Fifth Third Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fifth Third Bank Bundle

Discover the critical external forces shaping Fifth Third Bank's trajectory with our comprehensive PESTLE analysis. From evolving political landscapes to technological advancements, understand the opportunities and threats impacting their operations. Gain a competitive edge by leveraging these expert insights. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Fifth Third Bank operates within a heavily regulated environment, where shifts in government policies from bodies like the Federal Reserve and Treasury Department directly shape its operational landscape. For instance, the Federal Reserve's anticipated interest rate adjustments in 2025 are expected to influence lending margins and consumer demand for credit, impacting Fifth Third's core business.

Furthermore, evolving discussions on financial stability and enhanced consumer protection measures could introduce new compliance burdens. These potential regulatory changes might necessitate increased investment in risk management frameworks and technology, thereby affecting the bank's overall cost structure and strategic planning for the coming years.

Government spending and taxation policies directly shape economic activity, influencing loan demand, deposit levels, and the credit quality of Fifth Third Bank. For instance, in 2024, the U.S. federal deficit was projected to reach $1.9 trillion, impacting overall economic conditions that banks operate within.

Fiscal stimulus or austerity measures significantly affect the financial well-being of Fifth Third Bank's customer base, especially within its key Midwestern and Southeastern markets. A shift towards stimulus could boost consumer spending and business investment, while austerity might temper these trends.

Monitoring the direction of fiscal policy is essential for accurately forecasting regional economic resilience and anticipating business growth patterns. This foresight allows Fifth Third Bank to better manage its risk exposure and capitalize on emerging opportunities.

Uncertainty in global trade policies and escalating geopolitical tensions continue to cast a shadow over business and consumer confidence, directly impacting commercial loan demand. Fifth Third Bank's Chief Economist highlighted in late 2023 that trade policy ambiguity could indeed dampen manufacturing momentum, as businesses need predictable regulatory environments to commit to long-term investments.

This broader economic sentiment, shaped by these political factors, significantly influences investment decisions and the overall stability of financial markets. For instance, ongoing trade disputes can lead to increased costs for imported goods, affecting corporate profitability and potentially reducing their capacity or willingness to borrow for expansion.

Political Stability and Elections

Major political events, such as the upcoming 2024 US Presidential election, introduce a degree of unpredictability for economic outcomes and the regulatory landscape. Fifth Third Bank's CEO, Tim Chen, has explicitly stated that clarity on election results and ongoing interest rate decisions from the Federal Reserve are crucial for boosting business confidence and encouraging investment. This political stability is essential for financial institutions like Fifth Third to engage in clearer long-term strategic planning and helps to mitigate market volatility.

The potential for shifts in fiscal policy, regulatory frameworks, and trade agreements stemming from election outcomes directly impacts the banking sector. For instance, changes in tax laws or banking regulations could alter profitability and operational strategies. The ongoing geopolitical tensions and their potential impact on global economic stability also add another layer of political risk that financial institutions must navigate.

- 2024 US Presidential Election: Creates uncertainty regarding future economic policies and regulatory changes.

- CEO Commentary: Fifth Third Bank's CEO emphasized the need for clarity on election results and interest rate decisions to boost business confidence.

- Impact on Planning: Political stability allows for more predictable long-term strategic planning and reduces market volatility for financial institutions.

- Regulatory Environment: Potential shifts in fiscal policy, banking regulations, and trade agreements are key political considerations.

Regional and Local Government Relations

Fifth Third Bank's extensive branch network, concentrated in the Midwest and Southeast, necessitates strong ties with state and local governments. These relationships are crucial for navigating diverse regulatory landscapes and fostering community engagement.

Local policies significantly shape the bank's operations, particularly in areas like community development and affordable housing. For instance, initiatives in cities like Cincinnati, where Fifth Third has a strong presence, directly influence the bank's investment strategies and branch planning. In 2023, Fifth Third Bank committed $1.5 billion to its Accelerate, Grow, and Empower initiative, which includes significant community development investments, directly tied to local economic conditions and government priorities.

- Community Reinvestment Act (CRA) Compliance: Local government priorities often align with CRA requirements, influencing loan origination and service offerings in underserved areas.

