Absa Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Absa Group Bundle

Absa Group navigates a dynamic financial landscape, facing intense rivalry from established banks and agile fintech disruptors. The bargaining power of buyers, particularly large corporate clients, and the constant threat of new entrants keen to capture market share are significant forces. Understanding these pressures is crucial for strategic planning.

The complete report reveals the real forces shaping Absa Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of key technology providers, like core banking system vendors, presents a significant factor in Absa Group's supplier power. With a limited number of dominant suppliers for critical IT infrastructure, their bargaining leverage rises, potentially driving up costs or dictating less favorable contract terms for Absa. For instance, in 2024, the global IT services market, which includes these critical vendors, was projected to reach over $1.3 trillion, indicating substantial market value and potential for supplier consolidation.

The bargaining power of suppliers for Absa Group is significantly shaped by the availability of alternative providers for critical services. For instance, the number of reliable payment processing networks or specialized financial software vendors directly impacts Absa's ability to negotiate terms. A scarcity of options empowers existing suppliers, whereas a broader selection bolsters Absa's leverage.

Absa's ongoing digital transformation, which includes substantial investments in cloud solutions and cybersecurity, underscores the importance of these supplier relationships. In 2024, the financial sector continued to see consolidation among key technology providers, potentially increasing the bargaining power of remaining suppliers for specialized cloud infrastructure and advanced cybersecurity platforms, crucial for Absa's operational resilience and innovation.

The bargaining power of suppliers for Absa Group is significantly influenced by switching costs, especially concerning deeply integrated systems like core banking platforms. These high costs, encompassing financial expenditure, time investment, and potential operational disruptions, make it challenging for Absa to easily change providers, thereby strengthening supplier leverage. For instance, the cost of migrating a core banking system can run into tens or even hundreds of millions of dollars, depending on the complexity and scale of the operation.

Supplier Power 4

The bargaining power of suppliers for Absa Group is influenced by the specialized nature of financial technology and data analytics. When Absa relies on niche providers for unique or proprietary technologies, these suppliers gain leverage. This is particularly true if there are few readily available alternatives for such specialized services.

Absa's strategic focus on advanced machine learning and data analytics underscores its dependence on suppliers who offer these sophisticated capabilities. For instance, the increasing adoption of AI in financial services means that providers of cutting-edge AI platforms or specialized data sets can command higher prices or more favorable terms. In 2024, the demand for advanced analytics tools in the banking sector saw significant growth, with many institutions investing heavily in AI-driven solutions to enhance customer experience and operational efficiency.

- Niche Technology Dependence: Absa's reliance on specialized financial technology, such as proprietary trading platforms or unique data analytics software, can empower certain suppliers.

- Proprietary Expertise: Suppliers possessing unique intellectual property or specialized expertise in areas like cybersecurity or advanced fraud detection hold considerable bargaining power.

- Limited Substitutes: The absence of readily available, comparable alternatives for critical technological components or data services strengthens supplier leverage.

- AI and Data Analytics Reliance: Absa's investment in AI and big data analytics means suppliers of these advanced solutions, particularly those with unique algorithms or extensive data sets, have increased influence.

Supplier Power 5

The bargaining power of suppliers for Absa Group is influenced by the availability of specialized talent. In fields like cybersecurity, artificial intelligence, and data science, a limited pool of skilled professionals or a few dominant recruitment agencies can significantly increase labor costs. This human capital becomes a powerful supplier, dictating higher salaries and recruitment fees, impacting Absa's operational expenses.

Absa Group recognizes this dynamic and has proactively invested in its workforce. By training thousands of employees in cutting-edge technologies such as Generative AI and cloud computing, Absa aims to reduce its reliance on external specialized talent. This internal development strategy directly addresses the potential for high supplier power from human capital providers.

- Talent Scarcity: Limited availability of AI and cybersecurity experts.

- Recruitment Agency Dominance: A few agencies controlling specialized talent acquisition.

- Cost Impact: Increased recruitment costs and salary demands for critical skills.

