The Wonderful Company Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Wonderful Company Bundle

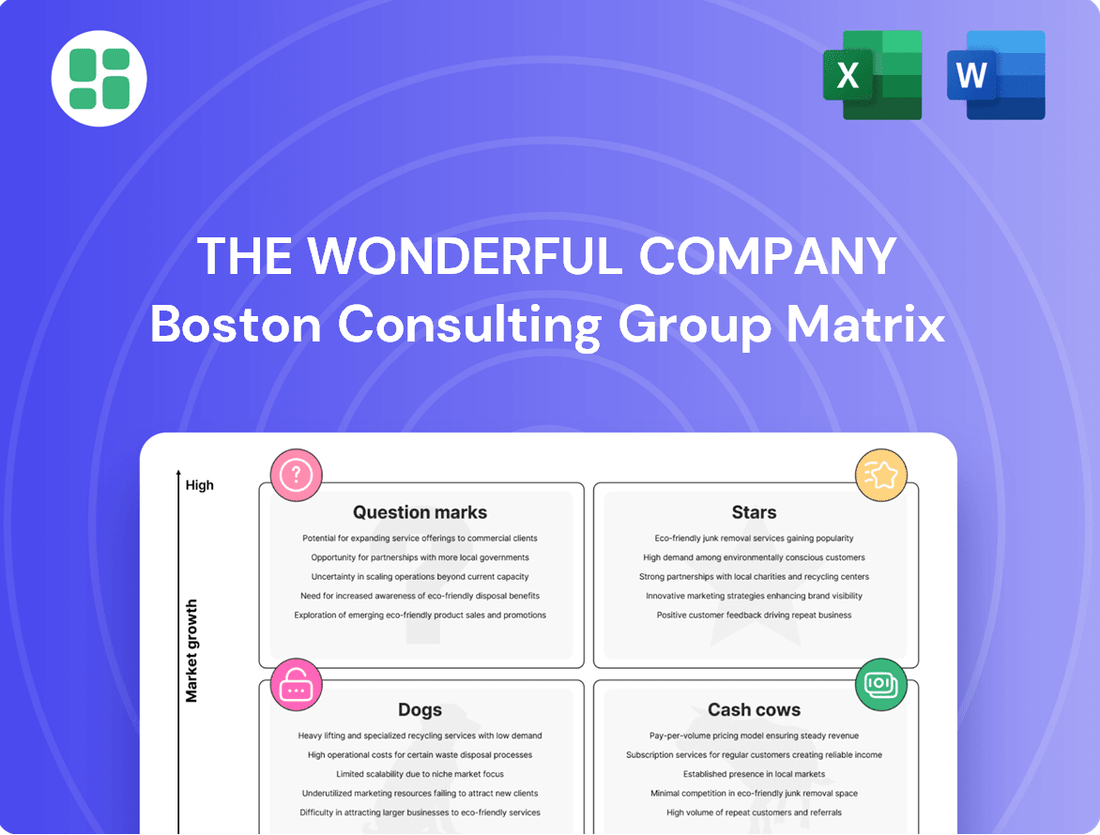

Discover the strategic positioning of The Wonderful Company's diverse product portfolio within our exclusive BCG Matrix. This preview offers a glimpse into their market performance, hinting at their Stars, Cash Cows, Dogs, and Question Marks.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix report. Gain a comprehensive understanding of each product's quadrant placement, backed by data-driven insights and actionable recommendations to fuel your own strategic decision-making.

Stars

Wonderful Pistachios currently occupies a strong position within the expanding global nuts market. This sector is anticipated to see a compound annual growth rate of 6.5% between 2024 and 2025, fueled by growing consumer interest in healthier eating habits and a rising demand for plant-based protein sources.

The brand consistently introduces innovative flavors, which helps maintain robust consumer interest and a significant market share within the snack nuts segment. This strategic approach positions Wonderful Pistachios as a potential star or cash cow in The Wonderful Company's BCG Matrix, depending on its investment needs versus its market growth rate.

Wonderful Halos Mandarins likely occupy the Star quadrant in The Wonderful Company's BCG Matrix. The mandarin market is robust, with an anticipated annual growth rate of 6.14% from 2024 to 2029, driven by the increasing consumer preference for organic and healthy food options. This positions Halos favorably within a high-growth sector.

The brand's significant consumer recognition and its dominant share in the easy-peel mandarin segment are key indicators of its Star status. Its appeal to health-conscious individuals and families further solidifies its strong market position and potential for continued expansion and profitability.

FIJI Water holds a dominant position in the premium bottled water segment. This market is projected to expand at a compound annual growth rate exceeding 6.7% between 2025 and 2034. This growth is driven by increasing consumer demand for healthier, high-quality hydration choices.

