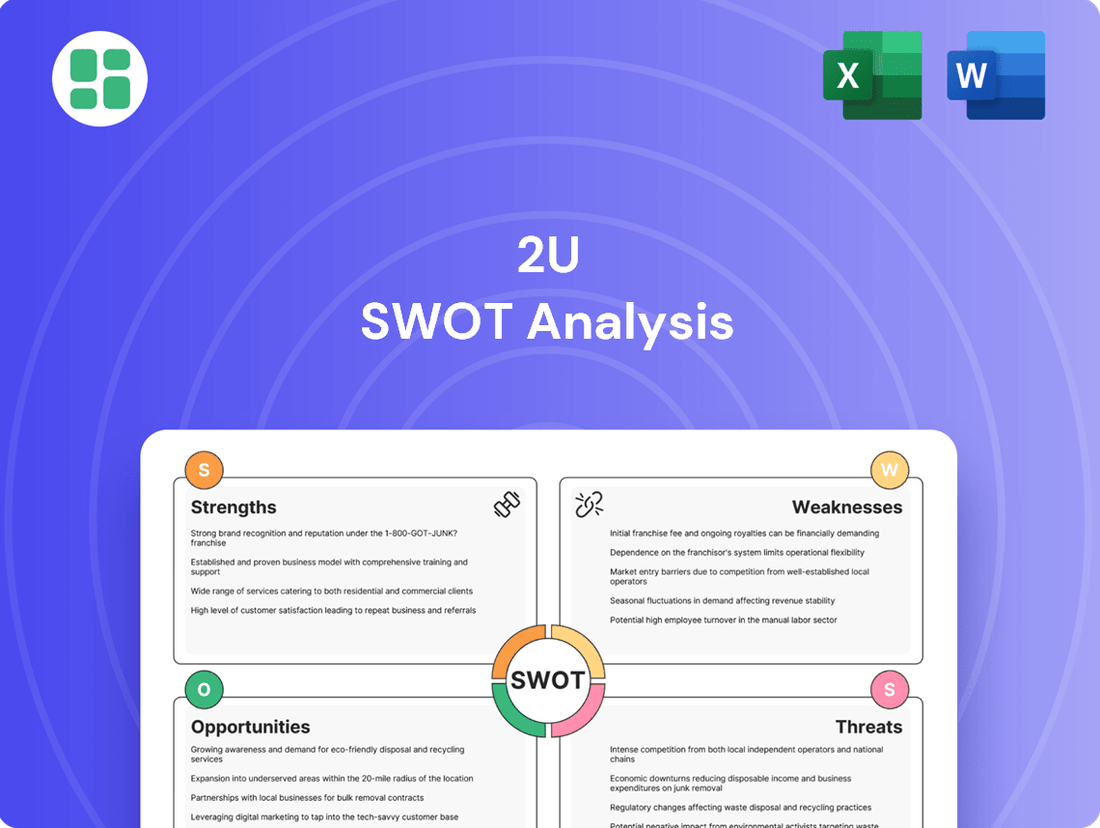

2U SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

2U Bundle

2U's strengths lie in its established brand and extensive university partnerships, but its weaknesses include high operating costs and reliance on tuition revenue. Understanding these dynamics is crucial for navigating the competitive online education landscape.

Want the full story behind 2U's opportunities for expansion and the threats posed by market saturation? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

2U's strength lies in its extensive network of over 260 university partnerships worldwide. This includes collaborations with highly respected institutions such as Harvard, Yale, MIT, and Columbia, which significantly boosts the credibility and appeal of its online offerings.

These strong university alliances translate into enhanced brand recognition for 2U's programs, attracting a more qualified and ambitious student base. The company's flexible degree partnership model is proving popular, with plans to introduce at least 80 new degree programs in 2024, underscoring the demand for these collaborations.

2U's comprehensive service offering is a significant strength, providing universities with an all-encompassing solution for online education. This includes everything from the underlying technology and course design to marketing and student retention efforts. This integrated model simplifies the complex process of launching and managing online programs, allowing institutions to focus on academic quality rather than operational hurdles.

