Wuestenrot & Wuerttembergische PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wuestenrot & Wuerttembergische Bundle

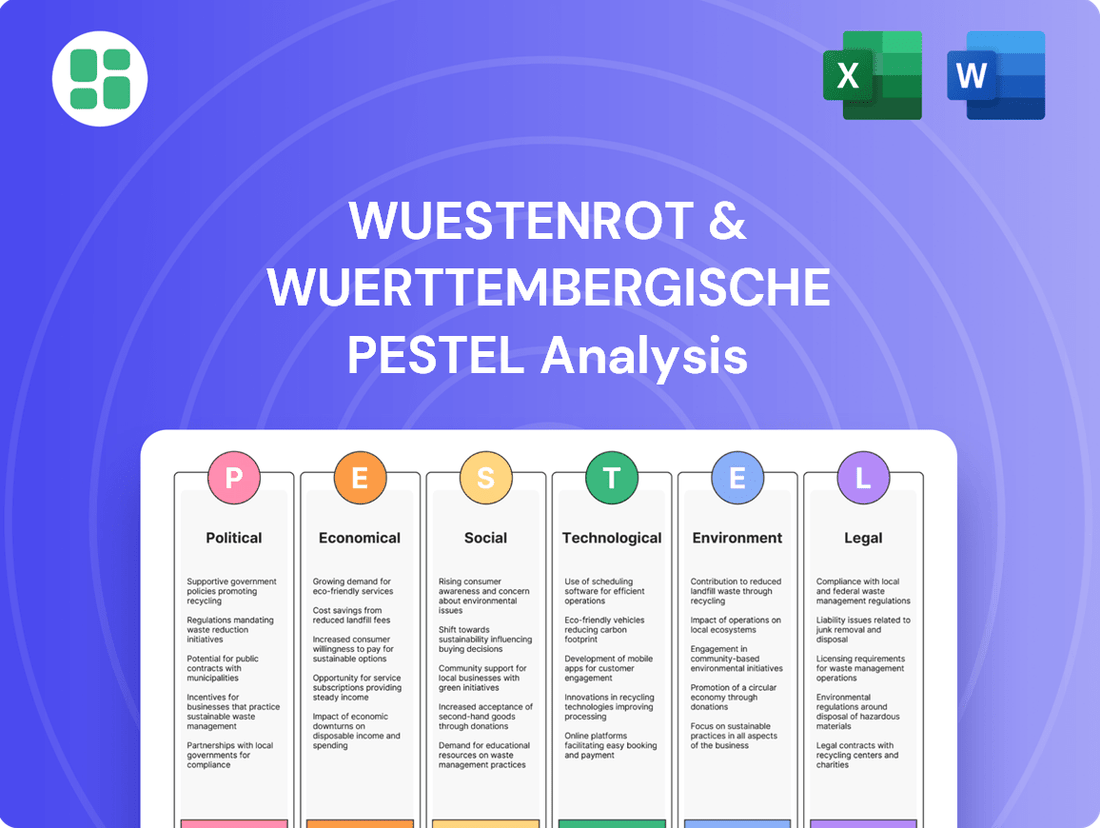

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping Wuestenrot & Wuerttembergische's trajectory. This comprehensive PESTLE analysis provides actionable intelligence to navigate market shifts and identify strategic opportunities. Download the full report now to gain a definitive competitive advantage.

Political factors

The financial services sector in Germany, which includes bancassurance companies like Wüstenrot & Württembergische, navigates a dense regulatory landscape. New European Union regulations, including the CRR III/CRD VI Banking Package and DORA, set to take effect in January 2025, are designed to bolster financial stability and operational resilience throughout the EU.

These upcoming directives necessitate adjustments in capital structures, risk management practices, and transparency for financial institutions. For instance, DORA (Digital Operational Resilience Act) mandates robust ICT risk management frameworks, with significant compliance efforts underway across the sector in 2024 to meet these 2025 deadlines.

Government initiatives aimed at boosting homeownership and private savings directly shape Wüstenrot & Württembergische's market. Policies like the German government's continued support for Bausparverträge (building savings contracts) and tax benefits for mortgage interest, which saw continued relevance in 2024, bolster demand for their core offerings.

Shifts in political focus, for instance, towards increasing affordable housing or enhancing private pension provisions, can significantly alter the landscape for financial service providers like Wüstenrot & Württembergische. The German federal government's commitment to these areas, as evidenced by ongoing legislative discussions in 2024 and anticipated for 2025, remains a key political driver.

