2U Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

2U Bundle

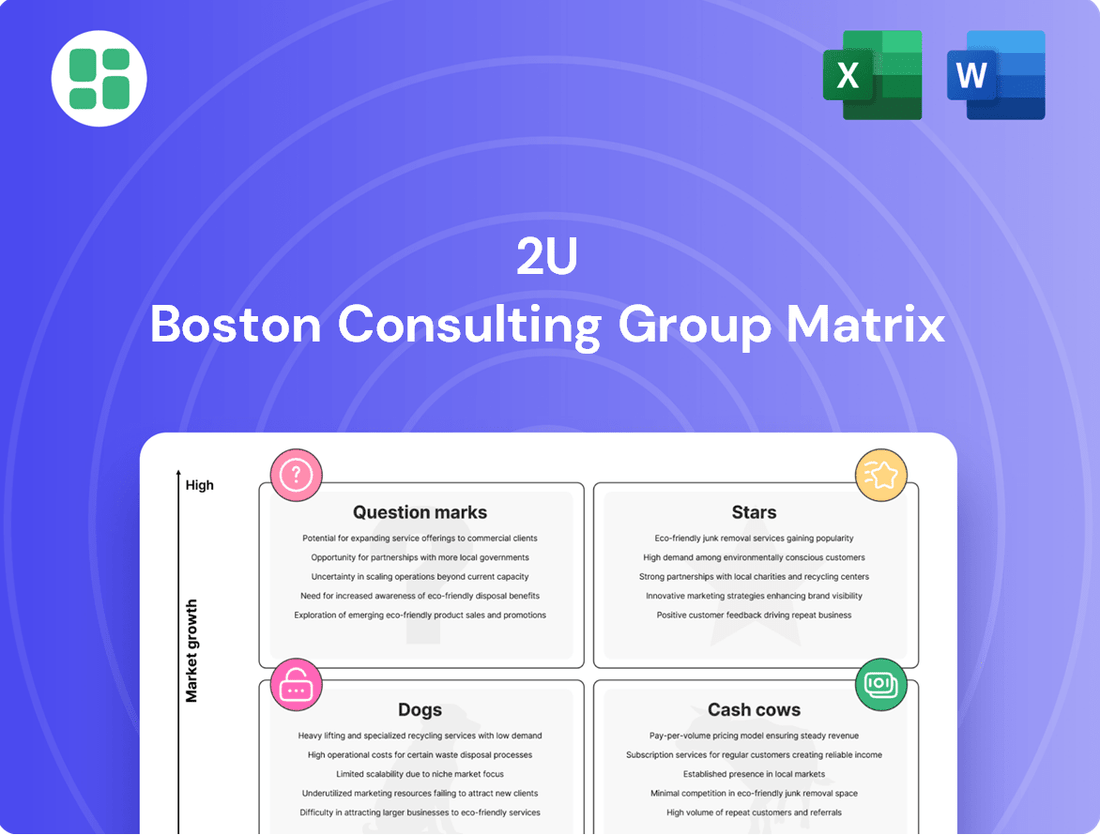

This glimpse into the BCG Matrix highlights the critical strategic positioning of a company's product portfolio. Understanding whether products are Stars, Cash Cows, Dogs, or Question Marks is fundamental to informed decision-making. Purchase the full BCG Matrix for a comprehensive analysis, actionable insights, and a clear roadmap to optimizing your business strategy and resource allocation.

Stars

2U's edX platform is making strides in AI-powered learning with tools like edX Xpert, an AI tutor, and a ChatGPT Plugin. These innovations are aimed at improving how students find and engage with educational content, offering immediate assistance. This positions 2U in a rapidly expanding market where AI is a crucial factor for success.

The company's commitment to AI is evident in its offering of over 450 programs featuring AI-related content. Notably, they provide an online master's degree in AI priced at $10,000, showcasing a substantial investment and strategic focus on this burgeoning field.

Innovative Technical Microcredentials represent a strategic shift for 2U, moving towards specialized, shorter-form learning experiences. This pivot is designed to tap into the growing demand for skills in areas like artificial intelligence and data science, which are critical for today's workforce.

This focus on microcredentials aligns with market trends showing increased learner interest in targeted, career-focused education. For instance, the global online education market, which includes microcredentials, was projected to reach over $370 billion by 2026, indicating a substantial opportunity for 2U's new direction.

