Williams Grand Prix Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Williams Grand Prix Holdings Bundle

Williams Grand Prix Holdings operates within a fiercely competitive motorsport landscape, where intense rivalry among established teams and the constant threat of new entrants significantly shape its market position. Understanding the bargaining power of suppliers, particularly for specialized components and talent, is crucial for managing costs and maintaining a competitive edge.

The threat of substitute products or services, while less direct in motorsport, can manifest through evolving fan engagement platforms and alternative entertainment options. Buyer power, exerted by sponsors and broadcast partners, also plays a vital role in revenue generation and strategic direction.

The complete report reveals the real forces shaping Williams Grand Prix Holdings’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Williams Racing's dependence on a select few highly specialized engine manufacturers, like Mercedes-AMG High Performance Powertrains, underscores their significant bargaining power. These suppliers hold vital proprietary technology and unique expertise, making it incredibly difficult and costly for teams like Williams to switch providers. This reliance directly translates into substantial leverage for the engine manufacturers.

The performance gap created by different engine suppliers can be a deciding factor in a Formula 1 team's success, directly impacting their on-track competitiveness. For instance, in 2023, Mercedes-AMG powertrains were widely considered among the strongest, a factor that would naturally increase their negotiating position with customer teams. This performance dependency further solidifies the suppliers' formidable leverage.

Williams Grand Prix Holdings faces significant supplier bargaining power due to its reliance on exclusive component and technology providers. For instance, Pirelli is the sole Formula 1 tire manufacturer, meaning Williams has no alternative for this critical performance element. This exclusivity, coupled with the high technical expertise required, grants Pirelli considerable leverage over pricing and supply terms.

Furthermore, highly advanced aerodynamic or electronic systems often originate from a very limited number of specialized suppliers. These niche providers possess unique intellectual property and face substantial barriers to entry for potential competitors. Consequently, Williams must accept these suppliers' terms to maintain its competitive edge on the track, as sourcing comparable technology elsewhere is often impossible.

The bargaining power of elite talent, particularly drivers, engineers, and strategists in Formula One, is exceptionally high. This is due to the extremely limited pool of individuals possessing the specialized skills and experience crucial for a team's performance. For instance, in 2024, top Formula One drivers can command annual salaries well into the tens of millions of dollars, reflecting their direct impact on race results and commercial appeal.

Logistics and Event Infrastructure Providers

Logistics and event infrastructure providers, while not as specialized as technical component suppliers, still wield considerable bargaining power over Williams Grand Prix Holdings. The sheer complexity of moving entire Formula 1 operations across continents for a demanding calendar means that reliable and experienced partners are critical. Their services are difficult to replicate, especially given the tight turnaround times and specific requirements of F1.

Consider the sheer scale: a Formula 1 team like Williams transports hundreds of tons of equipment, including cars, spares, garages, and hospitality units, to over 20 global locations annually. This requires a robust and specialized logistics network. In 2024, the F1 calendar expanded to 24 races, further intensifying the demand for these services and potentially increasing their leverage. For instance, a major logistics provider might handle multiple F1 teams, giving them significant volume and thus more negotiating strength.

- High Switching Costs: Finding and vetting new logistics and infrastructure partners for a global F1 operation is a time-consuming and costly endeavor, deterring frequent changes.

- Limited Substitutes: The niche expertise required for F1 trackside setup and global freight forwarding means there are few readily available alternatives that can meet the stringent demands.

- Essential Service: Without these providers, the racing operation simply cannot function, placing Williams in a position where they must accommodate supplier demands to ensure continuity.

High-Performance Materials and Manufacturing Specialists

The bargaining power of suppliers for high-performance materials and manufacturing specialists is significant for Williams Grand Prix Holdings. Formula One cars rely on cutting-edge carbon fiber composites and intricate precision engineering, areas where specialized suppliers often hold a strong hand.

Suppliers in this niche frequently possess unique intellectual property or highly specialized manufacturing processes. This exclusivity limits Williams' alternatives, thereby enhancing the suppliers' leverage. The critical nature of these components, essential for car performance and safety, further amplifies this power.

