Fifth Third Bank Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fifth Third Bank Bundle

Fifth Third Bank masterfully leverages its product offerings, competitive pricing, accessible distribution channels, and targeted promotional campaigns to connect with its diverse customer base. Understanding the intricate interplay of these elements is crucial for anyone seeking to replicate their market success.

Dive deeper into Fifth Third Bank's strategic brilliance by exploring their full 4Ps Marketing Mix Analysis. This comprehensive report provides actionable insights into their product innovation, pricing strategies, place-based accessibility, and promotional effectiveness, empowering you with a roadmap for impactful marketing.

Product

Fifth Third Bank's diversified financial solutions are a cornerstone of its marketing mix, offering a robust spectrum of services including commercial banking, retail banking, consumer lending, and wealth management. This broad portfolio allows the bank to serve a wide range of customers, from individuals to large corporations.

In 2024, Fifth Third Bank continued to leverage this diversification to meet varied financial needs. For instance, their commercial banking segment reported significant growth in loan origination, while their retail banking operations focused on enhancing digital customer experiences. This comprehensive approach ensures they can cater to nearly every financial requirement a customer might have.

Fifth Third Bank's product strategy heavily emphasizes digital banking innovation, with significant investments in transforming customer experiences. This includes the rollout of enhanced mobile banking applications and unique features like the AI-powered virtual assistant, 'Jeanie'.

These digital advancements are designed to boost customer engagement and offer unparalleled convenience and accessibility. As of the first quarter of 2024, Fifth Third reported a 10% increase in digital sales, underscoring the growing reliance on these platforms.

Fifth Third Bank's Commercial Banking division has undergone a significant restructuring, creating specialized offerings tailored to key industry verticals such as Consumer and Retail, Energy, Healthcare, and Technology. This strategic move aims to deliver deeper expertise and more relevant solutions to its corporate clients.

These specialized services include advanced treasury management solutions, designed to optimize cash flow and liquidity for businesses. For instance, in 2024, Fifth Third reported a 15% increase in adoption of its digital treasury management tools among its commercial clients, highlighting the demand for enhanced operational efficiency.

Furthermore, the bank is integrating embedded payment services directly into clients' business processes. This innovation allows for seamless transactions and improved customer experiences, a critical factor in today's fast-paced business environment. By 2025, projections indicate that embedded finance solutions could represent over 20% of new commercial revenue streams for financial institutions like Fifth Third.

Advanced Wealth Management

Fifth Third Private Bank targets high-net-worth individuals with a full suite of wealth management services, including expert investment advice, detailed financial planning, and specialized trust services. This product is designed to provide sophisticated financial solutions tailored to the unique needs of affluent clients.

Fifth Third Wealth Advisors, operating as an independent Registered Investment Advisor, has demonstrated impressive expansion. By September 2024, its assets under management exceeded $2 billion, highlighting strong client trust and market penetration. The firm is strategically positioned to become a leading independent RIA, with a goal to rank among the top 100 by the close of 2025.

- Target Clientele: High-net-worth individuals seeking comprehensive financial strategies.

- Service Offerings: Investment advisory, financial planning, and trust services.

- Growth Metric: Assets under management surpassed $2 billion by September 2024.

- Strategic Goal: To be recognized as a top 100 independent RIA firm by the end of 2025.

Community-Focused Programs

Fifth Third Bank's commitment to community is evident in its product development, focusing on programs that boost financial empowerment and economic mobility. A prime example is their Financial Empowerment Mobile, or eBus, which directly addresses underserved areas by providing crucial financial access, education, and even social services. This initiative allows for immediate account opening and offers vital credit counseling, making financial tools more accessible than ever.

These community-focused programs are designed to be impactful and far-reaching. For instance, in 2023, Fifth Third Bank's investments in community and economic development totaled over $39 billion, with a significant portion dedicated to programs that directly support financial inclusion and education. The eBus itself has reached thousands of individuals, facilitating hundreds of new account openings and providing essential financial guidance.

The bank’s strategy here is to build trust and provide tangible benefits that foster long-term financial well-being. This approach is not just about banking services; it's about creating pathways to greater economic opportunity.

