2U PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

2U Bundle

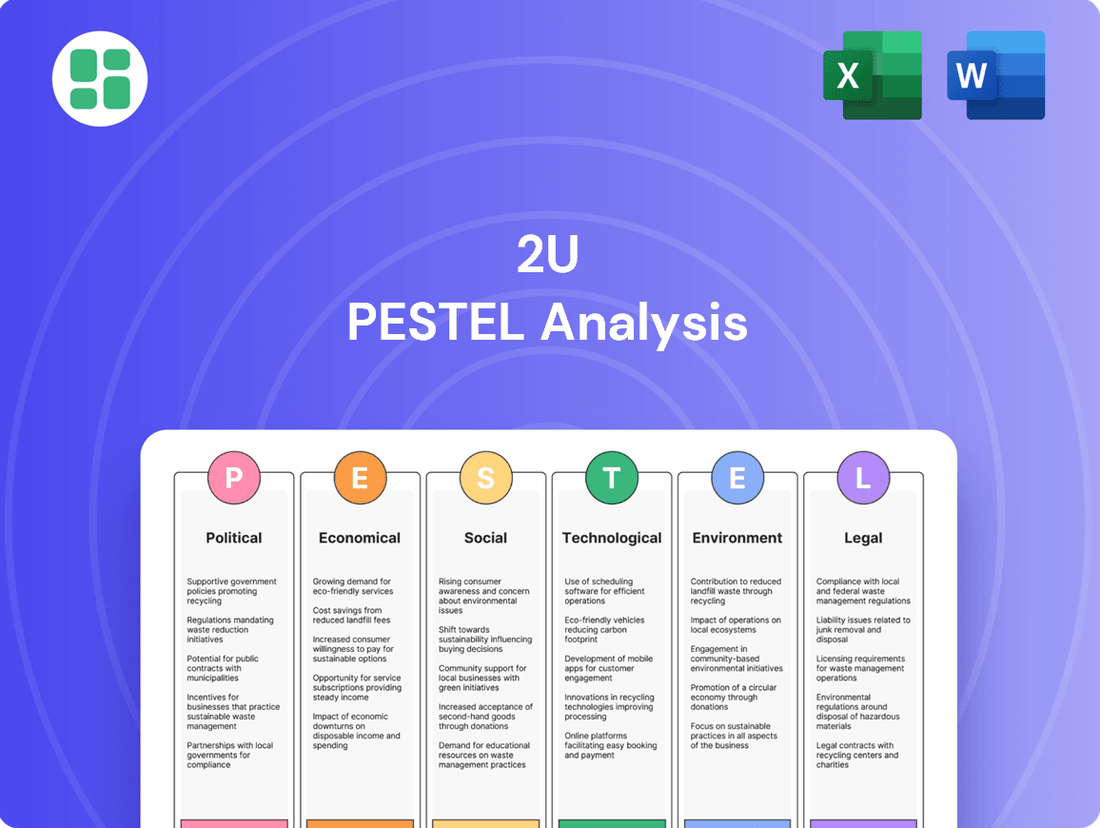

Navigate the complex external forces shaping 2U's trajectory with our comprehensive PESTLE analysis. Uncover critical political, economic, social, technological, legal, and environmental factors influencing the online education landscape. Equip yourself with actionable intelligence to anticipate challenges and seize opportunities. Download the full analysis now and gain a decisive strategic advantage.

Political factors

Government policies and regulations are a major force shaping the online education landscape, affecting everything from accreditation to how companies like 2U secure funding. Shifts in political priorities, especially with a new administration or legislative session, can directly impact operational flexibility and growth potential. For instance, the trend observed in 2024 towards increased state-level regulation over federal oversight suggests a potentially more complex and varied compliance environment for companies operating nationwide.

The evolving landscape of accreditation for online education significantly impacts 2U's business model, which relies on partnerships with established non-profit universities. As digital learning gains prominence, new standards and processes for online program accreditation are becoming critical for ensuring credibility and market acceptance. For instance, the Council for Higher Education Accreditation (CHEA) continues to refine its recognition processes for accrediting bodies, influencing how institutions evaluate and approve online program providers.

The U.S. Department of Education's oversight of accrediting agencies plays a vital role in shaping the regulatory environment. Any shifts in their stance on accreditor recognition or changes in accreditation standards could directly affect existing university partnerships and the ability to form new ones, potentially impacting 2U's growth trajectory and market access.

The evolving landscape of student data privacy regulations, including federal laws like FERPA and COPPA, alongside state-specific acts such as the Texas SCOPE Act, presents significant compliance challenges for EdTech providers like 2U. These regulations dictate how student information can be collected, stored, and utilized, impacting everything from marketing to educational delivery.

