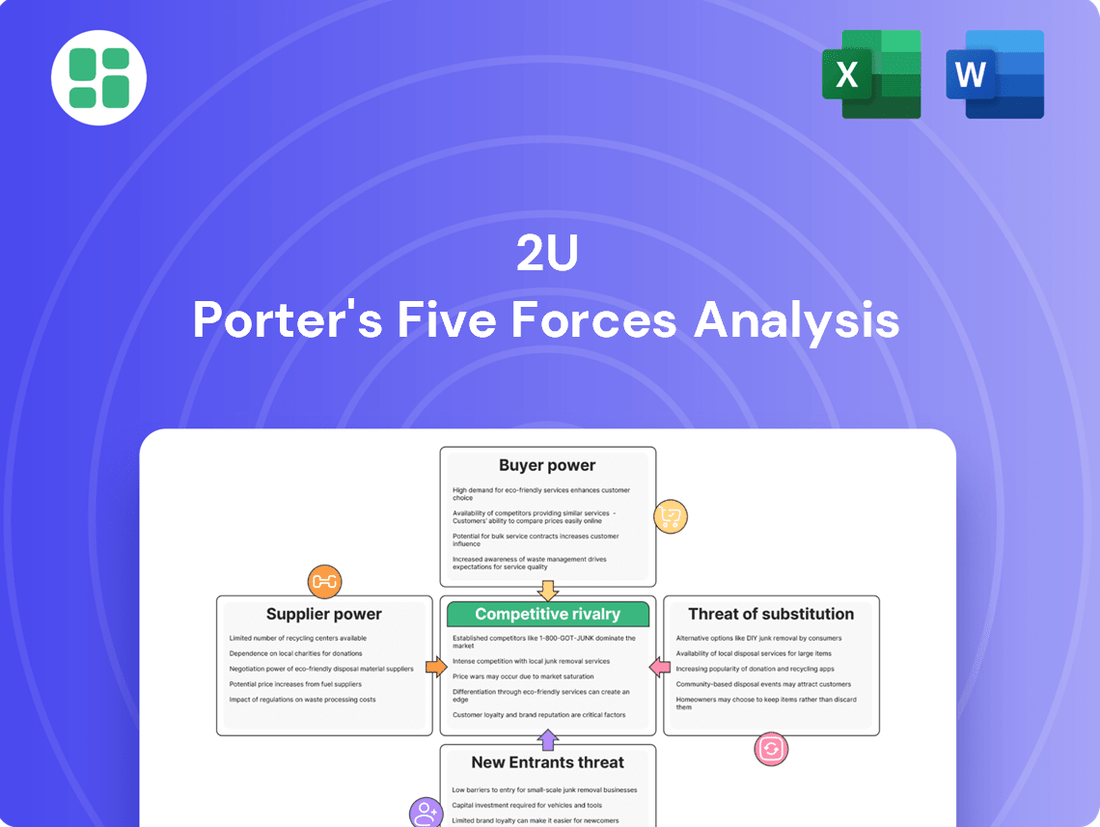

2U Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

2U Bundle

2U faces intense competition from established universities and emerging online learning platforms, impacting its pricing power and market share. The threat of substitutes, like free online courses and alternative credentialing, also looms large, demanding constant innovation.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore 2U’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Universities act as crucial content and accreditation providers for 2U, granting them considerable leverage. 2U's financial success is directly linked to these academic collaborations, as the prestige of a partner university significantly impacts student enrollment. This dependence enables universities to dictate terms and pricing structures that favor their institutions.

Technology providers, particularly major cloud service providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, wield considerable bargaining power over companies such as 2U. These giants dominate the cloud infrastructure market, with AWS alone holding an estimated 31% market share as of Q1 2024. This concentration means 2U has limited alternatives for its critical online platform needs, enabling these providers to exert pricing power.

The reliance on a few key technology vendors creates a risk of vendor lock-in for 2U. Switching cloud providers can be complex and costly, involving significant data migration and platform reconfigurations. This dependency can lead to increased operational expenses for 2U if providers raise prices or alter service terms, making the management of these relationships a key strategic consideration for cost control and operational continuity.

