ABC Supply PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ABC Supply Bundle

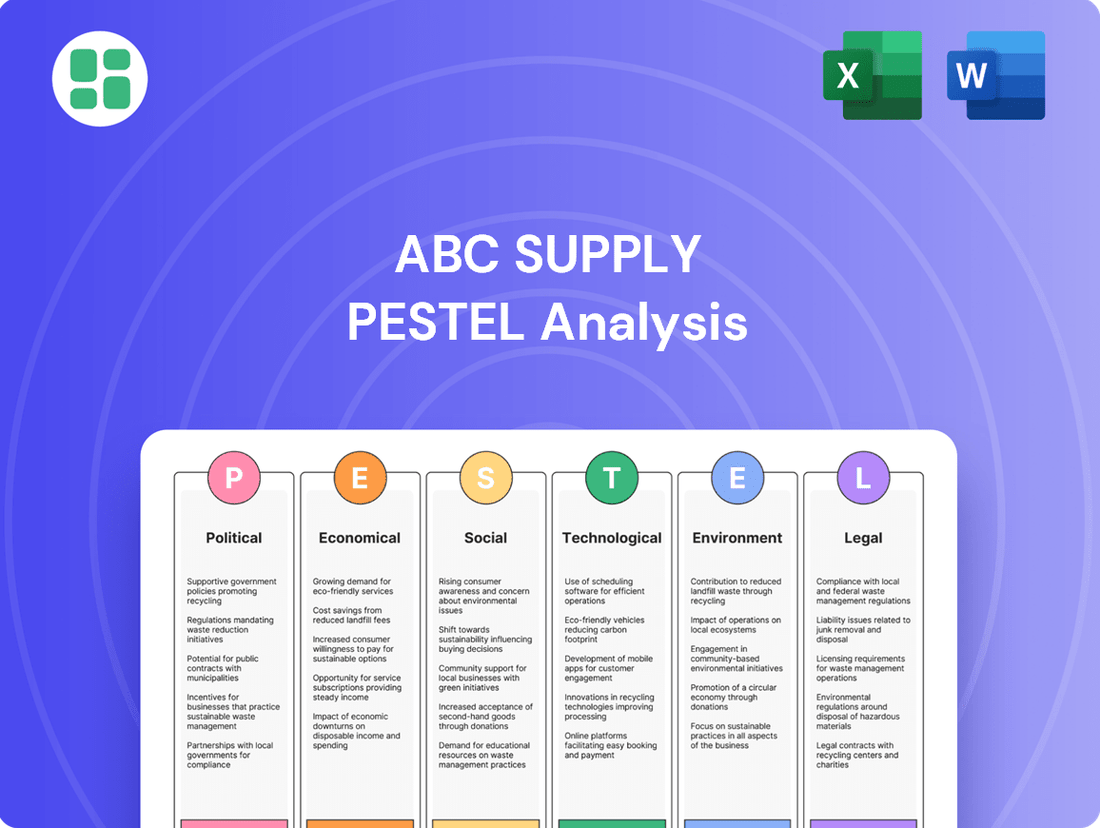

Navigate the complex external forces shaping ABC Supply's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors impacting their operations and market position. Gain a competitive edge by leveraging these actionable insights to refine your own strategies. Download the full version now for a complete understanding.

Political factors

Government infrastructure spending is a major tailwind for companies like ABC Supply. Initiatives such as the Infrastructure Investment and Jobs Act (IIJA) and the Inflation Reduction Act (IRA) are injecting over $1 trillion into the economy, specifically targeting transportation, water, energy, and broadband upgrades. This substantial investment directly translates into increased demand for the building materials ABC Supply distributes, supporting public sector construction projects through at least 2026.

Changes in trade policies, particularly tariffs on key imported building materials like lumber, steel, and aluminum, directly affect ABC Supply's procurement expenses and overall profitability. While a significant portion of materials are produced domestically, global commodity markets are still vulnerable to trade disruptions, which can cause price fluctuations. For instance, in 2024, ongoing discussions around potential tariffs on imported steel could lead to increased costs for construction projects.

Evolving building codes, such as updates to the International Energy Conservation Code (IECC), increasingly mandate energy-efficient and low-carbon construction materials. For instance, the 2021 IECC introduced more stringent requirements for building envelope performance, impacting material choices. ABC Supply must ensure its product portfolio aligns with these stricter standards, potentially driving demand for sustainable alternatives.

