Fifth Third Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fifth Third Bank Bundle

Unlock the strategic blueprint behind Fifth Third Bank's success with a comprehensive Business Model Canvas. This detailed analysis breaks down their customer segments, value propositions, and revenue streams, offering a clear view of how they operate and innovate in the financial sector. Discover the core components that drive their market position and gain actionable insights for your own business endeavors.

Partnerships

Fifth Third Bank actively partners with fintech firms to boost its digital services and introduce new products. For example, their Newline API platform facilitates embedded finance, letting businesses integrate payments, cards, and deposits. This strategic move in 2024 allows Fifth Third to expand its market presence and technical capabilities in the fast-moving digital finance sector.

Fifth Third Bank actively cultivates relationships with private credit providers, exemplified by its recent collaboration with Eldridge. This strategic alliance is designed to broaden the financing options available to its Commercial Bank clients, catering to the dynamic demands of the private credit landscape.

These partnerships are crucial for Fifth Third Bank as they allow the bank to tap into specialized expertise and capital from entities like Eldridge, which is a significant player in the alternative investment space. For instance, Eldridge manages over $80 billion in assets as of late 2023, showcasing the substantial capacity these partners bring.

By joining forces with private credit providers, Fifth Third Bank can offer more tailored and flexible financing solutions than traditional bank lending might allow. This approach leverages the complementary strengths of both parties, ultimately enhancing the value proposition for commercial customers seeking diverse funding avenues.

Fifth Third Bank actively collaborates with a diverse array of community development organizations, both public and private. These partnerships are fundamental to their mission of fostering economic mobility and revitalizing historically underserved areas. For instance, their Neighborhood Program leverages these relationships to tackle critical needs in affordable housing, small business expansion, and financial literacy.

Payment Network Providers

Fifth Third Bank's relationships with major payment network providers like Visa and Mastercard are absolutely critical. These partnerships are the backbone that allows the bank to process card transactions smoothly for both individuals and businesses. Without them, Fifth Third's debit and credit cards wouldn't be widely accepted, hindering their core payment services.

These collaborations ensure that Fifth Third's card products function reliably wherever consumers shop. It's through these networks that the bank can offer a robust suite of payment solutions, from everyday purchases to more complex business transactions. For instance, in 2024, Visa and Mastercard continued to see significant transaction volume growth, underscoring the importance of these networks to financial institutions like Fifth Third.

- Visa and Mastercard: Essential for enabling card acceptance and transaction processing.

- Seamless Processing: Facilitates smooth payment flows for all customers.

- Widespread Acceptance: Guarantees the functionality of Fifth Third's card products.

- Comprehensive Solutions: Underpins the bank's ability to offer diverse payment services.

Technology and Cloud Service Providers

Fifth Third Bank actively collaborates with major technology and cloud service providers, including giants like Amazon Web Services (AWS). These partnerships are fundamental to constructing a digital banking infrastructure that is not only scalable and secure but also highly resilient to disruptions.

These strategic alliances are crucial for Fifth Third Bank's ongoing initiatives to modernize its core platforms, bolster its cybersecurity defenses against evolving threats, and foster continuous innovation across its digital service offerings. For instance, in 2024, banks across the industry continued to heavily invest in cloud migration, with many reporting significant portions of their workloads already in the cloud to enhance agility and reduce operational costs.

- AWS Partnership: Facilitates access to advanced cloud computing services for data analytics, AI/ML, and scalable application hosting.

- Cybersecurity Enhancements: Leverages cloud provider security expertise and tools to protect customer data and banking systems.

- Digital Transformation: Enables the rapid deployment of new digital features and services, improving customer experience and operational efficiency.

- Resilience and Scalability: Ensures the banking infrastructure can handle fluctuating demand and maintain high availability.

Fifth Third Bank's key partnerships extend to core financial infrastructure providers like Visa and Mastercard, ensuring seamless card transaction processing and widespread acceptance for its customers. These relationships are vital for offering robust payment solutions, from everyday purchases to complex business needs, with continued transaction volume growth observed in 2024 underscoring their importance.

Collaborations with fintech firms, such as through its Newline API platform, allow Fifth Third to embed financial services and expand its digital reach. Furthermore, strategic alliances with private credit providers like Eldridge, which manages over $80 billion in assets as of late 2023, enable the bank to offer more flexible financing options to commercial clients.

Partnerships with community development organizations are also central, supporting initiatives like the Neighborhood Program to address affordable housing and small business growth in underserved areas. Additionally, alliances with cloud providers like AWS are critical for modernizing infrastructure, enhancing cybersecurity, and driving digital innovation.

| Partner Type | Example Partner | Strategic Importance | 2024 Relevance |

|---|---|---|---|

| Payment Networks | Visa, Mastercard | Transaction processing, widespread acceptance | Continued transaction volume growth |

| Fintech Firms | Newline API | Embedded finance, digital service expansion | Facilitates new product integration |

| Private Credit Providers | Eldridge | Expanded financing options for commercial clients | Complements traditional lending |

| Community Development | Various non-profits | Economic mobility, underserved areas | Supports Neighborhood Program goals |

| Cloud Services | AWS | Infrastructure modernization, cybersecurity, innovation | Industry-wide investment in cloud migration |

What is included in the product

A detailed breakdown of Fifth Third Bank's operations, outlining its diverse customer segments, multi-channel delivery, and core value propositions.

This model provides a strategic overview of Fifth Third Bank's revenue streams, cost structure, key resources, and activities, reflecting its established market position.

Fifth Third Bank's Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their core components, simplifying complex financial strategies.

This tool efficiently addresses the pain of information overload by condensing Fifth Third Bank's strategy into a digestible format for quick review and understanding.