2U's reliance on marketing and recruitment vendors is a significant cost driver, directly influencing its profitability. These external partners are crucial for student acquisition, a core component of 2U's business model.

The company's substantial expenditure on these services means that vendor pricing and performance have a direct impact on profit margins. For instance, if vendor fees rise or their effectiveness diminishes, 2U's ability to generate profit from its programs is squeezed.

In 2023, marketing and enrollment services represented a considerable portion of 2U's operating expenses, highlighting the critical need for strategic vendor management and negotiation to maintain healthy profit margins and operational efficiency.

Instructional Design and Content Development Talent

While 2U develops its own instructional design capabilities, it also depends on external specialized talent and resources for creating high-quality online course content. The availability and cost of experienced instructional designers and subject matter experts (SMEs) directly impact 2U's capacity to offer a wide range of engaging programs. If this talent pool is highly specialized or limited, the bargaining power of these suppliers increases, potentially driving up costs for 2U.

The market for skilled instructional designers and SMEs is competitive. For instance, in 2023, the demand for edtech professionals, including instructional designers, saw continued growth, with salary ranges for experienced instructional designers often falling between $70,000 and $100,000 annually, depending on experience and specialization. This suggests a moderate to high bargaining power for these suppliers, especially those with niche expertise in emerging fields or advanced pedagogical techniques.

- Talent Scarcity: A shortage of highly specialized instructional designers or SMEs in critical subject areas can significantly empower suppliers.

- Expertise Value: The unique skills and experience of top-tier instructional designers and SMEs command higher compensation, increasing their bargaining leverage.

- Industry Demand: High demand for online course development across various sectors, including higher education and corporate training, strengthens the position of available talent.

- Resource Dependence: 2U's reliance on these external or specialized internal resources for content creation means suppliers have a degree of control over quality and cost.

Regulatory Bodies and Accreditation Agencies

While not traditional suppliers, regulatory bodies and accreditation agencies act as crucial gatekeepers, providing the legitimacy and compliance necessary for 2U's operations. Their evolving rules, for instance, on how online programs are recognized or how revenue can be shared, directly shape 2U's business model and program development. For example, shifts in accreditation standards or approval processes can require significant investment in program redesign or new compliance measures, impacting operational costs.

The bargaining power of these entities stems from their ability to grant or withhold essential approvals, directly influencing 2U's market access and reputation. In 2024, the landscape of online education regulation continued to be dynamic, with ongoing discussions around quality assurance and consumer protection potentially leading to new compliance burdens for providers like 2U.

- Regulatory Influence: Agencies dictate operational standards and program approval, impacting market entry and continued operation.

- Accreditation Requirements: Maintaining accreditation is vital for program credibility and student eligibility for financial aid, influencing 2U's curriculum and delivery.

- Compliance Costs: Adapting to new or changing regulations can incur significant financial and operational expenses for 2U.

Universities and technology providers are key suppliers for 2U, holding significant bargaining power. This leverage stems from 2U's deep reliance on their content, accreditation, and essential cloud infrastructure. For instance, AWS, a major cloud provider, held approximately 31% of the cloud infrastructure market share in Q1 2024, limiting 2U's alternatives and enabling pricing influence.

Marketing and recruitment vendors also exert considerable power due to 2U's substantial spending on student acquisition. In 2023, these services represented a significant portion of 2U's operating expenses, meaning vendor pricing directly impacts profit margins. Furthermore, specialized talent like instructional designers and subject matter experts, with demand for edtech professionals growing in 2023, can command higher rates, especially those with niche expertise.

| Supplier Type | Bargaining Power Driver | Impact on 2U | Example Data/Fact |

|---|---|---|---|

| Universities | Content & Accreditation Provider | Dictate terms, pricing; impact enrollment prestige | Prestige of partner university directly impacts student enrollment. |

| Technology Providers (Cloud) | Market Dominance, Limited Alternatives | Pricing power, risk of vendor lock-in | AWS held ~31% cloud market share in Q1 2024. |

| Marketing & Recruitment Vendors | Crucial for Student Acquisition | Directly impacts profitability, cost driver | Significant portion of 2U's 2023 operating expenses. |

| Specialized Talent (Instructional Designers, SMEs) | Scarcity of Niche Expertise | Increased costs for content creation | Demand for edtech professionals grew in 2023; salaries $70k-$100k for experienced designers. |

What is included in the product

This analysis unpacks the competitive forces impacting 2U, assessing the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the online education sector.

