Fifth Third Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fifth Third Bank Bundle

Fifth Third Bank operates within a dynamic financial landscape, significantly shaped by the bargaining power of its customers and the intense rivalry among existing players. Understanding these forces is crucial for any stakeholder looking to navigate its competitive environment.

The complete report reveals the real forces shaping Fifth Third Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Fifth Third Bank's reliance on specialized technology and software providers, particularly in fintech and core banking systems, means these suppliers hold a moderate to high level of bargaining power. The significant costs and complexities associated with switching these critical systems can make it difficult for Fifth Third to negotiate favorable terms.

The limited number of highly capable and specialized providers in this sector further enhances their negotiating leverage. For instance, the global market for core banking software is dominated by a few key players, and Fifth Third, like many large financial institutions, invests heavily in these platforms, making them somewhat captive to their chosen vendors.

The bargaining power of suppliers, particularly in human capital, is a significant factor for Fifth Third Bank. The demand for skilled financial professionals, cybersecurity experts, and data scientists remains high, intensified by the increasing integration of AI and automation within the banking sector. This competitive landscape for talent means employees, as essential suppliers of labor, possess considerable bargaining power.

This leverage translates into a need for Fifth Third Bank to offer attractive compensation packages and robust benefits to secure and retain top talent. For instance, in 2024, the average salary for a data scientist in the financial services industry saw an increase, reflecting this demand. Banks are investing heavily in employee development and competitive pay to counter the power of these skilled individuals.

Fifth Third Bank relies on a diverse funding mix, including customer deposits, wholesale funding, and capital markets. In 2024, the bank's total deposits stood at approximately $160 billion, representing a significant portion of its funding base. However, when market liquidity tightens or interest rates rise, the bargaining power of these funding sources, particularly those from capital markets and larger wholesale depositors, can increase considerably, impacting the bank's cost of funds.

Data and Analytics Providers

Data and analytics providers hold moderate bargaining power over banks like Fifth Third. Access to accurate, timely data is vital for credit assessment, market analysis, and risk management. Specialized providers offer unique insights and proprietary algorithms that are difficult to replicate, making their services essential for informed, data-driven decisions.

The reliance on these providers for competitive advantage means banks cannot easily switch or develop comparable internal capabilities overnight. For example, in 2024, the global financial analytics market was valued at billions of dollars, with a significant portion driven by specialized data providers serving financial institutions. This indicates a substantial investment and dependence on these external sources.

- Essential Data: Banks need specialized data for credit scoring, fraud detection, and market trend analysis.

- Proprietary Algorithms: Providers offer unique analytical tools and insights that are hard to replicate internally.

- Market Dependence: The significant investment in financial data services highlights the moderate power of these suppliers.

- Switching Costs: High costs and the learning curve associated with new data platforms limit a bank's ability to easily switch providers.

Real Estate and Infrastructure

Fifth Third Bank's extensive branch network means real estate lessors and utility providers are essential suppliers. The bargaining power of these suppliers can fluctuate significantly depending on the specific geographic locations of Fifth Third's branches and the bank's existing long-term lease agreements. For instance, in markets with high commercial real estate vacancy rates, Fifth Third might find itself in a stronger negotiating position with landlords.

In 2024, the commercial real estate market continued to show regional variations. While some urban centers experienced increased office vacancy rates, impacting lease negotiations, other areas remained stable or saw modest growth. Utility providers, while generally having strong bargaining power due to the essential nature of their services, might offer more favorable terms to large, long-term commercial clients like Fifth Third, especially if the bank represents a significant portion of their customer base in a particular area.

- Real Estate Lessors: Their power is influenced by local market conditions, including vacancy rates and demand for commercial space. Fifth Third's long-term leases can mitigate some of this power.

- Utility Providers: Essential services grant these suppliers inherent power, though large-scale contracts can create negotiation leverage for Fifth Third.

- Geographic Variation: Bargaining power for both real estate and utilities is not uniform, differing significantly from one region to another based on local economic factors.

Suppliers of specialized technology and data are key influencers for Fifth Third Bank, given the high costs and complexity of switching core banking systems and data analytics platforms. In 2024, the continued reliance on advanced fintech solutions and proprietary algorithms means these providers hold considerable sway, as banks invest heavily in these essential tools to maintain a competitive edge and manage risk effectively.