The brand's strong recognition, coupled with its reputation for purity and premium positioning, enables FIJI Water to capture a substantial market share within this specialized niche of the broader bottled water industry.

POM Wonderful (Pomegranate Juice)

POM Wonderful holds a commanding position in the pomegranate juice sector. This market is anticipated to expand at a compound annual growth rate of 7% between 2025 and 2033. This growth is fueled by heightened consumer understanding of pomegranate's health advantages, especially its antioxidant qualities.

The brand effectively uses its substantial market share and health-centric marketing to benefit from the increasing preference for functional beverages.

- Market Dominance: POM Wonderful is the clear leader in the pomegranate juice segment.

- Projected Growth: The market is expected to grow at a 7% CAGR from 2025 to 2033.

- Health-Driven Demand: Increasing consumer awareness of health benefits, particularly antioxidants, is a key driver.

- Strategic Positioning: The brand capitalizes on this demand through strong market share and health messaging.

Wonderful Seedless Lemons

Wonderful Seedless Lemons are strategically positioned within the expanding citrus market, catering to consumers who prioritize convenience and premium quality. The broader citrus industry is experiencing robust growth, fueled by increasing consumer focus on health and wellness, as well as the versatile use of citrus in food, beverages, and personal care products.

While precise market share figures for the seedless lemon segment are not readily available, its distinct advantage in a burgeoning market indicates strong potential for future growth, aligning with the characteristics of a Star in the BCG Matrix. The global citrus fruit market was valued at approximately USD 100.5 billion in 2023 and is projected to reach USD 145.7 billion by 2030, growing at a compound annual growth rate of 5.4% during the forecast period.

- Market Growth: The global citrus market is expanding, driven by health consciousness.

- Consumer Appeal: Seedless lemons offer convenience, a key purchasing driver.

- Competitive Edge: Unique product offering in a growing segment.

- Potential: Positioned for high growth and market share capture.

Wonderful Halos, with a projected 6.14% annual growth in the mandarin market through 2029, exemplify Star status. Their significant brand recognition and dominance in the easy-peel segment, appealing to health-conscious families, solidify their position in a high-growth category.

FIJI Water, targeting a premium bottled water market expected to grow over 6.7% annually until 2034, also fits the Star profile. Its strong brand equity and reputation for quality hydration capture a substantial share in this expanding niche.

POM Wonderful leads the pomegranate juice market, which is forecast to grow at 7% annually until 2033, driven by health benefits. Its market dominance and health-focused marketing capitalize on the demand for functional beverages.

Wonderful Pistachios, in a nuts market growing at 6.5% CAGR through 2025, shows Star potential due to innovation and strong consumer interest in healthy snacks and plant-based proteins.

| Product | Market Growth Rate (CAGR) | Market Segment | Key Strengths |

|---|---|---|---|

| Wonderful Halos | 6.14% (2024-2029) | Easy-Peel Mandarins | Brand recognition, dominant share, health appeal |

| FIJI Water | >6.7% (2025-2034) | Premium Bottled Water | Brand equity, purity reputation, premium positioning |

| POM Wonderful | 7% (2025-2033) | Pomegranate Juice | Market leadership, health-centric marketing, antioxidant benefits |

| Wonderful Pistachios | 6.5% (2024-2025) | Snack Nuts | Product innovation, strong consumer interest, healthy eating trend |

What is included in the product

The Wonderful Company's BCG Matrix analysis reveals strategic insights into its diverse product portfolio, guiding investment decisions.

Simplifies complex portfolio analysis by visually categorizing The Wonderful Company's business units, easing strategic decision-making.

Cash Cows

Wonderful Pistachios, as an established brand within The Wonderful Company's portfolio, functions as a significant cash cow. Despite the overall nuts market experiencing growth, many segments, including pistachios, are mature. Wonderful Pistachios has achieved substantial market saturation and strong brand loyalty, enabling it to generate consistent, robust cash flow with comparatively lower marketing expenditures.

FIJI Water, a prominent player in the premium bottled water segment, is positioned as a Cash Cow within The Wonderful Company's portfolio. This brand benefits from a well-established market, which, while mature, offers consistent demand. The global bottled water market was valued at an estimated USD 348.64 billion in 2024, highlighting the significant scale of this industry.

With its strong brand recognition and extensive distribution network, FIJI Water consistently generates substantial profits. This allows the company to operate with a focus on maintaining its current market position rather than requiring heavy investment for aggressive growth. The projected growth of the bottled water market to USD 509.18 billion by 2030, with a CAGR of 6.4%, further supports the stable, cash-generating nature of this product.