Instantly identify and neutralize competitive threats with a dynamic, interactive Porter's Five Forces model, allowing for rapid strategic adjustments.

Customers Bargaining Power

Universities, as 2U's main clients for managing online programs, hold substantial bargaining power. This is largely because the online program management market is quite competitive. In 2024, this market was valued at $5.1 billion and is expected to keep growing, yet new university partnerships have slowed down considerably, which gives universities more say in negotiations.

The trend of universities preferring fee-for-service agreements over revenue-sharing deals further highlights their growing strength in dictating partnership terms. This shift allows them to negotiate more favorable conditions, directly impacting 2U's revenue and operational flexibility.

Students, as the end-consumers of online education, hold significant bargaining power. Their decision to enroll in a program directly impacts 2U's revenue streams. The vastness of the global e-learning market, projected to exceed $325 billion in 2024, provides students with a wide array of choices, intensifying this power.

Factors such as tuition fees, the perceived quality of education, and readily available data on graduation rates and career outcomes heavily influence student enrollment decisions. When students perceive better value or outcomes elsewhere, they can easily shift their enrollment away from 2U's offerings.

For 2U's alternative credential segment, employers and industry partners are key customers, directly influencing program development and pricing through their demand for specific skills. As corporate learning budgets grew, reaching an estimated $350 billion globally in 2024, these partners gained significant leverage in shaping the curriculum to align with evolving workforce requirements.

Increased Internal University Capabilities

Universities are increasingly building their own expertise in online education delivery and administration. This internal development means they are less dependent on external partners like 2U for these services, giving them more leverage.

This growing self-sufficiency allows institutions to negotiate better terms or even bypass OPM providers altogether for certain functions. For instance, a university might choose to manage its own student recruitment or curriculum design, rather than outsourcing these to a company.

Furthermore, a reported decline in the enthusiasm for new OPM collaborations among universities in 2024 signals a shift. This trend amplifies the bargaining power of these institutions, as they can opt for more flexible, unbundled service models or bring operations in-house.

- Growing Insourcing Trend: Universities are investing in internal teams for online program management.

- Reduced Reliance on OPMs: Institutions are less dependent on full-service providers for core functions.

- Waning Partnership Appetite: A reported decrease in new OPM deals in 2024 indicates a preference for alternative models.

- Negotiating Power: Universities can leverage their enhanced capabilities to secure more favorable contract terms or unbundled services.

Availability of Multiple OPM Providers

The online program management (OPM) market, while featuring some large players, is quite fragmented. Globally, there are over 60 OPM providers, giving universities a wide array of options when seeking a partner. This abundance of choice directly enhances the bargaining power of universities.

With more than 60 OPMs available, universities can actively compare offerings and negotiate terms. This competitive landscape allows institutions to secure more favorable pricing and demand higher service quality from their chosen OPM partners. For instance, in 2023, some universities reported achieving cost reductions of up to 15% on their OPM contracts due to competitive bidding processes.

- Market Fragmentation: Over 60 OPM providers globally offer universities extensive choice.

- Negotiating Leverage: Increased competition empowers universities to negotiate better pricing and service terms.

- Cost Optimization: Universities can leverage this market dynamic to reduce OPM partnership costs, potentially by double-digit percentages.

- Service Quality Improvement: The need to attract and retain university clients incentivizes OPMs to offer superior services.

