Wallstein Holding GmbH & Co. KG PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wallstein Holding GmbH & Co. KG Bundle

Navigate the complex external landscape impacting Wallstein Holding GmbH & Co. KG with our comprehensive PESTEL Analysis. Understand how political stability, economic fluctuations, technological advancements, environmental regulations, and social shifts are shaping its operational environment and strategic opportunities. Gain the foresight needed to make informed decisions and secure your competitive advantage.

Political factors

Governmental energy transition policies are a major driver for Wallstein. For instance, the German government's commitment to the Energiewende, aiming for a significant increase in renewable energy sources, directly influences demand for optimizing existing industrial plants and building new, cleaner ones. In 2023, Germany's renewable energy share in gross electricity consumption reached approximately 55%, a figure expected to grow, creating opportunities for Wallstein's expertise in emissions reduction and efficiency improvements.

Incentives like tax credits for energy-efficient industrial equipment or subsidies for carbon capture technologies, as seen in various EU directives and national programs, can unlock substantial market potential for Wallstein's specialized services. The European Green Deal, for example, sets ambitious targets for climate neutrality by 2050, encouraging investments in sustainable industrial processes where Wallstein operates.

However, the pace of policy implementation and potential shifts in political priorities pose a risk. Delays in regulatory frameworks or changes in subsidy programs could slow down project development and investment in the industrial sector, impacting Wallstein's project pipelines and revenue streams.

Stricter industrial emission regulations, particularly within the European Union, are a significant political driver for Wallstein. For instance, the EU's Industrial Emissions Directive (IED) sets stringent limits for pollutants from large combustion plants, directly increasing demand for Wallstein's flue gas cleaning technologies. As of 2024, the ongoing review and potential tightening of these limits, especially concerning CO2 and NOx, further underscore the need for advanced environmental solutions.

Governmental subsidies, grants, and tax incentives for green technologies are a major driver for Wallstein's target industries. For example, in 2024, the US Inflation Reduction Act (IRA) allocated $369 billion towards clean energy and climate initiatives, directly impacting the financial viability of projects incorporating energy efficiency upgrades and advanced environmental controls. This political commitment to financial support can significantly accelerate the adoption of Wallstein's solutions, making them more attractive to clients.

Geopolitical Stability and Energy Security

Geopolitical stability significantly impacts global energy markets and supply chains, directly influencing industrial investment confidence. For instance, ongoing geopolitical tensions in Eastern Europe, which began in early 2022 and continued through 2024, have led to significant volatility in oil and natural gas prices. This volatility can either accelerate or slow down national initiatives aimed at diversifying energy sources and bolstering industrial energy independence. Consequently, this influences the demand for Wallstein's energy optimization and environmental technologies as nations and industries seek greater control over their energy consumption and sourcing.

Stable political environments are crucial for fostering long-term industrial planning and investment. In 2024, regions experiencing prolonged periods of peace and predictable governance, such as parts of Western Europe and North America, have generally seen higher levels of capital expenditure in industrial infrastructure and technology upgrades. Conversely, areas with heightened political instability or the risk of trade disputes often face hesitant investment, potentially delaying the adoption of advanced energy solutions that Wallstein offers. The International Monetary Fund's 2024 outlook highlighted that geopolitical fragmentation could reduce global GDP by 0.7% in 2025 compared to a baseline without such fragmentation, underscoring the economic impact of instability.

- Impact of Geopolitical Events: Conflicts and trade disputes directly affect energy prices and availability, influencing demand for energy efficiency solutions.

- Diversification Efforts: Geopolitical instability prompts nations to accelerate efforts in diversifying energy sources, creating opportunities for companies like Wallstein.

- Investment Climate: Stable political environments encourage long-term industrial planning and investment in new technologies, including those related to energy optimization.

- Global Economic Outlook: Geopolitical fragmentation is projected to negatively impact global GDP, indirectly affecting industrial investment and technology adoption rates.

International Climate Agreements

International climate agreements, such as the Paris Agreement, establish national decarbonization targets. These commitments directly influence Wallstein's industrial clientele, necessitating investments in advanced environmental and energy-efficient technologies. For instance, Germany, a key market for Wallstein, aims to reduce greenhouse gas emissions by 65% below 1990 levels by 2030, a goal that spurs demand for solutions like flue gas treatment and heat recovery.

Wallstein's core competencies in flue gas treatment and heat recovery become increasingly critical as nations strive to meet their emission reduction obligations. The political imperative to adhere to these international accords fosters a sustained market for Wallstein's specialized engineering services and technologies. This political commitment shapes long-term market dynamics, creating a stable demand environment for climate-focused industrial solutions.

