ABC Supply Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ABC Supply Bundle

Curious about ABC Supply's strategic product positioning? This glimpse into their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. Unlock the full potential of this analysis by purchasing the complete report for actionable insights and a clear path to optimizing your product portfolio.

Stars

ABC Supply is making significant strides in the solar roofing sector, offering a comprehensive suite of products like solar panels, racking, inverters, and integrated solar shingles. This strategic move taps into a rapidly expanding market fueled by the global push for renewable energy and eco-friendly construction. In 2024, the solar energy market continued its upward trajectory, with installations projected to reach new heights, indicating strong demand for integrated solutions.

By combining solar offerings with their established roofing materials, ABC Supply is positioning itself as a one-stop shop for contractors. This approach simplifies the supply chain, allowing builders to source all necessary components from a single, reliable provider. This integration is crucial in a market where efficiency and convenience are paramount for contractors.

The market for advanced sustainable building materials is experiencing robust growth, with demand surging ahead of the general construction sector. This trend is driven by increasing consumer awareness and stricter environmental regulations. For instance, the global green building materials market was valued at approximately $250 billion in 2023 and is projected to reach over $450 billion by 2030, showcasing a compound annual growth rate of over 8%.

ABC Supply is well-positioned to capitalize on this expansion with its range of sustainable products. Their offerings, including energy-efficient metal roofing, durable composite shingles, and advanced high-performance windows, directly address the growing need for environmentally responsible construction solutions. These materials not only reduce a building's carbon footprint but also offer long-term cost savings through improved insulation and reduced maintenance.

ABC Supply's strategic partnerships with platforms like ServiceTitan and RoofIT CRM are a key driver of its growth. These collaborations offer contractors real-time pricing and efficient order management, streamlining operations. This digital integration is crucial for capturing market share in a transforming construction supply chain.

Expansion into New, Growing Geographic Markets

ABC Supply is actively pursuing expansion into new, growing geographic markets, a key strategy for maintaining its robust market share. This involves identifying and entering regions with significant development potential or those that have been historically underserved by its extensive distribution network.

A prime example of this strategy in action was the acquisition of America Building Materials in Los Angeles in August 2024. This move directly supports ABC Supply's objective to replicate its high-market-share model in these burgeoning territories. The Los Angeles market, with its significant construction activity, presents a prime opportunity for growth.

These strategic expansions are designed to leverage ABC Supply's established operational efficiencies and market leadership. By entering areas experiencing increased construction demand, the company can effectively capture new revenue streams and solidify its overall market dominance. This approach is crucial for sustained growth and competitive advantage in the building materials sector.

- Strategic Acquisitions: Focused on acquiring companies in rapidly developing or underserved regions.

- Market Replication: Aiming to implement its high-market-share model in new territories.

- Leveraging Existing Strengths: Utilizing established distribution networks and market leadership.

- Capturing New Revenue: Targeting areas with increased construction activity to drive revenue growth.

Specialized Commercial Roofing Systems

While traditional roofing might be a steady performer, specialized commercial roofing systems, especially for flat roofs using materials like TPO and EPDM, are really taking off. This growth is fueled by a busy commercial construction sector and a strong push for buildings that save energy. ABC Supply, with its vast stock and know-how in these advanced systems, is well-positioned to keep a significant slice of this growing market.

The company's capacity to handle large commercial projects is a key advantage, cementing its leadership in this high-growth area. For instance, the commercial construction market in the US saw significant activity in 2024, with reports indicating a steady increase in non-residential building permits, directly impacting demand for these specialized roofing solutions. ABC Supply's focus on these materials and project types aligns perfectly with current market trends.

- Market Growth: Specialized commercial roofing, particularly TPO and EPDM, is a key growth driver, outpacing traditional roofing segments.

- Energy Efficiency Demand: Increased focus on energy-efficient buildings directly boosts demand for modern flat roofing materials.

- ABC Supply's Position: Extensive inventory and expertise in complex systems allow ABC Supply to capture a substantial market share.