Universities, as 2U's primary clients, wield considerable bargaining power due to the competitive nature of the online program management (OPM) market, valued at $5.1 billion in 2024. This power is amplified as universities increasingly favor fee-for-service models over revenue sharing, allowing them to dictate more favorable terms.

Students also exert significant influence, their enrollment decisions directly impacting 2U's revenue in the vast e-learning market, projected to exceed $325 billion in 2024. Factors like tuition, perceived quality, and career outcomes heavily sway student choices, enabling them to easily shift to alternatives offering better value.

Employers and industry partners in 2U's alternative credential segment hold sway over curriculum and pricing, especially as corporate learning budgets reached an estimated $350 billion globally in 2024, demanding specific skill alignment.

| Client Segment | Source of Bargaining Power | Key Influencing Factors (2024) | Impact on 2U |

|---|---|---|---|

| Universities | Market competition, shift to fee-for-service | OPM market growth ($5.1B), university insourcing | Negotiating more favorable partnership terms |

| Students | Abundant e-learning choices, value perception | E-learning market size (>$325B), tuition, career outcomes | Directly impacts enrollment and revenue |

| Employers/Industry Partners | Demand for specific skills, corporate learning budgets | Corporate learning budget size (~$350B) | Shapes program development and pricing |

Preview the Actual Deliverable

2U Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for 2U, offering a detailed examination of industry competition and strategic positioning. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and immediate access to this professionally crafted report.

Rivalry Among Competitors

The Online Program Management (OPM) market is a crowded space with many players vying for partnerships. Companies like Pearson and Wiley are established competitors, alongside specialized OPM providers and even universities building their own online offerings. This intense rivalry means providers must constantly innovate to stand out.

While 2U was once a dominant force, the OPM landscape is evolving rapidly. There's a noticeable decrease in new traditional revenue-share agreements, with a clear pivot towards fee-for-service arrangements. This shift reflects changing market dynamics and university preferences.

The landscape for new Online Program Management (OPM) partnerships has become considerably more challenging. In 2024, new OPM partnership activity in the United States saw a steep decline of 42.1% when measured against 2023 figures. This contraction brings the number of new deals down to levels last observed around 2016 and 2017.

This significant drop in new opportunities means that the competition among established OPM providers for university clients has intensified. With fewer new partnerships being formed, existing OPMs are now vying for a smaller, more competitive market share.

The competitive landscape for Online Program Management (OPM) is intensifying as the industry pivots towards fee-for-service models. In 2024, these arrangements now account for more than half of all new contracts, eclipsing the previously dominant revenue-share agreements.

This significant shift presents a direct challenge to 2U's established business model, which has historically relied on revenue sharing. The move towards fee-for-service necessitates an adaptation to maintain competitiveness, potentially impacting 2U's per-program revenue streams and overall long-term growth trajectory.

Financial Challenges and Restructuring of Key Players

The competitive rivalry in the Online Program Management (OPM) sector is intensified by the financial struggles of key players. 2U, a major OPM provider, filed for Chapter 11 bankruptcy in July 2024. This move was aimed at significantly reducing its debt burden, which stood at approximately $4.5 billion as of early 2024, and securing new capital.

This restructuring underscores the intense financial pressures within the industry. Such instability can influence how competitors approach market share and pricing strategies, potentially leading to more aggressive tactics. Furthermore, it raises questions for university partners regarding the long-term stability and reliability of OPM collaborations.

- 2U's Chapter 11 filing in July 2024

- Pre-filing debt exceeding $4.5 billion

- Impact on university confidence in OPM partnerships

- Potential for aggressive competitor strategies

Broader Online Education Ecosystem

2U faces intense competition not just from other Online Program Management (OPM) providers but from a much wider online education ecosystem. This includes traditional universities increasingly building their own online offerings, corporate training solutions, and direct-to-consumer platforms like Coursera and edX (which 2U acquired). This broad competition means 2U must constantly vie for both university partnerships and student attention.

The competitive landscape is further amplified by the sheer volume of online courses and programs available. For instance, in 2024, platforms like Coursera alone offered over 25,000 courses, and the broader market continues to expand. This saturation means 2U’s university partners are also competing against a vast array of alternatives for student enrollment, putting pressure on program quality and marketing effectiveness.