- Zoning and Permitting: Branch expansion and renovation projects are subject to local zoning laws and permitting processes, requiring proactive engagement with municipal authorities.

- Economic Development Incentives: State and local governments may offer incentives for job creation or investment, which can impact Fifth Third Bank's strategic decisions regarding new facilities or market entry.

- Partnerships for Social Impact: Collaborations with local entities on issues like financial literacy and small business support are often facilitated through government-backed programs or partnerships.

Political factors significantly influence Fifth Third Bank's operational environment, from national monetary policy set by the Federal Reserve to local community development initiatives. The upcoming 2024 US Presidential election, for instance, introduces uncertainty regarding future economic policies and regulatory shifts, as highlighted by Fifth Third's CEO, Tim Chen, who stressed the importance of clarity for business confidence. These political dynamics necessitate careful navigation of evolving fiscal policies, banking regulations, and trade agreements, all of which impact the bank's strategic planning and market stability.

What is included in the product

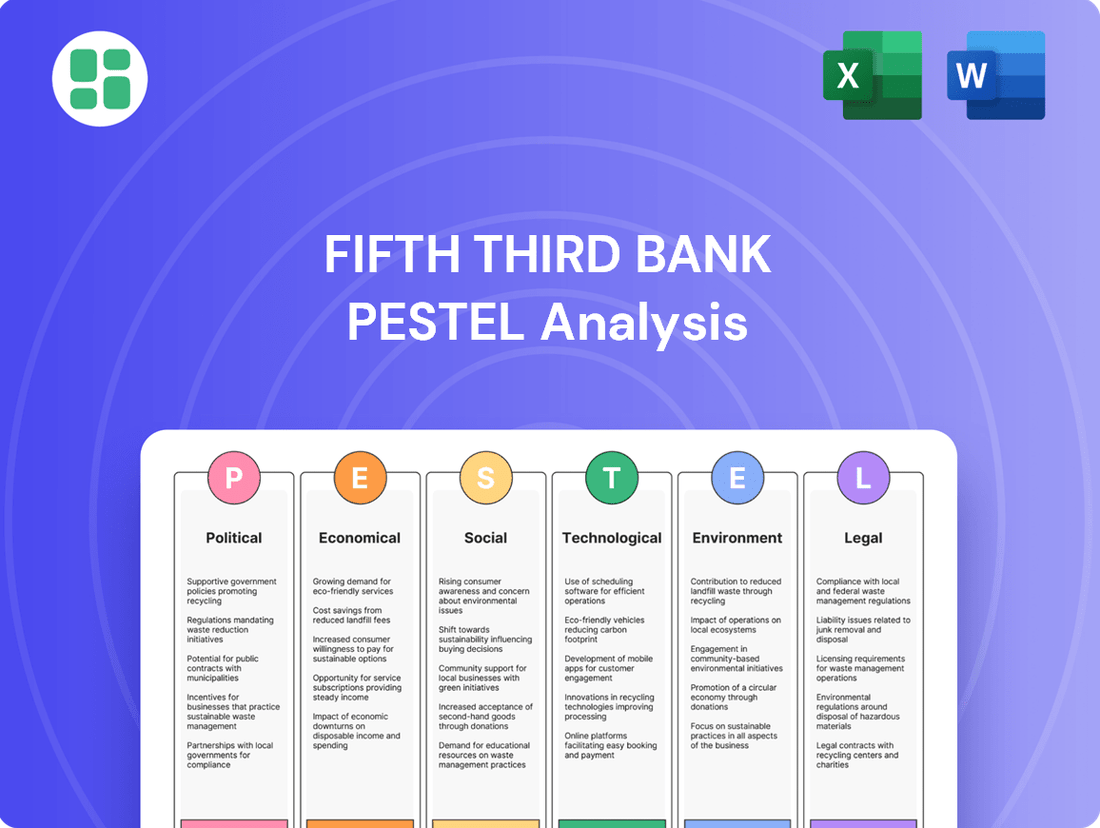

This PESTLE analysis examines the external macro-environmental factors influencing Fifth Third Bank, covering political, economic, social, technological, environmental, and legal dimensions.

It provides actionable insights into how these global and regional forces create both challenges and strategic opportunities for the bank.

