The Wonderful Company SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Wonderful Company Bundle

The Wonderful Company boasts strong brand recognition and a diverse product portfolio, but faces intense competition and evolving consumer preferences. Understanding these dynamics is crucial for strategic planning.

Want the full story behind The Wonderful Company’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

The Wonderful Company’s strength lies in its diverse and iconic brand portfolio, featuring household names like FIJI Water, POM Wonderful, Wonderful Pistachios, Wonderful Halos, and Teleflora. This broad range, spanning nuts, citrus, juices, water, wine, and floral services, effectively minimizes dependence on any single product category. This strategic diversification ensures broad consumer appeal and resilience in varied market conditions.

The success of individual brands within this portfolio is a key indicator of its strength. For instance, Wonderful Pistachios achieved a significant milestone, surpassing $1 billion in annual North American retail sales. This remarkable performance highlights strong consumer preference and robust demand for the company's healthy snacking options, underscoring the power of their established brands.

The Wonderful Company's extensive vertical integration, managing operations from farming to marketing, grants them significant control over their supply chain, often described as 'tree to heart.' This approach fosters enhanced quality assurance and operational efficiency, crucial for their branded consumer packaged goods.

This deep integration allows The Wonderful Company to better manage costs and ensure a consistent flow of raw materials. Their substantial investments, exceeding $1 billion, in operations and capacity are key to maintaining a year-round supply, even when specific crops, like pistachios, experience natural fluctuations in harvests.

The Wonderful Company demonstrates a robust commitment to sustainability, evident in its substantial investments. By 2025, the company aims for 100% renewable electricity across its U.S. operations, a significant step towards environmental responsibility.

The company has allocated over $400 million towards sustainable agriculture initiatives, focusing on critical areas like water conservation and waste reduction. These efforts include increasing the use of recycled plastic in packaging and diverting substantial amounts of waste from landfills, showcasing a holistic approach to environmental stewardship.

This dedication to sustainability resonates with increasing consumer and investor preferences for eco-conscious businesses. Furthermore, these practices proactively address potential long-term operational risks stemming from climate change, positioning Wonderful Company for resilience.

Significant Philanthropic and Community Investment

The Wonderful Company and its co-owners have demonstrated a remarkable commitment to philanthropy, pledging over $2.5 billion to social responsibility initiatives worldwide. This significant investment is strategically directed towards the communities where their employees reside and operate, with a pronounced emphasis on California's Central Valley.

Their substantial contributions span critical areas such as education, health and wellness, and overall community development. This deep-seated engagement not only bolsters the company's brand image but also cultivates stronger employee loyalty and cultivates a more supportive environment for their operations.

- Global Philanthropic Commitment: Over $2.5 billion pledged to date.

- Geographic Focus: Strong emphasis on California's Central Valley, where many employees live and work.

- Investment Areas: Education, health and wellness, and community development are key priorities.

- Strategic Benefits: Enhanced brand reputation, increased employee loyalty, and a positive operating environment.

Positive Workplace Culture and Recognition

The Wonderful Company fosters a positive workplace culture, evidenced by its inclusion on Fortune magazine's 100 Best Companies to Work For list for both 2024 and 2025. This prestigious recognition, alongside its high ranking on PEOPLE magazine's Companies That Care list, stems directly from confidential employee feedback, underscoring a genuinely supportive environment. Such a strong culture is a significant asset, contributing to increased employee loyalty, enhanced productivity, and overall business success.

The Wonderful Company's strength is anchored in its impressive portfolio of well-recognized brands like POM Wonderful, Wonderful Pistachios, and FIJI Water, which ensures broad market appeal and stability. This diversification across various product categories, from healthy snacks to beverages and floral services, significantly reduces reliance on any single market segment.

The company's commitment to vertical integration, managing everything from farming to final product, provides exceptional control over quality and efficiency. This 'tree to heart' approach, backed by over $1 billion invested in operations, ensures consistent supply and quality, a critical advantage in the consumer packaged goods sector.

Wonderful Company's dedication to sustainability is a key strength, with ambitious goals like achieving 100% renewable electricity for U.S. operations by 2025 and investing over $400 million in sustainable agriculture, including water conservation and waste reduction.

