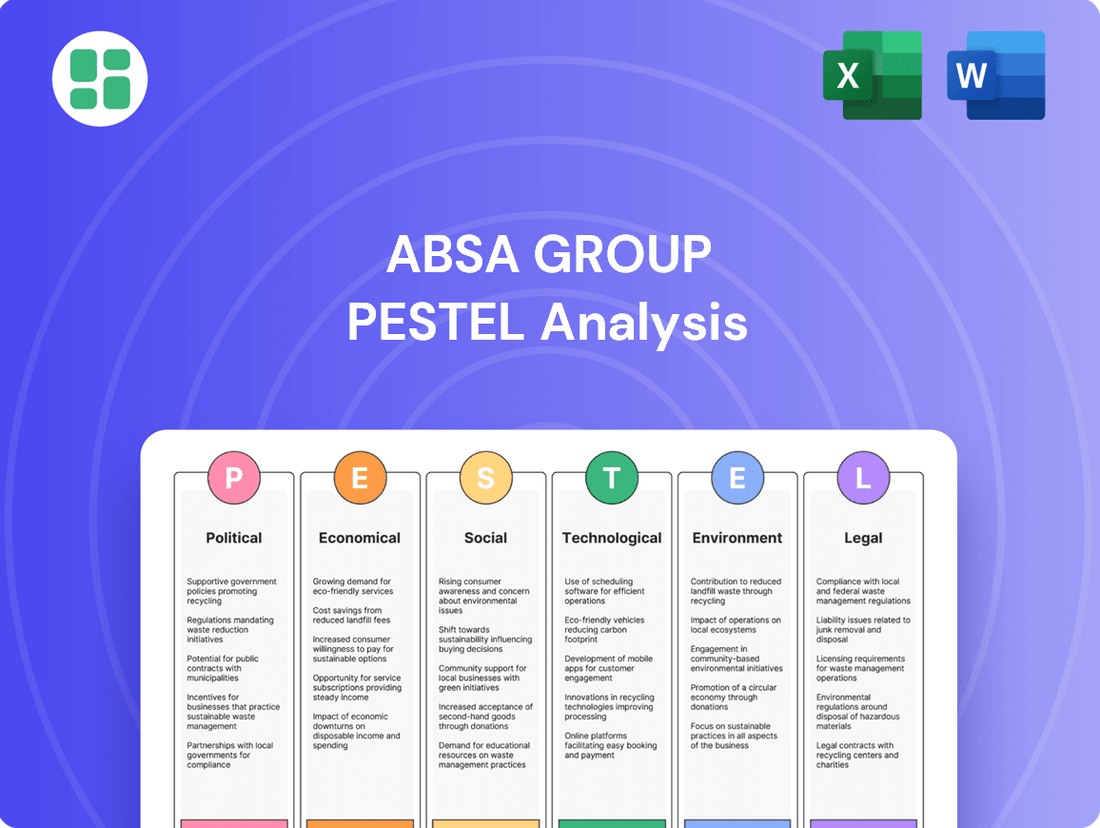

Absa Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Absa Group Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors influencing Absa Group's strategic direction. Our comprehensive PESTLE analysis provides actionable intelligence to navigate these complex external forces. Gain a competitive advantage by understanding the landscape shaping Absa Group's future. Download the full report now for deep-dive insights and informed decision-making.

Political factors

Absa Group's operations are significantly shaped by the political stability within South Africa and its other key African markets. For instance, South Africa's general elections in 2024, while resulting in a coalition government, introduced a period of policy recalibration that investors closely monitored. This political landscape directly impacts the investment climate and Absa's strategic planning.

Government policies are a critical determinant of Absa's growth. Regulations concerning capital requirements, digital banking initiatives, and consumer protection, as seen in proposed amendments to financial sector laws in various African nations during 2024-2025, can either foster expansion or introduce operational hurdles. Absa must navigate these evolving policy frameworks to maintain its competitive edge.

A proactive understanding of the political trajectory is essential for Absa's long-term vision. For example, the African Continental Free Trade Area (AfCFTA) agreement, with ongoing implementation efforts in 2024 and 2025, presents significant opportunities for cross-border banking services, contingent on supportive political will and harmonized regulations across member states. This underscores the importance of political foresight in risk assessment and strategic development.

Central bank decisions, particularly regarding interest rates and monetary policy, are pivotal for Absa Group. For instance, the South African Reserve Bank's Monetary Policy Committee's decisions on the repo rate directly influence Absa's net interest income and lending volumes. In 2024, the expectation of rate cuts, if they materialize, could ease borrowing costs for customers, potentially boosting loan growth, while also impacting Absa's margins on existing variable-rate loans.