- Commercial Construction Impact: Robust commercial construction activity in 2024 directly translates to higher demand for ABC Supply's specialized offerings.

Stars in the BCG Matrix represent business units with high market share in high-growth industries. ABC Supply's solar roofing offerings fit this description perfectly, capitalizing on the booming renewable energy sector. The company's ability to provide integrated solutions, from panels to shingles, positions it as a leader in this expanding market.

The solar energy market's rapid expansion, with global installations continuing to climb in 2024, underscores the 'star' potential of ABC Supply's solar roofing division. This segment benefits from strong demand driven by environmental initiatives and technological advancements in energy efficiency.

By combining solar products with their existing roofing materials, ABC Supply creates a compelling value proposition for contractors, simplifying procurement and enhancing project efficiency. This strategic integration is key to solidifying their leadership in this high-growth, high-potential market segment.

The company's proactive approach to expanding into new geographic markets, exemplified by the August 2024 acquisition in Los Angeles, further reinforces its 'star' status. This expansion aims to replicate its success in high-growth regions, ensuring continued market leadership.

What is included in the product

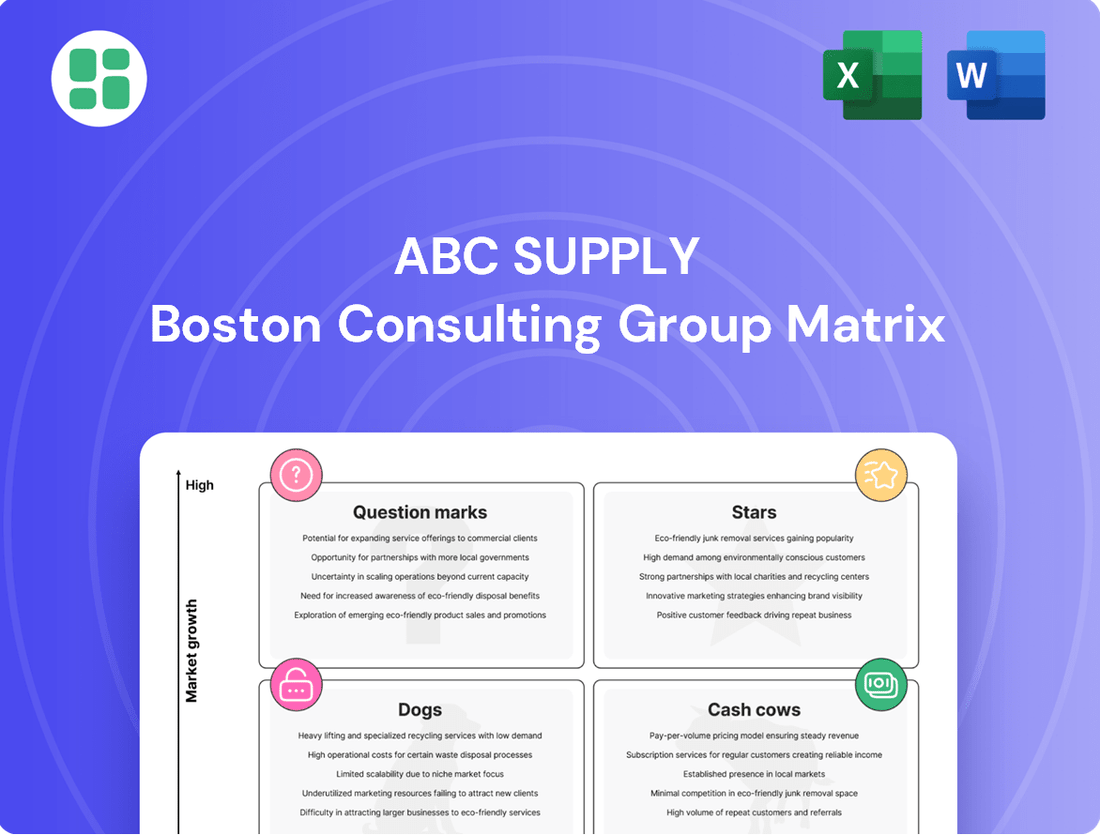

Analysis of ABC Supply's product portfolio using the BCG Matrix to identify Stars, Cash Cows, Question Marks, and Dogs.