The bargaining power of human capital suppliers, particularly skilled financial professionals, cybersecurity experts, and data scientists, is significant for Fifth Third Bank. The intense competition for talent in 2024, amplified by AI integration, necessitates competitive compensation and benefits to attract and retain these essential employees.

Fifth Third Bank's funding sources, ranging from customer deposits to capital markets, also represent suppliers whose bargaining power can increase during periods of market liquidity tightening or rising interest rates. In 2024, while deposits remained a stable base, wholesale funding and capital market access became more sensitive to economic conditions, impacting the bank's cost of funds.

| Supplier Type | Bargaining Power Level | Key Factors | 2024 Context |

|---|---|---|---|

| Technology & Software Providers | Moderate to High | Switching costs, limited number of specialized providers | Continued investment in fintech and core systems |

| Human Capital (Skilled Labor) | High | High demand for specialized skills (AI, data science), competitive talent market | Increased salaries for data scientists in financial services |

| Funding Sources (Wholesale & Capital Markets) | Moderate to High (variable) | Market liquidity, interest rate environment | Sensitivity to market conditions impacting cost of funds |

| Data & Analytics Providers | Moderate | Proprietary algorithms, essential data for decision-making | Significant global market valuation driven by specialized providers |

What is included in the product

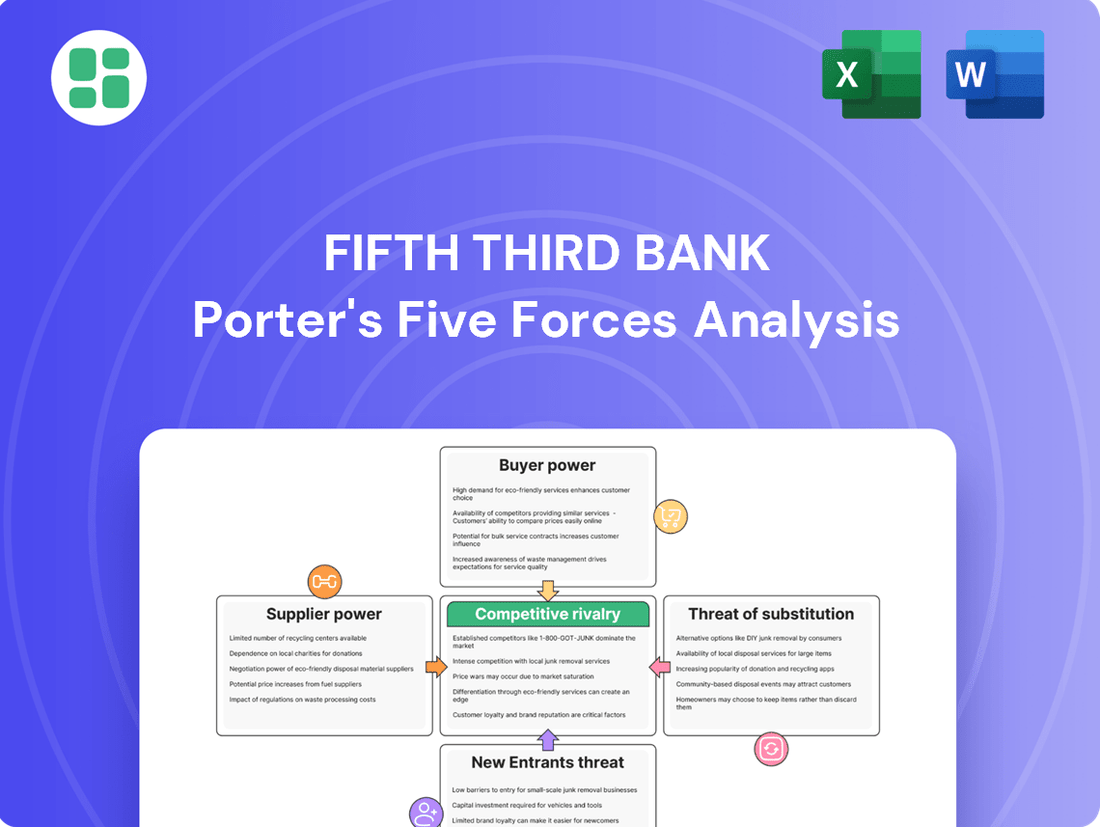

A Porter's Five Forces analysis for Fifth Third Bank reveals intense industry rivalry and significant buyer bargaining power, while also highlighting moderate threats from new entrants and substitutes, and low supplier power.

