A2A SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

A2A Bundle

A2A's strengths lie in its diversified energy and environmental services portfolio, offering stability and multiple revenue streams. However, potential weaknesses include regulatory changes impacting the energy sector and the capital-intensive nature of its operations. Discover the complete picture behind A2A's market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

A2A's strength lies in its highly diversified business model, which spans electricity, gas, integrated water services, and waste management. This broad operational scope provides significant resilience against sector-specific downturns, ensuring more stable revenue streams. For instance, in the first nine months of 2024, A2A reported a net profit of €1.1 billion, demonstrating the strength of its integrated operations even amidst market volatility.

A2A has showcased robust financial performance, with its EBITDA reaching €2.05 billion in 2023, marking a significant increase. This strong financial footing is further evidenced by a net profit of €367 million for the same year, demonstrating healthy profitability.

The company is actively deploying capital, earmarking €13 billion for its 2022-2030 strategic plan, which includes substantial investments in energy transition and circular economy initiatives. This commitment to investment underscores A2A's capacity to fund both internal development and external growth opportunities.

A2A's strategic focus on sustainability and the circular economy is a significant strength, with substantial investments channeled into decarbonization efforts, renewable energy expansion, and sophisticated waste management technologies.

The company has established ambitious goals for reducing its emissions and is recognized as a frontrunner in waste-to-energy projects, championing a model that prioritizes resource efficiency and environmental responsibility. For instance, A2A aims for a 90% reduction in CO2 emissions by 2030 compared to 2019 levels.

This dedication not only bolsters A2A's corporate image but also positions it favorably to capitalize on the growing global demand for environmentally conscious solutions and circular business practices.

Strategic Infrastructure Development

A2A is significantly bolstering its strategic infrastructure, particularly in electricity distribution and renewable energy. For instance, the company committed €1.9 billion to grid modernization and decarbonization initiatives through 2027, aiming to enhance network resilience and efficiency. These investments are crucial for supporting the energy transition and ensuring reliable service delivery to its customers.

The company's strategic infrastructure development is further solidified by recent acquisitions, such as the purchase of a substantial stake in power grid assets. This move, completed in early 2024, strengthens A2A's presence in regulated markets, providing a stable revenue base and operational synergies. Such strategic moves are designed to improve long-term growth prospects and operational performance.

These infrastructure upgrades are not just about expansion; they are also about modernization and efficiency. A2A is investing in advanced waste treatment facilities, aiming to boost recycling rates and energy recovery. By 2025, the company targets a 70% recycling rate in its serviced municipalities, underscoring a commitment to circular economy principles and sustainable operations.

The ongoing investments in critical infrastructure, including electricity networks and renewable generation, position A2A favorably for future market demands. By the end of 2023, A2A had already increased its renewable energy capacity by 15% year-on-year, demonstrating tangible progress in its strategic goals.

Provider of Essential Services

As a multi-utility provider, A2A's strength lies in delivering essential services such as electricity, gas, and water. This fundamental role ensures a steady and predictable demand for its services, underpinning its financial stability. For instance, in 2023, A2A reported a significant portion of its revenue derived from regulated energy networks, highlighting the inelastic nature of demand for these utilities.

The company's position as a provider of critical infrastructure fosters deep community integration and builds substantial stakeholder trust. This societal importance translates into a resilient business model, less susceptible to economic downturns. A2A's commitment to essential services is a core element of its enduring market presence.

- Essential Service Provision: A2A supplies electricity, gas, and water, services that are non-discretionary for consumers and businesses.

- Stable Demand Profile: The inherent necessity of these utilities creates a consistent and relatively inelastic demand, ensuring predictable revenue streams.

- Societal Role and Trust: By providing critical infrastructure, A2A cultivates strong community ties and a high level of stakeholder trust, enhancing its long-term viability.