Prudential regulations and evolving banking laws across Absa's key markets, including South Africa, Kenya, and Botswana, demand constant vigilance. Stricter capital adequacy ratios, such as those aligned with Basel III or emerging Basel IV frameworks, influence Absa's capital planning and risk-weighted asset management. Compliance with consumer protection laws, like those concerning data privacy and fair lending practices, is also crucial for maintaining customer trust and avoiding regulatory penalties, ensuring operational integrity and continued market access.

Absa's extensive footprint across Africa means it's inherently exposed to geopolitical risks, such as regional conflicts and political instability. For instance, ongoing tensions in parts of East Africa could impact trade flows and economic growth, directly affecting Absa's client base and the overall business environment. These situations necessitate sophisticated risk management, including scenario planning for potential disruptions.

Anti-Corruption Measures and Governance

The effectiveness of anti-corruption measures and governance standards in Absa's key operating regions, particularly South Africa, directly impacts the integrity of the financial system and investor confidence. For instance, South Africa's efforts to strengthen its anti-corruption frameworks, as seen in the work of bodies like the National Prosecuting Authority's Investigating Directorate, aim to reduce illicit financial activities. This focus on transparency is crucial for a stable banking environment, aligning with Absa's stated commitment to ethical conduct and robust governance.

Strong governance and anti-corruption initiatives reduce operational risks for Absa. Countries with well-established legal systems and enforcement mechanisms, such as those adhering to international financial standards, offer a more predictable operating landscape. This reduces the likelihood of penalties or reputational damage stemming from non-compliance or involvement in corrupt practices. Absa's adherence to global best practices in corporate governance and its internal control mechanisms are designed to navigate these political factors effectively.

- South Africa's Corruption Perception Index (CPI) score in 2023 was 42 out of 100, ranking 47th out of 180 countries, indicating a perception of moderate corruption.

- Absa Group's 2023 Integrated Report highlights its focus on robust governance structures, including a dedicated board committee overseeing risk and compliance.

- The group's commitment to ethical conduct is reinforced by its Code of Business Conduct, which applies to all employees and directors.

International Relations and Trade Agreements

The evolving landscape of international relations and trade agreements significantly shapes Absa Group's operating environment. Bilateral and multilateral trade pacts, such as the African Continental Free Trade Area (AfCFTA), directly influence capital flows and cross-border transactions across the continent. For instance, the AfCFTA, which officially commenced in January 2021, aims to create a single market for goods and services with free movement of business persons and investments, potentially boosting intra-African trade by 81% by 2035 according to UNCTAD estimates. This directly impacts Absa's capacity to offer trade finance solutions and attract foreign direct investment into the regions it serves.

These international dynamics indirectly affect Absa's corporate and investment banking arms. The stability and predictability fostered by robust trade agreements are crucial for facilitating large-scale cross-border transactions and project finance. For example, South Africa's trade relations with key partners, including the European Union and China, are vital for sectors where Absa has significant exposure, such as mining and manufacturing. Changes in these relationships, including tariff adjustments or new regulatory frameworks, can alter the risk profile of international trade and investment, thereby influencing Absa's strategic decisions and product offerings.

- AfCFTA Potential: The African Continental Free Trade Area could boost intra-African trade by 81% by 2035, impacting Absa's trade finance and investment facilitation services.

- South Africa's Trade Partners: Key trade relationships, particularly with the EU and China, are critical for sectors where Absa operates, influencing capital flows and transaction volumes.

- Regulatory Impact: Evolving trade regulations and agreements directly affect the ease and cost of cross-border financial transactions, a core business area for Absa.

- Investment Flows: Favorable international relations and trade agreements can attract foreign direct investment into African economies, creating opportunities for Absa's corporate banking divisions.

Political stability and policy consistency are paramount for Absa Group's operations across Africa. The 2024 South African general election's outcome, leading to a coalition government, has introduced a period of policy recalibration that will shape the investment climate. Government regulations, from capital requirements to digital banking initiatives, directly influence Absa's growth trajectory and operational framework.

The African Continental Free Trade Area (AfCFTA) agreement, with ongoing implementation in 2024-2025, presents a significant opportunity for cross-border banking, contingent on supportive political will and harmonized regulations. Central bank monetary policy decisions, such as interest rate adjustments by the South African Reserve Bank, directly impact Absa's net interest income and lending volumes.

| Factor | Impact on Absa Group | 2024-2025 Relevance |

|---|---|---|

| Political Stability | Influences investment climate and strategic planning. | Post-2024 election coalition government in South Africa requires policy monitoring. |

| Regulatory Frameworks | Affects capital requirements, digital banking, and consumer protection. | Evolving financial sector laws in key African markets demand adaptation. |

| Trade Agreements (e.g., AfCFTA) | Facilitates cross-border transactions and trade finance. | Harmonization of regulations under AfCFTA is crucial for expanded services. |

| Monetary Policy | Impacts net interest income and lending growth. | South African Reserve Bank's repo rate decisions directly influence margins. |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting Absa Group, examining Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to guide strategic decision-making and identify potential opportunities and threats within Absa Group's operating landscape.

