Wuestenrot & Wuerttembergische Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wuestenrot & Wuerttembergische Bundle

Wuestenrot & Wuerttembergische operates within a competitive landscape shaped by moderate buyer power and the ever-present threat of substitutes in the financial services sector. Understanding these forces is crucial for strategic planning.

The full Porter's Five Forces Analysis offers a comprehensive deep dive into Wuestenrot & Wuerttembergische’s market dynamics, revealing the intricate interplay of industry rivalry, supplier power, and the threat of new entrants. Unlock actionable insights to navigate this complex environment.

Suppliers Bargaining Power

The bargaining power of capital providers for Wüstenrot & Württembergische AG (W&W) is currently moderate. This power is significantly shaped by prevailing market interest rates and the broader economic climate. For example, in early 2024, expectations of interest rate stabilization in major economies provided a more predictable environment for W&W's funding activities.

W&W's capacity to secure necessary capital for its mortgage lending operations and sustain its financial foundation hinges on negotiating favorable terms with these capital suppliers, including institutional investors and bondholders. The cost of this capital directly influences W&W's profitability margins on its core business activities.

An illustration of this influence is how global interest rate trends can directly impact W&W. If interest rates were to rise significantly, as seen in some periods of 2023, the cost of borrowing for W&W would increase, potentially squeezing its net interest income and overall profitability.

The bargaining power of suppliers for Wuestenrot & Wuerttembergische (W&W) is growing, particularly with key technology and IT service providers. As digitalization becomes crucial for financial services, W&W's reliance on these specialized vendors for its ongoing digital transformation, like the 'W&W Besser!' initiative, increases their leverage. This dependence can translate into greater influence over pricing and service level agreements for essential IT infrastructure and software solutions.

The bargaining power of suppliers for Wüstenrot & Württembergische (W&W) is notably influenced by the human capital market. Skilled financial advisors, IT specialists, and actuarial professionals are in high demand, giving them considerable leverage. W&W's extensive network, comprising over 5,000 independent field service partners, 1,000 Wüstenrot ServiceCenters, and 2,000 Württembergische offices, underscores its reliance on a vast sales force for customer reach.

This dependence on skilled labor directly impacts operational costs. To attract and retain these essential professionals, W&W must offer competitive compensation packages and robust development programs. In 2024, the financial services sector continued to see salary increases for specialized roles, reflecting the ongoing competition for talent and the resultant pressure on W&W's cost structure.

Supplier Power 4

Reinsurance providers hold moderate bargaining power, particularly following significant claims events. Germany experienced a notable increase in natural catastrophe claims in 2024, which can strengthen the position of reinsurers. This dynamic can translate into higher costs and less favorable terms for primary insurers like W&W.

W&W's property and casualty insurance operations, despite their general profitability, were impacted by substantial storm damage claims in 2024. This heightened claims environment can embolden reinsurers to demand increased premiums and impose more stringent contract conditions. Consequently, the underwriting profitability of W&W's insurance segments could face pressure.

The increased frequency and severity of natural disasters in 2024 directly influence the reinsurance market. Insurers relying on reinsurance may find themselves negotiating from a weaker position, as reinsurers adjust their pricing and terms to account for elevated risk exposure. This shift can impact the overall cost structure for companies like W&W.

This situation highlights the sensitivity of the insurance industry to external factors like weather events. The bargaining power of suppliers, in this case, reinsurers, is amplified when the demand for their services surges due to widespread insured losses.

Supplier Power 5

Data providers and analytics firms are increasingly influential in the financial sector, including for companies like Wuestenrot & Wuerttembergische (W&W). Their role in risk assessment, customer segmentation, and product development makes them indispensable. As the industry becomes more reliant on data, access to high-quality, real-time information is a significant competitive differentiator.

This growing dependence means W&W, like many financial institutions, must invest in these specialized services. For example, the global big data and business analytics market was projected to reach over $370 billion in 2024, highlighting the significant investment and value placed on data capabilities. This trend suggests that data providers can command higher prices as their offerings become more critical and sought-after, thereby increasing their bargaining power.

