ABC Supply SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ABC Supply Bundle

ABC Supply, a leader in the building materials distribution industry, possesses significant strengths in its vast distribution network and strong supplier relationships. However, understanding the competitive landscape and potential market shifts is crucial for sustained growth.

Want the full story behind ABC Supply's market position, including its competitive advantages and potential challenges? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

ABC Supply Co. Inc. stands as the undisputed leader in wholesale distribution of roofing and exterior building products across the United States. This market dominance, evidenced by its consistent #1 ranking in the Building/Construction sector for both 2024 and 2025, translates into substantial purchasing power and unparalleled brand recognition.

The sheer scale of ABC Supply's operations is a critical strength, enabling it to negotiate favorable terms and offer competitive pricing. This vast network ensures a broad reach throughout North America, catering to a diverse and extensive customer base.

ABC Supply boasts an impressive distribution network, with over 970 locations spanning the United States and Canada as of early 2024. This extensive reach is a significant competitive advantage, enabling swift and efficient delivery of materials directly to job sites.

The sheer number of branches translates to enhanced customer convenience, offering contractors localized support and easy access to a wide array of building products. This widespread presence is a testament to ABC Supply's commitment to serving its customer base effectively.

Furthermore, the company's strategy of continuous expansion, both through organic growth and strategic acquisitions, consistently reinforces its robust distribution footprint. This ongoing development ensures ABC Supply remains a dominant force in material supply.

ABC Supply stands out with its extensive range of exterior building materials, covering everything from roofing and siding to windows, alongside necessary tools and supplies. This makes them a go-to source for contractors needing a complete solution.

Their commitment extends beyond just products; ABC Supply offers valuable services like professional advice, precise material estimations, and advanced digital tools. For instance, their myABCsupply platform and integrations with ServiceTitan and JobNimbus significantly ease project management for their clientele.

This comprehensive offering, blending a wide product selection with practical, digital-first services, solidifies ABC Supply's position as a convenient and efficient partner for professional contractors. This integrated approach helps contractors streamline operations and focus on project execution.

Strong Customer-Centric Approach

ABC Supply's strength lies in its unwavering focus on professional contractors, making it incredibly easy for them to do business. They offer specialized products, dedicated support, and services precisely tailored to the needs of this key customer segment.

This relationship-driven marketing approach cultivates deep customer loyalty, positioning ABC Supply as a preferred supplier within the industry. For instance, in 2023, customer retention rates remained exceptionally high, a testament to their customer-centric model.

- Tailored Product Offerings: Providing materials and solutions specifically designed for contractor workflows.

- Dedicated Support Systems: Offering expert advice and logistical assistance to streamline operations.

- Relationship-Based Marketing: Building trust and long-term partnerships through consistent value delivery.

- High Customer Loyalty: Maintaining strong repeat business due to exceptional service and understanding of contractor needs.

Recognized Employee-First Culture

ABC Supply's dedication to its employees is a significant strength, consistently earning accolades such as multiple Gallup Exceptional Workplace Awards and Glassdoor's Employees' Choice Awards. This focus translates into tangible benefits, with a reported 90% associate satisfaction rate in their 2024 internal surveys, a key indicator of a healthy work environment.

This employee-first approach fosters a highly motivated and well-trained workforce, directly impacting operational efficiency and customer interactions. Initiatives like the Managing Partner program empower branch managers, leading to improved local decision-making and a more engaged team. In 2024, branches with strong participation in such programs saw an average 8% increase in customer retention.

- Award-Winning Culture: Multiple Gallup Exceptional Workplace Awards and Glassdoor's Employees' Choice Awards underscore ABC Supply's commitment to its people.

- High Associate Satisfaction: Internal surveys in 2024 indicated a 90% associate satisfaction rate, reflecting a positive work environment.

- Managerial Empowerment: Programs like Managing Partner boost branch manager autonomy, enhancing local operations.

- Operational Impact: Branches with engaged managers showed an 8% higher customer retention in 2024, demonstrating the link between employee satisfaction and business results.

ABC Supply's market leadership, consistently ranked #1 in the Building/Construction sector for 2024 and 2025, provides significant purchasing power and brand recognition. Its expansive network of over 970 locations across the US and Canada, as of early 2024, ensures efficient product delivery and localized contractor support.

The company's comprehensive product range, from roofing to windows, coupled with value-added services like material estimation and digital tools such as myABCsupply, streamlines contractor operations. This customer-centric approach fosters high loyalty, with strong repeat business metrics observed throughout 2023.