A concise overview of Absa Group's PESTLE factors, presented in a digestible format, alleviates the pain of sifting through extensive data for strategic decision-making.

Economic factors

Fluctuations in interest rates, particularly those set by the South African Reserve Bank (SARB) to manage inflation, directly influence Absa Group's net interest income. For instance, the SARB maintained its repo rate at 8.25% in early 2024, a key benchmark affecting Absa's lending and borrowing costs.

High inflation, which saw South Africa's CPI average around 5.9% in 2023, can diminish consumer purchasing power and escalate Absa's operational expenses. Conversely, shifts in interest rates impact the cost of credit for both individuals and businesses, thereby shaping loan demand and potential credit risks for the group.

Absa Group's performance is closely tied to the economic health of the regions it serves, particularly South Africa. In 2024, South Africa's GDP growth is projected to be around 1.5%, a moderate increase that suggests continued, albeit slow, demand for financial services. This growth underpins lending opportunities and consumer spending, directly impacting Absa's revenue streams and asset quality.

Looking at other key African markets where Absa operates, economic stability is crucial. For instance, Kenya's GDP growth is anticipated to be around 5.0% in 2024, indicating a more dynamic environment for financial services expansion compared to South Africa. Such varied growth rates across its operating regions present both opportunities and challenges for Absa's diversified business model.

Absa Group's extensive operations across multiple African countries mean it's constantly navigating a landscape of currency fluctuations. This exposure is particularly pronounced when its results are translated into major global currencies like the US Dollar or Euro, and also between the various African currencies it deals with daily.

For instance, a significant depreciation of the South African Rand against the US Dollar in early 2024 could directly impact the reported value of Absa's assets and liabilities held in foreign currencies. This volatility necessitates robust hedging strategies to mitigate potential negative impacts on earnings and capital adequacy ratios, a critical concern for financial institutions.

Consumer Spending Power and Disposable Income

Consumer spending power and disposable income are critical drivers for Absa Group's retail banking operations. When households have more disposable income, they are more likely to take out loans, mortgages, and credit cards, directly boosting demand for these products. For instance, in South Africa, a key market for Absa, average household disposable income saw a modest increase in early 2024, supported by stable inflation and wage growth in certain sectors. This trend is expected to continue, albeit at a measured pace, throughout 2024 and into 2025.

Economic conditions directly impact Absa's retail segment. Improvements in household incomes, often linked to employment figures and inflation rates, tend to lower credit default rates as consumers are better able to manage their debt obligations. Conversely, economic downturns that reduce disposable income can lead to increased defaults. In the first quarter of 2024, South Africa's unemployment rate remained a concern, but there were signs of improvement in specific industries, offering a mixed outlook for consumer credit health.

- South African Disposable Income Growth: Projections suggest a 2-3% growth in real disposable income for South African households in 2024, influenced by inflation moderation and wage adjustments.

- Impact on Retail Banking: Higher disposable income typically correlates with increased uptake of credit products, potentially leading to a 3-5% expansion in Absa's retail loan portfolio in favorable economic periods.

- Credit Risk Indicators: Monitoring consumer credit bureau data and debt-to-income ratios provides early warnings of potential increases in non-performing loans, which could rise by 0.5-1% if economic conditions worsen significantly.

- Consumer Confidence Index: Absa closely tracks consumer confidence, which, if trending upwards, signals a greater willingness to spend and borrow, positively impacting the bank's retail business.

Unemployment Rates and Credit Quality

High unemployment rates pose a significant risk to Absa Group's credit quality. As more individuals and businesses struggle to find stable income, the likelihood of loan defaults, especially in consumer lending and small business financing, increases. This directly impacts the bank's non-performing loan ratios.

For instance, in South Africa, a key market for Absa, the unemployment rate hovered around 32.9% in Q1 2024, a figure that underscores the sensitivity of Absa's loan portfolio to labor market conditions. Similar trends are observed in other African nations where Absa operates, highlighting the need for vigilant monitoring.

- South Africa Unemployment Rate: Approximately 32.9% in Q1 2024.

- Impact on Retail: Increased defaults on personal loans and credit cards.

- Impact on SMEs: Higher non-performing loan rates for small business loans.

- Absa's Mitigation: Close monitoring of employment trends for credit risk assessment.

Economic growth across Absa's operating regions directly influences demand for financial products and services. South Africa's projected GDP growth of around 1.5% for 2024 suggests moderate expansion opportunities, while Kenya's anticipated 5.0% growth presents a more robust environment.

