ABC Supply Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ABC Supply Bundle

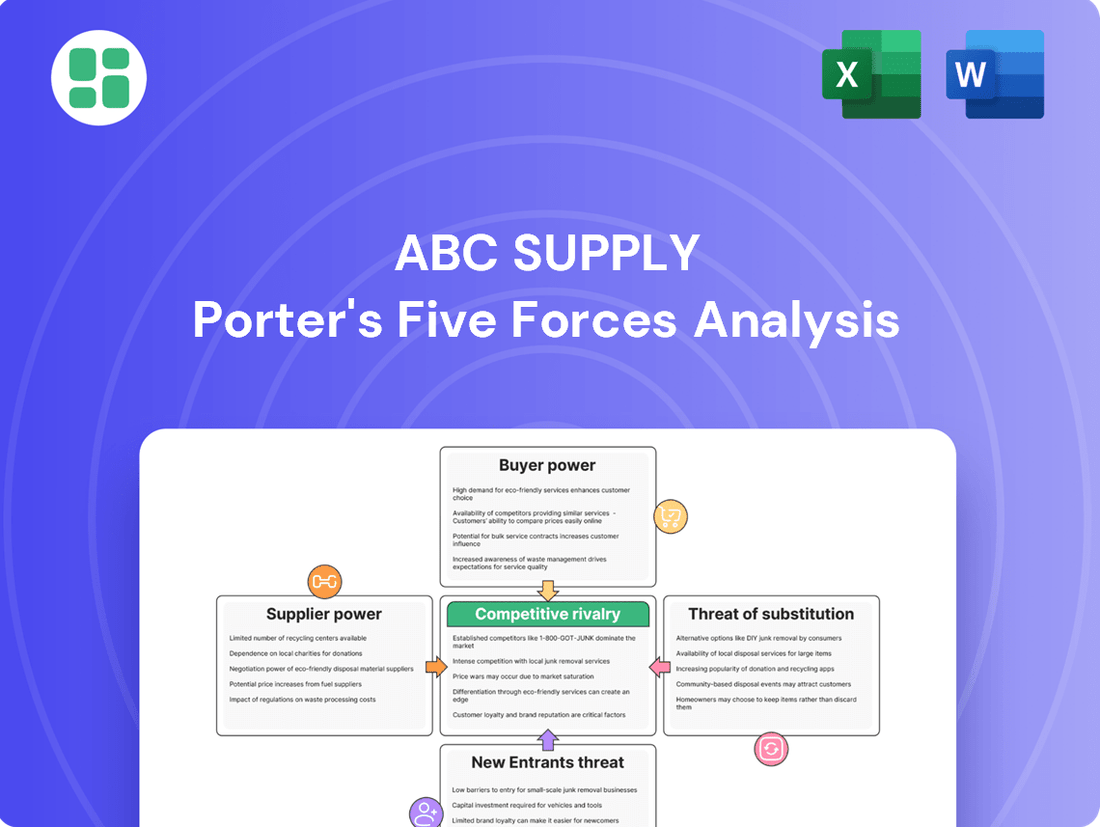

ABC Supply, a leader in the building materials distribution industry, faces a dynamic competitive landscape shaped by five key forces. Understanding the bargaining power of both their suppliers and customers is crucial, as is assessing the threat of new entrants and the availability of substitutes. The intensity of rivalry within the industry also significantly impacts ABC Supply's strategic positioning.

The complete report reveals the real forces shaping ABC Supply’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for ABC Supply generally sits in the moderate to high range, largely due to how concentrated the manufacturing base is for certain building materials. While ABC Supply's status as the largest distributor gives it considerable purchasing volume and some sway, the situation changes when dealing with specialized or patented products. In these cases, a smaller pool of manufacturers can exert more individual power.

The economic climate plays a significant role here. We've observed increasing raw material costs and ongoing supply chain disruptions throughout 2024, trends expected to continue into 2025. These pressures empower suppliers, allowing them to more easily pass on higher prices to distributors like ABC Supply, which can then squeeze profit margins.

Switching costs for ABC Supply to change suppliers can vary significantly. For commoditized items like standard lumber or basic shingles, the ease of finding alternative suppliers means ABC Supply faces lower switching costs, giving them leverage in negotiations. This low barrier to entry for competitors in these segments keeps supplier power in check.

