The Wonderful Company Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Wonderful Company Bundle

The Wonderful Company navigates a landscape shaped by intense rivalry and the constant threat of new entrants, particularly in the competitive snack and beverage markets. Understanding the bargaining power of both its suppliers and buyers is crucial for maintaining profitability and market share.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore The Wonderful Company’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The Wonderful Company's extensive ownership of agricultural land and integrated farming operations, particularly for key products like pistachios and almonds, significantly curbs the bargaining power of external suppliers. This vertical integration means they control a substantial portion of their raw material sourcing, reducing dependence on independent growers and thus limiting price negotiation leverage for those outside their direct control.

This direct control over farming allows The Wonderful Company to dictate quality standards and manage supply chains more effectively, a stark contrast to companies reliant on the open market. For instance, in 2024, the company's vast pistachio orchards, covering tens of thousands of acres, ensured a stable and predictable supply, insulating them from the price volatility that can affect other agricultural businesses.

The Wonderful Company, despite its integrated farming operations, still relies on external suppliers for vital agricultural inputs. These include essential water rights, specialized fertilizers, and sophisticated farming machinery, which are crucial for its extensive operations.

The scarcity of water, particularly in key agricultural regions like California, significantly amplifies the bargaining power of water rights holders. Furthermore, inflationary pressures in 2024 and projected into 2025 are driving up the costs of these specialized inputs, giving suppliers greater leverage.

Data from early 2025 indicates a notable uptick in agricultural input expenses. For instance, fertilizer prices have seen a significant increase, and the cost of advanced agricultural equipment has also risen, directly impacting The Wonderful Company's cost structure and its dependence on these suppliers.

The availability and cost of skilled agricultural labor significantly impact supplier power, particularly for labor-intensive crops like those The Wonderful Company cultivates. In 2024, the agricultural sector continued to grapple with labor shortages, a trend that can drive up wages and give farmworkers more leverage.

Recent legal developments, such as unionization efforts at Wonderful Nurseries in 2024-2025, highlight a growing potential for labor to exert greater bargaining power. These challenges could lead to increased labor costs and potentially affect the stability of the supply chain for The Wonderful Company.

Technology and Equipment Providers

Suppliers of advanced agricultural technology, processing machinery, and logistics solutions, such as those involved in cold chain infrastructure, possess a degree of bargaining power. As The Wonderful Company continues to invest in its industrial park and logistics hubs, its dependence on these specialized providers may grow, potentially increasing their leverage.

For instance, the agricultural technology sector is seeing significant innovation. In 2024, global spending on agricultural technology, or AgTech, was projected to reach over $30 billion, highlighting the increasing reliance on sophisticated equipment and software. Companies that offer proprietary or highly specialized solutions vital for The Wonderful Company's operations, like advanced irrigation systems or automated harvesting equipment, can command better terms.

- Specialized Equipment: Providers of unique processing machinery for nuts and fruits, or advanced logistics tracking systems, can exert influence due to limited alternatives.

- Technological Advancement: Suppliers at the forefront of AgTech, offering efficiency gains or sustainability improvements, are highly valued.

- Infrastructure Dependence: As The Wonderful Company expands its physical footprint, reliance on providers for critical infrastructure like cold storage facilities can amplify supplier power.

Climate and Environmental Factors

Adverse weather events significantly impact agricultural supply chains, directly influencing supplier bargaining power. For instance, the late 2024 hurricane season, which brought significant damage to Florida's citrus crops, demonstrated how natural disasters can drastically reduce available product. This scarcity empowers the remaining suppliers or those with alternative sources, allowing them to command higher prices.

Climate change introduces a persistent layer of uncertainty into agricultural markets, a key input for companies like The Wonderful Company. Risks such as increasing water scarcity and more frequent extreme weather events make the predictability and cost of agricultural inputs less reliable. This long-term volatility can lead to higher input costs and a greater dependence on suppliers who can mitigate these environmental challenges.

- Impact of Weather: Hurricanes in late 2024 affected Florida citrus, reducing supply and increasing supplier leverage.

- Climate Change Risks: Water scarcity and extreme weather create long-term unpredictability in agricultural inputs.

- Cost Implications: These environmental factors can lead to higher, less predictable input costs for businesses reliant on agriculture.