Strategic recommendations for investing in, holding, or divesting ABC Supply's business units based on their market position.

The ABC Supply BCG Matrix provides a clear, one-page overview, instantly relieving the pain of strategic uncertainty by showing where each business unit stands.

Cash Cows

ABC Supply's traditional residential roofing materials, primarily asphalt shingles, represent a classic Cash Cow. This segment benefits from a mature but stable market, driven by consistent demand for repairs and replacements in the vast existing housing stock, alongside new construction projects.

The ongoing need for maintenance and upgrades in this sector ensures a reliable and substantial cash flow. For instance, the U.S. residential roofing market alone is substantial, with asphalt shingles dominating a significant portion of this. The industry's projected growth, around 6.6% annually in the U.S. through 2028, means this business line will continue to be a strong performer without needing major capital injections.

Standard siding and exterior cladding, encompassing materials like vinyl and fiber cement, are a significant cash cow for ABC Supply. This segment serves a mature market where demand for both new construction and renovations remains steady. In 2024, the residential construction market, a key driver for siding, saw continued activity, with housing starts projected to remain robust, contributing to consistent sales for ABC Supply's traditional offerings.

The replacement windows and doors market, especially in older neighborhoods, offers ABC Supply a dependable income. In 2024, the U.S. housing market saw continued demand for renovations, with the home improvement sector expected to grow moderately. ABC Supply’s extensive product range and strong ties with contractors in this area contribute to its significant market share, ensuring steady cash flow.

Established Branch Network Operations

ABC Supply's extensive network, boasting over 1,000 branches in the U.S. and Canada, operates as a significant cash cow within its business portfolio. These established locations benefit from economies of scale and well-developed logistics, consistently generating substantial profits from their established product lines.

The mature nature of this segment, characterized by limited expansion and high operational efficiency, means these branches generate more cash than they require for ongoing operations. This surplus cash flow is crucial for funding other strategic initiatives and investments within ABC Supply.

- Established Network: Over 1,000 branches across the U.S. and Canada.

- Profitability Driver: Leverages economies of scale and efficient logistics for consistent profits.

- Cash Generation: Produces more cash than consumed due to low growth and high efficiency.

- Strategic Funding: Surplus cash supports other business ventures and investments.

Basic Contractor Tools and Supplies

The distribution of basic contractor tools and supplies, including fasteners and general installation materials, represents a significant Cash Cow for ABC Supply. This segment holds a high market share due to its essential nature for roofing, siding, and window contractors.

These products are akin to commodities, experiencing steady demand from ABC Supply's core customer base. This consistent purchasing behavior generates predictable, though typically lower-margin, cash flow for the company.

ABC Supply's extensive branch network provides contractors with the convenience of one-stop shopping for these necessary items, reinforcing their loyalty and repeat business.

- High Market Share: ABC Supply dominates the market for essential contractor tools and supplies.

- Consistent Demand: Contractors rely on these products for daily operations, ensuring steady sales.

- Stable Cash Flow: The predictable nature of these sales contributes reliably to ABC Supply's revenue.

- Customer Loyalty: One-stop shopping convenience fosters strong relationships with the contractor base.

ABC Supply's established distribution network, encompassing over 1,000 branches, functions as a significant cash cow. This extensive footprint leverages economies of scale and optimized logistics, consistently generating substantial profits from its core product lines.

These mature business lines require minimal reinvestment for growth, allowing them to produce more cash than they consume. This surplus cash is vital for funding other strategic ventures within ABC Supply.