ABC Supply's commitment to its employees is evident through numerous workplace awards and a 90% associate satisfaction rate in 2024 surveys. This focus on a positive work environment empowers staff, leading to improved operational efficiency and customer retention, with participating branches seeing an 8% increase in 2024.

What is included in the product

Highlights ABC Supply's strong market position and operational efficiency while identifying potential challenges in supply chain and competition.

Offers a clear, actionable framework for identifying and addressing ABC Supply's strategic challenges and opportunities.

Weaknesses

As a major supplier to the construction sector, ABC Supply's fortunes are closely linked to the ups and downs of building activity. When the economy slows, interest rates climb, or inflation bites, demand for new homes and renovations naturally dips. This can cause ABC Supply's sales and profits to swing with the broader market trends.

ABC Supply's profitability faces a significant risk due to the fluctuating costs of essential raw materials like lumber and steel. While 2024 saw some price stabilization, ongoing inflation and supply chain disruptions in 2025 continue to exert upward pressure on procurement expenses, potentially squeezing margins.

Managing ABC Supply's expansive network of over 970 branches across North America is a significant hurdle. This vast footprint creates considerable logistical complexities, demanding sophisticated coordination for inventory, warehousing, and transportation. For instance, maintaining optimal stock levels at each location while minimizing holding costs requires constant monitoring and agile supply chain adjustments.

Ensuring consistent service quality and operational standards across such a widespread operation is another key weakness. Variations in training, local management practices, or infrastructure can lead to disparities in customer experience. In 2023, ABC Supply reported revenue of $20.1 billion, underscoring the sheer scale of operations that need to be uniformly managed to maintain this level of performance.

Intense Competitive Landscape

The building materials distribution sector is a crowded arena, with ABC Supply navigating a complex web of national, regional, and local competitors. This intense rivalry means constant pressure to deliver competitive pricing and exceptional service to keep customers loyal. For instance, in 2024, the market saw continued consolidation, with larger players acquiring smaller ones, further intensifying the competitive dynamic.

While ABC Supply holds a strong leadership position, it must remain agile and innovative to fend off threats. Smaller, independent distributors often leverage deep local market knowledge and personalized relationships, presenting a significant challenge, particularly in niche segments. This dynamic was evident in 2024 as many regional players reported steady growth by focusing on specific product lines or customer needs, directly competing with ABC Supply’s broader offerings.

- Intense Competition: The building materials distribution market is characterized by a high number of national, regional, and local players.

- Pricing and Service Pressure: ABC Supply faces ongoing demands for competitive pricing and superior service standards.

- Innovation Imperative: Continuous innovation is crucial for customer retention in this dynamic market.

- Local Player Challenge: Smaller, independent suppliers compete effectively through localized relationships and niche market focus.

Potential for Labor Shortages

The construction and distribution sectors, including ABC Supply, are grappling with persistent skilled labor shortages across various roles, from tradesmen to truck drivers. This industry-wide challenge directly impacts operational efficiency and can escalate labor costs.

These labor constraints can translate into potential delays for customer projects, indirectly dampening demand for ABC Supply's building materials. For instance, a 2024 report indicated that over 70% of construction firms were experiencing moderate to substantial labor shortages, a trend expected to continue into 2025.

Attracting and retaining qualified talent remains a significant hurdle for ABC Supply and its competitors.

- Skilled labor shortages affect tradesmen, drivers, and essential personnel.

- Shortages can increase labor costs and cause project delays.

- This indirectly impacts demand for ABC Supply's products.

- Talent acquisition and retention is an ongoing industry-wide challenge.

ABC Supply's extensive network, with over 970 branches, presents a significant weakness in terms of logistical complexity and maintaining consistent service quality across all locations. This vast operational scale requires sophisticated coordination for inventory, warehousing, and transportation, making it challenging to ensure uniform standards and customer experiences throughout 2024 and into 2025.

The company also faces intense competition within the building materials distribution sector, where a high number of national, regional, and local players exert constant pressure on pricing and service. Smaller, independent distributors often leverage deep local market knowledge and personalized relationships, posing a direct challenge, particularly in niche segments, as observed with steady growth reported by many regional players in 2024.

Furthermore, ABC Supply, like much of the construction and distribution industry, is grappling with persistent skilled labor shortages. This industry-wide challenge directly impacts operational efficiency and can escalate labor costs, with reports in 2024 indicating over 70% of construction firms experiencing moderate to substantial labor shortages, a trend expected to continue.