While The Wonderful Company's vertical integration limits supplier power for raw materials, it still relies on external providers for critical inputs like water, fertilizers, and specialized machinery. In 2024, rising costs for these essentials, coupled with agricultural labor shortages, increased supplier leverage. Furthermore, advancements in AgTech and dependence on specialized infrastructure providers grant them significant bargaining power.

| Input Category | 2024/2025 Trend | Impact on Supplier Power |

| Water Rights | Scarcity Amplifies Power | Increased leverage for water rights holders |

| Fertilizers | Inflationary Pressures | Higher costs and greater supplier influence |

| AgTech & Machinery | Technological Advancement | Proprietary solutions enhance supplier leverage |

| Skilled Labor | Shortages & Unionization | Potential for increased labor costs and supply chain disruption |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to The Wonderful Company's diverse agricultural and consumer product portfolio.

Instantly understand competitive pressures with a clear, actionable summary of Porter's Five Forces for The Wonderful Company, simplifying complex market dynamics for strategic clarity.

Customers Bargaining Power

The Wonderful Company's consolidated retail channels, primarily large chains and supermarkets, wield considerable bargaining power. Their immense purchasing volumes, exemplified by the fact that major grocery retailers in the US can command annual revenues exceeding tens of billions of dollars, allow them to negotiate favorable pricing. This scale means they can pressure suppliers like The Wonderful Company for lower costs, better payment terms, and significant promotional support, impacting the company's margins.

The Wonderful Company leverages its strong portfolio of recognizable brands, including Wonderful Pistachios, Wonderful Halos, POM Wonderful, and FIJI Water. This brand equity is a significant factor in managing customer bargaining power, as consumers often exhibit a preference for these specific products, reducing retailers' ability to push alternatives. Indeed, Wonderful Pistachios and Halos hold the distinction of being America's number one brands in their respective categories, underscoring this loyalty.

The availability of private-label brands and generic alternatives in categories like nuts, juices, and bottled water significantly enhances customer bargaining power. For instance, major retailers often carry their own store-brand versions of popular products, offering consumers a more budget-friendly option. This trend, evident across the consumer packaged goods (CPG) sector, allows retailers to negotiate more aggressively with suppliers like The Wonderful Company, potentially switching if pricing or terms are unfavorable.

Consumer Price Sensitivity

Consumer price sensitivity significantly impacts the bargaining power of customers, especially in categories like bottled water and basic nuts where differentiation is limited. Retailers often leverage this sensitivity, passing cost pressures directly back to suppliers.

The economic climate of 2024 and projected into 2025 highlights increased consumer cost-consciousness due to persistent inflation in the food sector. This heightened awareness means consumers are more likely to switch brands or retailers based on price, amplifying their influence.

- Increased Price Sensitivity: Consumers are actively seeking value, making price a primary decision factor in purchasing staple goods.

- Retailer Leverage: Retailers use consumer price sensitivity to negotiate lower prices from suppliers, thereby increasing their own bargaining power.

- Impact on Suppliers: Suppliers face pressure to absorb cost increases or reduce their own margins to maintain shelf space.

Diversified Product Portfolio

The Wonderful Company's extensive product range, encompassing brands like Wonderful Pistachios, POM Wonderful, Fiji Water, and Halos, significantly mitigates the bargaining power of its customers. This diversification means that if a large retailer attempts to exert pressure on pricing for one product, Wonderful Company can leverage its strength and customer loyalty in other categories. For instance, their substantial market share in pistachios, a popular snack item, provides a strong negotiating position that isn't solely reliant on their citrus or juice offerings.

This broad portfolio also diversifies their customer base, reducing the impact of any single customer's demands. Whether dealing with major grocery chains, food service providers, or direct-to-consumer channels, the company's ability to offer a variety of popular products ensures that no single buyer holds disproportionate leverage. In 2023, The Wonderful Company reported significant growth across its portfolio, with its top brands consistently ranking high in their respective categories, further solidifying its position against customer demands.

The company's strategic approach to brand building and consumer engagement also plays a crucial role. By fostering strong brand loyalty, Wonderful Company creates demand that flows from the end consumer to the retailer. This indirect influence lessens the direct bargaining power of B2B customers, as they are often compelled to stock Wonderful Company products to meet consumer preferences. Their investment in marketing, for example, the substantial advertising spend on Wonderful Pistachios, directly impacts consumer demand, thereby reducing the customer’s ability to dictate terms.