- Absa's Strategy: Investing in internal GenAI and cloud training for thousands of employees.

The bargaining power of suppliers for Absa Group is significantly influenced by the concentration of key technology providers, especially for critical systems like core banking. Limited options for these essential services empower suppliers, potentially leading to higher costs for Absa. For instance, the global IT services market, a key area for these vendors, was projected to exceed $1.3 trillion in 2024, highlighting the substantial market value and potential for supplier leverage.

Absa's reliance on specialized financial technology and data analytics also bolsters supplier power, particularly when few alternatives exist for unique or proprietary solutions. The increasing demand for AI in financial services in 2024 meant that providers of advanced AI platforms and specialized data sets could command premium pricing, impacting Absa's investment in innovation and customer experience enhancement.

| Factor | Impact on Absa's Supplier Power | Example/Data Point (2024) |

| Concentration of Tech Providers | High | Global IT services market projected over $1.3 trillion |

| Availability of Alternatives | Low for specialized tech | Limited providers for niche AI/data analytics solutions |

| Switching Costs | High | Core banking system migration can cost tens to hundreds of millions of dollars |

| Specialized Talent Scarcity | High | Increased recruitment costs for AI and cybersecurity experts |

What is included in the product

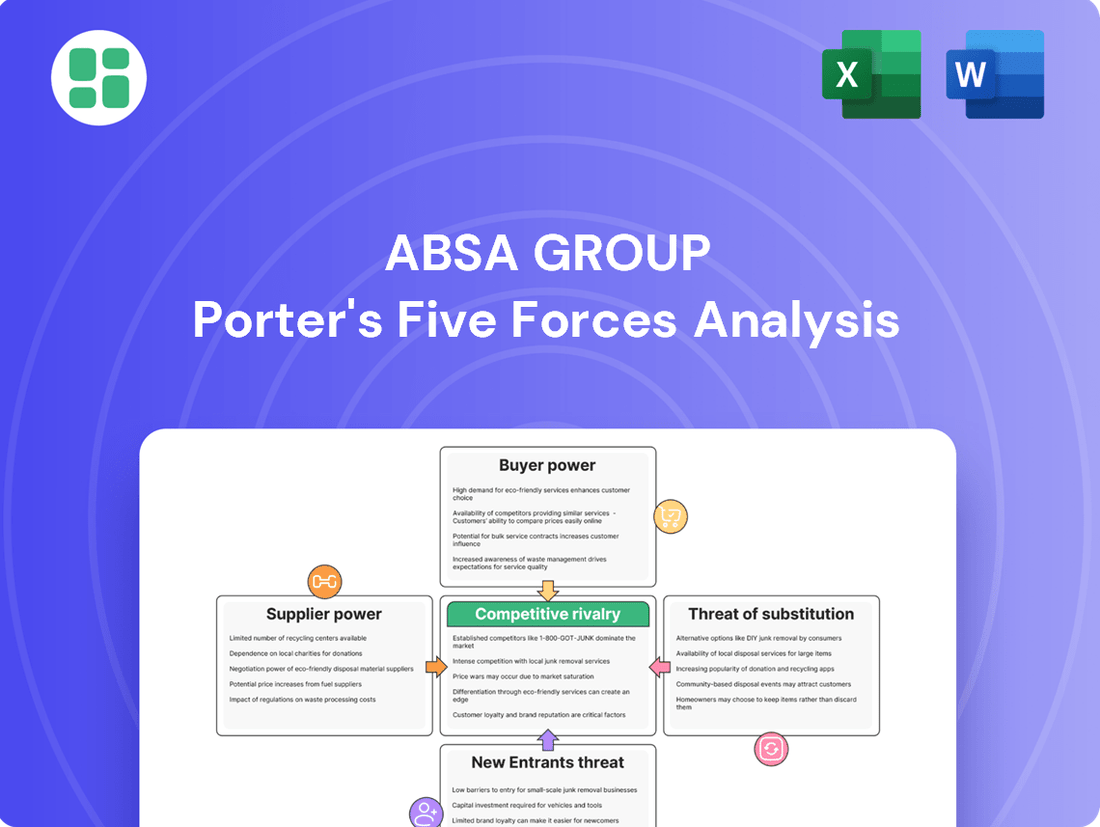

Provides a comprehensive examination of the competitive forces impacting Absa Group, including the threat of new entrants, bargaining power of buyers and suppliers, threat of substitutes, and the intensity of rivalry within the banking sector.