- Data Dependency: Financial firms increasingly rely on external data providers for critical insights, enhancing supplier leverage.

- Market Growth: The expanding big data and business analytics market, expected to exceed $370 billion in 2024, signifies the growing importance and value of data services.

- Competitive Edge: Access to unique or proprietary data sets can give providers a significant advantage, further strengthening their position.

- Investment Necessity: W&W's need to invest in advanced analytics for competitive advantage translates into increased costs and supplier influence.

The bargaining power of suppliers for Wuestenrot & Wuerttembergische (W&W) is elevated by the increasing reliance on specialized IT and data providers. As W&W continues its digital transformation, its dependence on these vendors for crucial infrastructure and analytics services grows, granting them greater leverage over pricing and terms. This trend is underscored by the significant growth in the big data and business analytics market, projected to surpass $370 billion in 2024, indicating the high value and demand for such specialized services.

Skilled human capital, particularly in financial advisory and IT roles, also presents a considerable source of supplier power for W&W. The company's extensive network of service centers and field partners highlights its deep reliance on a skilled workforce, which is currently experiencing increased demand and competitive compensation pressures. In 2024, salary benchmarks for these specialized financial sector roles saw upward adjustments, directly impacting W&W's operational costs.

Reinsurance providers also exhibit growing bargaining power, especially in the wake of increased natural disaster claims observed in 2024. This heightened claims environment allows reinsurers to negotiate for higher premiums and stricter contract conditions, potentially affecting W&W's underwriting profitability in its property and casualty segments.

| Supplier Type | Bargaining Power Level | Key Drivers | Impact on W&W |

|---|---|---|---|

| IT & Data Providers | Growing | Digital transformation, data dependency, market growth ($370B+ in 2024) | Increased costs, influence on service terms |

| Skilled Labor (Financial Advisors, IT Specialists) | High | High demand, competitive compensation, extensive sales network reliance | Increased operational costs, retention challenges |

| Reinsurance Providers | Moderate to High | Increased natural disaster claims (2024), risk exposure adjustments | Higher reinsurance premiums, potential pressure on underwriting profitability |