However, when dealing with specialized or proprietary building systems, ABC Supply encounters higher switching costs. These costs can include substantial investments in re-training their workforce on new product installation and maintenance, updating inventory management systems to accommodate different product codes, and potentially losing access to unique, high-demand product lines that differentiate their offerings. For instance, a supplier offering a unique, high-performance insulation system might command greater power if ABC Supply's customers specifically request it, making a switch costly and disruptive.

The threat of suppliers integrating forward and selling directly to contractors, bypassing distributors like ABC Supply, is typically low, especially given the fragmented nature of the professional contractor market. Manufacturers often find it more efficient to utilize established distribution networks rather than invest in the complex logistics and credit services required for direct sales.

Availability of Substitute Inputs

The bargaining power of suppliers in the building materials sector is significantly influenced by the availability of substitute inputs. For many specific building materials, direct substitutes are limited, giving those suppliers considerable leverage. For instance, a unique type of engineered wood might not have a perfect replacement, allowing its producers to command higher prices.

However, the landscape can shift if alternative materials or innovative manufacturing processes emerge that can achieve comparable results. For example, the rise of advanced composite materials or new concrete formulations could diminish the power of traditional suppliers of steel or lumber. This pressure spurs innovation among existing suppliers, pushing them to develop more cost-effective or performance-enhanced products to remain competitive.

- Suppliers of specialized, proprietary building components often hold higher bargaining power due to a lack of direct substitutes.

- The emergence of new construction technologies, such as 3D printing with novel materials, can introduce substitutes and weaken the position of traditional suppliers.

- In 2024, the construction industry saw a continued focus on sustainable and recycled materials, creating new substitute options for conventional inputs and potentially reducing supplier power in certain segments.

- For example, the increasing adoption of cross-laminated timber (CLT) as a substitute for concrete and steel in mid-rise construction impacts the bargaining power of cement and steel manufacturers.

Uniqueness of Supplier Products/Services

The uniqueness of products offered by suppliers significantly impacts their bargaining power. Suppliers of highly differentiated or technologically advanced building materials, such as specific energy-efficient windows or innovative roofing systems, possess greater power due to the lack of direct alternatives. For more generic products, suppliers compete more on price and delivery, reducing their individual power.

For instance, in 2024, the demand for advanced, sustainable building materials continued to rise, driven by regulatory changes and consumer preference. Companies specializing in these niche products, like high-performance insulation or smart home integration systems for construction, could command higher prices and favorable terms. This trend suggests that suppliers offering unique, value-added solutions to companies like ABC Supply often wield considerable influence.

- Supplier Differentiation: The more unique a supplier's product or service, the less likely a buyer is to find a suitable substitute, thereby increasing the supplier's leverage.

- Technological Advancement: Suppliers at the forefront of technology in areas like building materials or construction techniques can exert greater influence.

- Market Trends: In 2024, the emphasis on green building and energy efficiency meant suppliers of certified sustainable materials had stronger bargaining positions.

- Lack of Alternatives: For specialized components or services with few or no direct competitors, suppliers can dictate terms more effectively.

Suppliers of specialized building materials, particularly those with unique or patented products, hold significant bargaining power over ABC Supply. This power is amplified when few alternatives exist, as seen with advanced insulation or specific roofing systems in 2024, where demand for sustainable options increased supplier leverage. The threat of suppliers integrating forward is generally low, but the availability of substitutes, like engineered wood replacing traditional lumber, can mitigate supplier influence.

The bargaining power of suppliers for ABC Supply is generally moderate to high. This is due to the concentrated nature of some manufacturing bases and the limited availability of substitutes for specialized building materials. For instance, in 2024, the push for energy-efficient building components meant suppliers of these niche products could command higher prices. Conversely, for commoditized items like standard lumber, ABC Supply's scale provides more negotiation leverage.

The power of suppliers is influenced by product differentiation and the availability of substitutes. Suppliers of unique, high-performance materials, such as specific energy-efficient window systems, often have greater power. The construction industry's 2024 trend towards sustainable and recycled materials created new substitute options, potentially weakening the position of traditional suppliers in certain segments, like the impact of cross-laminated timber on steel and concrete manufacturers.