- Diversified Revenue Streams: Reduces reliance on any single product category, making the company less vulnerable to price pressures from specific customer segments.

- Brand Loyalty: Strong consumer brand recognition translates into retailer demand, diminishing the bargaining power of wholesale or retail customers.

- Market Share Strength: Dominant positions in key markets, such as pistachios and mandarins, provide leverage in negotiations with buyers.

- Product Innovation: Continuous introduction of new products and variations keeps the portfolio fresh and appealing, maintaining customer interest and reducing dependency on any one item.

The bargaining power of customers for The Wonderful Company is moderated by several factors. Large retail chains, due to their sheer purchasing volume, can exert significant pressure on pricing and terms. However, Wonderful Company's strong brand portfolio, featuring market leaders like Wonderful Pistachios and Halos, creates direct consumer demand that retailers must meet. This brand loyalty, coupled with a diversified product range, reduces the leverage of any single buyer.

The economic environment of 2024, marked by persistent inflation, has heightened consumer price sensitivity. This makes consumers more inclined to seek value, which in turn empowers retailers to negotiate more aggressively with suppliers like The Wonderful Company. The presence of private-label alternatives also provides customers with choices, further strengthening their negotiating position against branded products.

The Wonderful Company's strategy of building strong consumer-facing brands directly influences the bargaining power of its wholesale customers. When consumers actively seek out specific Wonderful Company products, retailers are compelled to stock them, thereby diminishing their ability to dictate terms. This consumer pull, supported by substantial marketing investments, ensures that the company maintains a degree of control in its B2B relationships.

| Factor | Impact on Customer Bargaining Power | Wonderful Company's Mitigation Strategy |

|---|---|---|

| Retailer Scale | High | Strong brand loyalty, diversified portfolio |

| Brand Recognition | Low | Market leadership in key categories (e.g., Pistachios #1) |

| Private Labels/Generics | High | Product innovation, unique product attributes |

| Consumer Price Sensitivity (2024) | High | Value proposition, efficient supply chain |