Wonderful Halos mandarins, during their peak season, operate as a classic cash cow for The Wonderful Company. Their established distribution channels and consistent consumer demand for this convenient, easy-to-peel citrus fruit generate significant and reliable revenue.

The brand commands a strong market position, translating into efficient sales and robust returns, particularly during its primary selling period. For instance, Wonderful Halos are a top-selling mandarin brand in the U.S. during the fall and winter months, often accounting for a substantial portion of the company's seasonal citrus sales.

While the broader citrus market experiences growth, the seasonal aspect and Wonderful Halos' dominant niche presence solidify its role as a dependable revenue generator, providing stable cash flow for the company.

JUSTIN Vineyards & Winery

JUSTIN Vineyards & Winery, a key asset within The Wonderful Company's portfolio, likely functions as a Cash Cow in the BCG Matrix. Operating in the mature wine market, where global wine consumption saw a slight dip in recent years, the premium segment, where JUSTIN excels, continues to demonstrate resilience and potential for growth.

As an established premium wine brand, JUSTIN Vineyards & Winery is expected to generate consistent, stable revenues and profits. Its focus is less on aggressive expansion and more on leveraging its brand prestige and cultivating a loyal customer base. This stability is characteristic of a Cash Cow, requiring minimal investment for maintenance while providing significant returns.

In 2024, the global wine market, while facing some headwinds, saw continued demand for premium and super-premium wines. JUSTIN, with its strong reputation and established distribution channels, is well-positioned to capitalize on this demand. The brand's ability to command higher price points contributes to its profitability and its role as a reliable income generator for The Wonderful Company.

- Market Position: Established premium brand in a mature but resilient wine segment.

- Financial Contribution: Generates stable, predictable profits with low reinvestment needs.

- Brand Equity: Benefits from strong brand recognition and a loyal customer following.

- Strategic Role: Funds growth initiatives in other areas of The Wonderful Company's portfolio.

Teleflora

Teleflora, a prominent floral wire service, operates within the mature floral gifting industry, securing a substantial market share. This sector is projected to experience a Compound Annual Growth Rate (CAGR) of 5.52% between 2024 and 2030, indicating a stable yet growing market.

Teleflora's established infrastructure and strong brand recall are key to its performance. These advantages enable the company to generate steady cash flows, with its strategy primarily focused on defending its existing market position rather than pursuing rapid growth.

- Market Position: Teleflora maintains a significant share in the mature floral gifting market.

- Industry Growth: The U.S. floral gifting market is expected to grow at a 5.52% CAGR from 2024 to 2030.

- Cash Flow Generation: Teleflora leverages its network and brand to produce consistent cash flow.

- Strategic Focus: The company prioritizes market position maintenance over aggressive expansion.

Wonderful Pistachios, a mature product in a growing nut market, consistently generates strong cash flow due to high brand loyalty and market saturation. The global snack nuts market was valued at USD 61.3 billion in 2024, with pistachios holding a significant share.

FIJI Water, a premium brand in the stable bottled water market, generates consistent profits. The global bottled water market was valued at USD 348.64 billion in 2024, with FIJI Water benefiting from its established premium positioning.

Wonderful Halos, a leading mandarin brand, provides reliable seasonal revenue. The U.S. fresh fruit market is robust, and Halos' strong distribution and consumer demand solidify its cash cow status.

Teleflora, a key player in the floral gifting industry, benefits from a stable market with projected growth. The U.S. floral gifting market is expected to grow at a 5.52% CAGR from 2024 to 2030, ensuring Teleflora's consistent cash generation.

Preview = Final Product

The Wonderful Company BCG Matrix

The BCG Matrix preview you are viewing is the identical, fully completed document you will receive immediately after purchase, offering a clear strategic overview of The Wonderful Company's product portfolio. This comprehensive report, devoid of watermarks or demo content, is meticulously prepared for immediate application in your business planning and analysis. You can trust that the insights and formatting presented here are precisely what you will download, ready to be utilized for informed decision-making and strategic discussions.

Dogs

Some of The Wonderful Company's older or less popular wine labels might be categorized as Dogs. These brands may not possess the same market recognition or premium appeal as flagship offerings like JUSTIN. For instance, if a label historically catered to a niche market that has since shrunk, its position would likely be weak.

The broader wine industry, particularly in developed markets, is experiencing shifts. For example, in 2024, reports indicate a continued trend of declining wine consumption volumes in several key European countries, especially for entry-level wines. This suggests that brands within The Wonderful Company's portfolio that are positioned in these segments could be facing significant headwinds.

