A2A Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

A2A Bundle

A2A faces significant competitive pressures, from the bargaining power of its customers to the potential disruption from new market entrants. Understanding these forces is crucial for navigating its industry landscape. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore A2A’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

A2A's dependence on a limited number of suppliers for critical inputs like natural gas and specialized energy infrastructure components grants these suppliers considerable leverage. For instance, in Q1 2025, the price of PUN (Prezzo Unico Nazionale) for electricity saw a notable increase, reflecting a tightening supply dynamic that can empower gas suppliers.

The ease with which A2A can switch to alternative sources for essential materials significantly influences supplier bargaining power. If switching is difficult or costly, suppliers can command higher prices. This is particularly relevant for specialized equipment where few manufacturers exist.

Fluctuations in global energy markets, such as the upward trend in PSV (Punto di Scambio Virtuale) gas prices observed in early 2025, directly impact the cost of raw materials for A2A. This price volatility can enhance the bargaining power of suppliers who control these essential commodities.

Suppliers providing unique technologies, such as specialized components for smart grid infrastructure or advanced recycling processes, can leverage their differentiation to demand higher prices from A2A. This is particularly true when these technologies offer significant performance advantages or are critical to A2A's service delivery.

The substantial costs and operational disruptions associated with switching suppliers for large, multi-year contracts, like those for renewable energy procurement or critical equipment maintenance, significantly strengthen the bargaining power of existing providers. For instance, a sudden change in a long-term natural gas supply contract could involve extensive renegotiations and potential delays in energy provision, making such switches economically unfeasible for A2A.

The threat of suppliers integrating forward into A2A's business, such as by creating their own energy distribution or waste management services, could significantly shift bargaining power. This would allow them to capture more of the value chain, potentially squeezing A2A's margins.

However, the utility sector, including A2A's operations, is characterized by substantial capital requirements and stringent regulatory hurdles. These factors generally act as significant deterrents, making it difficult and costly for suppliers to successfully implement forward integration strategies.

Availability of Substitute Inputs

The availability of substitute inputs significantly impacts a supplier's bargaining power. When alternative raw materials or technologies emerge, a company like A2A gains more options, thereby diminishing the leverage held by existing suppliers. For instance, the increasing adoption of renewable energy sources in Italy, which reached 49% low-carbon electricity generation in 2024, provides a clear example of how alternative inputs can reduce reliance on traditional fossil fuel suppliers. A2A's strategic investments in renewable energy projects further amplify this effect, creating a more diversified and resilient supply chain.

This shift towards renewables offers A2A several advantages:

- Diversification of Energy Sources: Reduces dependence on a single type of fuel or supplier.

- Cost Volatility Mitigation: Lessens exposure to price fluctuations in traditional energy markets.

- Enhanced Sustainability Profile: Aligns with environmental goals and regulatory trends.

- Innovation Opportunities: Encourages the exploration of new and more efficient energy technologies.

Regulatory Environment

Government policies and regulations significantly shape the bargaining power of suppliers within the energy sector. For A2A, directives concerning renewable energy mandates, emissions standards, and waste management protocols directly impact the types of suppliers available and the costs associated with their services. For example, stringent environmental regulations requiring specific waste treatment technologies can limit the pool of qualified waste management providers, thereby enhancing the leverage of those that meet the criteria.

Furthermore, policies promoting local content or mandating the use of particular technologies can restrict A2A's supplier options. If regulations favor domestically sourced components or specific types of equipment, A2A may have fewer suppliers to choose from. This reduced choice can empower those select suppliers, allowing them to negotiate more favorable terms, potentially increasing A2A's operational costs.

In 2023, the European Union continued to emphasize sustainability and circular economy principles, with new directives impacting waste management and energy production. These evolving regulations can create opportunities for specialized suppliers who can meet these advanced requirements, while potentially increasing costs for A2A if compliance necessitates more expensive inputs or services. For instance, stricter rules on the disposal of industrial byproducts could drive up costs for companies like A2A that rely on specialized waste processing services.

- Regulatory Impact on Supplier Choice: Policies promoting local content or specific technological standards can reduce A2A's supplier options, increasing supplier leverage.

- Environmental Standards and Costs: Stricter environmental regulations, particularly in waste management and emissions, can elevate the bargaining power of compliant suppliers and increase A2A's operational expenses.

