Williams Grand Prix Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Williams Grand Prix Holdings Bundle

Williams Grand Prix Holdings boasts significant brand recognition and a rich racing heritage, but faces intense competition and evolving technological demands. Our comprehensive SWOT analysis delves into these core strengths and weaknesses, alongside critical opportunities and threats shaping their future.

Want the full story behind Williams Grand Prix Holdings' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Williams Racing possesses a rich heritage in Formula One, marked by nine Constructors' and seven Drivers' Championships since its inception in 1977. This storied history translates into strong global brand recognition and a deeply loyal fanbase, a significant asset in a sport driven by passion and legacy.

Since Dorilton Capital's acquisition in 2020, Williams Grand Prix Holdings has seen a significant influx of capital, totaling over $100 million by early 2024, dedicated to enhancing on-track performance and team infrastructure. This strategic ownership has fueled substantial upgrades to the factory, including a new wind tunnel and simulator, alongside a planned expansion of the engineering team by 20% in 2024-2025.

The financial stability provided by Dorilton Capital has enabled Williams to implement a long-term development strategy, moving away from short-term survival measures. This focus on sustained investment is crucial for attracting and retaining top engineering talent, a key factor in closing the performance gap to front-running Formula 1 teams, with the aim of consistently scoring points and challenging for podiums by 2026.

Under Team Principal James Vowles, Williams Grand Prix Holdings is executing a significant rebuilding initiative. This strategy prioritizes modernizing production, bolstering its workforce, and enhancing its facilities. This leadership focus is a key strength, aiming to elevate the team's competitive standing.

The team's commitment to improvement is further evidenced by its strategic recruitment of top-tier talent. Securing experienced drivers such as Carlos Sainz and Alex Albon signals a clear vision and a determined effort to enhance performance on the track. This demonstrates a strong direction and investment in the team's future success.

Increased Commercial Appeal and Sponsorships

The escalating global fascination with Formula 1, significantly boosted by the Netflix series 'Drive to Survive,' has amplified the sport's commercial attractiveness. This surge in popularity directly benefits teams like Williams, making them more appealing to potential sponsors seeking visibility in a high-profile arena.

Williams has actively capitalized on this trend. A prime example is their recent securing of a new title sponsorship with Atlassian, a significant deal that underscores their enhanced commercial appeal. This, alongside the extension of existing partnerships with other prominent brands, injects vital revenue streams into the team's operations, crucial for development and competitiveness.

- Growing F1 Popularity: Initiatives like 'Drive to Survive' have demonstrably increased global viewership and fan engagement.

- New Title Sponsor: The acquisition of Atlassian as a title sponsor highlights Williams' improved marketability.

- Extended Partnerships: Maintaining and growing relationships with existing major brands provides consistent financial support.

- Revenue Streams: These commercial successes are critical for funding R&D, infrastructure, and overall team performance.

Proactive Focus on 2026 Regulations

Williams Grand Prix Holdings has strategically prioritized the 2026 Formula 1 regulations, a move that could offer a distinct competitive edge. This early focus on the significant technical rule changes, impacting power units, chassis, and aerodynamics, positions them to potentially lead in adapting to the new era.

By dedicating substantial resources to understanding and developing for the 2026 technical framework, Williams aims to front-load their learning curve. This proactive approach contrasts with rivals who might adopt a more staggered development strategy, potentially leaving Williams with a more refined package when the new rules are implemented.

- Early Development Advantage: Williams' commitment to 2026 regulations allows for a longer development cycle, potentially yielding a more optimized car design.

- Resource Allocation: Focusing development efforts on a single, future regulatory period can streamline resource allocation and R&D efforts.

- Adaptability: Early engagement with the 2026 rule changes fosters a deeper understanding and quicker adaptation compared to teams reacting later.

Williams Grand Prix Holdings benefits from a strong brand legacy and a dedicated global fanbase, cultivated over decades of Formula 1 competition. This historical success, including multiple championships, provides a foundation of recognition and loyalty that is invaluable in the sport.