- Specialized Materials: Advanced carbon fiber composites, crucial for lightweight yet strong chassis, are produced by a limited number of highly skilled manufacturers.

- Precision Engineering: Complex engine components and aerodynamic parts require specialized machining and assembly services, often proprietary to a few providers.

- Intellectual Property: Suppliers may hold patents on unique material treatments or manufacturing techniques, creating a barrier to entry for competitors and increasing their pricing power.

- Critical Dependency: Williams' ability to compete directly correlates with the quality and innovation of these supplied components, making supplier relationships paramount and their bargaining power substantial.

Williams Grand Prix Holdings faces considerable supplier bargaining power, particularly from engine manufacturers like Mercedes-AMG High Performance Powertrains, which supply critical, proprietary technology. This reliance, coupled with the high cost and complexity of switching, grants these suppliers substantial leverage in negotiations. The performance advantage derived from these powertrains, as seen in 2023 with Mercedes-AMG's strong showing, further amplifies their negotiating position.

Pirelli, as the sole tire supplier for Formula 1, exemplifies this power; Williams has no alternative for this essential performance component. Similarly, specialized suppliers of advanced aerodynamic or electronic systems possess unique intellectual property and face high barriers to entry, forcing Williams to accept their terms to remain competitive. This situation is further exacerbated by the limited pool of elite drivers and engineers in 2024, commanding multi-million dollar salaries reflecting their impact on team performance.

Logistics providers also hold significant sway due to the immense complexity and global scale of Formula 1 operations. Transporting hundreds of tons of equipment across over 20 locations annually, a task intensified by the 24-race calendar in 2024, requires specialized and reliable partners, limiting alternatives and increasing their leverage. The specialized nature of high-performance materials and precision engineering suppliers, such as those providing advanced carbon fiber composites and complex engine components, also contributes to their strong bargaining position due to unique intellectual property and limited competition.

| Supplier Category | Key Dependence for Williams | Factors Granting Bargaining Power | Example/Data Point |

|---|---|---|---|

| Engine Manufacturers | Proprietary powertrain technology and performance | High switching costs, unique expertise, performance impact | Mercedes-AMG powertrains considered strong in 2023 |

| Tire Suppliers | Exclusive supply of critical performance component | Sole provider status, technical expertise | Pirelli is the sole F1 tire manufacturer |

| Specialized Component Suppliers (Aerodynamics, Electronics) | Access to advanced, unique intellectual property | Limited substitutes, high barriers to entry, proprietary technology | Niche providers of cutting-edge systems |

| Elite Talent (Drivers, Engineers) | Specialized skills crucial for performance | Extremely limited pool of qualified individuals | Top drivers commanding multi-million dollar salaries in 2024 |

| Logistics & Infrastructure Providers | Global transport and trackside setup capabilities | Complexity, scale, specialized requirements, limited alternatives | Moving hundreds of tons of equipment to 20+ global locations annually |

| High-Performance Materials & Manufacturing | Cutting-edge materials and precision engineering | Unique IP, specialized processes, critical dependency for performance/safety | Advanced carbon fiber composite manufacturers |