Understand the competitive landscape of Absa Group's banking sector with a visual representation of each force, simplifying complex market dynamics.

Customers Bargaining Power

The bargaining power of customers for Absa Group is significantly influenced by low switching costs across many retail banking products. For instance, opening a new current or savings account is relatively straightforward, allowing customers to readily shift their business to a competitor offering better rates or service. This dynamic compels Absa to remain highly competitive to retain its customer base.

The increasing prevalence of digital banking and the emergence of neobanks in South Africa further amplify customer power by reducing friction in account switching. In 2024, the South African banking sector saw continued growth in digital adoption, with a significant portion of new account openings occurring through online channels, making it easier than ever for consumers to compare and move between providers.

The increasing transparency of product pricing and features, fueled by digital comparison platforms and financial aggregators, significantly enhances customer bargaining power. This allows customers to easily compare offerings from Absa Group and its competitors, forcing the bank to offer more competitive rates and services. For instance, in 2024, the growth of fintech comparison sites in South Africa, like CompareGuru and Hippo.co.za, has made it simpler for consumers to find the best deals on banking products, directly impacting Absa's pricing strategies.

Absa Group faces significant bargaining power from its customers due to the highly competitive South African and broader African financial services landscape. With numerous traditional banks, emerging digital banks, and innovative fintech companies vying for market share, customers have a wealth of alternatives. This readily available choice empowers them to switch providers if they find better terms, services, or pricing, directly impacting Absa's ability to dictate terms.

Customer Power 4

Customers, particularly large corporate and institutional clients, wield considerable bargaining power over Absa Group. Their increasing financial literacy and the presence of dedicated treasury departments, often supported by sophisticated financial advisors, allow them to demand and negotiate highly customized banking products and services. This sophistication, coupled with their significant revenue contributions, amplifies their ability to influence terms.

Absa's Corporate and Investment Banking (CIB) division, a key growth area, directly engages with these powerful clients. While this segment is crucial for revenue, it inherently comes with elevated customer expectations and a greater capacity for clients to leverage their market position. For instance, in 2024, Absa's CIB segment continued to be a significant driver of group revenue, but the intense competition and the concentrated nature of these client relationships mean that Absa must remain highly responsive to their evolving needs and pricing sensitivities.

- Sophisticated Clients: Corporate and institutional clients possess advanced financial knowledge and often employ treasury departments and external advisors.

- Customization Demands: These clients expect tailored financial solutions and are adept at negotiating customized product features and service level agreements.

- Revenue Significance: Large clients represent substantial revenue streams, giving them leverage in negotiations.

- CIB Segment Focus: Absa's Corporate and Investment Banking unit, while a growth engine, deals with clients who have high expectations and a strong negotiating stance.

Customer Power 5

Customer sensitivity to interest rates, fees, and service quality significantly influences Absa Group's competitive landscape. In 2024, with inflation remaining a concern, customers are more attuned to the cost of financial services. This heightened awareness amplifies their bargaining power, compelling Absa to maintain competitive pricing and superior service delivery to retain its customer base.

Absa's strategic shift, emphasizing sustainable growth over aggressive market share acquisition, suggests a recognition of this customer power. By focusing on delivering value and enhancing customer retention, the group aims to mitigate the impact of price sensitivity. For instance, in early 2024, Absa reported a notable increase in customer satisfaction scores, indicating positive movement in service quality perception.

- Customer Price Sensitivity: High sensitivity to interest rates and fees can lead to significant customer churn if competitors offer better terms.