Suppliers of specialized or proprietary building systems often possess considerable bargaining power. This is particularly true when few direct substitutes are available, as was evident in 2024 with the growing demand for advanced, sustainable construction materials. While ABC Supply's large purchasing volume offers some leverage, suppliers of unique, high-demand products can exert significant influence, especially if switching costs for ABC Supply are high due to retraining or system updates.

| Factor | Impact on ABC Supply | 2024/2025 Trend |

| Supplier Concentration | Moderate to High (for specialized items) | Continued demand for specialized, sustainable materials strengthens power. |

| Availability of Substitutes | Low for specialized, High for commoditized | Emergence of new materials (e.g., CLT) challenges traditional suppliers. |

| Switching Costs | High for specialized, Low for commoditized | Investment in new product integration can increase supplier leverage. |

| Supplier Differentiation | High for unique/tech products | Increased focus on green building boosts power of certified sustainable material suppliers. |

What is included in the product

This analysis dissects the competitive forces impacting ABC Supply, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Instantly visualize competitive pressures with a dynamic, interactive model that highlights key threats and opportunities.

Customers Bargaining Power

ABC Supply's customer bargaining power is moderate, largely due to its diverse customer base of professional contractors. While individual contractors might not represent enormous individual sales, their collective purchasing volume is substantial, giving them leverage. For instance, in 2023, ABC Supply served hundreds of thousands of customers across its network, highlighting the distributed nature of its sales volume.

The company's strategy of maintaining a widespread network of over 900 branches nationwide is designed to serve a broad spectrum of contractors, from small local businesses to larger regional ones. This wide reach means that while no single customer dominates, the aggregate demand from these numerous, often geographically dispersed, professional buyers creates a significant force that ABC Supply must manage.

Switching costs for professional contractors in the building materials sector are generally low for basic products, as numerous distributors carry comparable items. This means contractors can often shift suppliers without significant disruption or added expense.

ABC Supply actively works to elevate these switching costs by offering a suite of value-added services. These include dependable delivery, deep product expertise from their sales teams, and user-friendly digital tools like the myABCsupply platform, which streamlines project and order management.

By providing these integrated services, ABC Supply cultivates customer loyalty. These offerings make it more convenient and efficient for contractors to manage their operations, thereby increasing the perceived cost or effort associated with switching to a competitor.

Professional contractors, a core customer base for ABC Supply, exhibit significant price sensitivity. This is primarily because the cost of building materials constitutes a substantial portion of their overall project budgets. In 2024, the construction industry continued to grapple with rising material costs, a trend expected to persist into 2025, further amplifying this price sensitivity among contractors.

The highly competitive nature of the construction sector intensifies this price sensitivity. With numerous contractors bidding on projects, the ability to offer competitive pricing on materials directly impacts a contractor's win rate. ABC Supply needs to strategically balance offering competitive prices with the value of its services to maintain customer loyalty in this environment.

Availability of Alternative Distributors

The availability of alternative distributors significantly amplifies customer bargaining power. For a company like ABC Supply, this means customers can easily switch to competitors such as SRS Distribution or Builders FirstSource if pricing or service levels are not met. This competitive landscape, with numerous regional and local suppliers also vying for business, compels ABC Supply to constantly innovate and deliver superior value.

In 2024, the building materials distribution market saw continued consolidation and intense competition, with companies like Builders FirstSource reporting strong revenue growth, indicating their market presence and ability to attract customers. This environment directly impacts ABC Supply by increasing the leverage customers hold, demanding a focus on service excellence and a comprehensive product offering to retain market share.

- Broad Market Options: Customers have access to national distributors like SRS Distribution and Builders FirstSource, alongside a vast network of regional and local suppliers.

- Customer Leverage: This wide array of choices grants customers considerable bargaining power, influencing pricing and service expectations.

- Competitive Pressure: ABC Supply must differentiate itself through superior service, product variety, and operational efficiency to counter this customer leverage.

- Market Dynamics: The competitive nature of the building materials sector in 2024 necessitates continuous adaptation to customer demands.

Customer Information and Transparency

The rising tide of readily available product information and pricing online significantly bolsters customer bargaining power. This transparency allows customers to easily compare offerings, putting pressure on suppliers to remain competitive. For instance, a 2024 study indicated that over 70% of B2B buyers conduct extensive online research before making a purchase decision.