Instantly visualize competitive pressures with a dynamic, interactive dashboard, simplifying complex market dynamics for Fifth Third Bank.

Customers Bargaining Power

Retail banking customers wield considerable bargaining power. With low switching costs for everyday banking needs and a vast array of options from traditional banks to fintech startups, customers can easily move their business. This competitive landscape, particularly evident in 2024, pushes banks like Fifth Third to offer more personalized services and superior digital platforms to retain clients.

Commercial clients, particularly large corporations, wield significant bargaining power over Fifth Third Bank. These sophisticated clients typically maintain relationships with several financial institutions, allowing them to solicit competitive bids and negotiate for customized financial solutions. Their ability to switch banks or leverage alternative financing options puts them in a strong position to secure more favorable terms on loans, treasury services, and other banking products.

Wealth management clients, particularly high-net-worth individuals and institutional investors, wield significant bargaining power. Their demand for tailored investment strategies, cutting-edge digital platforms, and international diversification means they can easily shift their substantial assets to competitors offering superior value. For instance, in 2024, reports indicated that a notable percentage of affluent investors considered switching wealth managers if their current provider failed to meet evolving digital expectations or deliver personalized advice.

Digital Natives and Tech-Savvy Consumers

Digital natives and tech-savvy consumers, especially younger demographics, are increasingly demanding seamless digital experiences and mobile-first solutions from their banks. This preference for immediate, convenient, and often embedded financial services significantly amplifies their bargaining power.

Their willingness to switch to fintech alternatives that offer superior digital platforms means traditional banks like Fifth Third Bank must continuously innovate. For instance, by mid-2024, a significant portion of banking transactions are expected to be conducted digitally, highlighting the critical need for robust online and mobile offerings to retain these customers.

- Digital Preference: A substantial percentage of Gen Z and Millennial consumers, representing a growing customer base, prioritize digital channels for banking.

- Fintech Competition: The ease with which these digitally adept customers can adopt new financial technologies puts pressure on incumbent banks to match or exceed the user experience offered by fintechs.

- Innovation Imperative: Banks failing to offer intuitive mobile apps, easy online account opening, and integrated digital services risk alienating this powerful customer segment.

Customers Seeking Specialized Services

Customers with highly specialized financial needs, like those seeking intricate commercial real estate financing or bespoke wealth management, often possess less individual bargaining power. However, their collective demand for tailored solutions that only a few institutions can deliver can significantly influence service offerings and pricing.

For instance, in 2024, the commercial real estate financing market saw a surge in demand for niche products, with specialized lenders capturing a larger share of deals exceeding $50 million, indicating a growing customer segment willing to pay a premium for expertise.

Fifth Third Bank, like its peers, must acknowledge this dynamic. The ability to provide these specialized services can become a competitive advantage, mitigating the bargaining power of these discerning customer groups by becoming an indispensable partner.

- Niche Market Demand: Customers requiring specialized financial products, such as complex structured finance or advanced estate planning, represent a segment where providers with unique capabilities gain leverage.

- Limited Provider Landscape: The scarcity of institutions capable of meeting these highly specific demands reduces customer options, thereby increasing the bank's ability to dictate terms.

- Premium Service Pricing: Banks that excel in offering these specialized services can often command higher fees, reflecting the value and expertise provided to these sophisticated clients.

- Client Retention: Successfully catering to these specialized needs fosters strong client loyalty, as switching providers becomes more complex and costly for the customer.

The bargaining power of customers remains a significant force for Fifth Third Bank. In 2024, the ease of digital switching and the proliferation of fintech options mean customers, from retail to commercial, can readily compare and demand better terms. This pressure necessitates continuous innovation in service delivery and pricing to maintain client loyalty.