- EU Directives: Ongoing EU initiatives in 2023 and beyond focusing on sustainability and circular economy principles are reshaping the supplier landscape for energy companies.

A2A's bargaining power with suppliers is influenced by the concentration of suppliers for critical inputs like natural gas and specialized infrastructure. When few suppliers exist, they hold more sway, as seen with PUN electricity price increases in Q1 2025. The difficulty and cost of switching suppliers, especially for long-term contracts or unique technologies, further bolster supplier leverage.

The availability of substitutes, such as renewable energy sources which accounted for 49% of low-carbon electricity generation in Italy in 2024, can diminish supplier power by offering A2A more options. However, stringent government regulations, like those promoting local content or specific environmental standards, can limit A2A's choices, empowering compliant suppliers and potentially increasing costs.

| Factor | Impact on A2A | Example/Data Point |

|---|---|---|

| Supplier Concentration | Increases supplier bargaining power | PUN electricity price increases in Q1 2025 |

| Switching Costs | Increases supplier bargaining power | High costs for changing long-term energy contracts |

| Availability of Substitutes | Decreases supplier bargaining power | Renewable energy at 49% of Italian low-carbon generation in 2024 |

| Regulatory Environment | Can increase supplier bargaining power | Local content mandates limiting supplier options |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to A2A's energy and environmental services sector.

Quickly identify and quantify competitive pressures across all five forces, enabling targeted strategies to alleviate market friction.

Customers Bargaining Power

Customer price sensitivity is a key factor for A2A, particularly with the liberalization of Italy's gas and electricity markets in 2024. Residential customers now have more choices, making them more inclined to switch providers based on price. This shift, observed with the end of the protected market for gas in January 2024 and electricity in April 2024, directly impacts A2A's ability to maintain pricing power.

Customers today have unprecedented access to information about alternative energy providers and service packages, enabling easier comparison of offerings. For instance, in the European energy market, price comparison websites are widely used, with some reporting over 50% of consumers using them to find better deals.

While switching energy suppliers can be quite simple in deregulated markets, the costs associated with switching for integrated water or waste management services can be significantly higher, often due to existing infrastructure dependencies and contractual obligations.

For A2A, the residential customer base is highly fragmented, meaning individual households have very little leverage to negotiate pricing or service terms. This widespread distribution of individual consumers significantly dilutes their collective bargaining power.

However, the situation changes for A2A when dealing with larger entities. Major industrial clients or significant municipal governments, who often contract for substantial volumes of services like waste management or public utilities, can exert considerable influence. These large-scale agreements allow them to negotiate more favorable terms and pricing due to the sheer volume of business they represent.

Threat of Backward Integration by Customers

The threat of backward integration by customers for A2A, while generally low for residential clients, becomes more pronounced with large industrial or commercial entities. These larger customers may explore generating their own energy, perhaps through on-site solar photovoltaic (PV) installations, or managing their waste internally. This directly reduces their dependence on A2A's core utility and environmental services.

The increasing prevalence of distributed generation, such as rooftop solar, in Italy amplifies this threat. By investing in their own energy production capabilities, these customers can potentially bypass A2A's supply chain, thereby exerting greater bargaining power.

- Customer Self-Generation: Large commercial and industrial clients may invest in on-site renewable energy sources like solar PV.

- On-Site Waste Management: Some businesses might opt for internal waste processing solutions instead of relying on A2A.

- Impact of Distributed Solar: The growth of rooftop solar in Italy directly enables customers to reduce their reliance on traditional energy providers like A2A.

- Reduced Dependence: Successful backward integration by customers weakens A2A's market position and bargaining power.

Regulation and Public Oversight

As a multi-utility company in Italy, A2A is subject to extensive regulation and public oversight. This oversight often involves regulatory bodies dictating tariff structures and service quality benchmarks. For instance, in 2024, the Italian Regulatory Authority for Energy, Networks and Environment (ARERA) continued to influence pricing mechanisms for electricity and gas distribution, directly impacting A2A's revenue potential and limiting its pricing flexibility.