What is included in the product

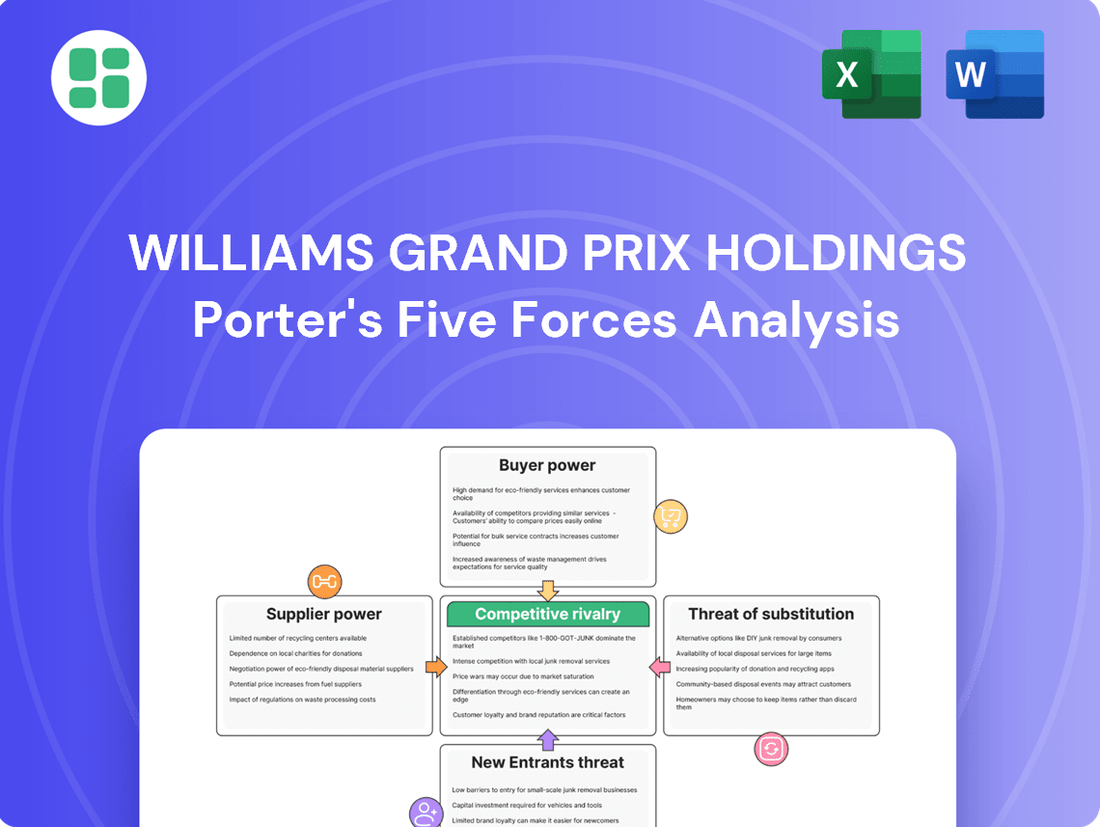

This Porter's Five Forces analysis for Williams Grand Prix Holdings dissects the intense competitive landscape of Formula 1, examining supplier power, buyer bargaining, the threat of new entrants and substitutes, and the intense rivalry among established teams.

Instantly assess the competitive landscape of Formula 1 with a clear, one-sheet summary of all five forces—perfect for quick strategic decision-making.

Customers Bargaining Power

Major sponsors are a vital revenue source for Williams Racing, with their financial backing essential for team operations and ongoing development. These significant corporate partners often wield considerable bargaining power, requiring specific performance benchmarks, extensive global visibility, and customized engagement strategies in return for their substantial financial commitments. In 2023, Williams Racing announced a multi-year partnership with Gulf Oil, a significant deal that underscores the importance of these relationships. The ability of these sponsors to consider other Formula 1 teams or entirely different sports leagues grants them considerable leverage in negotiations.

Formula One Management (FOM), now owned by Liberty Media, and the FIA hold significant power over Williams Grand Prix Holdings. These entities act as the sport's regulators and commercial rights holders, setting the rules and determining prize money distribution, directly influencing Williams' financial performance and strategic direction.

Williams, like the other nine teams, has minimal individual leverage against FOM and the FIA. Their collective bargaining power is limited, as these governing bodies control crucial aspects such as the Concorde Agreement, which dictates revenue sharing and technical regulations, making them highly influential stakeholders.

In 2023, FOM generated substantial revenue, with Liberty Media reporting approximately $2.5 billion in F1 revenue for the year. The FIA, while not a commercial entity in the same vein, plays a critical role in sanctioning races and setting technical standards, impacting development costs and competitiveness for teams like Williams.

Broadcasters and digital media platforms are significant players, paying substantial fees for Formula One broadcasting rights. These fees form a crucial part of the sport's revenue, which is then shared with the teams. For instance, in 2023, broadcast revenue was a key driver of the sport's financial success, underscoring the power these rights holders wield.