A2A's diversified business model, encompassing electricity, gas, water, and waste management, provides significant resilience against sector-specific downturns, leading to more stable revenue. This broad operational scope is a key differentiator. For instance, A2A's net profit reached €1.1 billion in the first nine months of 2024, showcasing the robustness of its integrated operations.

The company's commitment to sustainability and the circular economy is a major strength, with substantial investments in decarbonization and waste-to-energy projects. A2A targets a 90% reduction in CO2 emissions by 2030 compared to 2019 levels, positioning it well for environmentally conscious market demands.

A2A is actively strengthening its infrastructure, particularly in electricity distribution and renewables, with a €1.9 billion commitment to grid modernization and decarbonization through 2027. This strategic investment enhances network resilience and efficiency, supporting the energy transition. By the end of 2023, renewable energy capacity had increased by 15% year-on-year.

| Key Strength | Description | Supporting Data/Fact |

| Diversified Business Model | Operates across electricity, gas, water, and waste management, reducing reliance on any single sector. | Net profit of €1.1 billion (Jan-Sep 2024). |

| Sustainability Focus | Invests heavily in decarbonization and circular economy initiatives, aligning with market trends. | Aims for 90% CO2 emission reduction by 2030 (vs. 2019). |

| Infrastructure Investment | Significant capital allocation towards grid modernization and renewable energy expansion. | €1.9 billion allocated to grid/decarbonization through 2027; 15% YoY increase in renewable capacity (end of 2023). |

| Essential Service Provider | Delivers non-discretionary utilities, ensuring stable demand and predictable revenue. | Significant revenue from regulated energy networks in 2023. |