These regulations are designed to protect consumers, particularly vulnerable households, by ensuring fair pricing and reliable service delivery. This increased protection inherently strengthens the bargaining power of A2A's customer base, as they are less susceptible to arbitrary price hikes and have recourse through regulatory channels. The focus on consumer welfare in 2024, as evidenced by ARERA's ongoing consumer protection initiatives, further solidifies this dynamic.

- Regulatory Price Setting: ARERA's influence on tariffs limits A2A's pricing autonomy, directly impacting profitability.

- Consumer Protection Measures: Regulations aimed at safeguarding customers enhance their power in dealings with A2A.

- Service Quality Standards: Mandated service levels reduce customer tolerance for underperformance, increasing their leverage.

A2A's customers, especially residential ones, gained significant bargaining power following Italy's energy market liberalization in 2024. The end of protected markets for gas and electricity meant consumers could easily switch providers based on price, with comparison websites showing over 50% usage in the European market. While individual households have little leverage, large industrial clients and municipalities can negotiate better terms due to high volumes, and the threat of backward integration, like on-site solar, further amplifies customer power.

| Customer Segment | Bargaining Power Factors | Impact on A2A |

|---|---|---|

| Residential Customers | Price sensitivity, ease of switching (post-2024 liberalization), access to information | Increased pressure on A2A's pricing, potential customer churn |

| Industrial/Commercial Clients | Volume of business, potential for backward integration (e.g., self-generation), negotiation leverage | Ability to secure more favorable contracts, reduced reliance on A2A services |

| Municipal Governments | Contract volume, strategic importance of services (e.g., waste management) | Significant negotiation power, influencing service terms and pricing |

Same Document Delivered

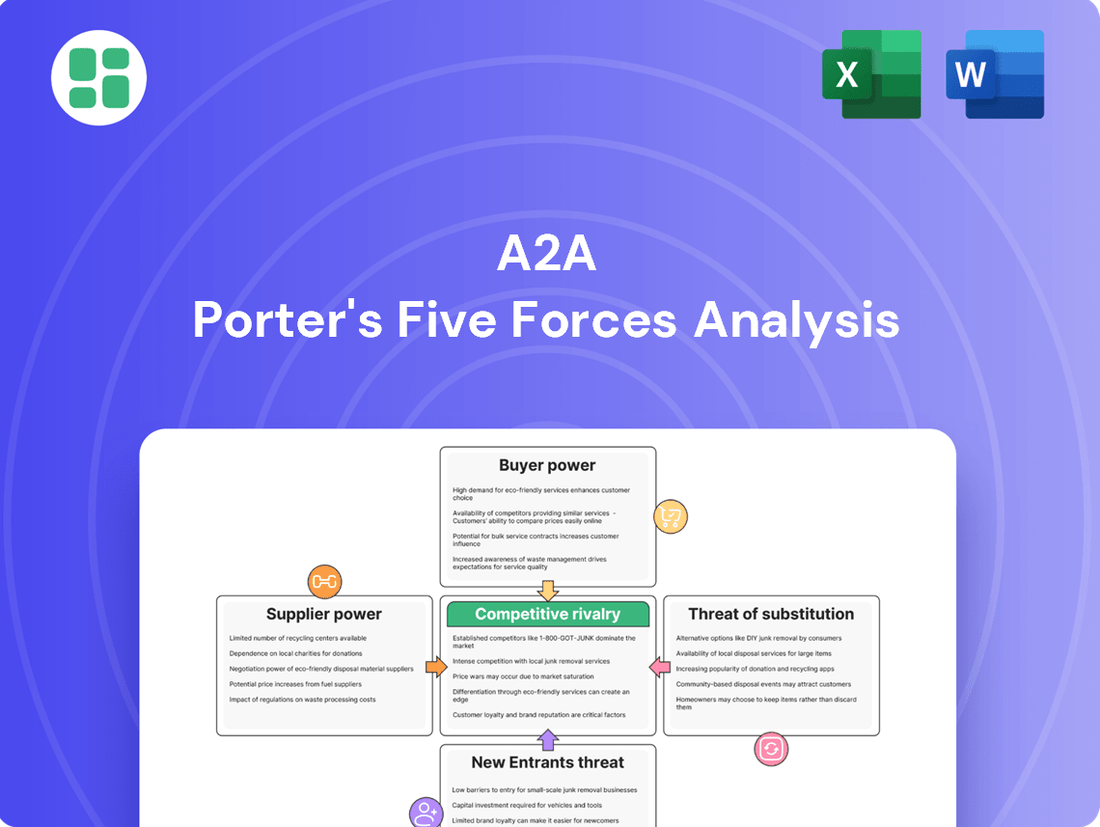

A2A Porter's Five Forces Analysis

This preview showcases the complete A2A Porter's Five Forces Analysis, providing a comprehensive examination of the competitive landscape. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive immediately after purchase, ensuring no surprises. You can confidently expect to download this exact file, equipped with all the insights needed for strategic decision-making.

