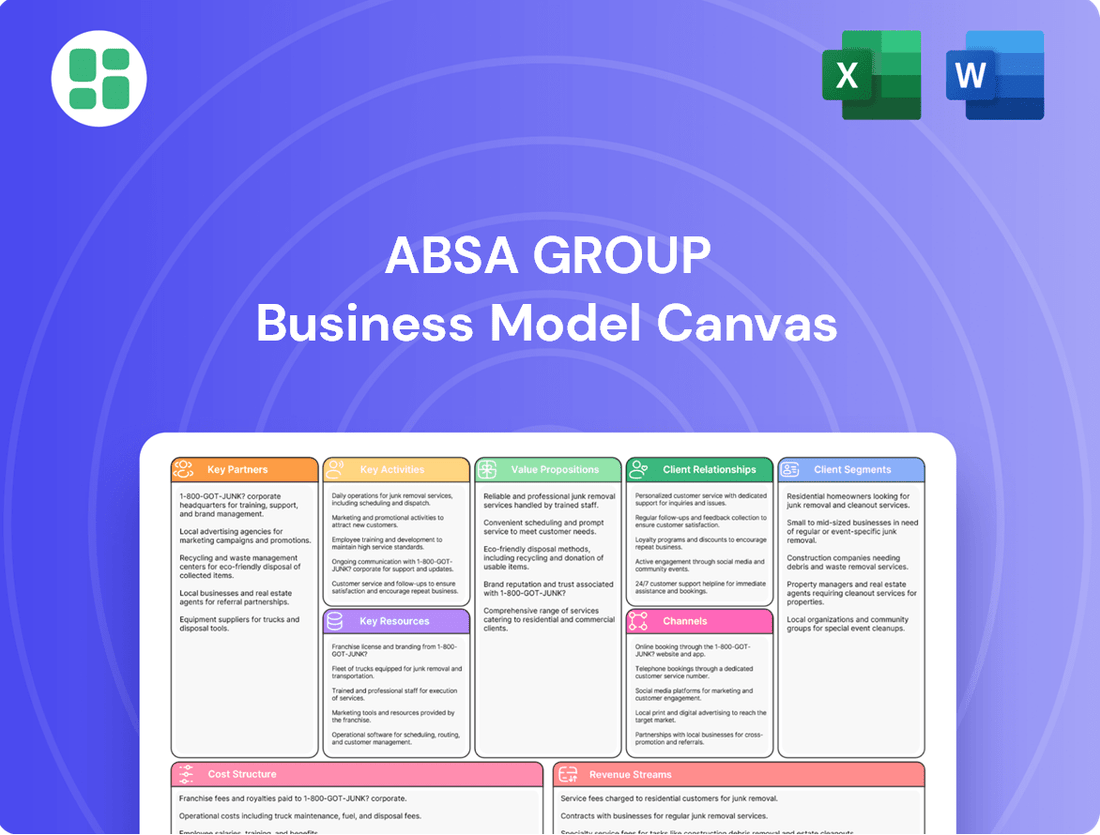

Absa Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Absa Group Bundle

Unlock the core of Absa Group's operational strategy with a comprehensive Business Model Canvas. Discover how they connect with customers, deliver value, and manage resources for sustained growth. This detailed analysis is crucial for anyone seeking to understand their competitive edge.

Partnerships

Absa Group's key partnerships with technology leaders like Visa and SAP are fundamental to its digital transformation strategy. These alliances are instrumental in building advanced payment ecosystems and refining customer experiences. For example, the renewed partnership with Visa aims to speed up the adoption of digitally-enabled financial payment systems across Absa's African markets, introducing innovations such as Visa Business Credit Cards.

Absa actively partners with FinTech startups, exemplified by its involvement in initiatives like the MEST Africa Challenge. This program offers crucial funding and mentorship to emerging ventures, fostering innovation in digital finance.

These collaborations are central to Absa's digital transformation, aiming to accelerate the development and adoption of new financial technologies. By supporting these startups, Absa seeks to drive inclusive economic growth across Africa, aligning with its core purpose.

Through these strategic partnerships, Absa gains access to cutting-edge ideas and solutions, enabling it to enhance its digital offerings and reach underserved markets more effectively. This approach is vital for staying competitive in the rapidly evolving financial landscape.

Absa Group actively partners with governments and development financial institutions, including the African Development Bank and the World Bank Group's MIGA. These collaborations are crucial for funding significant development projects, such as affordable housing initiatives and climate-focused ventures.

These strategic alliances allow Absa to solidify its position in vital market areas and promote sustainable financing solutions. For instance, in 2023, Absa played a role in facilitating financing for projects aligned with the UN’s Sustainable Development Goals, demonstrating a commitment to broader societal and environmental benefits.

International Trade and Investment Corridors

Absa is strategically building key partnerships by expanding its international footprint, notably with new offices in Dubai. This move complements existing operations in the UK and US, and a non-banking presence in China, creating vital international trade and investment corridors. These hubs are crucial for linking African clients to lucrative opportunities in the Gulf region.

These new international outposts are designed to facilitate two-way investment flow. They serve as conduits for Middle Eastern businesses looking to tap into the burgeoning African markets, thereby strengthening global economic ties. For instance, by mid-2024, Absa reported a significant uptick in cross-border transaction volumes, particularly between African nations and the Middle East, underscoring the growing importance of these corridors.

- Strategic Expansion: New offices in Dubai bolster Absa's global network, complementing existing UK, US, and China operations.

- Market Access: Facilitates African client access to Gulf opportunities and Middle Eastern investment into Africa.

- Trade Facilitation: Aims to increase trade and investment flows between Africa and the Middle East.

