Williams Grand Prix Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Williams Grand Prix Holdings Bundle

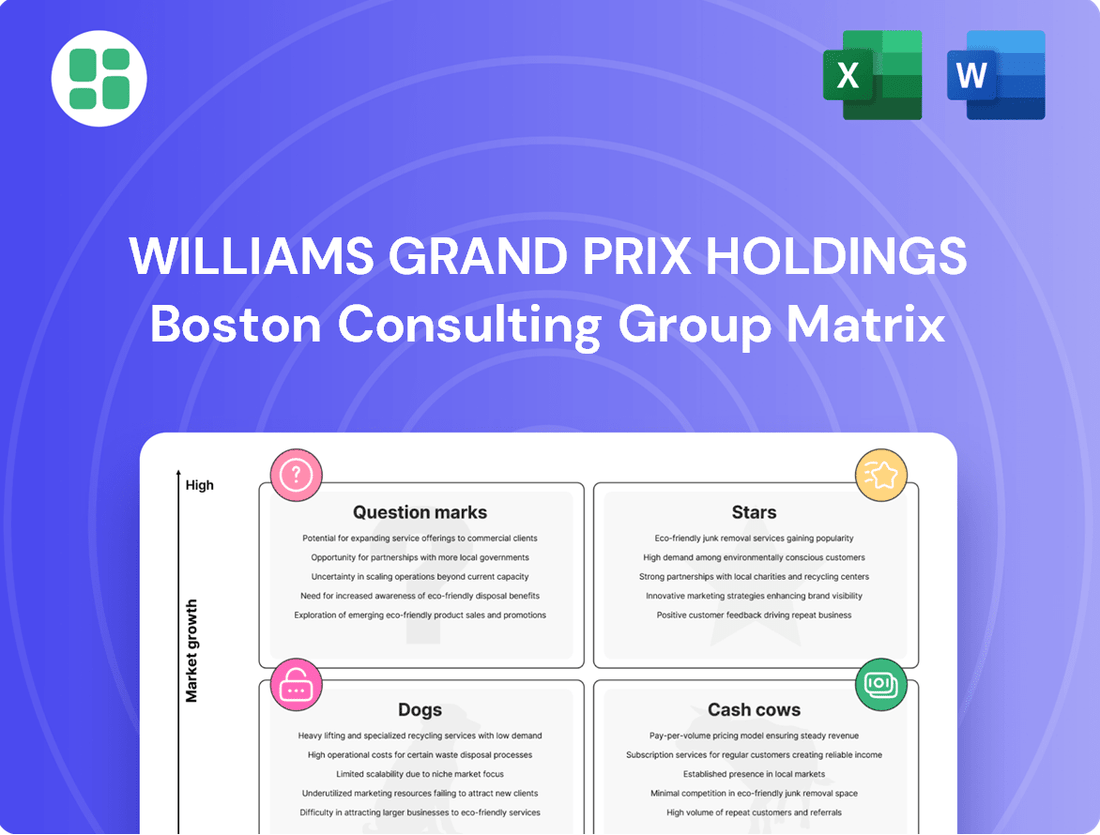

Williams Grand Prix Holdings' BCG Matrix offers a crucial snapshot of its diverse business units. Understand which ventures are fueling growth (Stars), generating steady income (Cash Cows), requiring careful consideration (Question Marks), or potentially hindering progress (Dogs).

Unlock the full strategic potential by purchasing the complete BCG Matrix report. Gain detailed insights into each quadrant, enabling you to make informed decisions about resource allocation and future investments for Williams Grand Prix Holdings.

Don't miss out on the complete picture! Secure the full BCG Matrix for Williams Grand Prix Holdings to receive actionable strategies and a clear roadmap for optimizing your portfolio and driving sustainable success.

Stars

Williams Racing is making substantial investments in upgrading its facilities and operational processes. This strategic move is crucial for enhancing its competitive edge in Formula One, aiming to build cutting-edge technology and capabilities. For example, the team has been investing in new wind tunnel technology and simulator upgrades.

This significant capital expenditure is designed to propel the team back to the forefront of Formula One racing. While these investments have led to current financial losses, they are considered essential building blocks for achieving sustained high performance and increasing market share in the future.

Despite facing on-track challenges and reporting financial losses, Williams Grand Prix Holdings saw its valuation surge to approximately $1.24 billion in 2024. This impressive growth is largely attributed to the broader surge in Formula One team valuations, driven by the sport's escalating global appeal and the introduction of financial regulations like the budget cap.

This substantial increase in asset value underscores Williams' attractiveness as an investment, signaling considerable potential for future financial gains and strategic opportunities within the sport.