Activities

Fifth Third Bank's core operations revolve around lending and credit origination. This crucial activity involves managing a wide array of loans, from commercial and consumer credit to mortgages and auto loans. The bank handles every step, from the initial application and thorough underwriting to the final disbursement and continuous servicing of these loans.

The bank's financial success is significantly bolstered by robust loan growth. In 2023, Fifth Third Bank reported a substantial increase in its loan portfolio, with commercial loans growing by 5% and consumer loans seeing a 7% rise. This consistent expansion in lending is a primary engine for its revenue and profitability.

Fifth Third Bank's key activity involves diligently attracting and managing a diverse range of deposits from individuals, small businesses, and larger corporations. These deposits are the bedrock of the bank's operations, providing the essential funding for its extensive lending portfolio.

The bank offers a variety of deposit products, including traditional checking and savings accounts, as well as more sophisticated money market and certificate of deposit options, catering to different customer needs and financial goals.

In 2024, Fifth Third reported total deposits of approximately $175 billion, highlighting the significant scale of this crucial funding source and its direct impact on the bank's ability to generate net interest income and maintain a robust balance sheet.

Fifth Third Bank's wealth management and advisory services are a cornerstone of its business model, focusing on providing high-net-worth individuals, families, and institutions with comprehensive financial solutions. This includes personalized financial planning, expert investment advisory, and robust trust services designed to preserve and grow wealth across generations.

These specialized services are crucial for client retention and attracting affluent customers. For instance, Fifth Third Wealth Advisors reported significant growth in assets under management, reaching over $50 billion by the end of 2023, demonstrating increasing client confidence and a strong market demand for sophisticated wealth management strategies.

Digital Banking and Technology Development

Fifth Third Bank's key activities heavily involve the continuous development, maintenance, and enhancement of its digital banking platforms. This includes their online and mobile applications, which are central to customer interaction and service delivery. The bank is actively investing in technology modernization to ensure these platforms remain robust and user-friendly.

A significant part of this effort is focused on improving the user experience and integrating cutting-edge features. For instance, the bank is looking at advancements like AI-enhanced virtual assistants to provide more personalized and efficient customer support. Security tools are also a priority, ensuring customer data and transactions are protected in an increasingly digital landscape.

This dedication to digital innovation is driven by the need to meet evolving customer expectations for seamless, on-demand banking services. By prioritizing digital development, Fifth Third Bank aims to enhance operational efficiency and maintain a competitive edge in the financial sector. In 2023, Fifth Third Bank reported a significant increase in digital engagement, with mobile banking users growing by 10% year-over-year, highlighting the success of these ongoing initiatives.

- Digital Platform Enhancement: Ongoing investment in upgrading online and mobile banking interfaces for improved usability and functionality.

- Technology Modernization: Implementing new technologies, including AI for virtual assistants, to streamline customer interactions and internal processes.

- User Experience Focus: Prioritizing intuitive design and feature integration to meet and exceed customer expectations for digital banking.

- Security Integration: Continuously updating and implementing advanced security measures to safeguard customer information and financial transactions.

Risk Management and Compliance

Fifth Third Bank's key activities heavily revolve around robust risk management and strict compliance. This includes diligently overseeing credit risk to minimize potential losses, managing operational risks that could disrupt services, and implementing strong cybersecurity measures to protect sensitive customer data. Adherence to all banking regulations is paramount, ensuring the bank operates legally and ethically.

To achieve this, the bank employs comprehensive internal controls and invests significantly in data security. Ongoing compliance monitoring is a continuous process, adapting to evolving regulatory landscapes. For instance, in 2024, Fifth Third Bank continued to enhance its cybersecurity defenses in response to an increasingly sophisticated threat environment, a common focus for financial institutions.

- Credit Risk Management: Analyzing borrower creditworthiness and portfolio diversification.

- Operational Risk Mitigation: Implementing strong internal processes and controls to prevent errors and fraud.

- Cybersecurity: Protecting customer data and financial systems from digital threats.

- Regulatory Compliance: Ensuring adherence to all federal and state banking laws and regulations.

Fifth Third Bank's key activities include managing a diverse deposit base, which is essential for funding its lending operations. The bank offers various deposit products to attract and retain customers, ensuring a stable source of capital. In 2024, Fifth Third reported total deposits of approximately $175 billion, a testament to its strong customer relationships and broad market reach.