- Paris Agreement Targets: Global commitment to limit warming to well below 2, preferably to 1.5 degrees Celsius, compared to pre-industrial levels.

- German Climate Act (2021): Mandates a 65% reduction in greenhouse gas emissions by 2030 (compared to 1990 levels) and climate neutrality by 2045.

- EU Emissions Trading System (ETS): Drives industrial investment in lower-carbon technologies by setting a price on carbon emissions.

- Renewable Energy Directives: Promote the uptake of renewable energy sources, indirectly influencing demand for associated industrial infrastructure and efficiency measures.

Governmental policies, particularly those focused on energy transition and emissions reduction, are a significant political driver for Wallstein. For example, Germany's Energiewende, aiming for a substantial increase in renewables, directly impacts demand for optimizing industrial plants, with renewable energy accounting for approximately 55% of gross electricity consumption in 2023. Political commitments to climate neutrality, such as the EU's Green Deal, further encourage investments in sustainable industrial processes where Wallstein operates.

Stricter industrial emission regulations, like the EU's Industrial Emissions Directive, directly boost demand for Wallstein's flue gas cleaning technologies, with ongoing reviews in 2024 potentially tightening limits on CO2 and NOx. Additionally, political support through subsidies and tax incentives, such as the US Inflation Reduction Act's $369 billion for clean energy in 2024, enhances the financial viability of projects adopting Wallstein's energy efficiency solutions.

Geopolitical stability plays a crucial role in industrial investment confidence and energy market dynamics. For instance, geopolitical tensions since early 2022 have caused significant volatility in oil and natural gas prices, influencing national efforts towards energy diversification and industrial energy independence, thereby impacting demand for Wallstein's optimization technologies. Stable political environments, prevalent in regions like Western Europe and North America in 2024, foster higher capital expenditure in industrial infrastructure and technology upgrades.

International climate agreements, such as the Paris Agreement, set national decarbonization targets that necessitate investments in advanced environmental technologies for industrial clients. Germany's goal to reduce greenhouse gas emissions by 65% by 2030 below 1990 levels, for example, directly drives demand for Wallstein's flue gas treatment and heat recovery solutions, creating a sustained market for climate-focused industrial services.

