Wuestenrot & Wuerttembergische Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wuestenrot & Wuerttembergische Bundle

Explore the strategic positioning of Wuestenrot & Wuerttembergische with our insightful BCG Matrix overview. Understand which of their offerings are market leaders and which require careful consideration. This glimpse into their portfolio is just the start.

Ready to unlock the full potential of Wuestenrot & Wuerttembergische's strategic blueprint? Purchase the complete BCG Matrix for a detailed breakdown of their Stars, Cash Cows, Dogs, and Question Marks, complete with actionable insights and data-driven recommendations to guide your investment decisions.

Stars

Württembergische Krankenversicherung is experiencing robust growth in new annual premiums, largely fueled by strong demand in the company health insurance sector. This surge highlights a significant market share within a rapidly expanding segment as businesses prioritize robust health benefits for their workforce.

This trend positions company health insurance as a vital growth engine for W&W, reflecting the increasing importance businesses place on employee well-being and retention. For instance, in 2024, the German private health insurance market saw continued expansion, with corporate policies playing a crucial role in this upward trajectory.

Württembergische Versicherung saw strong performance in its new and replacement business throughout 2024, a positive trajectory that carried into early 2025 with an impressive 8.3% growth. This segment is a clear high-growth area for W&W.

The company's active expansion of its property and casualty insurance portfolio in this sector indicates a robust market position. This strategic focus suggests W&W is investing heavily for sustained future profitability.

Adam Riese, W&W's digital mortgage brand, is a prime example of a Star in the BCG matrix. Its new business volume surged by 13.8% in the first two months of 2025, showcasing rapid growth in the digital financial services sector.

This impressive performance highlights Adam Riese's success in capturing market share within a rapidly expanding digital landscape. The brand's appeal to tech-savvy consumers positions it as a key growth engine for W&W.

Sustainable Investment Products

Wüstenrot & Württembergische (W&W) is actively integrating sustainability into its offerings, recognizing the significant growth in demand for environmentally and socially conscious investments. This strategic pivot is designed to capture a larger share of an expanding market.

The global sustainable investment market experienced substantial growth, with assets under management reaching an estimated $35.3 trillion in 2024, according to the Global Sustainable Investment Alliance. This trend underscores the increasing investor preference for ESG (Environmental, Social, and Governance) compliant products.

- Growing ESG Market: The global sustainable investment market is projected to continue its upward trajectory, driven by regulatory support and increasing investor awareness.

- W&W's Strategic Alignment: W&W's focus on 'Green' product lines positions it to benefit from this market expansion.

- Future Market Share: By investing in and promoting sustainable products, W&W aims to secure a strong position in this high-growth sector.

Construction Financing (New Lending)

Construction Financing (New Lending) represents a significant growth area for Wüstenrot & Württembergische (W&W). The new lending business within the Housing division demonstrated robust expansion, with a notable 19.7% increase in 2024 compared to the previous year. This upward trajectory continued into the early part of 2025, showing a further growth of 22.6% in the first two months.

This strong performance is underpinned by a market characterized by high demand for homeownership. W&W is well-positioned to capitalize on this trend, particularly in segments focused on existing properties and crucial energy-efficient renovations. Such growth indicates W&W's leadership in a dynamic and expanding market segment.

- New Lending Growth: 19.7% in 2024, 22.6% in Jan-Feb 2025.

- Market Drivers: High demand for homeownership, existing properties, energy-efficient renovations.

- W&W Position: Leader in a growing and high-demand market segment.

Stars in the W&W BCG matrix represent high-growth, high-market-share businesses. Adam Riese, W&W's digital mortgage brand, is a prime example, showing 13.8% growth in new business volume in early 2025. This indicates strong performance in the rapidly expanding digital financial services sector.

The company health insurance sector is another Star, as Württembergische Krankenversicherung experienced robust growth in new annual premiums in 2024. This segment benefits from businesses prioritizing employee well-being, a trend reflected in the German private health insurance market's expansion.