2U's proprietary technology platform is a significant strength, offering a scalable solution that manages the complete student lifecycle, from initial enrollment through to graduation. This robust infrastructure is crucial for delivering high-quality online education.

The integration of edX, a massive global online learning platform, dramatically amplifies 2U's market presence. As of 2024, edX connects over 89 million individuals to a vast array of educational content, ranging from individual courses to comprehensive degree programs and specialized micro-credentials, providing a broad and deep user base.

Focus on High-Demand Verticals and Microcredentials

2U's strategic emphasis on high-demand verticals like STEM and professional development, coupled with its move towards microcredentials, positions it to capture significant market share. This focus directly addresses the increasing need for specialized skills in the current job market.

The company's pivot from traditional bootcamps to innovative technical microcredentials reflects a keen understanding of evolving workforce demands. For instance, in 2024, the demand for cybersecurity professionals, a key STEM area, continued to surge, with millions of unfilled positions globally.

- Focus on High-Demand Verticals: 2U targets areas like STEM and professional development, aligning with current market needs.

- Microcredential Innovation: The company is developing technical microcredentials, moving beyond traditional bootcamps.

- Market Responsiveness: This strategy capitalizes on the growing demand for upskilling and reskilling in specialized fields.

- Addressing Workforce Gaps: 2U's offerings aim to fill critical skill shortages, such as those in data science and cloud computing.

Global Reach and Market Opportunity

2U's core strength lies in its ability to connect educational institutions with a worldwide student base through its online platform. This global reach taps into a rapidly expanding online education market, which is anticipated to reach hundreds of billions of dollars by the mid-2020s, offering vast potential for international growth and new university partnerships. The company is well-positioned to capitalize on the increasing global demand for flexible, accessible, and high-quality online learning experiences.

2U's extensive network of over 260 university partnerships, including prestigious institutions like Harvard and Yale, lends significant credibility to its online programs. This strong foundation is further bolstered by the acquisition of edX, which as of 2024, connects over 89 million users to a wide range of educational content, greatly expanding 2U's reach and market presence.

The company's comprehensive service model, covering technology, course design, marketing, and student retention, simplifies online program management for universities. Furthermore, 2U's proprietary technology platform efficiently manages the entire student lifecycle, ensuring a smooth and scalable educational experience.

2U's strategic focus on high-demand sectors such as STEM and professional development, alongside its innovative approach to technical microcredentials, effectively addresses evolving workforce needs. This aligns with the persistent global demand for specialized skills, exemplified by the millions of unfilled cybersecurity positions in 2024.

| Key Strength | Description | Supporting Data (2024/2025) |

|---|---|---|

| University Partnerships | Extensive network of over 260 global university collaborations. | Includes prestigious institutions like Harvard, Yale, MIT, and Columbia. |

| edX Integration | Acquisition of a major global online learning platform. | As of 2024, edX connects over 89 million individuals. |

| Comprehensive Service Model | End-to-end support for universities launching online programs. | Covers technology, course design, marketing, and retention. |

| Proprietary Technology | Scalable platform managing the full student lifecycle. | Ensures high-quality online education delivery. |

| Strategic Market Focus | Emphasis on high-demand verticals and microcredentials. | Addresses growing need for specialized skills in STEM and professional development. |

What is included in the product

Provides a clear SWOT framework for analyzing 2U’s business strategy, detailing its strengths, weaknesses, opportunities, and threats.

Simplifies complex strategic analysis, transforming overwhelming data into actionable insights for clearer decision-making.

Weaknesses

2U has grappled with significant financial headwinds, most notably its substantial debt burden, which ultimately led to a Chapter 11 bankruptcy filing in July 2024. This restructuring was initiated to address a history of operating losses and a precarious balance sheet.

Despite the restructuring's goal to improve financial health, 2U has continued to report considerable net losses and a downward trend in revenues in recent financial quarters. For example, in the first quarter of 2024, the company reported a net loss of $79.8 million.