ABC Supply actively mitigates this by investing in its own digital platforms. These tools offer contractors streamlined order management and access to account specifics, positioning ABC Supply as the most convenient and reliable partner. This focus on digital convenience aims to foster loyalty and reduce the likelihood of customers seeking alternatives based solely on price comparisons.

- Increased Online Information: Customers can readily access product details and pricing, enhancing their ability to compare suppliers.

- Digital Tool Investment: ABC Supply counters this by offering proprietary digital tools for order management and account access.

- Convenience as a Differentiator: The strategy aims to make ABC Supply the preferred and most user-friendly source for contractors.

- Relationship Building: By providing superior digital experiences, ABC Supply seeks to deepen customer relationships and reduce price-driven switching.

ABC Supply's customers, primarily professional contractors, possess moderate bargaining power. This stems from the fragmented nature of their customer base, where individual contractors have limited individual impact, but their collective purchasing volume is significant. The availability of numerous alternative distributors for building materials means contractors can often switch suppliers with ease, especially for standard products, putting pressure on ABC Supply to remain competitive on both price and service.

The construction industry's inherent price sensitivity, amplified by rising material costs in 2024, further empowers contractors. For example, the Producer Price Index for construction materials saw a notable increase throughout 2024. This sensitivity compels ABC Supply to offer value beyond just product availability, focusing on services that increase switching costs and foster loyalty.

ABC Supply's strategic response involves enhancing customer loyalty through value-added services like dependable delivery and expert product support. Their investment in digital platforms, such as myABCsupply, aims to streamline operations for contractors, making ABC Supply the more convenient and efficient choice. This approach directly counters the leverage customers gain from readily available online pricing and product information, a trend evidenced by over 70% of B2B buyers conducting extensive online research in 2024.

| Factor | Impact on ABC Supply | Mitigation Strategy |

|---|---|---|

| Customer Price Sensitivity | High due to material costs comprising a large project budget share. | Offer competitive pricing and value-added services to justify costs. |

| Availability of Alternatives | Significant, with numerous national and regional distributors. | Differentiate through service, digital tools, and product expertise. |

| Online Information Transparency | High, enabling easy price and product comparison. | Invest in proprietary digital platforms for enhanced customer experience. |

| Switching Costs | Generally low for basic products. | Increase perceived switching costs through integrated services and loyalty programs. |

Same Document Delivered

ABC Supply Porter's Five Forces Analysis

This preview showcases the complete ABC Supply Porter's Five Forces Analysis, detailing the competitive landscape of the building materials distribution industry. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry among existing competitors. The document you see here is exactly what you’ll be able to download after payment, offering a comprehensive understanding of these critical forces.

Rivalry Among Competitors

The building materials distribution sector is a crowded arena. ABC Supply, the industry leader, faces a landscape populated by many competitors, from national giants like SRS Distribution and Builders FirstSource to a multitude of smaller, regional, and local businesses. This fragmentation means ABC Supply is constantly navigating a competitive environment where market share is actively pursued by numerous entities.

The building materials distribution sector is quite mature, with its growth closely mirroring the ups and downs of residential and commercial construction. For 2025, we anticipate moderate growth in new builds, alongside substantial opportunities in the remodeling and repair segments. This maturity often fuels intense rivalry as companies vie for a share of established demand, emphasizing cost-effectiveness and superior service to stand out.

For commodity building materials, product differentiation is inherently low, meaning competition often boils down to price. This is a significant factor in the industry's competitive rivalry.

However, successful distributors like ABC Supply carve out advantages by differentiating on service. This includes offering a wider array of products, including specialized and even proprietary items, alongside exceptional logistical support and dedicated customer service. In 2023, ABC Supply's revenue reached $20.4 billion, demonstrating the success of its differentiated approach in a competitive market.

Exit Barriers

Exit barriers for ABC Supply are substantial, primarily stemming from its significant investment in physical infrastructure. The company operates a vast network of warehouses and distribution centers, coupled with an extensive fleet of delivery vehicles. These fixed assets represent a considerable sunk cost, making it economically challenging for any single entity to exit the market without incurring substantial losses.

The deep-rooted relationships ABC Supply has cultivated with both suppliers and a broad customer base also contribute to high exit barriers. These established networks are not easily replicated and provide a competitive advantage that is difficult to divest. Consequently, even during periods of economic slowdown, companies like ABC Supply are incentivized to remain operational and continue competing fiercely, rather than abandoning their market positions.