Construction financing, particularly new lending, also qualifies as a Star. W&W's Housing division saw a 19.7% increase in new lending in 2024 and a further 22.6% in the first two months of 2025, driven by high demand for homeownership and energy-efficient renovations.

The growing market for sustainable investments, with global assets reaching an estimated $35.3 trillion in 2024, positions W&W's 'Green' product lines as a Star. This strategic focus aligns with increasing investor preference for ESG-compliant products.

| Business Unit | Growth Rate | Market Share | BCG Category |

|---|---|---|---|

| Adam Riese (Digital Mortgages) | 13.8% (Jan-Feb 2025) | High | Star |

| Company Health Insurance | Strong growth in new premiums (2024) | Significant | Star |

| Construction Financing (New Lending) | 22.6% (Jan-Feb 2025) | High | Star |

| Sustainable Investments ('Green' Products) | High market growth (Global est. $35.3T in 2024) | Growing | Star |

What is included in the product

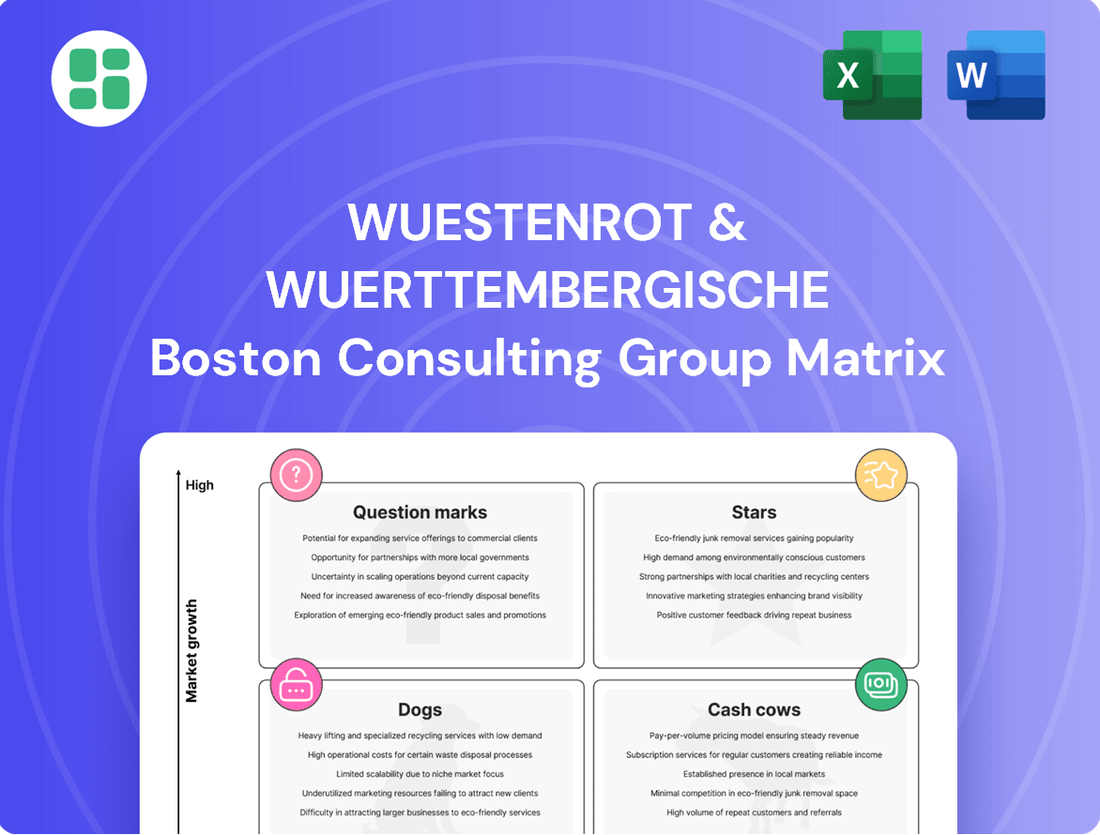

The Wuestenrot & Wuerttembergische BCG Matrix offers a strategic overview of their business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

Visualize Wuestenrot & Wuerttembergische's portfolio to identify underperforming "Dogs" and under-resourced "Question Marks," easing strategic decision-making.

