Western Union PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Western Union Bundle

Western Union operates within a dynamic global landscape, heavily influenced by political stability, economic fluctuations, and evolving social attitudes towards financial services. Understanding these external forces is crucial for strategic planning and risk mitigation. Our comprehensive PESTLE analysis delves deep into these factors, offering actionable intelligence to navigate the complexities of the international money transfer market. Unlock the full potential of your Western Union strategy—download our detailed PESTLE analysis now!

Political factors

Political stability in Western Union's key remittance corridors is paramount, directly influencing its operational continuity and the reliability of its extensive global network. For instance, the company's significant presence in regions like Latin America and South Asia, which have historically experienced varying degrees of political volatility, necessitates robust contingency planning.

Geopolitical tensions, such as ongoing conflicts or the imposition of international sanctions, can severely disrupt money flows. In 2024, the impact of sanctions on countries like Russia and Iran continued to present challenges, potentially forcing temporary service suspensions or increasing compliance burdens for Western Union in those markets, thereby affecting transaction volumes and revenue streams.

Western Union must maintain vigilant monitoring of the global political landscape. This includes staying abreast of evolving international regulations and directives, such as those related to anti-money laundering (AML) and counter-terrorist financing (CTF), to ensure ongoing compliance and adapt its business strategies accordingly, safeguarding its reputation and market access.

Governments globally enforce strict rules on money transfer services, focusing on anti-money laundering (AML), combating terrorist financing (CTF), and knowing your customer (KYC). These regulations are constantly changing and differ across nations, demanding significant investment in compliance infrastructure for Western Union to prevent substantial penalties and reputational harm. For instance, in 2023, financial institutions globally faced billions in AML fines, highlighting the critical nature of these requirements.

Western Union's extensive global network means its operations are directly impacted by the ebb and flow of international relations. Favorable bilateral and multilateral agreements, such as those promoting free trade or financial cooperation, can significantly ease cross-border money transfers by reducing regulatory hurdles and transaction costs. For instance, strong diplomatic ties between the United States and Mexico have historically facilitated significant remittance flows, a key market for Western Union.

Conversely, geopolitical tensions or the imposition of protectionist policies can create substantial challenges. Strained relations might lead to increased scrutiny of financial transactions, capital controls, or even outright bans on certain services, directly affecting Western Union's ability to operate in specific regions. The company's sensitivity to the global political climate was evident during periods of trade disputes where currency fluctuations and regulatory uncertainty impacted its revenue streams.

Government Support or Restrictions on Digital Payments

Governments worldwide are actively shaping the digital payments landscape, presenting both opportunities and hurdles for Western Union. Many nations are pushing for greater financial inclusion via digital channels. For instance, India's Unified Payments Interface (UPI) has seen exponential growth, processing over 12 billion transactions in Q4 2023, demonstrating the potential for digital payment adoption when supported by government initiatives. This creates fertile ground for Western Union to expand its digital services.

Conversely, restrictive policies can significantly impede progress. Data localization mandates, requiring sensitive customer data to be stored within a country's borders, can increase operational complexity and costs for global companies like Western Union. Similarly, stringent regulations around digital currencies or cross-border data flows can create compliance burdens and limit service offerings in certain markets. For example, some countries have implemented outright bans or severe restrictions on certain types of cryptocurrency transactions, impacting potential digital remittance corridors.

Western Union's digital growth strategy must therefore be intricately linked to the diverse national digital payment agendas. Navigating these varying regulatory environments requires flexibility and a keen understanding of local policies. The company's ability to adapt its digital offerings to comply with and leverage these government stances will be crucial for its success in the evolving global payments market.

- Government Promotion of Digital Payments: Initiatives like India's UPI processing over 12 billion transactions in Q4 2023 highlight the positive impact of supportive government policies on digital payment adoption.

- Data Localization Requirements: Mandates for storing customer data within national borders can increase operational costs and complexity for international payment providers.

- Cryptocurrency Regulations: Varying national stances on digital currencies, from outright bans to permissive frameworks, directly influence Western Union's potential digital remittance corridors.

- Alignment with National Agendas: Western Union's digital expansion success hinges on its ability to adapt to and integrate with diverse national digital payment strategies and regulatory landscapes.

Fiscal Policies and Taxation

Governments worldwide are continually adjusting fiscal policies, impacting Western Union's operational landscape. For instance, changes in corporate tax rates, such as the OECD's Pillar Two initiative aiming for a global minimum corporate tax rate of 15%, could influence Western Union's overall tax burden and profitability in various jurisdictions.