Delivered as Displayed

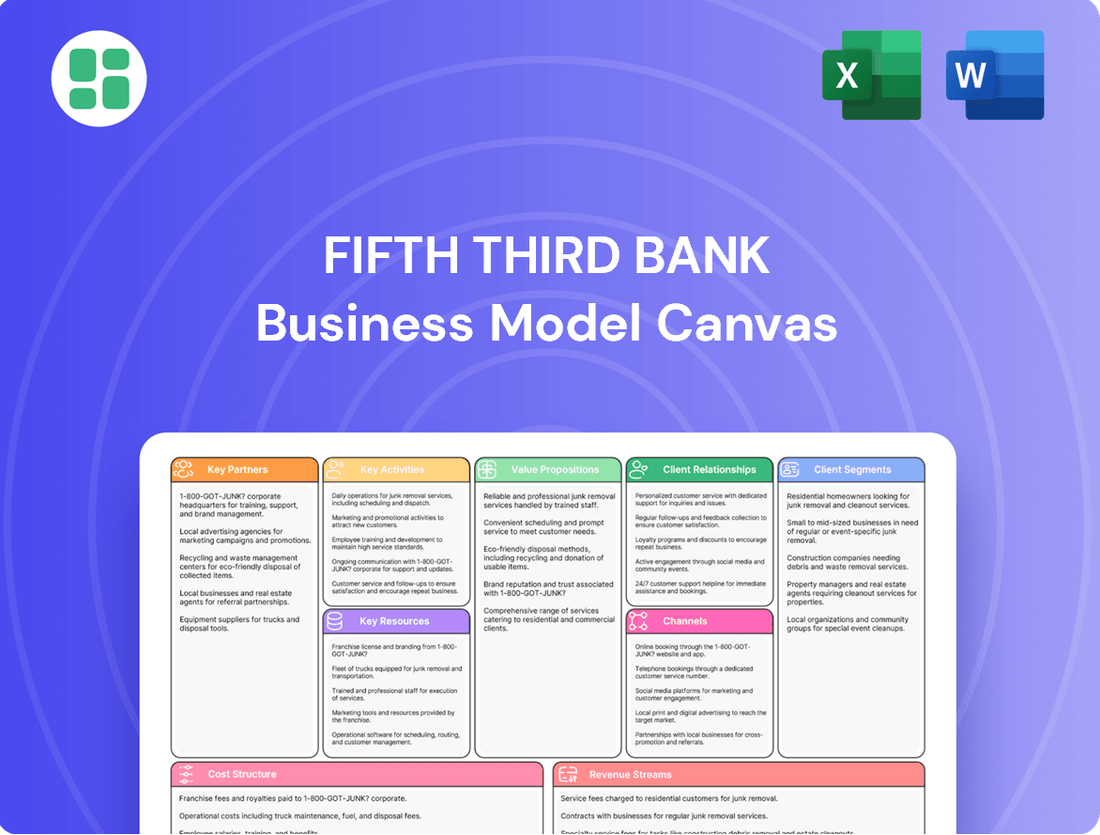

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the comprehensive analysis of Fifth Third Bank's strategic framework. Once your order is complete, you will gain full access to this same, professionally structured document, ready for your review and application.

Resources

Fifth Third Bank's financial capital is its bedrock, primarily sourced from robust customer deposits and a solid shareholder equity base. This financial muscle allows the bank to engage in essential activities like lending, investing, and maintaining crucial liquidity.

As of the first quarter of 2024, Fifth Third Bank reported total assets of approximately $224 billion, showcasing the sheer scale of its financial resources. This substantial capital base is fundamental to its stability and its capacity for future expansion and innovation in the financial services sector.

Fifth Third Bank's extensive branch and ATM network is a cornerstone of its business model, acting as a crucial physical touchpoint for customers. This network, strategically positioned across the Midwest and Southeast, not only facilitates everyday banking transactions but also drives deposit growth and enables vital in-person advisory services.

The bank's commitment to physical presence is evident in its ongoing expansion efforts, with a particular focus on high-growth markets in the Southeast. As of the first quarter of 2024, Fifth Third reported approximately 1,079 financial centers and 1,700 ATMs, underscoring the scale and reach of this key resource.

Fifth Third Bank leverages advanced technology infrastructure, including robust data centers and extensive cloud computing capabilities, as a cornerstone of its operations. These digital platforms are essential for delivering secure and scalable banking services to millions of customers.

The bank's proprietary digital platforms are meticulously designed to ensure efficient operations and powerful data analytics. In 2024, Fifth Third continued to invest heavily in these areas, recognizing their critical role in maintaining a competitive edge.

Ongoing, significant investments in technology are vital for Fifth Third Bank's strategy. These investments fuel innovation, enhance the bank's competitive advantage, and are paramount in providing a seamless and superior customer experience across all digital touchpoints.

Skilled Workforce

Fifth Third Bank's skilled workforce is a cornerstone of its business model. This human capital includes a diverse range of professionals, such as experienced bankers, financial advisors, IT specialists, risk managers, and dedicated customer service representatives. Their collective expertise is crucial for developing innovative financial products, nurturing strong client relationships, and ensuring smooth, efficient operations.

The talent and commitment of Fifth Third Bank's employees are fundamental to its ability to offer a wide array of financial solutions and uphold customer trust. In 2024, the bank continued to invest in its people through various training and development programs aimed at enhancing their skills and knowledge across all functional areas.

- Human Capital: Experienced bankers, financial advisors, IT professionals, risk managers, and customer service representatives form the core of Fifth Third Bank's skilled workforce.

- Expertise Driven: Employee expertise fuels product development, client relationship management, and the pursuit of operational excellence.

- Talent and Trust: The dedication and talent of the workforce are essential for delivering diverse financial solutions and maintaining customer confidence.

- Investment in People: In 2024, the bank prioritized employee development, reflecting a commitment to nurturing its most valuable asset.

Brand Reputation and Trust

Fifth Third Bank's brand reputation is a cornerstone of its business model, built on a legacy of reliability and ethical operations. This deep-seated trust is a vital intangible asset that not only attracts new customers but also fosters long-term loyalty among its existing client base.

The bank's commitment to community engagement further bolsters its image, positioning it as a responsible corporate citizen. This recognition as a leading regional bank, coupled with its adherence to ethical practices, significantly enhances its competitive advantage and opens doors for expanded business ventures.

- Customer Loyalty: In 2024, Fifth Third reported a strong customer retention rate, a direct reflection of the trust placed in its brand.

- Community Impact: The bank's continued investment in community development programs in 2024 underscored its commitment to local economies, reinforcing its reputation.

- Ethical Recognition: Fifth Third has consistently been recognized for its sound governance and ethical business conduct, contributing to its robust brand equity.

- Brand Value: Independent analyses in 2024 valued Fifth Third's brand reputation as a significant driver of its market position and customer acquisition efforts.

Fifth Third Bank's key intellectual property includes its proprietary technology platforms, data analytics capabilities, and established brand recognition. These intangible assets are crucial for delivering innovative financial products and maintaining a competitive edge in the market.

The bank's commitment to research and development in 2024 focused on enhancing its digital offerings and improving customer experience. This ongoing investment in intellectual capital is vital for adapting to evolving consumer needs and technological advancements.