Ensuring robust data security and adherence to these privacy mandates is paramount for 2U to maintain trust with its university partners and the students they serve. Failure to comply can result in substantial legal penalties and severe reputational damage, directly affecting business operations and future growth opportunities in the EdTech sector.

International Education Policies

International education policies significantly shape 2U's global reach. Regulations on international student enrollment and cross-border education directly influence 2U's capacity to expand its online program offerings worldwide. For instance, changes in visa policies or international student quotas in key markets could curb growth opportunities.

The fluctuating landscape of international student mobility, often tied to immigration policies, presents a direct challenge to 2U's expansion strategies. A decline in international student numbers in countries like the United States or the United Kingdom, for example, could negatively impact 2U's revenue streams from these regions. In 2023, the U.S. hosted over one million international students, a figure that remains sensitive to policy shifts.

- Policies impacting international student visas and work authorization can reduce the addressable market for 2U's programs.

- Government initiatives promoting or restricting offshore online education programs directly affect 2U's partnership opportunities with foreign universities.

- Changes in national education standards or accreditation requirements can necessitate costly adaptations for 2U's course offerings in new markets.

- Geopolitical tensions and trade relations can indirectly influence student mobility and collaboration, impacting 2U's international growth.

Public-Private Partnerships in Education

The increasing trend of public-private partnerships (PPPs) in higher education, a key political factor, offers 2U significant avenues for growth. These collaborations allow for expanded reach and the introduction of innovative educational models, potentially boosting 2U's market presence. For instance, in 2023, government funding for educational technology initiatives aimed at increasing access and affordability saw a notable uptick in several key markets where 2U operates.

However, these partnerships also bring political complexities. Navigating the scrutiny surrounding for-profit involvement in public education systems requires careful management of public perception and regulatory compliance. The debate over the efficacy and equity of PPPs in education continues to be a prominent political discussion, impacting policy decisions and funding allocations for such ventures.

Key considerations for 2U regarding PPPs include:

- Government Funding Trends: Monitoring changes in public education budgets and specific allocations for technology and online learning programs is crucial.

- Regulatory Environment: Understanding and adapting to evolving regulations governing PPPs in education across different jurisdictions is essential.

- Public Perception: Proactively addressing concerns about the role of for-profit companies in public education can mitigate reputational risks.

- Partnership Sustainability: Ensuring the long-term viability and mutual benefit of PPPs is vital for sustained growth and impact.

Government policies, particularly regarding student data privacy and accreditation standards, directly influence 2U's operational framework and partnership viability. Shifts in state and federal regulations, as seen with increased state-level oversight in 2024, create a dynamic compliance environment for EdTech providers. The U.S. Department of Education's role in accreditor recognition remains a critical factor for 2U's university collaborations.

International education policies, including visa regulations and student mobility trends, significantly impact 2U's global expansion strategies. Changes in immigration policies can directly affect the addressable market for online programs in key regions. For example, the U.S. hosted over 1 million international students in 2023, a figure sensitive to policy shifts.

The rise of public-private partnerships (PPPs) in higher education presents both opportunities and challenges for 2U. Government funding trends for educational technology initiatives, which saw an uptick in 2023, can fuel growth. However, navigating public perception and regulatory scrutiny surrounding for-profit involvement in public education is crucial for sustained success.

| Policy Area | 2024/2025 Trend/Consideration | Impact on 2U |

|---|---|---|

| Accreditation Standards | Refinement of online program accreditation by bodies like CHEA. | Ensures credibility of 2U's partner programs; potential for evolving compliance needs. |

| Student Data Privacy | Increased state-level regulations (e.g., Texas SCOPE Act) alongside federal laws (FERPA, COPPA). | Requires robust data security and adherence to diverse privacy mandates; risk of penalties for non-compliance. |

| International Student Mobility | Fluctuations tied to immigration policies and geopolitical relations. | Affects revenue streams from international markets; potential reduction in addressable market. |

| Public-Private Partnerships | Government funding for EdTech initiatives (uptick in 2023); ongoing debate on for-profit involvement. | Offers growth avenues; necessitates careful management of public perception and regulatory compliance. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting 2U, dissecting them across Political, Economic, Social, Technological, Environmental, and Legal dimensions to reveal strategic opportunities and threats.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for actionable strategy development.

Economic factors

Global economic conditions significantly influence educational spending. Economic downturns and persistent inflation, like the 3.4% annual inflation rate observed in the US as of April 2024, can erode disposable income, making higher education a less accessible option for many students. This directly impacts enrollment in programs, including online offerings from companies like 2U.

While online education is often perceived as more affordable, a widespread economic strain can still lead to reduced overall demand or a pivot towards shorter, more cost-effective certifications rather than full degree programs. 2U's own financial restructuring in late 2023, involving significant debt reduction, underscores the company's efforts to navigate these economic headwinds and adapt its business model.