Environmental regulations, including the EPA's C-MORE program, are also pushing for materials with lower embodied carbon. The EPA's planned labeling program for low embodied carbon materials, expected to launch in 2024/2025, will directly influence contractor and consumer purchasing decisions, creating opportunities for ABC Supply to highlight compliant and eco-friendly product lines.

Tax Policies and Incentives

Government tax policies and financial incentives play a significant role in shaping demand for ABC Supply's products. For example, initiatives that encourage green building or energy-efficient home improvements directly stimulate the market for sustainable materials. These incentives make eco-friendly options more accessible and appealing to contractors and homeowners alike, influencing purchasing decisions and driving adoption of new technologies.

The Inflation Reduction Act (IRA) of 2022 is a prime example of such policy. It allocates substantial funding to support manufacturers in creating Environmental Product Declarations (EPDs). This legislation is designed to foster a more sustainable construction industry by making it easier for companies to demonstrate the environmental impact of their products, which can indirectly benefit distributors like ABC Supply by increasing the availability and demand for certified green building materials.

- Tax Credits for Energy Efficiency: Federal tax credits, such as those available under the IRA, often incentivize homeowners and businesses to invest in energy-efficient upgrades, boosting demand for related building materials distributed by ABC Supply.

- Green Building Incentives: State and local governments frequently offer property tax abatements or grants for projects meeting specific sustainability standards, creating a favorable market environment for green construction products.

- Manufacturing Support: Government programs aimed at bolstering domestic manufacturing of sustainable building materials, like those supporting EPD development, can lead to more competitive pricing and wider availability of these products for ABC Supply.

Political Stability and Elections

The political landscape significantly impacts the construction materials sector. For instance, the 2024 US presidential election, with its potential for policy shifts, could influence infrastructure spending, a key driver for companies like ABC Supply. Uncertainty surrounding election outcomes can temporarily dampen investor confidence and delay long-term planning for major construction projects.

While bipartisan support for infrastructure exists, major political realignments can alter the pace and scale of government-funded projects. For example, a new administration might prioritize different types of infrastructure or adjust funding levels, directly affecting demand for building materials. This can create volatility in the market, requiring companies to be agile in their strategic responses.

- Infrastructure Spending: In 2023, the US enacted the Infrastructure Investment and Jobs Act, allocating $1.2 trillion, with a significant portion directed towards transportation and infrastructure. This provides a baseline of demand, but future political support for such initiatives remains crucial.

- Regulatory Environment: Political decisions also shape building codes, environmental regulations, and permitting processes, all of which can impact construction timelines and material choices.

- Trade Policies: Tariffs and trade agreements, often driven by political considerations, can affect the cost and availability of imported materials, influencing ABC Supply's sourcing and pricing strategies.

Government infrastructure spending remains a critical driver, with initiatives like the Infrastructure Investment and Jobs Act continuing to inject substantial funds into projects through 2026. Political shifts, such as those potentially arising from the 2024 elections, could alter the trajectory and scale of these investments. Evolving environmental regulations and building codes, like the 2021 IECC mandates, also shape material demand, pushing for more energy-efficient and sustainable options.

| Political Factor | Impact on ABC Supply | 2024/2025 Data/Trend |

|---|---|---|

| Infrastructure Spending | Increased demand for building materials | IIJA funding continues, supporting projects through 2026. |

| Regulatory Environment | Demand for sustainable/energy-efficient materials | Stricter building codes (e.g., IECC 2021) and EPA initiatives (C-MORE program) influencing material choices. |

| Trade Policies | Potential cost fluctuations for imported materials | Ongoing discussions on tariffs (e.g., steel) impacting procurement expenses. |

| Tax Policies/Incentives | Boosts demand for specific product categories | IRA incentives for energy efficiency and green building drive market growth. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting ABC Supply across Political, Economic, Social, Technological, Environmental, and Legal dimensions, offering actionable insights for strategic decision-making.

The ABC Supply PESTLE analysis provides a clear, summarized version of the full analysis, acting as a pain point reliever by offering easy referencing during meetings and presentations.

By visually segmenting the ABC Supply PESTLE analysis by category, it allows for quick interpretation at a glance, relieving the pain point of sifting through complex data.