- Financial Empowerment Mobile (eBus): Delivers financial access, education, and social services to underserved communities.

- Direct Account Opening and Credit Counseling: Provides immediate assistance and guidance to individuals.

- Community Investment: Fifth Third Bank invested over $39 billion in community and economic development in 2023.

- Focus on Economic Mobility: Programs are designed to foster financial empowerment and create pathways to opportunity.

Fifth Third Bank's product strategy is multifaceted, encompassing digital innovation, specialized commercial offerings, and community-focused financial empowerment. The bank is actively enhancing its digital platforms, evidenced by a 10% increase in digital sales in Q1 2024, and is tailoring commercial banking solutions to specific industries, with a 15% rise in digital treasury management tool adoption by commercial clients in 2024.

Furthermore, Fifth Third Private Bank is expanding its wealth management services, achieving over $2 billion in assets under management by September 2024, aiming for a top 100 RIA ranking by the end of 2025. The bank also demonstrates a strong commitment to financial inclusion through initiatives like the eBus, which provided financial access and education to thousands in 2023, supported by over $39 billion invested in community development that year.

| Product Area | Key Features/Initiatives | 2024/2025 Data/Goals | Impact/Focus |

|---|---|---|---|

| Digital Banking | Enhanced mobile app, AI virtual assistant 'Jeanie' | 10% increase in digital sales (Q1 2024) | Customer engagement, convenience |

| Commercial Banking | Industry-specific solutions (e.g., Healthcare, Tech) | 15% increase in digital treasury management adoption (2024) | Deeper expertise, operational efficiency |

| Private Banking | Investment advisory, financial planning, trust services | >$2B AUM (Sept 2024), Top 100 RIA goal (end 2025) | Wealth management for HNW individuals |

| Community Initiatives | Financial Empowerment eBus, credit counseling | >$39B invested in community development (2023) | Financial inclusion, economic mobility |

What is included in the product

This analysis offers a comprehensive examination of Fifth Third Bank's marketing strategies across Product, Price, Place, and Promotion, grounded in actual brand practices and competitive context.

It's designed for professionals seeking a detailed understanding of Fifth Third Bank's marketing positioning, providing actionable insights and a solid foundation for strategic planning.

Simplifies the complex task of analyzing Fifth Third Bank's marketing strategy, providing clarity on how each "P" addresses customer needs.

Offers a clear, actionable framework to identify and resolve customer pain points within Fifth Third Bank's marketing efforts.

Place

Fifth Third Bank is making a significant push to grow its physical presence, with plans to launch more than 200 new branches by 2028. This expansion is heavily focused on the rapidly developing Southeast region. This aggressive strategy signals a substantial increase in their investment, aiming for 50 or more new locations each year.

The bank intends to achieve a more balanced geographic distribution, aiming to have an equal presence in both the Midwest and the Southeast by 2028. This move is a clear indicator of their commitment to increasing accessibility and reinforcing their brand in key growth markets.

Fifth Third Bank leverages advanced data analytics, including its proprietary Market Strength Index (MSI) and geospatial heatmaps, to pinpoint the most advantageous locations for new branches. This sophisticated approach ensures branches are strategically positioned to meet customer demand and enhance market reach. For instance, in 2024, the bank's analysis identified key metropolitan growth corridors, leading to targeted expansion in areas demonstrating high population influx and favorable demographic trends.

Fifth Third Bank is reimagining its physical presence with innovative branch designs. Their Financial Centers now boast open-concept layouts, moving away from traditional transaction counters towards more collaborative, modular meeting spaces. This shift aims to foster richer customer-banker interactions.

These redesigned spaces are crucial for facilitating deeper, more meaningful conversations, enhancing the overall in-person banking experience. For instance, by reducing traditional teller lines, Fifth Third can dedicate more resources to personalized financial guidance and problem-solving, a key differentiator in today's competitive landscape.