What is included in the product

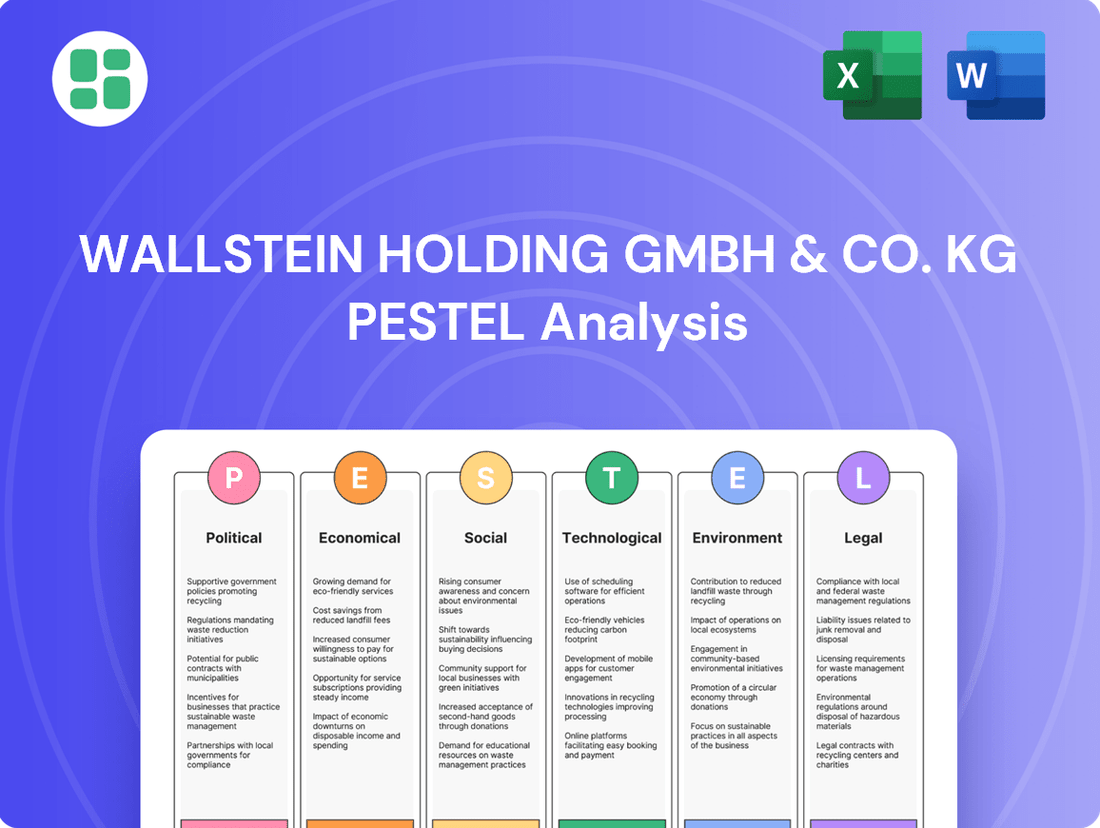

This PESTLE analysis explores how external macro-environmental factors uniquely affect Wallstein Holding GmbH & Co. KG across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides forward-looking insights to support scenario planning and proactive strategy design, helping to identify both threats and opportunities.

The Wallstein Holding GmbH & Co. KG PESTLE analysis provides a clear, summarized version of external factors, acting as a pain point reliever by offering easy referencing during meetings and strategic planning.

Economic factors

Fluctuations in global energy prices, especially for natural gas, coal, and electricity, directly affect the operating expenses of industrial customers such as power plants and waste incineration facilities. For instance, in early 2024, natural gas prices saw significant swings, impacting the energy budgets of many European industrial players.

High and unpredictable energy costs strongly encourage these sectors to invest in Wallstein's energy efficiency and heat recovery technologies, aiming to lower consumption and gain cost stability. This trend is supported by the ongoing push for decarbonization and energy independence across many economies.

Conversely, periods of persistently low energy prices could potentially lessen the immediate need for such capital expenditures, although long-term strategic benefits often still drive adoption.

The health of the industrial sector is a critical driver for Wallstein's business. In 2024, global industrial production growth is projected to be around 2.5%, with significant regional variations. For instance, manufacturing output in the Eurozone saw a modest uptick in early 2024, signaling a potential increase in demand for specialized engineering services.

Investment cycles directly impact the pipeline of projects available to Wallstein. In 2024, capital expenditure in the energy sector, a key market for Wallstein, is expected to rise by approximately 8% globally, driven by investments in renewable energy infrastructure and upgrades to existing power generation facilities. This trend suggests a positive outlook for installation and maintenance services.

Conversely, economic slowdowns can dampen industrial activity. If industrial production contracts, as it did in some regions during late 2023, it can lead to postponed investment decisions and a reduction in the frequency of maintenance projects. For example, a projected 1% contraction in manufacturing output in a specific European country could translate to a 3-5% decrease in demand for certain Wallstein services.

Rising inflation directly impacts Wallstein Holding GmbH & Co. KG by increasing the costs of essential inputs like raw materials, components, and labor. For instance, the Producer Price Index (PPI) in Germany, a key indicator of manufacturing costs, saw significant increases throughout 2023 and into early 2024, impacting sectors reliant on industrial materials. This surge in operational expenses can squeeze project profitability and may necessitate price adjustments for clients, potentially influencing project acquisition rates.

To navigate these inflationary pressures, Wallstein's emphasis on robust supply chain management and strategic hedging becomes paramount. For example, securing long-term contracts for key materials or utilizing financial instruments to hedge against currency fluctuations can help stabilize costs. The ability to effectively manage these economic headwinds is crucial for maintaining healthy profit margins and ensuring competitive pricing in the market, especially as inflation forecasts for the Eurozone in 2024 and 2025 continue to be a focal point for businesses.

Access to Capital and Interest Rates

Access to capital is a crucial economic factor for Wallstein's clients, directly impacting their investment decisions. Prevailing interest rates and lending conditions dictate the cost of financing for new plants or upgrades. For instance, in early 2024, the European Central Bank's key interest rates remained elevated, making borrowing more expensive for industrial firms. This can lead to a slowdown in capital expenditures, directly affecting demand for Wallstein's engineering and construction services.

Conversely, a decrease in interest rates can significantly boost investment. If rates were to fall, say by 0.50% in late 2024 or early 2025, it would make large-scale projects more financially viable for Wallstein's customers. This improved affordability would likely translate into increased orders for the company. The sensitivity of project funding to interest rate fluctuations means Wallstein must closely monitor monetary policy developments.

