialized services and often lower fees, directly challenges Absa's traditional revenue streams. For instance, the South African digital banking market saw a substantial increase in user adoption throughout 2023 and early 2024, with many customers migrating to more agile, app-based banking solutions, putting pressure on Absa's pricing strategies and profitability.

Absa Group, like all financial institutions, faces a significant and escalating threat from cyber-attacks and fraud. The digital landscape is increasingly targeted by sophisticated actors, and Absa itself has reported a substantial 400% surge in attempted cyber-attacks over a two-year period.

Economic pressures and the continuous evolution of cybercrime methodologies are fueling a rise in fraud and financial crime. This necessitates ongoing, substantial investments in advanced cybersecurity infrastructure and maintaining a high level of operational vigilance to safeguard customer data and financial assets.

Challenging macroeconomic conditions continue to pressure Absa Group, especially within its primary market of South Africa. Persistent inflation, coupled with elevated interest rates, is squeezing household disposable income. For instance, South Africa's headline inflation remained above the South African Reserve Bank's target range for much of 2024, impacting consumer spending power.

Further exacerbating these pressures are risks like currency volatility and rising global commodity prices, particularly oil and food. A weaker rand can increase import costs, feeding into inflation and further eroding consumer purchasing power. This environment directly translates to a higher likelihood of credit defaults and a dampened demand for banking products and services.

Evolving Regulatory Landscape and Compliance Costs

Absa Group, like other financial institutions, navigates a complex web of regulations across its operating regions, with heightened focus on cybersecurity, artificial intelligence, fraud prevention, and consumer protection. The introduction of revised market risk frameworks from July 2025, alongside potentially increased regulatory reserving requirements in certain African markets, signals a growing burden of compliance. These evolving demands necessitate significant investment in systems and expertise, directly impacting operational costs and requiring agile adjustments to business practices.

The financial sector's increasing digitization and the integration of new technologies like AI amplify the complexity of regulatory compliance. Institutions must invest heavily in robust data governance, cybersecurity measures, and ethical AI frameworks to meet stringent requirements. For Absa Group, this translates to ongoing expenditure on technology upgrades, specialized personnel, and continuous training to ensure adherence to evolving global and local standards, potentially impacting profitability if not managed efficiently.

Key areas of regulatory evolution impacting Absa Group include:

- Cybersecurity and Data Privacy: Stricter data protection laws (e.g., GDPR-like regulations emerging globally) require substantial investment in security infrastructure and compliance protocols.

- AI Governance: Emerging regulations around the ethical use and risk management of AI in financial services will necessitate new compliance frameworks and oversight mechanisms.

- Market Risk and Capital Requirements: The implementation of revised market risk frameworks from July 2025 will likely lead to adjustments in capital allocation and risk management strategies.

- Consumer Protection: Enhanced regulations aimed at safeguarding consumers from financial crime and unfair practices demand robust internal controls and transparent reporting.

Sovereign Debt Challenges and Political Instability in African Regions

Sovereign debt challenges and political instability in certain African Regional Operations (ARO) markets pose a significant threat to Absa Group's economic stability and can disrupt its business operations. For instance, by the end of 2023, several African nations faced escalating debt burdens, with some countries’ debt-to-GDP ratios exceeding 70%, impacting their fiscal flexibility and increasing the likelihood of austerity measures.

Rising government debt can trigger austerity measures, leading to higher unemployment and reduced disposable incomes for households. This economic pressure directly translates into increased credit risks for Absa Group, as individuals and businesses may struggle to meet their financial obligations. The International Monetary Fund (IMF) has highlighted a growing number of African countries at high risk of or already in debt distress, underscoring the systemic nature of this threat.

Geopolitical risks remain elevated across various African regions, further exacerbating sovereign debt challenges. These risks can manifest as social unrest, policy uncertainty, and potential capital flight, all of which negatively impact the operating environment for financial institutions like Absa. For example, recent political transitions in some ARO markets have introduced periods of uncertainty regarding economic policy and regulatory frameworks, directly affecting investor confidence and business continuity.

- Escalating Debt Levels: Several African nations are grappling with high debt-to-GDP ratios, with some surpassing 70% by late 2023, limiting fiscal maneuverability.

- Impact on Credit Risk: Austerity measures driven by debt can worsen unemployment and reduce household incomes, increasing the likelihood of loan defaults for Absa.

- Geopolitical Volatility: Elevated geopolitical risks, including social unrest and policy uncertainty in ARO markets, create an unstable operating environment.

Intensifying competition from agile fintechs and digital banks poses a significant threat, as seen in the 2023-2024 surge in digital banking adoption in South Africa, pressuring Absa's pricing and profitability.

Absa faces escalating cybersecurity threats, evidenced by a reported 400% increase in attempted cyber-attacks over a two-year period, demanding continuous investment in advanced defenses.

Challenging macroeconomic conditions, including persistent inflation and high interest rates in South Africa throughout 2024, reduce consumer spending power and increase credit default risks.

Evolving regulations, particularly around cybersecurity, AI governance, and market risk frameworks effective from July 2025, necessitate substantial compliance investments, impacting operational costs.

SWOT Analysis Data Sources

This Absa Group SWOT analysis is built upon a robust foundation of publicly available financial statements, comprehensive market research reports, and expert industry commentary. These sources provide a well-rounded perspective on the company's internal capabilities and the external environment it operates within.