Their influence stems from the immense value they contribute to Formula One's global visibility and financial stability. High viewership and engagement figures directly enhance the appeal of sponsors and the sport itself, giving broadcasters considerable leverage in negotiations.

Indirect Influence of the Global Fan Base

The global fan base for Formula 1, and by extension Williams Grand Prix Holdings, wields significant indirect influence. While fans aren't directly buying F1 cars, their passion fuels viewership and attendance, which are vital for attracting sponsors and broadcasters. For instance, Formula 1 reported an average of 50 million viewers per Grand Prix in 2023, highlighting the scale of this indirect customer base.

Williams, like all F1 teams, must consider fan desires for competitive and engaging racing. A decline in fan interest directly impacts the sport's commercial appeal, thereby diminishing Williams' revenue streams from sponsorship and media rights. The 2024 season saw continued high engagement, with social media metrics for F1 as a whole showing substantial growth, underscoring the importance of this fan connection.

- Fan Engagement as a Revenue Driver: Fan viewership and attendance directly correlate with broadcast rights fees and sponsorship value.

- Demand for Exciting Racing: Teams must deliver compelling on-track action to maintain fan interest and, consequently, commercial viability.

- Indirect Economic Impact: A strong fan base enhances the overall attractiveness of Formula 1, benefiting all participating entities, including Williams.

Strategic Technical Partners and Collaborators

Williams Grand Prix Holdings' bargaining power of customers is influenced by strategic technical partners. These collaborators, beyond financial sponsors, offer critical expertise or components. Their influence stems from the essential nature of their contributions and proprietary intellectual property, potentially impacting Williams' design and operational decisions.

For instance, a key engine supplier or a cutting-edge aerodynamics partner could wield significant leverage. If such a partner were to withdraw or significantly alter their terms, it could directly affect Williams' competitiveness on the track. The 2024 Formula 1 season saw teams heavily reliant on specific powertrain manufacturers, highlighting the dependency on these technical relationships.

- Technical Partners' Influence: Expertise and components provided by partners can shape design and strategy.

- Intellectual Property Leverage: Unique IP held by partners grants them a degree of control.

- Critical Contributions: The essential nature of a partner's input amplifies their bargaining power.

- Dependency in 2024: Formula 1 teams' reliance on engine suppliers underscores this dynamic.

The bargaining power of customers for Williams Grand Prix Holdings is multifaceted, encompassing not only direct financial sponsors but also crucial technical partners and the broader fan base. While sponsors and technical partners hold direct leverage through their financial and intellectual contributions, the massive global fan base exerts significant indirect influence by driving viewership and engagement, which in turn affects broadcast revenue and sponsorship appeal.

| Customer Segment | Type of Influence | Key Drivers of Power | 2023/2024 Relevance |

|---|---|---|---|

| Major Sponsors | Financial & Strategic | Performance benchmarks, global visibility, engagement strategies | Multi-year deals like Gulf Oil highlight sponsor importance; ability to switch sports. |

| Technical Partners | Operational & Design | Critical expertise, proprietary IP, essential components | Teams' reliance on engine suppliers in 2024 season demonstrates this leverage. |

| Broadcasters/Media | Revenue & Visibility | Broadcasting rights fees, viewership figures | Key revenue driver for F1; high engagement in 2023/2024 fuels these deals. |

| Global Fan Base | Indirect Economic & Engagement | Viewership, attendance, social media engagement | F1 averaged 50 million viewers per GP in 2023; social media growth in 2024 reinforces fan impact. |

Preview Before You Purchase

Williams Grand Prix Holdings Porter's Five Forces Analysis

This preview displays the complete Porter's Five Forces Analysis for Williams Grand Prix Holdings, detailing the competitive landscape and strategic positioning within the Formula 1 industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, offering actionable insights without any alterations or placeholders. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this comprehensive analysis, ready for immediate use and strategic application.

Rivalry Among Competitors

Williams Racing operates in an intensely competitive environment, directly challenging nine other Formula One teams for every championship point and podium position. This fierce rivalry is fueled by constant innovation in car technology, the acquisition of top-tier driver talent, and sophisticated race strategy, with significant financial investment poured into gaining any advantage.

