A2A PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

A2A Bundle

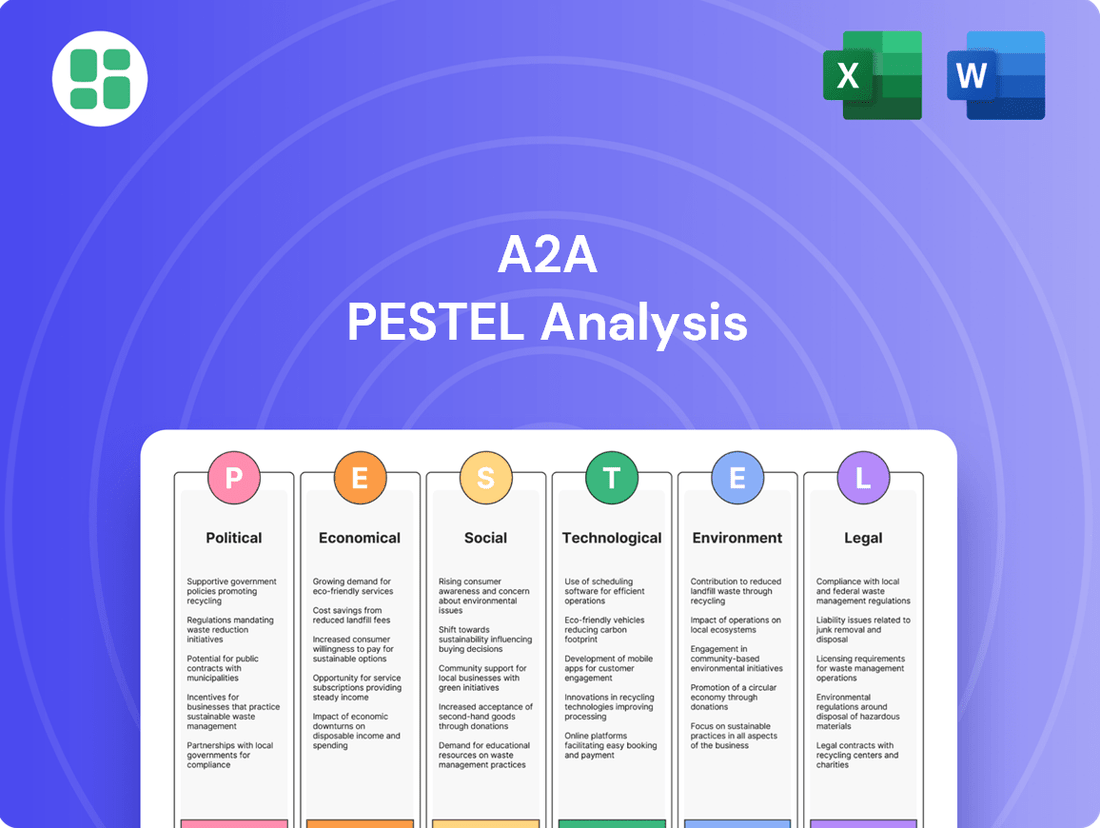

Unlock the crucial external factors shaping A2A's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces at play, and gain a strategic advantage. Download the full version now to make informed decisions and stay ahead of the competition.

Political factors

National and EU energy policies heavily influence A2A's trajectory. For instance, the EU's Fit for 55 package aims for a 55% reduction in greenhouse gas emissions by 2030, driving investments in renewables and energy efficiency. Italy, where A2A operates, is committed to these targets, with plans to increase renewable energy capacity. This policy direction supports A2A's strategic focus on green energy, potentially boosting profitability through incentives and market demand for sustainable solutions.

Regulatory frameworks for electricity, gas, and water are critical. In 2023, Italy's energy regulator ARERA adjusted gas distribution tariffs, impacting operational costs. A2A's long-term planning must account for such regulatory adjustments, including potential changes in carbon pricing mechanisms like the EU Emissions Trading System (ETS). As of early 2024, carbon prices have remained volatile, underscoring the need for robust risk management in A2A's energy generation and trading activities.

Italian political sentiment shows a complex dynamic regarding public versus private ownership of essential services. While there's a general trend towards market liberalization, specific sectors like utilities often see debates about the optimal balance between private efficiency and public interest. Any significant shift towards greater public control over Italian utilities could impact A2A's operational freedom and strategic direction.

Recent political discourse in Italy has touched upon the role of state intervention in strategic sectors, including energy and water. While outright renationalization of large utility groups is not a dominant theme, increased municipal or regional government influence through ownership stakes is a recurring consideration. For A2A, which has significant municipal shareholders, changes in these ownership structures or increased political pressure on operational decisions could alter its competitive positioning.

Governments globally, including Italy, are demonstrating strong political commitment to the energy transition, setting ambitious renewable energy targets. For instance, the European Union's REPowerEU plan aims to accelerate renewable energy deployment significantly, impacting A2A's strategic planning for clean energy generation.