Williams' ambition to attract top talent is clearly demonstrated by securing Carlos Sainz for the 2025 season. This move, bringing in a driver from a leading team, signals a strong belief in Williams' potential for significant growth within Formula 1. Sainz's expertise is anticipated to be crucial in advancing car development and strategic planning, thereby speeding up the team's overall progress.

Major New Title Sponsorship

The multi-year title sponsorship with Atlassian, announced as Williams' most significant commercial agreement to date, is set to inject substantial new funding starting with the 2025 Formula 1 season. This major endorsement signals a strong resurgence of external confidence in Williams' strategic recovery plan and its trajectory for future growth.

This crucial financial injection directly supports Williams' ongoing transformation and development initiatives, providing the necessary resources to accelerate progress. The partnership underscores a belief in the team's potential to regain competitiveness and achieve long-term success in Formula 1.

- Atlassian's Title Sponsorship: A multi-year deal described as Williams' largest ever, commencing in 2025.

- Financial Impact: Provides substantial new funding, bolstering the team's resources.

- Confidence Indicator: Signifies renewed external belief in Williams' comeback strategy and future growth.

- Strategic Support: Crucial for funding transformation and development programs.

Overall F1 Market Growth

The Formula One market is currently experiencing a significant boom. In 2023, Formula 1 reported a record revenue of $3.2 billion, a substantial increase from previous years, driven by strong commercial performance and race attendance. This overall market growth creates a favorable environment for all teams, including Williams.

This expansion is fueled by several factors, including increased global viewership, a growing number of races on the calendar, and heightened interest from new manufacturers and sponsors. For instance, the 2023 season saw an average global TV audience of 530 million viewers, highlighting the sport's widespread appeal.

Williams, as a long-standing Formula 1 constructor, is positioned to capitalize on this upward trend. The rising tide of the F1 market directly benefits the team by increasing the potential value of its assets, broadcast rights, and sponsorship opportunities. This expanding market amplifies the potential return on Williams' strategic investments in infrastructure, technology, and driver development.

- Record Revenue Growth: Formula 1's revenue reached $3.2 billion in 2023, indicating robust market expansion.

- Increased Fan Engagement: Global viewership for the 2023 season averaged 530 million, demonstrating heightened fan interest.

- Sponsorship Value Surge: The growing popularity of F1 attracts significant investment from global brands, boosting sponsorship revenues across the grid.

- Positive Market Outlook: The ongoing expansion of the F1 calendar and commercial deals suggests continued growth for the sport.

Williams' strategic investments in facilities and talent, including the signing of Carlos Sainz for 2025 and a major title sponsorship with Atlassian, position it as a "Star" within the BCG matrix. These moves are designed to leverage the booming Formula 1 market, which saw record revenues of $3.2 billion in 2023 with an average global TV audience of 530 million. This strong market performance, coupled with Williams' ambitious development plans, suggests a high growth potential for the team.

| BCG Category | Williams' Position | Rationale |

|---|---|---|

| Stars | High Market Growth, High Relative Market Share (potential) | Significant investments in infrastructure, talent (Sainz), and sponsorship (Atlassian) aim to capitalize on F1's growth. The team's valuation surged to $1.24 billion in 2024, reflecting this potential. |

What is included in the product

This BCG Matrix analysis highlights which Williams Grand Prix Holdings units to invest in, hold, or divest based on their market share and growth.

A clear BCG Matrix visualization helps Williams Grand Prix Holdings prioritize investments, relieving the pain of resource allocation uncertainty.

Cash Cows

Williams Racing benefits from a significant portion of Formula One's commercial rights income. This revenue stream, while tied to championship performance, offers a stable financial foundation. For instance, while their 2023 revenue reflected a lower 2022 championship standing, their improved 7th place finish in 2023 is projected to boost this income in the coming years.

This core revenue source generally demands minimal incremental investment to sustain its baseline contribution. It represents a fundamental asset that generates ongoing returns for the team.

Williams Grand Prix Holdings' established sponsorship portfolio acts as a strong Cash Cow. Long-term partnerships with brands like Duracell and Gulf Oil, alongside newer agreements with companies such as MyProtein and Santander, generate predictable and consistent revenue. This stability is crucial for funding ongoing operations without requiring significant investment in new market development.

The recurring nature of these sponsorship deals provides a reliable income stream, a hallmark of a Cash Cow. For instance, the renewal of partnerships and the addition of new collaborators, such as Atlassian for the 2025 season, underscore the enduring value and appeal of Williams' brand in attracting and retaining major sponsors.