Cash Cows

Wüstenrot Bausparkasse, the second-largest private home loan and savings bank, holds a significant portfolio of loans tied to building savings contracts. This portfolio saw a notable increase, growing by 6.3% by the end of 2024 compared to the prior year.

While the pace of new business has settled after exceptional performance, the established loan book continues to be a reliable source of stable cash flow. This stability is characteristic of a mature market where established players like Wüstenrot benefit from their existing customer base and long-term contracts.

Classic life insurance products, while experiencing a slight dip in new business premium sums in 2024, remain a cornerstone for Württembergische Lebensversicherung. Early 2025 saw a robust 12.6% increase in current new premiums, underscoring the stability of this market segment.

These offerings are characterized by their consistent revenue generation, acting as reliable cash cows for the company. Their significant contribution to overall profitability is a testament to the enduring demand and the established, loyal customer base.

The existing mortgage loan portfolio, a significant component of Wuestenrot & Wuerttembergische's financial structure, continues to be a stable performer. As of the end of February 2025, the portfolio's value grew to €28.8 billion, up from €28.4 billion, highlighting its substantial and established presence in the market.

This mature segment functions as a reliable cash cow, consistently producing interest income. Its steady generation of cash flow underpins the company's financial stability, even as growth in this area naturally moderates.

Standard Property Insurance

Standard Property Insurance within W&W's portfolio, categorized as a Cash Cow, experienced a robust expansion of its premium volume by 7.1% in 2024. This segment, despite facing increased claims due to severe weather events throughout the year, continues to generate a consistent and reliable income stream. Its stability is crucial for W&W's overall financial health.

- Market Maturity: The property and casualty insurance sector is generally considered mature, indicating stable demand and predictable revenue patterns.

- Portfolio Growth: W&W's property insurance portfolio saw a significant increase of 7.1% in 2024, demonstrating ongoing strength in this core business.

- Resilience to Claims: Despite the impact of severe weather events in 2024, the segment maintained its steady premium generation, highlighting its underlying resilience.

- Financial Foundation: This consistent premium flow from standard property insurance is a cornerstone of W&W's stable financial structure.

Brokerage Activities for Financial Products

W&W's brokerage activities for financial products function as a significant cash cow within their business model. This segment benefits from a vast, established distribution network, reaching millions of customers through over 20,000 brokers. This multi-channel approach ensures consistent revenue streams from mature financial products.

The efficiency of this distribution channel allows for steady commission and fee generation with minimal incremental investment. For instance, in 2023, the German financial advisory market saw continued demand for investment products, with brokerage fees forming a core revenue component for established players like W&W. This robust network is the key differentiator.

- Extensive Broker Network: Over 20,000 brokers provide broad market access.

- Mature Product Distribution: Leverages established financial products for consistent revenue.

- Efficient Revenue Generation: Generates steady commissions and fees with low ongoing investment.

- Multi-channel Reach: Accesses millions of customers through diverse distribution channels.

The established loan book at Wüstenrot Bausparkasse, which grew by 6.3% in 2024, represents a mature segment consistently generating stable cash flow. Similarly, Württembergische Lebensversicherung's classic life insurance products, despite a slight dip in new business premiums in 2024, saw a significant 12.6% increase in current new premiums early in 2025, highlighting their role as reliable cash cows. The €28.8 billion mortgage loan portfolio, up from €28.4 billion by February 2025, also acts as a steady income generator, reinforcing the company's financial stability.

| Business Segment | 2024/Early 2025 Data Point | BCG Category | Key Characteristic |

|---|---|---|---|

| Wüstenrot Bausparkasse Loan Book | 6.3% growth in 2024 | Cash Cow | Stable, predictable cash flow from existing contracts |

| Württembergische Lebensversicherung Classic Life Insurance | 12.6% increase in current new premiums (early 2025) | Cash Cow | Consistent revenue generation from a loyal customer base |

| W&W Mortgage Loan Portfolio | €28.8 billion (as of Feb 2025) | Cash Cow | Steady interest income, underpinning financial stability |

