Western Union Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Western Union Bundle

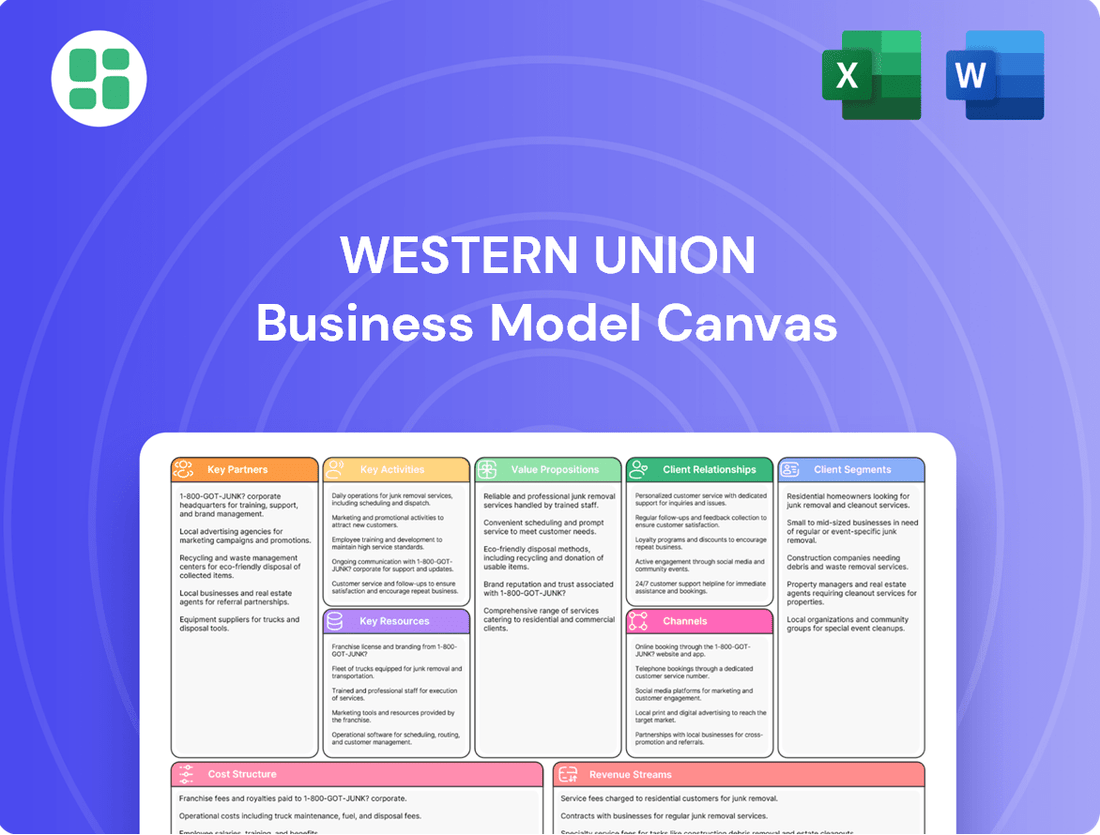

Unlock the strategic blueprint behind Western Union's global operations. This comprehensive Business Model Canvas reveals how they connect people and businesses worldwide through innovative financial services. Discover their customer segments, value propositions, and revenue streams.

Dive into the intricacies of Western Union's success with our complete Business Model Canvas. This professionally crafted document details their key partnerships, cost structure, and competitive advantages, offering invaluable insights for your own business strategy.

Ready to understand how Western Union dominates the money transfer market? Download the full Business Model Canvas to explore their core activities, channels, and customer relationships. It's the perfect tool for market analysis and strategic planning.

Partnerships

Western Union's global agent network is a cornerstone of its business, featuring hundreds of thousands of retail locations like convenience stores, post offices, and pharmacies in over 200 countries and territories. These partnerships are vital for enabling cash transactions and reaching customers in areas with less developed banking systems.

This extensive network of physical locations is a significant competitive advantage, allowing Western Union to facilitate billions of dollars in transactions annually. In 2024, the company continued to leverage these relationships to maintain its broad accessibility for remittances and payments.

Western Union's collaborations with financial institutions and banks are crucial for its business model, enabling direct bank account transfers and payouts. These partnerships significantly extend Western Union's digital reach, allowing for seamless integration into the global financial ecosystem and offering customers a wider array of receiving options.

As of late 2024, Western Union actively collaborates with thousands of financial institutions worldwide, facilitating millions of cross-border transactions. This extensive network ensures that funds can be reliably and efficiently delivered directly to bank accounts in numerous countries, a key component of their value proposition.

Western Union actively partners with digital platform providers and technology firms to bolster its online and mobile service offerings. These collaborations are crucial for integrating new payment methods and improving user experience, reflecting a commitment to digital innovation.

For instance, leveraging cloud infrastructure from providers like Amazon Web Services (AWS) enables Western Union to scale its operations efficiently and securely. In 2023, Western Union continued to invest in its digital channels, with digital transactions representing a significant portion of its overall revenue, underscoring the importance of these tech partnerships in driving growth and maintaining a competitive edge in the evolving financial landscape.

Mobile Network Operators

Western Union's engagement with mobile network operators is crucial for integrating mobile wallets, especially in markets where mobile money is a primary financial tool. These collaborations are vital for broadening digital payout capabilities and reaching an expanding customer base that prefers mobile transactions. For instance, in 2023, mobile money transactions globally saw significant growth, with Africa leading the charge, indicating a strong market for such integrations.

These partnerships allow Western Union to tap into the vast user bases of mobile operators, offering convenient and accessible ways for customers to receive remittances directly to their mobile accounts. By leveraging these networks, Western Union can bypass traditional banking infrastructure in many regions, making cross-border payments more efficient. The company has actively pursued these alliances across key growth markets.

Western Union has strategically built a robust network of mobile operator partnerships, particularly across Africa and Asia Pacific. These regions represent high potential for digital remittances due to widespread mobile phone penetration and the increasing adoption of mobile money services. For example, in 2024, it's estimated that over 70% of the adult population in many sub-Saharan African countries has access to a mobile money account, underscoring the importance of these partnerships.

