A2A Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

A2A Bundle

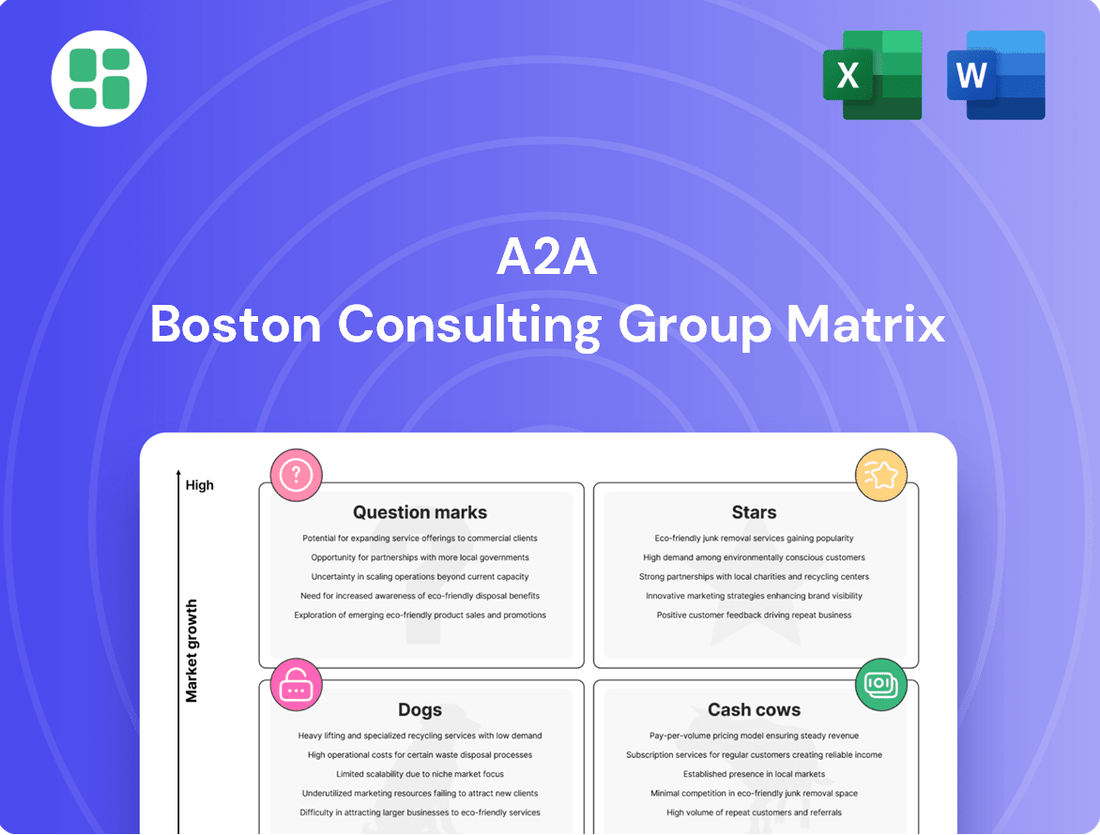

Curious about the strategic positioning of this company's product portfolio? Our A2A BCG Matrix preview offers a glimpse into its Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the actionable insights that can drive your business forward.

Unlock the full potential of your strategic planning by purchasing the complete BCG Matrix. Gain a comprehensive understanding of each quadrant, enabling you to make informed decisions about resource allocation and future investments.

This isn't just a matrix; it's your roadmap to market dominance. Invest in the full BCG Matrix today and transform your understanding of competitive advantage.

Stars

A2A is aggressively expanding its renewable energy capacity, targeting 5.7 GW by 2035. This strategic push involves substantial capital expenditures, positioning A2A as a key player in the rapidly growing green energy sector. The company's focus on solar and wind, bolstered by long-term Power Purchase Agreements, signals a strong commitment to leading the energy transition and capturing market share.