Economic factors

High interest rates remain a considerable challenge for the construction sector, impacting both residential building and the cost of financing projects. While some easing of short-term rates is expected by mid-2025, elevated mortgage rates are still suppressing demand for new homes and renovation work.

ABC Supply's revenue is directly tied to these financing conditions, as they shape the volume of work available to its contractor customers. For instance, the Federal Reserve's target federal funds rate, which influences broader lending costs, has remained in a range of 5.25%-5.50% as of early 2024, a level that increases borrowing expenses for builders and consumers alike.

Persistent inflation and escalating material costs continue to pose significant challenges for the construction industry, directly impacting contractor profitability and project affordability. While the pace of price increases for building materials has slowed, overall costs are still projected to climb due to ongoing labor shortages and supply chain disruptions. For example, the Producer Price Index for construction materials saw a year-over-year increase of 3.2% in April 2024, a notable moderation from previous highs but still indicating upward pressure.

The US housing market is poised for a rebound in residential construction during 2025, with projections indicating growth in both single-family and multi-family segments. This uptick is largely attributed to anticipated stabilizing inflation and a downward trend in interest rates.

Despite the positive outlook for new construction, demand for existing homes is likely to remain subdued. This is primarily due to persistently elevated mortgage rates and a scarcity of available inventory, impacting overall market activity.

As a key distributor serving residential contractors, ABC Supply's performance is directly tied to the volume of new housing starts and renovation projects undertaken by these builders.

Commercial Construction Growth

While residential construction can experience significant swings, the commercial sector is showing more resilience. We anticipate moderate expansion driven by demand in key areas like data centers, manufacturing plants, healthcare facilities, and educational institutions. This diversification helps ABC Supply maintain a more stable revenue flow, even if other segments face temporary slowdowns.

Government spending is also a significant contributor, with ongoing investments expected to bolster growth in public sector construction projects. For instance, the Infrastructure Investment and Jobs Act, enacted in late 2021, continues to allocate substantial funds towards infrastructure improvements, many of which involve commercial or public-facing structures.

- Data Centers: Global data center construction spending was projected to reach over $200 billion in 2024, a testament to the increasing demand for digital infrastructure.

- Manufacturing: Reshoring initiatives and advancements in automation are driving new factory and industrial facility construction, with significant investment expected through 2025.

- Healthcare and Education: Modernization of existing facilities and the construction of new ones to meet evolving needs are creating consistent demand in these sectors.

- Public Infrastructure: Federal and state governments are investing billions in infrastructure upgrades, directly benefiting commercial construction firms and their suppliers.

Supply Chain Dynamics

Supply chain disruptions, while easing, still impact the construction sector. ABC Supply navigates these by sometimes regionalizing sourcing or using multiple suppliers to reduce risk. These ongoing issues can still cause project delays and higher expenses for contractors.

The ongoing evolution of supply chain dynamics presents a mixed outlook for 2024 and into 2025. While some bottlenecks have eased, certain materials remain subject to availability concerns. For instance, reports in late 2024 indicated continued, albeit reduced, lead times for specific lumber and steel products, impacting project timelines and budgets. Companies are actively exploring strategies to build resilience.

- Regionalization Efforts: Many construction material distributors, including those serving ABC Supply's customer base, are increasing their focus on domestic or near-shore sourcing to shorten transit times and reduce vulnerability to global shipping disruptions.

- Dual-Sourcing Strategies: To combat single-point-of-failure risks, businesses are increasingly adopting dual-sourcing for critical components, ensuring alternative suppliers are readily available.

- Impact on Costs: Persistent supply chain complexities contributed to an average increase of 5-7% in construction material costs in certain regions throughout 2024, with projections for 2025 indicating a stabilization but not a significant decrease in many categories.

- Inventory Management: Advanced inventory management systems are being implemented to better forecast demand and maintain optimal stock levels, mitigating the impact of unexpected shortages.

Economic factors significantly influence ABC Supply's operations, primarily through interest rates and inflation impacting construction demand. While interest rates are expected to moderate by mid-2025, elevated mortgage rates continue to dampen new home sales and renovation activity. Persistent inflation, though slowing, still drives up material costs, affecting contractor margins.