Taxation on financial transactions and remittances presents a direct challenge. Some nations are exploring or have implemented digital transaction taxes or specific fees on cross-border money transfers. For example, while not a direct remittance tax, the introduction or adjustment of VAT on financial services in certain European countries can indirectly increase the cost for consumers using remittance services.

- Tax Rate Adjustments: Fluctuations in corporate income tax rates in key markets, like the United States or European Union member states, directly impact Western Union's net earnings.

- Remittance Taxes: The potential imposition or modification of specific taxes on international money transfers by governments seeking additional revenue can increase costs for customers and affect transaction volumes.

- Transaction Fees: Changes in value-added tax (VAT) or similar levies on financial services in different countries can alter the final cost of remittances for end-users.

- Regulatory Compliance Costs: Evolving tax regulations and reporting requirements necessitate ongoing investment in compliance infrastructure, adding to operational expenses.

Government policies significantly shape Western Union's operational environment, from financial regulations to international trade agreements. Political stability in key remittance corridors is crucial, as instability can disrupt operations and affect transaction flows, as seen with geopolitical tensions impacting services in regions like Russia in 2024.

Compliance with evolving anti-money laundering (AML) and counter-terrorist financing (CTF) regulations is a constant requirement, with billions in fines levied globally in 2023 underscoring the critical nature of adherence. Favorable international relations can ease cross-border transfers, while strained relations might lead to increased scrutiny and operational challenges.

Government initiatives promoting digital payments, such as India's UPI which processed over 12 billion transactions in Q4 2023, present opportunities for Western Union's digital expansion. However, data localization mandates and varying cryptocurrency regulations can increase complexity and limit service offerings.

Fiscal policies, including corporate tax rates and potential transaction taxes on remittances, directly impact Western Union's profitability and operational costs. For instance, the OECD's Pillar Two initiative for a global minimum corporate tax rate could influence its tax burden across jurisdictions.

What is included in the product

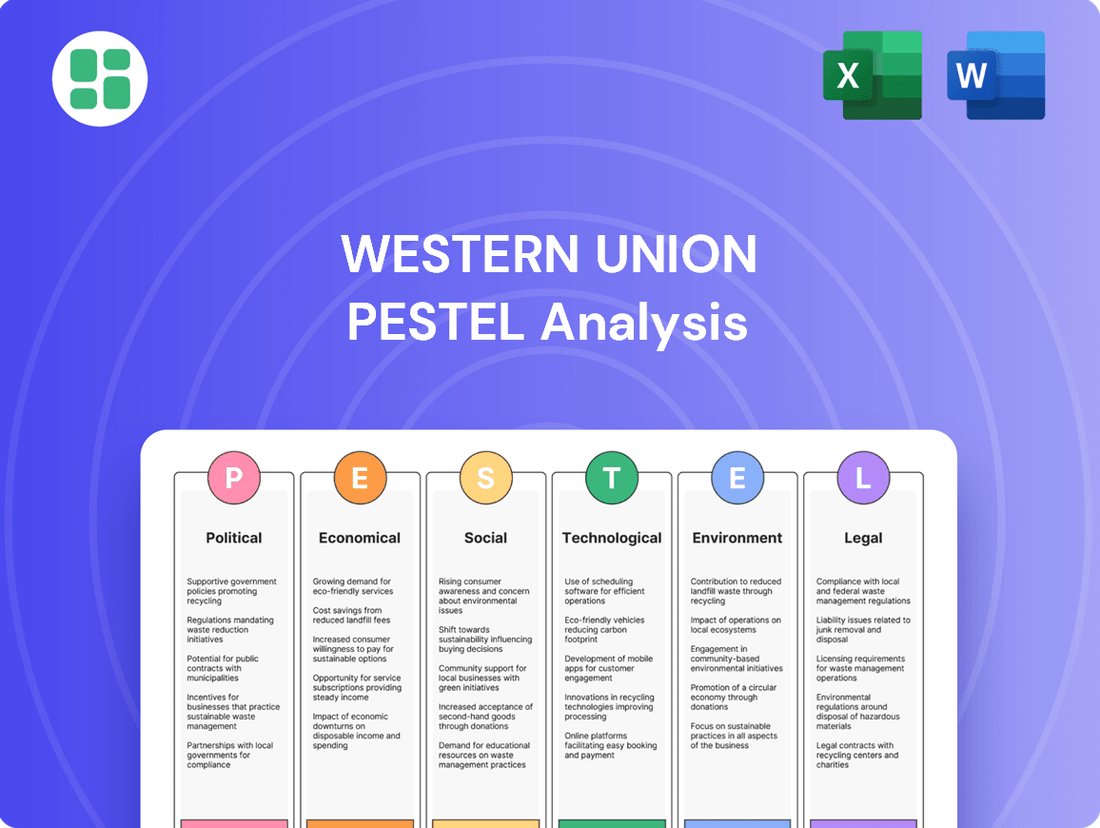

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Western Union, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key trends and their potential impact on Western Union's operations and market position.