A2A's electricity distribution network is poised for substantial expansion, with planned investments projected to elevate its Regulated Asset Base (RAB) to 3.4 billion euros by 2035. This growth trajectory will see electricity RAB surpass that of gas, signaling a strategic shift.

Key to this expansion is the acquisition of Duereti, a move that effectively doubles the network's size and unlocks significant operational synergies. This strategic consolidation is crucial for A2A's ambition to strengthen its market leadership.

The electricity distribution segment thrives in a market fueled by the increasing electrification of consumption. A2A is actively capitalizing on this trend, diligently expanding its presence and solidifying its market dominance.

A2A is doubling down on its leadership in the waste management sector by investing heavily in advanced circular economy initiatives. This includes significant expansion of waste-to-energy capabilities and sophisticated material recovery from challenging waste streams like plastics and textiles.

By 2035, A2A plans to process an impressive 7 million tons of waste annually, with several new, cutting-edge facilities currently under construction to facilitate this growth. These strategic investments position A2A at the forefront of a rapidly expanding market that prioritizes resource recovery and sustainability.

District Heating with Data Center Heat Recovery

A2A's focus on district heating, especially leveraging heat recovery from data centers, is a significant growth opportunity. For instance, the company's €25 million investment in a new plant in Brescia, operational since late 2023, aims to connect 20,000 inhabitants to its network, utilizing waste heat. This initiative underscores A2A's strategy to decarbonize urban environments by repurposing otherwise lost energy.

This strategic move places A2A at the forefront of smart city development and sustainable energy solutions. The global district heating market is projected to reach over $500 billion by 2030, with heat recovery technologies being a key driver of this expansion. A2A's early adoption and successful implementation of data center heat recovery projects position it to capture a substantial share of this burgeoning market.

- Market Growth: The global district heating market is expected to grow significantly, driven by sustainability initiatives and energy efficiency demands.

- Technological Innovation: Data center heat recovery represents a cutting-edge approach to energy efficiency and carbon reduction.

- Strategic Investment: A2A's investments, like the Brescia project, highlight a commitment to expanding its district heating network and embracing innovative solutions.

- Decarbonization Impact: Utilizing waste heat from data centers contributes directly to urban decarbonization goals, aligning with broader environmental targets.

Electrification-Driven Customer Base Expansion

A2A is targeting an expansion of its customer base to over 5 million by 2035, with a strong emphasis on attracting new electricity customers.

This initiative is a core component of their strategy to capitalize on the ongoing energy transition and the increasing adoption of electrified services, aiming to secure a larger slice of this expanding market.

Past successes in customer acquisition campaigns, coupled with a robust multi-channel approach, provide a solid foundation for achieving this ambitious growth objective.

For instance, A2A's 2023 results showed a growing customer base, with electricity customers forming a significant portion of this expansion, indicating positive momentum towards their 2035 goal.

A2A's electricity distribution and renewable energy segments are prime examples of its "Stars" in the A2A BCG Matrix. These areas exhibit high growth potential and strong market positions, driven by significant investments and favorable market trends. The company's aggressive expansion in renewables, targeting 5.7 GW by 2035, and the doubling of its electricity distribution network through acquisitions like Duereti, underscore their status as high-growth, high-share businesses.

| Business Segment | Market Growth | Market Share | A2A's Position | BCG Category |

| Renewable Energy | High | Strong/Growing | Aggressive expansion (5.7 GW by 2035) | Star |

| Electricity Distribution | High (Electrification) | Leading/Expanding | RAB to €3.4bn by 2035, Duereti acquisition | Star |

What is included in the product

The A2A BCG Matrix provides a strategic overview of a company's product portfolio, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

A clear visual of your portfolio's strengths and weaknesses, simplifying strategic decisions.

Cash Cows

A2A's traditional waste collection and disposal operations are firmly positioned as Cash Cows within the BCG Matrix. This segment boasts a high market share in a mature industry, ensuring a steady and predictable income stream for the company.