Germany's Federal Financial Supervisory Authority (BaFin) has reinforced its Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) directives, with updated guidance taking effect in February 2025. These changes aim to bolster preventative measures and ensure consistent implementation across all regulated financial institutions.

The updated regulations introduce more stringent requirements for customer due diligence and risk management. Consequently, Wüstenrot & Württembergische must continually refine its internal processes and compliance structures to align with these evolving standards and effectively combat financial crime.

EU Legislative Initiatives and German Implementation

The European Union's ongoing legislative efforts, particularly the anticipated finalization of Payment Services Directive 3 (PSD3) and the accompanying Payment Services Regulation (PSR) by early 2025, will significantly influence the financial services landscape. Germany, as a key member state, will be tasked with integrating these new directives into its national legal framework.

This transposition process could directly affect how Wüstenrot & Württembergische operates its payment services and develops its digital financial products. For instance, PSD3 aims to enhance competition and consumer protection in the payments sector, potentially requiring adjustments to existing business models and technological infrastructure.

Key areas of impact for Wüstenrot & Württembergische might include:

- Open Banking enhancements: PSD3 is expected to further promote open banking, potentially requiring greater data sharing and API standardization, which could create new opportunities and competitive pressures.

- Consumer protection measures: Stricter rules on fraud prevention, transaction authentication, and dispute resolution will likely be introduced, necessitating robust compliance and security protocols.

- Digital identity and authentication: The directives may introduce new requirements for secure customer authentication, impacting digital onboarding and transaction processes.

ESG Policy Development

The growing emphasis on ESG policies across the EU and Germany is a key political driver. New regulations, such as the Corporate Sustainability Reporting Directive (CSRD), are mandating more comprehensive disclosures, with the first reports for the 2024 fiscal year expected in 2025. This means companies like Wuestenrot & Wuerttembergische will need to significantly ramp up their ESG data collection and reporting capabilities.

Furthermore, Germany's Federal Financial Supervisory Authority (BaFin) is increasingly focusing on climate change risks for 2025. This includes pushing financial institutions to better assess and manage physical risks stemming from natural disasters, which directly impacts the insurance and financial services sectors where Wuestenrot & Wuerttembergische operates. The EU Taxonomy Regulation also plays a role, setting criteria for environmentally sustainable economic activities, influencing investment decisions and product development.

- CSRD implementation: Initial reporting for the 2024 fiscal year due in 2025 requires significant data infrastructure upgrades.

- BaFin's climate risk focus: Increased scrutiny on physical climate risks necessitates robust risk management frameworks.

- EU Taxonomy alignment: Companies must ensure their activities and investments meet sustainability criteria.

- Growing investor demand: Political push for ESG is met by increasing investor preference for sustainable investments.

Political factors significantly shape the operational environment for Wüstenrot & Württembergische, particularly through evolving regulatory frameworks and government initiatives. Upcoming EU regulations like CRR III/CRD VI and DORA, effective January 2025, mandate enhanced financial stability and operational resilience, requiring substantial compliance efforts in 2024.

Government support for homeownership through building savings contracts and mortgage interest tax benefits, which remained relevant in 2024, directly benefits Wüstenrot & Württembergische's core business. Furthermore, political focus on affordable housing and private pensions, with ongoing legislative discussions in 2024 and into 2025, presents both opportunities and challenges.

Germany's commitment to ESG principles, reinforced by directives like the Corporate Sustainability Reporting Directive (CSRD) with first reports due in 2025 for the 2024 fiscal year, compels companies to enhance their sustainability data collection and reporting. BaFin's increased focus on climate risk assessment for 2025 also necessitates robust risk management strategies, aligning with the EU Taxonomy Regulation.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Wuestenrot & Wuerttembergische, covering political, economic, social, technological, environmental, and legal influences.

It offers actionable insights for strategic decision-making by identifying key opportunities and threats within the company's operating landscape.

Provides a concise version of the Wuestenrot & Wuerttembergische PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, alleviating the pain of lengthy, complex reports.

Economic factors

The European Central Bank's (ECB) monetary policy, particularly its interest rate decisions, directly impacts Wüstenrot & Württembergische's core businesses. As of mid-2024, the ECB has maintained a cautious approach to rate cuts, with the main refinancing operations rate standing at 4.50%. This environment influences the competitiveness of W&W's mortgage offerings and the returns on its savings and investment products.