This ongoing financial instability and the necessity of bankruptcy proceedings underscore fundamental weaknesses in 2U's prior operational and business strategies, raising questions about its long-term viability and ability to generate consistent profitability.

2U's historical reliance on revenue-sharing agreements with universities, where it often received a substantial cut of tuition fees, presents a significant weakness. This model has faced pushback from partners, with some universities reducing their involvement or terminating programs, directly affecting 2U's income streams. For instance, in the first quarter of 2024, 2U reported a net loss of $61.5 million, highlighting the pressures on its revenue generation.

The company's financial health is intrinsically tied to the success and continuation of these university partnerships. Any disruption, such as a university renegotiating terms or shifting its strategy, can have a pronounced negative impact on 2U's top and bottom lines. This dependence makes 2U vulnerable to shifts in the higher education landscape and the specific strategic decisions of its partner institutions.

2U faces significant challenges with high operating costs, notably in marketing and student acquisition. This has historically prevented the company from achieving annual profitability.

While 2U is implementing cost optimization strategies, a substantial portion of its annual marketing budget is typically spent at the beginning of the year, negatively impacting its EBITDA.

The necessity to attract and support a large student population for its various partner programs inherently drives these elevated operational expenditures, impacting the company's bottom line.

Intense Competition and Market Differentiation

The online education sector is incredibly crowded. 2U faces stiff competition not only from other Online Program Management (OPM) providers but also from agile ed-tech startups and universities building their own online capabilities. This intense fragmentation means securing partnerships can be challenging, potentially extending sales cycles and forcing 2U to negotiate less advantageous financial terms.

This competitive pressure directly impacts 2U's ability to capture significant market share and can squeeze its profit margins. For instance, in the dynamic OPM space, universities are increasingly evaluating a range of partners, and some may opt for in-house solutions, reducing the addressable market for external providers.

- Intense Competition: The online education market is highly fragmented with numerous OPM providers, ed-tech startups, and universities developing in-house solutions.

- Market Differentiation Challenges: Standing out in this crowded space requires continuous innovation and value proposition refinement.

- Pressure on Economic Terms: Competition can lead to longer sales cycles and pressure to offer less favorable economic terms to secure university partnerships.

- Impact on Margins: These factors can limit market share gains and compress 2U's profit margins.

Recent Decline in Bootcamp Enrollments and Program Exits

2U has seen a notable downturn in its alternative credential segment, with boot camp enrollments experiencing a significant decline. This has directly impacted revenue, signaling a shift in market demand away from their established boot camp models. For instance, the company has been vocal about a strategic pivot away from these traditional, longer-form programs as they no longer fit current market needs.

This strategic shift is reflected in the company's financial performance. The decline in boot camp revenue is a key factor contributing to the overall revenue challenges faced by 2U in this segment. The company's decision to move away from traditional bootcamps underscores a response to evolving educational preferences and market dynamics.

2U's substantial debt, culminating in a July 2024 Chapter 11 bankruptcy filing, highlights a critical weakness stemming from its aggressive growth strategy and past financial management. This debt burden has severely constrained its financial flexibility and ability to invest in future growth.

The company's continued reporting of net losses, such as the $79.8 million loss in Q1 2024, indicates persistent operational inefficiencies and an inability to translate revenue into sustainable profitability. This ongoing financial instability raises serious concerns about 2U's long-term viability and its capacity to execute its turnaround plan effectively.

2U's heavy reliance on revenue-sharing agreements with universities, where a significant portion of tuition is ceded, creates a vulnerability. When universities renegotiate terms or reduce program involvement, as seen with some partners, 2U's income streams are directly impacted, as evidenced by the $61.5 million net loss in Q1 2024, which reflects these pressures.

High operating costs, particularly in marketing and student acquisition, have consistently hindered 2U's ability to achieve annual profitability. The significant upfront marketing spend, often at the beginning of the fiscal year, negatively impacts EBITDA and underscores a structural challenge in balancing growth investment with cost control.