Key benefits of these collaborations include:

- Expanded Reach: Access to millions of mobile wallet users, enhancing customer acquisition.

- Digital Innovation: Facilitates seamless integration of digital payout options, aligning with evolving consumer preferences.

- Cost Efficiency: Potentially reduces transaction costs by utilizing existing mobile infrastructure.

- Market Penetration: Enables deeper penetration into emerging markets where mobile money is dominant.

Compliance and Regulatory Bodies

Western Union's key partnerships with compliance and regulatory bodies are foundational for its global operations. These collaborations are essential for navigating the complex web of anti-money laundering (AML) and financial crime prevention regulations across numerous jurisdictions. While not directly contributing to revenue, these relationships are critical for maintaining operational licenses and the company's reputation for trust and security.

The company actively engages with a vast array of regulatory agencies worldwide. For instance, in 2024, Western Union continued its dialogue with bodies like FinCEN in the United States and the Financial Conduct Authority (FCA) in the United Kingdom, among many others. These interactions ensure ongoing adherence to evolving financial regulations, which is paramount for uninterrupted service delivery.

- Regulatory Adherence: Partnerships ensure compliance with AML and Know Your Customer (KYC) regulations globally, crucial for preventing illicit financial activities.

- Operational Licensing: Maintaining positive relationships with regulators is vital for securing and retaining the necessary licenses to operate in different countries.

- Trust and Reputation: Collaboration fosters trust among consumers and financial institutions, reinforcing Western Union's image as a secure and reliable money transfer service.

- Global Engagement: Western Union works with hundreds of regulatory bodies, demonstrating a commitment to meeting diverse international compliance standards.

Western Union's strategic alliances with financial institutions are paramount, facilitating seamless bank-to-bank transfers and expanding its digital payment ecosystem. These collaborations, involving thousands of banks globally as of 2024, enable direct account deposits and withdrawals, significantly enhancing customer convenience and transaction speed.

The company also relies on partnerships with technology providers to innovate its digital platforms, ensuring secure and efficient online and mobile money transfer services. These tech collaborations are crucial for integrating new payment technologies and improving user experience, a key focus for Western Union in the evolving digital landscape.

Furthermore, collaborations with mobile network operators, particularly in emerging markets, are vital for leveraging mobile money services. These partnerships grant access to millions of mobile wallet users, allowing for direct payouts and broadening Western Union's reach in regions with high mobile penetration.

Western Union’s extensive network of over 500,000 agent locations worldwide, including retailers and post offices, remains a critical component of its business model. These physical touchpoints are essential for serving customers who prefer cash transactions or lack access to digital banking services.

| Partnership Type | Key Function | Reach/Impact (as of 2024) | Strategic Importance |

| Financial Institutions | Bank transfers, account payouts | Thousands of banks globally, millions of transactions | Extends digital reach, enhances convenience |

| Technology Providers | Platform innovation, digital services | Cloud services, payment gateway integration | Drives digital transformation, improves user experience |

| Mobile Network Operators | Mobile money integration, digital payouts | Millions of mobile wallet users in key markets | Expands access in emerging economies |

| Retail Agent Network | Cash-in/cash-out, accessibility | 500,000+ locations in 200+ countries | Serves unbanked populations, offers physical convenience |

What is included in the product

A detailed Western Union Business Model Canvas outlining key customer segments like migrant workers and small businesses, their value propositions of fast, reliable global money transfers, and the extensive agent network and digital platforms used as channels.

This canvas highlights Western Union's revenue streams from fees and foreign exchange margins, its key resources including its brand and technology, and its cost structure dominated by transaction processing and compliance.

Western Union's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their complex global money transfer operations, simplifying understanding for stakeholders.

This allows for quicker identification of key customer segments and value propositions, streamlining strategic discussions and problem-solving.

Activities

Money transfer processing is the heart of Western Union's operations, focusing on the secure and efficient movement of funds both across borders and within countries. This core activity encompasses managing transactions initiated at their vast network of agent locations, as well as through their increasingly important digital platforms, including their website and mobile application.

The emphasis is on delivering speed, unwavering reliability, and absolute accuracy for every transaction. In 2024, Western Union continued to process billions of dollars in transactions, with their digital channels showing significant growth, reflecting a strategic shift towards online and mobile services to meet evolving customer needs.

Western Union's core activities revolve around maintaining and growing its vast global network. This includes managing relationships with thousands of agent locations worldwide and continuously enhancing its digital platforms.

A significant effort is placed on onboarding new partners and launching innovative digital services across different regions. This ensures the network remains robust and accessible to a wider customer base.

The company's strategic plan, Evolve 2025, directly addresses this by aiming to stabilize and expand its retail operations while rapidly growing its branded digital business. For instance, in the first quarter of 2024, Western Union reported a 10% increase in digital transaction growth, highlighting the focus on this channel.

Western Union's technology development and innovation efforts are centered on building and enhancing its digital platforms and mobile applications. This involves significant investment in the underlying technology infrastructure to maintain a competitive edge in the fast-evolving financial services landscape.

Leveraging cutting-edge technologies such as artificial intelligence, cloud computing, and blockchain is a key focus. These technologies are instrumental in streamlining operations, bolstering fraud prevention measures, and ultimately elevating the customer experience for users worldwide.

In 2024, Western Union's information and communications technology (ICT) spending was projected to exceed $100 million. This substantial investment underscores their commitment to technological advancement and innovation as a core driver of their business strategy.

Compliance and Risk Management

Western Union's key activities heavily rely on maintaining strict adherence to a complex web of global regulatory requirements. This includes robust anti-money laundering (AML) and anti-fraud measures, which are continuously updated to combat evolving threats. For instance, in 2024, financial institutions globally, including Western Union, are investing heavily in advanced analytics and AI to detect and prevent illicit financial activities, with AML compliance spending projected to reach billions worldwide.