The escalating burden of student loan debt, exceeding $1.7 trillion in the U.S. as of early 2024, directly impacts enrollment decisions, with many students weighing future earnings against immediate educational costs. This financial pressure can steer prospective students towards more affordable educational pathways.

Changes in federal and state funding models for higher education, including Pell Grant adjustments and loan forgiveness programs, directly affect the financial capacity of 2U's university partners and the attractiveness of their online offerings to students. For instance, shifts in federal student aid policies can alter the net price of degrees, influencing demand.

Online degree programs, often characterized by lower overhead and tuition compared to traditional on-campus education, represent a more accessible financial option for many, potentially boosting demand for 2U's co-created programs as students seek value and flexibility in their educational investments.

The online education sector, where 2U operates, is seeing a surge in competitors, including many non-profit universities enhancing their digital programs. This intensified competition can lead to price wars and requires companies like 2U to find unique selling propositions. For instance, the global online education market was valued at approximately $250 billion in 2023 and is projected to reach over $600 billion by 2030, indicating substantial growth but also a crowded landscape.

Market saturation is further fueled by the growing demand for shorter, skills-based certifications over traditional degrees. Companies must adapt their offerings to meet this evolving market need. In 2024, there's a notable trend towards micro-credentials and bootcamps, with many platforms reporting significant user engagement in these flexible learning formats.

Cost Optimization and Operational Efficiency

2U's commitment to cost optimization and operational efficiency is paramount for its economic health. The company has been actively engaged in financial restructuring, aiming to reduce its substantial debt burden, which stood at approximately $778 million as of the end of the first quarter of 2024. This focus on streamlining operations and improving profitability is essential for navigating the highly competitive EdTech landscape and fostering sustainable growth.

Key initiatives and financial data supporting this focus include:

- Debt Reduction: 2U has prioritized paying down its debt, a crucial step in improving its financial flexibility and reducing interest expenses.

- Operational Streamlining: Efforts to make operations more efficient are ongoing, aiming to boost margins and improve the company's bottom line.

- Profitability Goals: The company is working towards achieving greater profitability, which is vital for long-term viability and investor confidence in the EdTech sector.

- Market Competitiveness: Enhanced efficiency helps 2U compete more effectively against other players in the online education market.

Demand for Upskilling and Reskilling

The rapid pace of technological change and automation is fundamentally reshaping the job market, creating a pronounced need for employees to acquire new skills or update existing ones. This dynamic fuels a growing demand for accessible, flexible learning solutions, particularly online short courses and microcredentials that offer targeted career advancement.

This trend represents a substantial economic opportunity for companies like 2U, which specialize in providing online education. By offering career-relevant programs, 2U can effectively tap into the market of professionals eager to enhance their employability and adapt to evolving industry requirements.

Data from 2024 highlights this shift. For instance, a recent LinkedIn report indicated that over 70% of professionals believe continuous learning is crucial for career progression. Furthermore, the global market for online learning, including short courses and certifications, was projected to reach over $370 billion by 2026, demonstrating significant growth potential.

- Growing Demand: The need for upskilling and reskilling is a persistent economic driver, with a significant portion of the workforce seeking to acquire new competencies.

- Online Learning Preference: Professionals increasingly favor online, flexible learning formats that accommodate their work schedules and allow for focused skill development.

- Microcredentials Value: Shorter, specialized credentials are gaining traction as efficient ways to demonstrate proficiency in specific, in-demand skills.

- Economic Opportunity: Companies like 2U are well-positioned to capitalize on this demand by providing career-oriented online education solutions.

Economic factors heavily influence the education sector, impacting student enrollment and institutional spending. High inflation rates, like the 3.4% in the US in April 2024, can reduce disposable income, making higher education less accessible. The substantial student loan debt exceeding $1.7 trillion in early 2024 also pressures students to weigh costs against future earnings, potentially favoring more affordable learning options.

The online education market, valued at around $250 billion in 2023 and projected to exceed $600 billion by 2030, shows significant growth but also intense competition. Companies like 2U must remain cost-efficient, as evidenced by their late 2023 financial restructuring aimed at reducing debt, which was approximately $778 million by Q1 2024.