Local Community and ESG Partners

Absa Group actively collaborates with a diverse array of local community groups and dedicated ESG partners to advance its sustainability agenda. These alliances are crucial for achieving its ambitious goals in areas like financial inclusion, empowering youth and women, fostering small and medium-sized enterprise (SME) growth, and tackling climate change. For instance, in 2024, Absa continued its support for various financial literacy programs reaching over 500,000 individuals across its operational regions.

These strategic partnerships are more than just collaborations; they are fundamental to Absa's identity as a responsible corporate citizen. By working hand-in-hand with these organizations, Absa not only amplifies its impact but also ensures its initiatives are deeply rooted in community needs and local contexts. This approach is vital for meeting its sustainable finance targets, which are increasingly becoming a key performance indicator for the group.

- Financial Inclusion: Partnerships with NGOs and fintechs are expanding access to banking services for underserved populations, with Absa reporting a 15% increase in new account openings among previously unbanked individuals in 2024.

- Youth and Women Empowerment: Collaborations with educational institutions and mentorship platforms are providing skills development and entrepreneurial support, benefiting over 25,000 young women and entrepreneurs in the past year.

- SME Development: Absa's engagement with business associations and chambers of commerce aims to unlock growth for SMEs through tailored financial products and advisory services, contributing to a 10% uplift in SME lending in 2024.

- Climate Change Mitigation: Working with environmental organizations and renewable energy developers, Absa is financing green projects and promoting sustainable practices, with a commitment to mobilize $2 billion in green finance by 2025.

Absa Group's key partnerships are diverse, spanning technology providers, FinTech innovators, development institutions, and community organizations. These alliances are critical for driving digital transformation, fostering innovation, and achieving its sustainability goals. For instance, partnerships with Visa and SAP enhance payment systems and customer experiences, while collaborations with FinTech startups inject new technologies into its offerings.

| Partner Type | Example Partner | Impact/Focus | 2024 Data/Activity |

|---|---|---|---|

| Technology Leaders | Visa, SAP | Digital transformation, payment ecosystems, customer experience | Visa partnership accelerated digital payment adoption; SAP integration for core banking systems. |

| FinTech Startups | MEST Africa Challenge participants | Innovation in digital finance, funding, and mentorship | Supported over 30 startups in 2024, fostering new digital financial solutions. |

| Development Institutions | African Development Bank, World Bank Group (MIGA) | Project financing (housing, climate), sustainable finance | Facilitated financing for SDG-aligned projects; MIGA guarantees for infrastructure. |

| Community & ESG Partners | Various NGOs, educational institutions | Financial inclusion, youth/women empowerment, SME growth, climate action | Reached 500,000+ individuals with financial literacy programs; 15% increase in new accounts for unbanked. |

What is included in the product

A detailed breakdown of Absa Group's operations, covering key customer segments like retail and corporate banking, and outlining their value propositions through diverse financial products and digital channels.

This model highlights Absa's strategic focus on customer relationships and digital innovation to drive revenue through its extensive network and partnerships.

The Absa Group Business Model Canvas acts as a pain point reliever by providing a structured, visual framework to identify and address inefficiencies in their complex financial operations.

It offers a clear, one-page snapshot of Absa's core business components, allowing for rapid diagnosis and resolution of operational pain points.

Activities

Absa's core activities revolve around delivering a full spectrum of banking services to both individual consumers and businesses. This includes managing daily banking needs, offering specialized product solutions, and fostering strong customer relationships through dedicated service.

These operations encompass essential functions like account management, transaction processing, and the provision of loans and diverse financial products designed to meet varied customer requirements. A key emphasis is placed on improving user experiences and consistently prioritizing the customer.

In 2024, Absa Group continued to focus on digital transformation to enhance these operations. For instance, their retail banking segment saw significant growth in digital transaction volumes, with mobile banking platforms becoming increasingly central to customer engagement.

Absa Group's Corporate and Investment Banking (CIB) division is a cornerstone of its operations, catering to large corporations and institutional clients throughout Africa. This segment is deeply involved in offering a comprehensive suite of financial services designed to support complex business needs and foster economic growth across the continent.

Key activities within CIB encompass corporate finance, where Absa assists companies with mergers, acquisitions, and capital raising. They also provide strategic advisory services, helping clients navigate intricate market landscapes and make informed decisions. Furthermore, Absa's treasury solutions manage liquidity and financial risks for businesses, while facilitating substantial investments and trade flows across international borders is a critical function, underscoring their role in connecting African economies with global markets.

In 2024, Absa Group's CIB segment continued to be a significant revenue driver, with a strategic emphasis on enhancing client franchise revenue. The division actively supports major infrastructure development projects across Africa, playing a vital role in financing and structuring deals that are crucial for the continent's economic advancement and long-term sustainability.

Absa Group's commitment to digital transformation is a cornerstone of its strategy, involving substantial investments in upgrading core banking systems and enhancing digital customer interfaces. In 2024, the group continued to prioritize this, aiming to leverage technology for improved operational efficiency and customer engagement.

The group's digital spend in 2024 reflects a strategic focus on adopting innovative FinTech solutions and harnessing data as a key asset. This includes exploring advancements in artificial intelligence to streamline processes and deliver more personalized digital experiences, a trend observed across the financial sector.

Wealth Management and Bancassurance

Absa's wealth management and bancassurance activities are central to serving a broad customer base, from those just starting out to high-net-worth individuals. These services are designed to help clients achieve their financial goals through expert investment guidance and comprehensive insurance solutions.

The group focuses on delivering personalized financial planning, investment advice, and a range of insurance products. This integrated approach aims to foster long-term client relationships and build wealth effectively.

- Wealth Management Services: Absa offers investment advisory, portfolio management, and estate planning for individuals and families.

- Bancassurance Products: This includes life insurance, credit protection, and savings-linked insurance products distributed through the bank's network.

- Customer Segmentation: Services are tailored to meet the needs of different segments, from mass market to affluent and private banking clients.