The US housing market is projected for a rebound in 2025, boosting residential construction, while the commercial sector shows resilience driven by data centers, manufacturing, and infrastructure spending. Government investments, like the Infrastructure Investment and Jobs Act, further support public sector projects.

| Economic Factor | 2024 Data/Projection | 2025 Projection | Impact on ABC Supply |

|---|---|---|---|

| Federal Funds Rate | 5.25%-5.50% (early 2024) | Expected moderation, but still elevated | Increases borrowing costs for contractors, potentially slowing project starts. |

| Construction Material Costs (PPI) | +3.2% YoY (April 2024) | Stabilizing but not decreasing significantly | Pressures contractor profitability, potentially impacting order volumes. |

| Residential Construction Starts | Subdued due to mortgage rates | Projected rebound | Directly correlates with demand for ABC Supply's products. |

| Commercial Construction Demand | Moderate expansion (data centers, manufacturing) | Continued resilience | Provides a more stable revenue stream, offsetting residential volatility. |

Preview the Actual Deliverable

ABC Supply PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive ABC Supply PESTLE Analysis delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into market trends and strategic considerations.

Sociological factors

The construction sector is grappling with persistent labor shortages, with a substantial portion of companies, around 70% in recent surveys, reporting challenges in finding qualified workers. This scarcity is intensified by an aging demographic of skilled tradespeople retiring and a declining number of younger individuals pursuing these careers.

These workforce dynamics directly affect ABC Supply's clientele, as contractors face difficulties completing projects on time and within budget due to increased labor expenses and limited capacity. This can consequently impact demand for building materials.

Consumers are increasingly prioritizing sustainability due to growing awareness of climate change. This translates into a strong preference for green building practices, such as energy-efficient homes and the use of recycled materials. For instance, a 2024 survey indicated that 65% of new homebuyers consider energy efficiency a top priority, a significant jump from previous years.

This shift in consumer demand directly impacts the building materials market. Buyers are actively seeking products with lower carbon footprints and those manufactured using environmentally responsible methods. This trend presents a clear opportunity for companies like ABC Supply to expand their portfolio of eco-friendly options, catering to a market segment that is willing to invest in sustainable solutions.

Ongoing urbanization and population growth continue to drive a robust demand for new housing and infrastructure. For instance, the United Nations projects that by 2050, 68% of the world's population will live in urban areas, a significant increase from today. This demographic shift directly translates into sustained demand for building materials, benefiting companies like ABC Supply.

Furthermore, the rise of remote work has accelerated housing demand in suburban and rural areas, expanding the market for construction and renovation projects. This trend supports both residential and commercial development, ensuring a consistent need for ABC Supply's diverse product offerings across a wider geographic footprint.

Homeownership Trends and Renovation Activity

Even with higher interest rates making new home purchases less appealing, homeowners are increasingly opting to renovate and remodel their existing properties. This shift is a significant driver for the building products sector, as people invest in improving their current homes instead of moving. This trend is expected to continue supporting demand for essential exterior building materials like roofing and siding, which are central to ABC Supply's product offerings.

The National Association of Home Builders (NAHB) reported in late 2023 that while new single-family home sales saw a dip, the remodeling market remained resilient. For instance, the NAHB/Wells Fargo Housing Opportunity Index indicated that affordability challenges in the new construction market were pushing more consumers towards renovations. This sustained activity directly benefits companies like ABC Supply, which are well-positioned to capitalize on this ongoing homeowner investment in their existing residences.

- Robust Remodeling Market: Homeowners are prioritizing renovations over moving due to affordability concerns, maintaining demand for building products.

- Sustained Demand for Exterior Products: Roofing and siding, key to ABC Supply's portfolio, are expected to see continued strong sales as homeowners upgrade existing homes.

- Interest Rate Impact: Higher interest rates, a factor in 2024, are dampening new home sales but indirectly boosting the renovation sector.

Safety and Wellness in Construction

The construction industry's growing emphasis on worker safety and wellness directly influences product innovation and service delivery. This trend means that materials designed for simpler and safer installation, or tools that alleviate physical stress, are becoming more attractive to contractors grappling with labor shortages. For instance, in 2024, the Occupational Safety and Health Administration (OSHA) continued its focus on reducing construction site injuries, with a particular emphasis on falls, struck-by incidents, and caught-in/between hazards, driving demand for safer product solutions.

Companies are actively integrating technology to enhance safety protocols on construction sites. This includes advancements like wearable sensors to monitor worker fatigue or environmental hazards, and drone technology for inspections, reducing the need for workers to access dangerous areas. The financial investment in construction technology aimed at improving safety is projected to grow significantly, with reports in late 2024 indicating a substantial increase in spending on safety-focused tech solutions by major construction firms.