High-net-worth and institutional clients, in particular, wield substantial influence due to their ability to move large volumes of assets. Their demand for personalized, digitally-enabled wealth management services means banks must constantly enhance their offerings to prevent client attrition. For instance, a significant percentage of affluent investors in 2024 indicated a willingness to switch providers based on digital experience alone.

| Customer Segment | Bargaining Power Drivers | Impact on Fifth Third Bank |

|---|---|---|

| Retail Banking Customers | Low switching costs, abundant alternatives (fintechs) | Pressure on fees, need for superior digital experience |

| Commercial Clients (Large) | Multiple banking relationships, ability to solicit bids | Negotiation leverage on loan rates, treasury services |

| Wealth Management Clients | Demand for tailored strategies, digital platforms, global access | Need for advanced advisory, competitive AUM fees |

| Digital Natives | Preference for mobile-first, seamless digital interaction | Requirement for intuitive apps, online onboarding |

Preview the Actual Deliverable

Fifth Third Bank Porter's Five Forces Analysis

This preview shows the exact Fifth Third Bank Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. It offers a comprehensive examination of the competitive landscape, detailing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products specific to Fifth Third Bank. This in-depth analysis is professionally formatted and ready for your immediate use.

Rivalry Among Competitors

Fifth Third Bank contends with formidable competition from major national banks, many of which boast significantly larger asset bases and wider geographic footprints. For instance, as of the first quarter of 2024, institutions like JPMorgan Chase, with over $3.9 trillion in total assets, and Bank of America, holding approximately $3.2 trillion in total assets, possess substantial advantages in resources and market reach.

These larger competitors leverage their scale to offer a broader array of financial products and services, often at more competitive pricing due to their ability to spread fixed costs over a larger operational base. Their extensive branch networks and well-established brand recognition also contribute to a stronger customer acquisition and retention capability, directly impacting Fifth Third Bank's market share.

Fifth Third Bank faces intense competition from other regional banks across the Midwest and Southeast. These institutions, often with established local roots, actively vie for the same customer base, leading to aggressive strategies in pricing, service offerings, and community engagement. For instance, in 2024, many regional banks continued to offer competitive interest rates on deposits and loans, directly impacting Fifth Third's market share in key geographic areas.

Fintech startups and neobanks are a major competitive force, offering digital-first banking and innovative financial tools. These agile players often boast lower overhead, allowing them to provide competitive rates and fees, directly challenging established institutions like Fifth Third Bank.

These digital disruptors are particularly effective at attracting younger demographics and those seeking seamless, mobile-first banking experiences. Their focus on user-friendly interfaces and specialized services, such as streamlined lending or investment platforms, erodes traditional revenue sources for incumbent banks.

In 2024, the fintech sector continued its robust growth, with venture capital funding reaching significant levels, signaling ongoing innovation and market penetration. For instance, reports indicate substantial investment in digital payment solutions and personalized financial advisory services, directly impacting how consumers interact with financial institutions.

Product and Service Overlap

Fifth Third Bank operates in a highly competitive landscape where many financial institutions offer very similar core products. This similarity forces banks to compete intensely on factors like interest rates for savings accounts and loans, as well as the fees charged for various services. For instance, in 2024, the average interest rate for a savings account hovered around 0.45%, creating a race to the bottom for many institutions.

To stand out, differentiation is key. Fifth Third Bank, like its peers, must focus on providing a superior customer experience, leveraging cutting-edge technology, and developing specialized services that cater to specific customer needs. This could include personalized financial advice, user-friendly mobile banking apps, or niche lending products.

- Product Similarity: Core banking products like checking accounts, savings accounts, and loans are largely commoditized across the industry.

- Price Competition: Interest rates on deposits and loans, along with service fees, are primary battlegrounds for customer acquisition and retention. In Q1 2024, net interest margins for many regional banks were compressed due to rising deposit costs.

- Differentiation Strategies: Banks are investing in digital transformation, enhanced customer service platforms, and specialized product offerings to carve out unique market positions.

Regulatory and Market Environment

The banking sector faces intense competition, further fueled by evolving regulations and market consolidation. Changes in regulatory frameworks can either ease or tighten the competitive landscape, impacting how banks operate and compete. For instance, in 2024, the banking industry continued to navigate a complex regulatory environment, with ongoing discussions around capital requirements and consumer protection measures.

Market consolidation through mergers and acquisitions (M&A) significantly reshapes competitive dynamics. While these deals aim for economies of scale and expanded market reach, they also result in larger, more powerful entities entering the fray. This trend was evident in 2024, with several significant M&A announcements, creating a more concentrated market with fewer, but stronger, players.