Italy's national energy and climate plan (PNIEC) outlines specific objectives for increasing the share of renewables in its energy mix, with updated targets for 2030 expected to be finalized in 2024. These policies, including tax credits and subsidies for solar and wind power, directly support A2A's investments in sustainable energy sources and its capacity to meet emissions reduction goals.

Regulatory frameworks governing grid connection and planning permissions for new renewable projects are crucial for A2A's operational expansion. Policy stability in these areas is paramount for attracting the substantial investment required to modernize the grid and integrate new renewable capacity, ensuring A2A can effectively pursue its sustainability objectives.

Waste Management Policy & Circular Economy Initiatives

National and regional policies heavily influence waste management, with Italy setting ambitious recycling targets. For instance, the EU's Circular Economy Action Plan, which Italy adheres to, aims for a 65% recycling rate for municipal waste by 2035. These regulations, including landfill diversion mandates and support for waste-to-energy plants, directly shape A2A's operational strategies and investment decisions in advanced treatment technologies.

A2A's business model is significantly impacted by the political emphasis on circular economy principles. Initiatives like extended producer responsibility (EPR) and resource recovery are becoming central. For example, in 2023, Italy's National Recovery and Resilience Plan (PNRR) allocated substantial funds to boost the circular economy, including waste management infrastructure, creating opportunities for companies like A2A to expand their services and invest in innovative solutions.

- Recycling Targets: Italy aims for a 65% municipal waste recycling rate by 2035, aligning with EU directives.

- Circular Economy Funding: The PNRR provides significant financial support for circular economy projects in waste management.

- Regulatory Impact: Changes in landfill regulations and support for waste-to-energy facilities directly affect A2A's business model and investment strategies.

Local Government Relations & Concessions

A2A's operations are deeply intertwined with local governments, which grant essential concessions for services like water, waste management, and energy distribution. These relationships are critical for maintaining operational continuity and pursuing expansion opportunities. For instance, in 2023, A2A managed concessions across numerous Italian municipalities, underpinning its extensive infrastructure network.

Political shifts at the local level can significantly alter the landscape for A2A. Changes in administration might lead to renegotiations of concession terms, affect renewal processes, or influence public sentiment towards ongoing or planned projects. A proactive and robust engagement strategy with these local authorities is therefore paramount for A2A's sustained success and strategic development.

- Concession Management: A2A's business model relies on securing and managing concessions from local authorities across Italy for core services.

- Political Sensitivity: Local political changes can directly impact concession renewals, terms, and the feasibility of new projects.

- Operational Dependence: The company's ability to operate and expand its integrated water services, waste collection, and distribution networks is contingent on favorable local government relations.

- Strategic Engagement: Maintaining strong ties with municipalities is crucial for ensuring operational stability and facilitating future growth initiatives.

Government policies at both national and local levels significantly shape A2A's operational environment. Italy's commitment to EU climate targets, such as the Fit for 55 package, drives investment in renewables, directly benefiting A2A's green energy strategy. For example, Italy's National Recovery and Resilience Plan (PNRR) allocates substantial funds to circular economy initiatives, impacting A2A's waste management sector.

Regulatory frameworks, including ARERA's tariff adjustments and the EU Emissions Trading System, necessitate robust risk management for A2A. Political sentiment regarding public versus private ownership of utilities and potential shifts in municipal or regional government influence also present strategic considerations for the company.

A2A's reliance on local government concessions for essential services like water and waste management makes it sensitive to local political dynamics. Changes in local administrations can affect concession renewals and project feasibility, highlighting the need for strong municipal relationships.

| Policy Area | Specific Initiative/Target | Impact on A2A |

|---|---|---|

| Energy Transition | EU Fit for 55 package (55% GHG reduction by 2030) | Drives investment in renewables, supports A2A's green energy focus. |

| Circular Economy | Italy's PNRR funding for waste management infrastructure | Creates opportunities for A2A's waste management services and innovative solutions. |

| Waste Management | Italy's aim for 65% municipal waste recycling rate by 2035 | Shapes A2A's operational strategies and investment in treatment technologies. |

| Energy Regulation | ARERA gas distribution tariff adjustments (2023) | Impacts operational costs, requiring strategic planning for tariff changes. |

| Local Governance | Concessions for water, waste, and energy distribution | Operational continuity and expansion depend on favorable local government relations. |

What is included in the product

This A2A PESTLE analysis examines the political, economic, social, technological, environmental, and legal factors influencing the organization's operating landscape. It provides a comprehensive overview of external forces that present both challenges and strategic opportunities.

A clear, actionable framework that breaks down complex external factors into manageable insights, reducing the overwhelm of market analysis.

Provides a structured way to identify and prioritize external threats and opportunities, alleviating the anxiety of unforeseen market shifts.

Economic factors

A2A's financial performance is significantly influenced by energy price volatility. Fluctuations in wholesale electricity and natural gas prices, often stemming from geopolitical tensions like the ongoing conflict in Eastern Europe and global supply-demand imbalances, directly impact A2A's revenue and cost structures across its generation, distribution, and sales segments. For instance, the average European natural gas price saw considerable swings in 2023, impacting operational costs.