- Service Quality Impact: In a competitive banking environment, superior service quality becomes a key differentiator, reducing customer willingness to switch based solely on price.

- Retention Focus: Absa's strategy prioritizes retaining existing customers by offering value, which directly counters the bargaining power derived from price competition.

- Market Dynamics: The broader economic climate in 2024, characterized by fluctuating interest rates, directly amplifies customer focus on cost-effectiveness.

The bargaining power of Absa Group's customers is considerable, driven by low switching costs in retail banking and the increasing ease of comparing financial products online. This is further amplified by a competitive market, especially in South Africa, where numerous traditional banks, digital-only banks, and fintech firms offer alternatives. Sophisticated corporate clients also exert significant influence, demanding tailored solutions and leveraging their substantial revenue contributions.

In 2024, the digital transformation of banking continued to empower consumers, with a growing percentage of new accounts opened via online channels, simplifying the process of switching providers. This accessibility, coupled with the proliferation of financial comparison platforms, forces Absa to remain competitive on pricing and service quality to retain its customer base.

Absa's Corporate and Investment Banking (CIB) division, a key revenue driver, directly engages with these powerful clients. While crucial for growth, these relationships necessitate a keen responsiveness to client needs and pricing sensitivities, as demonstrated by the continued intense competition within this segment throughout 2024.

| Factor | Impact on Absa Group | 2024 Context |

|---|---|---|

| Switching Costs | Low for retail products, increasing customer power. | Digital account opening processes further reduced friction. |

| Competition | High from traditional, digital, and fintech players. | Continued market expansion by neobanks and fintechs. |

| Customer Sophistication | High for corporate clients, demanding customization. | Increased use of treasury departments and financial advisors by clients. |

| Price Sensitivity | Significant, especially with inflation concerns. | Customers more focused on interest rates and fees in 2024. |

Preview Before You Purchase

Absa Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of Absa Group, detailing the competitive landscape and strategic implications for the financial services sector. The document you see here is the exact, fully formatted analysis you will receive immediately after purchase, offering actionable insights without any surprises.

Rivalry Among Competitors

The South African banking sector is mature and highly concentrated, with Absa Group facing intense rivalry from its 'big four' peers: Standard Bank, FNB, and Nedbank. This dominance by a few large players means competition for market share is fierce.

Despite the market's maturity, growth is actively pursued through aggressive pricing strategies and continuous product innovation. For instance, in 2024, the South African banking sector saw continued efforts in digital transformation and customer acquisition, with banks like Absa investing heavily in their digital platforms to attract and retain customers amidst this competitive landscape.

The competitive landscape for Absa Group is becoming increasingly dynamic, largely due to the rise of nimble digital banks and innovative fintech firms. These new players are shaking things up by introducing fresh business models and unique customer experiences, often targeting specific market niches or providing exceptionally convenient, digitally-driven services. This trend is compelling Absa to speed up its own digital transformation and innovation initiatives to stay competitive.

For instance, in South Africa, digital banks like TymeBank and Discovery Bank have significantly ramped up competition. TymeBank, which launched its fully digital offering in 2019, had already acquired over 2 million customers by early 2023, demonstrating the rapid adoption of digital-first banking. Discovery Bank, another key player, reported a 70% year-on-year increase in its customer base in 2023, reaching over 1 million clients, highlighting the growing demand for digitally integrated financial services and the pressure this puts on traditional institutions like Absa to adapt and innovate.

Competitive rivalry within the banking sector, particularly for a group like Absa, is intense, with product and service differentiation serving as a crucial battleground. Banks are continuously innovating to present distinct value propositions, ranging from highly personalized digital interactions and sophisticated wealth management platforms to bespoke solutions for businesses. This focus on differentiation is vital for reducing direct price wars and fostering customer loyalty.

Absa Group, for instance, is actively investing in enhancing user experiences and championing digital innovation. In 2023, Absa reported a significant increase in digital customer engagement, with over 70% of its retail transactions conducted through digital channels, underscoring the importance of these efforts in a competitive landscape.