Furthermore, the company's significant philanthropic efforts, including a pledge of over $2.5 billion, particularly benefiting California's Central Valley, enhance its brand reputation and foster strong community ties. This commitment, combined with being recognized as a top workplace by Fortune in 2024 and 2025, highlights a robust organizational culture that drives loyalty and productivity.

| Brand Portfolio Strength | Vertical Integration | Sustainability Commitment | Workplace Culture & Philanthropy |

| Iconic brands (FIJI Water, POM Wonderful, Wonderful Pistachios) | Farm to table control | 100% renewable electricity goal (US ops by 2025) | Fortune 100 Best Companies to Work For (2024, 2025) |

| Diversified product categories | Enhanced quality assurance | $400M+ in sustainable agriculture | $2.5B+ pledged in philanthropy |

| Minimizes dependence on single products | Operational efficiency | Water conservation, waste reduction | Focus on California's Central Valley |

What is included in the product

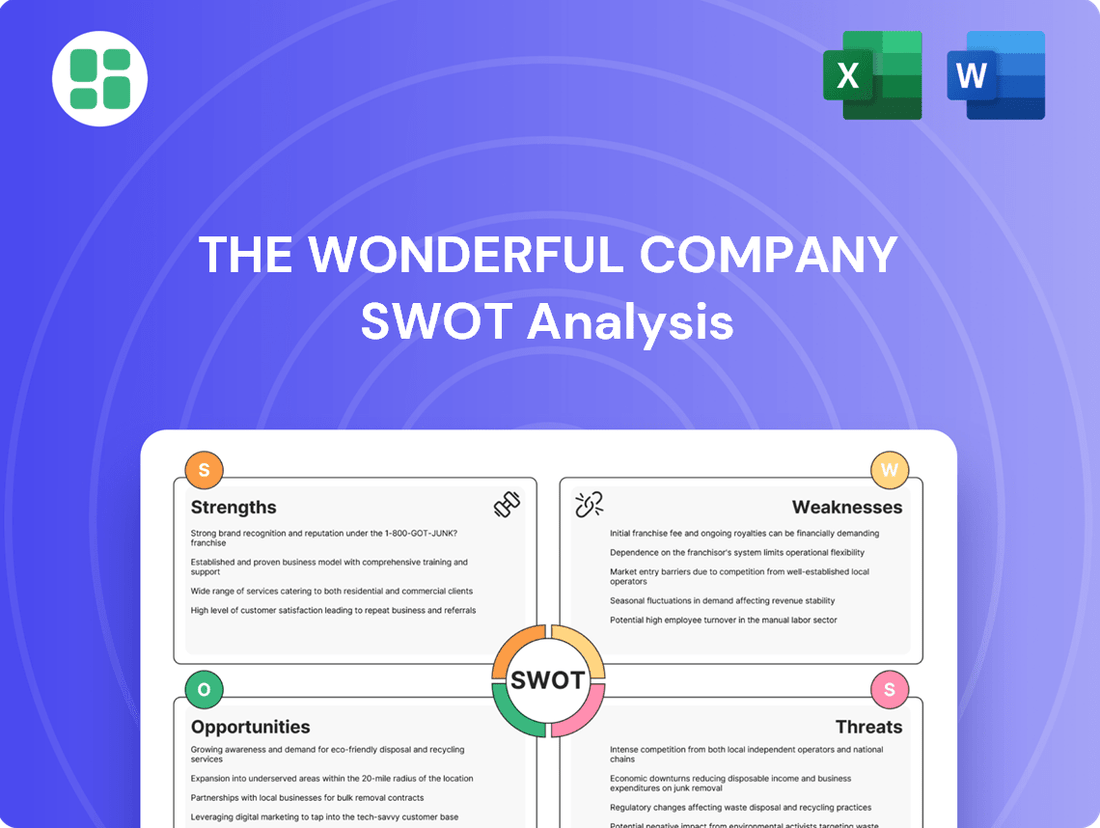

Delivers a strategic overview of The Wonderful Company’s internal and external business factors, detailing its strengths in brand recognition and market share, weaknesses in product diversification, opportunities in emerging markets, and threats from competition and changing consumer preferences.

Offers a clear, actionable framework to identify and address The Wonderful Company's market vulnerabilities and competitive threats.

Weaknesses

The Wonderful Company's reliance on agriculture makes it inherently vulnerable to environmental challenges. Climate change, prolonged droughts, and pest infestations directly threaten crop yields and quality, impacting the company's bottom line. For instance, California's ongoing water scarcity, a critical issue for The Wonderful Company's operations, highlights the significant risk posed by water availability and its management.

The Wonderful Company's status as a privately held entity, with reported revenues exceeding $6 billion, means it doesn't publicly share detailed financial statements. This lack of transparency poses a challenge for external parties, such as financial analysts and potential collaborators, who need to conduct thorough due diligence or fully evaluate the company's financial standing and growth prospects.