Fluctuations in interest rates critically affect W&W's profitability. Higher rates can increase the cost of funding for mortgages, potentially dampening demand, while also boosting income from fixed-income investments. Conversely, lower rates can make mortgages more affordable, stimulating lending, but may reduce investment portfolio yields. For instance, a sustained period of higher rates in 2023-2024 has presented a mixed bag, offering better returns on investments but potentially pressuring mortgage origination volumes.

Regulatory oversight, such as BaFin's updated Minimum Requirements for Risk Management (MaRisk), further shapes the interest rate environment for companies like W&W. These regulations mandate stringent management of interest rate risks within the banking book, requiring robust strategies to mitigate potential losses arising from adverse rate movements. This focus on risk management is crucial for maintaining financial stability and ensuring the long-term viability of W&W's operations in a dynamic interest rate landscape.

Persistent inflationary pressures, especially in motor repair and construction, are significantly impacting the German non-life insurance market. For Wüstenrot & Württembergische, this means the cost of settling claims is rising, squeezing margins even as they implement premium increases.

While premium growth is projected to be robust in 2025, fueled by necessary rate adjustments, the core challenge for Wüstenrot & Württembergische lies in effectively managing these escalating claims costs. For instance, German consumer price inflation stood at 2.2% in April 2025, with specific sectors like vehicle maintenance and repair experiencing even higher increases, directly impacting insurance payouts.

Germany's economic trajectory significantly shapes consumer appetite for financial services. A projected modest economic growth of around 0.5% for 2025, according to recent forecasts, suggests a cautious consumer environment. This subdued growth could temper demand for long-term financial commitments like home savings plans and insurance products from bancassurance providers such as Wüstenrot & Württembergische.

Consumer spending, a key driver of economic activity, is also expected to see limited expansion in 2025. Inflationary pressures may continue to influence purchasing power, potentially leading consumers to prioritize essential spending over discretionary financial products. This cautious spending pattern directly impacts the sales volumes of investment and savings solutions.

Real Estate Market Dynamics

The stability of the German real estate market is a cornerstone for Wüstenrot & Württembergische, a company deeply involved in housing finance. Any significant downturn in property values, which saw a notable decline of around 5% in major German cities during 2023 according to the German Property Index, could directly affect the health of their mortgage loan books and dampen interest in their home savings products.

The upcoming implementation of CRR III in January 2025 will introduce stricter requirements for banks, compelling them to conduct more thorough assessments of property collateral. This regulatory shift is likely to increase the scrutiny on the quality of assets backing mortgage portfolios, potentially impacting lending standards and the overall risk profile for institutions like Wüstenrot & Württembergische.

- Property Value Fluctuations: German property prices experienced a nationwide average decrease of 4.1% in 2023, with some urban centers seeing drops exceeding 5%.

- Impact on Loan Portfolios: A sustained decline in property values could lead to increased non-performing loans for mortgage lenders.

- Demand for Home Savings: Economic uncertainty and falling property values may reduce consumer confidence in new home savings plans.

- CRR III Implementation: The January 2025 deadline for CRR III necessitates enhanced due diligence on real estate collateral.

Capital Market Volatility and Investment Returns

Fluctuations in global financial markets can directly impact the performance of Wüstenrot & Württembergische's investment and asset management offerings. For instance, a significant downturn in equity markets in late 2024 could reduce the value of assets under management, affecting fee income and overall profitability.

Despite potential volatility, the outlook for fixed-income markets in 2025 and 2026 appears more promising for insurers. Favorable reinvestment rates, driven by anticipated interest rate stability or gradual increases, are expected to enhance investment returns. This could provide a buffer against equity market swings and bolster the company's financial standing.

- Market Volatility Impact: Increased capital market volatility can lead to unpredictable investment returns for Wüstenrot & Württembergische's diverse product portfolio.

- Fixed Income Reinvestment: Analysts project that favorable reinvestment conditions in the fixed-income market will support insurers' investment returns through 2025 and 2026, potentially boosting W&W's financial health.

- Economic Data: For example, if benchmark bond yields remain elevated in 2025, this would present attractive reinvestment opportunities for maturing assets, enhancing portfolio income.