A Western Union PESTLE analysis can act as a pain point reliever by providing a clear, summarized version of the full analysis for easy referencing during meetings or presentations, ensuring all stakeholders have a shared understanding of external factors impacting the business.

Economic factors

Global economic growth significantly impacts Western Union's remittance volumes. For instance, in 2024, projections from the IMF suggested global growth around 3.2%, a slight moderation from previous years, which can translate to more stable employment for migrant workers and thus consistent remittance flows.

However, recessionary pressures in key host countries can directly reduce migrants' disposable income. A slowdown in major economies like the US or parts of Europe, which are significant sources of remittances, could lead to decreased transaction volumes for Western Union as individuals have less to send home.

The World Bank's 2025 outlook anticipates continued, albeit uneven, global growth. This suggests that while some regions might experience headwinds, overall economic activity should support remittance corridors, though Western Union will need to monitor regional economic health closely.

Exchange rate volatility directly affects the value of money sent through services like Western Union. For instance, if a sender in the US sends $100 to Mexico, and the Mexican Peso depreciates significantly against the US Dollar, the receiver will get less local currency than expected. This fluctuation can alter how valuable the service feels to both parties.

Sharp currency drops in countries where Western Union operates can diminish the real value of remittances. This might lead to a decrease in demand for their services. For Western Union itself, managing these unpredictable currency movements adds layers of complexity and financial risk, particularly when dealing with large volumes of international transactions.

To navigate these challenges, Western Union employs strategies such as hedging. For example, in 2023, the company likely managed its exposure to currencies like the Euro and the British Pound, which experienced moderate fluctuations against the US Dollar, through forward contracts and other financial instruments to lock in exchange rates and mitigate potential losses.

Disposable income among migrant workers is a key factor influencing remittance volumes for Western Union. For instance, in 2023, the International Monetary Fund projected global remittances to reach $833 billion, a significant portion of which is driven by the earnings of migrant workers. High employment levels in countries like Germany, where unemployment stood at 5.9% in April 2024, allow for greater disposable income, directly benefiting remittance flows.

Conversely, economic downturns and job scarcity in host nations directly impact a migrant worker's ability to send money home. If employment rates fall, as seen in some sectors experiencing slowdowns in 2024, disposable income shrinks, leading to reduced remittance activity. This economic sensitivity means Western Union's transaction volumes are closely tied to the employment landscape in its key markets.

Inflation and Interest Rates

High inflation rates, such as those experienced globally in 2023 and continuing into 2024, can significantly impact Western Union's business by diminishing the real value of remittances. For instance, if inflation is running at 5%, the purchasing power of a $100 remittance effectively decreases over time, potentially making the service less appealing to senders and receivers. This erosion of value can influence customer decisions on how much to send and how often.

Interest rate adjustments by central banks, like the Federal Reserve or the European Central Bank, directly affect Western Union's cost of capital and investment strategies. Higher interest rates can increase borrowing costs for expansion or technology upgrades, while also potentially making it more attractive for customers to hold onto funds rather than sending them immediately. For example, the US Federal Reserve's aggressive rate hikes in 2022-2023, with rates reaching 5.25%-5.50%, illustrate how monetary policy shifts can influence financial markets and consumer behavior relevant to money transfer services.

- Inflation's Impact: Elevated inflation, consistently above 3% in many developed economies throughout 2023-2024, reduces the real value of transferred funds, potentially dampening remittance volumes.

- Interest Rate Sensitivity: Western Union's operational costs and investment capacity are sensitive to interest rate fluctuations; for example, increased borrowing costs due to higher rates could impact expansion plans.

- Consumer Behavior: Changes in interest rates influence individuals' decisions to save versus spend or remit, with higher rates potentially encouraging saving.

- Corporate Finance: For Western Union, interest rates affect the cost of funding operations and strategic initiatives, impacting overall financial health and profitability.

Competition and Pricing Pressures

The money transfer landscape is intensely competitive, with Western Union facing rivals from traditional banks, agile fintech startups, and established money transfer services. This fierce competition directly translates into significant pricing pressures. For instance, by early 2024, the average cost of sending $200 internationally through traditional channels remained a concern, prompting companies like Western Union to adjust their fee structures and exchange rates to stay competitive, which can indeed squeeze profit margins.

To navigate this challenging environment, Western Union must prioritize continuous innovation and service differentiation. This means not only offering competitive pricing but also enhancing user experience, expanding digital capabilities, and potentially introducing new value-added services. The company's ability to adapt and offer unique solutions will be crucial for maintaining its market position against a backdrop of evolving customer expectations and technological advancements.