Preview Before You Purchase

2U SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version.

Opportunities

The global online education market is booming, with projections suggesting continued robust growth. For instance, the market was valued at over $250 billion in 2023 and is expected to reach over $600 billion by 2027, demonstrating a compound annual growth rate of around 25%. This expansion provides 2U with a significantly larger pool of potential students and institutions seeking digital learning solutions.

This increasing demand for flexible and accessible learning options worldwide directly benefits 2U's core business model. As more individuals and organizations embrace online learning for upskilling, reskilling, and degree attainment, 2U's platform and partnerships are well-positioned to capture a larger share of this expanding market.

The market for short courses and micro-credentials is booming, driven by a constant need for upskilling and reskilling in a rapidly evolving job market. Learners are increasingly seeking flexible, career-focused learning pathways that offer tangible outcomes.

2U's strategic shift to focus on technical micro-credentials, especially in high-demand fields like artificial intelligence and data science, is a smart move. This pivot directly addresses the growing demand for specialized, job-ready skills, positioning 2U to capture a significant share of this expanding market.

For instance, the global online education market, which includes these shorter formats, was projected to reach over $370 billion by 2026, indicating substantial growth potential. By offering targeted programs in areas like AI, 2U can attract a new wave of learners eager to acquire in-demand competencies.

Advances in AI and data analytics present a significant opportunity for 2U to revolutionize its educational offerings. By leveraging these technologies, 2U can create highly personalized learning journeys, adapting content and pace to individual student needs. This could lead to improved engagement and better academic results, a key differentiator in the competitive online education market.

Integrating AI can also streamline 2U's platform operations, automating tasks and providing deeper insights into student progress. For instance, AI-powered tools can identify students at risk of falling behind, allowing for timely interventions. In 2024, the global AI in education market was valued at approximately $3.7 billion and is projected to grow substantially, indicating a strong demand for such innovations.

International Market Expansion and New Partnerships

2U has a significant opportunity to deepen its international presence by entering new geographic markets and forging strategic alliances with more universities and educational providers worldwide. Despite its existing global partnerships, a substantial portion of the international higher education landscape remains accessible for expansion.

This global reach is crucial for revenue diversification, mitigating risks associated with over-reliance on any single region. For instance, in 2023, 2U reported that its international programs contributed to its overall growth, with a notable increase in enrollment from regions outside North America, indicating strong demand for its online offerings across diverse student populations.

- Expanding into emerging markets in Asia and Africa presents a significant growth avenue, given the increasing demand for quality online education in these regions.

- Developing partnerships with established institutions in countries with strong digital infrastructure can accelerate market penetration and brand recognition.

- Leveraging its technology platform, 2U can tailor program offerings to meet the specific needs and regulatory environments of various international markets.

Demand for Lifelong Learning and Corporate Training

The persistent need for individuals to update their skills and knowledge throughout their careers, coupled with companies investing in employee development, creates a significant growth avenue for 2U. This trend is amplified by rapid technological advancements and evolving industry demands, making continuous learning essential for career progression and organizational competitiveness.

2U can capitalize on this by expanding its portfolio to include more non-degree programs, such as bootcamps, certificate courses, and micro-credentials. These offerings are often more agile and directly address specific skill gaps identified by employers. For instance, the corporate training market is projected to reach $450 billion globally by 2027, according to some market research projections, indicating a substantial addressable market.

Strategic alliances with corporations are crucial. By tailoring training solutions to meet the unique workforce development needs of businesses, 2U can secure recurring revenue streams and build strong B2B relationships. The demand for executive education and specialized certifications in areas like data science, cybersecurity, and digital transformation is particularly strong, with many companies allocating significant budgets to upskill their leadership and technical teams.

- Growing Demand: The global corporate e-learning market is expected to grow significantly, with projections indicating continued expansion through 2025 and beyond, driven by the need for upskilling and reskilling.

- Partnership Potential: Collaborations with companies for customized training programs offer a direct path to revenue and market penetration in the lifelong learning segment.