What is included in the product

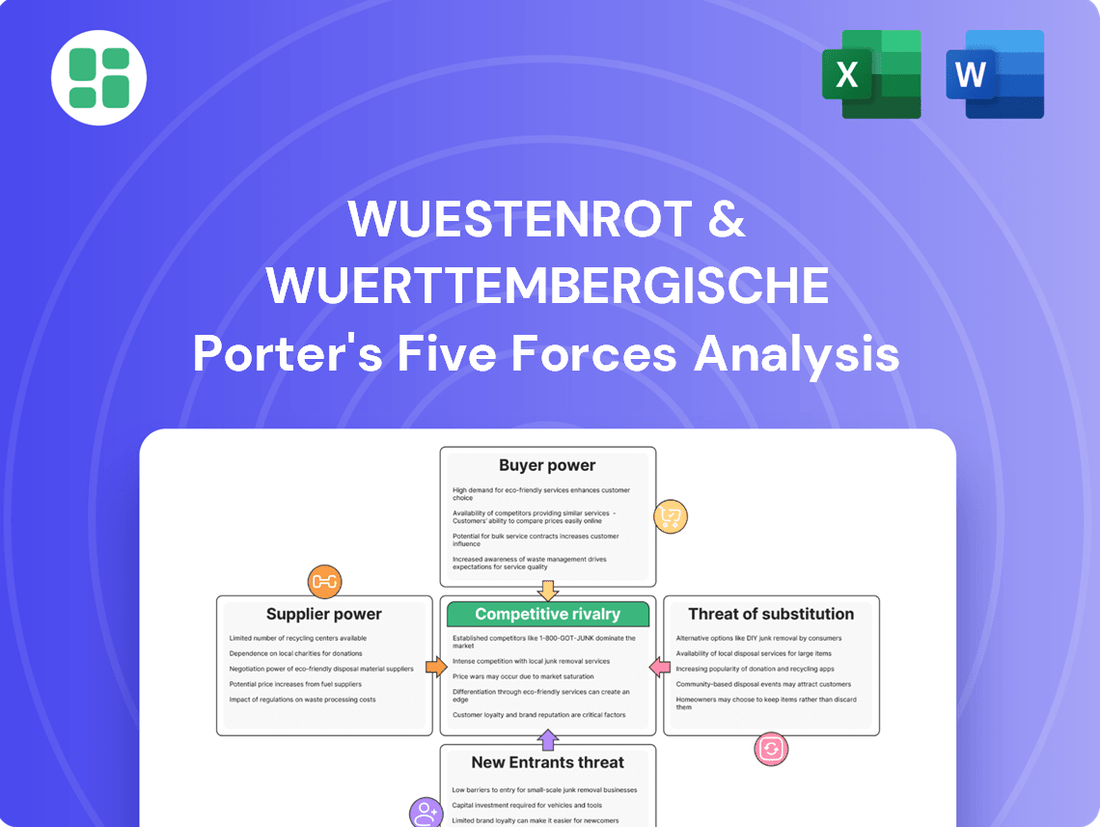

This Porter's Five Forces analysis specifically examines the competitive landscape for Wuestenrot & Wuerttembergische, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants and substitutes.

Quickly identify and mitigate competitive threats with a visual breakdown of Wuestenrot & Wuerttembergische's Porter's Five Forces, enabling proactive strategic adjustments.

Customers Bargaining Power

Customers in the German financial services sector, particularly for straightforward products like savings accounts and basic insurance, show a considerable degree of price sensitivity. This is evident as consumers actively seek the best deals, making it challenging for companies like W&W to maintain margins without competitive pricing. For instance, the German online insurance market saw significant price comparison activity in 2024, with many consumers switching providers based on minor rate differences.

Customers wield substantial bargaining power due to the wide array of alternative providers. This includes traditional banks, other building societies, insurance companies, and a burgeoning landscape of fintech firms, all offering diverse financial solutions.

While W&W's bancassurance model seeks to provide integrated offerings, customers are not tethered to these bundled services. They can readily select specialized providers for distinct financial requirements, diminishing the lock-in effect.

In 2024, the financial services sector continued to see strong competition, with fintechs attracting significant venture capital investment, further empowering consumers with more choices and potentially lower prices for specific products like mortgages or savings accounts.

Customer bargaining power is a significant factor for Wuestenrot & Wuerttembergische. While switching costs exist, especially for complex products like mortgages, digitalization is actively reducing these barriers. For instance, online comparison tools and streamlined application processes in 2024 are making it easier for customers to explore and move to competitors.

The increasing availability of transparent pricing and product information online further empowers customers. In 2024, many financial services platforms offer detailed feature comparisons and customer reviews, allowing individuals to make more informed decisions and negotiate better terms. This shift towards greater transparency directly increases customer leverage.

Customer Power 4

Customers today have unprecedented access to information. Through online comparison sites, financial blogs, and independent advisory services, the traditional gap in knowledge between W&W and its clientele has significantly narrowed. This empowers customers to thoroughly research product features, compare pricing across various providers, and understand the competitive landscape.

This increased transparency directly impacts W&W's ability to command premium pricing or retain customers without offering competitive terms. For instance, in the German insurance market, price comparison portals like Check24 played a significant role in driving down premiums for certain insurance products in recent years, highlighting the power of informed consumers.

- Informed Consumers: Customers can easily access detailed product information and pricing from competitors.

- Price Sensitivity: Greater transparency leads to increased price sensitivity and a focus on value for money.

- Negotiating Power: Informed customers are better equipped to negotiate terms and seek out the best deals.

- Differentiation Imperative: W&W must clearly articulate its unique value proposition to stand out in a transparent market.

Customer Power 5

Wuestenrot & Wuerttembergische (W&W) benefits from a substantial customer base, with an average of three contracts per customer and strong retention rates. However, the broader German financial market is experiencing a decline in customer loyalty.

Customers are increasingly focused on price and are less tied to specific brands. They are actively seeking personalized services and competitive offers, which puts pressure on W&W's market share if these demands are not met effectively.

- Customer Loyalty Decline: In 2023, a survey by Statista indicated that over 60% of German consumers stated they were more price-sensitive than in the previous year when choosing financial products.