Fifth Third Bank's intellectual property is a significant driver of its operational efficiency and its ability to offer personalized financial solutions. The continuous development and protection of these assets are paramount to its long-term success.

Value Propositions

Fifth Third Bank's comprehensive financial solutions act as a powerful value proposition, positioning the bank as a central hub for a wide spectrum of financial needs. This extensive suite covers everything from everyday retail banking and consumer lending to sophisticated commercial banking and wealth management services.

This all-encompassing approach offers significant convenience, allowing individuals, businesses, and even larger institutions to consolidate their financial activities. For instance, in 2024, Fifth Third reported a robust net interest income, underscoring the volume of transactions and services facilitated by this broad offering.

Fifth Third Bank offers unparalleled convenience through its extensive network of physical branches and ATMs, ensuring customers have easy access to banking services across its footprint. This physical presence is complemented by sophisticated digital platforms, including a user-friendly online banking portal and a feature-rich mobile app, allowing for banking anytime, anywhere.

In 2024, Fifth Third Bank continued to prioritize digital innovation, enhancing its mobile app with features designed to simplify customer interactions. For instance, improvements were made to streamline the process of switching banks, a common pain point for consumers, making it easier for new customers to join Fifth Third.

Fifth Third Bank prioritizes personalized financial advice and relationship management for both individual and commercial clients. This focus fosters deep, enduring connections by understanding unique client needs and delivering tailored guidance, especially within their wealth management and commercial banking sectors.

Security and Reliability

Fifth Third Bank prioritizes a secure and reliable banking experience, evident in its substantial investments in advanced cybersecurity and fraud prevention. This dedication is crucial for building customer trust in an increasingly digital financial landscape.

The bank's financial strength, demonstrated by a resilient balance sheet and stringent operational controls, further reinforces its capacity to safeguard customer assets and sensitive data. For instance, in 2023, Fifth Third Bank reported a Common Equity Tier 1 (CET1) ratio of 10.6%, well above regulatory requirements, underscoring its financial stability.

Digital security is enhanced through features like SmartShield, which offers customers advanced protection for their online banking activities. This commitment to security is a cornerstone of their value proposition, ensuring customers feel confident managing their finances.

- Cybersecurity Investment: Fifth Third Bank consistently allocates resources to bolster its defenses against evolving cyber threats.

- Fraud Prevention: Proactive measures are in place to detect and prevent fraudulent transactions, protecting customer accounts.

- Financial Resilience: A strong balance sheet and robust controls provide a stable foundation for protecting customer assets.

- Digital Security Features: Tools like SmartShield offer enhanced protection for online and mobile banking users.

Community Commitment and Impact

Fifth Third Bank's commitment to community is a core value proposition, extending beyond typical financial offerings. They actively invest in affordable housing, a critical need in many areas. In 2024, for example, Fifth Third Bank committed $2.8 billion to affordable housing and community development projects across its footprint, aiming to create over 10,000 new homes.

This dedication to local revitalization is further showcased through their Neighborhood Program. This initiative focuses on targeted investments in underserved communities, driving economic mobility and social impact. Their support for nonprofit organizations also amplifies their reach, enabling vital services and programs that benefit countless individuals.

- Community Investment: $2.8 billion committed to affordable housing and community development in 2024.

- Impact Goal: Aiming to create over 10,000 new homes through these initiatives.

- Strategic Focus: Neighborhood Program targets underserved areas for revitalization.

- Broader Support: Partnerships with nonprofit organizations extend social impact.

Fifth Third Bank offers a comprehensive suite of financial solutions, acting as a one-stop shop for diverse customer needs, from everyday banking to complex commercial services. This broad offering provides significant convenience, allowing clients to manage multiple financial aspects through a single, trusted provider.

The bank's extensive physical branch and ATM network, coupled with advanced digital platforms like its mobile app and online portal, ensure accessibility and ease of use for all customers. In 2024, Fifth Third Bank enhanced its digital offerings, streamlining processes like customer onboarding to improve the user experience.

Fifth Third Bank's value proposition is built on personalized financial guidance and strong relationship management, fostering trust and loyalty by tailoring advice to individual client circumstances. This client-centric approach is particularly evident in their wealth management and commercial banking divisions.

The bank's commitment to security is paramount, backed by substantial investments in cybersecurity and fraud prevention, along with features like SmartShield for enhanced online protection. This focus on safeguarding assets and data builds crucial customer confidence.

Fifth Third Bank actively invests in community development, notably dedicating $2.8 billion in 2024 to affordable housing and community projects, aiming to create over 10,000 new homes. Their Neighborhood Program further targets underserved areas, promoting economic mobility and social impact.

| Value Proposition | Description | 2024/2023 Data Point |

|---|---|---|

| Comprehensive Financial Solutions | One-stop shop for retail, commercial, and wealth management. | Robust net interest income reported in 2024. |

| Accessibility & Convenience | Extensive branch network and advanced digital platforms. | Enhanced mobile app features for easier customer interactions in 2024. |

| Personalized Relationship Management | Tailored financial advice and guidance for clients. | Focus on deep client connections in wealth and commercial sectors. |

| Security & Trust | Significant investment in cybersecurity and fraud prevention. | CET1 ratio of 10.6% in 2023, indicating financial stability. |

| Community Impact | Investment in affordable housing and local development. | $2.8 billion committed to community development in 2024. |

Customer Relationships

Fifth Third Bank focuses on building deep, personalized connections, especially in its wealth management and commercial banking areas. They assign dedicated advisors and relationship managers who get to know each client's unique financial aspirations.

This approach means understanding both individual and business objectives to craft customized financial solutions and strategic guidance. For instance, in 2023, Fifth Third reported a significant increase in client engagement across its advisory platforms, reflecting the success of this personalized strategy.