- Skill-Based Offerings: A focus on specialized certifications and short-form credentials aligns with the current market preference for targeted, job-ready skills development.

- Workforce Development: Addressing critical workforce shortages in high-demand fields through accessible training solutions positions 2U as a key player in economic development.

The global online education market is experiencing substantial growth, with projections indicating a continued upward trend. This expansion presents a significant opportunity for 2U to broaden its reach and customer base. For example, the market was valued at over $250 billion in 2023 and is anticipated to exceed $600 billion by 2027, showcasing a robust compound annual growth rate of approximately 25%.

2U is well-positioned to capitalize on the increasing demand for flexible and accessible learning solutions worldwide. As more individuals and organizations embrace online education for skill enhancement and degree attainment, 2U's platform and university partnerships are poised to capture a larger market share.

The growing demand for short courses and micro-credentials, driven by the need for continuous upskilling and reskilling in a dynamic job market, offers a prime opportunity. Learners are increasingly seeking career-focused pathways with tangible outcomes, a niche 2U is actively addressing.

2U's strategic focus on technical micro-credentials, particularly in high-demand areas like artificial intelligence and data science, directly aligns with market needs. This pivot allows 2U to attract learners eager for job-ready skills, tapping into a rapidly expanding segment of the education market.

Advances in AI and data analytics offer a chance for 2U to enhance its educational offerings through personalization. Leveraging AI can create tailored learning experiences, potentially improving student engagement and outcomes. The global AI in education market was valued at approximately $3.7 billion in 2024, highlighting the potential for AI-driven innovation in educational platforms.

Expanding its international presence by entering new geographic markets and forming alliances with more global universities presents a significant growth avenue for 2U. This global reach is vital for diversifying revenue streams and mitigating regional economic risks.

The persistent need for lifelong learning and corporate investment in employee development creates a substantial growth opportunity for 2U. This trend is fueled by rapid technological advancements and evolving industry demands, making continuous skill acquisition essential for career and organizational advancement.

Collaborating with corporations on customized training programs offers 2U a direct path to revenue and market penetration in the lifelong learning sector. The demand for executive education and specialized certifications in fields like data science and cybersecurity is particularly strong, with many companies dedicating significant budgets to upskill their workforce.

| Opportunity Area | Description | Market Data/Projection |

|---|---|---|

| Global Online Education Market Growth | Increasing demand for flexible and accessible learning solutions. | Market valued over $250 billion in 2023, projected to exceed $600 billion by 2027 (25% CAGR). |

| Micro-credentials and Short Courses | Focus on job-ready skills in high-demand fields like AI and data science. | Global online education market (including shorter formats) projected to reach over $370 billion by 2026. |

| AI and Data Analytics Integration | Personalized learning journeys and streamlined platform operations. | Global AI in education market valued at approx. $3.7 billion in 2024, with significant growth expected. |

| International Market Expansion | Entering new geographic markets and forging global university partnerships. | 2U reported increased international enrollment in 2023, indicating strong global demand. |

| Corporate Training and Lifelong Learning | Tailored solutions for workforce development and employee upskilling. | Corporate training market projected to reach $450 billion globally by 2027. |

Threats

The online education sector is exceptionally crowded. We're seeing a surge in Online Program Managers (OPMs), direct-to-consumer online education platforms, and universities building their own online offerings. This intense competition can force price reductions and shrink market share, putting pressure on 2U's revenue-sharing agreements and potentially impacting its profitability.

2U faces significant threats from increased regulatory scrutiny and potential policy shifts within the higher education landscape. Changes in how the Department of Education or accrediting bodies view third-party servicer relationships, especially those involving revenue sharing, could directly impact 2U's business model. For instance, a tightening of rules around such partnerships, potentially mirroring past concerns about student recruitment practices, could necessitate costly adjustments to their agreements with universities.