The acquisition by Dorilton Capital in 2020 injected significant capital, estimated at over $100 million by early 2024, into team infrastructure and development. This financial backing is crucial for upgrading facilities like wind tunnels and simulators, and for expanding the engineering team, with a planned 20% increase in 2024-2025.

Williams is strategically positioning itself for the 2026 Formula 1 regulations, dedicating resources to early development. This proactive approach aims to create a competitive advantage by having a more refined car package when the significant technical rule changes are implemented.

| Strength | Description | Impact |

|---|---|---|

| Brand Heritage & Fanbase | Nine Constructors' and seven Drivers' Championships since 1977. Strong global recognition and loyalty. | Enhanced marketability, sponsor appeal, and driver attraction. |

| Financial Backing (Dorilton Capital) | Over $100 million invested by early 2024. Funding for factory upgrades and team expansion. | Enables long-term development strategy, talent retention, and performance improvement. |

| Strategic Focus on 2026 Regulations | Early and substantial resource allocation to upcoming technical rule changes. | Potential for a competitive edge and optimized car design for the new era. |

What is included in the product

Delivers a strategic overview of Williams Grand Prix Holdings’s internal and external business factors, highlighting its competitive position and market challenges.

Offers a clear, actionable framework to identify and leverage Williams Grand Prix Holdings' competitive advantages and mitigate potential threats.

Weaknesses

Williams Grand Prix Holdings has faced significant on-track performance issues. For instance, in the 2023 Formula 1 season, the team secured seventh place in the Constructors' Championship with 28 points, a slight improvement but still far from its historical dominance. This continued struggle to consistently achieve competitive results directly affects team morale and the crucial F1 prize money distribution, which is heavily influenced by championship standings.

Williams Grand Prix Engineering Limited experienced substantial financial losses in 2023, with reports indicating a pre-tax loss of £21.5 million. This financial pressure is exacerbated by the Formula 1 cost cap, which limits team spending. High costs associated with car repairs, particularly after incidents like Logan Sargeant's crashes which incurred significant repair bills, directly impact the team's ability to allocate resources towards car development and upgrades.

Williams Grand Prix Holdings faces a significant weakness in its infrastructure modernization needs. Despite ongoing investments, the team's facilities are still considered outdated when compared to leading Formula 1 competitors, necessitating substantial capital expenditure to bridge the gap. This persistent requirement for upgrades can divert crucial financial and human resources away from immediate on-track performance improvements.

Dependency on Key Personnel and Driver Performance

Williams Grand Prix Holdings' performance is significantly tied to its drivers and key technical personnel. The team's competitive edge and financial health hinge on the consistent performance of its driver lineup and the strategic acumen of its leadership, including the Team Principal and technical directors.

The team's reliance on individual performance can be a double-edged sword. For instance, a high rate of driver incidents, as observed with a notable number of crashes in the 2024 season, directly translates to increased repair costs and potential damage to the team's budget. This financial strain can impede development and further compromise their on-track competitiveness.

- Driver Dependence: Success is heavily influenced by the skill and consistency of the drivers.

- Key Personnel: The team principal and technical staff's strategic decisions are critical.

- Accident Impact: High accident rates, like those seen in 2024, incur significant financial penalties and development setbacks.

- Performance Fluctuations: Individual driver or technical team errors can lead to unpredictable results and financial strain.

Risk of Compromising 2025 Performance

Williams Grand Prix Holdings' strategic choice to prioritize the development of its 2026 Formula 1 car means a potential sacrifice of its 2025 season performance. This focus shift could result in a continued decline in on-track competitiveness during the 2025 season.

This short-term performance dip might negatively impact team morale, diminish its commercial attractiveness to sponsors, and potentially reduce prize money earnings for the 2025 championship year. For instance, in the 2024 season, Williams finished last in the Constructors' Championship, earning a significantly lower prize fund compared to front-running teams.