A concise PESTLE analysis for Fifth Third Bank that highlights key external factors, transforming complex market dynamics into actionable insights for strategic decision-making and risk mitigation.

Economic factors

The interest rate environment is a critical factor for Fifth Third Bank, directly influencing its net interest income (NII). For instance, in the first quarter of 2025, the bank saw stable NII sequentially and a 4% increase year-over-year, attributed to effective management of deposits and wholesale funding.

However, the bank's outlook is sensitive to monetary policy. Fifth Third Bank projects record NII for 2025, contingent on no further interest rate reductions by the Federal Reserve, underscoring how potential rate cuts could squeeze profit margins.

Overall economic growth, tracked by Gross Domestic Product (GDP), significantly impacts a bank like Fifth Third. Strong GDP growth typically translates to higher demand for loans, better asset quality as borrowers are more likely to repay, and increased consumer spending, all of which are beneficial for the bank's performance.

Fifth Third's Q1 2025 earnings report highlighted this connection, noting loan growth in both its commercial and consumer segments. This suggests that even with some broader economic uncertainties, the underlying economic conditions were robust enough to support increased borrowing and spending.

The bank's strategic focus on expanding into the Southeast region is a direct play on economic growth differentials. This region has been outperforming the national average in terms of GDP expansion, offering Fifth Third a prime opportunity to capture market share and benefit from a more dynamic economic environment.

Inflationary pressures directly affect Fifth Third Bank by impacting consumer purchasing power and the cost of doing business, which in turn influences loan demand and credit risk. For instance, the Consumer Price Index (CPI) in the U.S. saw a notable increase, with annual inflation rates hovering around 3.0% to 3.5% in late 2024 and early 2025, remaining above the Federal Reserve's 2.0% target. This persistent inflation can lead to higher operating expenses for the bank and its clients.

Despite these challenges, Fifth Third Bank's focus on disciplined expense management has been a key factor in maintaining positive operating leverage and improving its efficiency ratio, which stood at approximately 55% in Q4 2024. This strategic approach helps the bank absorb some of the inflationary impact. However, continued high inflation could potentially lead to an uptick in consumer loan delinquencies and may temper business investment decisions, creating a more cautious lending environment.

Employment and Wage Growth

Employment levels and wage growth are crucial for consumer financial health, directly impacting loan repayment and the demand for banking services. Fifth Third's Chief Economist closely watches unemployment claims as a key signal for potential economic downturns.

A robust labor market within Fifth Third's operational footprint is beneficial, fostering stronger deposit growth and leading to fewer credit losses. For instance, in Q1 2024, the U.S. unemployment rate hovered around 3.9%, indicating a relatively tight labor market which generally supports consumer spending and, by extension, banking sector stability.

- Strong employment supports loan demand: A healthy job market means more individuals and businesses can afford to take out loans, driving revenue for banks like Fifth Third.

- Wage growth fuels spending: Rising wages increase disposable income, leading to higher consumer spending and greater demand for banking products and services.

- Unemployment claims as a recession indicator: An uptick in initial jobless claims can signal weakening economic conditions, prompting banks to adjust risk assessments and lending strategies.

- Impact on credit quality: A strong labor market generally correlates with lower default rates on loans, improving the overall credit quality of a bank's portfolio.

Consumer Spending and Debt Levels

Consumer spending habits and how much debt households carry are crucial for banks like Fifth Third. These factors directly influence how much people borrow and how likely they are to repay loans. Fifth Third's first quarter of 2025 saw a rise in revenue from its consumer banking division, suggesting that people are still actively spending.

The bank is actively working to support consumers and bring in new deposits. Initiatives like offering free overdraft windows and making it easier to switch direct deposit accounts show they understand how people manage their money today. This focus on consumer financial behavior is key to their strategy.

- Consumer Spending: Sustained consumer activity, as evidenced by Fifth Third's Q1 2025 consumer banking revenue increase.

- Debt Levels: Household debt impacts demand for lending products and potential default risks.

- Bank Offerings: Fifth Third's services, like free overdraft windows, cater to current consumer financial behaviors.

- Deposit Growth: Strategies to attract new deposits are tied to understanding and supporting consumers.