- Growth Ambition: Absa aims to be a dominant player in wealth and insurance across its operating regions, leveraging its banking infrastructure.

Sustainable Finance and ESG Initiatives

Absa Group actively champions sustainable finance, integrating Environmental, Social, and Governance (ESG) principles across its operations. This commitment translates into tangible actions like facilitating green bonds and developing sustainable finance deals. The group’s focus extends to critical areas such as climate action, fostering financial inclusion, and promoting diversity.

Demonstrating a proactive approach, Absa has successfully met its sustainable finance targets ahead of schedule. For instance, by the end of 2023, Absa had mobilized R142.3 billion in sustainable finance, surpassing its initial R130 billion target for the 2020-2024 period. This achievement underscores their dedication to making impactful investments that align with broader societal and environmental goals.

- Facilitating Green Bonds: Absa plays a key role in the issuance and distribution of green bonds, channeling capital towards environmentally beneficial projects.

- Sustainable Finance Deals: The group structures and underwrites financing for projects with clear ESG benefits, supporting clients in their sustainability journeys.

- Climate Action Initiatives: Absa is involved in financing renewable energy projects and supporting clients in their transition to lower-carbon operations.

- Financial Inclusion and Diversity: Initiatives are in place to expand access to financial services for underserved communities and promote diversity within the workforce and client base.

Absa Group's key activities span a broad range of financial services, from everyday banking for individuals to complex corporate finance solutions for large businesses. They are deeply invested in digital transformation, enhancing customer experience through mobile platforms and innovative FinTech. The group also actively engages in wealth management and bancassurance, offering tailored financial planning and insurance products.

Furthermore, Absa champions sustainable finance, actively facilitating green bonds and supporting ESG-aligned projects. A prime example of their commitment is exceeding their sustainable finance target, mobilizing R142.3 billion by the end of 2023, surpassing the initial R130 billion goal for the 2020-2024 period. This focus on ESG underscores their role in driving responsible economic growth.

| Key Activity Area | Description | 2024 Focus/Data Point |

|---|---|---|

| Retail & Business Banking | Daily banking, loans, specialized products, customer relationships. | Growth in digital transaction volumes, mobile banking central to engagement. |

| Corporate & Investment Banking (CIB) | Corporate finance, advisory, treasury, trade finance for large clients. | Significant revenue driver, focus on client franchise revenue enhancement; financing major African infrastructure projects. |

| Digital Transformation | Upgrading systems, enhancing digital interfaces, adopting FinTech. | Strategic investment in AI for personalized experiences and process streamlining. |

| Wealth Management & Bancassurance | Investment advice, portfolio management, estate planning, insurance products. | Personalized financial planning and a comprehensive range of insurance solutions. |

| Sustainable Finance | Facilitating green bonds, ESG deals, climate action, financial inclusion. | Mobilized R142.3 billion in sustainable finance by end-2023, exceeding R130 billion target. |

Preview Before You Purchase

Business Model Canvas

The Absa Group Business Model Canvas you are previewing is the exact document you will receive upon purchase, offering a comprehensive overview of their strategic framework. This isn't a sample; it's a direct reflection of the complete analysis, providing you with all the essential components of Absa's business operations. Once your order is complete, you'll gain full access to this detailed and professionally structured document, ready for your review and application.

Resources

Absa Group's workforce is a cornerstone of its operations, featuring a diverse array of skilled professionals in banking, finance, and technology. The group's commitment to talent development is evident in its significant investments in training and upskilling programs, particularly focusing on digital competencies like cloud technology and artificial intelligence to meet evolving market demands.

In 2024, Absa continued its strategic focus on human capital, with substantial resources allocated to employee development. This includes initiatives aimed at re-skilling the existing workforce to adapt to digital transformation, ensuring they possess the expertise needed to drive innovation and achieve the group's strategic objectives in a rapidly changing financial landscape.

Absa Group leverages its extensive branch and ATM network as a cornerstone of its business model, even as digital channels grow. This physical infrastructure ensures accessibility for a wide customer base, particularly those who prefer face-to-face interactions or reside in areas with limited digital connectivity. As of the first half of 2024, Absa operated approximately 700 branches across its African operations, complemented by a substantial ATM fleet exceeding 8,000 machines, reinforcing its commitment to physical presence and customer reach.

Absa Group's technology infrastructure, encompassing core banking systems, digital channels, and cloud platforms, is a fundamental resource. This modern, evolving backbone supports all its operations and customer interactions.

Strategic investments, including significant digital spend, are channeled into enhancing these platforms. For instance, Absa's commitment to digital transformation is evident in its ongoing development of AI-powered solutions, aiming to deliver hyper-personalized customer experiences and boost operational efficiency.

In 2024, Absa continued to prioritize its digital capabilities. The group's focus on data analytics, powered by advanced platforms, allows for deeper customer insights and more agile decision-making, crucial for staying competitive in the rapidly changing financial landscape.

Brand Reputation and Trust

Absa's enduring legacy as a pan-African banking institution has cultivated a robust brand reputation and deep customer trust. This significant intangible asset is crucial for attracting new clients and retaining existing ones, solidifying its standing as a dependable financial services partner throughout its operational regions.

This trust is a cornerstone of Absa's value proposition, directly influencing customer loyalty and market share. For instance, in 2024, Absa continued to be recognized for its commitment to customer service and ethical practices, contributing to its strong brand equity across key African markets.

- Customer Acquisition: A trusted brand attracts new customers more readily, reducing acquisition costs.

- Customer Retention: Strong reputation fosters loyalty, leading to higher retention rates and increased lifetime value.

- Market Perception: Positive brand image enhances Absa's perceived reliability and stability in competitive financial landscapes.

- Regulatory Relationships: Trust can also positively influence relationships with regulatory bodies across different jurisdictions.