Preview Before You Purchase

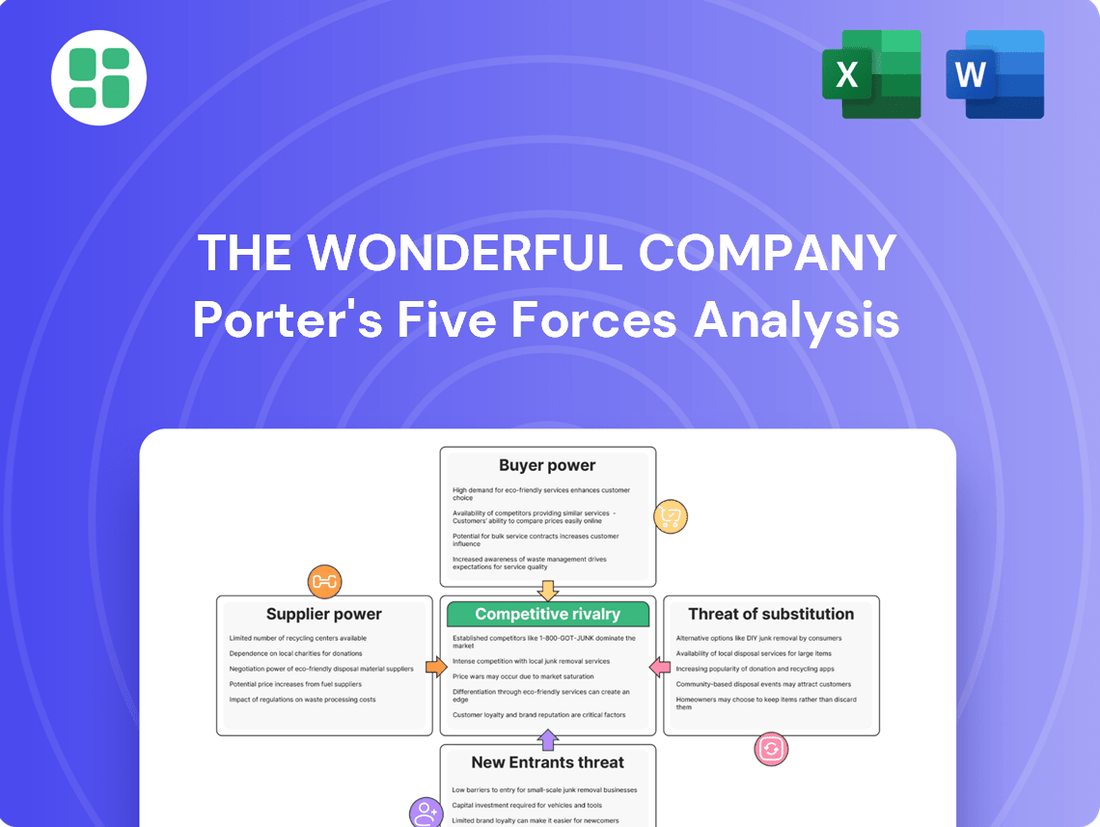

The Wonderful Company Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of The Wonderful Company, detailing the competitive landscape and strategic implications within its industry. The document displayed here is the exact, fully formatted analysis you’ll receive immediately after purchase, ensuring no surprises or missing sections. You can trust that what you see is precisely the professionally written report you'll be able to download and utilize for your business insights.

Rivalry Among Competitors

The Wonderful Company navigates a landscape of diverse and fragmented market segments, meaning competition varies significantly depending on the specific product category. For example, in the healthy snack aisle, they face off against giants like Frito-Lay and Planters, while in the citrus market, their rivals include Sunkist Growers and Tropicana. This broad exposure ensures a constant need to adapt to different competitive pressures across their portfolio.

The agricultural and food processing sectors, where The Wonderful Company operates, are characterized by substantial fixed costs. These include significant investments in land, specialized farming equipment, and advanced processing facilities. These high upfront costs necessitate high operational volumes to spread expenses and achieve profitability, intensifying competition.

This environment fuels aggressive pricing and promotional strategies among competitors as they strive to maintain market share and utilize their fixed assets efficiently. The fruit and nut farming market, a key area for The Wonderful Company, exemplifies this, with projections indicating substantial growth, further amplifying the need for scale and market presence.

Competitive rivalry in the beverage and snack industries, where The Wonderful Company operates, is significantly shaped by brand differentiation and the intensity of marketing efforts. Companies must invest heavily in advertising, product innovation, and brand building to capture consumer attention and loyalty. This is particularly true for The Wonderful Company, whose flagship brands such as POM Wonderful and Fiji Water command premium positioning, demanding ongoing marketing campaigns to sustain their market leadership against numerous competitors.

Global Market Presence

The Wonderful Company operates in a highly competitive global food and beverage market. This means they are up against numerous domestic and international companies vying for market share. For instance, in 2024, the global packaged food market was valued at over $1 trillion, showcasing the sheer scale of competition.

Geopolitical events and supply chain issues, prevalent in 2024 and projected into 2025, significantly impact this rivalry. These factors can disrupt the flow of goods, increase operational costs for imports and exports, and even shift consumer loyalties towards locally sourced or more readily available products.

- Global Competition: The Wonderful Company faces rivals across all its product categories worldwide, from nuts and snacks to beverages.

- Supply Chain Vulnerability: Disruptions in 2024, such as port congestion and labor shortages, have highlighted how global supply chains can be leveraged or exploited by competitors.

- Market Access Shifts: Geopolitical tensions in 2024-2025 can lead to trade barriers or preferential treatment, altering the competitive landscape for international players.

Sustainability and Health Trends

The Wonderful Company faces heightened competitive rivalry driven by growing consumer demand for healthy, sustainable, and ethically sourced products. This trend forces companies to innovate and differentiate themselves in a crowded marketplace.

Firms that successfully integrate Environmental, Social, and Governance (ESG) principles and offer appealing options like functional foods, plant-based alternatives, or low-sugar products are better positioned to capture market share. For instance, in 2024, the global market for plant-based foods was projected to reach over $74 billion, highlighting a significant area of competition.

- Intensifying Rivalry: Consumer preference for health and sustainability directly fuels competition among food and beverage companies.

- ESG Integration: Companies are increasingly judged on their ESG performance, impacting consumer choice and brand loyalty.

- Product Innovation: The demand for plant-based, functional, and low-sugar options necessitates continuous product development and marketing.