The company actively monitors millions of transactions daily, flagging any suspicious patterns for further investigation and reporting to relevant authorities as mandated by law. This proactive approach is fundamental to safeguarding its operations and reputation. A significant portion of Western Union's operational budget in 2024 is allocated to these compliance and monitoring systems, reflecting the critical nature of these functions.

- Global Regulatory Adherence: Ensuring compliance with diverse financial regulations across all operating regions.

- AML and Anti-Fraud Measures: Implementing and constantly refining systems to prevent money laundering and fraudulent transactions.

- Transaction Monitoring: Real-time analysis of transactions to identify and report suspicious activities.

- Risk Mitigation: Developing strategies to manage financial, operational, and reputational risks associated with money transfer services.

Customer Service and Support

Western Union prioritizes customer service through a multi-channel approach. This includes direct support from their extensive agent network, offering a personal touch for transactions and inquiries. Additionally, digital helpdesks and online resources are available to assist customers with a wide range of issues, from transaction status to fee clarification, ensuring a seamless experience.

This dedication to support is crucial for building and maintaining customer loyalty. By effectively resolving issues and providing clear information, Western Union aims to foster trust and encourage repeat business. For instance, in 2024, Western Union reported a significant increase in digital customer interactions, highlighting the importance of robust online support alongside their physical agent presence.

- Agent Network Support: Providing in-person assistance at over 550,000 agent locations worldwide.

- Digital Channels: Offering support via websites, mobile apps, and chatbots for immediate query resolution.

- Issue Resolution: Addressing transaction-specific problems, fee inquiries, and service-related questions promptly.

- Customer Satisfaction: Aiming to enhance user experience and build lasting relationships through reliable support.

Western Union's key activities are centered on the efficient processing of global money transfers, both through its extensive physical agent network and its growing digital platforms. This involves managing billions of dollars in transactions annually, with a strategic focus in 2024 on expanding digital services, which saw a 10% increase in transaction growth in Q1 2024.

The company actively invests in technology, with over $100 million projected for ICT spending in 2024, to enhance its digital offerings and leverage innovations like AI and cloud computing. This technological push supports streamlined operations and improved customer experience.

Crucially, Western Union maintains rigorous adherence to global regulatory requirements, including robust AML and anti-fraud measures, with significant operational budget allocation in 2024 dedicated to these compliance systems. This ensures the integrity and security of its financial services.

Customer support is a vital activity, delivered through both its vast agent network and digital channels, aiming to resolve inquiries and build loyalty. In 2024, the increase in digital customer interactions underscored the importance of accessible online support.

| Key Activity | Description | 2024 Data/Focus |

|---|---|---|

| Money Transfer Processing | Secure and efficient movement of funds globally and domestically. | Billions of dollars processed; significant growth in digital channels. |

| Network Management & Growth | Maintaining and expanding the global agent network and digital platforms. | Onboarding partners, launching new digital services; Evolve 2025 strategy. |

| Technology Development & Innovation | Building and enhancing digital platforms and mobile applications. | ICT spending > $100 million; leveraging AI, cloud, blockchain. |

| Regulatory Adherence & Risk Mitigation | Ensuring compliance with AML, anti-fraud, and other financial regulations. | Continuous refinement of monitoring systems; proactive flagging of suspicious activities. |

| Customer Service & Support | Providing assistance through agent locations and digital channels. | Increased digital customer interactions; focus on seamless user experience. |

Full Version Awaits

Business Model Canvas

The Business Model Canvas preview you are viewing is an exact representation of the document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises and immediate usability. You can be confident that the comprehensive analysis and strategic framework presented here will be yours to edit and implement immediately after completing your transaction.

Resources

Western Union's global agent network is its cornerstone, boasting over 500,000 agent locations across more than 200 countries and territories.

This extensive physical infrastructure is crucial for facilitating cash-based money transfers, reaching customers who may lack access to traditional banking services.

The sheer scale of this network provides Western Union with a significant competitive advantage in serving diverse global markets.

Western Union's proprietary digital platform and technology are the backbone of its operations, enabling seamless money transfers through its website and mobile applications. This robust IT infrastructure, including advanced cybersecurity, is vital for handling millions of transactions securely and efficiently. In 2023, Western Union continued to prioritize digital investments, with a focus on enhancing user experience and expanding its digital payment capabilities to meet evolving customer needs.

Western Union's brand, established over 170 years, is a cornerstone of its business, fostering deep trust across its global customer base. This extensive history translates into significant brand recognition and reliability, particularly crucial for financial services where security and dependability are paramount.

In 2023, Western Union reported approximately 136 million customer transactions across its digital and retail channels, underscoring the vast reach and continued reliance on its established brand for sending and receiving money worldwide.

This strong brand equity acts as a powerful intangible asset, attracting and retaining customers who value the perceived safety and convenience associated with Western Union for critical financial needs, including remittances.

Human Capital and Expertise

Western Union's human capital is a critical asset, encompassing a diverse range of skilled professionals. This includes dedicated compliance officers ensuring adherence to global financial regulations, technology specialists driving digital innovation, and customer service representatives providing essential support. A robust global management team also guides strategic direction.

The collective expertise of these employees is fundamental to Western Union's success. Their deep understanding of financial services, navigating complex international regulations, and embracing digital advancements are what power the company's day-to-day operations and long-term strategic goals. This intellectual capital is a core differentiator.

- Skilled Workforce: Compliance officers, technology specialists, customer service, and global management.

- Expertise Areas: Financial services, international regulations, digital innovation.

- Operational Impact: Drives company operations and strategic initiatives.

- Talent Investment: Western Union's commitment to employee development is key to maintaining its competitive edge in a rapidly evolving financial landscape.

Financial Capital and Liquidity

Western Union's financial capital and liquidity are crucial for its expansive global operations. Sufficient financial resources allow the company to invest in critical technology upgrades, manage the inherent risks associated with foreign exchange fluctuations, and importantly, to return value to its shareholders. This financial backbone is essential for sustaining day-to-day business and seizing future growth avenues.