What is included in the product

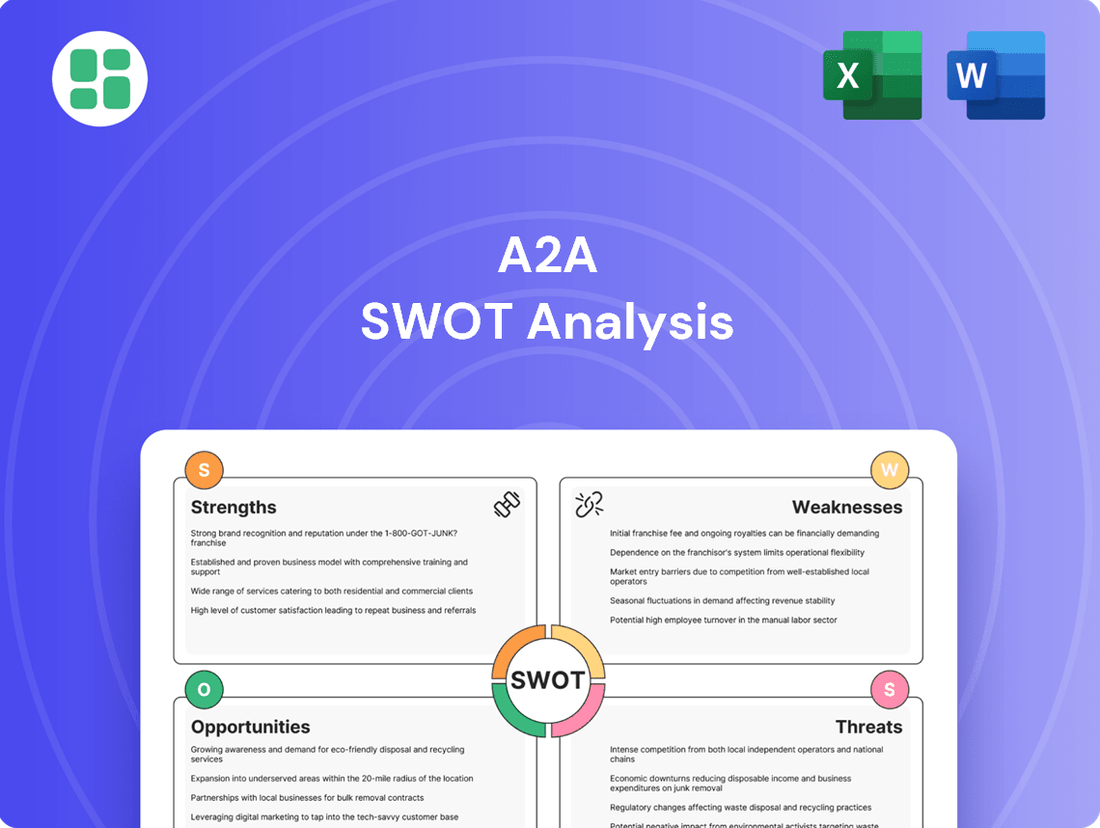

Analyzes A2A’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic challenges, reducing uncertainty and enabling focused problem-solving.

Weaknesses

A2A's strategic roadmap, heavily invested in the energy transition and circular economy, demands significant upfront capital. For instance, the company allocated €13 billion for its 2023-2030 strategic plan, with a substantial portion dedicated to these growth areas.

This high investment intensity, while vital for future profitability, can strain immediate cash flow and increase financial leverage. Managing these capital requirements without compromising financial stability remains a key challenge for the company.

A2A's operations are intrinsically tied to Italy's utility sector, which is subject to substantial government regulation. This means A2A's pricing, investment plans, and ultimately its profitability are directly influenced by policy decisions. For instance, changes in renewable energy incentives or grid access rules, which are common in the sector, can significantly alter the company's financial outlook.

Political instability or shifts in government priorities can introduce considerable uncertainty for A2A. A new administration might implement different energy policies or revise existing regulations, potentially impacting A2A's long-term strategic investments and revenue streams. This dependency makes the company vulnerable to exogenous political and regulatory changes that are outside its direct control.

A2A's reliance on natural gas, a volatile commodity, presents a significant challenge. For instance, in the first half of 2024, fluctuating natural gas prices directly impacted the company's energy generation costs, contributing to earnings volatility. This exposure means that unexpected price spikes can squeeze profit margins, even with diversification efforts.

Furthermore, A2A's substantial hydroelectric capacity, while a strength in its renewable portfolio, is inherently tied to weather patterns. In 2024, periods of lower rainfall in certain regions led to reduced hydroelectric output, directly affecting the company's earnings and highlighting the vulnerability to hydrological conditions. This variability in renewable generation can create unpredictable revenue streams.

Intense Market Competition in Liberalized Segments

While A2A enjoys a solid footing in its regulated business areas, the Italian energy retail market, a key liberalized segment, presents a formidable challenge. This intense competition directly impacts A2A's ability to attract and keep customers, potentially squeezing profit margins.

The liberalized energy market, especially in retail, is characterized by a multitude of players vying for consumer attention. This forces A2A to constantly adapt its strategies to remain competitive.

- Intense Competition in Energy Retail: The Italian energy retail sector is highly fragmented, with numerous operators competing for market share.

- Pressure on Margins: Aggressive pricing and promotional activities by competitors can lead to reduced profitability for A2A in its liberalized segments.

- Customer Acquisition and Retention Costs: The need to continuously attract new customers and retain existing ones in a competitive landscape increases operational expenses.

Integration Challenges with Acquisitions

A2A's pursuit of growth through mergers and acquisitions, exemplified by the Duereti acquisition, introduces significant integration challenges. Successfully merging substantial electricity distribution assets, as seen in the Duereti deal, requires navigating complex operational adjustments and potential cultural clashes.

These large-scale integrations carry inherent risks, particularly in achieving the projected synergies that justify the acquisition. Failure to manage these complexities effectively can hinder the expected positive impact on A2A's overall financial performance.

For instance, the integration of Duereti, a significant acquisition, highlights the critical need for robust post-merger management to unlock value and avoid operational disruptions.

- Operational Complexities: Integrating diverse asset bases and IT systems can lead to inefficiencies if not managed proactively.

- Cultural Integration: Merging different organizational cultures is often a stumbling block, impacting employee morale and productivity.