This opacity makes it difficult to benchmark The Wonderful Company's performance against publicly traded competitors in the agribusiness and consumer packaged goods sectors. Investors and analysts often rely on publicly available data for valuation and comparative analysis, which is not readily accessible for this company.

The consumer packaged goods (CPG) arena where many Wonderful Company brands compete is intensely crowded. This means they're up against a multitude of well-established companies and newer entrants vying for shelf space and consumer attention in categories like nuts, juices, and bottled water.

This fierce competition necessitates constant product innovation and substantial marketing expenditures, often requiring competitive pricing strategies. For instance, the global CPG market was valued at over $2 trillion in 2023, highlighting the sheer scale of investment needed to stand out.

Sustaining market share and achieving growth in such a dynamic environment demands significant resources. The pressure to continually invest in marketing, research and development, and promotional activities can place a strain on the company's financial capacity.

Potential for Negative Public Perception and Labor Disputes

The Wonderful Company has encountered public scrutiny concerning its water usage in drought-affected California. This has contributed to a negative public perception, potentially impacting consumer choices and brand loyalty.

Labor disputes represent another significant weakness. For instance, the company was involved in a lawsuit in 2024 challenging a new state law designed to facilitate employee unionization. Such legal battles and ongoing labor relations can disrupt operations and incur substantial legal expenses.

- Water Management Criticism: Faced public backlash over water practices in drought-stricken California.

- Labor Dispute in 2024: Lawsuit filed to block a state law easing unionization efforts.

- Potential Consequences: Negative public perception, consumer boycotts, and increased operational costs due to legal challenges.

Geographic Concentration Risk

The Wonderful Company's reliance on California's Central Valley for key crops like pistachios, almonds, and citrus presents a significant weakness. This geographic concentration, while potentially efficient, heightens vulnerability to region-specific challenges.

- Environmental Regulations: California's stringent environmental regulations, particularly concerning water usage and pesticide application, directly impact operations in the Central Valley.

- Climate Vulnerabilities: The region is susceptible to droughts, extreme heat, and other climate-related events that can severely affect crop yields and quality. For example, California experienced significant drought conditions in recent years, impacting agricultural output across the state.

- Labor Market Dependence: A concentrated agricultural footprint often leads to a heavy reliance on the local labor market, which can be subject to availability and wage pressures.

The Wonderful Company's significant reliance on agriculture makes it susceptible to environmental factors and regulatory pressures, particularly in California. For instance, ongoing water scarcity in the state, a crucial area for their operations, poses a substantial risk to crop yields and overall production. Additionally, the company has faced public criticism for its water usage practices in drought-affected regions, potentially impacting brand perception.

The company's private ownership limits financial transparency, making it difficult for external stakeholders to assess its financial health and growth prospects compared to publicly traded competitors. This lack of detailed public financial data hinders in-depth analysis and benchmarking within the highly competitive consumer packaged goods (CPG) sector.

Intense competition within the CPG market requires substantial and continuous investment in marketing, innovation, and promotional activities to maintain market share. The global CPG market, valued at over $2 trillion in 2023, underscores the scale of resources needed to compete effectively against numerous established and emerging brands.

Labor disputes, such as the 2024 lawsuit challenging a state law facilitating unionization, represent another operational weakness. Such legal challenges can disrupt operations and lead to increased legal expenses, impacting financial performance.

Full Version Awaits

The Wonderful Company SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. This comprehensive report covers The Wonderful Company's Strengths, Weaknesses, Opportunities, and Threats. You'll gain valuable insights into their strategic positioning and market dynamics.

Opportunities

The Wonderful Company is strategically positioned to leverage the expanding global demand for health and wellness products. Consumers are increasingly seeking natural, plant-based snacks and beverages, a trend that aligns perfectly with Wonderful's established offerings in nuts, fruits, and juices. For instance, the global healthy snacks market was valued at approximately $113.7 billion in 2023 and is projected to grow significantly, offering substantial opportunities for Wonderful.

The company can capitalize on this by innovating new products and expanding its popular healthy lines, such as Wonderful Pistachios No Shells. Highlighting the inherent nutritional benefits of their existing portfolio, like the protein and fiber content in pistachios, will further resonate with health-conscious consumers. This focus on natural goodness and nutritional value is key to capturing market share in this burgeoning sector.