The essential nature of waste management, coupled with A2A's robust infrastructure and established market presence, guarantees consistent cash flow. For instance, in 2023, A2A reported significant revenue from its integrated waste management services, highlighting the stability of this business line.

While the growth prospects for traditional waste collection might be modest, its role as a reliable generator of funds is crucial. This stable income fuels investments in other, more dynamic areas of A2A's portfolio, reinforcing its overall financial resilience.

A2A's Integrated Water Services, a key player in Lombardy, operates within a stable, regulated market. This segment boasts a high market share, translating into predictable revenue streams and consistent cash flow. The low need for promotional and placement investments makes it a reliable generator of returns for the company.

A2A's existing gas distribution networks, especially those intended to remain within the company, are mature businesses with a dominant market position. These regulated operations are designed to deliver consistent earnings, generating surplus cash that can be reinvested elsewhere. For instance, in 2023, A2A's regulated asset base in gas distribution contributed significantly to its overall stable cash flow generation, underpinning its financial resilience.

Hydroelectric Power Generation

A2A's substantial hydroelectric power generation capacity firmly places it within the cash cow quadrant of the BCG matrix. This segment benefits from mature assets that consistently deliver high energy output with comparatively low operational expenses.

These hydroelectric plants are a cornerstone of A2A's renewable energy portfolio, contributing significantly to Italy's energy landscape. In 2023, A2A's hydroelectric production reached approximately 6.5 TWh, underscoring its role as a major player in renewable energy generation.

- Leading RES Producer: A2A is a top producer of renewable energy in Italy, with hydroelectricity forming a significant part of its generation mix.

- Mature and Efficient Assets: Hydroelectric facilities represent established technology, offering reliable and cost-effective energy production.

- Stable Cash Flow Generation: The consistent output from these plants ensures a predictable and substantial contribution to A2A's overall financial performance.

- Environmental Benefits: Beyond financial returns, hydroelectric power is a clean energy source, aligning with sustainability goals.

Efficient Thermoelectric Production

A2A's efficient thermoelectric production facilities are firmly positioned as Cash Cows within its portfolio. These combined cycle plants are vital for grid stability, effectively managing the intermittent nature of renewable energy sources and bolstering national energy security. Their operational efficiency and strategic necessity translate into robust cash flow generation.

Despite the company's clear commitment to decarbonization, these modern thermoelectric plants continue to be significant contributors to energy generation. In 2023, A2A's thermoelectric generation played a key role in the Italian energy mix, which saw a considerable increase in gas-fired power generation to compensate for lower hydroelectric output due to drought conditions. This highlights the continued, albeit transitional, importance of such assets.

- Mature Market Share: These plants represent a dominant market share in their operational segment, benefiting from established infrastructure and long-term power purchase agreements.

- Strong Cash Flow Generation: High operational efficiency and strategic importance ensure consistent and substantial cash flow, supporting investments in other areas of A2A's business.

- Balancing Renewables: Their ability to provide stable, dispatchable power is critical for integrating and balancing the variable output from A2A's growing renewable energy assets.

- Strategic Importance: As a provider of baseload and peak load power, these facilities are indispensable for maintaining energy security and grid reliability.

Cash Cows in A2A's portfolio represent established businesses with high market share in mature industries, generating consistent and predictable cash flow. These segments, like waste management and water services, require minimal investment for maintenance and growth, allowing them to provide surplus capital. This stable income is vital for funding expansion into new or growing markets and supporting the company's overall financial stability.