- Interest Rate Impact: Higher borrowing costs in 2024 made large industrial investments less attractive for many of Wallstein's clients.

- Financing Availability: Tighter lending standards, sometimes accompanying higher rates, can further restrict clients' ability to secure necessary capital.

- Stimulus Potential: Anticipated rate cuts by central banks in late 2024 or 2025 could reignite demand for capital-intensive projects.

- Economic Sensitivity: Wallstein's order pipeline is directly linked to the economic health and financing capacity of its client base.

Competition and Market Pricing

The competitive landscape for Wallstein Holding GmbH & Co. KG, operating in heat exchangers, flue gas, and environmental technology, is shaped by numerous players, both large and small. This intense rivalry directly impacts market pricing, potentially leading to price erosion and squeezing profit margins for all involved. For instance, the global heat exchanger market was valued at approximately USD 17.2 billion in 2023 and is projected to grow, but this growth is accompanied by significant competition.

Wallstein's ability to command premium pricing hinges on its specialized expertise and commitment to innovation within these sectors. Companies that can differentiate through superior technology, custom solutions, or exceptional service can often maintain healthier margins despite economic pressures. The overall economic climate significantly influences how aggressively competitors engage in pricing strategies, with downturns often triggering more aggressive price wars.

- Market Value: The global heat exchanger market reached an estimated USD 17.2 billion in 2023, indicating a substantial market size with inherent competitive pressures.

- Pricing Power: Wallstein's revenue and profit margins are directly influenced by its capacity to differentiate through specialized expertise and innovation, enabling premium pricing strategies.

- Economic Impact: Economic conditions dictate the intensity of competition and the prevalence of aggressive pricing tactics among market participants in the environmental technology sectors.

- Industry Dynamics: Intense competition can lead to price erosion, making a strong market position and technological advancement crucial for maintaining profitability.

Economic factors significantly influence Wallstein's operational environment. Fluctuations in energy prices, particularly natural gas and electricity, directly impact industrial clients' operating expenses, driving demand for Wallstein's efficiency solutions. For example, the volatility in European gas markets in early 2024 highlighted this dependency. Furthermore, global industrial production growth, projected around 2.5% for 2024, and investment cycles within the energy sector, with an estimated 8% global capex increase in 2024, are critical indicators for Wallstein's project pipeline. Rising inflation, as evidenced by Germany's Producer Price Index increases through 2023-early 2024, directly affects input costs and necessitates careful cost management and pricing strategies.

Access to capital, heavily influenced by interest rates, plays a crucial role in client investment decisions. Elevated ECB rates in early 2024 made financing more costly, potentially slowing project initiation. Conversely, anticipated rate cuts in late 2024 or 2025 could stimulate demand for capital-intensive projects. The competitive landscape, with the global heat exchanger market valued at approximately USD 17.2 billion in 2023, intensifies pricing pressures, underscoring the importance of Wallstein's technological differentiation and specialized expertise to maintain profitability.

| Economic Factor | Impact on Wallstein | 2024/2025 Data/Trend |

|---|---|---|

| Energy Prices | Affects industrial client operating costs, driving demand for efficiency solutions. | Volatile natural gas prices in early 2024. |

| Industrial Production | Key driver for demand for Wallstein's services. | Projected 2.5% global industrial production growth in 2024. |

| Capital Expenditures (Energy Sector) | Directly impacts project pipeline and demand for installation/maintenance. | Estimated 8% global capex increase in energy sector for 2024. |

| Inflation | Increases input costs (materials, labor), impacting profitability. | Rising German PPI through 2023-early 2024. |

| Interest Rates | Influences client investment decisions and cost of capital. | Elevated ECB rates in early 2024; potential cuts anticipated late 2024/2025. |

| Competition | Affects pricing power and profit margins. | Global heat exchanger market ~$17.2 billion in 2023; intense rivalry. |

Preview Before You Purchase

Wallstein Holding GmbH & Co. KG PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This detailed PESTLE analysis of Wallstein Holding GmbH & Co. KG covers all critical external factors impacting the company's strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a comprehensive understanding of the Political, Economic, Social, Technological, Legal, and Environmental landscape relevant to Wallstein Holding.

The content and structure shown in the preview is the same document you’ll download after payment. It provides actionable insights for navigating the complex business environment faced by Wallstein Holding.

Sociological factors

Public concern over industrial emissions, particularly regarding air quality and climate change, is escalating. This heightened awareness, evident in global surveys showing a significant majority of people concerned about environmental issues, directly influences corporate behavior. As of early 2025, reports indicate a surge in consumer preference for brands demonstrating strong environmental stewardship, impacting purchasing decisions.