Consequently, these less prominent wine labels likely hold a low market share within a slow-growing or even declining market segment. Their contribution to overall profitability would therefore be minimal, making them candidates for divestment or a complete repositioning strategy rather than significant investment.

Underperforming regional agricultural products, not central to The Wonderful Company's core brands like Wonderful Pistachios or POM Wonderful, could be classified as Dogs. These might be niche items struggling in shrinking local markets, possessing minimal market share. For instance, a specific regional fruit variety with declining demand in its primary geographic area would fit this profile.

Niche or discontinued product lines, like some of The Wonderful Company's older citrus varieties or specialty snack items that didn't achieve widespread adoption, would fall into the Dogs category. These products typically have a low market share and operate in stagnant or shrinking markets, making them unattractive for further investment. For instance, if a particular flavor of Wonderful Pistachios saw a significant decline in sales, dropping to less than 1% of the overall snack nut market by 2024, it would likely be considered a Dog.

Specific Fruit Varieties with Declining Demand

Within The Wonderful Company's portfolio, certain niche fruit varieties could be categorized as Dogs in the BCG Matrix. These are products with a low market share in a market that is not growing or is shrinking. For instance, if the company cultivates a specific, unbranded variety of grapefruit that has seen a significant decline in consumer preference over the past decade, it would likely fit this description.

The challenges faced by such products are multifaceted. Declining consumer demand, often driven by changing dietary trends or the rise of more popular alternatives, is a primary factor. Additionally, increased competition from other growers or even different fruit categories can further erode market share.

Consider a hypothetical scenario where The Wonderful Company produces a particular type of plum that has experienced a steady decrease in sales. Data from 2023 indicated a 5% year-over-year decline in plum consumption in the US, with specialty varieties showing even steeper drops.

- Specific Citrus Variety: A non-Halos branded navel orange variety facing disease pressure and reduced shelf space in supermarkets.

- Niche Berry: A less common berry, like gooseberries, that has seen a consistent drop in consumer interest and limited retail availability.

- Outdated Stone Fruit: An older variety of peach or nectarine that has been largely replaced by newer, more disease-resistant, and sweeter cultivars.

Underutilized or Obsolete Infrastructure

The Wonderful Company's agricultural operations may possess underutilized or obsolete infrastructure. This could include processing facilities or farming plots that have become less efficient or are no longer aligned with the company's high-growth brands. Such assets consume resources without generating proportionate returns, especially if they are part of a low-growth operational segment.

- Underutilized Processing Facilities: Aging or inefficient processing plants for legacy crops might be a prime example.

- Obsolete Farming Plots: Land parcels that are no longer cost-effective for current cultivation methods or crop types.

- Resource Drain: These assets represent a drain on capital and operational resources, impacting overall profitability.

Certain niche or older product lines within The Wonderful Company's diverse portfolio might be classified as Dogs. These typically exhibit low market share in slow-growing or declining markets. For instance, a specific, less popular flavor of Wonderful Pistachios that saw its market share dip below 1% by 2024 would likely be a Dog.

These products often face challenges like declining consumer preference or intense competition from more popular alternatives. A hypothetical example could be an older citrus variety that has lost favor, with 2023 data showing a 5% year-over-year drop in overall citrus consumption for similar niche segments.

Consequently, these brands or products are unlikely candidates for significant investment, often being considered for divestment or a strategic overhaul to improve their standing.

The Wonderful Company's portfolio might also contain underutilized agricultural assets. These could include farming plots for less profitable or obsolete crop varieties, or aging processing facilities that no longer align with the company's core, high-growth brands.

| Product Category | Example | Market Trend (2024 Data) | Potential BCG Status |

| Wine | Older, less popular wine labels | Declining consumption volumes in key European markets for entry-level wines | Dog |

| Snacks | Niche or discontinued snack items (e.g., specific flavor) | Sales decline, potentially dropping below 1% market share in snack nuts | Dog |

| Agriculture | Niche fruit varieties (e.g., specific plum type) | 5% year-over-year decline in US consumption for specialty varieties | Dog |

| Infrastructure | Underutilized processing facilities for legacy crops | Low return on investment, resource drain | Dog |

Question Marks

The Wonderful Company, known for its agricultural prowess, is likely investigating novel plant-based food and beverage products. These new ventures would target the rapidly expanding plant-based sector, but would start with a modest market presence.

Significant investment in branding and distribution networks will be crucial for these innovations to capture consumer interest and achieve significant growth. For example, the global plant-based food market was valued at approximately $29.7 billion in 2023 and is projected to reach $169.8 billion by 2030, indicating a strong growth trajectory.