- Market Growth: The plant-based food sector alone demonstrates the substantial market opportunity and competitive pressure in this space.

The Wonderful Company contends with intense rivalry across its diverse product lines, from healthy snacks to beverages and agricultural products. This competition is amplified by high fixed costs in agriculture and food processing, compelling companies to pursue scale and market share through aggressive pricing and promotions.

Brand differentiation and robust marketing are crucial differentiators, especially for premium brands like POM Wonderful and Fiji Water, which require sustained investment to maintain leadership against numerous global players. The sheer size of the global packaged food market, exceeding $1 trillion in 2024, underscores the breadth of this competitive landscape.

Furthermore, evolving consumer preferences for healthy, sustainable, and ethically sourced goods, exemplified by the projected over $74 billion valuation of the plant-based food market in 2024, drive innovation and intensify competition as companies vie for market share by integrating ESG principles and developing new product categories.

| Product Category | Key Competitors | Market Dynamics | 2024 Market Insight |

|---|---|---|---|

| Healthy Snacks | Frito-Lay, Planters | Brand loyalty, product innovation, distribution | High growth segment, increased private label competition |

| Beverages (e.g., Water) | Sunkist, Tropicana, Coca-Cola, PepsiCo | Brand strength, marketing spend, distribution networks | Continued demand for functional and flavored waters |

| Citrus/Agricultural Products | Sunkist Growers, Dole Food Company | Commodity pricing, supply chain efficiency, weather impacts | Global supply chain disruptions impacting availability and cost |

| Nuts | Blue Diamond Growers, Diamond Foods | Quality, pricing, health benefits messaging | Growing consumer interest in plant-based protein sources |

SSubstitutes Threaten

Consumers have a vast selection of healthy snack alternatives that can readily substitute for The Wonderful Company's nut and citrus offerings. These include fresh fruits, vegetables, yogurt, granola bars, and a growing segment of protein-focused snacks. This broad availability means consumers can easily switch if they perceive The Wonderful Company's products as too expensive or less appealing.

The healthy snacks market itself is experiencing robust growth and diversification, presenting a significant threat of substitutes. With the market projected to reach USD 185.40 billion by 2034, new and innovative healthy snack options are constantly emerging, further diluting the unique appeal of any single company's products.

The threat of substitutes for The Wonderful Company's beverages, particularly juices and bottled water, is significant. Consumers have a wide array of alternatives, including readily available tap water, a vast selection of soft drinks, and popular beverages like teas and coffees. For instance, the global bottled water market, a key segment for Wonderful, saw significant growth, but tap water remains a free and accessible substitute for many.

Furthermore, the growing consumer preference for healthier options presents a dynamic landscape of substitutes. The rise of functional beverages, which offer added benefits like vitamins or probiotics, directly competes with traditional juices. This trend is reflected in market data; by 2024, the global functional beverage market was projected to reach hundreds of billions of dollars, indicating a strong consumer shift towards these alternatives.

Teleflora, a key player in The Wonderful Company's portfolio, faces robust competition from a wide array of non-floral gifting options. These include popular choices like gourmet chocolates, versatile gift cards, memorable experience-based gifts, and a diverse selection of home decor items. The sheer variety of these alternatives means consumers have many ways to express sentiment or decorate their spaces without resorting to traditional floral arrangements.

While flowers possess a distinct charm and emotional resonance, the expanding market for substitute gifts presents a substantial threat. For instance, the global gifting market is substantial, with reports indicating significant growth in non-traditional gift categories. In 2024, the market for experience gifts alone was projected to reach hundreds of billions of dollars, demonstrating a clear consumer preference for alternatives that offer lasting memories or practical utility.

Shift in Dietary Trends and Preferences

Shifting consumer tastes, like the growing popularity of plant-based foods and a focus on reduced sugar, present a significant threat. For instance, the global plant-based food market was valued at approximately $29.7 billion in 2023 and is projected to reach $162.5 billion by 2030, demonstrating a strong move away from traditional animal-based products. This evolution means consumers might opt for alternatives that align with these new preferences, impacting demand for The Wonderful Company's existing product lines.

The increasing emphasis on precision wellness and the burgeoning market for alternative proteins further challenge established food categories. Consumers are actively seeking out products tailored to specific health goals or ethical considerations. This trend could divert consumers from conventional offerings, such as traditional snacks or beverages, towards innovative substitutes that cater to these precise needs.