| Business Segment | BCG Matrix Quadrant | Key Characteristics | 2023 Data Highlight |

|---|---|---|---|

| Waste Collection & Disposal | Cash Cow | High market share, mature industry, steady income | Significant revenue from integrated waste management services |

| Integrated Water Services | Cash Cow | High market share, regulated market, predictable revenue | Stable cash flow generation in Lombardy operations |

| Gas Distribution Networks | Cash Cow | Dominant market position, regulated, consistent earnings | Significant contribution to stable cash flow from regulated assets |

| Hydroelectric Power Generation | Cash Cow | Mature assets, high output, low operational expenses | Approximately 6.5 TWh hydroelectric production |

| Thermoelectric Production | Cash Cow | Operational efficiency, strategic necessity, robust cash flow | Key role in Italian energy mix, compensating for lower hydro output |

Preview = Final Product

A2A BCG Matrix

The A2A BCG Matrix document you are previewing is the identical, fully unlocked version you will receive immediately after your purchase. This means you get the complete, professionally formatted analysis without any watermarks or sample data, ready for your strategic planning.

What you see here is the exact A2A BCG Matrix report that will be delivered to you upon completing your purchase. It's a comprehensive, ready-to-use tool designed for insightful business strategy, ensuring you receive the full, uncompromised analysis.

This preview accurately represents the final A2A BCG Matrix document you will obtain after purchase. You're not looking at a demo; you're seeing the actual, professionally crafted report that will be instantly downloadable for your immediate use.

Dogs

A2A's divestment of certain gas distribution assets, like those in Lombardy sold to Ascopiave, places them in the Dogs quadrant of the BCG Matrix. These operations typically exhibit low growth and a declining market share, making them less strategic for A2A's core focus on ecological transition.

This strategic move allows A2A to reallocate capital and management attention towards higher-potential areas, such as renewable energy and circular economy initiatives. For instance, in 2023, A2A continued its strategic pruning, aiming to optimize its portfolio and enhance overall profitability.

Legacy, inefficient thermoelectric plants within A2A's portfolio are likely classified as Dogs in the BCG matrix. As A2A prioritizes investments in modern combined cycle plants and renewable energy sources, these older assets, if not slated for modernization or hydrogen blending, face diminishing relevance and profitability. For instance, in 2023, A2A continued its strategy of phasing out less efficient generation, with a focus on assets contributing to decarbonization goals.

A2A's loss of the safeguarded energy market tender marks a significant shift. This segment, where the company previously held a low market share, will no longer provide the recurring revenue it once did. The move away from these low-return, low-share activities aligns with a strategic pivot towards more profitable ventures.

Small-Scale, Non-Strategic Traditional Retail Contracts

Within A2A's portfolio, smaller, non-strategic traditional energy retail contracts often represent the 'dogs' in the BCG matrix. These segments may demand significant resources for customer acquisition and retention, yet yield minimal returns due to low margins in a saturated market. For instance, in 2024, the traditional gas and electricity retail market in Italy, where A2A operates, saw intense competition, with average margins for residential customers hovering around 3-5%.

These contracts typically lack substantial growth prospects and require disproportionate effort to maintain profitability. A2A's strategic shift towards electrification and acquiring higher-value customers naturally de-prioritizes these low-yield areas. In 2024, A2A's investment in renewable energy and smart grid solutions aimed to capture higher growth segments, implicitly reducing focus on legacy, low-margin retail contracts.

- Low Profitability: Margins in traditional retail energy can be razor-thin, often in the low single digits, making these contracts difficult to sustain profitably.

- High Acquisition/Retention Costs: The competitive landscape necessitates significant spending on marketing and customer service, further eroding profitability.

- Limited Growth Potential: These segments are mature with little to no expected market expansion, offering minimal upside for A2A.

- Resource Diversion: Maintaining these contracts diverts valuable resources and management attention from more promising, high-growth initiatives like electrification.

Aging or Underperforming Infrastructure (not targeted for upgrade)

Within A2A's vast infrastructure network, certain older utility segments that are not prioritized for significant upgrades could be categorized as Dogs. These assets may be characterized by escalating maintenance expenditures and declining operational efficiency.