The core idea is to foster enduring trust and a mutual understanding, ensuring clients feel supported and valued. This long-term perspective is crucial for retaining clients and growing their financial well-being through tailored advice.

Fifth Third Bank offers robust digital self-service tools via its online and mobile platforms, enabling customers to handle tasks like account management and transactions without direct assistance. This digital approach aligns with the growing preference for independent banking.

To support these self-service options, the bank integrates AI-powered virtual assistants and comprehensive customer service channels. This dual approach ensures that customers can find answers quickly or receive human support when complex issues arise, enhancing the overall banking experience.

In 2024, Fifth Third Bank reported a significant increase in digital engagement, with mobile banking users completing over 1.5 billion transactions. This highlights the effectiveness of their digital self-service strategy in meeting customer needs and driving efficiency.

Fifth Third Bank cultivates strong customer relationships by actively engaging with communities, particularly through initiatives supporting affordable housing, small business expansion, and financial literacy. This dedication to local well-being, exemplified by programs like the Empowering Community Leaders cohort, builds trust and deepens connections with both individuals and businesses.

Proactive Problem Resolution

Fifth Third Bank prioritizes proactive problem resolution, aiming to address customer concerns swiftly across all touchpoints. This includes their physical branches, busy call centers, and increasingly important digital platforms. Their commitment is to resolve issues efficiently, reducing customer frustration and boosting overall satisfaction.

To illustrate this, consider their approach to common banking challenges. For instance, Fifth Third introduced a free overdraft window, a move designed to alleviate financial stress for customers during periods of transition or unexpected shortfalls. This initiative directly tackles a significant pain point for many account holders.

- Proactive Issue Management: Fifth Third Bank focuses on anticipating and resolving customer issues before they escalate, ensuring a smoother banking experience.

- Multi-Channel Support: Customer service is integrated across branches, call centers, and digital channels to provide consistent and accessible assistance.

- Customer Pain Point Reduction: Initiatives like the free overdraft window demonstrate a commitment to easing common financial burdens for their clientele.

- Enhanced Customer Satisfaction: By minimizing friction and offering responsive support, Fifth Third aims to cultivate stronger, more loyal customer relationships.

Loyalty Programs and Incentives

Fifth Third Bank actively cultivates customer loyalty through tailored programs and incentives. These initiatives are designed to reward existing customers and attract new ones by offering tangible benefits. For instance, in 2024, the bank might offer tiered rewards based on account longevity or transaction volume, potentially including preferential interest rates or reduced fees.

The bank's strategy includes special offers that encourage deeper engagement with its product suite. This could manifest as bonus rewards for opening a new checking account and linking it to a savings or investment product, thereby fostering a more comprehensive banking relationship. Such incentives aim to increase customer stickiness and provide a competitive edge.

- Loyalty Tiers: Implementing reward structures that escalate benefits for customers who maintain longer relationships or higher balances.

- Product Bundling Rewards: Offering enhanced incentives when customers utilize multiple Fifth Third Bank products, such as checking, savings, and credit cards.

- Streamlined Onboarding: Providing immediate benefits or simplified processes for new customers to encourage initial engagement and build rapport.

- Referral Bonuses: Incentivizing existing customers to refer new clients, further expanding the bank's customer base and strengthening community ties.

Fifth Third Bank fosters deep, personalized relationships, particularly in wealth management and commercial banking, by assigning dedicated advisors. This personalized approach, which saw increased client engagement across advisory platforms in 2023, aims to understand unique financial aspirations for tailored solutions.

The bank also champions digital self-service through robust online and mobile platforms, supported by AI virtual assistants and comprehensive customer service channels. This dual strategy ensures both convenience and accessible human support, evidenced by over 1.5 billion mobile banking transactions in 2024.

Community engagement, through initiatives like affordable housing support and financial literacy programs, builds trust and strengthens connections. Proactive problem resolution across all channels, including the introduction of a free overdraft window, further enhances customer satisfaction and loyalty.

Channels

Fifth Third Bank leverages a substantial physical branch network, a cornerstone of its customer engagement strategy, with over 1,000 locations primarily situated in the Midwestern and Southeastern U.S. This extensive footprint facilitates direct customer interaction, offering essential services and personalized financial advice.

The bank is strategically investing in its physical infrastructure, particularly in high-growth areas of the Southeast. For instance, in 2024, Fifth Third announced plans to open new branches in markets like Florida and North Carolina, aiming to capture new customers and deepen existing relationships through accessible, community-focused banking centers.

The online banking portal is a crucial digital gateway, enabling customers to perform a wide array of banking tasks like account management, bill payments, and fund transfers from any internet-connected device. This channel is central to Fifth Third Bank's digital offerings, emphasizing convenience and extensive functionality for daily financial activities.

Fifth Third Bank reported that in 2023, over 80% of its customer transactions occurred through digital channels, highlighting the portal's significance. The bank continues to invest in modernizing this platform, aiming for an even more intuitive and feature-rich user experience by mid-2024.

The mobile banking application serves as a vital channel, providing customers with convenient, round-the-clock access to a comprehensive suite of banking services. This includes features like mobile check deposit, streamlined bill payment, and robust account management tools, all accessible from anywhere.

Fifth Third Bank has demonstrably prioritized enhancing its mobile platform, investing heavily in user experience and security. The bank's commitment is evident in features like SmartShield, a security tool designed to protect users, and a general focus on creating a frictionless digital banking journey.

In 2024, Fifth Third's mobile app has garnered recognition for its strong functionality, particularly when compared to other regional banks. This user-centric approach and continuous improvement are key to retaining and attracting customers in the digital age.

Automated Teller Machine (ATM) Network

Fifth Third Bank's extensive ATM network serves as a crucial channel, offering customers 24/7 access for essential banking tasks like cash withdrawals, deposits, and balance checks. This network significantly enhances convenience and accessibility, acting as a bridge between their physical branch presence and burgeoning digital platforms.