The threat of substitutes is amplified by several key factors:

- Evolving Dietary Habits: Consumers are increasingly adopting plant-based diets, reducing sugar intake, and seeking specific nutritional profiles, leading them to explore alternatives to conventional products.

- Rise of Precision Wellness: Health-conscious consumers are prioritizing products that offer targeted nutritional benefits or support specific wellness goals, often found in newer market segments.

- Growth of Alternative Proteins: The expanding market for plant-based and lab-grown proteins offers direct substitutes for traditional protein sources, potentially impacting categories like snacks and beverages.

Home-Grown and Local Produce

Consumers are increasingly seeking out home-grown and locally sourced produce, especially for items like citrus. This preference presents a potential substitute for the large-scale agricultural output typically supplied by companies like The Wonderful Company. For instance, by mid-2024, the demand for locally grown fruits and vegetables saw a significant uptick, with many consumers willing to pay a premium for produce with a shorter supply chain.

Advancements in urban and vertical farming technologies further bolster this trend. These methods allow for localized production, potentially reducing reliance on traditional agricultural giants. While currently a more niche market, the growth in direct-to-consumer sales channels for small-scale producers indicates a rising competitive pressure.

- Consumer Preference Shift: Growing demand for local and home-grown produce by mid-2024, with a willingness to pay more.

- Urban and Vertical Farming: Technological advancements enable localized production, offering alternatives to large-scale agriculture.

- Niche Market Growth: Increasing direct-to-consumer sales for small producers signal a developing competitive threat.

The threat of substitutes for The Wonderful Company's products is substantial, driven by evolving consumer preferences and market innovation. For instance, the healthy snacks market, a key area for Wonderful, is projected to reach $185.40 billion by 2034, meaning a constant influx of new alternatives will continue to challenge existing offerings. Similarly, the global functional beverage market, which directly competes with Wonderful's juices, was expected to reach hundreds of billions of dollars by 2024, highlighting a significant consumer shift towards specialized health drinks.

Furthermore, the gifting sector, where Teleflora operates, sees strong competition from experience-based gifts, which were projected to generate hundreds of billions of dollars in 2024. This indicates consumers are increasingly valuing memorable experiences over traditional tangible goods. The rise of plant-based foods, valued at approximately $29.7 billion in 2023 and projected to reach $162.5 billion by 2030, also represents a significant dietary shift that could impact demand for conventional food products.

Consumer interest in locally sourced produce, observed to have a significant uptick by mid-2024, presents another substitute threat, particularly for citrus. This trend is supported by advancements in urban and vertical farming, enabling localized production and reducing reliance on large-scale suppliers.

| Category | Key Substitute Products | Market Trend/Data Point |

|---|---|---|

| Healthy Snacks | Fresh fruits, vegetables, yogurt, granola bars, protein snacks | Global market projected to reach $185.40 billion by 2034 |

| Beverages | Tap water, soft drinks, teas, coffees, functional beverages | Functional beverage market expected to reach hundreds of billions by 2024 |

| Floral Gifting | Gourmet chocolates, gift cards, experience gifts, home decor | Experience gift market projected to reach hundreds of billions in 2024 |

| Food Products | Plant-based alternatives, reduced-sugar options | Plant-based food market valued at $29.7 billion in 2023, projected to reach $162.5 billion by 2030 |

| Produce | Locally grown fruits and vegetables, home-grown produce | Increased consumer demand for local produce by mid-2024 |

Entrants Threaten

Entering the agriculture and consumer packaged goods sectors, where The Wonderful Company operates, demands immense capital. Think about the costs for land, sophisticated farming equipment, processing facilities, and a robust distribution network. These upfront expenses create a formidable barrier for anyone looking to compete at a similar scale.

For instance, acquiring prime agricultural land alone can run into millions, and building state-of-the-art processing plants requires hundreds of millions more. The Wonderful Company itself is investing heavily, as evidenced by its ongoing expansion of its industrial park, signaling a commitment to scale that new entrants would need to match financially.

Newcomers face significant hurdles in accessing established distribution channels and securing prime retail placement. The Wonderful Company's deep-rooted relationships with major grocery chains and mass merchandisers create a formidable barrier, as these networks are difficult for new entrants to penetrate. For instance, in 2024, major retailers continued to consolidate their supplier relationships, favoring partners with proven sales volumes and extensive product lines, which new entrants typically lack.