The company's ability to generate strong cash flow from operations directly underpins its capacity to maintain its worldwide network and explore new market opportunities. For instance, in the first quarter of 2024, Western Union reported a consolidated operating revenue of $1.14 billion, demonstrating its ongoing revenue generation capabilities. This financial health is a direct enabler of its strategic initiatives.

- Financial Strength: Western Union's robust financial capital allows for significant investments in digital transformation and expanding its global reach.

- Liquidity Management: Effective management of liquidity ensures the company can meet its obligations, manage currency exposures, and fund growth initiatives.

- Cash Flow Generation: Positive cash flow from operations, as seen in its consistent revenue streams, is vital for sustaining operations and shareholder returns.

- Investment Capacity: Adequate financial resources enable Western Union to invest in new technologies and services that enhance customer experience and operational efficiency.

Western Union's key resources include its vast global agent network, proprietary digital platforms, strong brand recognition, skilled workforce, and substantial financial capital. These elements collectively enable the company to facilitate secure and efficient money transfers worldwide, catering to both cash-based and digital transactions.

| Key Resource | Description | Impact/Data Point |

|---|---|---|

| Global Agent Network | Over 500,000 agent locations in 200+ countries. | Facilitates cash transfers, reaching unbanked populations. |

| Digital Platforms & Technology | Proprietary website and mobile apps, advanced cybersecurity. | Enables secure and efficient digital transactions; continued investment in 2023. |

| Brand Recognition | Over 170 years of history. | Fosters trust and reliability; 136 million transactions in 2023 across channels. |

| Skilled Workforce | Compliance officers, tech specialists, customer service, management. | Drives operations, innovation, and regulatory adherence. |

| Financial Capital & Liquidity | Sufficient resources for operations and investment. | Supports technology upgrades, risk management; $1.14 billion revenue in Q1 2024. |

Value Propositions

Western Union's global reach is truly impressive, enabling money transfers to over 200 countries and territories. This vast network is a cornerstone of their value proposition, ensuring that individuals and businesses can connect financially across borders.

The accessibility is further amplified by a hybrid approach, blending a massive network of physical agent locations with robust digital channels. This strategy makes it possible for funds to reach even remote or underserved regions, a critical factor for many users.

In 2024, Western Union continued to facilitate billions of transactions, connecting to a multitude of bank accounts, millions of digital wallets, and various card networks. This broad integration underscores their commitment to making financial services universally available.

Western Union's core value proposition centers on the speed and reliability of its money transfer services. Funds are frequently available for pickup or direct deposit within minutes, a crucial benefit for customers needing to send money urgently for family support or business transactions.

This rapid availability is underpinned by their real-time transaction processing system. In 2024, Western Union processed an average of over 250 million transactions globally, highlighting the scale and efficiency of their operations in delivering funds quickly and dependably.

Western Union offers unparalleled convenience by allowing customers to send and receive money through a variety of channels. This includes their extensive network of retail agent locations, the user-friendly Western Union website, and their dedicated mobile app.

This omnichannel strategy ensures accessibility for a broad customer base, catering to those who prefer in-person transactions as well as digital solutions. In 2024, Western Union reported that its digital services continued to grow, with a significant portion of its transactions occurring through its app and website, highlighting the importance of these channels.

Furthermore, the company provides multiple payment options to suit different customer needs, further enhancing the convenience factor. Whether it's cash, bank transfers, or card payments, Western Union aims to make the process as seamless as possible.

Trust and Security

Western Union's value proposition centers on trust and security, built over 170 years of operation. They employ robust compliance and cybersecurity measures to safeguard customer transactions. This commitment to security is crucial for customers entrusting their funds for cross-border transfers.

The company actively combats fraud and diligently adheres to evolving regulatory standards worldwide. This proactive approach ensures customers can feel confident and secure when using their services for international money movement.

- 170+ years of experience in money transfer services.

- Robust compliance and cybersecurity infrastructure to protect transactions.

- Active anti-fraud programs and adherence to global regulations.

Financial Inclusion and Essential Services

Western Union extends financial inclusion to underserved populations worldwide, including migrant workers. Beyond remittances, they offer vital services like bill payments and foreign exchange, connecting individuals to the global economy. In 2023, Western Union processed billions of dollars in cross-border transactions, demonstrating their reach.

This focus on accessible financial services fosters economic empowerment. By providing these essential tools, Western Union helps individuals and communities thrive. Their network facilitates participation in the formal financial system, opening doors to greater opportunity.

- Accessible Services: Bill payments, foreign exchange, and remittances for global populations.

- Financial Inclusion: Connecting underserved individuals, like migrant workers, to the financial system.

- Economic Empowerment: Facilitating prosperity by enabling participation in the global economy.

- Global Reach: Billions processed in cross-border transactions in 2023 highlight extensive service delivery.

Western Union's value proposition is built on providing fast, reliable, and convenient money transfers globally. In 2024, they continued to facilitate billions of transactions, connecting millions of digital wallets and card networks to their extensive service. This broad integration ensures funds reach recipients quickly, often within minutes, which is critical for urgent needs.

Their accessibility is further enhanced by a hybrid model, combining over 100,000 agent locations with a growing digital presence. This allows customers to send and receive money via their app, website, or in person, catering to diverse preferences. In 2024, digital channels saw continued growth, underscoring their commitment to user convenience.

Trust and security are paramount, with over 170 years of experience and robust cybersecurity measures in place. Western Union actively combats fraud and adheres to global regulations, ensuring customer confidence in every transaction. This dedication to safety underpins their ability to connect individuals and businesses financially across borders.

| Value Proposition Aspect | Key Features | 2024 Data/Context |

|---|---|---|

| Global Reach & Accessibility | Money transfers to 200+ countries/territories; Hybrid agent/digital network | Billions of transactions facilitated; Millions of digital wallets/card networks connected |

| Speed & Reliability | Funds often available within minutes; Real-time processing | Over 250 million transactions processed globally on average in 2024 |

| Convenience & Options | Omnichannel service (app, web, in-person); Multiple payment methods | Continued growth in digital transactions via app and website |

| Trust & Security | 170+ years of experience; Robust compliance & cybersecurity | Active anti-fraud programs and adherence to global regulations |

Customer Relationships

Agent-assisted service remains a cornerstone for Western Union, particularly for customers who prefer cash transactions or have limited digital access. These knowledgeable agents at physical locations are the primary point of contact, offering direct support and guidance.