The demand for upskilling and reskilling is a strong economic driver, with over 70% of professionals in 2024 viewing continuous learning as vital for career advancement. This trend benefits online learning platforms offering flexible, career-focused programs and microcredentials, tapping into a market eager for efficient skill development.

| Economic Factor | Impact on 2U | Relevant Data (2024/2025) |

|---|---|---|

| Inflation | Reduces student affordability and institutional budgets. | US Inflation Rate: 3.4% (April 2024) |

| Student Debt | Influences enrollment decisions, favoring cost-effective programs. | US Student Loan Debt: >$1.7 trillion (Early 2024) |

| Market Growth & Competition | Drives need for efficiency and differentiation in a crowded space. | Global Online Education Market: ~$250 billion (2023) to >$600 billion (2030) |

| Upskilling Demand | Creates opportunity for career-focused online courses and certifications. | 70%+ professionals see continuous learning as crucial (2024) |

| Company Financials | Necessitates cost optimization and debt management for sustainability. | 2U Debt: ~$778 million (Q1 2024) |

Full Version Awaits

2U PESTLE Analysis

The preview you see here is the exact 2U PESTLE Analysis document you’ll receive after purchase, providing a comprehensive overview of the factors influencing the company.

This is a real screenshot of the product you’re buying—the 2U PESTLE Analysis delivered exactly as shown, no surprises, allowing you to understand its strategic context.

The content and structure shown in the preview is the same 2U PESTLE Analysis document you’ll download after payment, ensuring you get the complete, ready-to-use analysis.

Sociological factors

The societal view of online education has transformed from a niche option to a widely accepted learning avenue. This evolution, accelerated by global events, has fueled a surge in online learning participation.

By the end of 2024, it's projected that the global online education market will reach approximately $400 billion, demonstrating this significant shift in perception and adoption. This growing acceptance directly benefits companies like 2U, as more individuals and organizations acknowledge the credibility and efficacy of online credentials.

Societal shifts are profoundly influencing education, with a strong demand for learning that fits busy lives. Adults juggling careers and families increasingly seek educational opportunities that offer flexibility and accessibility, moving away from traditional, rigid classroom settings. This trend is a significant driver for the growth of online learning platforms.

2U's core business model, which involves collaborating with established universities to deliver online degree programs, is perfectly aligned with this societal demand. By making high-quality academic content available online, 2U opens doors for a global and diverse student population who might otherwise be unable to pursue higher education due to geographical or time constraints. For instance, in 2024, the global online education market was valued at over $300 billion and is projected to grow substantially, reflecting this persistent demand for flexible learning solutions.

Adult learners are increasingly shaping the higher education landscape, with those aged 25-29 representing a significant driver of undergraduate enrollment growth. This trend highlights a substantial market for flexible learning solutions.

Online education platforms like 2U are well-positioned to capitalize on this demographic shift. Their ability to offer career-focused programs and flexible scheduling directly addresses the needs of working professionals seeking to upskill or pivot in their careers.

Data from the National Center for Education Statistics indicated that in Fall 2022, over 35% of students enrolled in postsecondary institutions were 25 or older, underscoring the growing importance of this segment for institutions and educational technology providers.

Workforce Trends and Skills Gap

The workforce is changing rapidly due to automation and technology, meaning people constantly need new skills. This societal shift drives a strong demand for online learning that directly prepares individuals for careers, such as the microcredentials and specialized courses 2U offers. These programs, developed with universities, are designed to bridge critical gaps in the skills employers need.

For instance, a 2024 report indicated that over 60% of global employers struggle to find candidates with the necessary digital skills. This highlights the urgency for accessible, flexible learning solutions. 2U's model directly addresses this by partnering with leading institutions to deliver high-quality online education tailored to in-demand fields.

- Skills Gap: A significant portion of the global workforce lacks proficiency in areas like data analytics, AI, and cybersecurity.

- Demand for Online Learning: In 2024, online education enrollment saw a 15% increase year-over-year, reflecting a growing preference for flexible learning.

- Microcredentials: The market for microcredentials is projected to reach $30 billion by 2027, demonstrating their value in upskilling.

- 2U's Role: 2U partners with over 80 universities, offering more than 500 online programs to meet evolving workforce needs.

Equity and Access in Education

Societal emphasis on equitable and accessible high-quality education significantly fuels the growth of online learning. 2U's core mission directly addresses this by empowering universities to extend their reach globally, thereby fostering greater educational inclusivity.

This societal push is evident in increasing demand for flexible learning options. For instance, by the end of 2024, global online education market is projected to reach over $400 billion, showcasing a strong societal preference for accessible learning solutions.

- Growing Demand: The number of students enrolling in online degree programs has steadily increased, with projections indicating continued growth through 2025.

- Access Initiatives: Many governments and non-profits are launching initiatives to bridge the digital divide, further promoting access to online education.

- University Partnerships: 2U's model, partnering with top-tier universities, directly responds to the societal desire for reputable and accessible educational opportunities.

- Global Reach: The platform's ability to connect students worldwide with specialized programs addresses the societal value of democratizing higher education.