Economic factors significantly shape Fifth Third Bank's performance, with interest rates, GDP growth, inflation, and employment levels being paramount. The bank's net interest income is directly tied to the Federal Reserve's monetary policy, with projections for record NII in 2025 contingent on stable rates.

Strong GDP growth fuels loan demand and improves asset quality, as seen in Fifth Third's Q1 2025 loan growth across commercial and consumer segments, further supported by strategic expansion into faster-growing Southeast regions.

Persistent inflation around 3.0%-3.5% in late 2024/early 2025 impacts operating costs and consumer spending, though Fifth Third's efficiency ratio of approximately 55% in Q4 2024 indicates effective expense management.

A robust labor market, with the U.S. unemployment rate around 3.9% in Q1 2024, supports consumer spending, deposit growth, and lower credit losses, directly benefiting Fifth Third's operational stability and revenue streams.

| Economic Factor | Impact on Fifth Third Bank | Relevant Data/Trend (2024-2025) |

|---|---|---|

| Interest Rates | Affects Net Interest Income (NII) | Stable NII in Q1 2025; projected record NII for 2025 if rates remain stable. |

| GDP Growth | Drives Loan Demand & Asset Quality | Loan growth in commercial and consumer segments in Q1 2025; Southeast region outperforming national GDP. |

| Inflation (CPI) | Impacts Operating Costs & Consumer Spending | Annual inflation around 3.0%-3.5% in late 2024/early 2025. |

| Unemployment Rate | Influences Consumer Health & Credit Quality | U.S. unemployment rate around 3.9% in Q1 2024. |

Preview Before You Purchase

Fifth Third Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of Fifth Third Bank. This detailed report meticulously examines the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank's operations and strategic positioning.

Sociological factors

Fifth Third Bank's strategic growth is significantly shaped by demographic shifts, especially the booming population in the Southeastern U.S. This region is experiencing population growth rates two to three times higher than the national average, driven by both urbanization and internal migration.

To capitalize on these trends, Fifth Third Bank intends to open 50 to 60 new branches each year in the Southeast until 2028. Their goal is for this rapidly expanding region to house half of their entire branch network by that same year.

Consumers increasingly favor digital banking for routine transactions, with mobile banking adoption continuing its upward trend. Fifth Third Bank has responded by enhancing its mobile platform, which was lauded as a leading regional banking app in 2024, featuring tools like SmartShield and its AI assistant, Jeanie. This digital focus complements their strategy of reimagining physical branches to better serve customers for more intricate needs and community interaction.

Fifth Third Bank actively promotes financial inclusion and literacy, recognizing their critical role in community well-being. Through initiatives like its Neighborhood Program, the bank is investing in historically underinvested areas, aiming to spur revitalization. This commitment is exemplified by the Empowering Black Futures initiative, which targets affordable housing, small business growth, and improved financial access.

The bank’s eBus program is a tangible effort to bring financial education and services directly to underserved communities, bridging geographical and accessibility gaps. In 2023, Fifth Third Bank reported investing $3.4 billion in communities through its Neighborhood Program, directly supporting affordable housing and small business development, underscoring a data-driven approach to social impact.

Community Engagement and Corporate Social Responsibility

Fifth Third Bank actively cultivates its image as a responsible corporate citizen, focusing on community development and substantial philanthropic contributions. This dedication to local impact directly influences public perception and strengthens customer loyalty.

The bank's commitment is evident in tangible actions:

- Community Development: Fifth Third prioritizes place-based initiatives, aiming to uplift the communities it serves.

- Employee Volunteerism: In 2023, Fifth Third employees dedicated over 110,000 hours to volunteering, showcasing a deep commitment to civic engagement.

- Philanthropic Giving: The bank's philanthropic efforts reached $35.3 million in 2023, supporting various social causes and community programs.

- Brand Reputation: This strong emphasis on corporate social responsibility is instrumental in building and maintaining a positive brand reputation and fostering deep trust within local communities.

Workforce Demographics and Talent Management

The banking sector, including Fifth Third Bank, faces a shifting workforce landscape. Adapting talent management to embrace diversity, equity, and inclusion (DEI) is paramount. Fifth Third's 2023 sustainability report underscores its dedication to employee well-being through comprehensive benefits and financial literacy programs, aiming to foster a stable and motivated workforce.