2U is strategically expanding its flexible degree partnerships, aiming to launch at least 80 new degrees in 2024. This aggressive growth is fueled by their 'flex' partnership model, designed to meet the increasing demand for adaptable and career-focused online education.

Examples like the University of Birmingham's new offerings in Digital Media & Global Communication and Strategic Marketing Practice highlight 2U's focus on high-demand fields. This expansion, involving both new and existing university clients, positions 2U to capture significant market share in the evolving higher education landscape.

Executive Education Offerings

The executive education segment is a bright spot, demonstrating robust growth. In the first quarter of 2024, revenue climbed by 11%, and full-time equivalent enrollments saw a significant 32% surge. This performance underscores a strong demand for advanced professional development and reskilling opportunities.

2U's success in attracting and retaining learners in this competitive market highlights a key strength.

- Revenue Growth: Executive education revenue increased by 11% in Q1 2024.

- Enrollment Surge: Full-time equivalent enrollments grew by 32% in Q1 2024.

- Market Demand: Strong appetite for professional development and upskilling programs.

- Competitive Advantage: 2U's ability to attract and retain learners suggests ongoing expansion potential.

Strategic Post-Bankruptcy Reinvestment

Following its successful financial restructuring and emergence as a private entity in September 2024, 2U is poised for a strategic reinvestment phase. This transition has fortified its balance sheet, injecting fresh capital to fuel innovation and expansion. The company plans to leverage this stronger financial footing to enhance its educational platforms and services.

- Strengthened Balance Sheet: 2U's emergence as a private company in September 2024 signifies a clean slate, with restructured debt and new equity capital.

- Focus on Innovation: The company intends to allocate capital towards developing new programs and improving existing offerings to meet evolving market demands.

- Enhanced Service Delivery: Investments are planned to upgrade student support services and technology infrastructure, aiming for a superior learner experience.

- Sustainable Growth Trajectory: The post-restructuring strategy prioritizes long-term viability and profitable growth, supported by a more manageable capital structure.

Stars, in the context of the BCG Matrix, represent business units or products with high growth potential and a significant market share. For 2U, its executive education segment clearly fits this description. The robust 11% revenue growth and a striking 32% increase in full-time equivalent enrollments in Q1 2024 highlight its strong performance and demand in a growing market.

What is included in the product

Strategic guidance on investing in Stars, milking Cash Cows, developing Question Marks, and divesting Dogs.

The 2U BCG Matrix simplifies complex portfolio analysis, offering a clear visual roadmap to identify strategic priorities and allocate resources effectively.

Cash Cows

Established Online Graduate Degree Programs are a cornerstone of 2U's business, functioning as its cash cows. The company boasts partnerships with over 40 universities, many of which offer long-standing online graduate programs. These established programs, especially those with prestigious university affiliations, represent a mature market where 2U holds significant market share due to its established relationships and strong brand presence.

These mature programs are crucial for 2U's financial stability, providing consistent and predictable revenue streams. For instance, in 2023, 2U reported revenue of $1.03 billion, with a substantial portion likely stemming from these well-entrenched offerings. The high market share in these segments allows 2U to maintain profitability and invest in other areas of its business.

Core Online Program Management Services are 2U's cash cows. These foundational offerings, encompassing technology, instructional design, marketing, and student support for established degree programs, hold a significant market share. They are crucial for the continuous operation of many university online programs, generating consistent revenue from existing students.

2U's long-term university partnerships, often spanning a decade, form the bedrock of its cash cow segment. These agreements provide a stable revenue stream, even as the growth of individual degree programs within this category moderates. For instance, in 2023, 2U reported that its core partnerships continued to be a significant contributor to its financial stability.

Select Portfolio of Professional Certificates

Professional certificate programs that have reached a significant enrollment and market acceptance are likely serving as cash cows for educational institutions. These offerings, having moved beyond the initial growth phase, demand less ongoing investment in marketing and curriculum development. Their established reputation attracts a consistent flow of learners, generating predictable revenue streams.

In 2023, the online professional certificate market saw robust growth. For instance, Coursera reported that over 3,000 institutions globally offered its certificates, with a significant portion of revenue coming from these specialized programs. This indicates a strong demand for skill-specific credentials that offer a quicker path to career advancement compared to traditional degrees.