Rivalry Among Competitors

The Italian multi-utility landscape is quite crowded, featuring major national players such as Enel, Hera, and Iren, alongside a multitude of smaller, regional competitors. This creates a dynamic competitive environment for A2A.

A2A's operations span energy generation, distribution, and sales, as well as water and waste management services. This broad operational scope means A2A faces varied competitive pressures across different market segments, making direct comparison across all its activities challenging.

For instance, in the energy generation market, A2A contends with large integrated energy companies. In contrast, its water and waste management divisions face competition from specialized regional operators and municipal entities.

While the core business of distributing essential utilities like water and electricity offers stable, albeit slower, growth, the real battleground for A2A and its competitors lies in emerging sectors. Areas like renewable energy development, the implementation of smart city technologies, and the adoption of circular economy principles are experiencing rapid expansion. This dynamism attracts substantial investment and fosters fierce competition as numerous companies vie for market share in these high-potential segments, directly aligning with A2A's strategic focus.

In the Italian energy market, particularly for commodity electricity and gas, product differentiation is minimal, intensifying price-based competition among providers. Differentiation efforts often focus on enhancing customer service, offering bundled packages, and highlighting sustainability initiatives to attract and retain customers.

The liberalization of the Italian energy sector has significantly lowered barriers to switching, making it easier for consumers to change electricity and gas suppliers. This increased ease of switching directly impacts competitive rivalry by empowering customers and forcing providers to compete more aggressively on price and service quality.

In 2023, Italy's energy market saw continued efforts to differentiate. For instance, some providers emphasized renewable energy sourcing, with a significant portion of new customer acquisitions in Q3 2023 attributed to green energy plans. However, the core commodity product remains largely undifferentiated, keeping price a primary competitive factor.

Exit Barriers

A2A faces substantial exit barriers due to its significant investments in infrastructure, such as power plants and extensive distribution grids. These capital-intensive assets, often coupled with long-term regulatory agreements, make it exceedingly difficult and costly for companies like A2A to divest or exit specific business segments. For instance, the energy sector often involves multi-billion euro investments in generation and network infrastructure that cannot be easily repurposed or sold.

These high exit barriers can trap companies in markets even when profitability is low, leading to prolonged and potentially intensified competition. Firms may continue operating, albeit at reduced margins, rather than incur substantial losses from abandoning their investments. This dynamic is particularly relevant in utility sectors where assets have specialized, non-transferable uses.

- High Capital Intensity: Investments in power generation, renewable energy facilities, and grid networks often run into billions of euros, creating a significant financial commitment.

- Long-Term Commitments: Regulatory frameworks and concession agreements in the utility sector frequently involve multi-year or even multi-decade commitments, binding companies to operations.

- Specialized Assets: Infrastructure like waste-to-energy plants or specific transmission lines have limited alternative uses, making them difficult to sell or redeploy if a company wishes to exit.

- Potential for Sustained Competition: The inability to easily exit means that even in challenging market conditions, established players like A2A remain, potentially leading to continued competitive pressure.

Strategic Commitments and Acquisitions

Competitive rivalry is intensified by significant strategic commitments. Many players are pouring substantial capital into renewable energy projects and critical infrastructure upgrades. This arms race for market position means competitors are not just competing on price but on long-term strategic advantage.

A2A's own strategic moves underscore this dynamic. In 2024, the company completed several key mergers and acquisitions, notably acquiring Duereti S.r.l. This acquisition was specifically aimed at bolstering A2A's electricity distribution network, a clear indication of the industry's push for consolidation and enhanced operational scale.

These actions highlight a fiercely competitive environment where strategic acquisitions are a primary tool for growth and market share expansion. Companies are actively seeking to integrate assets that offer synergies and economies of scale, further concentrating market power and increasing the barriers to entry for smaller players.