Williams Grand Prix Holdings faces intense competitive rivalry, significantly shaped by substantial financial and resource disparities among Formula 1 teams. Top teams often boast budgets many times larger than those of outfits like Williams, directly impacting their capacity for cutting-edge research and development, attracting premier engineering talent, and maintaining a larger operational scale. For instance, in 2023, the top three teams likely spent well over $200 million each, while Williams operated closer to the $135 million cost cap, highlighting this chasm.

While Formula 1's cost cap, introduced to foster closer competition, aims to mitigate these differences, established teams with deep pockets and extensive historical infrastructure still possess inherent advantages. These advantages translate into greater aerodynamic testing capabilities, more advanced simulator technology, and a larger pool of experienced personnel, creating formidable barriers for teams with more limited financial means to overcome and directly influencing the intensity of rivalry.

Formula 1 teams, including Williams, face fierce competition for sponsorship. In 2024, securing and maintaining these partnerships is paramount, as they directly fuel a team's ability to invest in car development and operational costs. A strong on-track performance significantly enhances a team's attractiveness to potential sponsors, creating a direct link between sporting success and commercial viability.

Williams must actively demonstrate its value proposition to brands, often competing head-to-head with other teams for limited sponsorship budgets. This intense rivalry for commercial revenue means that financial stability is as hard-fought as race wins, with sponsorship income being a critical differentiator for funding ongoing operations and future technological advancements.

Continuous Technological Arms Race

Formula One's competitive rivalry is characterized by a continuous technological arms race, as innovation is paramount in this sport. Teams are locked in a perpetual cycle of developing faster and more efficient cars, pushing the boundaries of aerodynamics, powertrains, and data analysis. This intense competition necessitates significant research and development expenditure, with teams investing hundreds of millions annually to stay ahead.

The drive for technological superiority fuels fierce rivalry among Formula One constructors. For instance, in 2023, the estimated R&D spend for leading teams like Red Bull Racing and Mercedes-AMG Petronas Formula One Team was reported to be in the region of $200-$300 million each. This constant need to out-innovate competitors requires highly specialized engineering talent and cutting-edge manufacturing capabilities.

- Technological Arms Race: Formula One is fundamentally a technology-driven sport, leading to an incessant 'arms race' in car design, aerodynamics, powertrain development, and data analytics.

- R&D Investment: Rivalry among teams is fueled by the need to innovate faster and more effectively than competitors, requiring substantial R&D investment.

- Specialized Engineering: This pursuit of innovation demands highly specialized engineering teams and advanced technological infrastructure.

- Performance Gap: Small technological advantages can translate into significant performance gains on the track, intensifying the competitive pressure.

Global Brand Recognition and Heritage

Williams Grand Prix Holdings faces intense competition from Formula 1 teams boasting deep historical roots and formidable global brand recognition. Teams like Ferrari and McLaren, with decades of racing pedigree, command significant fan loyalty. This heritage translates directly into commercial appeal, attracting sponsors and media attention. For instance, as of the 2024 season, the cumulative brand value of top F1 teams, including those with long histories, is a substantial factor in their revenue generation. Newer, highly successful outfits such as Red Bull Racing and Mercedes also present formidable competition, leveraging recent victories to build their own strong global brands and fan bases.

The rivalry for fan engagement and commercial partnerships is fierce. Williams, with its own storied past, must continually innovate and perform to maintain its standing against these established and emerging powerhouses. This competition for market share within the sport's ecosystem is not just about on-track performance but also about maintaining a compelling brand narrative that resonates globally.

- Global Brand Recognition: F1 teams with long histories, like Ferrari and McLaren, have cultivated extensive global fan bases.

- Heritage Advantage: A rich heritage contributes to a team's established commercial attractiveness and fan loyalty.

- Competitive Landscape: Williams competes against historic rivals and dominant recent performers like Red Bull Racing and Mercedes for fan attention and market share.

- Commercial Impact: Brand recognition directly influences a team's ability to secure lucrative sponsorship deals and media rights in the 2024 F1 landscape.