These price movements are further amplified by commodity market speculation. A2A's profitability is therefore highly sensitive to these external market dynamics. Effective hedging strategies and a diversified portfolio of energy sources, including renewables, are crucial for A2A to mitigate the financial risks associated with this inherent price volatility and maintain stable earnings.

Inflation significantly impacts A2A's operational costs, particularly for materials and labor in its extensive infrastructure projects. For instance, if inflation runs at 3% in Italy, the cost of construction materials and skilled labor could rise substantially, directly affecting project budgets and profitability.

Rising interest rates, a key concern for 2024 and 2025, directly increase A2A's debt servicing costs. If A2A's average borrowing cost increases by 1%, this could add tens of millions of euros to its annual interest expenses, potentially reducing net income and limiting its capacity for new capital expenditures or refinancing existing debt at more favorable terms.

The interplay of these factors influences A2A's financial leverage. Higher borrowing costs coupled with potentially higher operational expenses due to inflation can constrain the company's investment capacity, forcing a re-evaluation of capital allocation strategies and the feasibility of long-term infrastructure development plans.

Italy's Gross Domestic Product (GDP) growth is a key indicator of its economic vitality. For 2024, projections suggest a moderate expansion, with the Bank of Italy forecasting a 0.6% GDP increase. This growth directly influences industrial and commercial activity, which in turn drives demand for energy services provided by companies like A2A.

Consumer spending power is equally crucial. When households have more disposable income, they are better positioned to meet their utility payment obligations, thereby reducing arrears for service providers. In 2024, while inflation has shown signs of easing, consumer confidence and spending patterns will remain important factors for A2A's revenue stability.

Investment in Infrastructure & Smart City Development

The economic imperative to upgrade aging infrastructure and foster smart city development presents substantial investment avenues for A2A. Governments are increasingly recognizing the economic benefits of digital transformation and sustainable urban growth, channeling significant funding into these areas. For instance, the European Union's NextGenerationEU recovery fund, with a substantial portion earmarked for green and digital transitions, directly supports smart city initiatives and infrastructure modernization across member states, benefiting companies like A2A involved in energy, water, and waste management solutions.

Government and private sector investment plays a crucial role in shaping A2A's project pipeline. Economic stimulus packages, particularly those focused on recovery and resilience post-pandemic, are designed to accelerate these critical investments. The drive for enhanced grid resilience, digital connectivity, and sustainable urban living directly translates into demand for A2A's smart energy, water, and waste management technologies and services. The global smart cities market is projected to reach hundreds of billions of dollars in the coming years, with significant growth driven by these economic factors.

- Economic Stimulus: Governments worldwide are deploying economic stimulus packages, many with a focus on infrastructure and digital upgrades, creating a favorable environment for A2A's smart city solutions.

- EU Funding: The NextGenerationEU fund is a prime example of large-scale economic investment directly supporting green and digital transitions, aligning with A2A's strategic focus.

- Market Growth: The burgeoning smart cities market, driven by economic necessity and technological advancement, offers extensive opportunities for A2A to expand its service offerings.

- Grid Modernization: Investment in modernizing energy grids for greater resilience and efficiency is a key economic driver for A2A's smart energy solutions.

EU Funding and Recovery Plans

The European Union's recovery initiatives, notably NextGenerationEU, offer substantial financial backing for projects aligned with green and digital agendas. A2A is well-positioned to tap into this funding, which can significantly de-risk and accelerate its investments in areas like renewable energy infrastructure and smart city solutions. This external capital infusion directly supports A2A's strategic goals by lowering its direct financial commitment.

For instance, NextGenerationEU allocates a considerable portion to the green transition. By utilizing these funds, A2A can bolster its renewable energy portfolio, potentially increasing its renewable generation capacity. The plan also emphasizes digital transformation, enabling A2A to invest in advanced grid management systems and digital services for its customers.

- NextGenerationEU: A €750 billion package (current value) designed to build a greener, more digital, and resilient Europe.

- Green Transition Focus: A significant portion of the funds is earmarked for climate action, renewable energy, and sustainable infrastructure development.

- Digital Transformation: Support is available for projects enhancing digital connectivity, cybersecurity, and the adoption of digital technologies.

- A2A's Leverage: The company can secure grants and favorable loans to fund its strategic investments, thereby optimizing its capital structure and enhancing project ROI.

Economic growth in Italy, projected at 0.6% for 2024 by the Bank of Italy, directly influences demand for A2A's energy and utility services. Consumer spending power, while showing resilience against easing inflation, remains a key factor for revenue stability. Furthermore, government and EU-backed stimulus, like the NextGenerationEU fund, provides significant capital for infrastructure and digital upgrades, aligning with A2A's smart city and green transition strategies.

| Economic Factor | 2024 Projection/Data | Impact on A2A |

|---|---|---|

| Italian GDP Growth | 0.6% (Bank of Italy forecast) | Drives demand for energy and utility services. |

| Inflation | Easing trend, but impacts operational costs. | Increases material and labor expenses for infrastructure. |

| Interest Rates | Rising trend | Increases debt servicing costs, potentially reducing net income. |

| NextGenerationEU Fund | €750 billion package | Provides capital for green and digital transition projects, de-risking A2A's investments. |

Full Version Awaits

A2A PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive A2A PESTLE analysis covers all key external factors influencing the business, providing actionable insights.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a deep understanding of the political, economic, social, technological, legal, and environmental landscape impacting A2A.