Competitive Rivalry 4

Absa Group operates in a sector characterized by high fixed costs, particularly in maintaining its extensive banking infrastructure, advanced technology, and stringent regulatory compliance. This necessitates a constant drive for economies of scale, pushing banks to aggressively compete for market share to maximize revenue and cover these substantial overheads. For instance, in 2023, Absa’s operating expenses were R40.4 billion, highlighting the significant fixed cost base.

This environment fosters intense rivalry as institutions vie for customer acquisition and retention. Banks like Absa must continually innovate and offer competitive pricing and services to attract and keep clients, thereby spreading their fixed costs over a larger operational footprint. Absa's strategic focus on cost efficiencies and operational optimization, as demonstrated by its efforts to improve its cost-to-income ratio, directly addresses this competitive pressure.

- High Fixed Costs: Significant investment in infrastructure, technology, and compliance creates pressure for scale.

- Customer Acquisition Focus: Banks compete fiercely for customers to spread fixed costs and improve profitability.

- Operational Efficiency: Absa's emphasis on cost reduction and operational optimization is a direct response to intense rivalry.

- Market Share Drive: The need to achieve economies of scale fuels aggressive competition for market share.

Competitive Rivalry 5

Absa Group faces intense competition as major African banking groups pursue aggressive expansion into new markets and customer segments. This dynamic intensifies rivalry, particularly as Absa extends its reach across the continent, encountering both established local institutions and other pan-African banking entities vying for market share and growth opportunities.

For instance, in 2024, Absa continued its strategic push into various African economies, aiming to leverage its diversified income streams derived from these regional operations. This expansion directly pits Absa against competitors like Standard Bank and Ecobank, both of which have also been actively pursuing pan-African growth strategies, leading to heightened competition for customer acquisition and service offerings.

- Increased Market Penetration: Competitors are actively increasing their presence in key Absa markets, such as South Africa, Nigeria, and Kenya.

- Product and Service Innovation: Banks are rapidly introducing new digital banking solutions and tailored financial products to attract and retain customers, forcing Absa to innovate continuously.

- Price Competition: Fee structures and interest rates are becoming increasingly competitive as players fight for market share, impacting Absa's revenue margins.

- Digital Transformation Race: The race to offer seamless digital experiences means Absa must invest heavily to keep pace with technologically advanced competitors.

The competitive rivalry for Absa Group is exceptionally high, driven by a mature and concentrated South African banking sector dominated by its main peers. This intensity is further fueled by aggressive strategies in pricing and product innovation, especially in the digital space, as seen with heavy investments in digital platforms throughout 2024 to capture market share.

The emergence of nimble digital banks and fintech firms, such as TymeBank and Discovery Bank, has significantly intensified this rivalry. TymeBank's rapid customer acquisition, exceeding 2 million by early 2023, and Discovery Bank's 70% year-on-year customer base growth in 2023 to over 1 million clients, underscore the pressure on Absa to innovate its digital offerings.

Absa's response includes a strong focus on differentiation through enhanced user experiences and digital innovation, with over 70% of its retail transactions conducted digitally in 2023. The high fixed costs associated with infrastructure and technology, exemplified by Absa’s R40.4 billion operating expenses in 2023, necessitate a constant drive for market share to achieve economies of scale and maintain profitability.