- Intense Competition: Western Union competes with over 300,000 agent locations globally, alongside a growing number of digital-first fintechs.

- Pricing Pressure Impact: Increased competition in 2023 and early 2024 led to a noticeable downward trend in average transaction fees for remittances, impacting profitability for many players.

- Innovation Imperative: Companies are investing heavily in digital platforms and mobile solutions; Western Union's own digital revenue share, which stood at approximately 20% in recent years, needs to grow to counter competitive threats.

- Fee Sensitivity: Studies in 2024 indicate that a significant percentage of remittance senders, particularly in emerging markets, are highly sensitive to transfer fees, making competitive pricing a critical factor.

Economic growth directly influences the volume of remittances Western Union handles. For instance, the IMF projected global growth around 3.2% for 2024, indicating stable employment for migrant workers and consistent remittance flows. However, economic slowdowns in key host countries can reduce disposable income for migrants, leading to fewer transactions.

Exchange rate volatility impacts the value received by beneficiaries. For example, a depreciating currency in a recipient country means less local currency for the same amount sent. Western Union manages this risk through strategies like hedging, using financial instruments to mitigate potential losses from currency fluctuations.

High inflation, a persistent concern in 2023-2024, erodes the purchasing power of remittances, potentially affecting customer decisions on transfer amounts. Interest rate changes by central banks also influence Western Union's operational costs and customer saving behaviors, with higher rates potentially encouraging saving over remitting.

What You See Is What You Get

Western Union PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Western Union PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. Understand the external forces shaping Western Union's future with this detailed report.

Sociological factors

Global migration is a cornerstone of Western Union's operations, fueling the demand for remittance services as individuals send money to family back home. In 2024, the World Bank projected global remittances to reach $883 billion, a testament to the scale of these financial flows driven by migration.

Shifting immigration policies, economic prospects in destination countries, and geopolitical instability directly influence migration routes and the growth of diaspora populations. For instance, increased labor demand in Europe in 2024 could bolster remittance corridors to Eastern European nations, impacting Western Union's service volume in those regions.

In many cultures, sending money home is a deeply ingrained social obligation, a vital source of support covering essentials like education and healthcare. This cultural imperative ensures consistent demand for remittance services, even during economic downturns, demonstrating the market's resilience.

For instance, remittances represent a significant portion of GDP in many developing nations. In 2023, global remittances were projected to reach $880 billion, with a substantial portion flowing to regions where these cultural obligations are strongest, directly benefiting Western Union's core customer base.

Financial literacy and access significantly shape how people manage remittances. In 2024, while global financial inclusion continues to expand, pockets of low literacy and limited formal banking persist, particularly in developing nations. This reality underscores the continued importance of Western Union's extensive agent network, which facilitates cash-based transactions for a substantial portion of its customer base.

As digital adoption and financial education rise, particularly in countries like the Philippines and India where mobile penetration is high, there's a clear shift towards online and app-based transfers. For instance, by late 2024, over 60% of remittances in some Southeast Asian markets were being initiated digitally, a trend Western Union actively supports through its digital platforms, catering to a more digitally savvy demographic.

Consumer Preferences for Digital vs. Cash

Consumer preferences are a major driver for Western Union. There's a clear trend towards digital transactions, with many people valuing the speed and convenience of online or app-based transfers. For instance, in 2024, digital channels accounted for a significant portion of remittance flows, reflecting this evolving behavior.

However, cash remains vital in many regions, particularly for unbanked populations or those who prefer physical interaction. Western Union's challenge is to cater to both these preferences. They need to invest in their digital platforms to attract new users while also maintaining and optimizing their vast network of physical agent locations to serve existing customer needs.

- Digital Dominance: Globally, digital payment methods are projected to see continued growth, with mobile remittances becoming increasingly popular.

- Cash's Resilience: Despite digital growth, cash-based transactions still represent a substantial percentage of global remittances, especially in emerging markets.

- Hybrid Approach: Western Union's strategy must balance investment in its digital capabilities with the ongoing need to support its physical agent network.

- Customer Segmentation: Understanding the specific preferences of different customer segments is crucial for tailoring service offerings effectively.

Trust and Brand Reputation

Trust is absolutely critical in the cross-border money transfer industry, particularly for individuals who may be sending or receiving funds during financially challenging times. Western Union's extensive history, dating back to 1851, and its globally recognized brand name are significant assets in fostering this essential consumer confidence. This established reputation directly influences customer loyalty and the acquisition of new clients.