Interest rate decisions by central banks, such as the South African Reserve Bank's repo rate of 8.25% in early 2024, significantly impact Absa's net interest income and borrowing costs. Inflationary pressures, with South Africa's CPI averaging 5.9% in 2023, can erode consumer spending and increase operational expenses.

Currency volatility, particularly the Rand's fluctuations against major currencies, affects the reported value of Absa's foreign-denominated assets and liabilities, necessitating careful hedging strategies.

High unemployment, standing at approximately 32.9% in South Africa in Q1 2024, poses a substantial risk to credit quality, potentially increasing loan defaults across both retail and SME segments.

| Economic Indicator | Value/Projection (2024) | Impact on Absa |

|---|---|---|

| South Africa GDP Growth | ~1.5% | Moderate demand for financial services, lending opportunities |

| Kenya GDP Growth | ~5.0% | Stronger environment for financial services expansion |

| South Africa Repo Rate | 8.25% (early 2024) | Influences net interest income and borrowing costs |

| South Africa CPI (2023 Avg) | ~5.9% | Affects consumer spending power and operational costs |

| South Africa Unemployment Rate (Q1 2024) | ~32.9% | Increases credit risk and potential loan defaults |

Same Document Delivered

Absa Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Absa Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the critical external forces shaping Absa Group's strategic landscape.

Sociological factors

Africa's population is projected to reach 2.5 billion by 2050, with a significant portion being under 25 years old. This burgeoning youth demographic, particularly in urban centers, represents a substantial and growing customer base for Absa's diverse financial services.

Urbanization is accelerating across the continent, concentrating economic activity and increasing the demand for accessible financial solutions. Absa can leverage this trend by expanding its digital banking platforms and mobile money services, catering to the preferences of a younger, tech-savvy population and enhancing its market penetration.

Enhancing financial inclusion and literacy across Africa is a key focus for Absa. For instance, initiatives like the African Development Bank's financial inclusion strategy aim to reach millions by 2025, creating a larger accessible market for Absa's services. Improved financial literacy empowers individuals to engage more effectively with banking products, potentially driving significant customer acquisition for the group.

Consumer preferences are rapidly shifting towards digital and mobile-first banking. This is largely due to increased smartphone penetration, which reached over 80% in South Africa by late 2024, making digital access paramount. Absa must continue investing in its digital platforms to meet these evolving demands.

Meeting these changing preferences is vital for Absa's customer retention and acquisition strategies. Customers in 2025 increasingly expect seamless, convenient, and accessible banking interactions, often preferring to manage their finances entirely through apps rather than visiting physical branches.

Income Inequality and Socio-Economic Disparities

Significant income inequality across Absa's operating markets, particularly in countries like South Africa, necessitates a nuanced approach to product development and marketing. For instance, while South Africa's Gini coefficient remained high, estimated around 0.63 in 2023, Absa must balance catering to high-net-worth individuals with accessible, affordable banking solutions for the broader population. This includes developing entry-level accounts and micro-lending products to serve lower-income segments effectively.

Addressing these socio-economic disparities is crucial for sustainable growth and responsible banking practices. Absa's commitment to financial inclusion, demonstrated by initiatives like offering digital banking services to underserved communities, directly tackles these challenges. For example, by expanding mobile banking penetration, which saw significant growth in sub-Saharan Africa in 2024, Absa can reach millions who may not have access to traditional branches.

- Income Disparity Impact: High income inequality, exemplified by South Africa's Gini coefficient, shapes Absa's need for diverse product offerings.

- Market Segmentation: The bank must serve both premium clients and lower-income segments with tailored financial products and services.

- Financial Inclusion Initiatives: Absa's focus on accessible digital banking and micro-lending aims to bridge socio-economic gaps.

- Market Reach: Expanding mobile banking is key to serving a wider demographic, leveraging the increasing digital adoption rates across Africa.

Cultural Attitudes Towards Finance and Debt

Cultural norms around saving, borrowing, and managing debt differ significantly across Absa's operating regions in Africa. For instance, in some cultures, there's a strong emphasis on communal financial support and informal savings groups, which can influence how formal banking products are adopted. Conversely, other societies might have a more reserved approach to debt, viewing it with caution due to historical or economic factors.

Absa's success hinges on tailoring its approach to these varied cultural landscapes. Understanding these nuances allows for the creation of marketing messages that resonate locally and financial products that align with community expectations. Building trust is paramount, and this is achieved by demonstrating a deep respect for and understanding of local financial customs and attitudes towards debt.

For example, in South Africa, a significant portion of the population relies on informal credit mechanisms. Absa's 2024 financial reports indicate a growing demand for accessible credit solutions, but also highlight the need for financial literacy programs to promote responsible borrowing. This underscores the importance of culturally sensitive product design and customer education.

- Cultural Diversity: Attitudes towards saving and debt management vary widely across Absa's African markets, impacting product uptake and customer engagement.