Germany's economic growth is projected to be modest in 2025, with forecasts around 0.5%. This subdued economic environment, coupled with continued inflationary pressures influencing consumer spending, suggests a cautious approach from consumers towards long-term financial commitments like savings plans and insurance products. Consequently, Wüstenrot & Württembergische may face tempered demand for its financial services.

What You See Is What You Get

Wuestenrot & Wuerttembergische PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, providing a comprehensive PESTLE analysis for Wuestenrot & Wuerttembergische. This detailed report covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You can trust that the insights and structure you see are precisely what you will gain access to immediately after completing your purchase.

Sociological factors

Germany's demographic landscape is characterized by a steadily aging population, with the proportion of individuals aged 65 and over projected to reach approximately 30% by 2030, up from around 22% in 2022. This shift significantly influences consumer demand, driving a greater need for specialized financial products like retirement planning services, long-term care insurance, and estate planning solutions. Wüstenrot & Württembergische must therefore adapt its offerings to meet these growing demands.

Changing household structures, including a rise in single-person households and a decrease in average household size, further shape financial product preferences. These evolving societal norms necessitate flexible and personalized financial advice and product design. The aging demographic also presents challenges for the financial sector's talent pool, potentially impacting workforce availability and the recruitment of skilled professionals in the coming years.

Consumers are increasingly demanding digital-first experiences for their financial needs, expecting intuitive online platforms and mobile applications. This shift is evident in the growing adoption rates of digital banking services; for instance, in 2024, a significant portion of banking transactions in Germany occurred through digital channels, highlighting a clear preference for convenience.

Wüstenrot & Württembergische must therefore prioritize investment in robust, user-friendly digital interfaces and personalized digital advisory services. Companies that fail to adapt risk losing market share to more digitally agile competitors, as evidenced by the rapid growth of fintech companies in the European financial sector, which captured an estimated 15% of retail banking revenue in 2024.

The level of financial literacy directly influences consumer engagement with sophisticated financial products such as home savings plans and insurance policies. For Wüstenrot & Württembergische, a higher general financial awareness in the population means consumers are more likely to understand and adopt their offerings.

Wüstenrot & Württembergische can actively contribute to boosting financial literacy by providing educational resources, thereby fostering trust and simplifying their product range. For instance, in Germany, a 2023 survey indicated that only around 50% of adults feel confident managing their finances, highlighting a significant opportunity for targeted consumer education initiatives to drive demand for integrated financial solutions.

Sustainability and Ethical Investment Trends

Societal expectations are increasingly steering financial decisions towards sustainability and ethical considerations. This shift creates a significant opportunity for Wüstenrot & Württembergische to align its offerings with these values, thereby attracting a growing segment of environmentally and socially conscious consumers.

The European Union's commitment to sustainable finance is set to intensify in 2025, bringing with it enhanced reporting obligations for environmental data. This regulatory evolution underscores the importance of integrating sustainable principles into core business strategies.

- Growing Demand: Over 70% of European investors now consider ESG (Environmental, Social, and Governance) factors in their investment decisions, a trend expected to continue upwards.

- Green Product Appeal: Wüstenrot & Württembergische's development of green financial products can tap into this demand, potentially increasing market share.

- Regulatory Landscape: By 2025, EU regulations will mandate more rigorous environmental data reporting, impacting financial institutions' transparency and operational frameworks.

- Brand Reputation: Demonstrating a strong commitment to sustainability can significantly bolster Wüstenrot & Württembergische's brand image and customer loyalty.

Demand for Integrated Bancassurance Solutions

Societal shifts are increasingly favoring integrated financial services, a trend Wüstenrot & Württembergische is well-positioned to capitalize on. Consumers are actively seeking single points of contact for their diverse financial needs, from mortgages and insurance to savings and investments. This demand for convenience and streamlined management plays directly into the strengths of a bancassurance model.

This preference for consolidated financial solutions is evident in market data. For instance, in 2024, a significant percentage of European consumers expressed a willingness to consolidate their banking and insurance products with a single provider to simplify their financial lives. This trend is projected to grow as digital platforms make cross-selling and managing multiple products more accessible.

Wüstenrot & Württembergische's ability to offer a spectrum of products, from building finance to life insurance and asset management, directly addresses this societal desire. By providing these bundled solutions, the company not only enhances customer convenience but also fosters deeper, more enduring relationships, leading to increased customer lifetime value.