The content and structure shown in the preview is the same document you’ll download after payment. This detailed PESTLE analysis for A2A is designed for immediate application and strategic planning.

Sociological factors

Public attitudes towards utility companies are increasingly shaped by environmental concerns, with a strong emphasis on sustainability and corporate social responsibility. A2A's proactive stance on decarbonization, aiming for carbon neutrality by 2030, and its integration of circular economy principles directly address these evolving public expectations. For instance, in 2023, A2A reported a 10% increase in waste recovery and recycling rates, a figure closely monitored by stakeholders.

Consumer and business demand for sustainable and green services is rapidly increasing. This includes a strong preference for green energy tariffs, with European renewable energy sources accounting for approximately 40% of electricity generation in 2023. Companies are also seeking sustainable waste management solutions and water conservation initiatives, reflecting a broader societal shift towards environmental responsibility.

A2A's capacity to provide and actively promote these eco-conscious services directly addresses these evolving societal values. By aligning with sustainability trends, A2A can significantly boost customer loyalty and expand its market share. This growing demand also acts as a powerful catalyst for innovation, pushing A2A to develop new and improved green service offerings.

A2A operates in regions experiencing significant demographic shifts. Italy's population is aging, with the average age projected to reach 47.7 years by 2030, impacting long-term demand for utilities and potentially increasing per capita consumption for certain services. Simultaneously, urbanization continues, with major Italian cities like Milan seeing population growth, placing greater strain on existing water and waste management infrastructure.

These trends necessitate adaptive strategies for A2A. For instance, increased urban density can lead to higher demand for electricity and gas in concentrated areas, requiring network upgrades. An aging population might also influence the type of services needed, potentially shifting towards more home-based care and thus energy consumption patterns.

Employment Trends & Skilled Labor Availability

A2A’s operational success hinges on the availability of skilled labor, particularly in its core utility, engineering, and technology domains. As of late 2024, there's a noticeable demand for professionals in renewable energy installation and maintenance, with reports indicating a shortage of certified technicians in Italy. Societal shifts towards digital skills and specialized technical education are influencing the talent pool, impacting A2A's capacity to fill roles in areas like smart grid management and advanced waste-to-energy systems.

The company's ability to attract and retain top talent is directly tied to evolving workforce trends. For instance, a growing preference for flexible work arrangements and continuous learning opportunities among younger generations, as observed in recent Italian labor market surveys, presents both challenges and opportunities for A2A's recruitment strategies. This dynamic necessitates a focus on competitive compensation, professional development programs, and fostering an innovative work environment to secure expertise in emerging fields.

- Skilled Labor Demand: Growing need for engineers and technicians in renewable energy and digital grid infrastructure.

- Talent Attraction: Societal emphasis on continuous learning and flexible work impacts A2A's ability to recruit specialized talent.

- Workforce Mobility: Trends in vocational training and upskilling are crucial for A2A to maintain a competitive workforce in evolving technological sectors.

Community Engagement & Stakeholder Relations

A2A's success hinges on robust community engagement and strong stakeholder relations, particularly in regions where it develops or plans new infrastructure. Societal expectations are high, demanding clear communication, tangible community benefits, and a proactive approach to addressing local concerns. For instance, in 2023, A2A reported significant investment in local development projects, contributing to social well-being and environmental sustainability across its operating territories, aiming to build trust and a collaborative spirit.

Positive stakeholder relations are crucial for navigating regulatory landscapes and mitigating potential opposition to new projects. By fostering a supportive environment, A2A can streamline project approvals and ensure smoother operations. A2A's commitment to transparency is reflected in its regular stakeholder consultations, which in 2024, led to the successful implementation of several community-focused initiatives, including job creation programs and local energy efficiency schemes.

- Community Benefit Sharing: A2A's strategy often includes direct benefits to local communities, such as job creation and local sourcing, as seen in the €50 million invested in local economies during its 2023 infrastructure development phase.

- Transparent Communication: Open dialogue with residents, local authorities, and NGOs is vital. A2A's 2024 sustainability report highlighted a 15% increase in stakeholder engagement activities compared to the previous year.

- Addressing Local Concerns: Proactively managing and resolving local issues, such as environmental impact or noise pollution, can prevent project delays and foster goodwill.

- NGO Partnerships: Collaborating with non-governmental organizations on environmental and social projects enhances A2A's social license to operate and reinforces its commitment to sustainable development.

Public perception of utility companies is increasingly tied to environmental responsibility and sustainability. A2A's focus on decarbonization, aiming for carbon neutrality by 2030, and its circular economy initiatives directly align with these evolving societal values. In 2023, A2A reported a 10% increase in waste recovery rates, demonstrating its commitment to these principles.