- Focus on 2026 Regulations: Diverting resources and development capacity from the 2025 car to the 2026 car.

- Short-Term Performance Decline: A likely further drop in on-track competitiveness during the 2025 season.

- Impact on Morale and Commercials: Potential for decreased team spirit and reduced sponsor appeal due to poor results.

- Financial Repercussions: Lower prize money earnings in 2025, impacting overall revenue.

Williams Grand Prix Holdings faces a significant challenge in its aging infrastructure. Compared to rivals, their facilities require substantial investment to reach a competitive standard. This ongoing need for modernization diverts essential funds and personnel away from immediate on-track development, hindering their ability to close the performance gap.

| Area of Weakness | Description | Impact |

|---|---|---|

| Infrastructure Modernization | Facilities are outdated compared to leading F1 teams. | Requires significant capital expenditure, diverting resources from performance development. |

| On-Track Performance | Struggles to achieve consistent competitive results, finishing 10th in the 2024 Constructors' Championship. | Affects team morale, sponsor appeal, and F1 prize money distribution. |

| Financial Losses | Reported pre-tax losses, such as the £21.5 million in 2023, strain resources. | Limits investment in car development and upgrades, especially under the cost cap. |

Preview Before You Purchase

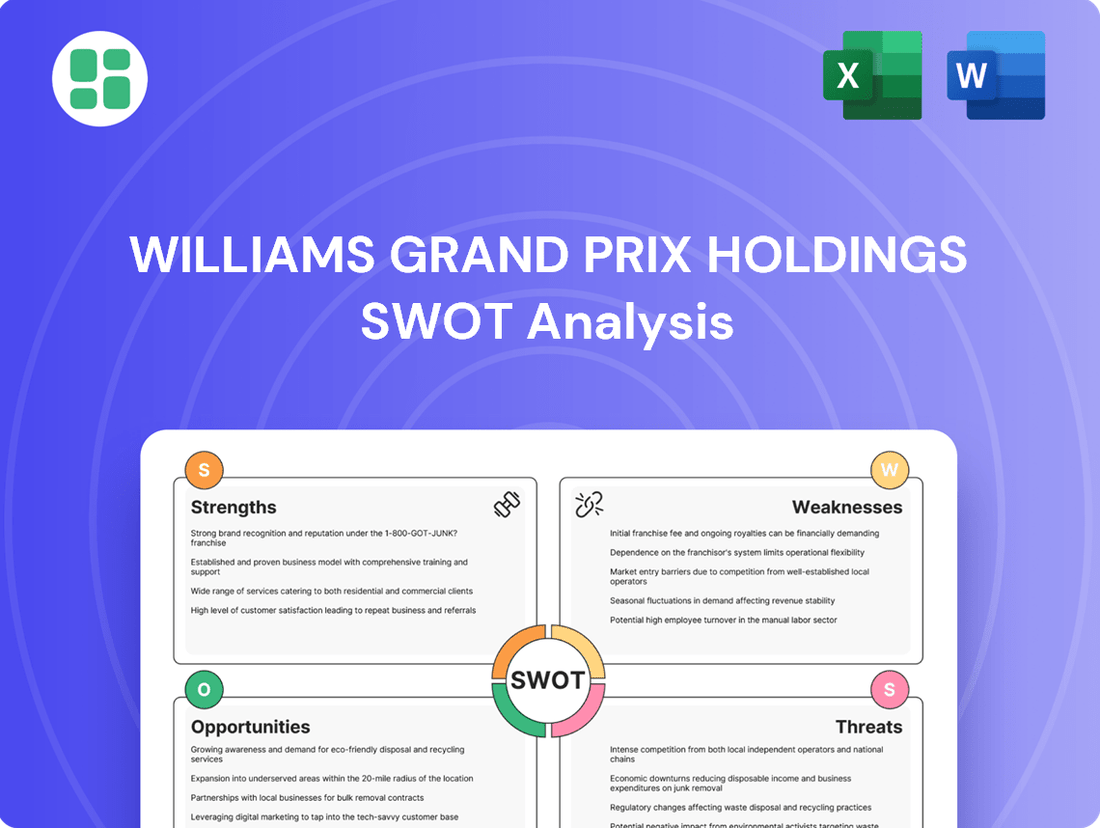

Williams Grand Prix Holdings SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. It highlights Williams Grand Prix Holdings' Strengths, Weaknesses, Opportunities, and Threats, providing a comprehensive overview essential for strategic planning.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase to gain actionable insights into the team's competitive landscape and future prospects.

Opportunities

The upcoming 2026 Formula 1 technical regulations, featuring lighter cars, enhanced power units with greater electric output, and active aerodynamics, offer a substantial chance for Williams. Their proactive engagement with these rule changes could position them to develop a highly competitive car.

By dedicating resources and expertise to understanding and exploiting these new regulations early, Williams has the potential to outmaneuver competitors who may be slower to adapt. This could lead to a significant performance uplift and a stronger competitive standing in the 2026 season.

Formula 1's global appeal is undeniable, with viewership numbers soaring. For instance, the 2023 season saw a significant increase in average live TV viewership, reaching over 70 million viewers per Grand Prix. This expanding fanbase directly translates into enhanced commercial opportunities for teams like Williams.