Delivered as Shown

Wuestenrot & Wuerttembergische BCG Matrix

The BCG Matrix analysis for Wuestenrot & Wuerttembergische that you are previewing is the exact, fully formatted document you will receive upon purchase. This comprehensive report, meticulously crafted with strategic insights, will be delivered to you without any watermarks or demo content, ready for immediate implementation in your business planning.

Dogs

Legacy life insurance products, often characterized by high guaranteed interest rates or older, less adaptable features, are likely positioned as Dogs in Wuestenrot & Wuerttembergische's BCG Matrix, especially in the current low-interest-rate environment. These policies typically exhibit low market growth due to their uncompetitive nature compared to modern offerings.

The administration costs for these older products can be substantial, while their profitability is diminished, particularly when contrasted with newer, more agile insurance solutions. This segment may also lead to capital being tied up in less productive assets, impacting overall financial flexibility.

Outdated investment advisory services are facing significant headwinds. In 2024, many traditional firms still rely on manual processes and less sophisticated technology, making them less competitive against digital-first platforms. These services risk becoming dogs in the BCG matrix if they don't adapt.

For instance, advisory firms that haven't integrated AI-driven analytics or personalized digital client portals are likely to see declining new client acquisition. The operational costs associated with legacy systems can also become a burden, especially if the revenue generated from these services is not growing. This stagnation can lead to a shrinking market share and reduced profitability.

Certain niche or specialized insurance lines, like coverage for unique collectibles or highly specific business risks, can struggle with low market demand. If these segments also face intense competition, they might represent a drain on resources for a diversified insurer like Wuestenrot & Wuerttembergische. For instance, the global specialty insurance market, while growing, often sees intense competition for smaller, more defined segments.

Physical Branch-Dependent Products in Declining Footfall Areas

Products that heavily depend on customers visiting a physical branch, especially in areas where fewer people are coming in or demographics are changing, can be seen as Question Marks in the BCG Matrix. Even though Wuestenrot & Wuerttembergische aims for a mix of sales channels, relying too much on older, less efficient methods for some products might mean they struggle to gain market share and end up spending more per customer interaction.

For instance, certain types of insurance policies or loan applications that traditionally required in-person meetings might fall into this category. In 2024, the trend of digital adoption continued to accelerate, with many consumers preferring online or mobile banking solutions. This shift means that physical branch-dependent products could see a decline in demand and profitability if not adapted.

- Low Market Share: Products requiring branch visits may struggle to compete with digitally native offerings.

- High Operating Costs: Maintaining physical branches for these products increases per-transaction expenses.

- Demographic Shifts: Younger generations and urban populations often favor digital channels, impacting footfall in traditional areas.

- Adaptation Challenges: Converting these products to fully digital or hybrid models can be complex and costly.

Non-Core, Underperforming Small Subsidiaries/Ventures

Non-core, underperforming small subsidiaries or ventures within Wüstenrot & Württembergische (W&W) that don't integrate well with the main bancassurance strategy and consistently show poor results would fall into the Dogs category of the BCG Matrix. These might be niche businesses with limited market presence and minimal impact on the group's overall financial performance or growth trajectory.

For example, in 2024, W&W might have a small digital solutions provider acquired a few years ago that, despite investment, has failed to gain significant traction. Such an entity would likely exhibit low revenue growth and potentially negative profitability, making it a prime candidate for the Dogs quadrant.

- Low Market Share: These subsidiaries typically hold a small percentage of their specific market, failing to establish a dominant or even competitive position.

- Underperformance: Consistent underperformance is a hallmark, characterized by low or negative profitability and minimal contribution to the group's earnings.

- Lack of Strategic Fit: They often operate outside the core bancassurance model, lacking synergy with the group's primary business activities.