Furthermore, Absa's pan-African expansion strategy in 2024 places it in direct competition with other major banking groups like Standard Bank and Ecobank, who are also aggressively pursuing growth across the continent, leading to heightened competition for customers and services in key markets.

| Competitor | Key Competitive Action (2023-2024) | Impact on Absa |

|---|---|---|

| Standard Bank | Aggressive digital platform enhancement, expansion into new African markets. | Increased competition for market share, particularly in retail and corporate banking across Africa. |

| FNB | Focus on integrated financial services, competitive pricing on digital offerings. | Pressure on Absa's pricing strategies and customer retention, especially for digitally-savvy customers. |

| Nedbank | Strategic partnerships for digital solutions, targeted lending for SMEs. | Challenges Absa in specific market segments, requiring continuous innovation in product development. |

| TymeBank | Rapid digital customer acquisition, low-fee banking model. | Erodes market share in the low-cost banking segment, forcing Absa to optimize its digital cost structure. |

| Discovery Bank | Growth in digitally integrated financial services, loyalty program integration. | Sets a benchmark for digital customer experience, compelling Absa to enhance its integrated offerings. |

SSubstitutes Threaten

The threat of substitutes for Absa Group is significant, primarily from non-traditional financial service providers. Mobile money operators, like M-Pesa which has over 30 million active users in Kenya as of early 2024, and digital payment platforms offer convenient, lower-cost alternatives to traditional banking.

These platforms can handle transactions, remittances, and even micro-lending, directly substituting core banking functions and bypassing the need for traditional bank accounts. This shift is particularly impactful in emerging markets where mobile penetration is high.

Innovations in mobile banking are rapidly transforming the financial landscape, presenting a direct challenge to established banking models. This trend is likely to accelerate, impacting Absa's traditional revenue streams.

Fintech companies offer compelling alternatives to traditional banking services. For instance, platforms specializing in peer-to-peer lending or investment apps can directly compete with Absa's lending and wealth management arms. These specialized fintechs often provide a more streamlined and cost-efficient experience for specific financial needs, drawing customers away from incumbent banks.

The rise of these digital disruptors significantly intensifies competition within the South African banking landscape. By 2024, the fintech sector in South Africa was experiencing robust growth, with an increasing number of startups focusing on niche financial services, thereby presenting a tangible threat of substitution for many of Absa Group's core offerings.

Informal lending networks and community-based savings schemes, particularly prevalent in some African markets, represent a significant substitute threat for Absa Group. These informal systems, often deeply embedded in local communities, provide accessible credit and savings options for segments of the population that may not engage with formal banking. For instance, in many Sub-Saharan African economies, the informal financial sector plays a crucial role in economic activity, with estimates suggesting it accounts for a substantial portion of financial transactions.

While these informal channels do not directly replicate the full suite of services offered by Absa, they effectively meet the basic needs for borrowing and saving for many individuals. This is especially true for those who find traditional banking services costly, inconvenient, or inaccessible due to documentation requirements or geographical limitations. Absa's financial inclusion initiatives, such as expanding digital banking and offering tailored products, are designed to counter this threat by drawing these customers into the formal financial system.

4

The threat of substitutes for Absa Group, particularly from emerging digital currencies and blockchain technology, is a growing consideration. Cryptocurrencies and decentralized finance (DeFi) platforms offer alternative avenues for transactions, especially for cross-border payments, potentially bypassing traditional banking services. While still in early stages, their increasing adoption signals a long-term challenge to established financial intermediation.

Absa acknowledges this evolving landscape and is actively exploring blockchain applications. Their interest extends to stablecoins, which aim to mitigate cryptocurrency volatility, and digital identity solutions, which could streamline customer onboarding and enhance security within the financial sector. These strategic explorations indicate a proactive approach to understanding and potentially integrating with these disruptive technologies.

For instance, the global cryptocurrency market capitalization reached over $2.5 trillion in early 2024, showcasing significant user adoption and investment. This growth highlights the increasing viability of these digital assets as potential substitutes for traditional financial instruments and services offered by institutions like Absa. The continued development and regulatory clarity surrounding these technologies will be key factors in their ultimate impact on the banking industry.

The potential for substitutes can be summarized as:

- Emergence of Cryptocurrencies: Offering alternative transaction methods, especially for international transfers.

- Decentralized Finance (DeFi): Providing financial services without traditional intermediaries.

- Blockchain Technology: Enabling new models for payments, lending, and asset management.

- Absa's Strategic Interest: Exploring stablecoins and digital identity solutions to adapt to technological shifts.