- Demand for Personalization: Financial institutions are seeing a rise in customer expectations for tailored advice and product offerings, with digital platforms playing a key role in delivering this.

- Price Sensitivity: The competitive landscape in Germany's insurance and banking sectors means that even small price differences can sway customer decisions, impacting established players like W&W.

The bargaining power of customers for Wuestenrot & Wuerttembergische (W&W) is significant, driven by increased transparency and a wide array of choices in the German financial services market. Customers can easily compare prices and product features online, leading to heightened price sensitivity. For example, in 2024, the German insurance market saw a surge in consumers switching providers based on minor price differences, underscoring this trend.

While W&W benefits from customer loyalty and multiple contracts per customer, the overall market is experiencing a decline in brand allegiance, with over 60% of German consumers reporting increased price sensitivity in 2023 according to Statista. This necessitates W&W to focus on competitive pricing and clear value propositions to retain its customer base.

The rise of fintech companies, bolstered by substantial venture capital in 2024, further empowers consumers with alternative, often specialized, financial solutions. This diminishes the lock-in effect for bundled services, allowing customers to cherry-pick providers for specific needs, thereby increasing their negotiating leverage.

Digitalization is actively reducing switching costs, making it simpler for customers to explore and move to competitors. Online comparison tools and streamlined application processes, prevalent in 2024, enable customers to make informed decisions and seek better terms, directly impacting W&W's pricing power.

| Factor | Impact on W&W | 2024 Trend/Data |

|---|---|---|

| Information Accessibility | Empowers customers to compare and negotiate | Increased use of online comparison portals |

| Price Sensitivity | Pressures margins, requires competitive pricing | Over 60% of Germans more price-sensitive (2023) |

| Availability of Alternatives | Reduces customer lock-in, increases switching | Growth of fintechs offering specialized products |

| Switching Costs | Decreasing due to digitalization | Streamlined online application processes |

What You See Is What You Get

Wuestenrot & Wuerttembergische Porter's Five Forces Analysis

This preview showcases the complete Wuestenrot & Wuerttembergische Porter's Five Forces Analysis, offering an in-depth examination of the competitive landscape. What you see here is the exact, professionally formatted document you will receive immediately upon purchase. Rest assured, there are no placeholders or missing sections; you'll gain instant access to this comprehensive strategic tool.

Rivalry Among Competitors

The German financial services market, Wuestenrot & Wuerttembergische's (W&W) operating ground, is a mature and highly fragmented landscape. This means there are many companies vying for customers, including big universal banks, focused building societies, and established insurance providers. This intense competition means companies must constantly innovate and offer competitive pricing to stand out.

W&W benefits from its strategic dual-brand approach and its bancassurance model, which integrates banking and insurance services. This integrated offering helps them provide a broader range of products to their customers, potentially creating stickier relationships and a competitive edge against more specialized rivals. For instance, in 2023, the German banking sector saw continued consolidation pressures, with smaller institutions struggling to compete with the scale of larger players, a trend that W&W's model is well-positioned to navigate.

Established financial segments like traditional banking and insurance are experiencing slower market growth, which naturally heats up the competition for market share. This means companies are fighting harder for every customer and every dollar. For Wuestenrot & Wuerttembergische (W&W), this translates to a more challenging environment where differentiation and efficiency are key.

The German insurance market, while showing steady growth, is seeing premium increases that are now aligning more closely with other European markets. This convergence reduces any previous competitive advantages based on pricing alone, forcing insurers to focus on product innovation and customer service to stand out. W&W must navigate this increasingly level playing field.

In 2024, W&W's new business volume for home loan savings normalized after hitting record highs driven by interest rates. This normalization signals a return to a more typical, and likely more competitive, growth trajectory for this segment, requiring W&W to adapt its strategies to secure new business in a less artificially stimulated market.

Competitive rivalry in the bancassurance sector, particularly for core products like home savings plans and mortgages, is often intense due to limited product differentiation. This forces companies like Wuestenrot & Wuerttembergische (W&W) to compete heavily on price and interest rates, a dynamic evident in the German market where margins can be slim.