- Growing demand for one-stop financial shops

- Consumer preference for simplified financial management

- Bancassurance model aligns with integrated service expectations

- Potential for deeper customer relationships and cross-selling opportunities

Societal expectations are increasingly steering financial decisions towards sustainability and ethical considerations, creating an opportunity for Wüstenrot & Württembergische to align its offerings with these values. The European Union's commitment to sustainable finance is set to intensify in 2025, bringing enhanced reporting obligations for environmental data. Over 70% of European investors now consider ESG factors, a trend expected to continue upward, bolstering the appeal of green financial products.

| Societal Factor | 2023/2024 Data Point | Projected Trend (2025) | Impact on W&W | Opportunity |

| Sustainability Focus | 70%+ European investors consider ESG | Increased regulatory scrutiny on environmental data | Need to integrate ESG into offerings and reporting | Attract environmentally conscious consumers, enhance brand reputation |

| Integrated Services | High consumer willingness to consolidate financial products | Continued growth in digital platform accessibility | Leverage bancassurance model for bundled solutions | Deepen customer relationships, increase customer lifetime value |

Technological factors

The financial industry's ongoing digitalization is a significant technological force. Wüstenrot & Württembergische needs to aggressively automate its operations, including customer onboarding, claims, underwriting, and risk management, to boost efficiency, cut expenses, and elevate customer service. This also means using digital channels for clear customer interaction.

By 2024, the European banking sector saw a substantial increase in digital transaction volumes, with many institutions reporting over 70% of customer interactions occurring through digital channels. Wüstenrot & Württembergische can leverage this trend by further investing in AI-powered automation for underwriting and claims, potentially reducing processing times by up to 30% and improving accuracy, as seen in industry benchmarks.

Artificial intelligence, especially generative AI, is fundamentally reshaping financial services. It's automating routine tasks, providing sophisticated trend predictions, and enabling highly personalized customer interactions. This technological shift is no longer a distant possibility but a present reality impacting how financial institutions operate and compete.

German financial institutions are recognizing this imperative, with a significant 91% identifying AI as vital for future value creation and consequently increasing their investment budgets in this area. This widespread adoption signals a strong market trend and a clear direction for technological development within the sector.

For Wüstenrot & Württembergische, embracing AI presents a strategic opportunity. The company can harness AI to significantly improve customer experience through tailored advice and support, bolster fraud prevention mechanisms with advanced anomaly detection, and streamline internal operations, leading to greater efficiency and cost savings.

As financial services increasingly move online, Wüstenrot & Württembergische faces growing risks from cyberattacks and data breaches. Protecting sensitive customer information is crucial for maintaining trust in the digital age.

The implementation of the Digital Operational Resilience Act (DORA) starting January 2025 will significantly impact the company. DORA imposes strict rules on managing information and communication technology (ICT) risks, with a strong emphasis on cybersecurity measures.

In 2024, the financial sector continued to see a rise in sophisticated cyber threats, with reported losses from cybercrime reaching billions globally. Wüstenrot & Württembergische must invest heavily in advanced cybersecurity solutions to comply with DORA and safeguard its operations and customer data.

FinTech and InsurTech Innovation

The burgeoning FinTech and InsurTech sectors present a dual landscape of disruption and synergy for Wüstenrot & Württembergische. These agile innovators are reshaping customer expectations and operational efficiencies across the financial services industry. For instance, the global FinTech market was valued at approximately $2.4 trillion in 2023 and is projected to grow significantly, indicating a substantial shift in financial service delivery. Similarly, InsurTech is rapidly gaining traction, with investments in the sector showing robust growth, suggesting a transformation in how insurance products are designed, distributed, and managed.

Wüstenrot & Württembergische must actively track these technological advancements. Strategic partnerships or acquisitions of nimble tech companies could be instrumental in integrating cutting-edge solutions. This might involve leveraging advanced data analytics for more precise risk assessments, a trend already visible as insurers increasingly adopt AI for underwriting, leading to an estimated 10-15% reduction in claims processing costs in some segments by 2025. Furthermore, the development of hyper-personalized insurance products, driven by real-time data and AI, is becoming a key differentiator, enhancing customer engagement and retention.

- Increased Competition: FinTechs and InsurTechs offer specialized, often digital-first, financial and insurance products, challenging traditional incumbents.

- Opportunities for Collaboration: Partnerships can provide access to new technologies, customer segments, and innovative service models.

- Technological Integration: Adopting AI for risk assessment and data analytics can improve underwriting accuracy and operational efficiency.