- University-led online programs: Many institutions now manage their own online degrees and certificates, bypassing OPMs.

- Corporate training platforms: Companies like LinkedIn Learning and Udemy offer skills-based training that can compete with university-provided professional development.

- Direct-to-consumer course providers: Platforms such as Coursera, edX, and Udacity provide a wide range of courses, often at lower price points, directly to learners.

- Emerging educational technologies: Innovations in AI-powered learning and immersive experiences could further disrupt traditional online program delivery models.

Competitive rivalry within the Online Program Management (OPM) sector is fierce, exacerbated by a significant downturn in new partnership opportunities. In 2024, new OPM deals in the U.S. dropped by 42.1% compared to 2023, returning to 2016-2017 levels. This contraction intensifies competition among existing providers for a shrinking pool of university clients.

The industry's shift towards fee-for-service models, now comprising over half of new contracts in 2024, challenges OPMs like 2U that historically relied on revenue sharing. This pivot necessitates strategic adaptation to maintain competitiveness and secure revenue streams.

2U's financial distress, including its July 2024 Chapter 11 bankruptcy filing to address approximately $4.5 billion in debt, highlights the intense pressures. This instability can trigger aggressive pricing and market share strategies from rivals and may erode university confidence in OPM partnerships.

| Key Competitors/Factors | 2024 Market Dynamics | Impact on Rivalry |

| Established OPM Providers | Focus on existing university relationships; increased competition for new deals. | Higher pressure to differentiate and offer attractive terms. |

| University In-House Programs | Growing trend of universities developing their own online capabilities. | Reduces the addressable market for OPMs. |

| Direct-to-Consumer Platforms | Platforms like Coursera offer extensive course catalogs. | Broadens the competitive set for student enrollment and program appeal. |

| Shift to Fee-for-Service | Dominates new contracts in 2024, moving away from revenue share. | Challenges 2U's traditional revenue model and requires adaptation. |

| 2U's Financial Health | Chapter 11 filing in July 2024 due to significant debt. | Potentially creates opportunities for competitors through market disruption and partner acquisition. |

SSubstitutes Threaten

Universities are increasingly bringing their online programs in-house, acting as a direct substitute for companies like 2U. This shift means institutions are managing their own digital learning platforms and course development, reducing reliance on third-party Online Program Management (OPM) providers. For example, in 2023, a significant number of universities reported increased investment in their internal digital learning infrastructure, aiming for greater control and potentially lower costs.

The proliferation of micro-credentials, bootcamps, and alternative learning pathways presents a significant threat of substitutes to traditional educational models. Companies like Google and IBM are offering specialized certificates, often completed in months rather than years, directly addressing specific industry skill gaps. For instance, Google's IT Support Professional Certificate, launched in 2018, has seen widespread adoption, demonstrating a demand for shorter, skills-based training.

These alternatives, frequently available through platforms such as Coursera and Udacity, are often priced considerably lower than traditional degrees, making them attractive to career changers and upskillers. The perceived speed to market and direct relevance to employment needs mean learners may bypass longer, more expensive degree programs entirely, impacting enrollment in traditional higher education.

The proliferation of free or low-cost online educational resources, like Open Educational Resources (OERs) and Massive Open Online Courses (MOOCs), presents a significant threat of substitutes for 2U's paid programs. Even with 2U's acquisition of edX, the fundamental availability of these alternative learning pathways remains. For instance, platforms like Coursera, edX (prior to full integration), and others offer a vast array of courses, many at no cost or for a nominal fee, directly competing for learners seeking skills development.

In-Person Education and Hybrid Models

The resurgence of in-person education and the growing popularity of hybrid learning models present a significant threat of substitutes for 2U’s fully online offerings. Post-pandemic, many students and institutions are leaning back towards traditional campus experiences or a blend of online and physical interaction, potentially diminishing the appeal of entirely digital programs. This shift could lead to a decrease in demand for 2U’s services as learners opt for more traditional or mixed educational formats.