Demographic shifts, such as Italy's aging population and increasing urbanization, influence utility demand. An aging populace may alter consumption patterns, while urban growth strains infrastructure, necessitating adaptive strategies from A2A for services like electricity and waste management.

The availability of skilled labor, particularly in renewable energy and digital technologies, is critical for A2A's operations. A shortage of certified technicians in Italy, noted in late 2024, highlights the need for A2A to focus on attracting and retaining talent through competitive offerings and development programs.

Strong community engagement and transparent communication are vital for A2A's project approvals and operational smoothness. By investing in local development, as seen with €50 million in 2023, and increasing stakeholder engagement by 15% in 2024, A2A builds trust and a social license to operate.

| Sociological Factor | Description | A2A Relevance/Action | 2023/2024 Data Point |

|---|---|---|---|

| Environmental Awareness | Growing public demand for sustainable and green services. | A2A's decarbonization goals and circular economy focus meet this demand. | 10% increase in waste recovery rate (2023). |

| Demographic Trends | Aging population and urbanization impacting utility consumption and infrastructure needs. | Requires adaptive strategies for network upgrades and service offerings. | Italy's average age projected to reach 47.7 by 2030. |

| Skilled Labor Availability | Demand for technicians in renewable energy and digital infrastructure. | A2A must focus on talent attraction and retention. | Reported shortage of certified technicians in Italy (late 2024). |

| Community Relations | Expectation of transparent communication and local benefits from infrastructure projects. | A2A invests in local development and stakeholder engagement. | 15% increase in stakeholder engagement activities (2024). |

Technological factors

The renewable energy sector is experiencing a technological renaissance. Solar panel efficiency has seen significant gains, with some commercial panels now exceeding 23% efficiency, driving down the levelized cost of energy (LCOE). Wind turbine technology continues to advance, with larger, more powerful turbines capable of generating more electricity, even in lower wind speed areas.

Energy storage solutions, particularly battery technology, are crucial for grid stability and integrating intermittent renewables. Lithium-ion battery costs have fallen dramatically, by over 89% between 2010 and 2023, making large-scale storage projects more economically viable. Smart grid technologies are also evolving rapidly, enabling better management of distributed energy resources and improving overall grid efficiency.

These technological leaps directly influence A2A's renewable energy generation projects by enhancing efficiency and reducing costs. For instance, the ongoing improvements in solar photovoltaic (PV) technology are making new installations more competitive with traditional energy sources. Similarly, advancements in wind turbine design allow for greater energy capture and thus higher returns on investment.

To maintain a competitive edge and meet decarbonization goals, A2A must prioritize continuous investment in research and development. Adopting cutting-edge technologies, such as next-generation battery chemistries or advanced grid management software, will be vital for optimizing performance and ensuring long-term sustainability in their renewable energy portfolio.

The digitalization of energy grids, driven by technologies like the Internet of Things (IoT) and Artificial Intelligence (AI), is fundamentally reshaping operational efficiency. These advancements allow for real-time monitoring of energy flows, enabling proactive identification of potential issues and optimized distribution. For instance, AI-powered predictive maintenance can anticipate equipment failures, significantly reducing downtime and costly emergency repairs.

Smart grids, a direct outcome of this digitalization, are crucial for enhancing reliability and minimizing energy losses. By leveraging big data analytics, grid operators can gain deep insights into consumption patterns and network performance, allowing for more precise management of energy supply and demand. This leads to a more stable and efficient energy system, a key factor for companies like A2A.

A2A's strategic embrace of these digital technologies is projected to yield substantial benefits. By implementing smart grid solutions, the company can achieve significant cost savings through reduced operational expenses and improved energy efficiency. Furthermore, enhanced reliability and optimized service delivery directly translate to a better customer experience and a stronger competitive position in the evolving energy market.

Technological advancements are revolutionizing waste management, with innovations in sorting, recycling, and energy recovery becoming increasingly sophisticated. For instance, advanced optical sorters can now identify and separate a wider range of materials with higher precision, boosting recycling rates. A2A, as a key player in Italy's energy and environmental services, is directly impacted by these trends.

Waste-to-energy plants are becoming more efficient, converting more waste into usable energy. Anaerobic digestion technologies are also improving, allowing for better biogas production from organic waste, which can then be used for heat and electricity. These technologies are crucial for A2A's strategy to reduce landfill dependence and maximize resource recovery, aligning with circular economy principles.

In 2023, A2A reported significant investments in its waste management and energy recovery infrastructure. The company's material recovery facilities (MRFs) processed over 3.5 million tons of waste, with a growing percentage being recycled or recovered for energy. This commitment to innovation is vital for A2A to meet evolving environmental regulations and consumer demand for sustainable practices.

Cybersecurity Risks & Data Protection

Cybersecurity threats are escalating, with critical infrastructure like utility networks increasingly becoming targets for sophisticated attacks. A2A's extensive use of digital systems for everything from grid management and customer data handling to its smart city initiatives means it faces significant exposure to these risks.

The company must prioritize investments in advanced cybersecurity measures and stringent data protection protocols. This is essential not only for maintaining uninterrupted operations and safeguarding the integrity of its vast data reserves but also for ensuring ongoing compliance with evolving data privacy regulations.