W&W differentiates itself by offering integrated solutions that span housing, financial security, and wealth accumulation, aiming to provide a holistic customer experience. This strategy seeks to build customer loyalty beyond just transactional product offerings, a crucial element in retaining market share amidst aggressive pricing by competitors.

In 2024, the German mortgage market, a key area for W&W, saw interest rates fluctuate, impacting pricing strategies. For instance, while rates may have stabilized compared to earlier periods, the competitive pressure to offer attractive terms remained a significant factor for W&W and its rivals.

Competitive Rivalry 4

The competitive rivalry within the financial services sector, particularly for established players like Wuestenrot & Wuerttembergische (W&W), is notably intense. High exit barriers are a significant factor here. These barriers stem from substantial investments in fixed assets, like extensive branch networks and IT infrastructure, coupled with the considerable cost and regulatory hurdles involved in divesting or winding down operations.

For instance, the German financial sector, where W&W primarily operates, has seen consolidation but still hosts numerous players. In 2023, the German banking sector alone comprised over 1,300 institutions, many of which are regional or specialized, contributing to a fragmented competitive landscape. This sheer number of entities, each with its own customer base and legacy systems, means that even under pressure, many find it difficult or uneconomical to exit entirely.

- High Fixed Assets: W&W's significant investments in physical infrastructure and technology create substantial sunk costs, making it challenging to exit specific markets or business lines without incurring significant losses.

- Large Customer Bases: Established customer relationships and the associated inertia are difficult to overcome, encouraging existing players to remain competitive rather than abandon their market share.

- Regulatory Obligations: Stringent regulations within the financial industry impose significant compliance costs and complexities on exiting a market or ceasing certain operations, effectively locking in established firms.

- Cost of Winding Down: The expense associated with closing down operations, including severance packages, contractual obligations, and data management, further deters companies from exiting, thus perpetuating rivalry.

Competitive Rivalry 5

Competitive rivalry within the German financial sector, particularly for companies like Wuestenrot & Wuerttembergische (W&W), is intensifying due to a strong focus on digitalization and innovation. Players are channeling significant investments into new technologies and digital customer engagement platforms.

Despite W&W's ongoing digital transformation efforts, the broader German financial landscape has historically been slower to adopt digital solutions compared to many other European markets. This lag presents a dual challenge: the need to catch up technologically while simultaneously fending off competition from more nimble, digitally-native rivals and emerging fintech companies.

- Digital Investment: German banks and insurers are increasing their IT spending. For instance, in 2023, the German banking sector's IT expenditure was estimated to be around €10 billion, with a significant portion allocated to digital initiatives.

- Fintech Growth: The number of fintech startups in Germany has grown substantially, attracting considerable venture capital. By late 2024, it's projected that over 1,000 fintechs will be operating in Germany, offering specialized digital services.

- Customer Expectations: Consumer demand for seamless digital experiences is rising, forcing traditional players to adapt or risk losing market share to more user-friendly digital alternatives.

- Regulatory Landscape: While regulations can sometimes slow down innovation, they also create opportunities for compliant digital solutions, further fueling competition.

Competitive rivalry within Wuestenrot & Wuerttembergische's (W&W) operating environment is fierce, driven by a mature and fragmented German financial services market. This intensity is amplified by high exit barriers, such as substantial investments in fixed assets and regulatory complexities, which keep many players engaged. For instance, in 2023, the German banking sector alone comprised over 1,300 institutions, reflecting this fragmentation and the difficulty of exiting.

The drive for digitalization further fuels this rivalry, with companies like W&W investing heavily in technology to meet evolving customer expectations. By late 2024, over 1,000 fintechs are projected to operate in Germany, directly challenging traditional players. This necessitates continuous innovation and efficient operations for W&W to maintain its market position.

SSubstitutes Threaten

Direct online banks and fintech lending platforms represent a substantial threat of substitutes for Wüstenrot & Württembergische. These digital-first competitors, like N26 or Revolut, offer streamlined application processes and often more competitive interest rates or flexible repayment options for mortgages and loans, directly challenging traditional banking services.