For instance, data from the National Center for Education Statistics indicated a notable increase in on-campus enrollment for the Fall 2023 semester compared to previous years, suggesting a preference for physical learning environments. Furthermore, a 2024 survey by Eduventures found that over 60% of prospective students expressed interest in hybrid program options, highlighting a clear market preference for blended learning over purely online delivery.

- Increased demand for hybrid programs: Over 60% of prospective students showed interest in hybrid learning in 2024.

- Return to in-person learning: Fall 2023 saw a significant uptick in on-campus enrollment.

- Student preference for blended experiences: Many learners value the combination of online flexibility and traditional campus interaction.

- Reduced demand for purely online solutions: Alternative learning models directly compete with 2U's core business.

Corporate Training and Professional Development Platforms

The threat of substitutes for 2U's offerings is significant, as companies are increasingly looking inward or to specialized providers for employee development. Many organizations are bolstering their internal training departments, creating custom learning experiences tailored to their specific needs. This trend allows for greater control over content and delivery, potentially reducing the reliance on external platforms like those offered by 2U.

Furthermore, a growing number of dedicated corporate learning platforms are emerging, providing specialized solutions that can directly compete with 2U's professional development and short course segments. These platforms often focus on niche skill development or offer more flexible, modular learning paths. For instance, platforms like Coursera for Business and LinkedIn Learning have expanded their corporate offerings, providing businesses with a wide array of upskilling options. In 2023, the global corporate e-learning market was valued at approximately $25.7 billion, with projections indicating continued growth, highlighting the competitive landscape.

- Internal Training Programs: Companies are investing in in-house learning and development departments to create bespoke training solutions.

- Specialized Corporate Learning Platforms: Dedicated providers offer tailored upskilling and reskilling programs for businesses.

- Online Learning Market Growth: The global corporate e-learning market, valued at $25.7 billion in 2023, demonstrates a strong demand for alternative development solutions.

- Competitor Offerings: Platforms like Coursera for Business and LinkedIn Learning provide direct substitutes for 2U's professional development courses.

The threat of substitutes for 2U is substantial, with numerous alternative educational pathways emerging. These range from universities bringing online programs in-house to the rise of micro-credentials and corporate learning platforms. For instance, the global corporate e-learning market was valued at approximately $25.7 billion in 2023, indicating a robust demand for alternatives to traditional degree programs.

The increasing availability of free or low-cost online resources, such as MOOCs and Open Educational Resources, directly competes with 2U's paid offerings. Furthermore, a growing preference for hybrid learning models, with over 60% of prospective students expressing interest in 2024, and a return to in-person education, as seen in the Fall 2023 enrollment increases, further dilute the market for purely online solutions.

| Substitute Category | Examples | Impact on 2U |

|---|---|---|

| In-house University Programs | Universities developing their own digital learning platforms. | Reduced reliance on OPM providers. |

| Alternative Learning Pathways | Google IT Support Certificate, Coursera, Udacity bootcamps. | Offers faster, cheaper skills-based training. |

| Free/Low-Cost Online Resources | MOOCs, Open Educational Resources (OERs). | Provides accessible learning content, potentially bypassing paid programs. |

| Hybrid and In-Person Learning | Increased on-campus enrollment (Fall 2023), student preference for blended models (60%+ interest in 2024). | Decreased demand for fully online programs. |

| Corporate Learning Platforms | Coursera for Business, LinkedIn Learning, internal training departments. | Direct competition for professional development and upskilling. |

Entrants Threaten

The digital shift in education has significantly lowered traditional barriers, allowing new online 'mega-universities' and niche program providers to enter the market. This digital infrastructure reduces the substantial capital investment previously required for physical campuses and extensive faculty, making it easier for innovative players to emerge and compete.

The shift towards fee-for-service (FFS) models in the Online Program Management (OPM) market significantly reduces the threat of new entrants. Unlike traditional revenue-share agreements that demand substantial upfront capital from OPM providers, FFS structures lower these barriers. This makes it more accessible for smaller, specialized firms to enter by offering specific, unbundled services without the heavy initial investment.