Societal expectations for lifelong learning and continuous upskilling are a major driver for online education. The increasing recognition of the value of flexible, accessible education directly benefits companies like 2U, which facilitate university partnerships for online program delivery. This trend is further amplified by a growing demand for career-focused credentials that can be acquired without disrupting existing work or personal commitments.

The global online education market is projected to exceed $400 billion by the end of 2024, underscoring a significant societal shift towards digital learning. This expansion reflects a broader acceptance of online degrees and certifications as legitimate pathways to career advancement. 2U's strategic focus on partnering with prestigious universities to offer high-quality online programs aligns perfectly with this societal demand for credible, flexible educational opportunities.

The increasing demand for flexible learning solutions is evident, with adult learners, particularly those aged 25-29, showing significant growth in higher education enrollment. By the end of 2024, the global online education market is expected to reach approximately $400 billion, a testament to this societal preference. 2U's model, which provides accessible, career-oriented programs, directly caters to this demographic seeking to enhance their skills and career prospects.

| Factor | Description | Impact on 2U | Data Point (2024/2025) |

|---|---|---|---|

| Lifelong Learning | Societal emphasis on continuous skill development and career adaptation. | Drives demand for 2U's flexible, upskilling-focused programs. | Global online education market projected to exceed $400 billion by end of 2024. |

| Flexibility & Accessibility | Growing need for education that fits busy schedules and geographical constraints. | Enhances the appeal of 2U's online degree and certificate offerings. | Over 35% of postsecondary students were 25 or older in Fall 2022. |

| Skills Gap | Workforce requires new skills due to technological advancements. | Creates demand for 2U's career-focused online programs. | Over 60% of global employers struggle to find candidates with necessary digital skills (2024 report). |

Technological factors

Artificial intelligence is fundamentally reshaping the online education landscape, presenting significant opportunities for personalized student journeys, automated content development, and improved user engagement. For instance, AI-powered adaptive learning platforms can adjust curriculum pace and content based on individual student performance, a trend that saw significant investment in edtech AI solutions in 2024, with projections indicating continued growth through 2025.

2U can strategically harness AI to deliver customized learning pathways, optimize administrative processes, and foster more dynamic and effective educational interactions for both its students and institutional partners. This integration could lead to enhanced student retention and partner satisfaction, critical metrics for 2U's continued success in the competitive online learning market.

Continuous advancements in Learning Management Systems (LMS) are vital for 2U's success in delivering high-quality online education. Platforms are increasingly incorporating AI-powered features for personalized learning paths and automated feedback, alongside intuitive user interfaces that enhance engagement. For instance, by mid-2024, the global LMS market was projected to reach over $20 billion, with a significant portion driven by higher education and corporate training sectors, underscoring the demand for sophisticated technological solutions.

2U's technology platforms must actively integrate these cutting-edge LMS functionalities to maintain a competitive edge. This includes supporting a wider array of course formats, from interactive simulations to virtual labs, and continuously improving the overall learning experience for students and instructors alike. The ability to adapt to new pedagogical approaches enabled by advanced LMS features directly impacts student retention and program effectiveness.

The widespread adoption of smartphones and tablets is fundamentally reshaping education delivery. By 2024, it's estimated that over 70% of internet traffic will originate from mobile devices, highlighting a critical need for educational platforms to be mobile-first. This trend directly impacts 2U, requiring its technological infrastructure to prioritize seamless, on-demand access to course materials and interactive features across a diverse range of mobile devices. Learners increasingly expect the flexibility to study anytime, anywhere, making robust mobile accessibility a non-negotiable component of 2U's platform strategy to maintain competitiveness and learner engagement.

Cybersecurity and Data Protection Technologies

Cybersecurity and data protection are critical for 2U, given the sensitive nature of student information. The company must continuously invest in advanced security technologies to safeguard user data and maintain trust, particularly as data privacy regulations become more stringent. For instance, the global cybersecurity market was valued at approximately $214 billion in 2023 and is projected to grow significantly, highlighting the importance of robust defenses for companies like 2U.

The evolving landscape of cyber threats necessitates ongoing investment in areas like encryption, access controls, and threat detection systems. Failure to adequately protect data can lead to severe reputational damage and financial penalties. In 2024, data breaches continued to be a major concern, with the average cost of a data breach reaching an all-time high of $4.45 million globally, according to IBM's 2024 Cost of a Data Breach Report.

- Investment in advanced encryption and tokenization to protect sensitive student and institutional data.

- Implementation of multi-factor authentication and granular access controls to prevent unauthorized access.

- Continuous monitoring and threat intelligence to proactively identify and mitigate potential cyber risks.

- Adherence to and exceeding global data privacy standards such as GDPR and CCPA, which impact how student data is collected, stored, and processed.