- Regulatory Shifts: Ongoing adjustments to banking regulations in 2024, such as those concerning liquidity and capital adequacy, can alter the competitive playing field.

- Market Consolidation: Increased M&A activity in 2024 has led to fewer, larger banking institutions, intensifying rivalry among these scaled-up competitors.

- Formidable Competitors: Acquisitions create larger entities with greater resources and broader service offerings, posing a significant challenge to existing players like Fifth Third Bank.

Competitive rivalry for Fifth Third Bank is intense, driven by a mix of large national banks, regional players, and agile fintech companies. The commoditization of core banking products means competition often centers on price, such as interest rates on deposits and loans, and service fees. For example, in Q1 2024, net interest margins were squeezed for many banks due to rising deposit costs, highlighting this pricing pressure.

Fifth Third Bank must differentiate itself through superior customer experience, technological innovation, and specialized offerings to stand out in this crowded market. The ongoing trend of market consolidation, with significant M&A activity in 2024, further intensifies this rivalry by creating larger, more resourced competitors.

| Competitor Type | Key Characteristics | Impact on Fifth Third Bank |

|---|---|---|

| Major National Banks (e.g., JPMorgan Chase, Bank of America) | Larger asset bases ($3.9T+ and $3.2T+ respectively in Q1 2024), wider geographic reach, broader product offerings, strong brand recognition. | Significant resource advantage, greater customer acquisition and retention capabilities, potential for more competitive pricing. |

| Regional Banks | Established local presence, compete aggressively on pricing (e.g., competitive deposit/loan rates in 2024), community engagement. | Direct competition for market share in key geographic areas, pressure on pricing strategies. |

| Fintech Startups & Neobanks | Digital-first approach, innovative tools, lower overhead, competitive rates/fees, attract younger demographics. | Erode traditional revenue streams, challenge established institutions with agile digital solutions and user-friendly interfaces. |

SSubstitutes Threaten

Digital payment platforms and wallets, such as PayPal, Apple Pay, and Venmo, present a significant threat of substitution for traditional banking services. These platforms enable consumers to bypass traditional bank accounts for many transactions, thereby diminishing the necessity of relying on banks for payment processing. In 2023, the global digital payments market was valued at over $9 trillion, highlighting the substantial shift away from traditional methods.

Online lending platforms and peer-to-peer (P2P) lending represent a significant threat of substitutes for Fifth Third Bank. These alternatives offer faster loan approvals and often more flexible terms, directly competing with traditional bank offerings. For instance, in 2024, the online lending market continued its robust growth, with fintech lenders capturing an increasing share of the small business and consumer loan market, providing a readily available alternative for borrowers seeking quick capital.

The proliferation of investment apps and robo-advisors significantly increases the threat of substitutes for Fifth Third Bank's wealth management services. These digital platforms offer remarkably low-cost, automated investment solutions, attracting a growing segment of the market, particularly younger, tech-savvy investors. For instance, by the end of 2023, the assets under management for robo-advisors in the US alone were projected to exceed $2 trillion, highlighting their substantial market penetration and competitive pressure.

Cryptocurrencies and Blockchain Technology

Cryptocurrencies and blockchain technology pose a developing threat to traditional financial institutions like Fifth Third Bank. These digital assets offer alternative methods for transactions and remittances, potentially bypassing established banking channels. The burgeoning decentralized finance (DeFi) sector, which saw significant growth in 2023 and early 2024, provides services like lending and borrowing without intermediaries, directly challenging bank revenue streams.

While not yet a mainstream substitute for core banking services for the majority of consumers, the long-term implications are considerable. For instance, the global remittance market, a significant area for many banks, is increasingly seeing interest from crypto-based solutions. By mid-2024, the total market capitalization of cryptocurrencies remained in the trillions, indicating a substantial alternative financial ecosystem.

- Growing Adoption: While volatile, crypto adoption continues to rise, with estimates suggesting over 420 million crypto users globally by early 2024.

- DeFi Innovation: Decentralized finance platforms offer alternative financial services, with total value locked (TVL) in DeFi protocols fluctuating but often in the hundreds of billions of dollars throughout 2023 and into 2024.