- Potential Divestment: Companies in this category are often candidates for divestment or restructuring to free up resources for more promising ventures.

Legacy life insurance products, particularly those with high guaranteed interest rates, are likely positioned as Dogs. These products face low market growth due to their uncompetitive nature against modern offerings and can incur substantial administration costs while generating diminished profitability. In 2024, the persistent low-interest-rate environment further exacerbates these challenges, making it difficult for these older policies to attract new business or remain profitable.

Outdated investment advisory services that haven't embraced digital transformation are also prime candidates for the Dogs quadrant. Firms relying on manual processes and legacy technology in 2024 struggle to compete with agile, digital-first platforms, leading to declining client acquisition and increased operational costs. This results in a shrinking market share and reduced profitability for these services.

Certain niche insurance lines with low market demand and intense competition can also be classified as Dogs. These segments may represent a drain on resources for a diversified insurer if they fail to gain significant traction or achieve profitability. For example, a specialized coverage for a shrinking industry segment might fall into this category.

Underperforming subsidiaries that lack strategic fit and consistently show poor results are also Dogs. These businesses often have limited market presence and minimal impact on the group's overall financial performance. In 2024, a small acquired digital solutions provider that failed to gain traction despite investment would be a prime example, exhibiting low revenue growth and negative profitability.

| Product/Service Category | BCG Matrix Position | Key Characteristics | 2024 Market Context |

|---|---|---|---|

| Legacy Life Insurance | Dogs | High admin costs, low profitability, uncompetitive features | Low-interest rates hinder profitability and new business |

| Outdated Investment Advisory | Dogs | Manual processes, legacy tech, low client acquisition | Digital-first platforms dominate, increasing competition |

| Niche Insurance Lines | Dogs | Low market demand, intense competition, resource drain | Market segments may be shrinking or highly fragmented |

| Underperforming Subsidiaries | Dogs | Lack of strategic fit, consistent underperformance, low revenue | Acquired entities failing to integrate or gain traction |

Question Marks

W&W's commitment to digital transformation, exemplified by their 'W&W Besser!' initiative, positions them to capitalize on the burgeoning digital investment platform market. This sector is experiencing rapid growth, driven by increasing consumer preference for online financial management. For instance, the global robo-advisor market, a key segment of digital-first platforms, was projected to reach over $2.5 trillion in assets under management by 2027, indicating substantial expansion potential.

Wüstenrot & Württembergische (W&W) can leverage its existing 'Green' product lines to develop more tailored ESG financial products. This includes specialized green bonds or sustainable investment funds, tapping into a rapidly expanding market. For example, the global sustainable bond market reached an estimated $1.5 trillion in 2023, showcasing significant investor appetite.

Launching these new offerings requires substantial marketing investment and a strong focus on customer education to drive adoption and gain market share. In 2024, the demand for ESG-compliant investment products is projected to continue its upward trajectory, with many investors actively seeking out these opportunities.

W&W's strategic focus on 'Data, Processes and AI' signals a clear intent to leverage advanced AI-driven advisory tools. This positions them within a rapidly expanding segment of the financial services industry, driven by technological innovation and increasing demand for personalized financial guidance.

These AI tools represent a high-growth market, estimated to reach over $100 billion globally by 2027, according to recent industry reports. While W&W's current market share in this specific niche is likely nascent, the investment indicates a commitment to capturing future market share.

The development and adoption of these AI advisory tools require significant investment and strategic execution. Success hinges on building robust platforms, ensuring data security and privacy, and fostering client trust to transition these offerings from question marks to market leaders.

Smart Home and IoT-Integrated Insurance Solutions

W&W's exploration into smart home and IoT-integrated insurance solutions positions them within a burgeoning sector of property and casualty insurance. This strategic move aims to leverage technology for enhanced risk management and customer engagement.