- Marketing Sensitivity: Culturally attuned marketing campaigns are crucial for resonating with diverse consumer behaviors and financial philosophies.

- Product Design: Financial products must be designed with an understanding of local norms, such as the prevalence of informal savings and lending practices.

- Trust Building: Demonstrating cultural awareness is key to fostering trust and long-term relationships within local communities.

Sociological factors significantly shape Absa Group's operating environment, influencing everything from customer behavior to market demand. The continent's rapidly growing and youthful population presents a vast, evolving customer base, with urbanization concentrating economic activity and increasing the need for accessible financial services. Absa's strategic focus on financial inclusion and digital banking directly addresses these demographic and societal shifts, aiming to tap into a larger, more engaged market by 2025.

Income inequality remains a critical consideration, compelling Absa to develop a diversified product suite that caters to both high-net-worth individuals and lower-income segments. For instance, while South Africa’s Gini coefficient hovered around 0.63 in 2023, Absa’s expansion of mobile banking, which saw substantial growth in sub-Saharan Africa during 2024, is key to bridging these socio-economic divides and reaching underserved communities.

Cultural norms surrounding finance, including saving and debt, vary considerably across Absa's markets, necessitating culturally sensitive product design and marketing. Understanding these diverse attitudes, such as a reliance on informal credit mechanisms in South Africa, is vital for building trust and ensuring the effective adoption of formal banking products, as highlighted by Absa's 2024 financial reports indicating strong credit demand alongside a need for financial literacy.

| Sociological Factor | Impact on Absa Group | Key Data/Trend (2024/2025) |

|---|---|---|

| Demographics (Youthful Population) | Growing customer base, demand for digital services | Africa's under-25 population significant; Urban centers key growth areas. |

| Urbanization | Increased demand for accessible financial solutions | Accelerating across the continent, driving need for digital platforms. |

| Financial Inclusion & Literacy | Market expansion, customer acquisition | AFDB strategy aims to reach millions by 2025; Digital banking penetration growth in Sub-Saharan Africa. |

| Consumer Preferences | Shift towards digital and mobile-first banking | Smartphone penetration over 80% in South Africa (late 2024); Expectation of seamless digital interactions. |

| Income Inequality | Need for diverse product offerings, tailored solutions | High Gini coefficient in South Africa (approx. 0.63 in 2023); Balancing premium and accessible products. |

| Cultural Norms | Influence on product adoption and marketing strategy | Varying attitudes towards saving/debt; Reliance on informal credit in some regions. |

Technological factors

Digitalization is accelerating across Africa, with mobile phone penetration reaching an estimated 70% in key Absa markets by the end of 2024. This trend directly fuels Absa's ambition to be a digitally-led institution. The group is heavily investing in mobile banking, online platforms, and digital payment solutions to enhance customer experience and operational efficiency.

By focusing on these digital channels, Absa aims to not only improve customer interactions but also significantly reduce operational costs. This digital push is vital for expanding the bank's reach, particularly into underserved and remote areas where traditional branch networks are less prevalent. For instance, Absa's digital customer acquisition in South Africa saw a 25% year-on-year increase in early 2025.

Absa Group's digital transformation amplifies its exposure to cybersecurity threats, with the global cost of cybercrime projected to reach $10.5 trillion annually by 2025. Data breaches can lead to significant financial penalties and erosion of customer trust, making robust defenses critical.

In 2024, financial institutions like Absa are investing heavily in advanced cybersecurity solutions. For instance, many are adopting AI-driven threat detection systems, which can identify and neutralize sophisticated attacks in real-time, safeguarding sensitive customer data and maintaining operational continuity.

The rise of FinTech firms presents a dynamic challenge and a chance for Absa to collaborate. These agile companies often deliver niche, intuitive services, compelling established banks to either accelerate their own innovation or join forces with FinTechs to improve services and stay competitive.

In 2024, the FinTech sector continued its rapid expansion, with global investment in FinTech reaching an estimated $100 billion. This surge highlights the increasing demand for digital financial solutions, a trend Absa must navigate by either developing its own innovative offerings or strategically partnering with FinTech disruptors to leverage their technology and customer reach.

Investment in Emerging Technologies (AI, Blockchain)

Absa Group's capacity to harness emerging technologies like Artificial Intelligence (AI) and blockchain is crucial for its competitive edge. AI can significantly enhance personalized customer experiences, bolster fraud detection capabilities, and streamline internal operations, leading to greater efficiency. For instance, in 2024, many financial institutions reported substantial improvements in fraud detection rates, with some seeing reductions of up to 20% through AI-powered analytics.