The appeal of these substitutes is amplified by their lower overhead costs, which can translate into reduced fees for consumers. For instance, in 2024, the average mortgage origination fee in Germany remained a point of contention, with fintechs often undercutting traditional banks on this front.

Pure-play online insurance providers and aggregators present a significant threat by offering direct alternatives to W&W's insurance products. These digital-first companies allow customers to easily compare and purchase policies, often at more competitive price points. This ease of access and potential cost savings directly challenges traditional insurers like W&W.

The German non-life insurance market, in particular, is seeing a notable increase in consumer reliance on comparison websites. In 2023, a significant portion of German consumers utilized online comparison portals to find insurance, indicating a clear shift in purchasing behavior. This trend underscores the growing power of substitutes that simplify the selection and acquisition process for insurance policies.

Fintech innovations pose a significant threat, offering alternatives to W&W's traditional investment and wealth management services. Robo-advisors and accessible, low-cost trading platforms are particularly attractive to younger investors and those who prefer a hands-on approach to managing their portfolios.

For example, the global robo-advisory market was valued at approximately $2.5 billion in 2023 and is projected to grow substantially. This growth indicates a clear shift in consumer preference towards digital, often more affordable, investment solutions, directly challenging W&W's established product lines.

Threat of Substitutes 4

The threat of substitutes for Wuestenrot & Wuerttembergische (W&W) products, particularly home savings plans and mortgage loans, is significant. Individuals can opt for self-financing by accumulating personal savings, which bypasses the need for traditional financial products. Furthermore, alternative investment vehicles like direct real estate investments or participation in peer-to-peer lending platforms offer different avenues for wealth building and property acquisition, thereby diverting demand away from W&W's core offerings.

In a dynamic economic climate, especially during periods of elevated interest rates, the appeal of self-sufficiency grows. For instance, in late 2023 and into 2024, rising interest rates made saving more attractive for some consumers, as it directly reduces their future borrowing needs and the overall cost of financing a home. This trend directly impacts the demand for mortgage loans, as individuals may delay or reduce their borrowing to avoid higher repayment burdens.

- Self-Financing: Individuals increasingly rely on personal savings to fund major purchases like homes, reducing reliance on financial institutions.

- Alternative Investments: Platforms offering direct real estate investment or peer-to-peer lending present competitive options for capital growth and property acquisition.

- Interest Rate Sensitivity: In high-interest rate environments, the cost of borrowing increases, making saving a more appealing substitute for financing needs.

- Market Trends: Data from 2024 indicates a continued interest in direct property investment and a cautious approach to long-term debt among certain consumer segments.

Threat of Substitutes 5

Government-backed social security programs and public housing initiatives represent a significant threat of substitutes for certain W&W products, particularly for lower-income demographics. These state-provided safety nets can reduce the perceived need for private insurance or home savings solutions.

For instance, in Germany, statutory pension insurance and state-subsidized housing programs offer a baseline level of security that can compete with private offerings. While W&W aims for comprehensive private solutions, the existence of these public alternatives can dampen demand for comparable private provisions, especially when cost is a primary consideration.

- Government Social Security: Public pension schemes and unemployment benefits provide a foundational safety net, potentially reducing reliance on private life insurance or long-term savings products.

- Public Housing Initiatives: State-supported housing programs and subsidies can offer affordable alternatives to private home ownership or rental insurance, impacting W&W's real estate financing and insurance segments.

- Reduced Perceived Necessity: The availability of robust public support systems can diminish the urgency for individuals to invest in private financial planning and protection products.

The threat of substitutes for W&W's offerings is multifaceted, encompassing digital alternatives, self-financing, and public programs. Digital banks and fintechs directly challenge traditional banking and insurance with streamlined processes and competitive pricing. For example, in 2024, fintechs continued to gain traction in the German mortgage market by offering lower origination fees compared to traditional institutions.

Consumers are increasingly turning to online comparison platforms for insurance, a trend that saw significant growth in 2023, with a substantial portion of Germans using these sites. Robo-advisors and low-cost trading platforms also present a substitute for wealth management services, with the global robo-advisory market projected for substantial growth beyond its 2023 valuation of approximately $2.5 billion. Furthermore, periods of high interest rates, like those observed in late 2023 and into 2024, can make self-financing via savings more attractive than taking out loans.