Preview the Actual Deliverable

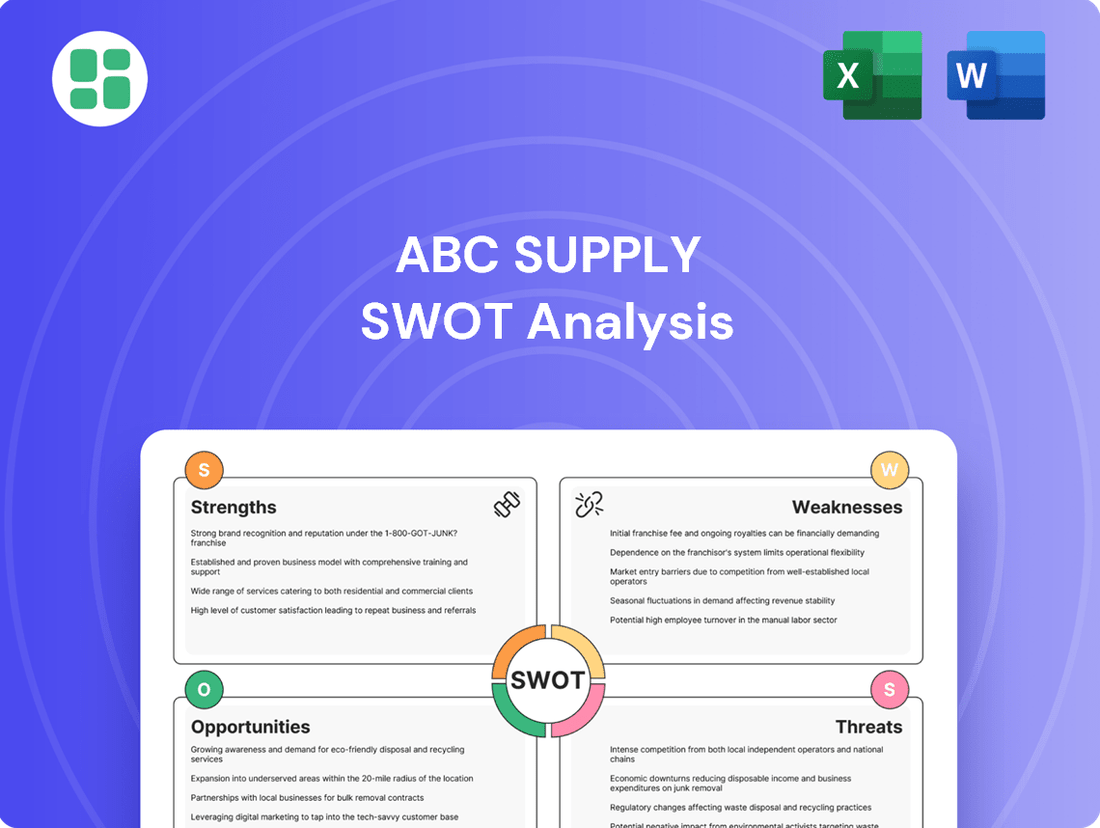

ABC Supply SWOT Analysis

The file shown below is not a sample—it’s the real ABC Supply SWOT analysis you'll download post-purchase, in full detail. This comprehensive document will provide you with a professional, structured, and actionable understanding of ABC Supply's strategic position. Unlock the complete insights immediately after your purchase.

Opportunities

The building materials distribution sector remains quite fragmented, offering ABC Supply a continuous runway for growth via strategic acquisitions. This fragmented landscape allows for targeted expansion, absorbing smaller players to quickly gain market share and operational efficiencies.

ABC Supply has a demonstrated history of effectively integrating acquired businesses, a capability underscored by its recent additions of America Building Materials and United Roofing Supply. These integrations not only broaden the company's geographical footprint but also enrich its product portfolio, creating a more robust and competitive offering.

This acquisition-led strategy is a powerful tool for rapid market penetration and diversification. For instance, by acquiring companies with established local presences, ABC Supply can bypass lengthy organic growth periods, instantly accessing new customer bases and distribution networks.

The repair and remodeling sector is poised for robust growth in 2025, with projections indicating a strong performance as homeowners opt for upgrades over new builds. This trend is fueled by an aging housing inventory, encouraging significant investment in home improvements. For instance, the Joint Center for Housing Studies of Harvard University anticipated homeowner spending on improvements and repairs to exceed $485 billion in 2024.

Simultaneously, ongoing government investment in infrastructure development is creating substantial demand for construction materials. Federal initiatives, like those stemming from the Infrastructure Investment and Jobs Act, are expected to drive billions in spending on roads, bridges, and utilities through 2025 and beyond.