- Strategic Investments: Competitors are heavily investing in renewables and infrastructure, signaling a long-term competitive battleground.

- M&A Activity: A2A's acquisition of Duereti S.r.l. in 2024 demonstrates a trend of strategic consolidation within the sector.

- Market Share Focus: Acquisitions are driven by the need to gain market share and achieve greater operational efficiencies through economies of scale.

- Intensified Rivalry: The aggressive pursuit of strategic assets indicates a highly competitive landscape where innovation and scale are paramount.

The Italian utility sector, particularly in energy and waste management, is characterized by intense rivalry. A2A faces competition from large national integrated players like Enel and Hera, as well as numerous regional specialists. This competition is amplified by the liberalization of energy markets, which lowers switching costs for consumers and drives price-based competition.

In 2023, the Italian energy market saw providers differentiate through green energy plans, with a notable portion of new customer acquisitions in Q3 2023 attributed to these offerings. However, the core commodity product remains largely undifferentiated, keeping price a primary competitive factor.

Strategic commitments, such as significant investments in renewable energy and infrastructure upgrades, further intensify rivalry. A2A's 2024 acquisition of Duereti S.r.l. to strengthen its electricity distribution network exemplifies the industry's consolidation trend, driven by the pursuit of market share and economies of scale.

| Competitor | Key Business Areas | 2023 Revenue (approx. EUR billion) | 2024 Strategic Focus |

|---|---|---|---|

| Enel | Electricity generation, distribution, sales, renewables | ~60 | Renewable growth, grid digitalization |

| Hera | Multi-utility (gas, electricity, water, waste) | ~13 | Energy transition, circular economy initiatives |

| Iren | Multi-utility (energy, water, waste, district heating) | ~7 | Smart city solutions, renewable energy expansion |

SSubstitutes Threaten

The rise of decentralized energy generation, particularly rooftop solar photovoltaic (PV) systems, presents a significant threat to traditional utility providers like A2A. As these technologies become more affordable and efficient, customers can increasingly generate their own electricity, diminishing their dependence on grid-supplied power. This trend is accelerating, with Italy experiencing a notable 23.8% year-on-year increase in solar generation as of March 2025, underscoring the growing competitive pressure.

Improvements in energy efficiency, like better insulation and smart appliances, significantly reduce the demand for traditional energy sources. For instance, the U.S. Department of Energy reported that in 2023, advancements in building technologies could lead to a 20% reduction in energy consumption for new homes.

This shift directly impacts utility providers by lowering overall consumption. The International Energy Agency noted in its 2024 outlook that energy efficiency measures are projected to save global consumers billions in energy bills, effectively acting as a substitute for purchasing more energy.

The widespread adoption of LED lighting alone, for example, has drastically cut electricity demand. By the end of 2023, LEDs accounted for over 75% of all lighting sales in many developed markets, displacing older, less efficient technologies and reducing the need for new power generation capacity.

The increasing adoption of alternative heating and cooling solutions poses a significant threat to traditional natural gas businesses. Heat pumps, for instance, are gaining traction due to their energy efficiency and lower carbon footprint. In 2023, the global heat pump market was valued at approximately $80 billion, with projections indicating continued robust growth.

District heating networks, which A2A actively develops, also serve as a substitute by providing centralized thermal energy, often from renewable or waste heat sources. These networks can reduce reliance on individual gas boilers. Furthermore, advancements in electric heating technologies and solar thermal systems offer further alternatives, directly impacting the demand for natural gas in residential and commercial sectors.

Water Conservation and Alternative Sources

Increased water conservation efforts, such as those promoted by European Union directives and national campaigns, can directly reduce the overall demand for integrated water services. For instance, advancements in water-efficient appliances and public awareness campaigns have contributed to lower per capita water consumption in many developed nations. In 2023, Italy, where A2A operates, saw a continued focus on water saving, with average household consumption per person showing a slight decrease compared to previous years. This trend, driven by both environmental consciousness and rising utility costs, presents a potential substitute for the volume of water A2A supplies.