Attracting and retaining top talent, particularly in high-demand areas like technology and specialized financial services, remains a critical challenge and opportunity. As of early 2024, the demand for cybersecurity professionals in the financial industry continues to outpace supply, with salary expectations rising significantly. Fifth Third's ability to secure these skilled individuals directly impacts its capacity for innovation and the quality of its customer service delivery.

- Demographic Shifts: The increasing representation of younger generations in the workforce brings new expectations regarding company culture, flexibility, and social responsibility.

- Talent Scarcity: Competition for specialized skills, especially in data analytics and digital banking, is intensifying, requiring proactive recruitment and retention strategies.

- DEI Imperative: Companies like Fifth Third are increasingly judged on their commitment to DEI, with studies showing diverse teams often outperform less diverse ones.

- Employee Engagement: Investing in employee development, financial wellness, and a supportive work environment is key to reducing turnover, which can cost businesses substantial amounts in recruitment and training.

Societal expectations are increasingly influencing banking practices, with a growing emphasis on corporate social responsibility and community engagement. Fifth Third Bank's commitment to financial inclusion and literacy, particularly through initiatives like the Empowering Black Futures program, directly addresses these societal demands. Their significant community investments, totaling $3.4 billion in 2023 via the Neighborhood Program, reflect a strategic alignment with social well-being and revitalization efforts.

Technological factors

Fifth Third Bank is heavily invested in its digital transformation, focusing on improving its mobile banking capabilities and online customer interactions. This strategic push is evident in its mobile app, which boasts 2.4 million users and was recognized as the top regional bank mobile app in the 2025 J.D. Power rankings.

The bank is consistently enhancing its mobile platform with new features designed to simplify banking, such as tools for direct deposit switching, advanced card controls, and robust fraud protection measures. These updates aim to provide a seamless and secure digital experience for its growing customer base.

Fifth Third Bank is actively embedding artificial intelligence and automation across its operations. The bank has rolled out Microsoft Copilot to its workforce and GitHub Copilot for its engineering teams, aiming to boost productivity and innovation. This strategic adoption is designed to enhance employee capabilities and streamline complex tasks.

Furthering its AI integration, Fifth Third Bank plans to introduce AI-powered features into its mobile banking application during the second half of 2025. This move is anticipated to significantly improve customer experience by offering more personalized and efficient self-service options, while simultaneously driving down operational costs within its service channels.

For Fifth Third Bank, cybersecurity and data privacy are critical. In 2024, financial institutions faced an escalating threat landscape, with data breaches costing an average of $4.45 million globally, according to IBM's 2024 Cost of a Data Breach Report. Fifth Third prioritizes safety and soundness, ensuring its AI initiatives are governed by strict standards to avoid security and compliance issues.

The bank actively enhances customer digital safety through features like SmartShield in its mobile app, offering gamified tools to educate and empower users. This proactive approach is essential for maintaining customer trust and protecting sensitive financial information in an increasingly digital environment.

Fintech Partnerships and Embedded Finance

Fifth Third Bank is strategically leveraging technological advancements by fostering fintech partnerships and developing an embedded finance infrastructure. Its API-first platform, Newline™, launched in 2024, is a key initiative in this regard. This platform was lauded as the Most Innovative Financial Institution in 2024 and recognized for its Best New Embedded Finance Platform capabilities. Newline™ allows businesses to easily integrate payment, card, and deposit functionalities directly into their own systems, streamlining financial operations for enterprises.

The bank's commitment to a digital-first approach is further evidenced by its collaborations with prominent fintech players. Partnerships with companies like Trustly and Stripe are crucial for expanding its reach and offering scalable financial solutions. These alliances enable Fifth Third to tap into new customer segments and provide innovative services that meet the evolving demands of the digital economy. For instance, Trustly's open banking solutions can facilitate faster and more secure payment processing, while Stripe's robust payment infrastructure supports global transactions.

- API-First Strategy: Fifth Third's Newline™ platform underscores its commitment to enabling seamless integration of financial services for businesses.

- Industry Recognition: Newline™ received accolades in 2024 for innovation and its embedded finance capabilities, validating its market approach.

- Strategic Partnerships: Collaborations with fintech leaders like Trustly and Stripe are vital for scaling digital-first financial offerings.