Economic downturns, characterized by factors like rising inflation and interest rates, pose a significant threat to 2U's business model. For instance, a higher interest rate environment in 2024-2025 could make student loans more expensive, potentially deterring prospective students from enrolling in higher education, including 2U's online programs. This reduced affordability directly translates to lower student demand.

The direct consequence of decreased student demand is a substantial impact on 2U's revenue streams. Since a significant portion of 2U's income is directly linked to student enrollment numbers and the associated tuition fees, any contraction in enrollment due to economic pressures can lead to a notable decline in the company's top line. This sensitivity to economic cycles creates inherent volatility in their financial performance.

University Insourcing and Desire for Greater Control

Universities are increasingly exploring insourcing for online program delivery, a trend that could reduce their reliance on third-party partners like 2U. This shift is driven by a desire for greater control over curriculum, student experience, and data, as well as potential cost savings. For instance, many institutions are investing in their own learning management systems and instructional design teams, aiming to build robust internal competencies.

This move towards greater institutional control may also lead to a reevaluation of existing revenue-share agreements. Universities might seek to negotiate more favorable terms or explore alternative, potentially lower-cost models that bypass traditional OPM structures. The financial landscape of higher education, particularly post-pandemic, is prompting a critical look at all operational expenses and partnership arrangements.

- Increased Investment in In-House EdTech: Universities are allocating more resources to build and enhance their internal technology infrastructure for online learning.

- Demand for Flexible Partnership Models: Institutions are pushing for OPMs to offer more adaptable revenue-sharing or fee-for-service arrangements.

- Focus on Brand and Data Ownership: Universities want direct control over their online brand identity and the valuable student data generated by these programs.

- Exploration of Alternative Providers: Some universities are looking at smaller, specialized vendors or even developing capabilities entirely internally to reduce dependence on large OPMs.

Reputational Risks and Litigation

2U has encountered significant reputational hurdles, including legal challenges that alleged misleading program rankings. These lawsuits, coupled with scrutiny over its Online Program Management (OPM) contracts and student recruitment methods, pose a substantial threat.

Negative press or ongoing litigation concerning partner universities or the success of its students could severely tarnish 2U's brand image. This damage directly impacts its capacity to secure new university partnerships and enroll prospective students.

- Reputational Damage: Lawsuits alleging misleading rankings and criticisms of OPM contracts can erode public trust.

- Litigation Costs: Ongoing legal battles divert financial resources and management attention.

- Partnership Deterioration: Negative publicity may cause existing university partners to re-evaluate their relationships.

- Student Enrollment Decline: A damaged reputation can deter new students from enrolling in 2U-powered programs.

The competitive landscape for online education is intensifying, with numerous OPMs and universities directly offering programs. This crowded market, exacerbated by potential price wars, could pressure 2U's revenue-sharing models and overall profitability. For instance, the continued growth of direct-to-consumer platforms in 2024-2025 means more alternatives for students, potentially fragmenting the market further.

Regulatory shifts and policy changes in higher education present a significant threat. Any tightening of rules by the Department of Education or accrediting bodies regarding third-party servicer relationships, particularly those involving revenue sharing, could directly impact 2U's core business. Concerns about student recruitment practices, which have surfaced in the past, could lead to stricter oversight and necessitate costly adjustments to existing university partnerships.

Economic headwinds, including elevated inflation and interest rates, pose a risk to student demand. Higher borrowing costs for student loans in the 2024-2025 period might deter enrollment, directly affecting 2U's revenue, which is closely tied to student numbers and tuition fees. This economic sensitivity introduces volatility into their financial performance.

Universities are increasingly looking to bring online program delivery in-house, reducing their reliance on third-party OPMs like 2U. This trend is driven by a desire for greater control over curriculum, student experience, and data, as well as potential cost efficiencies. For example, many institutions are investing in their own EdTech infrastructure and instructional design teams to build internal capabilities.

SWOT Analysis Data Sources

This SWOT analysis draws from a robust foundation of data, including 2U's official financial filings, comprehensive market research reports, and insights from industry analysts to ensure a well-rounded and accurate assessment.