5

The threat of substitutes for Absa's corporate banking services is significant, particularly from large corporations developing robust in-house financial departments. These internal units can increasingly handle treasury functions, payment processing, and even certain investment activities, diminishing their need for external banking partners for routine operations. This trend directly impacts the demand for Absa's corporate and investment banking products.

For example, the rise of sophisticated treasury management systems and digital payment platforms allows companies to manage cash flow, execute transactions, and optimize working capital more efficiently internally. This capability directly substitutes for services traditionally offered by banks, such as payment clearing and settlement or short-term financing for working capital needs. Absa's corporate and investment banking division must therefore continuously innovate and demonstrate clear value propositions to retain these sophisticated clients.

- In-house capabilities: Large corporations are building internal expertise and technology to manage treasury, payments, and investments, acting as substitutes for bank services.

- Reduced reliance: This internal capacity lessens dependence on external banks for day-to-day financial operations, impacting product demand.

- Value proposition: Absa's corporate and investment banking unit must offer superior value, such as specialized advisory, risk management solutions, or advanced digital platforms, to counter this substitution threat.

The threat of substitutes for Absa Group is substantial, with fintechs and digital platforms offering streamlined, cost-effective alternatives to traditional banking services. Mobile money operators, for example, have gained significant traction, particularly in emerging markets, by providing accessible payment and remittance solutions. By early 2024, mobile money services in Africa had facilitated billions of dollars in transactions, directly competing with Absa's core offerings.

Furthermore, the rise of cryptocurrencies and decentralized finance (DeFi) presents an evolving substitute threat, offering alternative transaction and investment avenues. The global cryptocurrency market capitalization exceeded $2.5 trillion by early 2024, indicating growing user adoption. Absa's exploration of blockchain and stablecoins reflects an awareness of these disruptive technologies and a strategy to adapt.

For corporate clients, the increasing sophistication of in-house treasury departments and treasury management systems acts as a direct substitute for Absa's corporate banking services. These internal capabilities allow large corporations to manage payments, cash flow, and even certain investment activities more efficiently, reducing their reliance on external banking partners for routine operations.

| Substitute Category | Examples | Impact on Absa | 2024 Market Data/Trend |

|---|---|---|---|

| Fintech & Digital Platforms | Mobile Money Operators, Digital Payment Apps, P2P Lending | Direct competition for transactions, lending, and payments | Billions in transactions facilitated by mobile money in Africa |

| Digital Currencies & DeFi | Cryptocurrencies, Decentralized Finance Platforms | Alternative transaction and investment channels | Global crypto market cap > $2.5 trillion (early 2024) |

| In-house Corporate Finance | Corporate Treasury Management Systems, Internal Payment Processing | Reduced demand for corporate banking services | Increasing adoption of sophisticated treasury tech by large corporations |

Entrants Threaten

The threat of new entrants in the banking sector, particularly for a group like Absa, is significantly mitigated by substantial regulatory and capital requirements. Central banks and financial authorities worldwide, including South Africa's South African Reserve Bank (SARB), impose stringent compliance standards and demand considerable financial resources to obtain a banking license. These hurdles, which can take significant time and investment to overcome, effectively deter many potential new players from entering the market.

The threat of new entrants in the banking sector is moderate. Building brand trust and customer loyalty takes considerable time and investment, creating a barrier for newcomers. Absa's established reputation and deep-rooted customer relationships, cultivated over many years, provide a significant advantage that is not easily replicated by new players in the market.

Absa's customer base grew by 4% to 12.7 million in 2024, underscoring its strong customer loyalty and the difficulty new entrants face in attracting and retaining customers. This established customer base represents a significant hurdle for any new competitor aiming to gain market share.

The threat of new entrants in the banking sector, particularly for a group like Absa, is somewhat mitigated by the substantial barriers to entry. Establishing extensive distribution networks, whether physical branches or sophisticated digital platforms, demands significant upfront capital. Absa's continued investment in its digital transformation, aiming for a seamless customer experience, underscores the high technology and cybersecurity investment required for any new player to compete effectively.