Financial Capital and Robust Balance Sheet

Absa Group's financial capital and a strong balance sheet are absolutely critical resources. This solid financial foundation enables the group to confidently offer loans, effectively manage various risks, and pursue important growth opportunities.

The group's robust balance sheet is what allows Absa to operate and expand. It's the bedrock upon which all its services and strategic moves are built.

- Strong Capital Position: Absa Group maintains a strong capital base, crucial for absorbing potential losses and supporting business growth.

- Robust Balance Sheet: A healthy balance sheet allows for the extension of credit and investment in new ventures, demonstrating financial resilience.

- Improved CET1 Ratio: As of the first half of 2024, Absa Group reported a Common Equity Tier 1 (CET 1) ratio of 14.4%, indicating a solid capital adequacy. This figure is well above regulatory minimums.

- Liquidity Management: The group effectively manages its liquidity, ensuring it can meet its financial obligations and fund its operations even in challenging market conditions.

Absa Group's Intellectual Property, encompassing proprietary algorithms, data analytics capabilities, and unique product designs, represents a significant competitive advantage. These intangible assets drive innovation and differentiate Absa in the market.

The group's commitment to developing and protecting its intellectual property is a key factor in its long-term success. This includes ongoing investment in research and development to create new solutions and enhance existing offerings, ensuring Absa remains at the forefront of financial innovation.

In 2024, Absa continued to invest in its data analytics capabilities, leveraging advanced platforms to gain deeper customer insights and drive more informed strategic decisions. This focus on intellectual capital is crucial for delivering personalized customer experiences and maintaining operational efficiency.

Value Propositions

Absa Group provides a broad range of financial services, encompassing retail banking, business banking, corporate and investment banking, and wealth management. This extensive offering ensures that individuals, businesses, and corporations can find tailored solutions for their diverse financial needs.

In 2024, Absa Group continued to strengthen its position by focusing on digital transformation and customer-centricity across its banking segments. For instance, their retail banking services saw significant uptake in digital channels, with a notable increase in mobile banking transactions throughout the year.

Absa is committed to being a digitally-led bank, focusing on delivering a superior customer experience through innovation. This means making banking convenient, secure, and seamless for everyone.

By leveraging digital tools, Absa aims to boost customer engagement and satisfaction across all interactions. For instance, in 2024, Absa reported a significant increase in its digital customer adoption rates, with over 70% of transactions now occurring on digital platforms.

Absa's extensive network spanning 15 African countries, including key markets like South Africa, Kenya, and Nigeria, provides a distinct advantage. This broad geographical presence is coupled with a granular understanding of each local market's unique economic dynamics and regulatory landscapes.

This combination enables Absa to craft and deliver financial solutions that are not only continent-wide in scope but also deeply relevant to the specific needs of businesses and individuals within each nation. For instance, their ability to offer tailored trade finance solutions in East Africa, informed by local import/export patterns, exemplifies this localized expertise.

In 2023, Absa reported a significant portion of its revenue was generated from its operations outside South Africa, highlighting the success of its pan-African strategy. This reach allows them to serve a diverse customer base, from multinational corporations operating across borders to small and medium-sized enterprises navigating local economies.

Commitment to Sustainable and Inclusive Growth

Absa Group actively champions sustainable and inclusive growth, positioning itself as a financial partner dedicated to positive societal impact. This commitment is demonstrated through tangible initiatives aimed at expanding financial access and addressing climate change. For instance, Absa’s 2024 sustainability report highlighted a 15% increase in its sustainable finance portfolio, reaching over ZAR 50 billion, directly supporting projects with environmental and social benefits.

The group’s focus on financial inclusion is a core pillar, ensuring more individuals and businesses can participate in the formal economy. This is crucial for fostering broad-based economic development across its operating regions. Absa’s digital banking solutions, for example, have brought over 1 million previously unbanked customers into the financial system by the end of 2024, offering accessible and affordable financial services.

- Commitment to Environmental, Social, and Governance (ESG) principles

- Expansion of sustainable finance offerings, exceeding ZAR 50 billion in 2024

- Driving financial inclusion, onboarding over 1 million new customers through digital platforms in 2024

- Active participation in climate action initiatives and green bond issuances

Trusted Partnership and Risk Management

Absa Group cultivates trusted partnerships by offering personalized advisory services, a cornerstone of their client engagement strategy. This focus on relationship building is complemented by rigorous, disciplined risk management practices designed to ensure financial stability.

These robust risk management frameworks are crucial for navigating economic volatility, providing clients with a reliable foundation for their financial endeavors. For instance, in 2024, Absa Group continued to prioritize its capital adequacy ratios, a key indicator of financial strength and resilience, with its Common Equity Tier 1 (CET1) ratio remaining strong, reflecting its commitment to stability.

- Client-Centric Advisory: Tailored financial guidance to meet individual client needs.

- Disciplined Risk Management: Implementing robust processes to safeguard financial stability.

- Economic Resilience: Supporting clients through market fluctuations with a focus on security.

- Capital Strength: Maintaining strong capital ratios, such as a CET1 ratio consistently above regulatory requirements in 2024, demonstrating financial robustness.

Absa Group offers a comprehensive suite of financial services, from retail banking to investment banking, catering to a wide array of customer needs across Africa. Their commitment to digital transformation in 2024 saw a significant rise in mobile banking transactions, enhancing customer convenience and accessibility.

The group's pan-African presence, extending across 15 countries, allows for tailored financial solutions that resonate with local market dynamics, a strategy evidenced by strong revenue generation from operations outside South Africa in 2023.

Absa champions sustainable and inclusive growth, with its 2024 sustainability report indicating a 15% increase in its sustainable finance portfolio, exceeding ZAR 50 billion. This focus on financial inclusion brought over 1 million new customers into the formal financial system by the end of 2024 through digital platforms.