The heightened interest fuels greater demand for sponsorship, with brands eager to align with the sport's dynamism. Williams can leverage this trend to secure more lucrative deals, potentially boosting revenue streams beyond race performance. Increased media rights revenue also benefits teams, as broadcast deals become more valuable with larger audiences.

With new ownership and a bolstered investment strategy, Williams Grand Prix Holdings is significantly enhancing its appeal to top-tier engineering talent and drivers. This renewed focus on long-term vision is making the team a more desirable destination for skilled professionals.

The recent acquisition of Carlos Sainz, a driver with multiple race wins, serves as a powerful testament to Williams' improved recruitment capabilities. This signing signals the team's growing capacity to attract high-profile individuals, a crucial factor in accelerating its progress back towards competitiveness.

Leveraging Dorilton Capital's Long-Term Vision

Dorilton Capital's patient, long-term investment strategy offers Williams a crucial advantage, enabling systematic rebuilding rather than a focus on immediate results. This sustained financial backing, which saw Dorilton acquire Williams for a reported £136 million in 2020, allows for strategic, foundational investments in infrastructure and talent.

This stability is vital for Williams as they navigate the competitive Formula 1 landscape. For instance, the team has been investing in new facilities, including a state-of-the-art wind tunnel, a project that requires significant capital and a multi-year commitment. This aligns perfectly with Dorilton's vision for sustainable growth.

The long-term perspective empowers Williams to:

- Invest in critical infrastructure upgrades, such as the aforementioned wind tunnel, which is essential for aerodynamic development.

- Attract and retain top engineering talent by offering job security and a clear development path.

- Develop a consistent and competitive car over multiple seasons, moving away from the stop-start development cycles of the past.

- Focus on long-term R&D without the pressure of immediate performance returns, fostering innovation.

Strategic Partnerships and Collaborations

Williams Grand Prix Holdings can leverage strategic partnerships beyond traditional sponsorship to foster innovation and operational improvements. For example, their existing collaboration with Atlassian, a software company, highlights the potential for deeper technical and commercial alliances within the broader motorsport and technology industries. These partnerships can lead to enhanced efficiency and the development of cutting-edge solutions.

Exploring collaborations with technology firms or even other Formula 1 teams on specific projects could unlock new revenue streams and technological advancements. For instance, joint ventures in areas like advanced simulation or sustainable energy solutions could offer significant competitive advantages. In 2024, the increasing focus on cost-cap regulations makes such collaborations even more attractive as they can distribute development costs.