- Embedded Finance Growth: The embedded finance market is projected for significant growth, with estimates suggesting it could reach $7 trillion globally by 2030, highlighting the strategic importance of Fifth Third's Newline™ initiative.

Cloud Computing and Infrastructure Modernization

Fifth Third Bank is actively modernizing its technological backbone, a key move in today's digital landscape. This includes substantial investments in building out its own private cloud infrastructure.

Furthermore, the bank has forged a strategic partnership with Amazon Web Services (AWS) to leverage public cloud capabilities. This hybrid approach, combining private and public clouds, is designed to offer enhanced scalability and resilience, crucial for managing growth from both organic expansion and potential acquisitions.

This foundational IT modernization is directly supporting the accelerated execution of Fifth Third Bank's digital banking strategy. For instance, by Q1 2024, Fifth Third Bank reported a 15% increase in digital sales compared to the previous year, a testament to the effectiveness of these infrastructure upgrades in facilitating customer engagement and transaction processing.

The benefits of this dual-cloud strategy are evident in its ability to rapidly scale operations. This agility allows Fifth Third Bank to quickly adapt to changing market demands and seamlessly integrate new technologies, ensuring it remains competitive in the evolving financial services sector.

Technological factors are driving significant transformation at Fifth Third Bank, with a strong emphasis on digital capabilities and AI integration. The bank's mobile app, boasting 2.4 million users, was recognized as the top regional bank mobile app in 2025 by J.D. Power, highlighting its success in enhancing customer digital experiences.

Fifth Third is actively embedding AI, deploying Microsoft Copilot and GitHub Copilot to boost workforce productivity and innovation, with AI-powered mobile features planned for late 2025 to further personalize customer interactions and reduce operational costs. The bank's commitment to cybersecurity is paramount, especially given the global average cost of a data breach reached $4.45 million in 2024, as reported by IBM.

The bank's API-first strategy, exemplified by its 2024-launched Newline™ platform, earned accolades for innovation and embedded finance capabilities. This platform, along with strategic fintech partnerships, is key to its digital-first approach and capitalizing on the projected growth of the embedded finance market, which could reach $7 trillion globally by 2030.

Fifth Third Bank is modernizing its IT infrastructure through a hybrid cloud strategy, combining private cloud investments with a public cloud partnership with AWS. This approach enhances scalability and resilience, directly supporting its digital banking strategy, which saw a 15% increase in digital sales by Q1 2024 compared to the prior year.

Legal factors

Fifth Third Bank navigates a stringent regulatory landscape, adhering to directives from the Federal Reserve, FDIC, and various state financial authorities. These regulations, encompassing capital adequacy, lending standards, and consumer safeguards, demand constant vigilance and significant investment in compliance infrastructure. The bank's 2024 annual report details the ongoing efforts and potential impacts of these evolving legal requirements.

Consumer protection laws significantly shape Fifth Third Bank's operations, particularly concerning fair lending, data privacy, and overdraft fee practices. These regulations directly influence how the bank designs its products and communicates with its customer base.

In response to evolving consumer expectations and regulatory scrutiny, Fifth Third has proactively introduced customer-centric features. For instance, the bank launched a free overdraft window for new customers and simplified the process for switching direct deposits, aiming to alleviate common financial anxieties and align with consumer protection mandates.

Fifth Third Bank navigates a complex legal landscape shaped by data privacy and cybersecurity mandates. With a significant portion of its operations now digital, the bank must strictly comply with state-specific privacy laws, such as the California Consumer Privacy Act (CCPA), and federal regulations like the Gramm-Leach-Bliley Act (GLBA) that govern the protection of customer financial information. These regulations are constantly evolving, requiring continuous adaptation.

The bank's proactive stance on cybersecurity, including robust governance frameworks for its artificial intelligence (AI) initiatives, demonstrates a commitment to meeting these stringent legal requirements. Protecting sensitive customer data is not just a best practice but a fundamental legal obligation for financial institutions like Fifth Third, especially as cyber threats become more sophisticated.