In 2024, Western Union continued to leverage its extensive global network of agent locations, which numbered in the hundreds of thousands worldwide. This physical presence allows them to serve a significant portion of their customer base who rely on face-to-face interactions for trust and personalized assistance with their money transfers.

Western Union's digital self-service channels, including its website and mobile app, allow customers to initiate and manage money transfers entirely on their own. This empowers users with convenience and a sense of control over their transactions, a key factor for today's digitally inclined consumer. In 2024, Western Union reported a significant portion of its transactions occurring through these digital platforms, reflecting strong adoption of its self-service capabilities.

Western Union offers robust customer support through multiple channels, including phone and email, to address inquiries and resolve issues efficiently. This multi-pronged approach ensures accessibility for a wide range of customer needs, whether they require help with a specific transaction or general account assistance.

Automated Notifications and Tracking

Western Union enhances customer relationships through automated notifications and robust transaction tracking. Customers are kept informed about their money transfers via email or app alerts, offering a transparent and convenient experience that minimizes direct inquiries. This proactive approach significantly boosts customer satisfaction.

This digital engagement strategy allows users to monitor their transactions in real-time, both online and through the Western Union mobile application. This accessibility provides peace of mind and reduces the operational burden on customer support teams. For instance, in 2023, Western Union reported over 220 million consumer-to-consumer transactions, highlighting the scale at which these automated systems operate and the importance of efficient tracking for customer retention.

- Automated Updates: Proactive notifications via email and app keep customers informed at every stage of their transaction.

- Real-time Tracking: Customers can monitor their transfers 24/7 through the Western Union website or mobile app.

- Enhanced Transparency: This feature builds trust by providing clear visibility into transaction progress.

- Reduced Support Load: Automated tracking lessens the need for customers to contact support for routine status inquiries.

Loyalty Programs and Promotions

Western Union actively cultivates customer loyalty through well-structured programs and strategic promotions. These efforts are designed to foster repeat transactions and strengthen enduring customer connections.

- Loyalty Programs: Western Union's loyalty programs often reward frequent users with exclusive benefits, such as reduced fees or preferential exchange rates, incentivizing continued engagement.

- Targeted Promotions: By analyzing customer transaction data, Western Union can implement targeted promotions, offering specific discounts or bonuses on services most relevant to individual customer needs, thereby driving usage and satisfaction.

- Customer Retention: These initiatives are crucial for customer retention in a competitive market, aiming to make Western Union the preferred choice for ongoing money transfer requirements.

Western Union manages customer relationships through a blend of personal assistance at its vast agent network and sophisticated digital self-service options. This dual approach caters to diverse customer preferences, ensuring accessibility and convenience for all users. In 2024, the company continued to emphasize these channels to foster trust and encourage repeat business.

The company's digital platforms, including its mobile app and website, are central to its customer engagement strategy. These channels offer real-time transaction tracking and automated notifications, enhancing transparency and reducing the need for direct customer support. This focus on digital self-service proved effective in 2023, with a substantial portion of Western Union's over 220 million consumer-to-consumer transactions managed through these platforms.

Loyalty programs and targeted promotions are key to cultivating strong customer relationships and driving retention. By offering incentives like reduced fees and personalized discounts, Western Union aims to solidify its position as the preferred choice for ongoing money transfer needs, a strategy that remains vital in a competitive financial landscape.

| Customer Relationship Aspect | Description | Key Features | 2023/2024 Data/Impact |

| Agent-Assisted Service | Personalized support at physical locations | Direct guidance, cash transactions, digital access assistance | Hundreds of thousands of global agent locations; critical for customers preferring face-to-face interaction. |

| Digital Self-Service | Online and mobile app capabilities | Initiate/manage transfers, convenience, control | Significant portion of transactions via digital platforms; over 220 million C2C transactions in 2023. |

| Customer Support Channels | Multi-channel assistance | Phone, email, in-app support for inquiries and issue resolution | Ensures broad accessibility for diverse customer needs. |

| Automated Engagement | Proactive communication and tracking | Email/app notifications, real-time tracking | Builds trust, enhances transparency, reduces support load, boosts satisfaction. |

| Loyalty & Promotions | Programs for retention and engagement | Rewards for frequent users, targeted discounts | Incentivizes repeat transactions and strengthens customer connections. |

Channels

Retail agent locations are Western Union's most extensive and traditional sales channel. This vast network, comprising hundreds of thousands of physical locations worldwide, acts as a crucial touchpoint for customers. These locations are typically found in everyday places like convenience stores, post offices, and grocery stores, making them highly accessible.

This extensive physical presence is particularly vital for facilitating cash-based transactions, a method still prevalent in many parts of the world. In 2024, Western Union continued to rely on this channel to serve customers, especially in regions where digital banking infrastructure is less developed. The sheer volume of these locations underscores their importance in reaching a broad customer base for both sending and receiving money.

The Western Union website, westernunion.com, acts as a cornerstone for customer engagement, enabling users to initiate money transfers, monitor transaction progress, and manage their personal accounts directly. This digital portal significantly enhances convenience and accessibility for individuals with internet connectivity, supporting a range of payout methods including direct bank deposits and cash pickups.

In 2023, Western Union reported that approximately 70% of its transactions were initiated digitally, highlighting the critical role of its website and mobile app in its overall business strategy. This online channel facilitates a seamless customer journey, from setting up a transfer to receiving confirmation, thereby expanding Western Union's reach beyond its physical agent locations.