The demand for products that contribute to a safer and healthier work environment is a key sociological factor. This translates into:

- Development of ergonomic tools: Tools designed to minimize repetitive strain injuries are gaining traction.

- Pre-fabricated components: Materials that can be assembled off-site reduce on-site exposure to hazards.

- Advanced safety equipment: Innovations in personal protective equipment (PPE) are a direct response to wellness concerns.

- Digital safety management systems: Software solutions that track safety compliance and training are becoming standard.

The aging workforce in skilled trades is a significant sociological factor, with a large percentage of experienced workers approaching retirement age. This demographic shift, coupled with a lower influx of younger individuals entering these fields, exacerbates labor shortages. For instance, a 2024 industry report highlighted that over 40% of skilled tradespeople are expected to retire within the next decade, directly impacting project timelines and material demand.

Consumer preferences are increasingly shaped by environmental consciousness and a desire for sustainable living. This trend is evident in the growing demand for eco-friendly building materials and energy-efficient home designs. Surveys from early 2025 indicate that nearly 70% of homeowners now consider sustainability when making purchasing decisions for home improvements, influencing the types of products that are sought after.

Urbanization and population growth continue to fuel the need for new housing and infrastructure, creating a consistent demand for building materials. As more people move to cities, the pressure to expand residential and commercial spaces intensifies. Projections for 2025 show that urban populations are expected to grow by an additional 1.5% globally, underscoring the sustained need for construction services and supplies.

The increasing emphasis on worker safety and well-being within the construction sector is driving demand for innovative, safer products and installation methods. This focus on reducing workplace injuries and promoting a healthier environment is leading contractors to seek materials and tools that minimize physical strain and exposure to hazards. OSHA's continued focus on site safety in 2024, with specific initiatives targeting fall prevention, further supports this trend.

| Sociological Factor | Impact on ABC Supply | Supporting Data (2024-2025) |

| Aging Skilled Workforce | Labor shortages for clients, potentially slowing project completion and impacting material demand. | 40%+ skilled tradespeople expected to retire within 10 years (2024 report). |

| Environmental Consciousness | Increased demand for sustainable and eco-friendly building materials. | ~70% of homeowners consider sustainability in purchasing decisions (early 2025 survey). |

| Urbanization & Population Growth | Sustained demand for new housing and infrastructure, driving consistent material needs. | Global urban population growth of 1.5% projected for 2025. |

| Worker Safety & Wellness | Demand for safer products, ergonomic tools, and pre-fabricated components. | Continued OSHA focus on site safety initiatives (e.g., fall prevention) in 2024. |

Technological factors

The digitalization of supply chain and logistics is fundamentally reshaping how businesses operate. Advanced technologies now enable real-time inventory tracking, predictive analytics for demand forecasting, and the optimization of delivery routes, leading to significant efficiency gains. For example, by the end of 2024, it's estimated that over 70% of global supply chains will have implemented some form of digital transformation, a trend that is only accelerating.

For ABC Supply, this digital transformation is crucial for maintaining a competitive edge. Their investment in digital tools like myABCsupply empowers contractors by allowing them to easily place orders, manage their accounts, and streamline logistics processes. This not only enhances operational efficiency but also significantly improves the customer experience, a key differentiator in the building materials sector.

The increasing adoption of Building Information Modeling (BIM) is transforming how construction projects are planned and executed. This technology, alongside the rise of Digital Twins, enhances collaboration and minimizes errors, directly impacting material demand and supplier integration. For instance, a significant portion of new construction projects in North America are now incorporating BIM, with estimates suggesting over 70% of large-scale projects utilized BIM in 2024.

The construction industry is rapidly adopting automation and robotics, with drones now common for site monitoring and AI-powered robots handling tasks like bricklaying and concrete pouring. This trend significantly boosts productivity and enhances safety on job sites.

For distributors like ABC Supply, these technological shifts mean a potential change in material demand, favoring pre-fabricated components, and a need to adapt delivery logistics to support these advanced construction methods.

Advanced and Sustainable Material Innovation

Continuous innovation in building materials is a significant technological factor influencing ABC Supply. The development of advanced composites, bio-based materials like hempcrete, and materials with high recycled content are actively reshaping product offerings in the construction industry. For instance, the global market for sustainable building materials was projected to reach over $250 billion by 2024, highlighting a strong trend towards eco-friendly solutions.