Blockchain technology offers Absa the opportunity to secure transactions and increase transparency, which are paramount in the financial sector. By investing strategically in these advanced technologies, Absa can ensure its future competitiveness and elevate the quality of its services. The global blockchain in financial services market is projected to reach over $20 billion by 2025, indicating a significant opportunity for early adopters.

Key areas of technological focus for Absa include:

- AI-driven personalization: Tailoring financial products and advice to individual customer needs.

- Enhanced fraud detection: Utilizing AI algorithms to identify and prevent fraudulent activities in real-time.

- Blockchain for secure transactions: Implementing distributed ledger technology for faster, more transparent, and secure financial operations.

- Operational efficiency: Automating processes and improving data management through advanced technological solutions.

Infrastructure Development and Connectivity

The availability and reliability of digital infrastructure, like internet and mobile networks across Absa's key markets, are crucial for its digital banking services. For instance, in South Africa, mobile penetration reached approximately 93.9% by the end of 2023, providing a strong foundation for digital adoption. However, disparities in connectivity persist in rural areas, potentially limiting the reach of Absa's digital transformation initiatives.

Ongoing infrastructure development is a double-edged sword for Absa. While improved connectivity, such as the expansion of 5G networks, enables enhanced digital offerings and customer experiences, underdeveloped infrastructure in certain regions can create adoption barriers. This means Absa must strategically invest in and adapt its digital strategies to account for varying levels of technological readiness across its operating footprint.

Key infrastructure factors influencing Absa's operations include:

- Internet Penetration Rates: South Africa's fixed broadband penetration was around 15.3% in early 2024, indicating room for growth in digital service uptake.

- Mobile Network Coverage: High mobile penetration across many African nations offers significant potential for mobile banking solutions, a core focus for Absa.

- Data Costs: The affordability of mobile data directly impacts customer engagement with digital banking platforms.

- Technological Advancements: Investments in fiber optics and 5G infrastructure by telecom providers will further enable Absa's digital innovation.

Technological advancements are reshaping the banking landscape, with Absa Group strategically leveraging digitalization. By the close of 2024, mobile phone penetration in key Absa markets was projected to hit 70%, underscoring the potential for mobile banking. Absa's investment in digital platforms aims to boost customer experience and efficiency, with digital customer acquisition in South Africa seeing a 25% year-on-year rise in early 2025.

The group's digital push also heightens cybersecurity risks, as global cybercrime costs are expected to reach $10.5 trillion annually by 2025. To counter this, Absa is adopting AI-driven threat detection, a trend seen across the industry to safeguard data. Furthermore, the burgeoning FinTech sector, which attracted an estimated $100 billion in global investment in 2024, presents both a competitive challenge and an opportunity for strategic partnerships for Absa.

Absa's competitive edge hinges on adopting technologies like AI and blockchain. AI enhances customer personalization and fraud detection, with institutions reporting up to a 20% reduction in fraud through AI analytics in 2024. Blockchain offers enhanced security and transparency; the blockchain in financial services market is forecast to exceed $20 billion by 2025, signaling a significant growth area.

Digital infrastructure is paramount for Absa's services. While South Africa's mobile penetration reached approximately 93.9% by the end of 2023, disparities in rural connectivity remain a challenge. Absa must navigate these varying levels of technological readiness across its operations, balancing the opportunities presented by expanding 5G networks with the need to address infrastructure gaps.

Legal factors

Absa Group navigates a dynamic landscape of banking regulations across Africa, with key areas including capital adequacy, liquidity, and risk management. For instance, adherence to Basel III standards remains critical for maintaining financial stability and operational licenses. Failure to comply can result in significant penalties, impacting profitability and market reputation.

South Africa's Protection of Personal Information Act (POPIA) significantly shapes Absa's data handling practices, requiring robust consent mechanisms and strict data security. Similar evolving data privacy regulations across Absa's operating regions necessitate continuous adaptation of data management strategies to ensure compliance and safeguard customer information.

Failure to comply with these stringent data protection laws, which often carry substantial penalties, poses a direct financial and reputational risk. For instance, non-compliance with GDPR in Europe, a benchmark for many African regulations, can result in fines of up to 4% of global annual turnover, a significant consideration for a multinational like Absa.

Absa Group operates under stringent Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations, alongside evolving international sanctions regimes. These legal frameworks necessitate substantial investment in sophisticated detection and prevention systems to identify and halt illicit financial flows. Failure to comply can result in severe penalties, impacting both financial performance and brand integrity.

In 2024, the global financial sector continued to see increased regulatory scrutiny on AML/CTF compliance. For instance, South Africa, Absa's primary market, has been actively strengthening its AML/CTF framework, with the Financial Intelligence Centre Act (FICA) undergoing regular updates to align with international best practices like those from the Financial Action Task Force (FATF). Absa's commitment to robust compliance, therefore, is not just a legal obligation but a critical operational imperative for maintaining trust and market access.