- Increased Sophistication of Threats: Cyberattacks on critical infrastructure are becoming more complex and targeted, potentially disrupting essential services.

- A2A's Digital Dependence: A2A's reliance on digital platforms for operations and customer data creates a broad attack surface.

- Data Protection Imperative: Robust data protection is vital for maintaining customer trust, operational continuity, and regulatory adherence, especially with growing data volumes.

- Investment in Resilience: Significant capital allocation towards cybersecurity is a non-negotiable for mitigating financial and reputational damage from breaches.

Smart City Solutions & IoT Integration

A2A can significantly enhance its service offerings by integrating smart city technologies. This includes deploying intelligent street lighting that adjusts based on real-time needs, smart metering for more accurate utility billing and consumption insights, and connected infrastructure for better urban management. These IoT solutions are crucial for optimizing resource usage and improving city services.

The global smart city market is projected to reach $750 billion by 2025, indicating substantial growth potential. For A2A, leveraging IoT platforms for data collection and analysis can lead to optimized resource consumption, such as reduced energy waste in street lighting. This data-driven approach also allows for improved urban services and a better quality of life for citizens, making it a key area for A2A's future development.

A2A's strategic focus on smart city solutions requires robust technological expertise and the formation of key partnerships. The company's investment in digital transformation is crucial for successful integration.

- Smart Metering: A2A's ongoing smart meter rollout aims to connect millions of households, providing granular data for energy efficiency.

- IoT Integration: The company is investing in IoT platforms to manage connected infrastructure, expecting to see operational cost reductions.

- Data Analytics: A2A is developing capabilities to analyze data from smart city deployments to identify optimization opportunities in water and energy distribution.

- Urban Mobility: Future integration could extend to smart traffic management and public transport systems, enhancing citizen convenience.

Technological advancements are rapidly transforming the energy sector, boosting efficiency and reducing costs for renewable sources. Solar panel efficiency continues to climb, with commercial panels now often exceeding 23%, making solar power more competitive. Similarly, larger and more powerful wind turbines are harvesting more energy, even in less windy locations.

Energy storage, particularly battery technology, is critical for grid stability. The cost of lithium-ion batteries has seen a dramatic decline, falling by over 89% between 2010 and 2023, making large-scale storage projects more feasible. Smart grid technologies are also evolving, improving the management of distributed energy and overall grid efficiency.

The digitalization of energy grids, powered by IoT and AI, is enhancing operational efficiency. These technologies enable real-time monitoring of energy flows and predictive maintenance, reducing downtime. Smart grids, a result of this digitalization, improve reliability and minimize energy losses through data analytics.

A2A's strategic adoption of these digital and renewable technologies is crucial for its future. By investing in cutting-edge solutions, the company can optimize performance, reduce costs, and maintain a competitive edge in the evolving energy landscape. Cybersecurity remains paramount, requiring significant investment to protect critical infrastructure and customer data.

Legal factors

A2A navigates a stringent legal landscape in the EU and Italy, shaped by directives promoting market liberalization and unbundling. Compliance with these rules, governing everything from electricity distribution to cross-border gas trade, is paramount for A2A's market access and competitive strategy. For instance, the EU's Third Energy Package, implemented in Italy, mandates the separation of network operators from energy suppliers, directly affecting A2A's operational structure and requiring ongoing adherence to ensure uninterrupted market participation.

A2A faces significant legal obligations under environmental protection laws, including stringent air and water quality standards, waste disposal regulations, and greenhouse gas emission limits. For instance, the European Union's Industrial Emissions Directive (IED) sets strict operational conditions for A2A's power plants and industrial facilities, requiring adherence to Best Available Techniques (BAT). Failure to comply can result in substantial fines and operational disruptions.

Future regulatory changes, particularly concerning climate change mitigation, pose a material risk. The EU's Fit for 55 package aims for a 55% net reduction in greenhouse gas emissions by 2030 compared to 1990 levels. This could necessitate substantial capital expenditure for A2A to upgrade existing infrastructure or invest in new, lower-emission technologies, potentially impacting its 2024-2025 operational costs and investment plans.

National and EU legislation dictates stringent waste management practices for A2A, covering collection, treatment, recycling, and disposal. Key directives, such as the EU's Circular Economy Action Plan, set ambitious recycling targets. For instance, the EU aims for 65% recycling of municipal waste by 2035, a significant increase from current levels.

These legal frameworks also impose restrictions on landfilling, pushing companies like A2A to invest heavily in advanced sorting and recycling technologies. Regulations for hazardous waste are particularly strict, requiring specialized handling and disposal methods to minimize environmental impact. A2A's waste management operations must continuously adapt to these evolving legal mandates to ensure compliance and foster a circular economy approach.

Water Quality & Supply Regulations

A2A's integrated water services operate within a robust legal framework, encompassing stringent drinking water quality standards, advanced wastewater treatment mandates, and comprehensive water resource management regulations. For instance, in Italy, where A2A has significant operations, the national transposition of EU directives sets benchmarks for parameters like nitrate levels, lead, and microbial contaminants in potable water, with periodic reporting required. Failure to meet these standards can result in substantial fines and operational sanctions.