The burgeoning e-commerce landscape presents a prime opportunity for The Wonderful Company to refine its distribution networks, broaden its market access, and potentially improve profitability. By bolstering its online sales infrastructure and investigating direct-to-consumer (DTC) strategies, the company can lessen its dependence on conventional retail avenues and cultivate more direct connections with its consumers.

In 2024, global e-commerce sales were projected to reach $6.3 trillion, a figure expected to grow further. This expansion allows The Wonderful Company to bypass traditional intermediaries, potentially leading to higher margins on products like Wonderful Pistachios and POM Wonderful pomegranate juice, while also gaining valuable first-party customer data.

The Wonderful Company can seize opportunities by boosting its investment in sustainable agriculture and cutting-edge technology. For instance, embracing climate intelligence tools, as seen in the agricultural sector's growing adoption of AI for yield prediction, can significantly de-risk supply chains and make resource use far more efficient. This focus on sustainability is increasingly valued by consumers, with a 2024 report indicating that 60% of consumers are willing to pay more for products from environmentally responsible companies.

Further advancements in processing, innovative packaging solutions, and developing superior pistachio genetics offer avenues for product differentiation. These innovations can lead to higher yields and a stronger market position. Companies adopting such strategies in 2024 have reported an average of 8% improvement in operational efficiency, directly translating to cost savings.

By prioritizing these technological and sustainable agricultural investments, The Wonderful Company can achieve substantial operational cost savings. Moreover, this commitment enhances its brand reputation, appealing to a growing segment of environmentally conscious consumers and investors, a trend that is expected to continue through 2025.

Strategic Diversification and Acquisitions

The Wonderful Company can strategically diversify by acquiring businesses in adjacent markets or expanding into new international territories. For instance, a move into the plant-based food sector could leverage existing distribution networks. The company's commitment to strengthening its logistics infrastructure, as seen in its partnership with SeaCube Cold Solutions for a California depot, not only improves efficiency but also opens avenues for diversification into logistics and cold chain services.

Further opportunities lie in expanding its industrial park, which represents a diversification into real estate and warehousing, potentially generating additional revenue streams. This strategic expansion could support both its core agricultural businesses and new ventures. The company's existing strong brand portfolio in categories like nuts, fruits, and beverages positions it well for cross-promotional opportunities and market penetration in related consumer goods.

- Strategic Acquisitions: Explore acquisitions in high-growth areas like plant-based foods or functional beverages to complement its existing portfolio.

- Geographic Expansion: Target emerging markets in Asia and South America for its established brands, leveraging its expertise in agricultural supply chains.

- Logistics and Real Estate: Capitalize on its logistics investments by offering third-party warehousing and distribution services, diversifying into real estate.

Global Market Expansion and Brand Penetration

The Wonderful Company has a significant opportunity to expand its global reach. By increasing market penetration in current international markets and entering new, developing economies, the company can tap into substantial growth.

The robust global demand for California pistachios, which has more than doubled in the last ten years, highlights the strong potential for key Wonderful Company products overseas.

To capitalize on this, Wonderful Company can tailor its product offerings and distribution strategies to suit local preferences and market dynamics.

- Increased Market Penetration: Leverage existing international infrastructure to deepen market share in countries where Wonderful Company products are already established.

- Emerging Market Expansion: Identify and enter new, high-growth potential markets, particularly in Asia and Africa, where demand for premium food products is rising.

- Product Localization: Adapt product formulations, packaging, and marketing campaigns to resonate with the specific tastes and cultural nuances of diverse international consumer bases.

- Strategic Partnerships: Form alliances with local distributors and retailers to enhance market access and navigate the complexities of new geographic regions.

The Wonderful Company is well-positioned to benefit from the increasing consumer focus on health and wellness. The global market for healthy snacks, valued at over $113 billion in 2023, presents a significant avenue for growth, aligning with Wonderful's core offerings of nuts and fruits.

Expanding its e-commerce presence offers a direct path to consumers, bypassing traditional retail and potentially increasing profit margins, especially as global e-commerce sales approach $6.3 trillion in 2024.

Investing in sustainable agriculture and technology, such as AI for yield prediction, can enhance operational efficiency by an estimated 8% and appeal to the 60% of consumers willing to pay more for eco-friendly products, as reported in 2024.

Diversification through strategic acquisitions in plant-based foods or expansion into logistics and real estate, leveraging its existing infrastructure, offers new revenue streams.

Threats

Climate change presents a significant threat to The Wonderful Company, given its heavy reliance on agriculture, especially in California. Persistent drought and water scarcity directly impact crop yields and quality. For instance, California's ongoing water challenges can escalate farming costs and create supply chain vulnerabilities.