These mature certificate programs benefit from economies of scale. The content is already developed and refined, and the marketing channels are well-established. This allows for higher profit margins as the incremental cost of serving each new student is relatively low. For example, many universities now highlight their professional certificates as key revenue drivers, often with completion rates exceeding 70% for popular programs.

- Mature Market Position: Established certificate programs benefit from brand recognition and a proven track record.

- Reduced Investment Needs: Lower ongoing costs for marketing and development compared to new or star products.

- Consistent Revenue: A stable and predictable income stream from a loyal or consistently attracted learner base.

- Profitability: Higher profit margins due to economies of scale and efficient operations.

Revenue from Existing Student Cohorts

The revenue generated from existing student cohorts represents a significant Cash Cow for 2U. The company's established presence in graduate degree programs and executive education courses provides a stable and predictable income stream.

As of the first quarter of 2024, 2U reported that its existing programs continue to drive substantial tuition revenue. This ongoing enrollment and progression of students through their degrees and courses ensures a consistent cash flow, underpinning the Cash Cow status of these offerings.

- Existing Graduate Programs: Over 60,000 graduates have completed 2U-supported programs, demonstrating a proven track record and a large base of continuing revenue.

- Executive Education: More than 300,000 individuals have completed executive education courses, highlighting a broad reach and recurring revenue potential from this segment.

- Predictable Revenue: The ongoing progress of these enrolled students creates a highly predictable and often high-margin revenue stream for 2U.

Established online graduate degree programs are 2U's primary cash cows. These mature offerings, often with long-standing university partnerships, represent a stable revenue source. In 2023, 2U's revenue reached $1.03 billion, with a significant portion derived from these well-entrenched programs.

The company's core online program management services, which support these established degrees, are also cash cows. They benefit from high market share and consistent student enrollment, generating predictable income. These services require less incremental investment due to economies of scale and established marketing channels.

Professional certificate programs that have achieved market acceptance also function as cash cows. They generate consistent revenue with reduced marketing and development costs, contributing to higher profit margins. For example, in 2023, Coursera noted that over 3,000 institutions globally offered its certificates, indicating a strong and stable market for such credentials.

2U's existing student cohorts, particularly in graduate programs and executive education, are a significant cash cow. As of Q1 2024, these ongoing enrollments continue to drive substantial tuition revenue, ensuring a predictable cash flow. Over 60,000 graduates from 2U-supported programs and more than 300,000 executive education completers underscore this stable income base.

| Program Type | Market Position | Revenue Contribution | Investment Needs | Profitability |

| Established Online Graduate Degree Programs | Mature, High Market Share | Significant & Predictable | Low | High |

| Core Online Program Management Services | Mature, High Market Share | Consistent | Low | High |

| Mature Professional Certificate Programs | Established, Growing | Consistent & Growing | Moderate | Moderate to High |

| Existing Student Cohorts (Graduate & Executive Ed) | Stable, Loyal Base | High & Predictable | Very Low | Very High |

Preview = Final Product

2U BCG Matrix

The BCG Matrix document you are previewing is the identical, fully functional report you will receive immediately after your purchase. This means no watermarks, no demo content, and no hidden surprises – just a professionally formatted and analysis-ready tool designed to provide clear strategic insights for your business.

Dogs

Traditional coding boot camps, a segment acquired by 2U through Trilogy Education, were officially exited by 2U in December 2024. This move followed a substantial downturn in enrollments, especially within the coding boot camp sector. This decline directly impacted revenue streams, highlighting a struggle to maintain a competitive edge in a saturated market.

As part of its strategic portfolio management, 2U has been actively terminating degree programs that are either underperforming financially or no longer align with its core strategy. This approach, akin to the divestment phase of the BCG Matrix, allows 2U to shed underperforming assets and reallocate resources to more promising areas.

A notable example of this strategy in action was 2U's mutual decision to end its partnership for the majority of degree programs with the University of Southern California. While such exits can sometimes involve exit fees, they are primarily driven by the identification of programs with low market share and diminishing growth prospects, which ultimately become a drain on the company's resources.

Programs with low enrollment and high overhead are the Dogs in the 2U BCG Matrix. These are online programs that consistently struggle to attract enough students to cover their significant operational and marketing expenses. For instance, in 2024, 2U continued to face challenges with certain niche graduate programs where enrollment targets were not met, leading to a disproportionate cost per student.