The competitive rivalry within Formula 1 is exceptionally intense, driven by a relentless pursuit of technological superiority and driver talent. Teams are constantly innovating, with R&D budgets for leading outfits often exceeding $200 million annually, as seen in 2023. This technological arms race means even minor performance gains are fiercely contested, requiring substantial investment in specialized engineering and advanced infrastructure.

Williams Grand Prix Holdings faces this high-stakes rivalry against teams with deep historical roots and strong global brand recognition, such as Ferrari and McLaren. These established brands benefit from decades of racing pedigree, fostering significant fan loyalty and commercial appeal. While the cost cap aims to level the playing field, teams with greater historical infrastructure and resources still maintain advantages in areas like aerodynamic testing and simulator technology, intensifying the competitive pressures for teams like Williams in the 2024 season.

| Factor | Description | Impact on Williams |

|---|---|---|

| Technological Arms Race | Constant innovation in car design, aerodynamics, and powertrains. | Requires significant R&D investment to remain competitive. |

| Talent Acquisition | Competition for top engineering and driver talent. | Higher costs and difficulty in attracting elite personnel. |

| Financial Disparities | Budget differences between top and midfield teams. | Limits development capabilities and operational scale. |

| Brand Heritage | Established teams leverage long histories for fan loyalty and sponsorship. | Williams must continually perform to maintain brand relevance. |

SSubstitutes Threaten

While Formula One holds a unique position, it's not without rivals for fan attention, sponsor dollars, and top engineering minds. Categories like Formula E, with its electric focus, IndyCar's distinct American racing style, the grueling demands of Endurance Racing (WEC), and the two-wheeled excitement of MotoGP all present compelling alternatives. These series offer different thrills and push technological boundaries, potentially drawing resources and interest away from F1.

For instance, Formula E's 2023-24 season saw significant growth in viewership, with an average of 1.8 million viewers per race, demonstrating its increasing appeal. Similarly, IndyCar’s 2024 season opener, the Firestone Grand Prix of St. Petersburg, drew a strong audience, indicating robust competition for motorsport enthusiasts. This diverse landscape of global motorsport means F1 must continually innovate to maintain its preeminence.

For general consumers and corporate sponsors, Formula One faces significant competition from a wide range of other major global sports and entertainment options. These alternatives, such as football, basketball, and the Olympics, directly compete for leisure time and discretionary spending. In 2023, global sports market revenue was estimated to be over $100 billion, highlighting the vastness of the entertainment landscape F1 operates within.

The entertainment industry as a whole, encompassing film, music, and gaming, also presents a substantial threat of substitutes. These sectors constantly innovate and capture consumer attention, vying for the same limited pool of leisure hours and marketing dollars that F1 seeks. For instance, the global video game market alone generated over $200 billion in 2023, demonstrating the scale of these competing entertainment avenues.

The burgeoning popularity of esports, especially in virtual racing, poses a significant threat of substitution for traditional motorsport. For instance, the global esports market was projected to reach over $2.1 billion in 2024, with virtual racing being a substantial contributor.

These digital platforms provide an immersive and cost-effective alternative for fans and participants. Players can engage in realistic racing simulations from their homes, bypassing the substantial expenses associated with attending live events or competing in real-world racing series.

This accessibility and lower barrier to entry can divert audience attention and potential revenue streams away from Formula 1 and other traditional racing formats, impacting viewership and sponsorship opportunities.

Shift Towards Sustainable or Autonomous Mobility Innovation

The threat of substitutes for Formula One's role as an automotive innovation showcase is growing, particularly from the burgeoning fields of sustainable and autonomous mobility. While F1 has invested in hybrid powertrains, sectors like electric vehicle (EV) racing series, such as Formula E, are capturing significant engineering talent and investment. For instance, by the end of 2024, Formula E's global audience was projected to reach hundreds of millions, demonstrating a strong consumer and industry interest in sustainable transport solutions.