Consumer Protection and Fair Lending Practices

Consumer protection laws are a significant legal factor for Absa Group. These regulations, such as those governing fair lending and debt collection, directly influence how Absa engages with its customer base, from setting interest rates to managing overdue accounts. Adherence to these rules is crucial for maintaining customer trust and avoiding costly litigation.

The regulatory landscape in 2024 and 2025 continues to emphasize transparency and consumer rights in financial services. For instance, in South Africa, the National Credit Act (NCA) sets strict guidelines on credit agreements, affordability assessments, and responsible lending. Absa, like other financial institutions, must ensure its practices align with these mandates to prevent accusations of predatory behavior.

Compliance with consumer protection frameworks is not merely a legal obligation but a strategic imperative. Failure to comply can lead to substantial fines and reputational damage. For example, in 2023, financial institutions globally faced increased scrutiny and penalties for non-compliance with consumer protection laws, underscoring the importance of robust internal controls and ethical conduct.

- Fair Lending Laws: Regulations like the NCA in South Africa mandate fair and transparent credit practices, impacting loan origination and pricing strategies.

- Debt Collection Regulations: Laws govern how Absa can pursue overdue payments, protecting consumers from harassment and unfair practices.

- Consumer Rights: Legislation empowers consumers with rights regarding disclosure, dispute resolution, and protection against unfair contract terms.

- Regulatory Scrutiny: Increased focus from bodies like the Financial Sector Conduct Authority (FSCA) in South Africa means continuous monitoring and potential enforcement actions for non-compliance.

Competition Law and Anti-Trust Regulations

Competition authorities across Absa's key operating markets, including South Africa, actively monitor the banking sector to curb monopolistic tendencies and encourage a level playing field. For instance, the Competition Commission in South Africa has historically investigated and fined banks for collusion, demonstrating a commitment to fair competition.

Absa Group must rigorously ensure its business strategies, including any proposed mergers or acquisitions, adhere strictly to prevailing anti-trust legislation. Failure to comply can result in significant penalties, reputational damage, and hinder the group's ability to operate effectively within a competitive financial environment.

- Regulatory Scrutiny: Absa faces ongoing oversight from competition authorities in its primary markets.

- Merger Compliance: All potential mergers and acquisitions must undergo thorough review to ensure they do not stifle competition.

- Fair Practice Mandate: The group is obligated to maintain business practices that promote fair competition within the financial services industry.

- Avoidance of Penalties: Adherence to anti-trust laws is crucial to prevent substantial fines and legal challenges.

Absa Group operates under a complex web of legal frameworks, including stringent capital adequacy and liquidity requirements dictated by international standards like Basel III, which are crucial for maintaining operational licenses and financial stability. In 2024, regulatory bodies globally, including South Africa's Prudential Authority, continued to emphasize robust risk management practices, with potential penalties for non-compliance remaining a significant deterrent.

Data privacy laws, such as South Africa's POPIA and similar regulations across Africa, mandate strict data handling protocols, requiring Absa to invest heavily in security and consent management to avoid substantial fines. For instance, non-compliance with GDPR-like regulations can incur penalties up to 4% of global annual turnover, a significant risk for a multinational entity.

Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations are paramount, with ongoing global efforts in 2024 to enhance compliance frameworks. South Africa's FICA, for example, is regularly updated to align with FATF recommendations, making robust AML/CTF systems a critical operational necessity for Absa to maintain trust and market access.

Consumer protection laws, such as South Africa's National Credit Act (NCA), dictate fair lending and debt collection practices, influencing Absa's customer engagement strategies. Failure to comply, as seen with global financial institutions facing increased scrutiny and penalties in 2023, can lead to significant fines and reputational damage.

Environmental factors

Climate change poses significant physical risks to Absa's loan portfolios, especially in sectors like agriculture and real estate that are susceptible to extreme weather events. For instance, increased frequency of droughts or floods could directly impact crop yields and property values, leading to higher default rates for Absa's clients.

Managing these evolving physical risks is critical for Absa's financial stability. The bank needs robust systems to assess potential losses arising from climate-related damage to collateral or reduced income streams for borrowers. This proactive risk management is essential to safeguard asset values and maintain a healthy balance sheet in the face of a changing climate.

Absa Group, like many financial institutions, is experiencing heightened investor scrutiny regarding its Environmental, Social, and Governance (ESG) performance. This translates into significant pressure to provide robust and transparent ESG reporting. For instance, by the end of 2024, global sustainable investment assets are projected to reach $50 trillion, underscoring the market's growing demand for companies with strong ESG credentials.

Demonstrating a clear commitment to sustainability is no longer optional; it's a critical factor in attracting responsible investment capital. Absa's ability to effectively communicate its ESG initiatives and performance data directly impacts its access to this expanding pool of capital and its overall reputation among a diverse stakeholder base.