In 2024, the company's consistent operational efficiency across this network ensured a reliable stream of surplus capital, reinforcing its position as a stable revenue generator.

| Business Segment | Market Maturity | Cash Flow Generation | Growth Potential | Strategic Role |

|---|---|---|---|---|

| Residential Roofing Materials | Mature, Stable | High, Consistent | Low | Cash Cow |

| Standard Siding & Cladding | Mature, Steady | High, Reliable | Low | Cash Cow |

| Replacement Windows & Doors | Mature, Dependable | High, Predictable | Low | Cash Cow |

| Contractor Tools & Supplies | Mature, Essential | High, Stable | Low | Cash Cow |

| Distribution Network (Branches) | Mature, Efficient | Very High, Surplus | Low | Cash Cow |

What You’re Viewing Is Included

ABC Supply BCG Matrix

The ABC Supply BCG Matrix preview you see is the identical, fully formatted report you will receive immediately after purchase. This means no watermarks or sample data, just a professional, analysis-ready document designed to provide clear strategic insights into ABC Supply's product portfolio.

Dogs

Certain traditional or highly specialized building materials, like reclaimed timber or specific types of slate roofing, can fall into the Dogs category. These often have a limited market appeal and diminishing demand as newer, more efficient, or aesthetically preferred alternatives gain traction.

For instance, while some niche markets still value traditional materials, their overall demand might be low. In 2023, the market for certain vintage building components saw a slight uptick driven by historical restoration projects, but overall sales remained a fraction of mainstream materials, contributing minimally to overall revenue for distributors like ABC Supply.

ABC Supply would likely maintain these materials only to service a very small, specific client base. This can lead to disproportionate inventory management costs relative to the minimal revenue generated, making them a prime candidate for a Dogs classification within a portfolio.

Underperforming remote branches in stagnant or declining regional markets, or those failing to capture local market share, would be classified as Dogs in ABC Supply's BCG Matrix. These locations often break even or operate at a loss, consuming valuable resources without contributing significantly to the company's profitability or strategic expansion. For instance, if a remote branch in a region with a projected -2% annual market growth rate only achieved a 1% market share after a $500,000 investment in 2023, it would likely fall into this category.

Discontinued or low-demand product SKUs are the Dogs in ABC Supply's BCG Matrix. These are specific items, like older model roofing shingles or outdated window frames, that contractors and homeowners are no longer actively seeking. This decline in demand can stem from evolving building trends, new energy-efficient technologies, or stricter building codes.

These products typically exhibit very low sales volumes and hold a minimal share of the market. For ABC Supply, this means capital is tied up in inventory that isn't moving, and valuable warehouse space is being occupied by items that are unlikely to sell. In 2023, the building materials industry saw a shift towards sustainable and smart home technologies, further marginalizing older product lines.

The strategy for these Dog SKUs is to aggressively minimize existing inventory, perhaps through clearance sales or bulk liquidations. Ultimately, ABC Supply aims to phase out these products entirely to free up resources and focus on more profitable and in-demand offerings. This proactive approach helps maintain operational efficiency and capital liquidity.

Non-Core, Legacy Service Offerings

Non-core, legacy service offerings at ABC Supply might include historically provided services that are no longer aligned with current market demands or the company's strategic focus. These could be services with declining customer interest or those that are difficult to scale efficiently in today's competitive landscape. For instance, if ABC Supply once offered extensive custom fabrication services that have since been largely automated or outsourced by competitors, these might fall into this category. In 2024, companies like ABC Supply are increasingly focusing on their core distribution and supply chain efficiencies, making older, less profitable service lines a potential drain on resources.

These legacy services often exhibit low utilization rates and consequently, low profitability. They can tie up valuable staff time and operational resources that could be better allocated to more promising areas of the business. A key characteristic is their lack of a significant strategic advantage; they don't contribute to market leadership or innovation. For example, a service that required significant manual labor and specialized, outdated equipment would likely struggle to compete on cost or speed with modern alternatives, leading to minimal revenue generation and potentially negative margins.

The evaluation of these non-core offerings is critical for optimizing resource allocation and enhancing overall business performance. ABC Supply, like many large distributors, must periodically assess its portfolio to identify services that no longer contribute meaningfully to its growth objectives. This often involves a rigorous analysis of:

- Revenue contribution: Assessing the actual income generated by the legacy service.