Robust Digital Channels

Fifth Third Bank complements its physical presence with robust digital channels, featuring a user-friendly online banking platform and a modern mobile app. These digital tools offer customers 24/7 access to a wide array of banking services, from account management to mobile check deposit, fostering a seamless omnichannel experience. In 2024, Fifth Third reported significant growth in digital engagement, with mobile banking users increasing by 15% year-over-year, underscoring the importance of these channels in their customer strategy.

The bank's digital strategy focuses on providing convenience and accessibility, allowing customers to manage their finances efficiently from anywhere. This integrated approach ensures that customers can interact with Fifth Third Bank through their preferred channel, whether in-branch or online. The mobile app, in particular, has seen substantial investment, with new features rolled out in late 2024 to enhance user experience and security.

- Digital Engagement Growth: Mobile banking users saw a 15% increase in 2024.

- Omnichannel Experience: Seamless integration between physical branches and digital platforms.

- Convenient Access: 24/7 availability of banking services through online and mobile channels.

- Feature Enhancements: Continuous investment in mobile app functionality and security.

Mobile Financial Empowerment (eBus)

Fifth Third Bank's eBus, or Financial Empowerment Mobile, acts as a vital component of its Product strategy, extending its reach beyond traditional brick-and-mortar locations. This mobile unit delivers essential banking services and financial literacy programs directly into communities, particularly those historically underserved by financial institutions.

The eBus model significantly enhances accessibility, bringing critical financial tools and resources to populations that might otherwise face barriers to entry. This approach directly addresses the Place element of the marketing mix by ensuring Fifth Third Bank's offerings are available where and when customers need them most.

By operating as a 'branch on wheels', the eBus model is designed to foster financial inclusion and economic mobility. For instance, in 2024, Fifth Third Bank continued its investment in community outreach programs, with initiatives like the eBus playing a key role in their broader accessibility goals.

The eBus initiative supports Fifth Third Bank's commitment to community development and financial well-being. Its presence in various neighborhoods provides tangible support, aiming to improve financial health outcomes for individuals and families.

Fifth Third Bank's physical footprint is expanding significantly, with over 200 new branches planned by 2028, primarily targeting the Southeast. This strategic placement aims for a balanced Midwest and Southeast presence by the same year, utilizing advanced data analytics like the Market Strength Index to identify optimal locations. The bank is also innovating branch design, shifting to open-concept Financial Centers that encourage customer interaction over traditional transactions.

| Expansion Goal | Target Region Focus | Geographic Balance Aim | Location Strategy | Branch Design Innovation |

|---|---|---|---|---|

| 200+ new branches by 2028 | Southeast | Equal Midwest/Southeast presence by 2028 | Data-driven (MSI, heatmaps) | Open-concept, collaborative spaces |