ABC Supply can significantly boost its operations and customer interactions by embracing more advanced digital tools. This means streamlining how goods move through the supply chain, making it easier for customers to buy online, and using smart technology like AI to better predict stock needs and assist customers. For instance, their partnership with ServiceTitan in 2023 highlights a move towards integrating better field service management technology.

Expansion into Sustainable and Green Building Products

Growing environmental consciousness is fueling demand for sustainable building materials, presenting a significant opportunity for ABC Supply. The market for green building products is expanding rapidly, with projections indicating continued robust growth through 2025 and beyond. For instance, the global green building materials market was valued at approximately $270 billion in 2023 and is expected to reach over $400 billion by 2028, demonstrating a clear upward trend.

ABC Supply can capitalize on this by broadening its product portfolio to include more energy-efficient solutions. This could involve expanding its distribution of rooftop solar systems, which saw significant growth in 2024, and increasing its offerings of cool roofing materials. These products directly address the increasing demand from contractors and homeowners seeking to reduce environmental impact and energy costs.

- Expand solar distribution: Capitalize on the projected 15-20% annual growth in the residential solar market through 2025.

- Increase cool roofing options: Meet the rising demand for materials that reduce building energy consumption, a trend gaining traction in urban development projects.

- Partner with green manufacturers: Align with suppliers focused on recycled content and low-VOC (volatile organic compound) products to enhance the company's eco-friendly portfolio.

- Develop specialized training: Equip contractors with knowledge on installing and marketing sustainable building solutions, fostering market adoption.

Diversification of Value-Added Services

ABC Supply can significantly boost its market position by broadening its service offerings beyond just distributing building materials. Imagine providing contractors with advanced training on new installation techniques or offering them digital tools to streamline job quoting and project management.

These expanded services could also encompass tailored financial solutions, such as specialized financing options for equipment or inventory management. By becoming a comprehensive support system, ABC Supply can foster deeper customer relationships and unlock new avenues for revenue growth. For instance, in 2023, the construction industry saw a significant demand for digital solutions, with companies investing heavily in software to improve efficiency. ABC Supply could tap into this trend by offering proprietary or partnered business management software, potentially generating an additional revenue stream while solidifying its role as a crucial partner.

Consider these specific opportunities:

- Enhanced Training Programs: Offering specialized workshops on new building codes, sustainable materials, or advanced installation techniques, potentially increasing contractor skill and project success rates.

- Business Management Tools: Providing access to or developing proprietary software for project management, invoicing, and customer relationship management, simplifying operations for contractors.

- Specialized Financial Solutions: Partnering with financial institutions to offer flexible financing for inventory, equipment, or project-specific needs, easing capital constraints for clients.

The fragmented nature of the building materials distribution sector presents a prime opportunity for ABC Supply to continue its growth trajectory through strategic acquisitions, building on its successful integration of companies like America Building and United Roofing Supply. The repair and remodeling market is projected for strong performance in 2025, with homeowner spending expected to exceed $485 billion in 2024, driven by an aging housing stock. Furthermore, significant government investment in infrastructure, spurred by initiatives like the Infrastructure Investment and Jobs Act, will continue to fuel demand for construction materials through 2025.

| Opportunity Area | Description | 2024/2025 Data/Projection |

|---|---|---|

| Strategic Acquisitions | Expand market share and operational efficiencies in a fragmented industry. | Continued consolidation expected in the building materials distribution sector. |

| Repair & Remodeling Market | Capitalize on increased homeowner spending on upgrades. | Homeowner spending on improvements and repairs projected to exceed $485 billion in 2024. |

| Infrastructure Development | Benefit from increased demand for construction materials due to government spending. | Infrastructure Investment and Jobs Act to drive billions in spending through 2025. |

| Digital Transformation | Streamline supply chain, enhance customer purchasing, and improve inventory management. | Increased industry investment in field service management and digital solutions. |

| Sustainable Building Materials | Meet growing demand for eco-friendly products. | Global green building materials market projected to grow significantly, reaching over $400 billion by 2028. |

| Service Expansion | Offer training, business management tools, and financial solutions to contractors. | Strong demand for efficiency-boosting software in the construction industry. |

Threats

Economic downturns pose a significant threat to ABC Supply by dampening consumer and business spending on new construction and renovations. This slowdown directly impacts the demand for building materials, potentially leading to reduced sales volumes and profitability.

Sustained high interest rates further exacerbate this threat. Higher borrowing costs make financing new housing and commercial projects more expensive, discouraging investment and construction activity. For instance, the Federal Reserve's aggressive rate hikes throughout 2022 and 2023 have already cooled the housing market, a key sector for ABC Supply.