- Synergy Realization Risk: Achieving anticipated cost savings and revenue enhancements from acquisitions is not guaranteed and depends heavily on execution.

A2A faces significant financial strain due to its ambitious strategic investments, particularly in the energy transition and circular economy, with a €13 billion allocation planned through 2030. This high capital expenditure can impact immediate cash flow and increase financial leverage, demanding careful management to maintain financial stability.

The company is heavily reliant on Italian government regulations, making its pricing, investment plans, and profitability susceptible to policy shifts and political instability. For example, changes in renewable energy incentives or grid access rules, common in the sector, can significantly alter A2A's financial outlook.

A2A's exposure to volatile natural gas prices, as seen in the first half of 2024 impacting generation costs, and its dependence on weather-dependent hydroelectric output, highlighted by reduced output in 2024 due to lower rainfall, introduce earnings volatility.

Intense competition in the Italian energy retail market pressures A2A's margins and increases customer acquisition and retention costs. Furthermore, the integration of large acquisitions, such as Duereti, presents operational complexities and risks to synergy realization, potentially hindering overall financial performance.

Same Document Delivered

A2A SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase. This ensures you know exactly what you're getting—a professional, comprehensive report. No surprises, just the full, detailed analysis.

Opportunities

Italy's ambitious decarbonization goals, aiming for a 55% reduction in greenhouse gas emissions by 2030 compared to 1990 levels, offer a prime growth avenue for A2A. The company's strategic alignment with the EU's renewable energy targets, which include achieving 42.5% of energy from renewables by 2030, positions it to capitalize on substantial investments in solar and wind power.

A2A's focus on ecological transition is well-supported by government incentives and the increasing demand for green energy solutions. This presents a clear opportunity to expand its renewable generation capacity, potentially increasing its renewable energy share beyond the current 50% of its total electricity production, thereby solidifying its market leadership in sustainable energy.

A2A's strategic focus on the circular economy and waste management presents significant opportunities, driven by increasing global and national commitments to sustainability. The company's existing leadership in Italy, evidenced by its extensive waste treatment and recovery infrastructure, positions it well to capitalize on this trend. For instance, A2A's investments in advanced sorting technologies and waste-to-energy plants are designed to maximize resource recovery, aligning with the European Union's ambitious recycling targets for 2030.

The growing global emphasis on smart cities presents a significant opportunity for A2A. Demand for integrated solutions like smart grids, advanced energy efficiency services, and digital utility management platforms is accelerating, creating avenues for A2A to expand its offerings and drive innovation.

By investing in digitalization, A2A can streamline its network operations, leading to greater efficiency and reliability. This technological advancement also enhances customer engagement through improved service delivery and personalized interactions, a key factor in today's competitive utility landscape.

Furthermore, A2A's involvement in smart city development directly supports urban sustainability goals. For instance, the company's smart grid initiatives in Italy, aiming to reduce energy losses and integrate renewable sources, align with the broader objective of creating more environmentally friendly urban environments.

Strategic Mergers and Acquisitions in the Utility Sector

The Italian utility sector is ripe for consolidation, presenting A2A with significant opportunities to grow its regulated asset base and market share through strategic mergers and acquisitions. This trend is driven by the need for greater economies of scale in an increasingly competitive landscape.

A2A's proven track record in executing successful M&A transactions positions it well to capitalize on these market dynamics. Such moves can enhance its competitive standing and operational efficiency.

- Expansion of Regulated Assets: Acquiring utilities with substantial regulated infrastructure, like electricity grids or water networks, offers stable, predictable revenue streams.

- Market Share Growth: Consolidation allows A2A to absorb competitors, increasing its customer base and overall market presence, particularly in key Italian regions.

- Economies of Scale: Merging operations can lead to cost savings through shared resources, optimized supply chains, and reduced overhead, boosting profitability.

- Synergistic Opportunities: Potential exists for integrating complementary services, such as combining waste management with energy production, creating a more robust and diversified business model.