- Profitability: Calculating the net profit after accounting for all associated costs.

- Resource intensity: Determining the staff time, equipment, and overhead consumed.

- Market relevance: Evaluating current and future demand for the service.

Highly Volatile Commodity Products

Highly volatile commodity products, characterized by fluctuating prices and a fragmented market with low barriers to entry for new suppliers, present a unique challenge within the ABC Supply BCG Matrix. If ABC Supply holds a low market share in these segments, they might be classified as potential question marks or even dogs, depending on their growth prospects and profitability.

For instance, consider the market for certain raw lumber or specialized metal components. In 2024, lumber prices saw significant swings, with futures contracts for framing lumber experiencing volatility driven by factors like housing market demand and supply chain disruptions. A company like ABC Supply, with a broad distribution network, might find it difficult to establish a dominant position or consistent profitability in such unpredictable markets. The effort required to manage these products, from sourcing to inventory control, could outweigh the returns, especially if ABC Supply cannot leverage economies of scale or secure favorable long-term contracts.

- Volatile Pricing: Building materials like lumber and certain metals experienced significant price fluctuations in 2024, impacting profitability.

- Fragmented Market: Easy entry for small suppliers in these commodity product markets leads to a fragmented competitive landscape.

- Strategic Consideration: ABC Supply should evaluate if its market share in these volatile segments justifies the resources allocated, especially if competitive advantages are limited.

- Resource Allocation: Managing highly unstable commodities may consume disproportionate resources relative to the achievable, consistent returns.

Dogs in ABC Supply's portfolio represent products, services, or business units with low market share and low growth potential. These are often legacy items or underperforming segments that consume resources without generating significant returns. For example, discontinued product SKUs, like older roofing shingle models, are prime examples, exhibiting minimal sales volume and tying up capital in inventory. In 2023, the building materials sector saw a trend towards sustainable technologies, further marginalizing older product lines.

Strategically, ABC Supply aims to phase out these Dog offerings to free up resources and enhance operational efficiency. This might involve aggressive inventory clearance or liquidation to minimize losses. The goal is to reallocate capital and focus on more profitable and in-demand segments of the market.

Underperforming remote branches in stagnant markets also fall into the Dogs category. These locations often break even or operate at a loss, consuming valuable resources without contributing significantly to overall profitability. For instance, a branch in a region with a negative market growth rate that fails to capture substantial local market share would be classified as a Dog.

Non-core, legacy service offerings that no longer align with market demands or the company's strategic focus also fit the Dog classification. These services typically have low utilization rates and profitability, potentially tying up staff time and operational resources. In 2024, ABC Supply's focus on core distribution efficiencies makes these less profitable service lines a potential drain.

Question Marks

Smart home exterior integration products, like dynamic tinting windows or sensor-embedded siding, are a burgeoning sector. For ABC Supply, these represent a high-growth opportunity, though current market penetration may be limited. The smart home market, valued at over $100 billion globally in 2023, is projected to grow significantly, with exterior integrations capturing a rising share.

ABC Supply's potential in specialized green building certifications like LEED and ENERGY STAR represents a question mark in the BCG matrix. While they distribute sustainable materials, offering direct consulting services in this niche could capture a growing market where their current share is minimal. This strategic move aligns with increasing demand for eco-friendly construction, a trend projected to see significant growth in the coming years.

Expanding ABC Supply into a wider array of interior building products, where their current distribution and brand strength are less established, would position these new ventures as Question Marks in the BCG Matrix. This segment, while offering considerable growth prospects, is also highly competitive, demanding significant capital investment to carve out a meaningful market presence against entrenched competitors.

The U.S. interior building products market is substantial, with estimates for 2024 suggesting continued growth, driven by both new construction and renovation projects. For example, the flooring segment alone is projected to reach tens of billions in revenue, and kitchen and bath remodeling continues to be a strong driver of interior product sales.