For instance, if a particular segment of the legacy electricity grid, estimated to represent 5% of A2A's total grid assets, is not slated for a smart grid overhaul, it might fall into this category. Such assets often yield diminishing returns and possess limited prospects for future growth, suggesting a strategy of minimal investment or eventual divestment.

- Aging Infrastructure: Assets in older utility segments not targeted for modernization.

- High Maintenance Costs: These components may require increased spending to remain operational.

- Diminishing Returns: The profitability or efficiency of these assets is declining.

- Limited Growth Potential: Future expansion or revenue generation from these assets is unlikely.

A2A's divestment of certain gas distribution assets, like those in Lombardy sold to Ascopiave, places them in the Dogs quadrant of the BCG Matrix. These operations typically exhibit low growth and a declining market share, making them less strategic for A2A's core focus on ecological transition.

Legacy, inefficient thermoelectric plants within A2A's portfolio are likely classified as Dogs. As A2A prioritizes investments in modern combined cycle plants and renewable energy sources, these older assets face diminishing relevance and profitability.

Within A2A's portfolio, smaller, non-strategic traditional energy retail contracts often represent the 'dogs.' These segments demand significant resources for customer acquisition and retention, yet yield minimal returns due to low margins in a saturated market. For instance, in 2024, the traditional gas and electricity retail market in Italy saw intense competition, with average margins for residential customers hovering around 3-5%.

Within A2A's vast infrastructure network, certain older utility segments not prioritized for significant upgrades could be categorized as Dogs. These assets may be characterized by escalating maintenance expenditures and declining operational efficiency, yielding diminishing returns.

Question Marks

A2A is making strategic moves in the burgeoning green hydrogen sector, eyeing its potential to drive decarbonization efforts. This market is poised for significant growth, but as an emerging technology, A2A's current market penetration is likely minimal, necessitating considerable R&D investment with uncertain near-term profitability.

This positions green hydrogen development as a Stars or Question Marks category within the BCG framework for A2A. The substantial investment required for R&D and infrastructure, coupled with the nascent stage of the market, suggests it's a high-risk, high-reward proposition. For instance, global investment in green hydrogen projects is projected to reach hundreds of billions by 2030, indicating the scale of opportunity and the capital needed to capture it.

A2A is strategically positioning itself to enter the burgeoning lithium-ion battery recycling market, a direct response to the accelerating adoption of electric vehicles and the expanding demand for energy storage. This move acknowledges the significant growth potential within this sector.

While the lithium-ion battery recycling market is experiencing rapid expansion, A2A's presence in this niche segment is currently minimal, classifying it as a question mark within the BCG matrix. This indicates a low current market share in a high-growth industry.

Significant capital outlay will be necessary for A2A to develop the specialized infrastructure, acquire the necessary technology, and build market share in lithium-ion battery recycling. The substantial investment required, coupled with the nascent stage of A2A's involvement, underscores the question mark status, highlighting both risk and substantial future opportunity.

The Rebag project, focused on transforming textile waste into new products, represents a nascent pilot within A2A's broader circular economy ambitions. This initiative targets a high-potential textile recycling market, which is projected to grow significantly, with some estimates suggesting a compound annual growth rate (CAGR) exceeding 5% in the coming years. However, Rebag's current market share is minimal, reflecting its early-stage development.

Significant investment is necessary for Rebag's scaling and operational refinement. The project's success hinges on its ability to overcome initial hurdles and demonstrate a clear path to profitability and market traction. Without substantial capital infusion and effective execution, its potential to transition from a question mark to a star performer in A2A's portfolio remains uncertain.

Advanced Smart City Solutions (Beyond Core Utilities)

A2A's advanced smart city solutions, such as integrated IoT platforms for urban management and sophisticated mobility services, are positioned in a rapidly expanding market. While the potential is substantial, A2A's current market share in these specific, cutting-edge areas may be nascent, reflecting the early stage of adoption for many such technologies.