Absa Group is actively participating in sustainability initiatives, including providing finance for renewable energy projects. For instance, in 2023, Absa committed R10 billion to renewable energy projects in South Africa, aiming to support the transition to a low-carbon economy. This focus on green finance not only addresses climate change concerns but also opens up new avenues for revenue generation.

The development and promotion of green finance products, such as green bonds and sustainable loans, are key strategies for Absa. These offerings cater to a growing segment of environmentally conscious clients and investors who prioritize ESG (Environmental, Social, and Governance) factors in their financial decisions. This strategic alignment with global sustainability trends positions Absa to attract and retain a valuable customer base.

Resource Scarcity and Operational Footprint

Resource scarcity, particularly concerning water and energy, directly influences Absa Group's operational expenses and long-term viability. Fluctuations in the availability and price of these essential resources can significantly affect profitability. For instance, rising global energy prices, a trend observed throughout 2024 and projected to continue into 2025, could increase Absa's energy bills across its branches and data centers.

Managing its own environmental footprint is paramount for Absa's operational efficiency and its commitment to corporate responsibility. This involves actively monitoring and reducing energy consumption and waste generation. Absa's 2023 sustainability report highlighted efforts to improve energy efficiency, aiming for a 10% reduction in Scope 1 and 2 emissions by 2025 compared to a 2020 baseline.

- Water Availability: Many of Absa's operating regions face increasing water stress, potentially impacting facilities and increasing water acquisition costs.

- Energy Costs: Global energy price volatility, influenced by geopolitical events and supply chain disruptions, directly affects Absa's operating budget.

- Operational Footprint: Absa's commitment to reducing its carbon footprint, including energy usage and waste, is crucial for both cost management and stakeholder perception.

- Renewable Energy Adoption: Investments in renewable energy sources for its operations are a key strategy to mitigate rising fossil fuel costs and environmental impact.

Reputational Risks from Environmental Practices

Public perception of Absa's environmental stewardship directly impacts its brand reputation and customer loyalty. Negative associations with environmentally harmful practices can erode trust and lead to customer attrition.

Absa's proactive engagement in sustainability initiatives is crucial for mitigating reputational risks. By actively promoting its commitment to environmental responsibility, the bank can cultivate a positive image and strengthen its brand equity.

- Brand Image: In 2024, surveys indicated that over 60% of banking customers consider a bank's environmental policies when making decisions.

- Customer Loyalty: Research from early 2025 suggests that customers are more likely to remain loyal to financial institutions demonstrating strong ESG (Environmental, Social, and Governance) performance.

- Investor Confidence: A positive environmental reputation can attract socially responsible investors, with ESG-focused funds managing an estimated $3.7 trillion globally as of late 2024.

- Regulatory Scrutiny: Increased public and regulatory focus on climate risk means that poor environmental practices could lead to greater compliance burdens and potential penalties for Absa.

Environmental factors significantly shape Absa Group's operating landscape, from physical risks like climate change impacting loan portfolios to resource scarcity affecting operational costs. The increasing global focus on sustainability and ESG performance means Absa must actively manage its environmental footprint and demonstrate commitment through initiatives like green finance, which aligns with growing investor demand for responsible investment capital. By late 2024, sustainable investment assets were projected to reach $50 trillion, highlighting the financial implications of strong environmental stewardship.

| Environmental Factor | Impact on Absa Group | Data/Trend (2024/2025) |

|---|---|---|

| Climate Change & Physical Risks | Increased default risk in agriculture and real estate due to extreme weather. | Frequency of droughts and floods impacting crop yields and property values. |

| Investor Scrutiny (ESG) | Pressure for robust ESG reporting and performance. | Global sustainable investment assets projected to reach $50 trillion by end of 2024. |

| Green Finance Initiatives | Revenue generation and attracting ESG-conscious clients. | Absa committed R10 billion to renewable energy projects in South Africa in 2023. |

| Resource Scarcity (Water/Energy) | Increased operational expenses and potential impact on profitability. | Rising global energy prices observed throughout 2024, impacting operational budgets. |

| Operational Footprint Reduction | Cost management and enhanced corporate responsibility. | Absa aimed for a 10% reduction in Scope 1 & 2 emissions by 2025 (vs. 2020 baseline). |

| Brand Reputation & Customer Loyalty | Impact on customer acquisition, retention, and overall brand equity. | Over 60% of banking customers consider environmental policies in 2024; customers increasingly loyal to ESG-performing banks in early 2025. |

PESTLE Analysis Data Sources

Absa Group's PESTLE Analysis draws on a robust foundation of data from official government publications, leading financial institutions like the IMF and World Bank, and reputable industry-specific research reports. This ensures that political, economic, social, technological, legal, and environmental insights are grounded in current and credible information.