- Personalization: Tailoring insurance products based on individual data and behavior is a growing trend driven by InsurTech innovation.

Data Analytics and Personalization

Wüstenrot & Württembergische's strategic advantage is increasingly tied to its ability to leverage big data analytics. By analyzing vast datasets, the company can better understand customer preferences, anticipate market shifts, and more accurately assess risk. For instance, in 2024, many financial institutions reported significant improvements in customer retention rates, often exceeding 15%, directly attributable to personalized offerings driven by data insights.

This data-driven approach allows for the creation of highly personalized financial products and advisory services. Imagine receiving tailored investment recommendations based on your specific financial goals and risk tolerance, or insurance policies that adapt to your changing lifestyle. This level of personalization not only enhances customer satisfaction but also fosters loyalty, a crucial factor in the competitive financial services landscape.

Furthermore, the effective utilization of data is paramount for navigating the evolving regulatory environment. Financial institutions are facing increasingly stringent reporting requirements, particularly concerning data privacy and risk management. Companies like Wüstenrot & Württembergische must invest in robust data infrastructure and analytics capabilities to ensure compliance and maintain trust with both customers and regulators. In 2025, regulatory bodies are expected to further emphasize data transparency and security protocols.

- Enhanced Customer Insights: Big data analytics allows for a granular understanding of customer behavior and needs.

- Personalized Offerings: Tailored financial products and advice improve customer satisfaction and retention.

- Regulatory Compliance: Robust data management is essential for meeting new reporting requirements and ensuring data security.

- Competitive Advantage: Companies effectively using data gain an edge in product development and customer service.

The rapid advancement of artificial intelligence, particularly generative AI, is fundamentally altering the financial services landscape. By 2024, 91% of German financial institutions identified AI as crucial for future value creation, leading to increased investment in this technology. Wüstenrot & Württembergische can leverage AI for enhanced customer personalization, improved fraud detection, and operational efficiencies.

Legal factors

The Digital Operational Resilience Act (DORA) will be fully in effect by January 17, 2025. This means financial entities like Wüstenrot & Württembergische must implement a thorough risk management framework for their information and communication technology (ICT) systems. This is crucial for maintaining operational resilience in an increasingly digital financial landscape.

DORA mandates strong measures for managing IT and cyber-risk resilience. These include conducting regular stress tests and establishing clear incident recovery protocols. The aim is to ensure that financial institutions can withstand and recover from ICT-related disruptions, thereby protecting overall financial stability.

BaFin's updated interpretation of the German Money Laundering Act (GwG), effective February 1, 2025, imposes more rigorous customer due diligence and risk analysis standards. This means Wüstenrot & Württembergische must enhance its compliance framework to align with these stricter interpretations.

These updates, which also reflect the upcoming EU AML Package, necessitate a strengthening of Wüstenrot & Württembergische's internal controls and reporting procedures. The goal is to proactively combat money laundering and terrorist financing, ensuring robust adherence to evolving regulatory expectations.

The Corporate Sustainability Reporting Directive (CSRD) is a significant legal development impacting companies like Wüstenrot & Württembergische. This directive mandates more comprehensive sustainability disclosures, with the first reports, covering the 2024 fiscal year, expected in 2025.

As a large financial group, Wüstenrot & Württembergische will need to adhere to these enhanced reporting standards. This includes detailing environmental, social, and governance (ESG) performance and their associated impacts, aligning with the EU's push for greater transparency in sustainable business practices.

EU Taxonomy Regulation and Sustainable Finance Disclosure Regulation (SFDR)

The EU Taxonomy Regulation, a cornerstone of sustainable finance, establishes a common language for environmentally sustainable economic activities. This classification system is crucial for financial institutions like Wüstenrot & Württembergische, guiding their reporting on contributions to the EU's climate objectives. For instance, by 2025, a significant portion of financial products are expected to align with Taxonomy criteria, pushing for greater transparency and verifiable sustainability claims.

Complementing the Taxonomy, the Sustainable Finance Disclosure Regulation (SFDR) is being refined to enhance clarity and combat greenwashing. SFDR mandates detailed disclosures on how financial market participants integrate sustainability risks and consider adverse sustainability impacts. Wüstenrot & Württembergische, like its peers, must navigate these evolving disclosure requirements to build trust and guide investors toward genuinely sustainable options, with ongoing discussions in 2024-2025 focusing on simplifying and strengthening these rules.