The storied history of Williams Racing, marked by nine Constructor's Championships and seven Drivers' Championships, forms a powerful historical brand legacy. This deep well of fan loyalty and recognition, cultivated over decades, continues to attract significant commercial partnerships and robust merchandise sales.

This iconic brand legacy generates consistent brand value and a baseline of revenue with minimal direct marketing expenditure. It serves as a foundational asset, passively bolstering the team's financial stability through its enduring appeal.

Mercedes Power Unit Partnership

The extended partnership with Mercedes-Benz as a power unit supplier, secured until 2026 and potentially further, offers Williams a dependable and cutting-edge engine. This strategic alliance allows Williams to concentrate its valuable engineering talent on refining chassis and aerodynamic designs, sidestepping the enormous research and development expenditures typically required for in-house power unit creation.

This stable and predictable cost structure for the power unit frees up capital and resources, enabling Williams to invest more heavily in other critical areas of car development. For example, in 2024, the Formula 1 industry saw significant investment in aerodynamic efficiency, with teams allocating substantial portions of their budgets to this area.

- Reliable Power Unit: Long-term deal with Mercedes ensures access to a top-tier engine.

- Cost Efficiency: Avoids massive R&D costs associated with developing a proprietary power unit.

- Resource Allocation: Enables focus on chassis and aerodynamic development, key performance differentiators.

- Predictable Costs: Provides a stable expense line item, aiding financial planning.

Stable Fan Engagement Platforms

Williams Racing benefits from established digital and social media platforms that foster a loyal global fanbase.

- Fanbase Loyalty: Williams boasts a dedicated global following across its official website and social media channels, ensuring consistent engagement.

- Revenue Streams: These platforms provide steady opportunities for merchandise sales and enhanced sponsor visibility with minimal incremental investment.

- Commercial Activation: The predictable audience allows for reliable commercial activation, supporting the team's financial stability.

Williams Grand Prix Holdings identifies several key areas functioning as Cash Cows within its portfolio. These are established, stable revenue generators that require minimal investment to maintain their profitability. They represent the bedrock of the team's financial stability, providing consistent returns that can be reinvested or used to support other ventures.

The team’s commercial rights income, while linked to performance, provides a reliable baseline. For example, their 7th place finish in the 2023 Constructors' Championship is expected to increase this income for 2024 and beyond. Similarly, their robust sponsorship deals, including long-standing partnerships and new additions like Atlassian for 2025, ensure predictable revenue streams without the need for substantial new business development.

The enduring brand legacy of Williams Racing, built on decades of success, also acts as a Cash Cow. This historical appeal drives consistent merchandise sales and attracts commercial partners, requiring little direct marketing expenditure. Furthermore, the strategic partnership with Mercedes-Benz for power units, secured until 2026, offers cost efficiency and allows resources to be focused on other performance areas, contributing to financial predictability.

| Business Unit | BCG Category | Key Financial Driver | Investment Required | Projected Return |

|---|---|---|---|---|

| Commercial Rights Income | Cash Cow | Championship Performance & Payouts | Low (for baseline maintenance) | Stable & Growing (with performance improvement) |

| Sponsorship Portfolio | Cash Cow | Long-term Partnerships & New Deals | Low | Consistent & Predictable |

| Brand Legacy & Merchandise | Cash Cow | Fan Loyalty & Historical Recognition | Minimal Marketing | Steady Revenue |

| Power Unit Supply Agreement (Mercedes) | Cash Cow | Cost Efficiency & Predictable Expenses | Low (relative to in-house development) | Resource Reallocation & Financial Stability |

What You See Is What You Get

Williams Grand Prix Holdings BCG Matrix

The preview you are currently viewing is the identical, fully realized Williams Grand Prix Holdings BCG Matrix report that you will receive immediately after purchase. This means no watermarks, no placeholder text, and no altered content—just the complete, professionally formatted document ready for your strategic analysis and business planning.

Dogs

In the 2024 Formula One season, Williams Racing has faced considerable challenges, currently sitting ninth in the Constructors' Championship with just 17 points after 18 races. This performance marks a step back from their seventh-place finish in 2023, reflecting a reduced competitive standing and market share within the sport.

This downturn in performance has direct financial implications, notably affecting the prize money distributed by Formula One and diminishing the team's appeal to potential sponsors. The struggle to gain points translates into lower revenue streams, impacting the team's overall financial health and ability to invest in future development.

Williams Grand Prix Engineering Ltd. experienced significant financial headwinds in 2023, reporting a substantial loss of £84 million. This figure represents a notable increase from the prior year's financial performance.

While these losses are partly attributable to strategic investments aimed at future growth, the immediate reality is that the business consumed more cash than it generated from its core racing activities. This cash deficit clearly positions Williams as a 'Dog' within the BCG Matrix framework, at least in the short term.