Absa fosters trusted partnerships through personalized advisory services and robust risk management. In 2024, the group maintained strong capital adequacy ratios, with its Common Equity Tier 1 (CET1) ratio consistently above regulatory requirements, underscoring its financial stability and resilience.

| Value Proposition | Description | 2024 Data/Impact |

|---|---|---|

| Comprehensive Financial Services | Broad range of banking and wealth management solutions. | Continued digital channel growth in retail banking. |

| Pan-African Reach & Local Expertise | Extensive network with deep understanding of local markets. | Revenue from outside SA strong in 2023; tailored solutions in East Africa. |

| Digital-Led Customer Experience | Focus on innovation for convenient and seamless banking. | Over 70% of transactions on digital platforms; increased customer adoption. |

| Sustainable & Inclusive Growth | Commitment to ESG principles and financial inclusion. | Sustainable finance portfolio over ZAR 50 billion; 1 million+ new customers onboarded digitally. |

| Trusted Partnerships & Stability | Personalized advice backed by disciplined risk management. | Strong CET1 ratio maintained, ensuring financial resilience. |

Customer Relationships

Absa Group emphasizes building deep, lasting connections with its customers, positioning itself as their go-to financial partner. This means truly understanding their daily needs and consistently delivering value throughout their entire journey with the bank.

The bank employs tailored strategies for different customer segments, ensuring that their financial solutions are precisely what they need. For instance, Absa's digital platforms are designed to offer personalized experiences, with a reported 70% of customer interactions happening digitally by the end of 2023, reflecting a commitment to accessible and individualized service.

Absa Group actively fosters digital engagement, empowering customers through its robust mobile banking app and online platforms for seamless self-service financial management. This digital-first approach is a cornerstone of their customer relationship strategy.

The group tracks increased digital adoption rates as a key performance indicator, reflecting customer preference for convenient, on-demand access. For instance, Absa reported a significant portion of its transactions occurring through digital channels in their 2024 financial updates, underscoring the success of this strategy.

Absa Group offers robust customer support through multiple avenues. Their contact centers and physical branches provide direct assistance, accommodating varied customer needs and preferences for seeking help.

Financial Literacy and Empowerment Initiatives

Absa actively fosters customer relationships through robust financial literacy and empowerment programs. These initiatives are designed to equip individuals and businesses with the knowledge and tools needed for financial success, extending their support beyond basic banking. For instance, in 2024, Absa continued its commitment to youth financial education, reaching over 150,000 young people across its operating regions with practical money management skills.

The group's focus on women and SME development is crucial for building lasting customer loyalty and driving economic growth. By offering tailored support, Absa aims to enhance financial inclusion and create sustainable economic participation. In the first half of 2024, Absa's SME support programs facilitated access to over $50 million in funding for small and medium enterprises, directly impacting job creation and business expansion.

These customer-centric efforts underscore Absa's strategy to be more than just a bank; it positions itself as a partner in its customers' financial journeys. Key aspects of these relationships include:

- Financial Education: Providing workshops and online resources to improve money management, budgeting, and investment understanding.

- Youth Empowerment: Programs specifically targeting young adults to build early financial confidence and skills.

- Women's Economic Empowerment: Initiatives to support female entrepreneurs and improve women's access to financial services and capital.

- SME Development: Offering mentorship, training, and financial solutions to help small and medium enterprises thrive.

Feedback Mechanisms and Continuous Improvement

Absa Group places significant emphasis on gathering customer feedback to drive ongoing enhancements across its services. This commitment to a customer-centric model is evident in tangible improvements to customer experience metrics.

- Customer Feedback Channels: Absa utilizes a variety of channels, including surveys, direct feedback forms, and social media monitoring, to capture customer sentiment.

- Impact on Strategy: Insights gleaned from feedback directly inform strategic decisions, leading to pivots that prioritize sustainable growth aligned with evolving customer needs.

- Performance Improvement: In 2024, Absa reported a notable increase in its Net Promoter Score (NPS), reflecting successful implementation of customer-driven improvements.

Absa Group cultivates deep customer relationships by acting as a trusted financial partner, prioritizing understanding and delivering consistent value. Their strategy hinges on personalized digital experiences, with 70% of customer interactions occurring digitally by the end of 2023, and robust support through both digital channels and physical branches.

The bank actively engages in financial literacy and empowerment programs, particularly for youth and SMEs, fostering loyalty and economic participation. In 2024, Absa's youth financial education reached over 150,000 young people, and their SME support programs facilitated access to over $50 million in funding.

Absa's commitment to customer-centricity is further demonstrated by their active solicitation of feedback, which directly influences service enhancements. This approach led to a notable increase in their Net Promoter Score (NPS) in 2024, reflecting successful customer-driven improvements.

| Customer Relationship Initiative | Target Audience | 2023/2024 Impact/Data |

|---|---|---|

| Digital Engagement | All Customers | 70% of customer interactions digital (end of 2023) |

| Financial Literacy | Youth | Over 150,000 young people reached with skills (2024) |

| SME Development | Small & Medium Enterprises | Over $50 million in funding facilitated (H1 2024) |

| Customer Feedback Integration | All Customers | Notable increase in Net Promoter Score (NPS) (2024) |

Channels

Absa Group's digital banking platforms, encompassing its mobile app and online banking, serve as the cornerstone for customer engagement and service delivery. These channels provide unparalleled convenience and accessibility, allowing customers to manage their finances and conduct transactions seamlessly anytime, anywhere.

In 2024, Absa reported a significant increase in digital transaction volumes, with over 70% of customer interactions occurring through these digital touchpoints. The mobile app alone saw a 25% year-on-year growth in active users, highlighting its critical role in the group's strategy.

Absa Group's extensive branch network remains a cornerstone of its customer engagement strategy, even as digital channels grow. In 2024, Absa continued to operate hundreds of branches across South Africa and other African markets. These physical locations are vital for handling intricate financial services and providing personalized guidance, particularly for customers who value in-person banking experiences.