Compliance with these legal obligations necessitates ongoing investment in infrastructure upgrades and rigorous operational protocols. A2A's commitment to meeting these requirements is reflected in its capital expenditure plans, which often include significant allocations for modernizing treatment plants and distribution networks. For example, investments in advanced filtration technologies are crucial for meeting evolving quality standards for treated wastewater discharge, safeguarding aquatic ecosystems.

- Drinking Water Standards: Adherence to national and EU directives, such as those setting limits for heavy metals and chemical contaminants, is paramount.

- Wastewater Treatment: Compliance with discharge permits, which dictate the permissible levels of pollutants released into water bodies, is a key legal requirement.

- Water Resource Management: Legal frameworks govern water abstraction rights and promote sustainable management of water resources to prevent scarcity.

- Licensing and Oversight: A2A's water operations are subject to licensing conditions and regular inspections by regulatory authorities, ensuring accountability.

Data Privacy (GDPR) & Cybersecurity Laws

A2A must navigate stringent data privacy laws like GDPR, impacting how it collects, stores, and processes customer and operational data. Failure to comply can lead to substantial financial penalties; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher. This necessitates robust data governance frameworks and transparent data handling practices.

Furthermore, evolving cybersecurity laws, particularly those targeting critical infrastructure, impose legal obligations on A2A to safeguard its digital systems. These regulations often mandate specific security measures and incident reporting protocols. In 2023, the European Union continued to strengthen its cybersecurity framework with initiatives like the NIS2 Directive, aiming to enhance resilience across various sectors, including energy and digital infrastructure, which directly affects A2A's operations.

- GDPR Fines: Potential penalties up to 4% of global annual revenue or €20 million.

- Cybersecurity Directives: Legal mandates for protecting critical digital infrastructure.

- NIS2 Directive Impact: Increased security and reporting requirements for essential entities.

- Reputational Risk: Non-compliance can severely damage public trust and brand image.

A2A's operations are heavily influenced by EU and Italian energy market regulations, particularly the unbundling requirements of the Third Energy Package, which mandates the separation of network operations from supply. Compliance with these rules is critical for market access and competitiveness, impacting A2A's operational structure and requiring continuous adaptation to ensure uninterrupted participation in 2024 and 2025.

Environmental laws impose strict standards on A2A, covering emissions, waste, and water quality, with directives like the Industrial Emissions Directive (IED) requiring adherence to Best Available Techniques (BAT). The EU's Fit for 55 package, aiming for a 55% emissions reduction by 2030, signals potential future capital expenditure needs for A2A to invest in lower-emission technologies.

Data privacy and cybersecurity are significant legal considerations for A2A, with GDPR fines potentially reaching up to 4% of global annual revenue or €20 million. The evolving NIS2 Directive further mandates enhanced security measures and incident reporting for critical infrastructure, directly impacting A2A's digital system protection strategies.

| Legal Area | Key Regulations/Directives | Impact on A2A | Compliance Focus for 2024-2025 | Potential Financial Impact |

|---|---|---|---|---|

| Energy Market Liberalization | EU Third Energy Package | Operational unbundling, market access | Maintaining separation of network and supply functions | Fines for non-compliance, market exclusion |

| Environmental Protection | IED, Fit for 55 Package | Emission limits, waste management, BAT adoption | Reducing carbon footprint, investing in cleaner tech | Capital expenditure, potential fines for breaches |

| Data Privacy & Cybersecurity | GDPR, NIS2 Directive | Data handling, digital security, incident reporting | Strengthening data governance, enhancing cybersecurity measures | GDPR fines up to 4% global revenue, NIS2 penalties |

Environmental factors

Climate change presents significant environmental challenges for A2A, with extreme weather events increasingly impacting infrastructure and operational continuity. For instance, the Italian government, aligning with EU directives, has set ambitious decarbonization targets, pushing companies like A2A to accelerate their transition. This regulatory pressure directly influences investment strategies toward renewable energy sources and energy efficiency measures.

A2A's strategic response involves substantial investments in decarbonization, aiming to align with national and international climate goals. In 2023, the company continued its focus on expanding renewable energy capacity and improving energy efficiency across its portfolio, demonstrating a commitment to reducing its carbon footprint. These efforts are crucial for mitigating climate-related risks and capitalizing on the opportunities presented by the green transition.

A2A faces significant environmental challenges regarding resource availability, particularly water and raw materials for energy. Increasing water stress in regions where A2A operates could directly impact its water utility services, potentially leading to higher operational costs and service disruptions. For instance, projections indicate that by 2050, over 5 billion people could experience water scarcity annually, a trend that directly affects utilities.

The company's reliance on finite fossil fuels for energy production exposes it to long-term supply volatility and price fluctuations. Global energy markets in 2024 and 2025 continue to be influenced by geopolitical events and the pace of the energy transition, with oil prices fluctuating significantly. A2A's commitment to resource efficiency and circular economy principles is therefore vital for mitigating these risks and ensuring long-term operational and financial sustainability.