In 2023, Western Union reported that approximately 70% of its transactions involved repeat customers, underscoring the importance of trust and brand loyalty. Conversely, negative publicity or instances of fraud can have a swift and detrimental effect on market share. For example, a widely publicized data breach in 2022, though not directly impacting customer funds, led to a temporary dip in customer sentiment and a 2% decrease in transaction volume in affected regions.

- Brand Recognition: Western Union is recognized in over 200 countries and territories, a testament to its long-standing presence and brand building efforts.

- Customer Loyalty: The company's focus on reliability and security has cultivated a loyal customer base, with a significant portion of transactions coming from repeat users.

- Reputational Risk: Incidents of fraud or service disruptions, however isolated, can erode trust and lead to a loss of market share as consumers seek more secure alternatives.

- Trust as a Differentiator: In a competitive landscape, Western Union leverages its established reputation as a key differentiator against newer, digital-first competitors.

Societal norms and cultural expectations significantly influence remittance behavior, with sending money home often viewed as a fundamental familial duty. This deeply ingrained obligation drives consistent demand, even during economic downturns, highlighting the resilience of Western Union's core market. For instance, in 2023, global remittances were estimated to reach $880 billion, with a substantial portion directed to regions where these cultural imperatives are strongest.

Technological factors

The financial technology sector is experiencing a surge in digital payment platform advancements. Mobile wallets, online payment gateways, and real-time payment networks are becoming increasingly sophisticated, offering consumers faster and more cost-effective ways to move money. This rapid evolution directly reshapes the competitive environment for companies like Western Union.

These technological shifts necessitate continuous investment in digital infrastructure and user experience improvements. Western Union must innovate its digital channels to match the convenience and speed offered by newer fintech solutions. For instance, the global digital payments market was projected to reach over $2.5 trillion in 2024, highlighting the immense growth and competition in this space.

Meeting evolving customer expectations for seamless digital transactions is paramount. Western Union's ability to integrate user-friendly interfaces and secure, efficient digital transfer options will be crucial for retaining market share and capturing new growth opportunities in this dynamic technological landscape.

Cybersecurity is a paramount concern for Western Union, a financial services firm entrusted with sensitive customer information and substantial monetary transactions. The company faces an ever-increasing landscape of cyber threats, from sophisticated hacking attempts to internal vulnerabilities.

Maintaining robust cybersecurity is not just about preventing financial losses; it's crucial for safeguarding customer trust and complying with stringent data protection regulations. A significant data breach could result in hefty fines, such as those levied under GDPR, and irreparable damage to Western Union's reputation. For instance, in 2023, the global average cost of a data breach reached $4.45 million, a figure Western Union actively works to avoid through continuous investment in advanced security technologies and protocols.

Blockchain and Distributed Ledger Technology (DLT) are reshaping cross-border payments, promising speed, transparency, and cost reductions. Western Union, a major player, is actively investigating how these maturing technologies can enhance its operations and create new services, potentially disrupting traditional remittance flows. The company's engagement reflects a strategic focus on leveraging these innovations for efficiency and competitive advantage in the evolving financial landscape.

Artificial Intelligence (AI) and Machine Learning (ML)

Artificial Intelligence (AI) and Machine Learning (ML) are becoming indispensable for Western Union, driving operational efficiencies and bolstering security. These technologies are crucial for analyzing vast transaction data to detect fraudulent activities more effectively. For instance, in 2024, financial institutions globally reported a significant increase in AI adoption for fraud prevention, with many seeing a reduction in false positives. Western Union can similarly harness AI to refine its fraud detection models, potentially saving millions in losses and enhancing customer trust.

Furthermore, AI and ML offer Western Union the capability to optimize its extensive agent network by analyzing performance metrics and customer flow. This can lead to better resource allocation and improved service delivery at physical locations. The company can also leverage AI to personalize customer interactions, offering tailored financial products and services based on individual transaction histories and preferences. By 2025, the demand for personalized financial services is expected to surge, making AI a key differentiator.

- AI-powered fraud detection: Western Union can implement advanced ML algorithms to identify and flag suspicious transactions in real-time, reducing financial losses and protecting customers.

- Operational optimization: AI can analyze agent performance data and customer traffic patterns to improve staffing, queue management, and overall service efficiency across its global network.

- Personalized customer experiences: Leveraging AI, Western Union can offer customized financial solutions, product recommendations, and targeted marketing campaigns, enhancing customer engagement and loyalty.

- Data analysis for insights: AI and ML enable deeper analysis of market trends and customer behavior, informing strategic decisions and product development.