The 2024 season has presented significant hurdles for Williams, particularly with the FW46 car. A key issue identified is its excessive weight, a problem team principal James Vowles openly acknowledged is costing the team approximately 0.45 seconds per lap. This fundamental design challenge directly impacts the car's performance and necessitates continuous development to reduce its mass.

These development setbacks place the FW46 firmly in the Dogs category of the BCG Matrix. The car's current lack of competitiveness, stemming from its overweight condition, suggests low market appeal and limited growth prospects in the short to medium term. The team is actively working on weight reduction strategies, but the initial design flaw represents a substantial impediment.

High Incidence of Crashes

The 2024 Formula 1 season has presented Williams Grand Prix Holdings with a significant challenge, characterized by an alarmingly high incidence of crashes involving both their drivers. This has resulted in substantial repair costs and a tangible disruption to their car development plans.

These frequent, high-impact incidents translate directly into lost points and, more critically, place immense strain on the team's already stretched financial and operational resources. The cumulative effect of costly damage without a corresponding uplift in performance represents a clear drain on the business.

- Financial Strain: The 2024 season has seen an 'unbelievable volume of heavy crashes' for Williams, leading to a massive repair bill.

- Development Disruption: These incidents have significantly disrupted the team's ability to develop the car, impacting performance potential.

- Resource Drain: The high frequency of costly damage strains both financial and operational resources, diverting funds and personnel from crucial development areas.

- Lack of Return: The current situation represents a clear drain on the business without proportionate returns in terms of points or competitive advantage.

Inconsistent Race Results

Inconsistent race results have been a hallmark of Williams' 2024 Formula 1 season. Beyond their championship standing, the team has struggled to achieve regular points finishes. For instance, in the first ten races of the 2024 season, Williams secured points in only three Grand Prix events, highlighting a significant lack of consistency.

This unpredictability makes it challenging for Williams to build any sort of competitive momentum. Their performance often seems dependent on external factors rather than inherent speed or reliability. This suggests that the team's car, the FW46, is not consistently meeting the demands of the competitive Formula 1 market.

- Inconsistent Points Finishes: Williams secured points in only 3 of the first 10 races in the 2024 season.

- Lack of Momentum: The team's performance fluctuates, preventing sustained competitive advantage.

- Market Expectations: The car's unreliability fails to meet the high expectations of the Formula 1 market.

- Strategic Challenge: This positions Williams as a "Question Mark" in the BCG matrix, requiring careful investment decisions.

Williams Grand Prix Holdings, specifically its Formula 1 racing operation, currently exhibits characteristics of a 'Dog' in the BCG Matrix. The team's 2024 performance, with only 17 points after 18 races and a ninth-place standing, indicates low market share and slow growth within the highly competitive F1 landscape. Financial results from 2023, showing a loss of £84 million, further underscore this position, as the business consumed more cash than it generated.

The core issues contributing to this 'Dog' status include the FW46 car's significant weight problem, which team principal James Vowles stated costs approximately 0.45 seconds per lap. This fundamental design flaw limits its market appeal and growth prospects. Additionally, an 'unbelievable volume of heavy crashes' in 2024 has led to massive repair bills and disrupted car development, draining resources without yielding competitive returns.

| Metric | 2023 Result | 2024 Performance (as of mid-season) | BCG Matrix Implication |

|---|---|---|---|

| Constructors' Championship Standing | 7th | 9th | Declining Market Share |

| Points Scored (approx. first half of season) | 28 | 17 (after 18 races) | Low Market Growth/Performance |

| Financial Performance | Loss of £84 million | Ongoing significant investment required | High Cash Consumption, Low Returns |

| Car Development Challenges | N/A (focus on 2024 issues) | Overweight car (FW46), frequent crashes | Low Competitive Advantage |

Question Marks

Williams Racing is in a critical rebuilding phase, marked by substantial investments in infrastructure, technology, and talent under new leadership. This strategic overhaul, initiated in late 2020 and continuing through 2024, aims to fundamentally reshape its operational efficiency and on-track competitiveness.

While this transformation signifies high growth potential for Williams, its current performance, reflected in a low market share within Formula 1, places it in the 'Question Marks' category of the BCG Matrix. The significant capital expenditure, such as the development of their new wind tunnel which became operational in 2023, is designed to boost future results but has yet to fully translate into competitive gains.

Williams Grand Prix Holdings is strategically positioning its new technical partnerships within the BCG matrix, likely as question marks. In 2024, the team announced collaborations with VAST Data for advanced data processing and Globant for digital transformation. These ventures aim to bolster their data analytics capabilities and overall digital infrastructure, introducing cutting-edge technology and specialized expertise.