These advanced offerings demand considerable investment in technological development and strategic alliances to foster widespread acceptance and establish a robust market presence. For instance, the global smart city market, excluding core utilities, was projected to reach over $1.7 trillion by 2026, with a significant portion driven by integrated platforms and advanced mobility.

- Market Potential: High-growth segment with significant future revenue opportunities.

- Investment Needs: Requires substantial capital for R&D, technology integration, and talent acquisition.

- Partnership Strategy: Crucial for accelerating development and market penetration in specialized areas.

- Competitive Landscape: Emerging players and established tech giants are also vying for dominance in these advanced solutions.

New Digital Services and Platforms (for customers and operations)

A2A's commitment to Group digitalization is evident in its exploration of new digital services and platforms. These initiatives, designed to enhance customer experience and streamline operations beyond standard online billing, represent potential question marks within the A2A BCG Matrix. The digital sector is characterized by rapid evolution and substantial growth potential, yet the market adoption and immediate revenue generation for these specific A2A ventures may be nascent, necessitating significant investment in marketing and ongoing development to realize their full value.

For instance, in 2024, many utility companies are investing in AI-powered customer service chatbots and personalized energy management apps. While these platforms aim to boost customer engagement and operational efficiency, their initial market penetration can be slow. A2A's progress in these areas, such as the development of advanced smart home energy solutions or predictive maintenance platforms for its infrastructure, would likely fall into the question mark category if their current market share and profitability are still developing.

- Digital Customer Engagement Platforms: Investments in advanced mobile apps offering real-time energy consumption insights and personalized saving tips.

- Operational Efficiency Tools: Development of AI-driven predictive analytics for grid maintenance or smart resource allocation systems.

- New Service Offerings: Exploration of digital platforms for electric vehicle charging network management or distributed energy resource integration.

- Market Adoption Metrics: Tracking user acquisition rates, engagement levels, and initial revenue streams for these new digital services.

Question Marks represent business units or products with low market share in high-growth industries. These ventures require significant investment to gain traction and have uncertain future potential. A2A's investments in green hydrogen and lithium-ion battery recycling, for example, fit this profile due to their nascent stages and substantial capital needs. The Rebag textile recycling project and advanced smart city solutions also exhibit characteristics of question marks, needing further development and market penetration to prove their viability.

These areas demand strategic capital allocation and careful market analysis to navigate the competitive landscape and technological uncertainties. While the potential rewards are high, the risks associated with market acceptance and profitability are also considerable. A2A's digital service initiatives, such as AI-powered customer engagement platforms, also fall into this category, requiring sustained investment to achieve meaningful market share.

The success of these question mark ventures hinges on A2A's ability to innovate, secure partnerships, and adapt to rapidly evolving markets. For instance, the global smart city market was projected to exceed $1.7 trillion by 2026, highlighting the scale of opportunity but also the intense competition for these advanced solutions. Effective execution and market entry strategies will be critical for these businesses to transition from question marks to stars.

| Business Unit/Project | Industry Growth Rate | Current Market Share | Investment Needs | Future Potential |

|---|---|---|---|---|

| Green Hydrogen | High | Low | High (R&D, Infrastructure) | Uncertain, High Reward |

| Lithium-ion Battery Recycling | High | Low | High (Technology, Infrastructure) | Uncertain, High Reward |

| Rebag (Textile Recycling) | Moderate to High | Minimal | Moderate to High (Scaling, Operations) | Uncertain, Potential Growth |

| Advanced Smart City Solutions | High | Low to Moderate | High (Technology Development, Partnerships) | High, Competitive |

| Digitalization Initiatives (New Services) | High | Low | Moderate to High (Marketing, Development) | Uncertain, Dependent on Adoption |

BCG Matrix Data Sources

Our A2A BCG Matrix leverages comprehensive data from financial reports, market share analysis, and industry growth projections to provide strategic clarity.