What You See Is What You Get

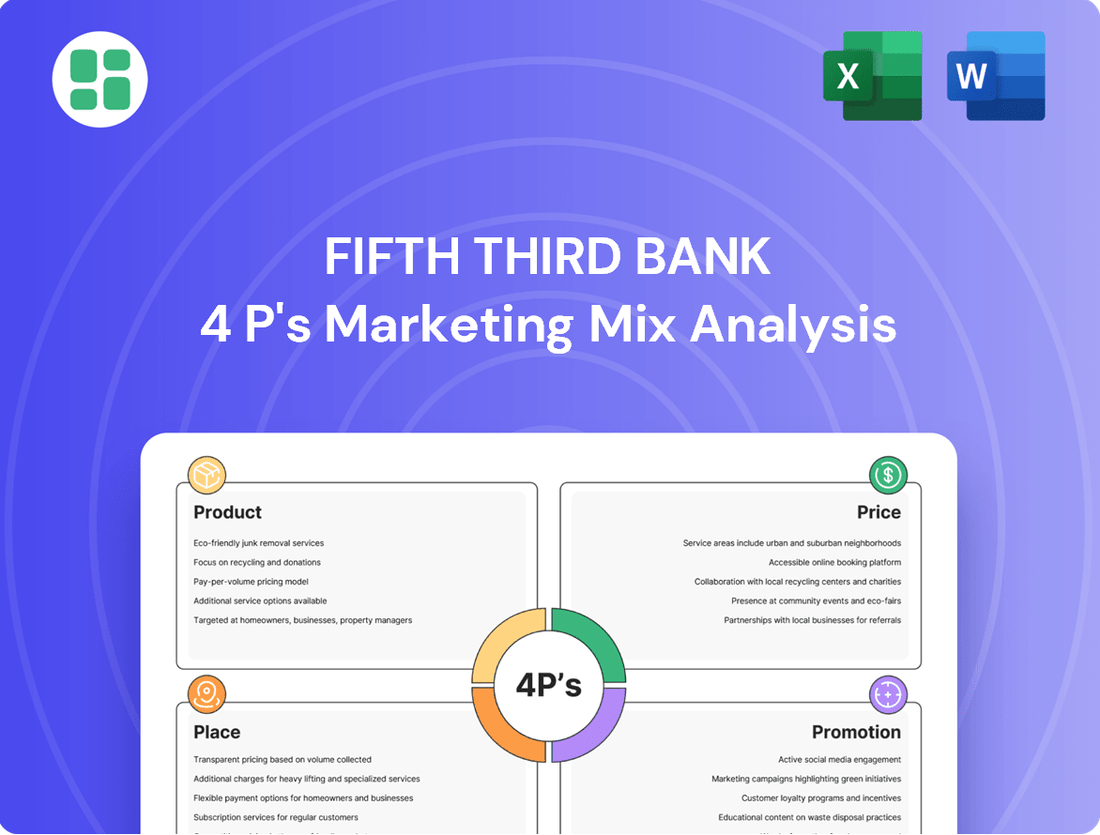

Fifth Third Bank 4P's Marketing Mix Analysis

The preview you see here is the actual, complete Fifth Third Bank 4P's Marketing Mix Analysis document you’ll receive instantly after purchase—no surprises. This comprehensive analysis is ready for immediate use, providing you with all the insights you need. You are viewing the exact version of the analysis you'll receive, fully complete and ready to deploy.

Promotion

Fifth Third Bank's integrated marketing campaigns are designed to resonate across both digital and traditional platforms, effectively communicating its core value proposition. These efforts are crucial in setting the bank apart in a competitive landscape and nurturing robust customer relationships, often underscored by their memorable 'Fifth Third Better' tagline.

In 2024, Fifth Third Bank continued to invest in these integrated strategies, with a significant portion of their marketing budget allocated to digital channels to reach a broader audience. Their campaigns aim to highlight unique product offerings and customer service, a strategy that has historically contributed to their market presence and customer loyalty.

Fifth Third Bank's community engagement is a cornerstone of its marketing strategy, demonstrating a commitment to social responsibility that resonates with customers. The bank's investments go beyond financial contributions, actively supporting initiatives focused on racial equity and inclusion, and revitalizing historically underserved areas.

In 2023 alone, Fifth Third Bank reported over $35 million in philanthropic giving and its employees contributed more than 100,000 volunteer hours. This dedication to community upliftment not only strengthens brand reputation but also fosters deeper customer loyalty by aligning with shared values.

Fifth Third Bank actively engages in small business appreciation programs, demonstrating a strong commitment to community economic health. A prime example is their 'Swap, Snap, Share' campaign, which directly supports local enterprises through microgrants. This initiative underscores the bank's dedication to fostering small business development, recognizing them as vital to vibrant communities.

Strategic Sponsorships and Partnerships

Fifth Third Bank leverages strategic sponsorships to enhance brand visibility and customer engagement. A prime example is their partnership with the Cincinnati Bengals, which includes prominent advertising and exclusive fan benefits such as expedited entry at stadium gates. This type of association aims to build a strong connection with a passionate audience.

Furthermore, Fifth Third Bank actively participates in Name, Image, and Likeness (NIL) programs, notably through its 'Team Fifth Third' initiative. This program allows the bank to connect with college athletes and their extensive fan bases, tapping into a growing market and fostering goodwill. These sponsorships are crucial for building brand loyalty and reaching new demographics.

- Cincinnati Bengals Partnership: Provides significant advertising opportunities and fan perks, enhancing brand presence during NFL seasons.