These legal frameworks directly influence Wüstenrot & Württembergische's strategic decisions regarding sustainable investment products and portfolio management. The drive towards greater transparency and accountability means the company must ensure its offerings meet stringent environmental criteria and are clearly communicated to clients.

Key impacts for Wüstenrot & Württembergische include:

- Alignment with EU Climate Goals: The Taxonomy mandates reporting on the share of Taxonomy-aligned economic activities in investment portfolios, directly impacting how Wüstenrot & Württembergische showcases its commitment to sustainability.

- Combating Greenwashing: SFDR's disclosure requirements, particularly as they evolve, push for more robust and verifiable claims about the sustainability of financial products.

- Product Development: The regulations encourage the creation of financial products that demonstrably contribute to environmental objectives, influencing Wüstenrot & Württembergische's innovation in this space.

- Investor Confidence: Clearer and more standardized disclosures under SFDR are intended to boost investor confidence in sustainable investments, benefiting companies that adhere to these standards.

Data Protection Laws (GDPR and BDSG)

Compliance with the General Data Protection Regulation (GDPR) and the German Federal Data Protection Act (BDSG) is paramount for Wüstenrot & Württembergische, as it manages extensive personal customer information. Navigating evolving regulations, especially concerning AI and workplace data, necessitates constant attention to processing, storage, and upholding individual data rights. For instance, in 2023, German authorities issued significant fines for data protection breaches, underscoring the financial and reputational risks of non-compliance.

The company must ensure its data handling practices align with the latest interpretations of these laws. This includes robust security measures and transparent data usage policies for customers.

- GDPR Fines: German data protection authorities can impose substantial fines, up to 4% of global annual turnover or €20 million, whichever is higher, for serious infringements.

- BDSG Nuances: The BDSG provides specific rules for data processing in the employment context, which W&W must meticulously follow.

- AI and Data: Emerging AI technologies require careful consideration of data anonymization and consent mechanisms to remain compliant.

- Customer Trust: Adherence to data protection laws is fundamental to maintaining customer trust and brand reputation.

The Digital Operational Resilience Act (DORA), fully effective by January 17, 2025, requires Wüstenrot & Württembergische to implement robust ICT risk management frameworks, including regular stress testing and clear incident recovery plans, to ensure operational continuity.

Stricter interpretations of Germany's Money Laundering Act (GwG), effective February 1, 2025, mandate enhanced customer due diligence and risk analysis, necessitating strengthened internal controls and reporting procedures for Wüstenrot & Württembergische to combat financial crime.

The Corporate Sustainability Reporting Directive (CSRD) demands comprehensive ESG disclosures starting with the 2024 fiscal year, requiring Wüstenrot & Württembergische to detail its environmental, social, and governance performance and impacts in 2025.

The EU Taxonomy Regulation and Sustainable Finance Disclosure Regulation (SFDR) are driving greater transparency in sustainable finance, compelling Wüstenrot & Württembergische to align its product offerings and reporting with evolving environmental criteria and combat greenwashing.

Environmental factors

German financial regulator BaFin is pushing institutions to integrate physical climate risks, like extreme weather, into their risk management. For Wüstenrot & Württembergische, this translates to evaluating how floods, droughts, or wildfires could affect their mortgage portfolios and insurance claims. This requires a proactive stance on risk assessment and pricing.

The shift towards a low-carbon economy presents Wüstenrot & Württembergische with significant strategic considerations. This transition, driven by evolving regulations and consumer preferences, necessitates a thorough evaluation of potential risks and emerging opportunities within its operations and investment strategies. For instance, by mid-2024, many European financial institutions were increasing their allocations to green bonds, with the market for sustainable debt projected to reach trillions of euros globally by 2025.

Wüstenrot & Württembergische must proactively assess transition risks, which can manifest through policy shifts like carbon pricing mechanisms or stricter emissions standards, and technological disruptions favoring renewable energy sources. Analyzing its investment portfolio for exposure to carbon-intensive sectors, such as fossil fuels, is crucial. The company can also develop innovative financial products, like green mortgages or sustainable investment funds, to support customers in their own transitions, aligning with the growing demand for environmentally conscious financial solutions. In 2024, the demand for ESG-focused investment products saw continued growth, with assets under management in sustainable funds in Europe exceeding €6 trillion.