Virtual and Augmented Reality (VR/AR) in Education

Virtual and augmented reality (VR/AR) are increasingly being adopted in educational settings, promising more engaging and interactive learning. For instance, the global VR in education market was valued at approximately $2.5 billion in 2023 and is projected to grow significantly, with some estimates suggesting it could reach over $15 billion by 2028. This growth indicates a strong trend towards immersive educational experiences.

These technologies offer 2U opportunities to enhance its course offerings, particularly for subjects that benefit from practical simulation or visualization. Imagine medical students practicing complex procedures in a risk-free virtual environment or engineering students interacting with 3D models of machinery. This could lead to improved learning outcomes and skill development.

While VR/AR adoption in education is still developing, its potential impact is substantial. Companies are investing heavily in this space; for example, Meta Platforms invested billions in its Reality Labs division in 2023, signaling a commitment to the metaverse and its educational applications. For 2U, exploring these technologies could be a strategic move to differentiate its digital learning platforms and cater to evolving student expectations for experiential learning.

Key opportunities for 2U include:

- Developing immersive VR/AR modules for vocational training and skill-based courses.

- Integrating AR elements into existing online courses to provide interactive 3D visualizations and simulations.

- Partnering with VR/AR content creators to expand the library of experiential learning resources.

- Leveraging VR/AR for remote lab experiences and virtual field trips, bridging geographical barriers.

Technological advancements, particularly in artificial intelligence and learning management systems, are critical drivers for 2U's future. AI-powered adaptive learning, which saw substantial investment in 2024, allows for personalized student experiences, a trend expected to continue through 2025. Similarly, the global LMS market, projected to exceed $20 billion by mid-2024, emphasizes the need for sophisticated platforms with AI features and intuitive interfaces to maintain engagement and improve learning outcomes.

The increasing reliance on mobile devices for internet access, estimated to be over 70% by 2024, necessitates a mobile-first approach for 2U's platforms, ensuring seamless access to course materials. Furthermore, robust cybersecurity is paramount, with the global market valued at approximately $214 billion in 2023, to protect sensitive data and maintain trust amidst rising data breach costs, which reached an average of $4.45 million globally in 2024.

Emerging technologies like virtual and augmented reality (VR/AR) present significant opportunities for immersive learning experiences. The VR in education market, valued at $2.5 billion in 2023, is poised for substantial growth, potentially reaching over $15 billion by 2028. 2U can leverage these technologies to develop engaging vocational training modules and enhance existing courses with interactive simulations, differentiating its offerings and meeting evolving student expectations for experiential learning.

| Technology Area | 2024/2025 Relevance | Market Data/Projections | Impact on 2U |

|---|---|---|---|

| Artificial Intelligence (AI) | Personalized learning, content automation | Edtech AI investment grew significantly in 2024; continued growth projected for 2025. | Enhanced student journeys, operational efficiency. |

| Learning Management Systems (LMS) | AI features, intuitive interfaces | Global LMS market projected over $20 billion by mid-2024. | Improved engagement, competitive edge. |

| Mobile Technology | Mobile-first access | Over 70% of internet traffic from mobile devices by 2024. | Essential for on-demand learning and learner engagement. |

| Cybersecurity | Data protection, privacy | Global cybersecurity market ~$214 billion (2023); average data breach cost $4.45 million (2024). | Safeguarding data, maintaining trust, mitigating financial/reputational risk. |

| VR/AR | Immersive learning | VR in education market ~$2.5 billion (2023); projected over $15 billion by 2028. | Differentiated course offerings, enhanced skill development. |

Legal factors

The increasing complexity of data privacy laws, such as the California Privacy Rights Act (CPRA) which took full effect in 2023, and ongoing updates to regulations like GDPR, directly affect how 2U handles student data. Compliance necessitates meticulous data processing agreements with partner universities, ensuring adherence to strict data handling protocols. Failure to comply can result in significant fines, with GDPR penalties reaching up to 4% of global annual revenue or €20 million, whichever is greater.

Accreditation is a critical legal and quality benchmark for higher education, directly impacting 2U's university partners and their online programs. Ensuring compliance with evolving standards from bodies like the Higher Learning Commission or the Council for Higher Education Accreditation is paramount. For instance, as of early 2024, many accreditors are refining guidelines for online program integrity and student support services, requiring 2U to adapt its technology and partner support to maintain program legitimacy and student satisfaction.

Consumer protection laws are critical for online education providers like 2U, dictating fair practices in marketing, enrollment, and student support. These regulations ensure transparency and prevent deceptive practices, safeguarding students' rights and investments.

2U's extensive service offerings, which include crucial student support functions, must meticulously comply with these consumer protection mandates. For instance, the Higher Education Act in the United States, and similar legislation globally, sets standards for program quality, advertising, and student outcomes, directly impacting how 2U operates and communicates with its student base.