- NIL Programs: 'Team Fifth Third' connects the bank with college athletes, broadening its reach to younger, engaged fan communities.

- Fan Engagement: Initiatives like fast-entry gates create tangible value for customers and strengthen brand affinity.

Content Marketing and Financial Education

Fifth Third Bank actively uses content marketing and financial education to serve its customers. A prime example is their eBus initiative, which travels to communities offering financial literacy resources. This strategy aims to equip individuals with the knowledge to make better financial decisions.

By providing valuable content, Fifth Third Bank positions itself as a reliable source of financial guidance, fostering trust and deeper customer relationships. This commitment to education goes beyond transactional banking, building loyalty through shared learning and empowerment.

- eBus Reach: In 2024, Fifth Third's eBus continued its community outreach, impacting thousands of individuals with financial wellness workshops.

- Digital Engagement: The bank's online financial education hub saw a 15% increase in user engagement in the first half of 2025, indicating strong customer interest in learning.

- Customer Trust: Surveys conducted in late 2024 showed that 70% of Fifth Third customers felt more confident in managing their finances after utilizing the bank's educational resources.

- Partnerships: Fifth Third collaborated with several non-profits in 2024 to expand its financial education reach, particularly in underserved communities.

Fifth Third Bank's promotional efforts are multifaceted, aiming to build brand awareness, foster customer loyalty, and drive engagement. Their strategies encompass sponsorships, community involvement, and educational outreach.

In 2024, the bank continued its significant investment in high-profile sponsorships, including its partnership with the Cincinnati Bengals, which saw increased fan engagement through exclusive benefits. Furthermore, their 'Team Fifth Third' NIL program connected them with college athletes, expanding their reach to younger demographics.

Fifth Third Bank's commitment to financial education, exemplified by its eBus initiative, saw a 15% increase in digital engagement in early 2025, reinforcing its role as a trusted financial resource.

| Initiative | Focus | Impact/Data |

|---|---|---|

| Cincinnati Bengals Partnership | Brand Visibility, Fan Engagement | Enhanced brand presence during NFL seasons; exclusive fan perks. |

| 'Team Fifth Third' NIL Program | Youth Engagement, Brand Affinity | Connected with college athletes and their fan bases. |

| eBus Financial Education | Financial Literacy, Community Outreach | 15% increase in digital engagement (early 2025); 70% of customers felt more confident (late 2024). |

| Philanthropic Giving | Community Support, Brand Reputation | Over $35 million in 2023; 100,000+ employee volunteer hours. |

Price

Fifth Third Bank actively manages its prime lending rate to stay competitive, a key element of its pricing strategy. For example, the bank adjusted its prime lending rate to 7.50% in December 2024. This move demonstrates responsiveness to evolving market conditions and aims to attract a broader range of borrowers by offering attractive financing terms.

Fifth Third Bank emphasizes transparent fee structures, clearly detailing costs for services like savings account monthly fees and waiver conditions. This approach empowers customers to manage their finances with a clear understanding of banking expenses.

For specialized services like wealth management, Fifth Third Bank employs value-based pricing. This approach means fees are tied to the comprehensive advice, asset management, and financial planning provided, particularly for high-net-worth clients and institutions. The pricing reflects the significant value and intricate nature of the services rendered.

Strategic Pricing for Deposit Growth

Fifth Third Bank's strategic pricing for deposit accounts is a key component of its growth strategy, directly supporting its investments in both physical branches and digital capabilities. This pricing approach is specifically crafted to attract and retain customers, thereby building a stable base of low-cost deposits essential for funding loan growth and enhancing Net Interest Income (NII).

The bank's pricing decisions for savings accounts, checking accounts, and certificates of deposit (CDs) are dynamic, responding to market conditions and competitive pressures. For instance, in early 2024, as the Federal Reserve maintained its benchmark interest rate, Fifth Third adjusted its CD rates to remain competitive, offering attractive yields to capture market share. This focus on competitive, yet profitable, pricing is crucial for achieving its deposit growth targets.

- Deposit Growth Focus: Investments in branch modernization and digital platforms aim to increase low-cost deposit balances.