The Western Union mobile application serves as a crucial, increasingly adopted channel for users to send and receive funds conveniently from their smartphones. This platform integrates features such as digital wallet capabilities, real-time transaction monitoring, and mobile-optimized payment methods, directly addressing the needs of the expanding base of mobile-first consumers.

Western Union reported substantial growth in its branded digital transactions throughout 2024 and into the first quarter of 2025. This surge underscores the mobile app's effectiveness in capturing market share and meeting evolving customer preferences for seamless, on-the-go financial services.

Direct to Bank Account Transfers

Direct to bank account transfers represent a vital channel for Western Union, enabling funds to reach recipients globally through their existing financial institutions. This method aligns with Western Union's digital transformation, offering a seamless experience for customers and expanding its reach into the traditional banking ecosystem.

In 2024, Western Union continued to bolster its bank transfer capabilities, recognizing its growing significance. This channel is particularly important for individuals and businesses that prefer or require funds to be deposited directly into their accounts for convenience and security.

Key aspects of this channel include:

- Global Reach: Facilitates transfers to billions of bank accounts across numerous countries, connecting diverse financial systems.

- Digital Integration: Supports Western Union's digital strategy by offering a streamlined, online process for sending and receiving money directly to bank accounts.

- Customer Preference: Caters to a growing customer segment that values the direct deposit feature for its efficiency and ease of use.

- Transaction Volume: Bank account transfers constitute a significant portion of Western Union's overall transaction volume, underscoring its importance as a primary delivery channel.

Digital Wallet and Card Payouts

Western Union's digital wallet and card payout channel is a key part of its strategy to reach customers who prefer mobile and digital financial services. This allows for convenient fund delivery directly to popular digital wallets and prepaid cards, aligning with modern consumer habits. By mid-2024, Western Union reported continued growth in its digital transactions, with a significant portion of these leveraging such payout methods.

- Expanded Reach: Facilitates payouts to a wide array of digital wallets and prepaid cards globally, increasing accessibility for unbanked and underbanked populations.

- Customer Preference: Directly addresses the growing demand for digital-first financial solutions, enhancing customer experience and loyalty.

- Transaction Growth: Digital outbound transactions, including those to wallets and cards, saw a notable percentage increase in the first half of 2024 compared to the same period in 2023, reflecting strong adoption.

Western Union leverages a multi-channel approach to serve its diverse customer base. Its extensive retail agent network remains a cornerstone, particularly for cash transactions in regions with less developed digital infrastructure. The company's digital platforms, including its website and mobile app, are increasingly vital, facilitating a significant portion of transactions and catering to the growing demand for convenient, on-the-go financial services. Direct bank transfers and payouts to digital wallets and cards further broaden accessibility and align with evolving consumer preferences.

| Channel | Key Characteristics | 2024/2025 Data Points |

|---|---|---|

| Retail Agent Locations | Extensive physical presence, crucial for cash transactions, high accessibility. | Hundreds of thousands worldwide; vital for regions with less digital banking. |

| Website (westernunion.com) | Digital initiation of transfers, transaction monitoring, account management. | Approximately 70% of transactions initiated digitally (as of 2023, trend continuing). |

| Mobile Application | Smartphone-based fund sending/receiving, digital wallet features, real-time monitoring. | Substantial growth in branded digital transactions reported through Q1 2025. |

| Direct to Bank Account | Global transfers to existing financial institutions, digital integration. | Continued bolstering of capabilities; significant portion of overall transaction volume. |

| Digital Wallet/Card Payouts | Convenient delivery to digital wallets and prepaid cards, mobile-first focus. | Notable percentage increase in digital outbound transactions (H1 2024 vs. H1 2023). |

Customer Segments

Migrant workers and their families represent a crucial customer segment for Western Union. These individuals rely heavily on remittance services to support loved ones back home, making reliability and accessibility paramount. For instance, in 2024, the World Bank projected global remittances to reach $1.3 trillion, highlighting the sheer volume of this market.

This segment often prioritizes convenient cash pickup options, a service Western Union has long provided. The demand for such services remains strong, especially in regions where digital banking penetration is lower. Western Union's extensive network of agent locations, numbering over 600,000 globally, directly addresses this need.

This segment encompasses individuals sending money internationally for diverse personal needs beyond typical remittances. Think of parents supporting students studying abroad, travelers paying for services overseas, or those assisting friends and family with various financial requirements in different countries.

These customers prioritize speed in their transactions, seeking to get funds to their recipients quickly. Competitive fees are also a major consideration, as they want to ensure the most value for their money. Convenience in how they can send and receive funds, through various channels, is equally important.

In 2024, the global remittance market, which shares many characteristics with this segment, continued its robust growth. For instance, the World Bank projected that remittances to low- and middle-income countries would reach $664 billion in 2024, indicating a significant volume of cross-border personal financial flows.

Small businesses and entrepreneurs frequently need to send money internationally for supplies, to pay freelance workers, or for other operational costs. These businesses are looking for ways to move money across borders that are not only secure but also affordable and efficient, often preferring digital platforms and dedicated business payment solutions.

In 2024, the demand for streamlined international payments among small and medium-sized enterprises (SMEs) continues to grow, with many actively seeking digital tools to manage cross-border transactions. Data from a 2024 industry report indicated that over 60% of SMEs surveyed had increased their use of online payment platforms for international business in the past year, highlighting a clear trend towards digital adoption.

Consumers Utilizing Bill Payment Services

Consumers in key markets like the United States and Argentina are increasingly leveraging Western Union for convenient bill payment solutions. This segment prioritizes accessibility, opting to settle their bills through the company's extensive network of agent locations or its user-friendly digital platforms. This focus on ease of use underscores their position within the Consumer Services segment.

This customer base values the reliability and familiarity of Western Union's brand for managing essential payments. For instance, in 2024, Western Union reported facilitating billions of dollars in transactions, a significant portion of which includes consumer bill payments, highlighting the scale of this segment's engagement.