ABC Supply must remain vigilant and adapt to these material advancements to effectively meet evolving customer demands for enhanced performance, increased durability, and improved sustainability. The company's ability to integrate these new materials into its supply chain and product portfolio will be crucial for maintaining a competitive edge. By 2025, it's anticipated that a substantial portion of new construction projects will incorporate at least one sustainable material, driven by regulatory changes and consumer preference.

- Advanced Composites: Offering superior strength-to-weight ratios and corrosion resistance, these materials are increasingly used in structural components and facades.

- Bio-based Materials: Hempcrete, for example, provides excellent insulation and carbon sequestration properties, aligning with green building initiatives.

- High Recycled Content: The push for circular economy principles means materials like recycled steel, plastic lumber, and reclaimed wood are gaining traction.

- Smart Materials: Innovations include self-healing concrete and phase-change materials for improved thermal regulation, which are expected to see wider adoption by 2025.

E-commerce and Online Platforms

The surge in e-commerce and online platforms is fundamentally altering how contractors acquire materials. This digital transformation necessitates robust online presence and efficient digital tools for businesses like ABC Supply.

ABC Supply is actively investing in its digital infrastructure, notably with its 'myABCsupply' platform. This initiative, coupled with integrations with popular contractor management software such as ServiceTitan and JobNimbus, aims to streamline the procurement process, offering greater convenience and efficiency for their customers. For instance, the construction industry's adoption of digital tools saw significant growth, with a projected 15% compound annual growth rate for construction technology solutions between 2023 and 2028, highlighting the importance of these digital investments.

- Digital Procurement Growth: E-commerce is increasingly the preferred channel for B2B material sourcing in the construction sector.

- Platform Investment: ABC Supply's 'myABCsupply' platform enhances online ordering capabilities.

- Integration Strategy: Partnerships with ServiceTitan and JobNimbus improve workflow for contractors.

- Market Trend: The construction technology market is expanding, emphasizing the need for digital adaptation.

Technological advancements are rapidly transforming the construction supply chain, with digital tools and automation becoming essential. By 2024, over 70% of global supply chains are expected to have undergone some form of digital transformation, a trend that directly impacts how ABC Supply operates and serves its customers.

The increasing use of Building Information Modeling (BIM) and Digital Twins enhances project planning and collaboration, influencing material demand and supplier integration, with over 70% of large North American projects utilizing BIM in 2024.

Innovations in building materials, such as advanced composites and sustainable options like hempcrete, are reshaping product offerings, with the sustainable building materials market projected to exceed $250 billion by 2024.

The construction technology market is expanding, with a projected 15% compound annual growth rate for solutions between 2023 and 2028, underscoring the importance of digital platforms like ABC Supply's myABCsupply and its integrations.

| Technology Trend | Impact on Construction | ABC Supply Relevance | 2024/2025 Data Point |

|---|---|---|---|

| Digitalization of Supply Chains | Increased efficiency, real-time tracking, predictive analytics | Streamlining operations, enhancing customer portals | >70% global supply chains digitally transformed |

| Building Information Modeling (BIM) | Improved project planning, collaboration, reduced errors | Adapting to new material integration and logistics | >70% large NA projects used BIM in 2024 |

| Advanced/Sustainable Materials | Enhanced performance, eco-friendliness, new product demand | Expanding product portfolio, meeting green building needs | Sustainable materials market >$250B in 2024 |

| E-commerce & Digital Platforms | Shift in procurement channels, demand for online services | Investing in myABCsupply, integrating with contractor software | Construction tech market CAGR 15% (2023-2028) |

Legal factors

Environmental regulations, such as those overseen by the EPA, significantly influence ABC Supply's operations. These laws cover critical areas like waste disposal, the origin of materials, and carbon emissions. For instance, programs like the EPA's C-MORE initiative and evolving standards for labeling low embodied carbon materials mean ABC Supply and its partners must adapt their practices.

Compliance with these stringent environmental protection laws is not optional; it's a fundamental requirement. This necessity often spurs the adoption of more sustainable products and robust waste management systems. As of early 2024, the construction industry, a key sector for ABC Supply, faces increasing pressure to reduce its environmental footprint, with many companies investing in greener supply chains and circular economy principles.