Anti-Money Laundering (AML) and Sanctions Compliance

Fifth Third Bank, like all financial institutions, operates under stringent Anti-Money Laundering (AML) and sanctions compliance frameworks. These regulations, enforced by bodies such as the Financial Crimes Enforcement Network (FinCEN) in the U.S., are critical for preventing the flow of illicit funds and ensuring adherence to international sanctions regimes. For instance, in 2023, FinCEN issued over $1 billion in civil penalties for AML violations, highlighting the significant financial risks associated with non-compliance.

To meet these legal obligations, Fifth Third must maintain robust internal controls. This includes implementing sophisticated transaction monitoring systems to identify and report suspicious activities, conducting thorough customer due diligence (CDD) and Know Your Customer (KYC) procedures, and establishing clear reporting channels for potential money laundering or terrorist financing. The Bank's commitment to these areas is crucial for avoiding substantial fines and protecting its reputation.

- Regulatory Scrutiny: Financial institutions face increasing regulatory oversight regarding AML and sanctions, with significant penalties for breaches.

- Operational Requirements: Legal mandates require continuous monitoring, reporting of suspicious transactions, and rigorous customer identification processes.

- Financial Impact of Non-Compliance: Failure to comply can lead to substantial fines, operational restrictions, and severe damage to brand trust and market standing.

Environmental, Social, and Governance (ESG) Reporting Standards

While not strictly legal mandates, the increasing formalization of Environmental, Social, and Governance (ESG) reporting standards significantly influences regulatory expectations and investor confidence for institutions like Fifth Third Bank. These evolving frameworks, such as those from the Global Reporting Initiative (GRI) and Sustainability Accounting Standards Board (SASB), are becoming de facto requirements for demonstrating robust corporate responsibility.

Fifth Third Bank actively engages with these standards, publishing annual Sustainability Reports that incorporate GRI and SASB indices. This practice showcases their transparency regarding environmental impact and social performance, crucial for maintaining stakeholder trust and preparing for potential future regulatory obligations.

- Increased Investor Scrutiny: In 2024, over 70% of investors surveyed by PwC indicated that ESG factors are important in their investment decisions, highlighting the need for clear reporting.

- Alignment with Global Frameworks: Fifth Third's use of GRI and SASB aligns with international best practices, facilitating comparability and demonstrating commitment to sustainability.

- Risk Mitigation: Proactive adherence to emerging ESG reporting norms helps mitigate risks associated with regulatory changes and reputational damage.

- Enhanced Stakeholder Relations: Transparent reporting fosters stronger relationships with customers, employees, and communities, who increasingly prioritize ethical business practices.

Fifth Third Bank operates under a strict legal framework, requiring adherence to directives from the Federal Reserve, FDIC, and state financial regulators. These rules cover capital adequacy, lending practices, and consumer protection, necessitating ongoing investment in compliance. For example, in 2024, the bank reported significant expenditures on technology upgrades to meet new data privacy and cybersecurity mandates.

Consumer protection laws are particularly impactful, influencing everything from fair lending practices to overdraft policies. In 2024, Fifth Third continued to refine its overdraft services, offering features like a free overdraft window for new customers to align with consumer advocacy and regulatory expectations.

The bank also faces stringent Anti-Money Laundering (AML) and sanctions compliance requirements. Failure to comply can result in substantial penalties; in 2023, FinCEN levied over $1 billion in fines for AML violations, underscoring the critical need for robust internal controls and transaction monitoring systems.

Fifth Third Bank’s commitment to legal compliance is evident in its proactive approach to cybersecurity and data protection, including adherence to state-specific privacy laws like the CCPA and federal regulations such as the Gramm-Leach-Bliley Act (GLBA). Their 2024 cybersecurity investments aim to safeguard sensitive customer financial information against evolving threats.

Environmental factors

Fifth Third Bank is actively managing climate-related risks, recognizing both the physical impacts of extreme weather and the transition risks inherent in moving towards a lower-carbon economy. This proactive approach is crucial as the financial sector navigates evolving regulatory landscapes and increasing investor focus on environmental, social, and governance (ESG) factors. For instance, the bank's 2023 ESG report highlighted continued investment in climate risk assessment tools.

Fifth Third Bank is actively pursuing sustainability goals, having achieved $45.3 billion of its ambitious $100 billion environmental and social finance target by the end of 2024, with the overall goal set for 2030.