- Regional Focus: Primarily active in the US and Argentina, demonstrating a strong presence in markets with high demand for accessible payment services.

- Value Proposition: Convenience and ease of use through both physical agent locations and digital channels for bill settlement.

- Market Significance: A crucial component of Western Union's Consumer Services segment, contributing significantly to transaction volumes and revenue.

Travelers and Expatriates

Travelers and expatriates represent a key customer segment for Western Union, relying on its services for essential financial management while abroad. These individuals frequently need to exchange currency or send money to family and friends back home, making convenient and reliable foreign exchange and remittance services crucial. For instance, in 2023, global tourism saw a significant rebound, with international tourist arrivals reaching 88% of pre-pandemic levels, highlighting the ongoing need for such services.

Western Union's foreign exchange capabilities are particularly valuable to this group. Whether it's for daily expenses, accommodation, or unexpected needs, having access to competitive exchange rates and a wide network of payout locations offers peace of mind. The company's digital platforms further enhance this convenience, allowing users to manage transactions on the go.

- Global Reach: Western Union operates in over 200 countries and territories, providing essential services to a mobile global population.

- Convenience: Access to physical agent locations and a robust digital app simplifies currency exchange and money transfers for those living or traveling internationally.

- Financial Management: For expatriates, Western Union facilitates ongoing financial ties with their home countries, supporting family needs and personal financial planning.

Migrant workers and their families are a core customer segment, relying on Western Union for dependable international money transfers to support loved ones. This group often prioritizes accessible cash pickup options, a need met by Western Union's extensive global agent network. In 2024, the World Bank projected global remittances to reach $1.3 trillion, underscoring the significant market size for these services.

Small businesses and entrepreneurs represent another vital segment, requiring efficient and affordable international payment solutions for operational needs like sourcing supplies or paying overseas freelancers. Many are increasingly adopting digital platforms for these transactions. A 2024 industry report indicated that over 60% of SMEs surveyed had increased their use of online payment platforms for international business, highlighting a strong trend towards digital adoption.

Travelers and expatriates depend on Western Union for managing finances abroad, including currency exchange and sending money home. The rebound in global tourism, with international arrivals reaching 88% of pre-pandemic levels in 2023, signifies a growing demand for these services. Western Union's broad international presence and digital tools cater to the financial needs of this mobile population.

| Customer Segment | Key Needs | Western Union's Offering | Market Data (2024 Projections/Trends) |

|---|---|---|---|

| Migrant Workers & Families | Reliable remittances, cash pickup | Extensive agent network, digital options | Global remittances projected at $1.3 trillion |

| Small Businesses & Entrepreneurs | Efficient, affordable international payments | Digital platforms, business solutions | 60%+ of SMEs increasing online payment platform use |

| Travelers & Expatriates | Currency exchange, international transfers | Global reach, digital app, forex services | International tourist arrivals at 88% of pre-pandemic levels (2023) |

Cost Structure

Western Union's cost structure is heavily influenced by agent commissions, a key expense for its extensive global network. These commissions are paid to the numerous retail locations that process customer transactions, acting as the frontline for the company's services.

Beyond direct commissions, significant costs are incurred in maintaining and managing the physical infrastructure of this agent network. This includes investments in technology, training, and support to ensure smooth operations across thousands of locations worldwide.

In 2024, while specific figures for agent commissions are proprietary, the scale of Western Union's operations suggests these costs represent a substantial part of their operating expenses. For instance, the company operates in over 200 countries and territories, relying on approximately 150,000 agent locations, highlighting the extensive network that drives these commission-related expenditures.

Western Union dedicates significant resources to its technology and digital infrastructure. This includes substantial investments in developing, maintaining, and enhancing its digital platforms, mobile applications, and the core IT systems that power its operations. A key focus is on robust cybersecurity measures to protect customer data and ensure transaction integrity.

The company also allocates funds towards leveraging advanced technologies like cloud services and artificial intelligence to improve efficiency and customer experience. These investments are crucial for staying competitive in the rapidly evolving digital payments landscape. For 2024, Western Union's estimated Information and Communications Technology (ICT) spending reached $109.7 million, highlighting the scale of this cost driver.

Western Union dedicates significant resources to marketing and advertising, encompassing global campaigns, brand building, and customer acquisition efforts. These costs cover a wide array of channels, from digital marketing and social media engagement to traditional advertising like television and print, as well as in-store promotions and partnerships. In 2024, the company continued to invest heavily in these areas to maintain its market presence and attract new users to its digital and retail services.

Regulatory Compliance and Risk Management

Western Union faces substantial costs in maintaining regulatory compliance and robust risk management. These expenses are critical for operating legally and ethically across diverse global markets, particularly in areas like anti-money laundering (AML) and anti-fraud measures.

Significant investments are directed towards sophisticated compliance systems, hiring specialized legal and compliance personnel, and fulfilling extensive reporting requirements mandated by financial authorities worldwide. For instance, in 2024, financial institutions globally continued to allocate considerable budgets towards compliance technology and expertise to navigate an increasingly complex regulatory landscape.

- AML and Fraud Prevention: Direct costs associated with software, data analytics, and personnel dedicated to identifying and mitigating illicit financial activities.

- Regulatory Reporting: Expenses for systems and staff to ensure accurate and timely submission of reports to various financial regulatory bodies.

- Legal and Advisory Fees: Outlays for external legal counsel and consultants to interpret and implement evolving regulations.

- Training and Development: Investment in ongoing training for employees to stay abreast of compliance standards and risk management best practices.

Operational and Administrative Overhead

Western Union's cost structure is significantly influenced by its operational and administrative overhead. This includes essential expenses like employee salaries for non-commissioned staff, the costs associated with maintaining its physical presence through real estate, utility expenses, and the broad spectrum of administrative functions required to run a global financial services company.

The company has actively pursued operational efficiency initiatives to manage and reduce these overheads. For instance, in its 2023 fiscal year, Western Union reported a focus on streamlining operations, which contributed to managing its SG&A (Selling, General, and Administrative) expenses, a key component of its overhead structure.