The smart home insurance market is experiencing rapid growth, with projections indicating a significant expansion in the coming years. For instance, the global smart home market, which underpins these insurance solutions, was valued at approximately $100 billion in 2023 and is expected to reach over $250 billion by 2028, demonstrating substantial potential for IoT-integrated insurance.

- Market Position: Currently, W&W's market share in this specific niche is likely low, reflecting the early stage of development for such integrated offerings.

- Growth Potential: The sector is characterized by high growth expectations, driven by increasing consumer adoption of smart home devices and a growing awareness of their benefits in preventing losses.

- Investment Needs: Significant investment is required in technological infrastructure, data analytics capabilities, and customer education to effectively scale these innovative insurance products.

- Competitive Landscape: Competitors are also beginning to enter this space, making early adoption and differentiation crucial for W&W to capture market share.

Personalized Digital Pension Solutions

Personalized digital pension solutions are emerging as a significant growth area, driven by an aging demographic and a rising need for adaptable retirement planning. W&W, with its bancassurance model, is strategically positioned to capitalize on this trend, though initial market penetration will likely be modest, requiring substantial investment in marketing and customer acquisition.

The market for these tailored digital offerings is expanding rapidly. For instance, by the end of 2024, it's estimated that over 40% of individuals aged 50 and above in developed economies will be actively seeking digital tools for retirement planning. This presents a substantial opportunity for providers like W&W to innovate.

- Market Opportunity: The global pension fund industry is projected to reach over $70 trillion by 2025, with a growing segment focusing on personalized digital services.

- W&W's Position: As a bancassurance provider, W&W can leverage existing customer relationships and financial expertise to develop integrated digital pension platforms.

- Challenges: High initial marketing costs and the need for robust user acquisition strategies are critical hurdles for new entrants in this competitive digital space.

- Growth Potential: Early adopters of personalized digital pension solutions are expected to see higher engagement and long-term loyalty, creating a strong foundation for sustained growth.

W&W's foray into personalized digital pension solutions represents a significant growth avenue, particularly as populations age and demand for flexible retirement planning rises. While initial market penetration may be modest, the bancassurance model offers a strong foundation for customer engagement and integrated financial services.

The market for these tailored digital offerings is expanding rapidly. By the end of 2024, over 40% of individuals aged 50 and above in developed economies are expected to actively seek digital tools for retirement planning, highlighting a substantial opportunity for W&W to innovate and capture market share.

The global pension fund industry is projected to exceed $70 trillion by 2025, with a growing segment dedicated to personalized digital services. W&W's ability to leverage existing customer relationships and financial expertise through its bancassurance model positions it well to develop integrated digital pension platforms, though high initial marketing costs and robust user acquisition strategies remain critical challenges.

| Initiative | Market Segment | Growth Driver | 2024 Data/Projection | W&W's Position |

|---|---|---|---|---|

| Digital Investment Platforms | Robo-advisors | Consumer preference for online financial management | Global robo-advisor market projected to exceed $2.5 trillion AUM by 2027 | Capitalizing on burgeoning digital platform market |

| ESG Financial Products | Green bonds, sustainable funds | Investor appetite for sustainable investments | Global sustainable bond market reached an estimated $1.5 trillion in 2023 | Leveraging existing 'Green' product lines |

| AI-Driven Advisory Tools | Personalized financial guidance | Technological innovation, demand for tailored advice | AI financial advisory market estimated to exceed $100 billion globally by 2027 | Investing in 'Data, Processes and AI' for advanced tools |

| IoT-Integrated Insurance | Smart home insurance | Adoption of smart home devices, enhanced risk management | Global smart home market valued at ~$100 billion in 2023, projected over $250 billion by 2028 | Exploring smart home and IoT-integrated solutions |

| Personalized Digital Pensions | Digital retirement planning tools | Aging demographics, need for adaptable retirement planning | Over 40% of individuals aged 50+ in developed economies expected to seek digital retirement planning tools by end of 2024 | Leveraging bancassurance model for integrated digital platforms |

BCG Matrix Data Sources

Our Wuestenrot & Wuerttembergische BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.