These underperforming programs often drain company resources, generating operating losses and increasing accumulated deficits. They require more cash to sustain than they bring in, highlighting their poor return on investment. Such situations typically signal a need for strategic review, potentially leading to divestiture or discontinuation to free up capital for more promising ventures.

Legacy Acquisitions with Poor Integration

Legacy acquisitions, like Trilogy Education, often become problematic for companies. These past deals, which contributed to debt, sometimes included programs that were later discontinued. This happened because the acquired assets didn't capture the expected market share or drive anticipated growth.

These underperforming acquisitions can turn into cash traps. They struggle to adapt to evolving market demands, necessitating costly restructuring efforts. For instance, 2U's acquisition of Trilogy Education in 2019 for $230 million was intended to bolster its online program management (OPM) business. However, by 2023, the market for certain online programs shifted, impacting the expected returns from this integration.

- Trilogy Education Acquisition: 2U acquired Trilogy Education in 2019 for $230 million.

- Debt Burden: This acquisition, along with others, contributed to 2U's significant debt.

- Market Shifts: Certain online program offerings, part of these acquisitions, faced declining demand or were phased out due to market changes.

- Restructuring Needs: Poor integration and underperformance led to the need for significant restructuring of these legacy assets.

Discontinued International Initiatives

The company has been scaling back some of its international bootcamp partnerships. For instance, a venture in the United Kingdom faced scrutiny, with a government regulator reporting low completion rates among students enrolled in its online programs. This strategic withdrawal from underperforming international markets aligns with a cautious approach to global expansion.

These discontinued or underperforming international initiatives are classified as Dogs within the BCG Matrix. This designation signifies that these ventures exhibit both low market share and low market growth in their respective geographies or operational formats. For example, the UK bootcamp program, having failed to gain significant traction and meet expected performance benchmarks, clearly fits this category.

- United Kingdom Bootcamp: Low student completion rates reported by a government watchdog.

- Strategic Withdrawal: Company actively pulling out of underperforming international ventures.

- BCG Classification: These initiatives are categorized as Dogs due to low market share and low growth.

- Performance Expectations: Failure to meet expected performance metrics in these specific markets.

Dogs in 2U's portfolio represent programs or ventures with low market share and low growth prospects, often requiring significant cash investment without generating substantial returns. These are typically niche offerings or those facing intense competition and declining demand. For example, certain legacy online graduate programs that consistently missed enrollment targets in 2024 exemplify this category.

These underperforming assets, like the divested Trilogy Education bootcamps, drain financial resources and hinder overall company performance. 2U's strategic decision to exit these segments, such as the December 2024 sale of its bootcamps, reflects a move to cut losses and reallocate capital. This aligns with a broader strategy to prune the portfolio of its "Dogs".

The company's exit from underperforming international ventures, such as the UK bootcamp with low completion rates, also falls under the Dog classification. These ventures, characterized by low market penetration and minimal growth, are being strategically withdrawn to improve the company's financial health and focus on more promising areas.

These "Dogs" often result from acquisitions that didn't meet expectations or from market shifts that rendered certain programs obsolete. For instance, the 2019 acquisition of Trilogy Education for $230 million, while intended to expand 2U's reach, included programs that later struggled in a changing educational landscape.

| Category | Description | 2U Example | Financial Implication | Strategic Action |

| Dogs | Low Market Share, Low Growth | Underperforming niche graduate programs, exited bootcamps | Cash drain, operating losses | Divestiture, discontinuation |

| Trilogy Bootcamps | Acquired in 2019 for $230M | Exited December 2024 due to enrollment downturn | Contributed to debt, impacted revenue | Strategic exit |

| UK Bootcamp | International venture | Low student completion rates reported | Requires investment without commensurate returns | Strategic withdrawal |

Question Marks

2U's newly launched microcredentials in emerging fields like AI represent a significant strategic push into high-growth markets. However, many of these offerings are nascent, meaning they haven't yet captured substantial market share. This places them squarely in the question mark category of the BCG matrix, requiring significant investment to build awareness and adoption.