The adoption of rainwater harvesting systems and, in specific regions, the increased reliance on private well usage can also serve as substitutes. While potable water quality from wells can vary and requires treatment, it offers an alternative source for non-potable uses like irrigation or industrial processes, thereby bypassing the need for A2A's services. In some Italian municipalities, local regulations encourage or mandate rainwater harvesting for new constructions, aiming to reduce strain on public water supplies. This diversification of water sources, though not a complete replacement for essential potable water, can affect the total volume of services A2A provides and its revenue streams from those volumes.

- Reduced Demand: Water conservation measures directly lower the volume of water A2A needs to supply.

- Alternative Sources: Rainwater harvesting and private wells offer substitutes, particularly for non-potable uses.

- Impact on Volume: While not a threat to potable water provision, these substitutes can reduce overall service volume.

- Regional Variations: The prevalence of private wells and local conservation policies can create regional differences in this threat's impact.

Waste Reduction and Reuse

The increasing emphasis on circular economy principles, including waste prevention, reuse, and repair initiatives by both consumers and businesses, poses a threat to A2A's traditional waste management services. These efforts directly reduce the volume of waste needing collection and treatment, potentially impacting revenue streams tied to waste processing and energy recovery.

Italy's commitment to waste reduction is evident in its high recycling rates. For instance, in 2022, Italy's recycling rate reached 65.8%, one of the highest in Europe, demonstrating a consumer and business behavior shift away from landfilling and incineration, which are core services for waste management companies like A2A.

This trend towards waste minimization and resource efficiency creates a substitute for A2A's services. Instead of paying for waste disposal or energy recovery from waste, consumers and businesses are increasingly opting for or being incentivized towards:

- Extended Producer Responsibility (EPR) schemes that place the burden of end-of-life product management on manufacturers.

- Product-as-a-service models where companies retain ownership and responsibility for maintenance and end-of-life handling.

- Digital platforms facilitating peer-to-peer reuse and repair, bypassing formal waste channels.

- Incentives for composting and local material recovery, reducing the need for centralized processing.

The threat of substitutes for A2A's electricity business is primarily driven by the proliferation of decentralized energy generation, particularly rooftop solar PV. As these systems become more accessible and cost-effective, consumers can increasingly meet their own electricity needs, reducing reliance on traditional utility providers. This trend is amplified by energy efficiency improvements, which lower overall demand for purchased electricity.

The increasing adoption of alternative heating and cooling solutions, such as heat pumps and district heating networks, directly substitutes for traditional natural gas consumption. Similarly, water conservation efforts and alternative water sources like rainwater harvesting and private wells can reduce the demand for A2A's water services. Finally, circular economy principles and waste minimization initiatives act as substitutes for conventional waste management services by reducing the volume of waste requiring processing.

| Substitute Category | Specific Substitute | Impact on A2A | Relevant Data/Trend |

|---|---|---|---|

| Electricity Generation | Rooftop Solar PV | Reduced demand for grid electricity | Italy solar generation up 23.8% YoY (March 2025) |

| Energy Efficiency | Building insulation, smart appliances | Lower overall electricity consumption | US DOE: 20% energy reduction potential in new homes (2023) |

| Heating/Cooling | Heat Pumps | Reduced natural gas demand | Global heat pump market valued at ~$80 billion (2023) |

| Water Services | Rainwater Harvesting, Private Wells | Lower water service volume | Continued focus on water saving in Italy (2023) |

| Waste Management | Reuse, Repair, EPR Schemes | Reduced waste processing volume | Italy recycling rate reached 65.8% (2022) |

Entrants Threaten

The utility sector, especially for integrated services like electricity and gas distribution, water infrastructure, and extensive waste management, demands massive initial capital for networks, power plants, and treatment facilities. A2A's significant investment of €2.94 billion in 2024 for strategic infrastructure development underscores this reality. These substantial financial hurdles effectively deter many potential new competitors from entering the market.

The Italian utility sector presents a formidable barrier to entry due to stringent regulatory requirements. Companies must navigate a complex web of licenses, permits, and adherence to rigorous environmental, safety, and operational standards. For example, obtaining a generation license in Italy can involve multiple stages and significant documentation, as outlined by authorities like the Italian Regulatory Authority for Energy, Networks and Environment (ARERA).