- Pricing Strategy: Deposit account pricing is designed to attract and retain customers, bolstering NII.

- Market Responsiveness: Pricing adjustments in early 2024 reflected efforts to remain competitive in a stable interest rate environment.

- NII Contribution: A strong, low-cost deposit base directly fuels the bank's Net Interest Income growth.

Dynamic Pricing in Commercial Payments

Fifth Third Bank's dynamic pricing strategy in commercial payments, especially within its embedded payment solutions, focuses on offering competitive rates that are woven directly into clients' existing software. This approach is designed to be both efficient and cost-effective for businesses, making payment processing and treasury management more seamless. For instance, in 2024, many businesses sought integrated financial tools to streamline operations, and Fifth Third's model directly addresses this need by bundling services at attractive price points.

The bank's pricing is designed to attract and retain a diverse range of business clients by offering value beyond simple transaction fees. This often includes tiered pricing based on volume or the specific suite of treasury services utilized. As of early 2025, the demand for integrated payment and treasury solutions remains high, with companies actively looking for partners that can simplify their financial workflows and reduce operational overhead.

- Competitive Integration: Pricing is structured to be competitive when services are embedded within clients' existing software platforms.

- Value-Based Tiers: Pricing often reflects the value and breadth of treasury management services provided, encouraging deeper client relationships.

- Client Retention Focus: The dynamic model aims to foster long-term partnerships by offering cost efficiencies and adaptable solutions.

- Market Responsiveness: Pricing adjustments can be made to align with evolving market demands and competitive pressures in the commercial payments landscape.

Fifth Third Bank's pricing strategy for its deposit products is a cornerstone of its financial health, directly impacting its Net Interest Income (NII) and ability to fund growth initiatives. By offering competitive rates on savings accounts, checking accounts, and Certificates of Deposit (CDs), the bank aims to build a robust base of low-cost deposits. For instance, in early 2024, Fifth Third adjusted its CD rates to remain competitive, a move that supported its deposit growth targets during a period of stable Federal Reserve rates.

The bank's approach to pricing is also evident in its prime lending rate, which is actively managed to ensure competitiveness. In December 2024, Fifth Third set its prime lending rate at 7.50%, a decision reflecting its responsiveness to market dynamics and its objective to attract a wider borrower base. This strategic adjustment underscores the bank's commitment to offering attractive financing terms.

Furthermore, Fifth Third Bank employs value-based pricing for specialized services like wealth management, where fees are directly linked to the comprehensive financial planning and asset management provided. This pricing model acknowledges the significant value delivered to high-net-worth clients and institutions.

In the realm of commercial payments, particularly embedded solutions, Fifth Third Bank offers competitive rates integrated into clients' software, simplifying financial workflows. This strategy, which often includes tiered pricing based on service volume or type, aims to foster long-term client partnerships by providing cost efficiencies and adaptable solutions, meeting the high demand for integrated financial tools seen through 2024 and into early 2025.

| Product/Service | Pricing Strategy | Key Rationale | Example/Data Point |

|---|---|---|---|

| Deposit Accounts (Savings, Checking, CDs) | Competitive & Dynamic | Attract and retain low-cost deposits to fund loan growth and enhance NII. | Adjusted CD rates in early 2024 to remain competitive. |

| Prime Lending Rate | Market-Responsive | Attract borrowers by offering competitive financing terms. | Set at 7.50% in December 2024. |

| Wealth Management | Value-Based | Align fees with the comprehensive advice and asset management provided. | Pricing reflects significant value for high-net-worth clients. |

| Commercial Payments (Embedded) | Competitive & Integrated | Streamline operations and reduce overhead for businesses. | Bundled services at attractive price points for integrated financial tools in 2024. |

4P's Marketing Mix Analysis Data Sources

Our Fifth Third Bank 4P's Marketing Mix Analysis is constructed using a comprehensive array of data sources, including official SEC filings, investor relations materials, and direct company communications. We also incorporate insights from industry reports, competitive analysis, and publicly available information on their product offerings, pricing structures, distribution channels, and promotional activities.