For instance, while the demand for AI skills is booming, with the global AI market projected to reach $1.81 trillion by 2030 according to Statista, 2U's specific microcredentials in this area are still establishing their footing. The company must heavily invest in marketing and content development to attract learners and demonstrate the value proposition of these new programs, a classic characteristic of question mark assets.

Expanding into niche degree specializations positions 2U's offerings in the question mark category of the BCG matrix. These new programs, targeting emerging fields, are designed for high growth potential but start with a small market share. For instance, a new master's degree in AI Ethics, launched in 2024, might enroll a few hundred students initially, reflecting its nascent market presence despite strong industry demand.

2U's strategy includes exploring new international markets, often through partnerships or pilot programs. For instance, in 2023, 2U announced a collaboration with an Australian university to offer a new online master's degree, signaling an effort to test demand in that region. These ventures are classified as question marks due to their inherent uncertainty; success hinges on navigating diverse regulatory environments and achieving cultural resonance with local student populations.

New Strategic Initiatives on the edX Platform

The broader platform strategy for edX, focusing on expanding access and affordability, positions it as a star or question mark within the 2U BCG Matrix. This initiative holds high potential due to edX's substantial user base, but its success hinges on converting users into high market share across new offerings and demonstrating the platform's full efficacy, requiring ongoing investment and strategic execution.

In 2024, edX continued to build on its foundation as a leading online learning platform. For instance, the platform reported a significant increase in course enrollments, with millions of new learners joining across a diverse range of disciplines. This growth underscores the platform's appeal and its potential to capture a larger share of the burgeoning online education market.

- Platform Expansion: edX's strategic initiatives aim to broaden its reach and make education more accessible, a key factor in its potential growth.

- User Base Monetization: While edX boasts a large user base, the challenge lies in effectively converting this engagement into higher market share for its expanding portfolio of courses and programs.

- Investment & Execution: Continued investment in platform development and a sharp focus on strategic execution are critical for edX to solidify its position and prove the value of its model.

- Market Dynamics: The online education sector is highly competitive, meaning edX must continually innovate to maintain its edge and capitalize on emerging trends in lifelong learning.

Leveraging AI for New Learning Models

Integrating AI into novel learning models or personalized educational pathways on platforms like edX represents a significant opportunity, placing it squarely in the Question Mark quadrant of the BCG matrix. While the potential for high growth in the dynamic education sector is evident, these advanced applications demand considerable investment in research and development.

These new AI-driven learning models, which go beyond basic AI tools, are poised to revolutionize how individuals acquire knowledge. They offer the promise of highly tailored educational experiences, adapting to each learner's pace and style. The market is increasingly receptive to personalized solutions, especially in areas like upskilling and reskilling, which are critical in today's rapidly changing job market.

- High Growth Potential: AI-powered personalized learning pathways can cater to individual needs, potentially increasing engagement and completion rates in online courses.

- Significant R&D Investment: Developing sophisticated AI for adaptive learning requires substantial resources for algorithm development, data analysis, and platform integration.

- Market Acceptance Uncertainty: While the demand for personalized education is growing, widespread adoption of entirely new AI-driven learning models will depend on demonstrating clear value and user-friendliness.

- Strategic Importance: Success in this area could position edX as a leader in the future of education technology, attracting a larger user base and potentially higher revenue streams.

Question marks in 2U's portfolio represent new ventures or offerings with high growth potential but currently low market share. These require significant investment to develop and gain traction. For instance, 2U’s expansion into new international markets, like its 2023 collaboration with an Australian university for a new online master's degree, falls into this category due to the inherent uncertainties of market acceptance and regulatory navigation.

Similarly, 2U’s newly launched microcredentials in fields like AI are question marks. While the AI market is projected to reach $1.81 trillion by 2030, these specific offerings are still establishing their presence. Significant marketing and content investment is crucial to build awareness and demonstrate their value proposition to learners.

The integration of AI into novel learning models, such as personalized educational pathways on edX, also fits the question mark profile. These advanced applications promise high growth but necessitate considerable R&D investment and face market acceptance uncertainty, even as demand for personalized education grows.

2U's strategic push into niche degree specializations, like a 2024 master's in AI Ethics, exemplifies question marks. These programs target emerging fields with high growth potential but begin with a small initial student enrollment, reflecting their nascent market position despite strong industry demand.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, growth rates, and competitive landscape analyses, to accurately position each business unit.