These alternative mobility sectors offer more direct and visible pathways to mass-market applications, potentially diverting R&D focus and capital away from traditional motorsport. The rapid advancements in battery technology and AI for autonomous driving in these areas present a compelling alternative for innovation. For example, in 2024, global investment in EV technology alone was estimated to exceed $500 billion, highlighting the scale of resources flowing into these substitute areas.

- Formula E's growing viewership: Demonstrates a strong market pull for sustainable mobility solutions.

- EV technology investment: Significant capital allocation signals a shift in R&D priorities away from traditional automotive innovation proving grounds.

- Direct consumer application: Sustainable and autonomous mobility offer clearer routes to market than F1's specialized racing technology.

Changing Consumer Preferences for Entertainment Consumption

The threat of substitutes for Formula 1 (F1) is amplified by changing consumer preferences in entertainment. Younger demographics, in particular, are increasingly drawn to on-demand content, short-form media, and immersive digital experiences. This shift means that traditional live sports broadcasting, even a high-octane one like F1, faces competition from platforms offering more immediate and personalized engagement.

If F1 fails to adapt its content delivery and fan engagement strategies, it risks being supplanted by entertainment forms that more closely align with these evolving preferences. For instance, the rise of esports and interactive gaming offers alternative forms of competitive entertainment that capture significant attention. In 2024, the global esports market was projected to generate over $1.5 billion in revenue, highlighting the scale of this competing entertainment sector.

- Evolving Consumer Habits: A significant portion of younger audiences now favors readily accessible, digital-first entertainment over scheduled live broadcasts.

- Digital Engagement Trends: The popularity of short-form video platforms and interactive streaming services demonstrates a clear preference for content that is easily digestible and engaging.

- Risk of Substitution: If F1's content and viewing experience do not evolve to meet these changing expectations, it could lose viewership and commercial appeal to more adaptable entertainment alternatives.

Formula 1 faces a significant threat from substitute entertainment options that vie for consumer attention and spending. These range from other motorsport categories like Formula E and IndyCar, which are gaining traction, to broader entertainment sectors such as gaming and esports.

The increasing popularity of esports, particularly virtual racing, offers an accessible and cost-effective alternative to traditional motorsport. For example, the global esports market was projected to exceed $2.1 billion in 2024, with virtual racing being a notable segment.

Furthermore, broader entertainment options like football, basketball, and even film and music compete for leisure time and marketing budgets. The global sports market alone was valued at over $100 billion in 2023, illustrating the scale of competition.

| Substitute Category | Key Examples | 2023/2024 Data Point | Impact on F1 |

|---|---|---|---|

| Motorsport | Formula E, IndyCar, WEC, MotoGP | Formula E viewership averaged 1.8 million per race (2023-24 season) | Diverts fan attention and potential sponsorship |

| Esports & Gaming | Virtual Racing Simulators | Global esports market projected >$2.1 billion (2024) | Offers accessible, low-cost alternative engagement |

| General Entertainment | Football, Basketball, Film, Music | Global sports market >$100 billion (2023) | Competes for leisure time and discretionary spending |

Entrants Threaten

The sheer cost of entering Formula One presents a monumental threat of new entrants. Establishing a competitive team requires hundreds of millions, often exceeding a billion dollars, for advanced technology, state-of-the-art facilities, and extensive research and development.

These prohibitive capital investment requirements act as a significant deterrent, effectively limiting potential new competitors to only the most financially robust entities, such as major automotive manufacturers or ultra-wealthy individuals.

Formula One's regulatory environment presents a formidable barrier to new entrants. The sport is governed by intricate technical, sporting, and financial rules set by the FIA and solidified through the Concorde Agreement. For example, the 2024 season continues to operate under a strict cost cap, which, while intended to level the playing field, also demands substantial initial investment and sophisticated financial management to comply with.

The scarcity of elite talent poses a significant barrier for new Formula 1 teams. Acquiring top-tier aerodynamicists, race engineers, and strategists is exceptionally difficult, as these individuals are often under long-term contracts with established teams. For instance, in 2024, the demand for experienced personnel in areas like CFD (Computational Fluid Dynamics) analysis remains exceptionally high, with many specialists commanding substantial salaries and benefits.