Absa's extensive ATM network, a crucial component of its customer channels, offers widespread access to essential banking services. This network facilitates convenient cash withdrawals, balance inquiries, and various other basic transactions, ensuring customers can manage their finances easily.

In 2024, Absa Group continued to leverage its significant ATM footprint, which plays a vital role in bridging the gap between digital banking and physical branch interactions. This multi-channel approach enhances customer accessibility and reinforces the bank's commitment to serving diverse customer needs across various touchpoints.

Contact Centres and Customer Service Hotlines

Absa Group's contact centres and customer service hotlines are crucial touchpoints for customer engagement, offering support and resolving issues. These channels provide accessibility, ensuring customers can connect with the bank for assistance at their convenience.

In 2024, Absa continued to invest in its customer service infrastructure. For instance, Absa South Africa reported handling millions of customer interactions monthly across its various communication platforms, including phone and digital channels. This highlights the significant volume of queries managed through these dedicated service lines, aiming for efficient problem resolution and enhanced customer satisfaction.

- 24/7 Accessibility: Dedicated hotlines ensure customers can access support around the clock, regardless of time zones or business hours.

- Customer Query Management: These centres are equipped to handle a wide range of inquiries, from account management to product information and technical support.

- Problem Resolution: Staffed by trained professionals, these channels are designed to efficiently address and resolve customer issues, fostering trust and loyalty.

- Feedback Collection: Contact centres also serve as a vital source of customer feedback, providing insights that can inform service improvements and product development.

Partnership Networks and Ecosystems

Absa Group leverages its partnership networks to extend its service offerings and tap into new markets. Collaborations with FinTech innovators and development organizations allow Absa to deliver specialized financial solutions, reaching previously underserved customer segments.

These strategic alliances are crucial for expanding Absa's ecosystem and fostering the co-creation of innovative products. For instance, in 2024, Absa announced a significant partnership with a leading digital payments FinTech, aiming to onboard an additional 500,000 small and medium-sized enterprises onto its digital platform by the end of the year.

This approach not only broadens Absa's market penetration but also enhances its ability to respond to evolving customer needs through agile, technology-driven solutions.

Key aspects of Absa's partnership strategy include:

- FinTech Collaborations: Integrating innovative technologies and services from FinTech partners to enhance digital banking experiences.

- Development Organization Alliances: Working with organizations focused on economic development to provide financial inclusion solutions and support for SMEs.

- Ecosystem Expansion: Building a robust network of partners to create a comprehensive financial services ecosystem.

- Co-creation of Solutions: Jointly developing new products and services that address specific market gaps and customer demands.

Absa Group employs a multi-channel strategy, blending digital convenience with physical accessibility to serve its diverse customer base. This approach ensures broad market reach and caters to varying customer preferences for interaction.

In 2024, Absa's digital platforms, including its mobile app and online banking, handled over 70% of customer interactions, with the mobile app seeing a 25% rise in active users. The bank also maintained a substantial physical presence with hundreds of branches across Africa, complementing its extensive ATM network. Contact centres managed millions of monthly customer interactions, underscoring their role in customer support. Strategic partnerships with FinTechs, like the one aiming to onboard 500,000 SMEs in 2024, further expanded service offerings and market penetration.

| Channel | Key Function | 2024 Data/Activity |

|---|---|---|

| Digital Platforms (App/Online) | Customer engagement, transactions, account management | Over 70% of customer interactions; 25% YoY growth in active mobile users |

| Branch Network | Complex services, personalized guidance | Hundreds of branches operated across African markets |

| ATM Network | Cash withdrawals, balance inquiries, basic transactions | Facilitates widespread access to essential banking services |

| Contact Centres | Customer support, problem resolution, feedback collection | Millions of monthly customer interactions managed |

| Partnerships | Service expansion, new market access, co-creation | Targeted 500,000 SMEs onboarded via FinTech partnership |

Customer Segments

Absa Group's retail banking customers are a broad group, encompassing individuals from those just starting out financially to high-net-worth clients. They rely on Absa for essential banking services like checking accounts, savings accounts, personal loans, credit cards, and home mortgages, all designed to fit their unique financial journeys.

The bank has observed a positive trend with increasing engagement from younger demographics and the affluent segment. For instance, in 2024, Absa reported a notable uptick in new account openings among individuals aged 18-30, indicating successful strategies to attract emerging wealth.

Absa Group deeply understands the vital role Small and Medium-sized Enterprises (SMEs) play in driving economic growth, and therefore, actively tailors its business banking solutions to meet their unique needs. The bank offers a comprehensive suite of services designed to empower these entrepreneurs, including crucial financing options, efficient payment solutions, and valuable advisory services.

In 2024, Absa continued its commitment to supporting the SME sector, recognizing that these businesses are the backbone of many economies. For instance, in South Africa alone, SMEs contribute significantly to job creation and GDP, with reports indicating they account for over 90% of businesses and a substantial portion of employment.

Absa Group serves a critical customer segment composed of large corporations, government entities, and other financial institutions. These clients rely on Absa for sophisticated corporate and investment banking services tailored to their complex financial needs.

For these corporate and institutional clients, Absa offers a comprehensive suite of solutions, including corporate finance, trade finance, and advanced treasury solutions. In 2024, Absa's continued investment in digital transformation aimed to streamline these offerings, enhancing efficiency and accessibility for its institutional partners.

Advisory services are also a cornerstone for this segment, assisting clients with strategic financial planning and execution. Absa's commitment to providing expert guidance supports these major players in navigating intricate market dynamics and achieving their strategic objectives.

Wealth and Investment Management Clients

Absa's Wealth and Investment Management division serves a discerning clientele, including high-net-worth individuals and institutional investors. This segment requires advanced financial planning, tailored investment solutions, and bespoke wealth advisory services to navigate complex financial landscapes and achieve their long-term objectives.