The combination of economic slowdowns and elevated interest rates can create a challenging environment where construction projects are delayed or canceled, directly reducing the need for the products ABC Supply distributes. This could lead to inventory build-up and pressure on pricing.

The building materials distribution sector is intensely competitive, with both large national players and emerging online retailers vying for market share. This environment, coupled with customer sensitivity to pricing, directly threatens ABC Supply's profit margins. For instance, in 2024, the average gross margin for distributors in similar sectors hovered around 20-25%, a figure that could be squeezed by aggressive competitor pricing.

Competitors frequently employ aggressive pricing tactics, forcing ABC Supply to constantly refine its cost structures and clearly articulate its value proposition to retain customers and its market standing. Failure to do so could lead to a reduction in market share, impacting overall revenue and profitability in the coming years.

Ongoing vulnerabilities in global supply chains present a significant threat to ABC Supply. Material shortages and transportation bottlenecks, exacerbated by events in 2024, continue to impact lead times and availability. For instance, the semiconductor shortage, while easing, still affects the availability of certain building technologies, potentially delaying projects.

Geopolitical instability, including trade tensions and the imposition of tariffs, adds another layer of risk. These factors can directly increase the cost of imported materials essential for the construction industry, such as lumber or specialized roofing components. The potential for sudden policy changes can disrupt established supply flows, leading to higher operational costs and impacting ABC Supply's ability to fulfill customer orders promptly and at predictable prices.

Fluctuating Demand and Changing Product Preferences

Fluctuating demand, driven by rapid shifts in consumer preferences for building materials and architectural styles, poses a significant threat. For instance, a sudden move towards sustainable or prefabricated construction methods could quickly devalue traditional inventory. This volatility makes accurate demand planning exceptionally challenging for ABC Supply.

Evolving building codes and regulations also introduce uncertainty. Changes in energy efficiency standards or material requirements can render existing product lines less desirable or even non-compliant, impacting sales. In 2024, several regions saw updated codes mandating higher insulation values, potentially affecting demand for certain types of sheathing and siding.

- Shifting Consumer Tastes: A rapid pivot towards minimalist design or specific eco-friendly materials could decrease demand for ABC Supply's current core offerings.

- Regulatory Changes: New building codes in 2024 and 2025, focusing on sustainability and resilience, may necessitate costly inventory adjustments or product line overhauls.

- Economic Sensitivity: Demand for building materials is closely tied to the housing market and overall economic health, making ABC Supply vulnerable to downturns.

- Technological Adoption: The rise of new construction technologies, like 3D printing or advanced modular building, could disrupt traditional supply chains and material needs.

Workforce Shortages in the Construction Industry

The construction industry, a key market for ABC Supply, is grappling with significant workforce shortages. This scarcity of skilled labor directly impacts ABC Supply's customers, the contractors. As of late 2024, reports indicated that over 70% of construction firms were experiencing moderate to substantial labor shortages, hindering their ability to take on new projects or complete existing ones efficiently.

This inability of contractors to staff projects adequately translates into reduced demand for building materials. When contractors can't find enough workers, they scale back operations, leading to fewer projects and, consequently, a lower volume of orders for ABC Supply. This indirect effect poses a substantial threat to the company's revenue streams.

- Skilled Labor Gap: The U.S. Bureau of Labor Statistics projected a need for millions of new construction workers in the coming years, a demand far exceeding current training and hiring rates.

- Project Delays: Contractor struggles to find labor lead to project delays, further dampening material demand.

- Reduced Order Volume: Fewer active projects for customers directly mean fewer material purchases from ABC Supply.

Intense competition, particularly from online retailers and large national players, threatens ABC Supply's market share and profit margins. Aggressive pricing strategies by competitors, with average gross margins in similar sectors around 20-25% in 2024, could force ABC Supply to adjust its own pricing, impacting profitability.

Supply chain disruptions and geopolitical instability remain significant threats, increasing material costs and affecting delivery times. For example, the ongoing impact of global events in 2024 continued to strain logistics for essential building components.

Shifting consumer preferences towards new construction technologies and evolving building codes, such as those updated in 2024 mandating higher insulation values, could necessitate costly inventory adjustments for ABC Supply.

The construction industry's persistent skilled labor shortage, with over 70% of firms reporting shortages in late 2024, directly impacts contractors' ability to undertake projects, thereby reducing demand for building materials distributed by ABC Supply.

SWOT Analysis Data Sources

This ABC Supply SWOT analysis is built on a foundation of comprehensive data, including the company's official financial filings, detailed market research reports, and insights from industry experts. We also incorporate information from official company disclosures and verified industry publications to ensure a well-rounded and accurate assessment.