While POM Wonderful is a strong Star in The Wonderful Company's portfolio, emerging functional beverage lines, particularly those venturing into highly competitive or nascent health and wellness categories, would likely be positioned as Question Marks. These markets, such as adaptogen-infused drinks or personalized nutrition beverages, are experiencing significant growth, with the global functional beverage market projected to reach $240 billion by 2027, according to Grand View Research. New entrants in these dynamic spaces face the considerable challenge of carving out market share against established players and rapidly evolving consumer preferences.

Teleflora, a prominent player in floral services, is seeing its subscription-based segment flourish, indicating a shift in consumer preference towards recurring floral deliveries. This burgeoning segment is experiencing significant growth, outpacing the more stable overall floral market.

The Wonderful Company's aggressive push into direct-to-consumer (DTC) floral subscriptions positions these initiatives as potential stars in the BCG matrix. While their current market share might be modest, the high growth trajectory of the subscription model suggests substantial future potential.

For instance, the US online flower delivery market was valued at approximately $4.7 billion in 2023 and is projected to grow at a CAGR of over 7% through 2030, with subscriptions being a key driver. This rapid expansion fuels the argument for The Wonderful Company's DTC floral subscriptions to be classified as question marks, requiring strategic investment to capitalize on their high growth potential.

Premium Nut Butter or Nut Milk Alternatives

The Wonderful Company's potential foray into premium nut butter and nut milk alternatives aligns with a booming plant-based market. This sector saw global sales of plant-based milk reach an estimated $20.4 billion in 2023, with projections indicating continued strong growth through 2030. Premium offerings would tap into consumer demand for higher quality ingredients and unique flavor profiles.

Entering this competitive landscape requires differentiation. Established brands already hold significant market share, but the premium segment offers an opportunity for innovation. The Wonderful Company could leverage its existing brand equity and supply chain expertise, perhaps focusing on specific nut varieties or functional benefits to capture consumer attention.

- Market Growth: The global plant-based milk market is expanding rapidly, with almond milk and other nut-based alternatives being key drivers.

- Consumer Trends: Increasing health consciousness and a desire for dairy-free options fuel demand for nut-based products.

- Competitive Landscape: The market features established players, necessitating a strong value proposition for new entrants.

- Potential Differentiation: Focusing on premium ingredients, unique flavors, or health benefits could carve out a niche.

Sustainable or Specialty Agricultural Offerings

Sustainable or specialty agricultural offerings, such as organic or fair-trade certified produce, would likely be classified as Stars or Question Marks within The Wonderful Company's BCG Matrix. The market for these products is experiencing robust growth, with global organic food sales projected to reach over $300 billion by 2027, indicating a strong upward trend.

If The Wonderful Company is investing in new, certified sustainable or specialty crop offerings that are not yet widely distributed or recognized, these would fall into the Question Mark category. These segments are characterized by high growth potential, fueled by increasing consumer demand for ethically and environmentally sound products, but currently hold a low market share.

- Market Growth: The organic food market alone was valued at approximately $220 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of around 9-10% through 2028.

- Consumer Drivers: Consumer preference for health, environmental sustainability, and ethical sourcing are key drivers for these specialty agricultural products.

- Investment Opportunity: New entries into these high-growth but low-penetration markets represent strategic investments for future market leadership.

New ventures in functional beverages and plant-based alternatives, particularly those in nascent or highly competitive health categories, are prime candidates for the Question Mark designation. These areas exhibit high growth potential, as seen in the global functional beverage market projected to reach $240 billion by 2027, but require significant investment to establish market share against established players.

The Wonderful Company's expansion into premium nut butter and milk alternatives, while tapping into the booming plant-based market (estimated at $20.4 billion for plant-based milk in 2023), also presents Question Mark characteristics. Success hinges on differentiation within a crowded space, leveraging brand equity to carve out a niche in premium offerings.

Similarly, investments in specialty agricultural products like organic or fair-trade produce, which benefit from a growing market (organic food sales projected over $300 billion by 2027), would be Question Marks if they represent new, low-market-share offerings. These segments demand strategic investment to capitalize on increasing consumer demand for ethical and sustainable products.

| Business Unit/Product Line | Market Growth | Relative Market Share | BCG Category | Strategic Implication |

|---|---|---|---|---|

| Emerging Functional Beverages | High | Low | Question Mark | Invest to gain share or divest if potential is low. |

| Premium Nut Butter/Milk Alternatives | High | Low | Question Mark | Requires significant investment for differentiation and market penetration. |

| New Specialty Agricultural Offerings (e.g., Organic) | High | Low | Question Mark | Strategic investment needed to build market presence and brand recognition. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable insights.