- Transaction Alternatives: Cryptocurrencies provide a parallel system for value transfer, potentially reducing reliance on traditional payment networks.

Non-Bank Financial Service Providers

Various non-bank entities, like insurance companies and credit card providers, offer specific financial products that can directly substitute for traditional banking services. This unbundling means customers can get a mortgage from a specialized broker and manage payments through a credit card company, bypassing a bank's bundled offerings. For instance, in 2024, the U.S. mortgage market saw a significant portion of originations handled by non-bank lenders, highlighting their competitive presence.

The increasing specialization of these non-bank financial service providers intensifies the threat of substitutes for traditional banks. They can often operate with lower overheads and regulatory burdens, allowing them to offer more competitive rates or tailored products. This unbundling of financial services, where customers pick and choose specific products from different providers, directly challenges the comprehensive service model of banks like Fifth Third.

- Specialized Lenders: Non-bank mortgage companies and online lenders provide alternative avenues for home financing, often with faster approvals.

- Fintech Innovations: Companies offering digital payment solutions, peer-to-peer lending, and investment platforms directly compete with bank services.

- Insurance Companies: Many insurance providers offer savings and investment products that can be seen as substitutes for bank deposits or investment accounts.

- Credit Card Companies: These entities provide a significant portion of consumer credit, directly competing with bank credit products and payment processing.

The threat of substitutes for Fifth Third Bank is substantial, driven by a surge in digital alternatives and specialized financial providers. These substitutes offer convenience, speed, and often lower costs, directly challenging traditional banking models. By mid-2024, the digital payment market continued its rapid expansion, with global transaction volumes consistently exceeding previous years.

Fintech innovations, from P2P lending to robo-advisors, are increasingly capturing market share, especially among younger demographics. For instance, by the close of 2023, assets managed by robo-advisors in the U.S. were estimated to be over $2 trillion, demonstrating a clear shift in investment preferences. Cryptocurrencies and DeFi platforms also present a growing, albeit volatile, alternative financial ecosystem.

| Substitute Category | Key Characteristics | Market Trend (2023-2024) | Impact on Banks |

|---|---|---|---|

| Digital Payment Platforms | Convenience, speed, bypass traditional accounts | Global market valued over $9 trillion in 2023; continued strong growth | Reduced transaction fees, customer disintermediation |

| Online Lending & P2P | Faster approvals, flexible terms | Robust growth in fintech lending market share | Loss of loan origination business, margin pressure |

| Investment Apps & Robo-advisors | Low-cost, automated solutions | U.S. robo-advisor AUM projected over $2 trillion by end of 2023 | Competition for wealth management clients, fee compression |

| Cryptocurrencies & DeFi | Alternative value transfer, decentralized services | DeFi TVL often in hundreds of billions; growing user adoption (420M+ users globally by early 2024) | Potential disruption of payment networks, new competitive landscape |

| Non-Bank Financial Providers | Specialized products (mortgages, credit) | Significant non-bank originations in U.S. mortgage market (2024) | Unbundling of services, loss of integrated customer relationships |

Entrants Threaten

The banking sector, including institutions like Fifth Third Bank, faces significant hurdles due to stringent regulatory and capital requirements. New entrants must navigate complex licensing procedures, maintain substantial capital reserves to absorb potential losses, and adhere to rigorous ongoing compliance mandates. For instance, in the United States, the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, along with subsequent regulatory updates, has amplified these barriers, demanding higher capital ratios and more robust risk management frameworks from all financial institutions.

Established financial institutions like Fifth Third Bank possess a significant advantage due to their long-standing brand recognition and the deep customer trust they've cultivated over years of operation. This trust is paramount in the financial sector, where customers entrust banks with their savings and financial futures. For instance, in 2024, Fifth Third Bank continued to leverage its trusted name, a factor that new entrants find incredibly challenging and expensive to replicate in a short timeframe.

Existing financial institutions like Fifth Third Bank benefit significantly from economies of scale. This means they can spread their operational, technological, and marketing costs over a larger customer base, leading to lower per-unit costs. For example, in 2024, major banks continue to invest billions in digital transformation and cybersecurity, a cost barrier that smaller, newer entities struggle to match.

Furthermore, strong network effects are at play. A wide-reaching branch network and extensive ATM access, as maintained by established banks, create a valuable ecosystem for customers. In 2024, the convenience of a broad physical and digital presence remains a key differentiator, making it difficult for new entrants without comparable infrastructure to attract and retain customers.