For instance, in 2024, the building materials distribution sector, where ABC Supply operates, saw continued consolidation. Companies with large, specialized asset bases, like ABC Supply's extensive branch network, found it more strategic to maintain operations and adapt to market shifts rather than to divest at a loss. This persistence fuels intense rivalry as players strive to retain market share despite economic headwinds.

- High Fixed Asset Investment: ABC Supply's extensive network of warehouses, distribution centers, and specialized vehicle fleets represent significant, difficult-to-recover costs.

- Established Relationships: Long-standing ties with a wide array of suppliers and a diverse customer base create switching costs and loyalty, making exit less appealing.

- Intensified Rivalry: The presence of high exit barriers compels companies to stay and compete aggressively, even during market downturns, as seen in the sector's performance throughout 2024.

Strategic Commitments of Competitors

Competitors in the building materials distribution sector, including ABC Supply, are demonstrating substantial strategic commitments. These include aggressive expansion of their branch networks, significant investments in upgrading technological infrastructure, and a proactive approach to mergers and acquisitions. This intense focus on growth and market share solidifies the competitive landscape.

ABC Supply's own strategic initiatives, such as its continued expansion and the promotion of managing partners in 2024 and into 2025, underscore this industry-wide drive for dominance. Such moves signal a deep-seated commitment to not only maintaining but also increasing their competitive standing.

- Industry Consolidation: Acquisitions are a key strategy, with many players seeking to gain scale and efficiency.

- Technological Investment: Companies are investing in digital platforms for sales, inventory management, and customer service.

- Geographic Expansion: Opening new branches or acquiring existing ones in new territories is a common tactic to reach more customers.

- Operational Efficiency: Focus on streamlining supply chains and logistics to reduce costs and improve delivery times.

The competitive rivalry within the building materials distribution sector, where ABC Supply operates, is intense. This is driven by a large number of competitors, including national players like SRS Distribution and Builders FirstSource, alongside numerous regional and local firms, all vying for market share in a mature industry. The low differentiation for commodity materials often forces competition into price wars, though leaders like ABC Supply differentiate through superior service and broader product offerings.

ABC Supply's revenue of $20.4 billion in 2023 highlights its success in this competitive environment. The sector experienced continued consolidation in 2024, with companies investing heavily in network expansion and technology to gain an edge. This strategic commitment from all players fuels ongoing, aggressive competition.

| Competitor | 2023 Revenue (Est.) | Key Strategy |

|---|---|---|

| ABC Supply | $20.4 billion | Service differentiation, geographic expansion |

| Builders FirstSource | $17.1 billion | Scale, integrated solutions |

| SRS Distribution | $14.0 billion | Specialty products, customer focus |

SSubstitutes Threaten

The threat of substitutes for ABC Supply's products arises from alternative materials that can serve similar construction purposes. For example, while asphalt shingles are a staple, metal roofing and eco-friendly options are increasingly popular for roofs. Similarly, various siding materials such as vinyl, fiber-cement, and wood present functional alternatives to traditional options.

New construction methods like modular and prefabricated building are emerging, which could lessen the need for traditional on-site material distribution. These approaches often involve assembling components off-site, potentially reshaping supply chains and material sourcing requirements.

For instance, the global modular construction market was valued at approximately $100 billion in 2023 and is projected to grow significantly. This shift means that companies like ABC Supply, which focus on traditional building materials, might face a reduced demand for their core offerings if these new methods gain widespread adoption.

Technological advancements are constantly introducing new building materials that offer superior performance, such as improved insulation or increased strength. For instance, innovations in composite materials or advanced polymers can serve as viable alternatives to traditional wood, steel, or concrete. This trend, evident throughout 2024, means contractors might shift towards these newer options, pressuring distributors like ABC Supply to diversify their inventory beyond established product lines.

DIY vs. Professional Services

While ABC Supply primarily caters to professional contractors, the growing DIY home improvement market presents an indirect threat. Consumers undertaking smaller projects might opt for DIY solutions, bypassing the need for professional services that rely on ABC Supply's products. This trend, fueled by accessible online tutorials and readily available materials at big-box retailers, could chip away at demand for certain types of contractor work.