Occupational Safety and Health Administration (OSHA) regulations set the bar for safety on construction sites, directly impacting contractors. These standards can indirectly influence ABC Supply by shaping customer demand for specific tools, equipment, and materials that ensure safe handling and installation. For instance, OSHA's emphasis on fall protection might boost sales of advanced safety harnesses and anchoring systems.

Product liability laws hold ABC Supply accountable for any defects or failures in the building materials it distributes, impacting manufacturers and sellers alike. This means ABC Supply must rigorously vet its suppliers to ensure the quality and safety of its inventory. For instance, in 2024, the construction industry saw increased scrutiny on material safety following several high-profile building failures, potentially leading to higher insurance premiums for distributors like ABC Supply.

Zoning Laws and Land Use Regulations

Local zoning laws and land use regulations are critical for ABC Supply, directly impacting where and what types of construction can occur, thus shaping demand for building materials. For instance, a city's decision to rezone an industrial area for residential use could significantly alter the market for specific products the company stocks.

Changes in these regulations can create new opportunities or impose limitations. For example, relaxed zoning in suburban areas might spur demand for residential construction materials, while stricter environmental land use rules in coastal regions could limit certain types of development and, consequently, the materials needed. ABC Supply must remain agile, adjusting its inventory and distribution networks to align with these evolving land use policies across its operating regions.

Recent trends show a growing emphasis on sustainable development and mixed-use zoning in many municipalities. This shift, evident in urban planning initiatives across the US in 2024 and projected to continue into 2025, encourages more diverse building projects. Such changes necessitate that ABC Supply's product offerings cater to a broader range of construction types, from multi-family dwellings to commercial spaces, rather than solely single-family homes.

- Zoning Impact: Dictates permissible construction types, influencing demand for specific building materials.

- Market Adaptability: Regulatory shifts can open new markets or restrict projects, requiring ABC Supply to adjust inventory and distribution.

- Sustainability Focus: Growing trend towards mixed-use and eco-friendly zoning in 2024-2025 necessitates a broader product range.

Contract and Consumer Protection Laws

Contract and consumer protection laws are fundamental to ABC Supply's operations, dictating how they engage with both contractors and end-users. Adhering to these regulations ensures fair dealings, clear communication regarding terms of service, and transparent product disclosures. This commitment to legal compliance is crucial for fostering customer trust and minimizing potential legal liabilities.

For instance, in 2024, the Federal Trade Commission (FTC) continued its focus on deceptive advertising and unfair business practices, with potential fines for non-compliance. State-specific consumer protection laws, such as California's Consumer Legal Remedies Act, also impose strict requirements on product warranties and disclosures. ABC Supply's adherence to these frameworks, including clear warranty information and accurate product specifications, is vital.

- Contractual Clarity: Ensuring all agreements with suppliers and customers clearly define responsibilities, payment terms, and dispute resolution mechanisms.

- Consumer Rights: Upholding consumer rights related to product quality, warranties, and return policies, as mandated by federal and state laws.

- Transparency in Sales: Providing accurate and complete information about products, including pricing, features, and potential limitations, to prevent misleading claims.

- Risk Mitigation: Proactively managing legal risks by staying updated on evolving consumer protection legislation and implementing robust compliance procedures.

Legal frameworks, including product liability and consumer protection laws, directly shape ABC Supply's responsibilities and customer interactions. Compliance with these regulations, such as those enforced by the FTC regarding deceptive advertising, is paramount for maintaining trust and avoiding legal penalties, especially given the increased scrutiny on building material safety observed in 2024.

Environmental factors

The demand for sustainable building materials is surging, fueled by stricter environmental regulations and a growing awareness among consumers and investors. This trend presents a significant opportunity for ABC Supply to broaden its product offerings. For instance, the global green building materials market was valued at approximately $253.8 billion in 2023 and is projected to reach $500.2 billion by 2030, growing at a CAGR of 10.2%.

Climate change is a significant environmental factor impacting the building industry. The increasing frequency and intensity of extreme weather events, such as hurricanes, heavy snow, and extreme heat, are driving a greater demand for resilient and durable building materials. This trend directly benefits companies like ABC Supply, which can meet this demand by offering products specifically designed for enhanced weather resistance, like impact-resistant shingles and high-wind rated siding.