Failure to adhere to these laws can result in significant penalties, reputational damage, and loss of consumer trust. In 2023, the Federal Trade Commission (FTC) continued to emphasize enforcement actions against educational institutions for misleading advertising and unfulfilled promises, highlighting the ongoing scrutiny in this sector.

Intellectual Property Rights

Intellectual property is a significant consideration for 2U, especially given its model of partnering with universities to deliver online courses. The creation and ownership of course materials, instructional designs, and proprietary technology platforms are all subject to intellectual property laws. Navigating these rights is crucial for legal compliance and safeguarding the interests of 2U and its university partners.

For instance, in 2023, 2U's revenue was $1.1 billion, a figure underpinned by agreements that clearly define IP ownership for the content developed. University partnerships often involve complex licensing agreements, where the university typically retains ownership of the core intellectual property of its academic content, while 2U holds rights to the technology and delivery platform. This division ensures that universities can leverage their established academic reputation while 2U profits from its technological expertise.

- Ownership Clarity: Agreements with over 80 university partners in 2024 stipulate clear ownership of course content, often granting universities primary IP rights.

- Licensing Models: 2U operates under various licensing agreements, some of which involve revenue-sharing based on the usage and success of jointly developed online programs.

- Platform Protection: 2U actively protects its proprietary technology and platform innovations through patents and copyrights, a key asset in its business model.

- Content Infringement: The company must monitor for and address potential infringement of intellectual property rights related to its extensive online course catalog.

Labor Laws for Online Educators

Labor laws significantly shape the landscape for online educators, impacting 2U's operational model. Regulations concerning employment status, such as distinguishing between employees and independent contractors, directly affect how 2U structures its partnerships with instructors and its own workforce. For instance, in 2024, the Department of Labor's focus on worker classification under the Fair Labor Standards Act continues to be a key consideration, potentially influencing how 2U compensates its online faculty and the benefits they are entitled to.

Changes in labor regulations, including potential minimum wage adjustments or new requirements for remote work conditions, can directly impact 2U's operational costs and the financial terms of its agreements with university partners. For example, as of early 2025, several states are reviewing or have enacted legislation pertaining to remote worker rights and benefits, which could necessitate adjustments to 2U's compensation models or support structures for its educators.

- Employment Status: Clarifying whether online educators are classified as employees or independent contractors impacts payroll taxes, benefits, and legal protections.

- Compensation Standards: Adherence to minimum wage laws, overtime rules, and fair pay practices is crucial for all educators engaged by 2U.

- Working Conditions: Regulations may evolve regarding expectations for remote work environments, including data security and ergonomic support for educators.

- Unionization Efforts: The potential for unionization among online educators could lead to collective bargaining agreements that alter compensation, benefits, and working terms.

Government regulations and legal frameworks significantly influence 2U's operations, particularly concerning educational standards, data privacy, and consumer protection. Compliance with evolving laws is essential for maintaining program integrity and avoiding penalties. For instance, the U.S. Department of Education's regulations on online learning, including gainful employment rules and program integrity standards, directly impact 2U's university partners and the programs they offer. As of 2024, ongoing discussions around student data privacy and cybersecurity continue to shape compliance requirements for educational technology providers.

The legal landscape also encompasses intellectual property rights, critical for 2U's business model which relies on licensing university content and proprietary technology. Clear agreements are necessary to define ownership and usage rights, safeguarding both 2U and its partners. Furthermore, labor laws, especially concerning the classification of online instructors and fair compensation practices, are vital considerations for 2U's operational structure and cost management. The company must navigate these legal complexities to ensure ethical operations and sustained growth.

| Legal Area | Key Considerations for 2U | Relevant Data/Trends (2023-2025) |

|---|---|---|

| Data Privacy | Compliance with GDPR, CPRA, and other data protection laws. | GDPR fines can reach 4% of global annual revenue. CPRA fully effective 2023. |

| Accreditation | Maintaining program legitimacy through adherence to accreditor standards. | Accreditors refining online program integrity guidelines (early 2024). |

| Consumer Protection | Ensuring fair marketing, enrollment, and student support practices. | FTC enforcement actions against misleading advertising continue (2023). |

| Intellectual Property | Defining ownership of course content and platform technology. | 2U revenue $1.1 billion (2023), underpinned by IP agreements. Over 80 university partners (2024). |

| Labor Laws | Worker classification, compensation, and remote work conditions. | Focus on FLSA worker classification (2024). State reviews of remote worker rights (early 2025). |

Environmental factors

The increasing focus on environmental sustainability is shaping how educational technology companies like 2U operate. This trend means 2U may need to highlight its commitment to green practices, even within its digital-first model. For instance, while online learning reduces the need for physical campuses, 2U could be expected to demonstrate sustainability in its data centers and overall business operations.