This significant financial commitment is directed towards lending and financing initiatives focused on critical areas such as renewable energy, green buildings, energy efficiency improvements, and the development of clean transportation solutions.

Through these targeted financial activities, Fifth Third Bank aims to play a substantial role in accelerating the broader transition towards a more sustainable and inclusive economic landscape.

Fifth Third Bank is actively working to shrink its environmental impact. The bank has committed to several operational sustainability goals aimed at reducing its carbon footprint.

By the end of 2024, Fifth Third successfully met its target of sourcing 100% renewable power. Furthermore, they achieved a 46% reduction in energy consumption, showcasing significant progress in their sustainability efforts.

These achievements, alongside advancements in reducing greenhouse gas emissions, water usage, and waste sent to landfills, underscore Fifth Third's dedication to operating responsibly and sustainably.

Renewable Energy Financing

Fifth Third Bank's commitment to environmental factors is evident in its significant investments in renewable energy. Since 2012, the bank has financed approximately $4 billion in renewable energy projects, demonstrating a clear strategic direction towards sustainable finance.

This focus is further solidified by the establishment of a national renewable energy finance center of excellence and the addition of a dedicated renewable investment banking team. These initiatives underscore Fifth Third's proactive approach to capitalizing on the growing renewable energy sector.

The bank's environmental strategy also includes a commitment to phasing out new lending to fossil fuel projects, with a stated goal of annually decreasing its legacy fossil fuel funding. This aligns with broader market trends and investor preferences for environmentally responsible financial institutions.

- $4 billion provided in renewable energy lending and capital raising services since 2012.

- Established a national renewable energy finance center of excellence.

- Added a renewable investment banking team to bolster expertise.

- Actively decreasing legacy fossil fuel funding annually.

ESG Reporting and Transparency

Fifth Third Bank's dedication to environmental responsibility is clearly shown through its detailed ESG reporting. The bank releases yearly Sustainability Reports that include the GRI Index, SASB Index, and Stakeholder Capitalism Metrics index. These reports offer clear insights into their progress on sustainability goals.

This focus on transparency is crucial for building trust with stakeholders and proving accountability. For example, in their 2023 Sustainability Report, Fifth Third highlighted a 24% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to their 2019 baseline. They also reported a 15% increase in renewable energy usage in their operations.

- ESG Reporting: Fifth Third publishes comprehensive annual Sustainability Reports.

- Transparency Frameworks: Utilizes GRI, SASB, and Stakeholder Capitalism Metrics indices for disclosure.

- Environmental Progress: Reported a 24% reduction in Scope 1 & 2 GHG emissions intensity (vs. 2019 baseline) and a 15% increase in renewable energy usage in 2023.

- Stakeholder Engagement: Commitment to disclosure fosters engagement and demonstrates accountability.

Fifth Third Bank is actively addressing climate change by managing both physical and transition risks. Their commitment is reflected in reaching $45.3 billion of their $100 billion environmental and social finance goal by the close of 2024, with a 2030 target. This financial push supports renewable energy and green initiatives.

Operationally, the bank has achieved 100% renewable power sourcing by the end of 2024 and a 46% reduction in energy consumption. These efforts contribute to their broader goals of reducing greenhouse gas emissions, water usage, and waste.

The bank's environmental strategy includes a significant focus on renewable energy, having financed approximately $4 billion in projects since 2012, and a commitment to annually decrease lending to fossil fuel projects.

| Environmental Initiative | Target/Status | Key Metric |

|---|---|---|

| Environmental & Social Finance | $45.3 billion achieved by end of 2024 (of $100 billion target by 2030) | Financing for renewable energy, green buildings, etc. |

| Renewable Power Sourcing | 100% achieved by end of 2024 | Operational energy consumption |

| Energy Consumption Reduction | 46% reduction achieved | Operational energy efficiency |

| Renewable Energy Financing | $4 billion since 2012 | Capital raised for renewable projects |

| Greenhouse Gas Emissions Intensity | 24% reduction (Scope 1 & 2 vs. 2019 baseline) | Reported in 2023 Sustainability Report |

PESTLE Analysis Data Sources

Our PESTLE analysis for Fifth Third Bank is built on a robust foundation of data from official government publications, reputable financial news outlets, and leading economic research firms. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are current and well-supported.