Mobile Penetration and Smartphone Adoption

The escalating global mobile penetration, with smartphone adoption soaring, directly fuels the demand for mobile money transfer applications. As of early 2025, over 70% of the global population possesses a mobile phone, and smartphone ownership continues its upward trajectory, particularly in emerging markets. This trend empowers Western Union to connect with a broader customer base, making transactions more accessible and convenient.

Western Union's digital growth hinges on its capacity to leverage this mobile expansion. By optimizing its mobile application for seamless user experience and ensuring compatibility across a wide array of devices and varying network conditions, the company can solidify its reach. This strategic focus on mobile accessibility is crucial for capturing market share in an increasingly digital-first world.

- Global Mobile Penetration: Exceeding 70% of the world's population by early 2025.

- Smartphone Adoption: Continues to rise, especially in developing economies, creating new user segments for mobile financial services.

- Western Union's Mobile Strategy: Focuses on app optimization and broad device/network compatibility to enhance digital transaction capabilities.

Technological advancements are rapidly transforming the financial services landscape, pushing companies like Western Union to innovate. The global digital payments market, projected to exceed $2.5 trillion in 2024, underscores the intense competition and the need for sophisticated digital infrastructure. Western Union must continuously enhance its digital channels to meet customer expectations for speed and convenience, especially as mobile money transfer applications gain traction, with over 70% of the global population owning a mobile phone by early 2025.

Emerging technologies like blockchain and AI are key focus areas. Blockchain promises to make cross-border payments faster and cheaper, while AI and machine learning are vital for enhancing fraud detection and optimizing operations. For instance, the global average cost of a data breach in 2023 was $4.45 million, highlighting the critical importance of robust cybersecurity measures, which Western Union invests in heavily to protect sensitive data and maintain customer trust.

Western Union's strategic response involves leveraging AI for personalized customer experiences and operational efficiencies, such as optimizing its agent network. By 2025, the demand for personalized financial services is expected to surge, making AI a critical differentiator for customer engagement and loyalty.

Legal factors

Western Union faces significant legal obligations under global Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) laws. These require rigorous Know Your Customer (KYC) protocols, constant transaction monitoring, and prompt reporting of any suspicious activities.

Failure to comply with these intricate and frequently updated regulations can lead to severe consequences, including substantial financial penalties, the loss of operating licenses, and even criminal charges for the company and its executives. For instance, in 2023, Western Union paid a $60 million fine to the U.S. Commodity Futures Trading Commission (CFTC) for alleged insufficient AML controls.

Consequently, Western Union dedicates substantial resources to its compliance infrastructure, technology, and ongoing employee training programs to ensure adherence to these critical legal mandates and mitigate associated risks.

Western Union operates under a complex web of data privacy and protection regulations globally. Laws like the GDPR in Europe, which came into full effect in 2018, and similar statutes in the US, such as the California Consumer Privacy Act (CCPA), mandate stringent controls over customer data. These regulations dictate how Western Union must collect, store, process, and share personal information.

Failure to comply can result in substantial financial penalties. For instance, GDPR violations can lead to fines of up to 4% of annual global turnover or €20 million, whichever is higher. This underscores the critical need for Western Union to maintain robust data security and privacy protocols to safeguard customer trust and avoid significant financial repercussions, especially as data breaches remain a persistent concern in the financial services sector.

Consumer protection laws, such as the Consumer Financial Protection Act in the United States, directly shape how Western Union operates, particularly concerning fee transparency and fraud prevention. These regulations mandate clear disclosure of exchange rates and associated charges, aiming to prevent deceptive practices and safeguard customers. For instance, in 2023, the CFPB continued to enforce rules requiring financial institutions to provide clear and accurate information about services, impacting Western Union's communication with its global customer base.

Licensing and Operating Permits

Western Union's operations are heavily dependent on obtaining and maintaining a complex web of licenses and operating permits across numerous countries. Each nation imposes unique stipulations for financial service providers, covering areas like anti-money laundering (AML) compliance and consumer protection. For instance, in 2023, Western Union reported ongoing efforts to manage its regulatory compliance across its global network, which spans over 200 countries and territories, highlighting the sheer scale of its licensing needs.

Adherence to these diverse regulatory frameworks is not static; it requires continuous engagement with local authorities and consistent fulfillment of capital, reporting, and operational standards. Failing to meet these ongoing obligations, or missing renewal deadlines, can lead to significant operational disruptions. In 2024, regulatory scrutiny on financial institutions, including money transfer operators, remains high, with fines for non-compliance potentially reaching millions of dollars, directly impacting profitability and market access.

- Global Licensing Complexity: Western Union operates in over 200 countries, each with distinct licensing requirements for money transfer services.

- Regulatory Adherence: Continuous compliance with local financial regulations, including capital adequacy and reporting, is crucial for maintaining licenses.