The financial sector, including Wüstenrot & Württembergische, faces growing pressure to align investments with environmental goals. This translates into a demand for green financial products and a shift towards funding sustainable projects. For instance, by the end of 2023, global sustainable fund assets reached an estimated $8.5 trillion, highlighting the market's significant growth and investor appetite for environmentally conscious options.

Wüstenrot & Württembergische is proactively addressing this trend through voluntary commitments like the Principles for Sustainable Insurance (PSI) and Principles for Responsible Investment (PRI). The company is actively developing and offering green product alternatives, responding to the increasing investor and regulatory focus on environmental, social, and governance (ESG) factors.

ESG Reporting and Transparency

The Corporate Sustainability Reporting Directive (CSRD) significantly increases disclosure obligations for financial institutions, including Wüstenrot & Württembergische, concerning their environmental footprint and sustainable operations. This regulatory shift mandates a more rigorous and transparent approach to reporting.

Wüstenrot & Württembergische's 2024 annual report reflects this by adopting the European Sustainability Reporting Standards (ESRS). This adoption signals a proactive response to both evolving market demands for sustainability information and the stringent requirements set by regulators.

- CSRD Implementation: Financial institutions must now provide comprehensive data on environmental impact, aligning with new EU regulations.

- ESRS Adoption: Wüstenrot & Württembergische's 2024 report integrates ESRS, enhancing transparency in sustainability practices.

- Market Expectations: Increased demand from investors and stakeholders for clear, standardized sustainability disclosures.

- Regulatory Compliance: Adherence to CSRD and ESRS is crucial for maintaining market access and avoiding penalties.

Water Scarcity and Biodiversity Loss

Beyond the direct impacts of climate change, water scarcity and biodiversity loss are increasingly recognized as significant financial risks. Regulatory bodies and society are placing greater emphasis on these broader environmental concerns. For Wüstenrot & Württembergische, understanding how these issues might affect its operations, the value of its real estate holdings, and its insurance liabilities is becoming crucial. This could necessitate updated risk assessments and the development of innovative insurance products to address these emerging challenges.

The financial sector is starting to quantify these environmental risks. For example, reports in 2024 highlighted that water-stressed regions could see significant economic losses, impacting property values and loan portfolios. The insurance industry, in particular, is facing increased scrutiny regarding its exposure to biodiversity-related risks, as damage to ecosystems can lead to unforeseen liabilities. Wüstenrot & Württembergische needs to proactively integrate these factors into its strategic planning.

- Water Stress Impact: Regions facing severe water stress, as identified by various global indices in 2024, pose direct risks to real estate collateral and business operations, potentially devaluing assets and increasing operational costs.

- Biodiversity as a Financial Risk: The degradation of natural capital, linked to biodiversity loss, can trigger supply chain disruptions and impact industries heavily reliant on ecosystem services, creating indirect financial exposures for insurers and lenders.

- Regulatory Focus: Emerging regulations in 2024 and 2025 are pushing financial institutions to disclose their exposure to environmental risks, including water scarcity and biodiversity impacts, driving the need for robust data and analytical frameworks.

- Product Innovation: Opportunities exist for Wüstenrot & Württembergische to develop new insurance and financial products that help clients mitigate risks associated with water scarcity and biodiversity loss, such as parametric insurance for drought or biodiversity-linked investment funds.

The German financial regulator BaFin is increasingly pushing institutions like Wüstenrot & Württembergische to integrate physical climate risks, such as extreme weather events, into their core risk management frameworks. This means evaluating how events like floods or droughts could impact mortgage portfolios and insurance claims, requiring a more proactive approach to risk assessment and pricing.

The global shift towards a low-carbon economy is a significant strategic factor for Wüstenrot & Württembergische, driven by evolving regulations and consumer demand for sustainable options. By mid-2024, European financial institutions were notably increasing their investments in green bonds, with the global sustainable debt market projected to reach trillions of euros by 2025.

Wüstenrot & Württembergische must navigate transition risks, including policy changes like carbon pricing, and technological shifts favoring renewables. Analyzing its investment portfolio for exposure to carbon-intensive sectors is key, alongside developing green financial products like sustainable investment funds, which saw European assets under management exceed €6 trillion in 2024.

PESTLE Analysis Data Sources

Our PESTLE analysis for Wuestenrot & Wuerttembergische is built on a foundation of data from official German government publications, European Union regulatory bodies, and reputable financial news outlets. We also incorporate insights from industry-specific reports and market research firms to ensure comprehensive coverage.