However, the scale and complexity of projects typically handled by ABC Supply's core clientele—professional roofers, remodelers, and builders—significantly limit direct substitution by DIY enthusiasts. For instance, a full roof replacement or a major structural renovation requires specialized skills, tools, and often permits that are beyond the scope of most DIYers. In 2024, the U.S. home improvement market was valued at over $500 billion, with professional services accounting for a substantial majority of this spend, underscoring the limited direct threat from DIY for large-scale projects.

- DIY Market Growth: The DIY home improvement sector continues to expand, offering consumers alternatives for smaller-scale projects.

- Limited Direct Substitution: For large-scale projects requiring professional expertise and materials, DIY remains a limited substitute for ABC Supply's core customers.

- Market Size Disparity: While DIY is growing, the professional services segment, which ABC Supply serves, represents a much larger portion of the overall home improvement spend.

Customer's Propensity to Substitute

Contractors' willingness to switch from ABC Supply's offerings hinges on several key factors. These include the total cost of ownership, the performance characteristics of alternative materials, and adherence to evolving regulatory mandates, particularly those concerning green building standards. For instance, if a new, eco-friendly roofing material offers comparable durability and installation ease at a competitive price point, contractors might readily adopt it.

The increasing emphasis on sustainability and energy efficiency in construction significantly influences this propensity. As building codes and client preferences increasingly favor environmentally responsible materials, contractors are more likely to explore and adopt greener alternatives. This shift can directly impact the demand for ABC Supply's traditional product lines if they are perceived as less sustainable or more costly in the long run due to energy performance differences.

- Cost Sensitivity: Contractors often balance upfront material costs with long-term performance and installation labor.

- Performance Requirements: Building projects have specific needs for durability, weather resistance, and aesthetics that alternatives must meet.

- Green Building Trends: The growing demand for LEED-certified or net-zero energy buildings pushes contractors towards sustainable material options.

- Ease of Integration: Materials that are easy to source, handle, and install with existing tools and expertise reduce switching barriers.

The threat of substitutes for ABC Supply is moderate but growing, driven by innovative materials and evolving construction methods. While traditional materials like asphalt shingles and wood siding remain popular, alternatives such as metal roofing, fiber-cement siding, and advanced composites are gaining traction due to their durability and sustainability. The rise of modular construction also presents a substitution threat by altering material sourcing needs.

Contractors' decisions to switch are influenced by cost, performance, and sustainability. For instance, the increasing demand for green building standards means that materials with better energy efficiency or lower environmental impact, even if slightly more expensive upfront, might be preferred. This trend was evident in 2024, with a notable uptick in interest for recycled and low-VOC (volatile organic compound) building materials.

| Material Type | Key Substitute | Advantages of Substitute | Considerations for ABC Supply |

|---|---|---|---|

| Roofing | Metal Roofing | Durability, longevity, energy efficiency | Need to offer a wider range of metal roofing options and competitive pricing. |

| Siding | Fiber-Cement Siding | Low maintenance, fire resistance, durability | Ensure competitive sourcing and availability to match demand. |

| Construction Methods | Modular/Prefabricated Building | Faster construction, reduced waste, controlled quality | Explore partnerships or distribution agreements with modular building component suppliers. |

Entrants Threaten

The threat of new entrants in the building materials distribution sector, like that faced by ABC Supply, is significantly diminished by high capital requirements. New companies need to invest heavily in physical infrastructure, including numerous branches and warehouses, alongside a robust transportation fleet. For instance, establishing a nationwide distribution network can easily run into hundreds of millions of dollars, a daunting figure for potential newcomers.

Furthermore, maintaining substantial inventory levels to meet diverse customer demands necessitates considerable working capital. This upfront investment in inventory, coupled with the costs of securing and managing distribution centers, creates a formidable financial barrier. In 2024, the average cost to set up a single, moderately sized distribution hub for building materials can range from $5 million to $15 million, excluding the fleet and inventory.

Incumbent distributors like ABC Supply leverage significant economies of scale in purchasing and logistics. Their substantial order volumes enable them to negotiate more favorable pricing with suppliers, a crucial advantage. For instance, in 2023, the building materials distribution sector saw continued consolidation, with larger players like ABC Supply further solidifying their market positions through strategic acquisitions, enhancing their scale.