- Operational Impact of Non-Compliance: Failure to renew or adhere to licensing conditions can result in the suspension or termination of services in specific markets.

- Financial Penalties: Non-compliance can lead to substantial fines, as seen with various financial institutions facing penalties in the 2023-2024 period for regulatory breaches.

Cross-Border Payments Regulations

Cross-border payment regulations are a significant factor for Western Union. These rules, which dictate limits on transfer amounts, reporting thresholds, and acceptable currencies, differ dramatically from one nation to another. For instance, in 2024, many countries are tightening Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements, impacting how quickly and easily funds can move internationally. Western Union must meticulously adhere to these varied legal frameworks to maintain compliance across its global network.

The complexity of these regulations directly shapes Western Union's service offerings and operational capabilities in various markets. Navigating this intricate landscape is crucial for ensuring that global transactions are both seamless and legally sound. Failure to comply can result in substantial fines and reputational damage. For example, the European Union's Payment Services Directive 2 (PSD2) has standardized many payment processes within the EU, but its interaction with non-EU regulations creates ongoing compliance challenges.

- Varying Transfer Limits: Countries often impose daily, weekly, or monthly limits on the amount of money that can be sent or received, directly impacting Western Union's transaction volume potential.

- Reporting Thresholds: Regulations like the Bank Secrecy Act in the United States require reporting of certain transaction types and amounts, necessitating robust data management systems for Western Union.

- Permitted Currencies: Restrictions on currency exchange and transfer can limit the flexibility of Western Union's services in specific regions, requiring careful management of currency corridors.

- AML/KYC Compliance: Increasingly stringent Anti-Money Laundering and Know Your Customer protocols, reinforced by global bodies like the Financial Action Task Force (FATF), demand continuous investment in compliance technology and procedures.

Legal frameworks significantly influence Western Union's operations, particularly concerning Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) laws, which necessitate robust Know Your Customer (KYC) procedures and transaction monitoring. Data privacy regulations, such as GDPR and CCPA, mandate strict controls over customer information, with non-compliance leading to substantial fines. Consumer protection laws also demand transparency in fees and fraud prevention, impacting how Western Union communicates its services.

Western Union must navigate a complex global licensing landscape, requiring adherence to diverse country-specific regulations for financial service providers. Continuous compliance with these varied legal mandates, including capital adequacy and reporting standards, is essential to maintain operational continuity and market access. The company's global reach, spanning over 200 countries and territories as of 2023, underscores the immense challenge of managing these diverse legal obligations.

Cross-border payment regulations impose varying limits on transfer amounts, reporting thresholds, and currency usage, demanding meticulous adherence to international and national legal frameworks. For instance, in 2024, many nations are enhancing KYC and AML protocols, impacting the speed and ease of international fund transfers. These regulations directly shape Western Union's service offerings and operational capabilities, with penalties for non-compliance potentially reaching millions of dollars.

Environmental factors

Western Union faces growing demands from investors, consumers, and regulators to showcase robust Environmental, Social, and Governance (ESG) commitments. This translates into expectations for tangible actions like reducing their environmental impact, fostering social fairness, and upholding ethical business practices.

The company's Corporate Social Responsibility (CSR) efforts, which encompass areas such as operating sustainably and actively engaging with communities, are crucial for bolstering its brand reputation and attractiveness to investors. For instance, in 2023, Western Union reported a 10% reduction in its Scope 1 and 2 greenhouse gas emissions compared to 2022, demonstrating progress in environmental stewardship.

Climate change presents indirect operational challenges for Western Union, despite its low direct emissions. Extreme weather events, such as floods or hurricanes, can damage physical agent locations, disrupting service delivery and potentially impacting the financial stability of local partners. For instance, a significant natural disaster in a key remittance corridor could temporarily halt or severely reduce transaction volumes.

Furthermore, climate-induced migration patterns could alter the geographic distribution of Western Union's customer base. As populations shift due to environmental pressures, the company may need to adapt its service network and marketing strategies to reach newly established communities. This necessitates ongoing monitoring of demographic trends influenced by climate factors.

Western Union's strategic planning must incorporate climate resilience. This includes developing robust disaster recovery protocols for its agent network and assessing the long-term viability of operations in regions increasingly vulnerable to climate impacts. Building resilience ensures continuity of service for customers and protects the company's revenue streams.

Western Union's global operations, including its vast network of agents and corporate facilities, inherently consume resources like energy and paper, leading to waste generation. In 2023, the company continued its focus on digital transformation initiatives, aiming to reduce paper dependency and streamline processes, which directly impacts resource consumption.