- Employee Salaries: Costs for administrative and support staff across various global functions.

- Real Estate: Expenses related to office spaces, data centers, and other physical infrastructure.

- Utilities: Costs for power, internet, and other services supporting operations.

- Administrative Functions: Investments in IT, legal, compliance, human resources, and marketing support.

Western Union's cost structure is heavily influenced by agent commissions, a key expense for its extensive global network, and significant investments in technology and digital infrastructure. These costs are essential for maintaining its vast agent network and enhancing its digital payment capabilities.

The company also allocates substantial funds towards marketing and advertising to maintain its market presence and attract new users. Furthermore, regulatory compliance and risk management are significant cost drivers, requiring investments in sophisticated systems and personnel.

Operational and administrative overhead, including employee salaries and real estate, also form a considerable part of Western Union's cost base, with ongoing efforts to improve efficiency.

| Cost Category | Key Components | 2023/2024 Relevance |

|---|---|---|

| Agent Commissions | Payments to retail locations for transaction processing | Substantial portion of operating expenses due to vast network |

| Technology & Digital Infrastructure | Platform development, cybersecurity, cloud services, AI | Estimated ICT spending of $109.7 million in 2024 |

| Marketing & Advertising | Global campaigns, brand building, customer acquisition | Continued heavy investment in 2024 for market presence |

| Regulatory Compliance & Risk Management | AML, fraud prevention, reporting, legal fees | Critical for global operations; significant budget allocation |

| Operational & Administrative Overhead | Salaries, real estate, utilities, general administration | Focus on streamlining operations for efficiency |

Revenue Streams

Western Union's core revenue generation hinges on transaction fees levied on every money transfer. These fees are dynamic, influenced by the transfer amount, the recipient's country, how the sender pays (e.g., bank account, cash), and how the recipient receives the funds (e.g., bank account, cash pickup).

For instance, in 2024, the company's financial reports consistently highlight these fees as the dominant income source, reflecting the value customers place on the accessibility and speed Western Union provides for global remittances.

Western Union earns a substantial portion of its revenue through foreign exchange (FX) markups. This occurs when they convert the currency sent by the customer into the currency received by the beneficiary. Even on transfers advertised as having no transaction fees, this FX spread is built into the exchange rate offered, adding to their income.

This markup, applied on top of the interbank exchange rate, is a critical revenue driver for Western Union. For instance, in 2023, the company's total revenue was approximately $4.5 billion, with FX revenue playing a significant role in achieving this figure. This strategy allows them to generate income even when transaction fees are minimized or waived.

Western Union generates revenue not only from its core money transfer services but also through a variety of consumer-focused fees. These include charges for bill payment services, which are particularly prevalent in markets like the United States and Argentina, and revenue from the sale of money orders.

Furthermore, the company profits from its retail foreign exchange services, catering to travelers and individuals needing currency exchange. This diversified fee structure has proven to be a significant growth driver for the company.

In 2024, Western Union's consumer services segment continued to demonstrate robust performance, with bill payment and foreign exchange services contributing meaningfully to overall revenue. This growth underscores the strategic importance of these fee-based offerings beyond traditional remittances.

Digital Channel Revenue Growth

Revenue is increasingly coming from transactions initiated on Western Union's digital channels, like their website and mobile app. This growth is fueled by both the fees charged for these digital transfers and the foreign exchange (FX) markups applied. In 2024, branded digital revenue saw a healthy increase of 7-8%.

- Digital Channels: Website and mobile app transactions are key revenue drivers.

- Revenue Components: Includes transaction fees and FX markups.

- 2024 Performance: Branded digital revenue grew by 7-8%.

Lending Partnerships and Prepaid Cards

Western Union generates revenue through strategic alliances in lending, offering financial solutions that extend beyond traditional money transfers. These partnerships allow them to tap into new customer segments and provide value-added services.

The issuance and ongoing usage of prepaid cards represent another significant revenue stream. These cards offer a convenient payment method for consumers and businesses, generating income through transaction fees and potential interchange revenue.

These diversified offerings bolster Western Union's financial services ecosystem, creating multiple avenues for income generation and enhancing customer loyalty. For instance, in 2024, the company continued to explore and expand its digital payment solutions, which often integrate prepaid functionalities.

- Lending Partnerships: Revenue from fees and interest generated through collaborations with lending institutions.

- Prepaid Card Revenue: Income derived from card issuance, transaction fees, and potential service charges.

- Diversification: These streams broaden Western Union's market reach and revenue base beyond core remittance services.

Western Union's revenue model is multifaceted, primarily driven by transaction fees on money transfers and foreign exchange (FX) markups. In 2024, digital channels continued to be a significant growth area, with branded digital revenue increasing by 7-8%. Beyond core remittances, the company also generates income from consumer services like bill payments and money orders, as well as through prepaid cards and lending partnerships.

| Revenue Stream | Description | 2024 Relevance |

|---|---|---|

| Transaction Fees | Charged on each money transfer, varying by amount, destination, and payment/receipt method. | Primary income source, reflecting service value. |

| Foreign Exchange (FX) Markups | Profit from the difference between the interbank exchange rate and the rate offered to customers. | Crucial for income, even on fee-free transfers; contributed significantly to $4.5 billion total revenue in 2023. |

| Consumer Services Fees | Revenue from bill payments, money orders, and retail foreign exchange services. | Demonstrated robust performance in 2024, enhancing overall revenue. |

| Digital Channels | Fees and FX markups from website and mobile app transactions. | Key growth driver, with branded digital revenue up 7-8% in 2024. |

| Lending & Prepaid Cards | Income from partnerships with lenders and revenue from prepaid card usage. | Diversifies income streams and expands the financial services ecosystem. |

Business Model Canvas Data Sources

The Western Union Business Model Canvas is informed by a blend of internal financial data, extensive market research on remittance trends, and competitive intelligence. These sources ensure a comprehensive understanding of customer needs and market opportunities.