The Wonderful Company is navigating a complex landscape of intensifying regulatory scrutiny, especially regarding its substantial water rights and environmental impact in California. This heightened oversight, particularly in drought-prone regions, poses a significant threat to its agricultural operations and resource management strategies.

Furthermore, the company faces persistent challenges from labor unions, notably the United Farm Workers, aiming to organize its workforce. The ongoing legal battles and potential for costly labor disputes could result in negative publicity and increased operational expenses, impacting profitability and brand reputation.

Consumer tastes are constantly evolving, and The Wonderful Company must remain agile. While their current product lines align with health-conscious trends, a rapid shift towards entirely new dietary fads or a strong preference for alternative sourcing, like hyper-local or specific organic certifications, could pose a significant challenge. For instance, a surge in demand for plant-based alternatives to pistachios or a sudden aversion to conventionally grown produce could impact their core markets.

Supply Chain Disruptions and Geopolitical Risks

Even with its vertical integration, Wonderful Company faces significant threats from global supply chain disruptions. Geopolitical events, trade disputes, and logistical hurdles can impact operations. For instance, approximately 15-20% of the U.S. pistachio crop, a key Wonderful product, is exported to China as of 2024, highlighting vulnerability to international trade relations.

These disruptions can translate into tangible financial consequences:

- Increased Costs: Supply chain bottlenecks often lead to higher transportation and material expenses.

- Production Delays: Inability to secure necessary inputs or ship finished goods on time can halt production.

- Lost Sales Opportunities: Stockouts due to disruptions mean missed revenue and potential loss of market share to competitors.

Commodity Price Volatility

The Wonderful Company's profitability hinges on agricultural products, making it susceptible to sharp swings in commodity prices. These price shifts are driven by a complex interplay of global supply and demand, unpredictable weather patterns, and significant geopolitical events. For instance, in late 2023 and early 2024, global almond prices experienced fluctuations due to supply concerns in key producing regions, directly impacting the cost of raw materials for companies like Wonderful. Similarly, citrus markets have seen volatility stemming from disease outbreaks and changing trade policies, affecting the cost and availability of key ingredients.

These price uncertainties create substantial challenges for financial forecasting and maintaining stable profit margins. For example, a sudden drop in the price of pistachios, a key Wonderful Company product, could significantly reduce revenue without a corresponding decrease in operational costs. Conversely, a sharp increase in the cost of packaging materials, influenced by global energy prices, could squeeze margins even if sales volumes remain consistent. This inherent volatility necessitates robust risk management strategies to mitigate the impact on the company's bottom line.

- Global almond prices saw a notable dip in late 2023 due to increased supply forecasts, impacting sourcing costs for companies reliant on this commodity.

- Citrus markets in early 2024 faced price pressures from adverse weather events in major growing regions, affecting the cost of juices and other fruit-based products.

- Energy price fluctuations in 2024 continue to influence the cost of packaging and transportation, adding another layer of volatility to agricultural supply chains.

Intensifying competition, particularly from international markets and new entrants focusing on niche healthy snacks, poses a significant threat. The company's reliance on popular brands like POM Wonderful and Wonderful Pistachios means it must continuously innovate and maintain market share against a growing array of alternatives, some of which may have lower production costs or different sourcing advantages.

The Wonderful Company's substantial water rights and agricultural operations in California are under increasing public and regulatory scrutiny, especially during periods of drought. This attention could lead to stricter water usage regulations or challenges to existing water allocations, directly impacting operational capacity and costs. For example, California's Central Valley, a key agricultural hub for the company, faces ongoing water management debates that could reshape farming practices.

Labor relations remain a persistent challenge, with ongoing efforts by organizations like the United Farm Workers to unionize agricultural workers. Potential labor disputes, strikes, or increased wage demands could lead to significant operational disruptions and added expenses, affecting profitability and brand reputation. The company has faced legal challenges related to labor practices, underscoring the sensitivity of this issue.

Shifting consumer preferences and dietary trends present a constant threat to established product lines. While the company benefits from the health-conscious movement, a rapid change in consumer demand towards novel ingredients, alternative sweeteners, or entirely different snack categories could diminish the appeal of its core offerings. For instance, a significant move away from nuts or juices towards entirely new food categories could impact market share.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of verified financial reports, comprehensive market intelligence, and expert commentary from industry analysts. These dependable sources ensure a data-driven and accurate assessment of The Wonderful Company's strategic position.