Favorable Regulatory Frameworks and Incentives

A2A benefits from a regulatory landscape that actively encourages green initiatives and infrastructure upgrades. For instance, European Union directives, such as the Renewable Energy Directive (RED III), set ambitious targets for renewable energy deployment, creating a fertile ground for A2A's investments in areas like energy storage and renewable energy communities. These policies translate into tangible financial support and a predictable market for sustainable solutions.

The Italian government, mirroring EU ambitions, has introduced various incentives that directly support A2A's strategic objectives. These include tax credits and subsidies for energy efficiency projects and the development of smart grids. In 2024, Italy continued to emphasize the importance of energy transition, with significant funding allocated to projects that modernize energy infrastructure and promote circular economy principles, aligning perfectly with A2A's business model.

- EU Green Deal Alignment: Policies like the EU's Fit for 55 package provide a strong tailwind for A2A's decarbonization efforts and investments in renewable energy sources.

- National Incentives: Italy's PNRR (National Recovery and Resilience Plan) earmarks substantial funds for green transition and infrastructure modernization, offering direct funding opportunities for A2A's projects.

- Energy Communities Support: Specific incentives for energy communities, as seen in recent Italian legislation, allow A2A to foster distributed renewable energy generation and consumption models, enhancing grid stability and customer engagement.

- Circular Economy Promotion: Regulatory frameworks promoting waste-to-energy and resource recovery create a supportive environment for A2A's waste management and circular economy segment, ensuring attractive returns on these investments.

A2A is well-positioned to benefit from Italy's and the EU's aggressive decarbonization targets, particularly through investments in solar and wind power, aiming to increase its renewable energy share beyond the current 50%. The company's leadership in circular economy initiatives, supported by advanced waste management technologies and EU recycling goals, offers substantial growth. Furthermore, the expanding smart city market presents opportunities for integrated solutions like smart grids, enhancing efficiency and customer engagement.

The Italian utility sector's consolidation trend provides A2A with avenues to expand its regulated asset base and market share through strategic acquisitions, leveraging its proven M&A capabilities for synergistic growth. Supportive regulatory frameworks, including EU directives and Italian incentives like the PNRR, offer financial backing and a predictable market for A2A's green initiatives and infrastructure upgrades, particularly in energy communities and circular economy projects.

| Opportunity Area | Key Drivers | A2A's Position | Example Initiatives |

|---|---|---|---|

| Renewable Energy Expansion | EU & Italian Decarbonization Targets (e.g., 55% GHG reduction by 2030) | Existing 50%+ renewable energy share | Investment in new solar and wind farms |

| Circular Economy & Waste Management | EU Recycling Targets, Demand for Green Solutions | Leading waste treatment infrastructure in Italy | Advanced sorting technologies, waste-to-energy plants |

| Smart City Development | Growing Global Demand for Integrated Urban Solutions | Focus on digitalization and smart grid initiatives | Smart grid implementation for energy efficiency |

| Sector Consolidation (M&A) | Need for Economies of Scale in Utilities | Proven M&A track record | Acquisition of smaller utilities to expand regulated assets |

| Supportive Regulatory Environment | EU Green Deal, Italian PNRR, Energy Community Incentives | Alignment with policy objectives | Projects funded by national recovery plans |

Threats

A2A faces significant risks from evolving regulatory landscapes. For instance, potential shifts in European Union energy policies, such as the implementation of carbon taxes or more stringent emissions targets beyond current projections, could directly impact A2A's operational costs and the economic viability of its existing and planned renewable energy projects. Changes in national policies regarding waste management and energy recovery also pose a threat, potentially affecting revenue streams from these crucial business segments.

A significant economic downturn in Italy or across Europe presents a substantial threat to A2A. Such a recession could directly lead to reduced energy consumption by industrial and commercial clients, impacting A2A's revenue streams and overall profitability. For instance, if Italy's GDP growth, projected by the Bank of Italy to be around 0.6% for 2025, were to turn negative, this would signal a contraction in economic activity, directly correlating with lower energy demand.