The construction sector, a key market for ABC Supply, faces increasing regulatory and consumer pressure to minimize landfill waste. For instance, by 2025, the UK aims to divert 70% of construction and demolition waste from landfill, a significant shift from the 60% achieved in 2023. This environmental push is driving demand for building materials incorporating recycled content, such as recycled plastic lumber or insulation made from recycled glass.

ABC Supply can capitalize on this by expanding its product lines to include more materials with high recycled content, potentially sourcing from suppliers actively involved in circular economy initiatives. Furthermore, exploring partnerships to facilitate on-site material segregation and take-back programs for recyclable waste could offer a competitive advantage and align with the industry's sustainability goals, mirroring successful programs seen in the European market where waste recovery rates are steadily climbing.

Energy Efficiency Standards for Buildings

Stricter energy efficiency standards for new and existing buildings, driven by updated building codes, are significantly boosting the market for advanced building materials. These regulations, such as those implemented in California's Title 24 or the European Union's Energy Performance of Buildings Directive, directly increase demand for high-performance insulation, energy-efficient windows, and other products that minimize energy consumption. ABC Supply is well-positioned to capitalize on this trend by supplying contractors with these essential, energy-saving components.

The push for greater building energy efficiency is creating substantial opportunities. For instance, the U.S. Department of Energy's Building Technologies Office has highlighted that improved building envelopes can reduce energy use by 15-30%. This translates into a growing need for specialized materials that ABC Supply offers.

- Increased demand for insulation: Building codes often mandate higher R-values, driving sales of spray foam and rigid foam insulation.

- Growth in energy-efficient windows: Double- and triple-pane windows with low-E coatings are becoming standard, benefiting suppliers like ABC Supply.

- Focus on air sealing: Materials that improve airtightness, such as advanced sealants and membranes, are seeing greater adoption.

- Retrofitting existing structures: Regulations encouraging or requiring energy upgrades in older buildings create a continuous market for efficiency products.

Resource Scarcity and Material Sourcing

Growing concerns over resource scarcity and the environmental toll of raw material extraction are significantly reshaping sourcing strategies for companies like ABC Supply. This trend is accelerating the adoption of renewable resources and materials with a reduced embodied carbon footprint. For instance, the global demand for critical minerals essential for construction and renewable energy technologies is projected to increase substantially; by 2040, demand for copper could rise by 40%, and lithium by over 40 times, according to the International Energy Agency (IEA) in their 2024 outlook. ABC Supply must actively assess and mitigate the environmental impact embedded within its extensive supply chain, ensuring the sustainability of the vast array of materials it distributes.

This focus on sustainability translates into tangible business imperatives:

- Supply Chain Resilience: Diversifying material sources and exploring alternative, more sustainable options can buffer against disruptions caused by resource depletion or geopolitical instability.

- Cost Management: While initially requiring investment, the long-term use of recycled or sustainably sourced materials can lead to cost savings as virgin resource prices fluctuate and regulatory pressures increase.

- Regulatory Compliance and Risk Mitigation: Adhering to evolving environmental regulations concerning material sourcing and waste management is crucial to avoid penalties and maintain operational continuity.

- Market Demand and Brand Reputation: Increasingly, customers and stakeholders favor businesses with demonstrable commitments to environmental responsibility, making sustainable material sourcing a competitive advantage.

Environmental factors significantly influence the building materials sector, driving demand for sustainable and resilient products. Stricter regulations and growing consumer awareness are pushing the market towards green building materials, with the global market valued at approximately $253.8 billion in 2023 and projected to reach $500.2 billion by 2030.

Extreme weather events necessitate durable materials, benefiting suppliers like ABC Supply. Additionally, waste reduction mandates are increasing the demand for recycled content in building products. For example, the UK aims to divert 70% of construction waste from landfill by 2025.

Energy efficiency standards are also a major driver, boosting the market for high-performance insulation and windows. The U.S. Department of Energy estimates improved building envelopes can reduce energy use by 15-30%.

Resource scarcity is prompting a shift towards renewable materials and those with lower embodied carbon. The demand for critical minerals like copper and lithium is expected to rise substantially by 2040, impacting sourcing strategies.

PESTLE Analysis Data Sources

Our PESTLE Analysis for ABC Supply is built on a robust foundation of data from official government publications, leading economic forecasting agencies, and reputable industry-specific reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the building materials supply chain.