The strategic deployment of ATMs across Fifth Third Bank's operational footprint underscores its commitment to serving a broad customer base with basic banking needs. In 2024, Fifth Third Bank operated approximately 1,100 ATMs, a testament to their investment in this accessible service channel.

- 24/7 Accessibility: ATMs provide round-the-clock banking, catering to immediate customer needs.

- Transaction Support: Facilitates cash withdrawals, deposits, and balance inquiries, covering fundamental banking activities.

- Channel Complementarity: Enhances the overall customer experience by integrating with branch and digital banking services.

- Geographic Reach: Extends banking convenience across Fifth Third Bank's extensive service area.

Call Centers and Customer Service

Fifth Third Bank leverages dedicated call centers and customer service teams as a vital channel for direct customer engagement. These teams handle inquiries, resolve issues, and assist with intricate transactions, offering a crucial human touch when digital channels fall short. In 2024, Fifth Third reported a significant volume of customer interactions across its service channels, with call centers playing a pivotal role in managing complex needs and ensuring customer retention.

These human-centric interactions are indispensable for fostering customer loyalty and addressing situations requiring nuanced understanding or personalized guidance. For instance, during the first half of 2024, the bank saw a notable increase in calls related to personalized financial advice and complex loan applications, highlighting the ongoing importance of this channel.

- Direct Support: Call centers provide immediate assistance for inquiries and problem resolution.

- Personalized Assistance: Human interaction offers tailored solutions for complex customer needs.

- Customer Satisfaction: Effective customer service is key to maintaining high satisfaction rates and reducing churn.

- Transaction Support: Facilitates the completion of intricate financial transactions that may not be suited for self-service.

Fifth Third Bank's channels encompass a robust physical branch network, extensive ATM access, and sophisticated digital platforms including online and mobile banking. These are complemented by dedicated call centers, all working in concert to provide seamless customer experiences and support for diverse financial needs.

| Channel | Description | Key Features/Focus | 2024 Data/Activity |

|---|---|---|---|

| Physical Branches | Extensive network for direct customer interaction and personalized advice. | Community focus, in-person services. | Over 1,000 locations, with new branches planned in high-growth Southeast markets. |

| Online Banking | Digital portal for account management, bill pay, and transfers. | Convenience, extensive functionality. | Over 80% of transactions in 2023 occurred digitally; platform modernization ongoing. |

| Mobile Banking | App for 24/7 access to banking services, including mobile deposit. | User experience, security (e.g., SmartShield). | Recognized for strong functionality; continuous investment in features. |

| ATM Network | 24/7 access for cash withdrawals, deposits, and balance inquiries. | Accessibility, transaction support. | Approximately 1,100 ATMs operated in 2024. |

| Call Centers/Customer Service | Human interaction for inquiries, issue resolution, and complex transactions. | Personalized assistance, customer satisfaction. | Pivotal role in managing complex needs; notable increase in calls for financial advice in H1 2024. |

Customer Segments

Individual consumers represent a core customer segment for Fifth Third Bank, encompassing a wide spectrum from everyday banking needs to wealth management. This group includes individuals looking for basic checking and savings accounts, as well as those requiring more complex financial solutions like mortgages, auto loans, and investment services. The bank aims to serve both the mass market and higher-net-worth individuals within this segment.

In 2024, Fifth Third Bank continued to focus on meeting the diverse financial requirements of individual consumers through its extensive branch network and robust digital platforms. The bank reported serving millions of consumer customers, offering a comprehensive suite of retail banking products. This includes deposit accounts, credit cards, and various consumer loans designed to support life's major purchases and everyday financial management.

Fifth Third Bank actively courts small and medium-sized businesses (SMBs), recognizing their vital role in the economy. For these businesses, the bank offers a comprehensive suite of commercial banking products, including essential business checking accounts, various loan options, and flexible lines of credit. Furthermore, Fifth Third provides robust treasury management solutions designed to streamline financial operations for SMBs.

The bank positions itself as a dedicated partner for SMBs, committed to fueling their expansion and addressing their day-to-day operational requirements. A key area of focus for this segment is Fifth Third's commercial payments services, which are specifically tailored to meet the unique transaction needs of smaller enterprises.

Fifth Third Bank caters to large corporations and institutions by offering a full suite of commercial and investment banking services. This includes intricate financial solutions, guidance on capital markets, and deep industry-specific knowledge.

For these sophisticated clients, Fifth Third provides tailored debt financing, robust treasury management solutions, and expert mergers and acquisitions advisory. The bank's corporate and investment banking division is specifically structured to meet the complex needs of this segment.

In 2024, Fifth Third Bank continued to emphasize its commitment to these clients, with its Commercial Bank segment reporting significant growth in net interest income, reflecting the demand for its specialized lending and treasury services among larger businesses and institutions.

High-Net-Worth Individuals (HNWI)

Fifth Third Bank serves High-Net-Worth Individuals (HNWI) through its Fifth Third Private Bank and Fifth Third Wealth Advisors. This segment demands highly personalized wealth management, encompassing investment planning, estate planning, and trust services. The primary objective is wealth preservation and growth, achieved through bespoke strategies and expert guidance.

In 2024, the demand for specialized wealth management services for HNWIs continues to rise, driven by complex financial landscapes and evolving tax regulations. Fifth Third's commitment to this segment is underscored by its investment in tailored solutions designed to meet the unique needs of affluent clients and their families.

- Personalized Wealth Management: Tailored financial plans, including investment strategies, risk management, and philanthropic planning.

- Estate and Trust Services: Comprehensive solutions for wealth transfer, legacy planning, and asset protection.

- Expert Advisory: Access to dedicated private bankers and wealth advisors offering specialized knowledge and personalized support.