Government social security and housing initiatives also act as substitutes, particularly for lower-income segments, by providing a baseline of financial security and housing access. These public programs can reduce the perceived need for comparable private insurance and savings products, especially when cost is a major factor for consumers.

| Substitute Category | Examples | Impact on W&W | 2024 Trend/Data Point |

|---|---|---|---|

| Digital Banking & Fintech | N26, Revolut, Online Lenders | Challenges mortgages, loans with lower fees and flexible terms. | Fintechs often undercut traditional banks on mortgage origination fees. |

| Online Insurance Providers & Aggregators | Comparison Websites, Direct Online Insurers | Offers easier comparison and potentially lower-cost insurance policies. | Increased consumer reliance on online comparison portals for insurance in Germany. |

| Investment & Wealth Management Alternatives | Robo-advisors, Low-cost Trading Platforms | Attracts investors seeking digital, affordable portfolio management. | Global robo-advisory market valued at ~$2.5 billion in 2023, with strong growth projections. |

| Self-Financing & Alternative Investments | Personal Savings, Direct Real Estate, P2P Lending | Reduces demand for W&W's home savings and mortgage products. | Higher interest rates in late 2023/2024 increased the appeal of saving over borrowing. |

| Government Social Security & Housing | Statutory Pension Insurance, Public Housing Programs | Can reduce the need for private insurance and savings, especially for lower-income groups. | State-subsidized housing and public pensions offer baseline security competing with private solutions. |

Entrants Threaten

The threat of new entrants in the German banking and insurance sectors, as it pertains to Wuestenrot & Wuerttembergische, is considerably low due to formidable regulatory barriers. New players must navigate exceptionally high capital requirements, a complex licensing process, and strict adherence to evolving compliance frameworks such as the Markets in Crypto-Assets Regulation (MiCAR) and the Digital Operational Resilience Act (DORA). For instance, in 2023, the average capital required for a new German bank license remained substantial, reflecting the robust oversight by the European Central Bank and BaFin.

The threat of new entrants in the banking and insurance sectors, particularly for a comprehensive provider like Wuestenrot & Wuerttembergische (W&W), is significantly mitigated by extremely high capital requirements. Establishing a regulated financial institution necessitates substantial upfront investment to comply with solvency ratios, operational infrastructure, and regulatory capital buffers, effectively deterring smaller or less-resourced players.

For instance, in 2024, the European Union's Solvency II directive continues to impose stringent capital adequacy requirements on insurance companies, demanding significant reserves to cover potential liabilities. Similarly, banks must adhere to Basel III and its evolving standards, requiring substantial capital to absorb unexpected losses. These regulatory hurdles, coupled with the need for robust IT systems and extensive distribution networks, create a formidable barrier to entry, limiting new competition to well-capitalized firms or highly specialized niche operators.

Established brand loyalty and deep customer relationships, like those W&W enjoys with its 6.5 million customers, present a formidable barrier. New entrants must invest heavily in marketing and brand building to even begin to erode this entrenched trust and extensive sales network.

Threat of New Entrants 4

The threat of new entrants in the financial services sector, particularly for a company like Wuestenrot & Wuerttembergische (W&W), is significantly influenced by the ability to establish effective distribution channels. W&W leverages a robust multi-channel strategy, encompassing tied agents, independent brokers, and digital platforms, which grants them extensive reach to a diverse customer base. This established network is a significant barrier for newcomers.

New entrants typically face considerable challenges in replicating such comprehensive distribution networks. Their efforts often concentrate on digital acquisition strategies, which, while scalable, may not offer the same depth of customer engagement or trust as traditional, personal interactions facilitated by established agent networks. For instance, in 2023, while digital banking adoption continued to rise, a significant portion of financial product sales still relied on intermediary relationships.

The capital requirements and regulatory hurdles also act as deterrents. Building a licensed financial services operation, including the necessary compliance infrastructure and customer support, demands substantial investment. This makes it difficult for smaller, less capitalized entities to compete directly with established players like W&W who have already navigated these complexities and built significant market presence.