4

The threat of new entrants in the banking sector, particularly for established players like Absa Group, is generally considered moderate. Achieving significant economies of scale is a major hurdle for newcomers. This includes efficiencies in transaction processing, robust data management systems, and sophisticated risk assessment capabilities, all of which require substantial upfront investment.

New entrants often find it challenging to compete on cost with incumbents like Absa, who leverage their extensive customer bases and highly optimized operational processes. For instance, Absa's focus on digital transformation and streamlined operations contributes to its competitive cost structure. While specific up-to-the-minute cost-to-income ratios fluctuate, Absa has historically aimed for ratios that reflect strong operational efficiency compared to industry benchmarks.

- Economies of Scale: New banks need massive scale to match Absa's operational cost efficiencies in areas like IT infrastructure and compliance.

- Capital Requirements: The significant capital needed to establish a regulated banking entity acts as a substantial barrier.

- Brand Loyalty and Trust: Absa benefits from decades of established customer relationships and a trusted brand, which new entrants must work hard to replicate.

- Regulatory Hurdles: Navigating complex banking regulations and licensing processes presents a significant challenge for aspiring new entrants.

5

The threat of new entrants for Absa Group is moderate, primarily due to the significant capital requirements and stringent regulatory hurdles inherent in the banking sector. Establishing a new bank requires substantial investment in infrastructure, technology, and compliance, which can deter many potential players.

However, the rise of FinTech companies and digital-only banks presents a more agile challenge. These entities can often bypass some traditional brick-and-mortar costs, focusing on niche markets or superior digital customer experiences. For instance, in 2024, the global FinTech market continued its robust growth, with significant investment flowing into areas like digital payments and challenger banks, indicating a persistent, albeit evolving, threat.

Access to a skilled workforce is a key barrier. New entrants must compete with established institutions like Absa for top talent in financial services, technology, and regulatory compliance. Building a team capable of managing complex banking operations and driving innovation is both time-consuming and costly. Absa's strategic focus on re-skilling its existing workforce and integrating AI technologies in 2024 aims to maintain its competitive edge in talent acquisition and operational efficiency.

- Capital Intensity: High initial capital is needed for licensing, technology, and physical presence.

- Regulatory Compliance: Navigating complex banking regulations is a significant barrier for new entrants.

- FinTech Disruption: Agile digital-first competitors can erode market share with innovative solutions.

- Talent Acquisition: Competing for skilled financial and tech professionals is a major challenge.

The threat of new entrants for Absa Group is moderate, largely due to high capital requirements and complex regulatory frameworks that deter many potential competitors. These barriers, coupled with the significant investment needed for technology and cybersecurity, make it difficult for newcomers to establish a foothold.

However, the banking landscape is evolving, with FinTech firms and digital-only banks posing a more agile threat by focusing on niche markets and superior digital experiences. Absa's customer base grew by 4% to 12.7 million in 2024, demonstrating its strong customer loyalty, which new entrants must overcome.

Absa's established brand trust, built over decades, and its pursuit of economies of scale through digital transformation and operational efficiencies, further solidify its position against new entrants. The need for new players to attract top talent in finance and technology also presents a considerable challenge.

| Barrier Type | Impact on New Entrants | Absa's Advantage |

|---|---|---|

| Capital Requirements | Very High | Established financial strength |

| Regulatory Compliance | Very High | Extensive experience and infrastructure |

| Brand Loyalty & Trust | High | Long-standing customer relationships (12.7M customers in 2024) |

| Economies of Scale | High | Optimized operations and digital platforms |

| Talent Acquisition | Moderate to High | Reputation and investment in workforce development |

Porter's Five Forces Analysis Data Sources

Our Absa Group Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Absa's annual reports, investor presentations, and financial statements. We also leverage industry-specific research from reputable sources like PwC and Deloitte, alongside macroeconomic data from the South African Reserve Bank and World Bank.