These partnerships represent a significant investment in future performance, bringing in external innovation that could yield substantial gains. However, the tangible impact of these collaborations on on-track results is still in its nascent stages and has not yet been fully realized, making their future market share and growth potential uncertain.

Williams Grand Prix Holdings is heavily investing in preparation for the 2026 Formula One technical regulations, viewing this as a prime growth avenue. Their strategic alignment with Mercedes for the new power unit era underscores this commitment, aiming to leverage a strong partnership for future competitiveness.

This forward-looking strategy, while promising a significant competitive uplift, also presents considerable risk. The substantial upfront capital expenditure required for the 2026 regulations means that returns on investment will be deferred, creating a period of financial strain before potential gains materialize.

Carlos Sainz's Influence and Development Input

Carlos Sainz's move to Williams for 2025 signifies more than just a driver change; it's a strategic investment in technical development and team culture. His experience with Ferrari, a team consistently competing at the sharp end, provides invaluable insights into car design and operational efficiency. This makes his role a high-potential initiative for accelerating Williams' progress.

Sainz's input is expected to directly influence car development, potentially fast-tracking the team's technical evolution. His understanding of what makes a front-running car could be a game-changer for Williams, which has been striving to climb the constructors' standings. For instance, in the 2024 season, Williams has been consistently battling in the lower midfield, with their best constructor result being 7th in 2023, accumulating 28 points.

- Driver Experience: Sainz brings experience from top-tier teams like McLaren and Ferrari, exposing him to advanced development processes.

- Technical Input: His feedback is anticipated to refine car design and upgrade pathways, crucial for a team aiming to improve its performance metrics.

- Cultural Shift: Sainz's integration is intended to foster a winning mentality and enhance team collaboration, vital for sustained growth.

- Performance Impact: While the potential is high, the actual on-track results and the speed of technical progress will be the ultimate measure of his influence.

Strategic Drive for New Sponsors

Williams Grand Prix Holdings is actively seeking new commercial partners beyond their existing agreements, such as the one with Atlassian. This strategic push is designed to boost revenue streams, which are vital for funding the team's ambitious development plans and future growth.

The team's pursuit of new sponsors reflects a high cash consumption rate, a characteristic of a business unit in the 'Stars' or 'Question Marks' quadrant of the BCG matrix, requiring significant investment to maintain its growth trajectory.

- In 2024, Williams Racing secured a multi-year partnership with K-Swiss, signaling their ongoing efforts to diversify revenue.

- The team's financial reports for 2023 indicated a significant increase in commercial revenue, partly attributed to new sponsorship agreements, though overall profitability remained a challenge due to high operational costs.

- Attracting major sponsors is critical for Williams to compete effectively, as Formula 1 teams typically require substantial budgets for car development and operational expenses.

Williams' strategic partnerships and significant investments, such as the new wind tunnel and collaborations with VAST Data and Globant, position them as 'Question Marks' in the BCG Matrix. These initiatives require substantial capital but have yet to yield a significant market share increase.

The team's focus on the 2026 regulations and the high-profile signing of Carlos Sainz for 2025 further underscore this 'Question Mark' status. While these moves signal high growth potential, they also represent considerable upfront investment with deferred returns, making their future success uncertain.

Williams' pursuit of new commercial partners, including the 2024 K-Swiss deal, highlights their high cash consumption. This is typical for units with high growth potential but low current market share, requiring ongoing investment to capture future opportunities.

| Initiative | BCG Quadrant | Rationale | Key Data Points |

| New Wind Tunnel | Question Mark | High investment, aims for future competitiveness, current impact not fully realized. | Operational in 2023. |

| VAST Data & Globant Partnerships | Question Mark | Investment in data analytics and digital infrastructure, potential for future gains, early stages of impact. | Announced in 2024. |

| 2026 Regulation Preparation | Question Mark | Significant upfront capital expenditure, deferred returns, high growth potential. | Strategic alignment with Mercedes for new power unit. |

| Carlos Sainz Signing (2025) | Question Mark | Investment in technical development and team culture, high potential impact, early stage. | Experienced driver from Ferrari. |

| New Commercial Partnerships | Question Mark | High cash consumption, critical for funding development, ongoing efforts to diversify revenue. | K-Swiss partnership secured in 2024; 2023 commercial revenue increased. |

BCG Matrix Data Sources

Our BCG Matrix for Williams Grand Prix Holdings is built on comprehensive data, including official financial statements, motorsport industry reports, and detailed market trend analysis.