- Distribution Network Advantage: W&W's established multi-channel distribution (tied agents, brokers, digital) provides superior customer access compared to new entrants primarily relying on digital acquisition.

- Customer Trust and Relationships: Traditional channels fostered by incumbents like W&W often build deeper customer trust, a difficult element for new digital-first entrants to replicate quickly.

- Capital and Regulatory Barriers: The significant capital investment and stringent regulatory compliance required to operate in financial services present a high barrier to entry for potential new competitors.

Threat of New Entrants 5

Technological advancements, particularly in fintech and AI, are creating new avenues for specialized players to enter financial services. While Wuestenrot & Wuerttembergische’s (W&W) established bancassurance model remains robust, these innovations allow agile fintechs to target specific segments with leaner operations and quicker market entry. For instance, digital lending platforms or specialized payment services can emerge with lower initial capital requirements compared to traditional banking infrastructure.

These emerging fintechs can leverage AI for more efficient customer onboarding, risk assessment, and personalized product offerings, potentially attracting a segment of the market that values digital-first experiences. In 2024, the European fintech market continued its growth trajectory, with significant investment flowing into areas like digital payments and alternative lending, demonstrating the ongoing potential for new entrants to disrupt specific niches.

The threat of new entrants for W&W is therefore nuanced; it's less about a direct assault on their core integrated model and more about the potential for specialized digital competitors to chip away at specific customer segments or product lines. This necessitates W&W's continued focus on digital transformation and innovation to maintain its competitive edge across all service areas.

- Fintech Investment: Global fintech investment reached approximately $150 billion in 2023, with a significant portion directed towards AI and digital platforms, indicating continued innovation and potential for new entrants.

- Digital Lending Growth: The digital lending market is projected to grow substantially, offering a clear example of a segment where new, technology-driven entrants can gain traction.

- AI in Financial Services: AI adoption in financial services is accelerating, enabling new entrants to offer personalized services and improved efficiency, potentially challenging incumbent models.

The threat of new entrants for Wuestenrot & Wuerttembergische (W&W) remains relatively low, primarily due to significant regulatory hurdles and high capital requirements in the German financial services sector. For instance, in 2024, compliance with directives like Solvency II for insurers and Basel III for banks necessitates substantial financial reserves and robust operational infrastructure, acting as a strong deterrent for less capitalized entities.

Furthermore, W&W benefits from deeply entrenched customer relationships and a well-established, multi-channel distribution network, including tied agents and brokers. Replicating this extensive reach and the trust it fosters is a considerable challenge for newcomers, who often focus on digital acquisition strategies that may not offer the same depth of engagement. In 2023, while digital adoption increased, a significant portion of financial product sales still relied on intermediary relationships.

While fintech innovations, particularly in AI and digital lending, offer avenues for specialized entrants to target niche segments, the overall threat to W&W's integrated bancassurance model is mitigated. These new players often require less initial capital for specific services but struggle to match the comprehensive offerings and established trust of incumbents. The continued investment in fintech, with global investment reaching approximately $150 billion in 2023, highlights this dynamic, but the core barriers for broad market entry persist.

| Barrier Type | Description | Impact on New Entrants | W&W's Position |

|---|---|---|---|

| Regulatory & Capital Requirements | High capital needs, licensing, compliance (e.g., MiCAR, DORA, Solvency II, Basel III) | Significant financial and operational burden, deterring smaller players. | Established compliance infrastructure, strong capital base. |

| Distribution Network & Brand Loyalty | Extensive multi-channel sales force, 6.5 million customers, strong brand recognition. | Difficulty in matching reach, customer trust, and sales effectiveness. | Deeply entrenched customer base and proven sales channels. |

| Technological Innovation (Fintech) | AI, digital lending, specialized platforms offer niche entry points. | Potential to disrupt specific segments with leaner, digital-first models. | Need for continuous digital transformation to counter specialized threats. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Wuestenrot & Wuerttembergische leverages data from annual reports, industry-specific market research, financial news outlets, and regulatory filings to provide a comprehensive view of the competitive landscape.