These operational efficiencies translate into lower per-unit distribution costs, creating a formidable barrier for new entrants. Without comparable scale, newcomers struggle to match the pricing power of established companies. This cost advantage makes it challenging for new businesses to enter the market and compete effectively on price, especially in a sector where margins can be tight.

ABC Supply's established distribution network, boasting over 1,000 locations nationwide, acts as a significant deterrent to new entrants. This vast infrastructure, coupled with deeply ingrained relationships with both suppliers and professional contractors, creates substantial barriers to entry. For instance, in 2023, ABC Supply reported revenues exceeding $10 billion, underscoring the scale and success of its established operations.

Brand Loyalty and Reputation

In the wholesale distribution of building materials, a strong reputation for reliability, exceptional service, and consistent product availability is paramount, often outweighing traditional consumer brand loyalty. ABC Supply has cultivated a robust reputation over its many years in business, emphasizing customer satisfaction and dependable supply chains. This established trust makes it significantly harder for new companies to rapidly acquire market share and customer confidence.

The threat of new entrants is therefore moderated by the difficulty new players face in replicating ABC Supply's established reputation. Potential competitors must invest heavily in building trust through consistent performance and superior customer engagement. For instance, in 2023, ABC Supply reported revenues of $20.1 billion, underscoring its significant market presence and the substantial barrier this scale represents to newcomers.

- Reputation as a Barrier: ABC Supply's long-standing commitment to service and reliability creates a significant hurdle for new entrants aiming to build similar trust.

- Market Share Challenge: New distributors struggle to quickly gain traction against an incumbent with deep customer relationships and a proven track record.

- Investment Required: Overcoming ABC Supply's established reputation necessitates substantial investment in operational excellence, customer support, and marketing to demonstrate equivalent value.

Regulatory Hurdles and Industry Expertise

While the building materials supply industry isn't as heavily regulated as some manufacturing sectors, new entrants face considerable challenges due to diverse building codes, material specifications, and complex logistical requirements that vary significantly by region. For instance, in 2024, compliance with different state-level energy efficiency standards for insulation materials, like those mandated by California's Title 24, necessitates specialized knowledge and product adaptation.

New companies entering this market must rapidly acquire deep industry expertise to navigate these varied standards and ensure their products meet all necessary compliance requirements. This steep learning curve, coupled with the capital investment needed to establish compliant operations and distribution networks, acts as a significant barrier, deterring many potential new competitors.

- Navigating diverse building codes: Compliance with varying state and local regulations is essential for product acceptance.

- Material specification adherence: Meeting specific technical requirements for materials like fire resistance or structural integrity is critical.

- Logistical complexities: Efficiently managing supply chains across different geographic regions presents a substantial operational hurdle.

- Industry expertise acquisition: The need for specialized knowledge in product application and regulatory compliance demands significant upfront investment and time.

The threat of new entrants for ABC Supply is considerably low due to substantial capital requirements and established economies of scale. New companies need significant investment for infrastructure, inventory, and logistics, making it difficult to compete on price. For instance, in 2024, the cost to establish a single distribution hub can range from $5 million to $15 million, excluding fleet and inventory.

ABC Supply's extensive network of over 1,000 locations and its strong reputation built over years create significant barriers. In 2023, ABC Supply reported revenues exceeding $20 billion, demonstrating its market dominance and the difficulty for newcomers to gain market share and customer trust.

Navigating complex building codes and material specifications across different regions also poses a challenge, requiring specialized knowledge and product adaptation. This, combined with the need for deep industry expertise, further deters potential new competitors from entering the market effectively.

| Barrier Type | Description | Impact on New Entrants | Example Data (2023/2024) |

|---|---|---|---|

| Capital Requirements | High investment in infrastructure, fleet, and inventory. | Significant deterrent. | Distribution hub cost: $5M-$15M (2024). |

| Economies of Scale | Lower per-unit costs due to large order volumes. | Price disadvantage for newcomers. | ABC Supply's 2023 revenue: $20.1B. |

| Brand Loyalty & Reputation | Established trust and customer relationships. | Difficult to replicate quickly. | ABC Supply's extensive nationwide network (1,000+ locations). |

| Regulatory Complexity | Varying building codes and material compliance. | Requires specialized knowledge and adaptation. | State-specific energy efficiency standards (e.g., California Title 24). |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for ABC Supply leverages a comprehensive dataset including industry-specific market research reports, company financial statements, and competitor analysis from trade publications.