Lack of Established Brand, Fan Base, and Commercial Relationships

Newcomers to Formula 1 face a significant hurdle due to the absence of established brand recognition, a dedicated fan base, and deep-rooted commercial partnerships. Teams like Williams have spent decades building these crucial assets, making it challenging for new entrants to attract major sponsors and secure advantageous commercial agreements. For instance, in 2024, established teams often benefit from multi-year deals with major automotive and technology brands, a level of partnership new teams struggle to replicate immediately.

This deficit directly impacts financial viability and on-track competitiveness. Without a strong brand and loyal following, it's harder to generate revenue through merchandise and ticket sales, and to command premium sponsorship rates. The ability to secure long-term, high-value contracts is often tied to a team's history and proven track record, which new entrants simply do not possess.

- Brand Equity: Decades of racing history contribute to brand loyalty and recognition, a significant advantage for established teams.

- Fan Base: A passionate and established fan base translates into consistent revenue streams from merchandise, hospitality, and broadcast viewership.

- Commercial Relationships: Long-standing partnerships with sponsors and suppliers provide financial stability and preferential terms.

- Market Entry Barrier: The difficulty in replicating these established advantages creates a substantial barrier for potential new competitors.

Limited Engine Supply Options and Technical Partnerships

The threat of new entrants into Formula 1 is significantly constrained by the limited availability of competitive engine supply options and the necessity for specialized technical partnerships. Securing a state-of-the-art power unit is non-negotiable for any team aiming for success, and the number of F1 engine manufacturers remains extremely low.

Newcomers face immense difficulty in negotiating supply agreements with established manufacturers. For instance, in 2024, only a handful of manufacturers like Mercedes, Ferrari, Renault, and Honda (through Red Bull Powertrains) supply engines to the grid. This exclusivity means a new team would likely be relegated to using older or less competitive technology.

- Limited Manufacturers: As of 2024, only four manufacturers (Mercedes, Ferrari, Renault, Honda/RBPT) officially produce F1 power units.

- High Development Costs: Developing a competitive F1 power unit requires billions of dollars in investment and extensive R&D, a prohibitive cost for most potential new entrants.

- Technical Expertise Barrier: The intricate nature of F1 powertrains demands highly specialized engineering talent, which is scarce and costly to acquire.

Alternatively, investing in the development of an entirely new powertrain represents an astronomically expensive and time-consuming undertaking. This massive capital requirement and the lead time needed to reach competitive performance levels create a formidable entry barrier, effectively deterring most new competitors.

The threat of new entrants into Formula 1, impacting teams like Williams Grand Prix Holdings, is significantly mitigated by the immense capital required to compete. Estimates for establishing a competitive F1 team in 2024 often range from $300 million to over $1 billion, covering everything from car development to operational costs.

Furthermore, the sport's stringent regulatory framework, including the 2024 cost cap of $135 million (excluding certain major items), necessitates sophisticated financial management and substantial initial investment to ensure compliance and competitiveness.

The scarcity of elite engineering talent and the difficulty in securing competitive engine supply from a limited pool of manufacturers (Mercedes, Ferrari, Renault, Honda/RBPT in 2024) present further substantial barriers, making entry exceedingly challenging for newcomers.

| Barrier Category | Description | Impact on New Entrants | 2024 Relevance/Data Point |

| Capital Investment | Cost of facilities, R&D, car development | Extremely High | Estimated $300M - $1B+ to be competitive |

| Regulatory Environment | FIA rules, Concorde Agreement, Cost Cap | Complex and Costly Compliance | 2024 Cost Cap: $135M (excluding certain items) |

| Talent Acquisition | Hiring skilled engineers and strategists | Difficult and Expensive | High demand for CFD and race engineers |

| Engine Supply | Access to competitive power units | Limited Options, High Negotiation Barrier | Only 4 major manufacturers supply engines |

| Brand & Fan Base | Establishing recognition and loyalty | Time-consuming and challenging | Established teams leverage decades of history |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Williams Grand Prix Holdings leverages data from their official annual reports and financial statements, alongside industry-specific publications and reputable motorsport news outlets.