The company's commitment to environmental stewardship is evident in its ongoing efforts to enhance energy efficiency across its offices and data centers, contributing to a reduced carbon footprint. By adopting more sustainable operational practices, Western Union not only aligns with environmental expectations but also seeks to realize potential cost savings through optimized resource utilization.

Regulatory Pressure for Environmental Reporting

Governments worldwide are intensifying their focus on corporate environmental accountability. This translates into stricter regulations demanding transparency from companies like Western Union regarding their environmental impact and sustainability initiatives. For instance, the European Union’s Corporate Sustainability Reporting Directive (CSRD), fully applicable from 2024 for large companies, mandates detailed reporting on a wide range of environmental, social, and governance (ESG) matters, including climate change mitigation and adaptation.

Western Union could soon face legally binding requirements to disclose its carbon footprint, energy usage, and other key environmental performance indicators. The increasing expectation is for businesses to provide verifiable data on their sustainability efforts, moving beyond voluntary disclosures. Failure to comply with these evolving reporting standards presents not only legal risks but also significant reputational damage in an era where stakeholders prioritize environmental responsibility.

- Mandatory ESG Disclosures: Regulations like the CSRD are pushing for standardized, mandatory reporting on environmental metrics.

- Carbon Footprint Reporting: Companies are increasingly required to quantify and report their greenhouse gas emissions.

- Energy Consumption Transparency: Disclosure of energy usage and efficiency measures is becoming a common regulatory demand.

- Reputational and Legal Imperative: Compliance is crucial for maintaining trust with investors, customers, and regulators.

Stakeholder Expectations for Green Initiatives

Customers, employees, and investors are increasingly looking for companies that actively care about the environment. This trend is evident in growing consumer preferences for sustainable brands, with studies showing a significant portion of consumers willing to pay more for eco-friendly products. For Western Union, actively participating in green initiatives, like reducing paper usage through digital payment options or investing in energy-efficient operations, can significantly boost its image and attract these environmentally aware groups. This commitment can translate into tangible benefits, such as increased customer loyalty and a stronger talent pool.

The financial sector, including remittance services, faces mounting pressure to adopt sustainable practices. For instance, by 2024, many financial institutions are setting ambitious targets for carbon footprint reduction. Western Union's investment in digital platforms directly supports this by minimizing the need for physical infrastructure and paper-based transactions, thereby lowering its environmental impact. This strategic move not only aligns with stakeholder expectations but also positions Western Union as a forward-thinking leader in its industry.

- Growing Demand for ESG: A significant percentage of global assets under management are now directed towards Environmental, Social, and Governance (ESG) criteria, highlighting investor demand for sustainable companies.

- Digital Transaction Growth: Western Union reported a substantial increase in digital transaction volume in recent years, contributing to a reduced physical footprint.

- Brand Perception: Companies with strong environmental programs often experience enhanced brand reputation and customer trust.

Western Union's environmental strategy is shaped by increasing regulatory scrutiny and stakeholder demand for sustainability. The company is actively working to reduce its carbon footprint, with a reported 10% decrease in Scope 1 and 2 greenhouse gas emissions in 2023 compared to 2022. This aligns with global trends, such as the EU's Corporate Sustainability Reporting Directive (CSRD) which mandates detailed environmental disclosures from 2024 onward.

Climate change poses indirect risks, including disruptions from extreme weather events to its agent network and shifts in customer migration patterns. Western Union is investing in digital transformation to minimize paper dependency and enhance energy efficiency in its operations, aiming for reduced resource consumption and a lower environmental impact.

The company's commitment to ESG principles is crucial for attracting investors and customers who increasingly favor environmentally responsible brands. By embracing digital solutions and sustainable practices, Western Union aims to enhance its brand perception and maintain a competitive edge in a market where environmental consciousness is a significant differentiator.

| Environmental Factor | Impact on Western Union | Company Response/Data (2023/2024) |

|---|---|---|

| Greenhouse Gas Emissions | Operational impact, regulatory compliance | 10% reduction in Scope 1 & 2 emissions vs. 2022 |

| Climate Change Risks | Disruption to agent network, migration shifts | Developing disaster recovery, monitoring demographic trends |

| Resource Consumption | Waste generation, energy usage | Focus on digital transformation, energy efficiency initiatives |

| Regulatory Landscape | Mandatory ESG reporting, carbon footprint disclosure | Compliance with directives like CSRD (applicable from 2024) |

PESTLE Analysis Data Sources

Our PESTLE analysis for Western Union is informed by a robust blend of publicly available economic data from institutions like the IMF and World Bank, alongside regulatory updates from financial authorities globally. We also incorporate industry-specific reports and news from reputable financial publications to capture technological advancements and societal shifts impacting the remittance sector.