- Technical Alliances: Partnering with technology providers for data analytics, AI, or advanced materials can boost on-track performance.

- Commercial Ventures: Collaborating on new product development or market entry strategies can diversify revenue.

- Shared R&D: Joint research and development projects can reduce costs and accelerate innovation in areas like powertrain efficiency.

- Data Sharing Agreements: Strategic data sharing with non-competing entities could lead to valuable insights and predictive modeling improvements.

The upcoming 2026 Formula 1 technical regulations, featuring lighter cars and enhanced power units, present a significant opportunity for Williams to develop a competitive car by proactively adapting to these changes.

Formula 1's growing global viewership, which saw average live TV viewership exceed 70 million per Grand Prix in 2023, translates into increased sponsorship and media rights revenue for teams like Williams.

Strategic partnerships, such as the one with Atlassian, offer Williams the chance to innovate and improve operations, potentially leading to enhanced efficiency and the development of cutting-edge solutions in collaboration with technology firms.

The team's ability to attract top talent, exemplified by the signing of Carlos Sainz, signals growing recruitment capabilities crucial for accelerating progress and competitiveness.

| Opportunity Area | Description | Potential Impact |

|---|---|---|

| Technical Regulations (2026) | Lighter cars, enhanced electric output in power units, active aerodynamics. | Develop a highly competitive car, outmaneuver slower adapting competitors. |

| Global Fanbase Growth | Increased viewership (70M+ per GP in 2023), heightened demand for sponsorship. | Secure lucrative sponsorship deals, boost revenue streams, increase media rights value. |

| Strategic Partnerships | Collaborations with technology firms (e.g., Atlassian) and potentially other F1 teams. | Foster innovation, improve operational efficiency, unlock new revenue streams, share R&D costs. |

| Talent Acquisition | Attracting high-profile drivers (e.g., Carlos Sainz) and top engineering talent. | Accelerate on-track performance, enhance team reputation, build a stronger competitive foundation. |

Threats

Formula One is an intensely competitive arena, with established manufacturer teams like Ferrari and Mercedes, and well-funded privateers such as Red Bull Racing, consistently outspending Williams. These rivals often possess superior aerodynamic development, larger engineering staffs, and more extensive testing capabilities, creating a significant resource gap. For instance, in 2024, top teams were estimated to have budgets exceeding $300 million, while Williams operated with a considerably smaller allocation, impacting their ability to develop upgrades at the same pace.

The Formula 1 cost cap, while intended to foster closer competition, presents a significant threat to teams like Williams, especially when coupled with high accident rates. Williams' 2024 season, marked by substantial crash damage, illustrates this vulnerability. The cost of repairs and replacement parts directly eats into the limited budget, diverting funds away from crucial car development and upgrades.

The inflexibility of the budget cap, underscored by the rejection of proposals for greater financial leeway, exacerbates this challenge. Without the ability to absorb unexpected repair costs without severely compromising development, teams are left in a precarious position. This rigid financial structure means that a single costly accident can have a disproportionately large and negative impact on a team's competitive trajectory throughout the season.

The upcoming 2026 Formula 1 technical regulations introduce a significant performance risk for Williams Grand Prix Holdings. Misinterpreting these complex new rules or failing to develop a car that is competitive under them could lead to substantial performance setbacks. For instance, a misjudged aerodynamic concept could render the car uncompetitive for an entire season, impacting revenue streams and sponsorship opportunities.

A failure to adapt effectively to the 2026 regulations poses a threat of extended underperformance, potentially impacting the team for multiple seasons. This could translate into a prolonged period of lower championship standings, directly affecting prize money distribution, which for 2024, saw teams earning millions based on their final constructor positions. Williams, aiming to climb the grid, cannot afford to misstep on this crucial regulatory shift.