- Focus on Growth and Preservation: Strategies aimed at both increasing asset value and safeguarding it against market volatility and unforeseen events.

Real Estate Investors and Developers

Fifth Third Bank actively supports real estate investors and developers by offering tailored lending solutions for both commercial and residential property ventures. This includes crucial financing for affordable housing projects and broader community development initiatives.

Their commitment extends to addressing systemic issues, as evidenced by their participation in housing crisis task forces, demonstrating a dedication to the long-term health of the real estate sector.

- Financing for Diverse Projects: Providing capital for a spectrum of real estate developments, from luxury residences to essential commercial spaces.

- Community Impact Focus: Specializing in funding that drives positive social outcomes, such as affordable housing and urban revitalization.

- Industry Engagement: Actively participating in discussions and initiatives aimed at resolving housing challenges, signaling a deep understanding of market needs.

Fifth Third Bank serves a broad range of customer segments, from individual consumers seeking everyday banking to large corporations needing complex financial solutions. The bank also actively targets small and medium-sized businesses (SMBs) and high-net-worth individuals (HNWIs) with specialized services.

In 2024, Fifth Third Bank continued to refine its offerings for each segment, emphasizing digital accessibility for consumers and tailored commercial banking products for businesses. The bank's strategy involves deepening relationships across all customer groups to drive growth and meet evolving financial needs.

Key customer segments include individual consumers, SMBs, large corporations, HNWIs, and real estate investors. Each segment benefits from distinct product suites and advisory services designed to foster financial well-being and business success.

| Customer Segment | Key Needs | Fifth Third Bank Offerings |

|---|---|---|

| Individual Consumers | Everyday banking, loans, investments | Checking/savings, mortgages, auto loans, wealth management |

| Small & Medium-Sized Businesses (SMBs) | Business accounts, loans, treasury management | Business checking, lines of credit, commercial payments |

| Large Corporations & Institutions | Capital markets, M&A, complex financing | Debt financing, treasury management, M&A advisory |

| High-Net-Worth Individuals (HNWIs) | Wealth preservation, estate planning | Private banking, investment planning, trust services |

| Real Estate Investors & Developers | Property financing, community development | Commercial/residential lending, affordable housing finance |

Cost Structure

Employee compensation and benefits represent a substantial cost for Fifth Third Bank. This includes salaries, wages, health insurance, retirement contributions, and performance-based incentives for its diverse workforce, from tellers to IT professionals.

In 2024, Fifth Third Bank continued to invest heavily in its human capital, recognizing that its employees are crucial for customer service and driving technological advancements. This investment is particularly evident in the costs associated with its expanding technology and digital innovation teams.

Fifth Third Bank's cost structure includes significant expenses for its branch and ATM network. These encompass rent, utilities, maintenance, security, and property taxes for its widespread physical presence. In 2023, the bank reported operating expenses of $3.2 billion, a portion of which directly supports this infrastructure.

The bank's strategic branch expansion, especially in the Southeast, is a planned driver of increased operational costs within this category. This investment in physical locations is designed to capture new markets and enhance customer accessibility.

Fifth Third Bank's technology infrastructure and cybersecurity expenditures represent a significant and growing part of its cost structure. These costs encompass everything from the physical servers and network equipment to the software licenses and cloud services that power its digital banking operations. In 2024, like many financial institutions, Fifth Third is heavily investing in modernizing its technology stack.

The bank is allocating substantial resources to cybersecurity measures, recognizing the increasing sophistication of cyber threats. This includes investments in advanced threat detection systems, data encryption, and employee training to safeguard customer data and maintain the integrity of its financial platforms. These are not optional expenses but rather essential for building and maintaining trust in an increasingly digital financial landscape.

Marketing and Advertising Expenses

Fifth Third Bank allocates significant resources to marketing and advertising to drive customer acquisition and enhance brand recognition. These costs encompass a wide range of activities, from digital campaigns and social media outreach to traditional media buys and sponsorships. In 2024, the banking sector continued to see substantial investment in these areas as institutions vied for market share.

The bank's marketing efforts are crucial for promoting its diverse portfolio of banking products and services, including checking accounts, loans, and investment solutions. Effective campaigns are essential for building customer loyalty and attracting new clientele in a competitive financial landscape. For instance, a strong digital presence is paramount, with many banks increasing their spend on search engine marketing and online advertising.

- Digital Marketing: Investments in online advertising, social media campaigns, and content marketing to reach a broad audience.

- Traditional Advertising: Spending on television, radio, print, and outdoor advertising to build brand awareness.

- Promotional Activities: Costs associated with special offers, discounts, and loyalty programs designed to attract and retain customers.

- Sponsorships: Funding for community events, sports teams, or cultural initiatives to enhance brand visibility and corporate social responsibility.

Regulatory Compliance and Legal Fees

Fifth Third Bank, like all financial institutions, faces substantial costs related to regulatory compliance. These expenses are critical for maintaining operational integrity and avoiding penalties. In 2024, the banking sector continued to see significant investments in compliance infrastructure and personnel to navigate a complex legal landscape.

These costs encompass a range of activities, including legal counsel for interpreting and implementing new regulations, external audits to verify adherence, and the development or acquisition of sophisticated compliance management systems. For instance, the Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations alone require continuous investment in technology and skilled staff.

- Legal Fees: Costs associated with legal experts ensuring adherence to banking laws and regulations.

- Audit Expenses: Fees paid for internal and external audits verifying compliance.

- Compliance Systems: Investments in technology and software for monitoring and reporting.

- Personnel Costs: Salaries and training for compliance officers and staff.