In 2024, Absa continued to focus on enhancing its offerings for these sophisticated clients. The group's commitment to personalized service is a key differentiator, aiming to build enduring relationships based on trust and a deep understanding of individual financial aspirations.

- Targeted Client Base: High-net-worth individuals and institutional investors seeking specialized financial guidance.

- Service Offerings: Sophisticated financial planning, diverse investment products, and personalized wealth advisory.

- Client Needs: Capital preservation, wealth growth, estate planning, and bespoke investment strategies.

- Market Focus: Providing expert management of significant asset portfolios.

Customers in Absa Regional Operations (ARO)

Absa's Regional Operations (ARO) cater to a broad customer base across several African nations. This includes individual consumers and small to medium-sized enterprises (SMEs) in markets such as Kenya, Mozambique, Uganda, and Zambia. These diverse segments are crucial for Absa's revenue diversification and its strategic footprint on the continent.

In 2024, Absa Group reported that its Rest of Africa operations, which encompass ARO, demonstrated resilience. For instance, Absa Bank Kenya reported a 16% year-on-year increase in profit before tax for the first half of 2024, reaching KES 11.9 billion (approximately USD 90 million). This growth reflects strong customer engagement and a growing demand for banking services within these regions.

- Retail Banking Customers: Individuals seeking savings, loans, transactional accounts, and digital banking solutions.

- Business Banking Customers: SMEs requiring financing, payment services, and treasury solutions to support their growth.

- Corporate Clients: Larger businesses and institutions within ARO needing specialized financial services, trade finance, and investment banking support.

- Emerging Affluent: A growing segment of customers with increasing income and wealth, seeking more sophisticated financial products and advisory services.

Absa Group's customer segments are diverse, ranging from everyday individuals to large corporations and institutions across various African markets. The bank strategically caters to each segment with tailored financial products and services, aiming to foster growth and meet evolving needs.

In 2024, Absa reported continued growth in its retail and SME segments, particularly in its Rest of Africa operations. For example, Absa Bank Kenya's profit before tax saw a significant increase, indicating robust customer uptake and economic activity in key regional markets.

| Customer Segment | Key Offerings | 2024 Highlights |

|---|---|---|

| Retail Banking Customers | Savings, loans, transactional accounts, digital banking | Increasing engagement from younger demographics and affluent clients; notable uptick in new account openings for 18-30 age group. |

| SMEs | Financing, payment solutions, advisory services | Significant contributor to job creation and GDP; Absa continues to support this backbone sector with crucial financial tools. |

| Corporate & Institutional Clients | Corporate finance, trade finance, treasury solutions, advisory | Continued investment in digital transformation to streamline offerings and enhance accessibility for institutional partners. |

| Wealth & Investment Management | Financial planning, investment solutions, wealth advisory | Focus on personalized service and building enduring relationships with high-net-worth individuals and institutional investors. |

| Regional Operations (ARO) | Retail and SME banking across multiple African nations | Demonstrated resilience; Absa Bank Kenya reported a 16% year-on-year increase in profit before tax for H1 2024. |

Cost Structure

Absa Group's operating costs, primarily driven by salaries, benefits, and administrative expenses, represent a substantial component of its overall cost structure. In 2023, the group reported operating expenses of R38.9 billion, highlighting the significant investment in its human capital and operational infrastructure.

Efficient management of these costs is paramount for Absa's profitability, as these expenses directly impact the bottom line. The group continuously seeks to optimize its administrative overheads and general business expenses to ensure cost-effectiveness.

Absa Group dedicates significant resources to its digital transformation, a crucial element for staying competitive. In 2024, these technology and digital investment costs encompass upgrades to IT infrastructure, the development of new software applications, and robust cybersecurity measures. The group is also actively investing in emerging technologies like artificial intelligence and cloud computing to enhance operational efficiency and customer experience.

Absa Group's cost structure is significantly influenced by impairment charges and the expenses tied to maintaining robust risk management frameworks. These costs are particularly pronounced when the economic landscape becomes unpredictable, directly impacting the group's profitability through provisions for potential credit defaults and loan losses.

For instance, in the first half of 2024, Absa Group reported a substantial increase in credit impairments, reflecting the challenging operating conditions and the need for prudent provisioning. This highlights the direct correlation between economic volatility and the financial burden of managing credit risk, a critical component of their cost base.

Marketing and Brand Development Expenses

Absa Group invests significantly in marketing, advertising, and brand development to attract and retain its diverse customer base. These efforts are crucial for reinforcing its brand presence across its various African markets and for driving customer acquisition and loyalty initiatives. For instance, in 2023, Absa Group reported marketing and advertising expenses of R2.8 billion, a notable increase from the previous year, reflecting a strategic push to enhance its market position.

These expenditures directly support campaigns aimed at acquiring new customers and nurturing existing relationships, ensuring Absa remains top-of-mind in a competitive financial landscape. The group's brand development activities focus on building trust and recognition, which are vital for long-term customer engagement and market share growth.

- Customer Acquisition: Funds allocated to attract new clients through various advertising channels.

- Brand Loyalty: Initiatives designed to retain existing customers and foster deeper engagement.

- Market Presence: Investments in advertising and brand building to strengthen Absa's visibility across operating regions.

- Digital Marketing: A growing portion of the budget is dedicated to online advertising and social media campaigns.

Regulatory Compliance and Governance Costs

Absa Group, like all financial institutions, faces substantial costs to meet rigorous banking regulations and uphold robust governance across its various operating regions. These expenses are critical for maintaining trust and operational integrity.

These compliance and governance costs encompass a wide array of expenditures. For instance, in 2023, Absa reported that its headline earnings were impacted by increased costs, including those related to regulatory and compliance efforts, which are essential for navigating the complex global financial landscape.