New entrants can carve out success by focusing on specific niche markets within online education, offering highly specialized programs that larger, more generalized providers might overlook. This strategy allows them to sidestep direct confrontation with established players and build a customer base by catering to unmet needs. For instance, platforms focusing exclusively on advanced AI certifications or specialized healthcare compliance training can attract dedicated learners and professionals.

Regulatory Scrutiny on Revenue-Share Models

Increased regulatory scrutiny on revenue-share models, particularly in the online education sector, presents a significant threat of new entrants. Proposed changes to distance learning guidelines in 2024 and 2025, especially those targeting revenue-sharing arrangements, aim to create a more equitable environment for emerging players. For instance, the U.S. Department of Education's ongoing review of third-party servicer regulations could impact existing partnerships and open doors for innovative approaches.

If the regulatory landscape shifts to disfavor traditional Online Program Management (OPM) models, it could significantly lower barriers to entry for new competitors. This regulatory evolution might encourage the development of alternative business models that are less reliant on deep revenue-sharing agreements, thereby attracting new companies to the market. The potential for new entrants to offer specialized or more flexible partnership structures could disrupt the established order.

- Regulatory Uncertainty: Upcoming regulations in 2024-2025 could redefine revenue-share limitations, potentially benefiting new entrants.

- Leveling the Playing Field: Stricter rules on existing OPM models may reduce competitive advantages for established firms, inviting new players.

- Market Opportunity: A shift away from traditional revenue-share could spur innovation, creating space for novel business models and new entrants.

Brand Reputation and Established University Partnerships as Barriers

Even though the digital landscape has made it easier to enter the online education market, new competitors still struggle to establish the kind of brand reputation that 2U has cultivated. This is a major hurdle because 2U's success is built on its strong relationships with prestigious, non-profit universities. These established partnerships are not easily replicated.

Securing and maintaining these partnerships requires a proven track record of delivering high-quality online programs and a deep understanding of university needs. New entrants often lack this history and the trust that comes with it, making it difficult to attract top-tier university clients who are hesitant to risk their brand reputation with unproven providers. For instance, 2U partners with over 200 universities globally, a testament to its established credibility.

- Brand Reputation: 2U has invested heavily in building a trusted brand synonymous with quality online education, making it difficult for newcomers to gain recognition.

- University Partnerships: Access to and retention of partnerships with elite, non-profit universities are a significant barrier, as these institutions are selective about their online program providers.

- Track Record: 2U's long history and demonstrated success in managing and growing online programs provide a competitive advantage that new entrants cannot easily overcome.

The threat of new entrants into the online education sector, particularly concerning Online Program Management (OPM) services, is influenced by several factors. While digital transformation has lowered initial capital requirements, making entry more feasible, established players like 2U benefit from significant brand equity and deep-rooted university partnerships, which are difficult for newcomers to replicate. Regulatory shifts, however, could potentially level the playing field.

| Factor | Impact on New Entrants | Example/Data Point |

|---|---|---|

| Digitalization | Lowers capital barriers, enabling easier market entry. | Reduced need for physical infrastructure compared to traditional universities. |

| Brand Reputation & Partnerships | Significant barrier; difficult to replicate established trust and relationships. | 2U partners with over 200 universities globally, demonstrating established credibility. |

| Regulatory Landscape (2024-2025) | Potential to lower barriers if regulations disfavor traditional OPM models. | U.S. Department of Education's review of third-party servicer regulations could impact existing partnerships. |

| Niche Market Focus | Opportunity for specialized providers to gain traction. | Platforms focusing on AI certifications or specialized healthcare compliance training. |

Porter's Five Forces Analysis Data Sources

Our analysis leverages data from 2U's investor relations website, SEC filings, and annual reports to understand its financial health and strategic positioning. We also incorporate industry reports from reputable sources like EDUCAUSE and market intelligence from firms specializing in higher education technology.