The Wonderful Company's established brands like Wonderful Pistachios and FIJI Water present a significant hurdle for newcomers. These brands have cultivated deep customer loyalty, making it challenging for new entrants to capture market share quickly. For instance, Wonderful Pistachios has consistently been a top-selling snack nut in the U.S., demonstrating the power of their brand equity.

Regulatory Hurdles and Food Safety Standards

The food and agriculture sectors face significant regulatory burdens, including rigorous food safety standards, detailed labeling requirements, and environmental compliance. For instance, in 2024, the U.S. Food and Drug Administration (FDA) continued to emphasize enhanced food safety measures under the Food Safety Modernization Act (FSMA), requiring extensive record-keeping and preventative controls that can be daunting for newcomers.

These complex and evolving regulatory landscapes present a substantial barrier to entry, demanding considerable investment in compliance, quality control systems, and legal expertise. New companies must allocate resources to understand and adhere to regulations like those governing pesticide residues or nutritional information, which can significantly increase startup costs and slow market penetration.

- Stringent Food Safety: Compliance with regulations like FSMA requires significant investment in preventative controls and traceability.

- Labeling Laws: Accurate and compliant labeling, including nutritional information and allergen warnings, adds complexity and cost.

- Environmental Regulations: Adherence to environmental standards for farming and processing can necessitate costly infrastructure changes.

- Cost of Compliance: Navigating these rules requires substantial financial and human resources, deterring many potential new entrants.

Access to Specialized Agricultural Knowledge and Resources

Newcomers face significant hurdles in accessing the specialized knowledge and resources vital for large-scale agriculture. This includes expertise in intricate areas like crop management, advanced pest and disease control strategies, efficient water management techniques, and climate-resilient farming practices.

The Wonderful Company, with its extensive history, has cultivated deep expertise and secured control over substantial agricultural assets, notably water rights. For instance, in 2023, The Wonderful Company managed over 100,000 acres of farmland, a scale that inherently limits new entrants who lack similar resource access and accumulated operational know-how.

- Specialized Knowledge: Decades of experience in crop science, irrigation, and pest management.

- Resource Control: Ownership or long-term leases of vast tracts of arable land and critical water rights.

- Economies of Scale: The ability to leverage large-scale operations for cost efficiencies unavailable to smaller players.

The threat of new entrants in the agriculture and consumer packaged goods sectors where The Wonderful Company operates is significantly mitigated by high capital requirements and established brand loyalty. For instance, The Wonderful Company's substantial investments in farmland and processing facilities, estimated in the hundreds of millions, create a formidable financial barrier. Furthermore, their well-recognized brands, such as Wonderful Pistachios, command strong consumer preference, making it difficult for new competitors to gain traction quickly.

Regulatory compliance and access to specialized agricultural knowledge also serve as significant deterrents. Navigating complex food safety standards, like those enforced by the FDA's Food Safety Modernization Act (FSMA) in 2024, requires substantial investment in systems and expertise. Additionally, securing access to vast agricultural land and critical water rights, as The Wonderful Company has done with over 100,000 acres in 2023, presents a challenge for new players lacking similar resource control and operational experience.

| Barrier | Description | Example/Data Point |

| Capital Requirements | High upfront costs for land, equipment, and facilities. | Hundreds of millions required for processing plants; millions for prime agricultural land. |

| Brand Loyalty | Established brands create strong customer preference. | Wonderful Pistachios is a consistently top-selling snack nut in the U.S. |

| Distribution Access | Difficulty penetrating established retail networks. | Major retailers in 2024 favored established suppliers with proven sales volumes. |

| Regulatory Compliance | Meeting stringent food safety and environmental standards. | FSMA compliance in 2024 necessitates extensive record-keeping and preventative controls. |

| Specialized Knowledge & Resources | Expertise in crop management, water rights, and large-scale operations. | The Wonderful Company manages over 100,000 acres, demonstrating significant resource control and accumulated know-how. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for The Wonderful Company is built upon a foundation of publicly available financial reports, including annual filings and investor presentations. We supplement this with data from reputable industry research firms and market intelligence platforms to capture competitive dynamics and consumer trends.