These extensive compliance demands translate into substantial time and financial investments for any aspiring entrant. The sheer cost and duration associated with securing necessary approvals effectively deter new competitors from entering the market, thereby protecting incumbent players like A2A.

Established multi-utility companies like A2A leverage substantial economies of scale across their diverse operations, from energy generation to waste management. This allows them to achieve lower per-unit costs in procurement, operations, and customer service, a significant barrier for newcomers. For instance, in 2023, A2A's integrated approach likely contributed to its robust EBITDA, reported at €2,045 million, reflecting the cost advantages of its scale.

Access to Distribution Networks and Infrastructure

A significant hurdle for new entrants in the energy sector is securing access to established distribution networks, such as electricity grids and gas pipelines. These existing infrastructures represent substantial investments and are often tightly controlled.

A2A's strategic move in acquiring Duereti in 2024 significantly bolstered its presence in electricity distribution. This acquisition makes it considerably more challenging for new players to either gain access to these vital networks or undertake the immense capital expenditure required to build competing infrastructure.

- Control over Existing Infrastructure: New entrants face a substantial barrier due to the established control of essential distribution networks by incumbent players like A2A.

- High Capital Requirements for Parallel Infrastructure: Building new, parallel distribution networks is prohibitively expensive and time-consuming, creating a significant deterrent.

- A2A's 2024 Duereti Acquisition: This strategic acquisition by A2A solidified its market position, further limiting access opportunities for potential new competitors in electricity distribution.

Brand Loyalty and Public Trust

Brand loyalty and public trust are significant barriers for new entrants, especially in essential services like utilities where reliability is paramount. Established companies, such as A2A, have cultivated decades of customer relationships and a strong reputation for dependable service delivery. For instance, A2A's commitment to grid stability and customer support, evidenced by their investments in infrastructure upgrades, fosters a deep sense of trust that new competitors find challenging to match. This established goodwill makes it difficult for newcomers to attract and retain customers, even in liberalized markets.

The perceived risk associated with switching providers for critical services can deter customers from embracing new entrants. Consumers often prioritize the proven track record and established credibility of incumbents like A2A. In 2024, A2A continued its focus on customer satisfaction, with reported service continuity rates consistently above 99.5% across its key operational areas, a metric that directly impacts customer retention and new entrant acquisition costs. This high level of trust is a formidable hurdle for any company aiming to disrupt the market.

- Customer Trust: A2A's long history and consistent service delivery build significant public trust, a difficult asset for new entrants to acquire.

- Reliability Focus: In essential services, customers prioritize dependable providers, making A2A's established reliability a strong deterrent.

- Reputation Building: The time and investment required for new entrants to build a comparable reputation and customer loyalty are substantial.

- Service Continuity: A2A's high service continuity rates, often exceeding 99.5% in 2024, reinforce customer preference for established providers.

The threat of new entrants for A2A is significantly mitigated by the immense capital required for infrastructure development, regulatory hurdles, and established economies of scale. A2A's €2.94 billion investment in 2024 for infrastructure highlights these entry barriers. Furthermore, stringent licensing and compliance in Italy demand considerable time and financial resources, effectively deterring potential competitors.

| Barrier Type | Description | Impact on New Entrants | A2A's Position/Data |

|---|---|---|---|

| Capital Requirements | Massive initial investment for networks and facilities. | High deterrent. | €2.94 billion invested in 2024 for infrastructure. |

| Regulatory Hurdles | Complex licenses, permits, and compliance standards. | Time-consuming and costly. | ARERA guidelines for generation licenses. |

| Economies of Scale | Lower per-unit costs due to integrated operations. | Disadvantage for smaller newcomers. | EBITDA of €2,045 million in 2023 reflects scale advantages. |

| Network Access | Control over existing distribution grids and pipelines. | Limited access or need for costly parallel infrastructure. | Acquisition of Duereti in 2024 strengthened electricity distribution control. |

| Brand Loyalty & Trust | Established customer relationships and reputation. | Difficult for new entrants to attract customers. | Service continuity rates above 99.5% in 2024. |

Porter's Five Forces Analysis Data Sources

Our A2A Porter's Five Forces analysis is built upon a robust foundation of data, including company annual reports, industry-specific market research, and government economic indicators.

We leverage insights from financial statements, competitor disclosures, and trade association publications to provide a comprehensive view of the competitive landscape.