Talent Poaching by Rival Teams

Williams Grand Prix Holdings faces a significant threat from rival Formula 1 teams actively poaching key personnel. As the team focuses on rebuilding and attracting new talent, experienced engineers and promising drivers are prime targets for competitors offering more lucrative packages or better performance prospects. This talent drain can severely impede Williams' development and competitiveness.

The high demand for skilled individuals in Formula 1 means that retaining top talent is a constant challenge. For instance, in the 2024 season, teams like Red Bull Racing and Mercedes have historically been very effective at securing top engineering minds. Williams' ability to counter this threat is directly tied to its performance on track and its investment in employee development and retention programs. Losing even a few critical engineers can set back development timelines significantly.

The financial implications of talent poaching are substantial. Beyond the direct cost of replacing personnel, there's the loss of institutional knowledge and the potential impact on car development. In 2023, while specific figures for Williams' talent loss aren't public, the overall F1 market saw significant driver and personnel movements, with estimated salary increases for top engineers reaching into the millions. This competitive landscape makes it difficult for a team like Williams, which has historically operated with tighter budgets compared to the top contenders, to retain its most valuable assets.

- Talent Drain Risk: Key engineers and drivers are vulnerable to recruitment by more successful or financially stronger rival teams.

- Impact on Development: Losing experienced personnel can hinder technical progress and car development cycles.

- Retention Costs: Countering poaching requires competitive salaries and benefits, increasing operational expenses.

- Competitive Disadvantage: A depleted talent pool weakens the team's ability to innovate and compete effectively on track.

Economic Downturns Affecting Sponsorship and F1 Revenue

A global economic downturn poses a significant threat to Williams Grand Prix Holdings. A recession can lead to reduced corporate spending, directly impacting sponsorship revenues, which are a crucial income stream for the team. For instance, in 2023, Williams secured new partnerships with brands like Gulf Oil and Komatsu, highlighting their reliance on such agreements.

Furthermore, a weakening global economy could also affect the commercial rights income generated by Formula 1 itself. This would indirectly impact Williams, as a portion of their revenue is tied to the sport's overall financial performance. This vulnerability was evident in the aftermath of the 2008 financial crisis, which saw a general dip in sports sponsorship.

- Economic Downturn Impact: Reduced corporate profits can lead to cuts in marketing budgets, directly affecting sponsorship deals.

- Formula 1 Revenue Sensitivity: A global recession might decrease viewership and event attendance, impacting the sport's overall commercial value and subsequent revenue distribution.

- Williams' Financial Stability: As a team heavily dependent on external funding, a significant drop in sponsorship and commercial rights income could severely limit Williams' ability to invest in car development and operational costs.

The intense competition in Formula 1 means rivals constantly innovate, often outspending Williams. This resource disparity, evident in 2024 with top teams exceeding $300 million budgets while Williams operated on a significantly smaller scale, directly impacts development pace.

The stringent Formula 1 cost cap, combined with high accident rates like those experienced by Williams in 2024, poses a critical threat. Repair costs consume a limited budget, diverting funds from essential car development and upgrades, a challenge exacerbated by the cap's inflexibility.

The upcoming 2026 technical regulations represent a substantial performance risk for Williams; misinterpreting these complex rules or failing to develop a competitive car could lead to prolonged underperformance, impacting prize money distribution and sponsorship opportunities.

Williams faces a constant threat from rival teams actively poaching key personnel, particularly engineers and drivers. This talent drain, a common issue in F1 where top engineers can command salaries in the millions, can severely impede development timelines and competitiveness.

A global economic downturn poses a significant risk to Williams' sponsorship revenue, a crucial income stream. Reduced corporate spending can impact deals, as seen with Williams' 2023 partnerships, and a weakening economy might also decrease Formula 1's overall commercial value.

SWOT Analysis Data Sources

This analysis is built upon a foundation of credible data, including Williams Grand Prix Holdings' official financial reports, comprehensive market research on the Formula 1 sector, and insights from industry experts and motorsport publications.