While A2A benefits from the essential nature of its services, offering some degree of resilience, prolonged economic contraction still poses a risk. A sustained economic slump can affect not only overall demand for energy and environmental services but also potentially impact collection rates from customers, adding another layer of financial pressure.

While A2A actively works to reduce its environmental footprint, the company remains exposed to the physical consequences of climate change. For instance, the 2023 drought in Italy, which impacted water availability, could directly affect A2A's hydroelectric power generation, a significant part of its energy mix. Such events can lead to reduced output, higher operational expenses for alternative energy sourcing, and potential disruptions to the reliable supply of electricity to its customers.

Cybersecurity Risks and Infrastructure Vulnerability

A2A's growing dependence on digital systems for smart grid management and operational improvements exposes it to significant cybersecurity threats. A breach could lead to service disruptions, data theft, or damage to vital infrastructure, resulting in substantial financial and reputational harm.

The increasing sophistication of cyber-attacks poses a constant challenge, with the global cost of cybercrime projected to reach $10.5 trillion annually by 2025, according to Cybersecurity Ventures. For A2A, this translates to a tangible risk of operational paralysis and financial penalties.

- Increased attack surface: As A2A expands its digital footprint, more entry points for malicious actors emerge.

- Critical infrastructure targeting: Energy grids are prime targets for nation-state actors and organized cybercriminal groups.

- Data privacy and compliance: Protecting sensitive customer and operational data is paramount, with significant fines for breaches under regulations like GDPR.

Public and Local Opposition to New Infrastructure

Developing new large-scale infrastructure, like waste-to-energy plants or renewable energy facilities, can encounter significant local opposition and protracted permitting procedures. These challenges can lead to substantial project delays, escalating costs, or even the outright cancellation of crucial investments needed for A2A's strategic expansion.

For instance, in 2023, Italy saw an average of 18 months for environmental impact assessments for major infrastructure projects, a timeline that can be extended considerably by public consultation phases and potential legal challenges. This regulatory environment directly impacts A2A's ability to implement its growth strategy, particularly in areas requiring new plant construction or significant upgrades.

- Project Delays: Public opposition can add years to project timelines, impacting revenue generation and return on investment.

- Cost Overruns: Extended permitting and legal battles often result in substantial increases in project capital expenditure.

- Strategic Setbacks: The cancellation or significant alteration of key infrastructure projects can hinder A2A's progress towards its decarbonization and circular economy goals.

A2A faces significant threats from regulatory shifts, particularly concerning EU energy policies and national waste management regulations, which could increase operational costs and impact revenue. Economic downturns in Italy or Europe pose a risk of reduced energy consumption and lower collection rates, directly affecting profitability. Furthermore, A2A's reliance on digital systems makes it vulnerable to sophisticated cyber-attacks, with global cybercrime costs projected to reach $10.5 trillion annually by 2025, threatening operational continuity and data security.

| Threat Category | Specific Risk | Potential Impact | Example/Data Point |

|---|---|---|---|

| Regulatory Changes | Stricter emissions targets / Carbon taxes | Increased operational costs, reduced project viability | EU energy policy shifts |

| Economic Downturn | Reduced energy demand / Lower collection rates | Decreased revenue, financial pressure | Italy GDP growth projected at 0.6% for 2025 (Bank of Italy) |

| Cybersecurity Threats | Data breaches / Infrastructure disruption | Financial and reputational damage | Global cybercrime costs projected to reach $10.5 trillion by 2025 |

| Project Development Hurdles | Local opposition / Permitting delays | Project delays, cost overruns, strategic setbacks | Average 18-month EIA for major Italian projects in 2023 |

SWOT Analysis Data Sources

This A2A SWOT analysis is built upon a robust foundation of data, including official company financial filings, comprehensive market intelligence reports, and expert industry evaluations to ensure a thorough and accurate strategic assessment.