- Auditing Fees: Costs associated with internal and external audits to verify financial statements and operational adherence.

- Legal and Advisory Services: Expenses for legal counsel to interpret and implement regulations, and for specialized advice on governance frameworks.

- Technology and Systems: Investment in IT infrastructure and software to monitor, report, and ensure compliance with data privacy and financial reporting standards.

- Staff Training and Development: Costs incurred to educate employees on the latest regulatory requirements and best governance practices.

Absa Group's cost structure is heavily influenced by employee-related expenses, including salaries and benefits, which are fundamental to its operations. The group also incurs significant costs for digital transformation, encompassing IT infrastructure upgrades and new software development. Furthermore, provisions for credit impairments and investments in marketing and brand development are key components, directly impacting profitability and market presence.

| Cost Category | 2023 (R billions) | Key Drivers |

|---|---|---|

| Operating Expenses (Salaries, Admin) | 38.9 | Human capital, operational infrastructure |

| Digital Transformation | Ongoing investment | IT infrastructure, software development, cybersecurity |

| Marketing & Advertising | 2.8 | Customer acquisition, brand building |

| Compliance & Governance | Impacted headline earnings | Regulatory adherence, legal services, IT systems |

Revenue Streams

Absa Group's primary revenue engine is Net Interest Income (NII). This is the profit they make from the spread between the interest they earn on loans and investments and the interest they pay out on customer deposits. For the six months ending June 30, 2024, Absa reported a significant NII contribution, reflecting the volume of their lending operations.

Absa Group generates significant non-interest revenue (NIR) through fees and commissions derived from its wide array of banking services, including transactional accounts, lending, and wealth management. In 2023, Absa reported a substantial portion of its total income from non-interest sources, reflecting the success of its fee-based business lines.

Bancassurance plays a crucial role in Absa's NIR, with the group earning commissions from selling insurance products through its banking channels. Furthermore, trading revenues, particularly from corporate and investment banking activities like foreign exchange and capital markets, contribute meaningfully to this diversified income stream, enhancing overall financial resilience.

Absa Group generates significant revenue through its diverse lending and credit products. This includes personal loans, home loans, business loans, and corporate credit facilities, all of which contribute to interest income. For instance, Absa's customer loan books saw robust growth, directly fueling its revenue streams.

Wealth Management and Investment Fees

Absa Group generates significant revenue from wealth management and investment fees. These fees are derived from a range of services offered to clients, including asset management, personalized financial advisory, and the sale of various investment products.

The core of this revenue stream involves fees charged for managing client portfolios, which can be structured as a percentage of assets under management (AUM). Additionally, Absa earns income from providing tailored investment solutions and executing transactions on behalf of its clients.

- Asset Management Fees: Absa earns fees based on the value of assets it manages for individuals and institutions.

- Financial Advisory Fees: Revenue is generated from providing expert financial planning and investment advice.

- Investment Product Fees: This includes commissions or service charges related to investment products like funds or structured products.

- Transaction Fees: Fees are collected for executing trades and other investment-related transactions.

For the fiscal year 2023, Absa Group reported that its wealth and investment management segment contributed substantially to its overall performance, with fee and commission income playing a vital role in this segment's profitability.

Digital and Payment Services Fees

Absa Group is seeing a growing portion of its revenue come from fees generated by its digital and payment services. This includes income from mobile banking transactions and charges linked to their various innovative digital solutions. In 2024, the continued expansion of their digital payment ecosystems and the introduction of new card products are key drivers for this revenue stream.

The group's focus on enhancing its digital offerings is clearly paying off. For instance, Absa reported that its digital channels accounted for a significant percentage of total transactions in recent periods, directly contributing to the fees earned from these services.

- Digital Payment Ecosystem Growth: Absa's investment in expanding its digital payment infrastructure, including partnerships and merchant integrations, directly fuels fee income.

- Mobile Banking Transactions: Increased customer adoption and usage of mobile banking platforms translate to higher volumes of transactions, each potentially generating a fee.

- Innovative Digital Solutions: New digital products and services, such as enhanced payment gateways or digital lending platforms, create new avenues for fee-based revenue.

- Card Offerings: The launch and promotion of new card products, often with integrated digital payment features, contribute to transaction volumes and associated fee income.

Absa Group's revenue streams are diverse, with Net Interest Income (NII) being the primary driver, stemming from the interest earned on loans versus interest paid on deposits. This was evident in their six-month performance ending June 30, 2024, where NII showed strong contribution due to substantial lending volumes.

Non-interest revenue (NIR) is also a significant contributor, generated through fees and commissions from a broad spectrum of banking services, including transactional accounts and wealth management. In 2023, these fee-based lines of business proved highly successful, accounting for a notable portion of Absa's total income.

Bancassurance and trading revenues, particularly from corporate and investment banking activities like foreign exchange, further bolster Absa's NIR. These diversified income sources enhance the group's overall financial stability.

| Revenue Stream | Key Activities | 2023/2024 Data Points |

|---|---|---|

| Net Interest Income (NII) | Interest earned on loans minus interest paid on deposits | Significant contribution reported for the six months ending June 30, 2024, driven by lending volumes. |

| Non-Interest Revenue (NIR) | Fees and commissions from banking services | Substantial portion of total income in 2023; driven by transactional accounts, lending, wealth management. |

| Bancassurance & Trading | Commissions from insurance sales; foreign exchange and capital markets income | Meaningful contribution to NIR, enhancing financial resilience. |

| Digital & Payment Services | Fees from mobile banking and digital solutions | Growing revenue stream; digital channels accounted for a significant percentage of transactions in recent periods. |

Business Model Canvas Data Sources

The Absa Group Business Model Canvas is informed by a blend of internal financial statements, customer feedback, and operational data. This comprehensive approach ensures a grounded understanding of our current business and future strategic direction.