Successfully entering and scaling in these interior product categories would require ABC Supply to build new supplier relationships, develop specialized sales and marketing strategies, and potentially acquire existing players to accelerate market penetration. The challenge lies in replicating their success in exterior products within a different, and arguably more fragmented, market landscape.

Advanced Pre-Fabricated or Modular Construction Materials

The pre-fabricated and modular construction sector is experiencing significant growth in the United States, driven by demand for faster, more efficient building processes. This trend creates a burgeoning market for specialized materials specifically engineered for off-site manufacturing environments.

ABC Supply's current market presence in these highly specialized, often proprietary, material systems is likely minimal. This segment demands unique product knowledge and established supply chains that may not align with traditional construction material distribution.

Strategic investments in forming partnerships with manufacturers of advanced pre-fabricated and modular construction materials, or developing in-house expertise for their distribution, represent a calculated risk. The potential upside is substantial if market adoption of these innovative building methods continues to accelerate.

- Market Growth: The US modular construction market was valued at approximately $15.1 billion in 2023 and is projected to grow at a CAGR of 6.8% from 2024 to 2030, according to Grand View Research.

- Material Specialization: This sector often utilizes engineered wood products, advanced insulation systems, and specialized panelized components that require a different sales and logistics approach than standard lumber or roofing.

- Strategic Gamble: Early entry and focused development in this niche could position ABC Supply as a key distributor as off-site construction gains wider acceptance, potentially capturing significant market share.

Integration of AI and Advanced Analytics for Supply Chain Optimization

ABC Supply's push into AI and advanced analytics for supply chain optimization presents a significant growth opportunity, though their current market share in this specific technological capability might be lower than pure logistics tech companies. This area is crucial for predictive inventory management and personalized customer recommendations. For instance, by 2024, the global supply chain analytics market was projected to reach over $10 billion, highlighting the immense potential for companies like ABC Supply to gain a competitive edge through data-driven insights.

To truly harness this frontier, ABC Supply would need substantial investment in robust data infrastructure and specialized AI talent. This investment is key to unlocking efficiencies such as optimizing delivery routes, forecasting demand with greater accuracy, and enhancing the customer experience through tailored product suggestions. Companies that effectively integrate AI into their supply chains in 2024 have reported significant improvements, with some seeing up to a 15% reduction in inventory holding costs.

- AI-driven demand forecasting: Enhances inventory accuracy, reducing stockouts and overstock situations.

- Predictive maintenance for logistics fleet: Minimizes downtime and associated costs, ensuring timely deliveries.

- Personalized customer recommendations: Improves customer satisfaction and drives sales through tailored offerings.

- Route optimization: Reduces fuel consumption and delivery times, leading to cost savings and environmental benefits.

These ventures, where ABC Supply has limited current market share but operates in high-growth potential areas, are classified as Question Marks. Success hinges on strategic investment and execution to convert them into Stars or potentially Cash Cows.

The smart home exterior integration market, while promising, requires ABC Supply to build new distribution channels and educate its customer base on these advanced products. Similarly, expanding into interior building products necessitates developing different supplier relationships and sales approaches compared to their established exterior offerings.

The pre-fabricated and modular construction sector presents an opportunity for specialized material distribution, but ABC Supply's current minimal presence means significant upfront investment in product knowledge and supply chain adaptation. Likewise, AI and advanced analytics for supply chain optimization demand substantial investment in technology and talent.

| Category | Current Market Share | Market Growth Potential | Strategic Consideration |

| Smart Home Exterior Integration | Low | High | Develop new channels, educate customers |

| Interior Building Products | Low | High | Build new supplier relationships, adapt sales |

| Pre-fabricated/Modular Materials | Low | High | Invest in product knowledge and supply chain |

| AI/Analytics for Supply Chain | Low | High | Invest in technology and talent |

BCG Matrix Data Sources

Our ABC Supply BCG Matrix leverages a blend of internal sales data, market share reports, and industry growth projections to accurately position products.