A2A faces increasing pressure to curb pollution, particularly concerning air emissions from its power generation facilities and wastewater discharge. In 2023, the company continued investing in technologies to meet stringent environmental standards, aiming to reduce its environmental footprint.

The company's commitment to waste reduction, reuse, and recycling is paramount, with ongoing initiatives to divert waste from landfills. For instance, A2A's circular economy projects focus on transforming waste into valuable resources, a strategy gaining traction as environmental regulations tighten across Europe.

Public and regulatory bodies are closely monitoring A2A's performance in pollution control. The European Union's Green Deal and national environmental policies in Italy set ambitious targets for emissions reduction and waste management, directly impacting A2A's operational strategies and compliance costs.

Biodiversity Protection & Land Use

A2A's infrastructure development, particularly in renewable energy and waste management, necessitates careful consideration of its environmental footprint. Evaluating the impact of new power plants and transmission lines on local ecosystems and biodiversity is crucial for sustainable operations. For instance, the company's ongoing investments in solar and wind farms, while contributing to decarbonization, require land acquisition that could affect natural habitats.

Sustainable land use planning and comprehensive environmental impact assessments are paramount for A2A to minimize ecological disruption and secure necessary project approvals. Mitigation measures, such as habitat restoration or wildlife corridors, are essential components of responsible development. In 2023, A2A reported €1.3 billion in investments, a significant portion of which is directed towards green initiatives, underscoring the increasing importance of these environmental considerations.

- Land Use Impact: A2A's expansion in renewable energy, such as new photovoltaic plants, requires careful site selection to avoid sensitive ecosystems and minimize habitat fragmentation.

- Biodiversity Assessment: Thorough ecological surveys are conducted before project commencement to identify potential impacts on flora and fauna, informing mitigation strategies.

- Mitigation Measures: The company implements measures like reforestation programs and the creation of ecological compensation areas to offset any negative environmental effects from its operations.

- Regulatory Compliance: A2A adheres to stringent national and EU environmental regulations, including those related to land use and biodiversity protection, to ensure responsible development.

Transition to Circular Economy Models

A2A is actively embracing circular economy principles, particularly in its waste management and resource recovery operations. This strategic shift moves away from the traditional linear 'take-make-dispose' model towards one that maximizes resource value through recycling, reuse, and energy recovery. This transition significantly lowers environmental impact by reducing landfill waste and conserving natural resources, aligning with global sustainability objectives.

The operational changes involve integrating advanced sorting technologies and developing new business streams focused on secondary raw materials. For instance, A2A's commitment to the circular economy is evident in its investments in modern waste-to-energy plants that not only generate power but also recover valuable materials. This approach contributes to resource efficiency and supports the development of a more sustainable industrial ecosystem.

- Increased Resource Recovery Rates: A2A aims to boost the recovery of materials from waste streams, contributing to a more closed-loop system.

- Reduced Greenhouse Gas Emissions: By diverting waste from landfills and optimizing energy recovery, A2A contributes to lower carbon footprints.

- Development of Secondary Raw Material Markets: The company is fostering markets for recycled materials, creating economic value from waste.

- Alignment with EU Circular Economy Action Plan: A2A's strategy supports broader European Union goals for sustainable resource management and waste reduction.

A2A's environmental strategy is heavily influenced by climate change and the need for decarbonization, with a focus on expanding renewable energy and improving efficiency. The company is also addressing resource availability, particularly water scarcity, and the volatility of fossil fuel markets. Pollution control and waste management are key priorities, with investments in technologies to meet stringent environmental standards and a strong push towards circular economy principles.

The company's infrastructure development, especially in renewables, requires careful management of its environmental footprint and land use impact. A2A is committed to mitigating ecological disruption through thorough assessments and implementing measures like habitat restoration. These efforts align with broader EU sustainability goals and national environmental policies, driving significant investment in green initiatives.

| Environmental Factor | A2A's Focus/Challenge | Key Data/Initiatives (2023-2025) |

| Climate Change & Decarbonization | Extreme weather impacts, regulatory pressure for emissions reduction | Ambitious decarbonization targets aligned with EU directives; Investments in renewable energy capacity and energy efficiency. |

| Resource Availability | Water stress, reliance on finite fossil fuels | Addressing water stress in operations; Managing fossil fuel price volatility through efficiency and transition strategies. |

| Pollution Control & Waste Management | Air emissions, wastewater discharge, landfill diversion | Investing in technologies for emission reduction; Circular economy projects for waste-to-resource conversion. |

| Land Use & Biodiversity | Impact of renewable energy infrastructure on ecosystems | Careful site selection for solar/wind farms; Ecological surveys and mitigation measures like reforestation. €1.3 billion in investments in 2023, with a significant portion for green initiatives. |

PESTLE Analysis Data Sources

Our A2A PESTLE Analysis draws from a comprehensive range of data sources, including official government reports, reputable financial institutions like the IMF and World Bank, and leading industry analysis firms. This ensures that each aspect of the macro-environment is informed by credible and up-to-date information.