Fifth Third Bank’s cost structure is heavily influenced by its extensive physical footprint and the ongoing digital transformation. Significant expenses are tied to maintaining its branch network, including rent, utilities, and staffing, alongside substantial investments in technology infrastructure and cybersecurity to support its digital offerings. Employee compensation and benefits are also a major cost driver, reflecting the bank's large workforce and its focus on talent in areas like technology and customer service.

| Cost Category | Description | 2023 Impact (Illustrative) |

|---|---|---|

| Employee Compensation & Benefits | Salaries, wages, insurance, retirement, incentives | Significant portion of operating expenses |

| Branch & ATM Network | Rent, utilities, maintenance, security | $3.2 billion total operating expenses in 2023, with a portion allocated here |

| Technology & Cybersecurity | Infrastructure, software, cloud services, security measures | Increasing investment in modernization and threat detection |

| Marketing & Advertising | Digital campaigns, traditional media, promotions | Crucial for customer acquisition and brand building |

| Regulatory Compliance | Legal fees, audits, compliance systems, personnel | Essential for operational integrity and navigating regulations |

Revenue Streams

Net Interest Income (NII) stands as Fifth Third Bank's core revenue engine, representing the profit generated from its lending and deposit-taking activities. This income is derived from the spread between the interest the bank earns on its assets, such as mortgages, commercial loans, and securities, and the interest it pays out on its liabilities, primarily customer deposits and wholesale funding.

In 2024, Fifth Third Bank's NII was significantly influenced by its robust loan portfolio and its ability to manage deposit costs effectively. For instance, the bank reported a substantial increase in its average earning assets, driven by strong commercial and consumer loan origination. This growth, coupled with a strategic approach to deposit pricing, allowed Fifth Third to widen its net interest margin.

Fifth Third Bank generates significant revenue through a variety of service charges and fees. These include charges on deposit accounts, such as monthly maintenance fees and overdraft fees, as well as fees for payment processing and other essential banking services. For instance, in 2024, the bank continued to see robust performance in its commercial payments segment, with deposit fees playing a key role in this growth.

Fifth Third Bank generates substantial non-interest income through wealth and asset management fees. These fees are primarily derived from wealth management, investment advisory, and trust services, often calculated as a percentage of assets under management (AUM) or through commissions on financial planning.

In 2024, Fifth Third's wealth management division continued to demonstrate robust growth, with assets under management reaching new highs. This expansion directly translates into increased fee revenue, solidifying its role as a key profit driver for the bank.

Card and Payment Interchange Fees

Card and payment interchange fees represent a significant revenue stream for Fifth Third Bank. These fees are generated each time a customer uses one of their debit or credit cards for a transaction, with a portion of the merchant's transaction fee flowing back to the issuing bank. This includes revenue from both consumer and commercial card usage, as well as fees associated with embedded payment solutions integrated into various business platforms.

Fifth Third processes a substantial volume of payment transactions, contributing directly to the interchange fee income. For instance, in 2023, the bank reported total payment processing volume exceeding $1 trillion. This massive scale underscores the importance of interchange fees as a core component of their revenue generation strategy.

- Interchange Fees: Revenue earned when Fifth Third cardholders make purchases, with a portion of the merchant's transaction fee paid to the issuing bank.

- Commercial Payments: Includes interchange fees generated from business-related card transactions and payment solutions.

- Embedded Payments: Revenue from payment processing integrated into third-party platforms and services.

- Payment Volume: Fifth Third processed over $1 trillion in payment volume in 2023, highlighting the scale of this revenue stream.

Loan Origination and Servicing Fees

Fifth Third Bank generates significant revenue through loan origination and servicing fees. These fees encompass charges for processing and managing various types of loans, including mortgages and commercial loans. For instance, mortgage origination fees are a common revenue source, while syndication fees are collected for arranging and managing larger commercial credit facilities.

These fees are a crucial component of the bank's lending operations, contributing to profitability beyond just interest income. While some of these fee-based revenues can exhibit seasonality, they remain a consistent and important revenue stream throughout the year. In 2024, the banking sector, including institutions like Fifth Third, continued to see a demand for lending services, supporting these fee-based income streams.

- Mortgage Origination Fees: Charges applied when a new mortgage loan is created.

- Syndication Fees: Fees earned by arranging and managing loans for multiple lenders.

- Loan Servicing Fees: Ongoing fees for managing loan payments, escrow, and customer service.

- Other Lending-Related Charges: Including processing fees, commitment fees, and late payment fees.

Fifth Third Bank’s revenue streams are diverse, extending beyond its core net interest income. These include various fees generated from customer transactions and services, such as deposit account fees and payment processing charges. Additionally, the bank benefits from wealth and asset management fees, which are typically tied to assets under management.

Card and payment interchange fees form a substantial part of their non-interest income. For instance, in 2023, Fifth Third processed over $1 trillion in payment volume, showcasing the significant scale of revenue derived from these transactions. Loan origination and servicing fees, including mortgage origination and syndication fees, also contribute consistently to their overall revenue.

| Revenue Stream | Description | 2023 Data/Impact |

|---|---|---|

| Net Interest Income (NII) | Profit from lending and deposit-taking activities. | Driven by robust loan growth and effective deposit cost management. |

| Service Charges & Fees | Charges on deposit accounts, overdrafts, and payment processing. | Strong performance in commercial payments segment. |

| Wealth & Asset Management Fees | Fees from advisory and trust services, based on AUM. | Assets under management reached new highs in 2024, increasing fee revenue. |

| Card & Payment Interchange Fees | Fees from debit and credit card transactions. | Processed over $1 trillion in payment volume in 2023. |

| Loan Origination & Servicing Fees | Charges for processing and managing loans. | Consistent revenue stream supporting lending operations; demand for lending services remained strong in 2024. |

Business Model Canvas Data Sources

The Fifth Third Bank Business Model Canvas leverages internal financial statements, customer transaction data, and market research reports. This comprehensive data ensures each component, from revenue streams to customer relationships, is grounded in empirical evidence and strategic understanding.