Fintech Startups and Niche Disruptors

Fintech startups are a significant threat, even with traditional banking's high entry barriers. They cleverly target underserved or less regulated niches, leveraging technology to offer innovative and customer-friendly solutions. For instance, companies specializing in peer-to-peer lending or digital payment gateways can rapidly gain traction without the extensive infrastructure of established banks.

These agile disruptors often focus on a single, high-demand service, allowing them to build a strong user base and capture market share incrementally. This focused approach enables them to be more responsive to evolving customer needs than larger, more bureaucratic institutions.

Consider the payments sector: in 2024, global digital payment transaction volume was projected to exceed $11 trillion, a substantial market ripe for specialized fintech innovation. This demonstrates the potential for new entrants to chip away at incumbents' market share by excelling in specific areas.

- Niche Focus: Fintechs often excel by concentrating on specific services like remittances or buy-now-pay-later (BNPL).

- Technological Edge: Advanced algorithms and user-friendly interfaces attract customers seeking seamless digital experiences.

- Regulatory Arbitrage: Operating in less regulated spaces allows for faster product development and deployment.

- Customer Acquisition: Innovative marketing and partnership strategies enable rapid user growth, as seen with neobanks acquiring millions of customers in just a few years.

Technology Giants (Big Tech)

Technology giants like Apple, Google, and Amazon present a significant long-term threat to traditional banks like Fifth Third Bank. These companies possess vast capital reserves, with Apple alone holding over $160 billion in cash and marketable securities as of early 2024. Their enormous, engaged customer bases, numbering in the billions globally, provide a ready platform for introducing financial services. Furthermore, their advanced technological capabilities, particularly in data analytics and user experience design, allow them to innovate rapidly and offer seamless digital financial solutions.

While these tech behemoths may not aim to become full-service banks in the traditional sense, they can strategically leverage their existing ecosystems to offer a range of financial products. This could include payment services, lending, investment platforms, and even insurance, directly competing with core banking functions. For instance, Apple Pay has seen widespread adoption, and Google Pay continues to expand its reach, demonstrating the potential for tech companies to capture market share in financial services. The threat lies in their ability to integrate these offerings seamlessly into their existing popular platforms, making them a convenient and attractive alternative for consumers.

- Immense Capital: Companies like Alphabet (Google) reported over $100 billion in cash and cash equivalents in Q1 2024.

- Vast Customer Bases: Apple reported over 2 billion active devices in early 2024.

- Technological Capabilities: Big Tech firms invest billions annually in R&D, driving innovation in AI and data management.

- Ecosystem Integration: Potential to embed financial services within widely used platforms like smartphones and online marketplaces.

The threat of new entrants into the banking sector, while generally considered moderate due to high barriers, is significantly amplified by agile fintech firms and tech giants. These new players often bypass traditional banking infrastructure, focusing on specific, high-demand services. Their ability to innovate rapidly and leverage technology allows them to attract customers and capture market share, even against established institutions like Fifth Third Bank.

Fintech companies, in particular, have been adept at identifying and serving niche markets with specialized digital solutions. For example, in 2024, the buy-now-pay-later (BNPL) market continued its rapid expansion, with transaction volumes reaching hundreds of billions of dollars globally, demonstrating the success of focused new entrants.

The immense capital and vast customer bases of technology behemoths like Apple and Google pose a more significant, long-term threat. With substantial cash reserves, such as Apple's over $160 billion in early 2024, and billions of active users, these companies can easily integrate financial services into their existing ecosystems. This seamless integration, combined with advanced user experience, presents a formidable challenge to traditional banks.

| New Entrant Type | Key Advantages | Example in 2024 |

|---|---|---|

| Fintech Startups | Niche focus, technological edge, regulatory arbitrage | Rapid growth in digital payments and BNPL services |

| Big Tech Companies | Immense capital, vast customer bases, ecosystem integration | Expansion of payment platforms (e.g., Apple Pay, Google Pay) and potential for lending |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Fifth Third Bank leverages data from their annual reports, investor presentations, and SEC filings. We also incorporate industry-specific data from financial news outlets and market research firms to understand competitive dynamics.