While 2U's online model inherently reduces the carbon footprint associated with physical campuses and student commuting, the environmental impact of its digital infrastructure is a growing concern. Data centers and cloud services powering these platforms consume significant energy. For instance, global data center energy consumption was estimated to be around 1.5% of total global electricity consumption in 2023, a figure projected to rise with increased digital activity.

Consequently, 2U may face increasing pressure from stakeholders, including investors and regulators, to adopt more energy-efficient technologies and sustainable practices. This could involve investing in renewable energy sources for its data centers or optimizing cloud service usage to minimize its carbon footprint, aligning with broader corporate environmental, social, and governance (ESG) expectations prevalent in 2024 and 2025.

Societal and workforce demand for education in environmental studies and sustainability is surging. This presents a significant opportunity for 2U to broaden its program portfolio through university partnerships, introducing more courses and degrees focused on climate action, environmental science, and sustainable development.

The global green economy is projected to grow substantially, with market research indicating a compound annual growth rate of over 20% for sustainability-focused industries between 2024 and 2030. This increasing demand directly translates to a greater need for skilled professionals, making 2U's expansion into these areas a strategically sound move to capture a growing market segment.

Resource Consumption (Energy, Paper)

Online learning platforms like 2U inherently minimize the consumption of physical resources such as paper and the energy demands associated with traditional, physical classrooms. This shift towards digital delivery significantly lowers the carbon footprint associated with educational delivery.

2U's business model, focused on providing online programs for universities, directly contributes to a reduced environmental impact when contrasted with the substantial resource consumption of physical campuses. This eco-friendly aspect can be a notable positive environmental factor for the company.

- Reduced Paper Usage: Digital course materials and submissions eliminate the need for printing, saving trees and reducing waste.

- Lower Energy Footprint: Eliminating physical classrooms reduces electricity consumption for lighting, heating, cooling, and maintenance of large buildings.

- Sustainable Operations: 2U's digital-first approach aligns with growing global demand for sustainable business practices.

- Potential for Carbon Offsetting: As 2U grows, it can invest in carbon offsetting programs to further mitigate its environmental impact.

Climate Change and Disaster Preparedness

Climate change is increasingly impacting educational delivery, with extreme weather events disrupting physical campuses and traditional learning. This makes the flexible, online model offered by companies like 2U particularly valuable. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that in 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters, highlighting the fragility of fixed infrastructure.

2U's platform is inherently resilient to geographical disruptions caused by climate-related events. This capability ensures continuity of learning for students, regardless of whether their physical location is affected by natural disasters. The company's focus on digital learning environments provides a stable educational pathway when physical access is compromised.

The growing emphasis on sustainability and climate resilience also influences institutional partnerships. Universities are increasingly seeking educational technology providers that can support their own environmental, social, and governance (ESG) goals. 2U's digital-first approach aligns with this trend, offering a lower carbon footprint compared to traditional, in-person education models.

- Increased Frequency of Climate Events: 2023 saw a record number of billion-dollar weather and climate disasters in the U.S., underscoring the need for resilient educational solutions.

- Online Learning Resilience: 2U's digital platform offers uninterrupted education, a significant advantage as climate change impacts physical access to learning.

- Institutional ESG Alignment: Universities are prioritizing partners that support their sustainability initiatives, favoring digital solutions like 2U's.

The increasing focus on environmental sustainability and climate action presents both challenges and opportunities for 2U. While its digital model inherently reduces the carbon footprint of education delivery, the energy consumption of its digital infrastructure is a key consideration. For instance, global data center energy consumption was around 1.5% of total global electricity consumption in 2023, a figure expected to grow.

Stakeholders, including investors and regulators, are increasingly scrutinizing companies' environmental, social, and governance (ESG) performance. 2U may face pressure to invest in renewable energy for its data centers or optimize cloud usage to meet these expectations. The surge in demand for education in environmental studies and sustainability also offers a market expansion opportunity for 2U through new university partnerships.

The growing frequency of climate-related disruptions, such as the 28 billion-dollar weather and climate disasters in the U.S. in 2023, highlights the resilience of 2U's online learning model. This inherent stability in the face of physical disruptions is a significant advantage. Furthermore, universities are increasingly seeking partners that align with their own ESG goals, making 2U's digital-first approach attractive.

PESTLE Analysis Data Sources

Our PESTLE analysis for 2U is grounded in data from official government publications, reputable academic research, and leading industry analysis firms. We meticulously gather information on political stability, economic indicators, technological advancements, and social trends to provide a comprehensive overview.