This societal expectation creates a robust market for companies like Wallstein that offer emission reduction solutions. Businesses are increasingly investing in technologies that not only comply with regulations but also bolster their public image and meet corporate social responsibility goals. For instance, the renewable energy sector saw a 20% growth in investment in 2024, driven partly by public demand for greener alternatives.

Conversely, negative public perception can trigger more stringent environmental regulations and significant community opposition to new industrial developments. This can lead to project delays or cancellations, underscoring the critical need for industries to proactively manage their environmental footprint and engage transparently with the public.

Societal expectations are rapidly evolving, with a strong emphasis on sustainability and the principles of a circular economy. This shift is directly impacting how businesses make purchasing decisions, moving beyond mere regulatory compliance to seeking partners who actively demonstrate environmental responsibility and efficient resource management.

Clients are increasingly prioritizing solutions that showcase genuine environmental stewardship. For instance, a 2024 report indicated that 78% of B2B buyers consider a supplier's sustainability practices as a key factor in their decision-making process. This underscores a growing demand for environmentally conscious industrial practices.

Wallstein's established expertise in energy efficiency and emission reduction positions them favorably to meet this burgeoning demand. Their offerings directly address the need for environmentally responsible industrial solutions, thereby cultivating a significant competitive advantage in the current market landscape.

The availability of skilled labor, particularly engineers and technicians, is paramount for Wallstein's success in delivering complex industrial systems. In Germany, for example, the number of engineering graduates has seen fluctuations, with a reported 38,000 engineering graduates in 2023, highlighting a competitive landscape for specialized talent.

Demographic shifts and evolving educational pathways directly influence recruitment. As the average age of skilled workers increases, companies like Wallstein face the challenge of replacing experienced personnel and adapting to new skill requirements driven by technological advancements. The demand for digital skills in manufacturing is particularly high.

To counter potential talent shortages and maintain project quality and timelines, Wallstein's commitment to continuous training and development programs is critical. This investment ensures their workforce remains adept at handling cutting-edge technologies and complex project demands, supporting long-term operational efficiency and growth.

Corporate Social Responsibility (CSR) Expectations

Societal pressure for businesses to act responsibly is growing, pushing clients to favor partners with strong ethical and environmental track records. This trend means companies like Wallstein Holding GmbH & Co. KG need to demonstrate robust Corporate Social Responsibility (CSR) practices to attract and retain business.

Clients increasingly scrutinize their supply chains, preferring to collaborate with suppliers who exhibit genuine commitment to sustainability and fair labor. For instance, a 2024 survey by Edelman found that 72% of consumers believe companies should be held accountable for their impact on society and the environment.

- Growing Client Demand for Ethical Sourcing: Clients are actively seeking suppliers whose operations align with their own CSR goals, impacting partnership decisions.

- Environmental Stewardship as a Differentiator: Wallstein's established environmental focus directly addresses this client need, making it a more attractive partner.

- Reputational Risk Mitigation: Partnering with companies demonstrating strong CSR helps clients avoid reputational damage associated with unethical supply chain practices.

- Investment Alignment: Many investment funds now integrate ESG (Environmental, Social, and Governance) criteria, meaning clients' investment strategies are inherently tied to their suppliers' CSR performance.

Occupational Health and Safety Standards

Societal values increasingly prioritize worker well-being, leading to robust occupational health and safety (OHS) standards. Wallstein Holding GmbH & Co. KG, operating in manufacturing, installation, and maintenance, must rigorously comply with these regulations.

Adherence to OHS standards, such as those mandated by the German Social Accident Insurance (DGUV) which reported 783,000 workplace accidents in 2023, is paramount. A strong safety culture not only fulfills legal obligations but also enhances employee morale and builds trust with clients, as demonstrated by companies with low incident rates often receiving preferential treatment in tenders.

- Stringent Regulations: Wallstein must meet OHS requirements, impacting operational procedures and costs.

- Employee Well-being: Prioritizing safety fosters a positive work environment and reduces absenteeism.

- Client Confidence: Demonstrating a commitment to safety enhances reputation and secures business.

- Incident Data: In 2023, Germany's DGUV reported a slight decrease in reported workplace accidents, highlighting a trend towards improved safety practices.

Societal expectations are increasingly focused on environmental responsibility and sustainability, driving demand for companies like Wallstein that offer emission reduction and energy efficiency solutions. This trend is evident in consumer and business purchasing decisions, with a significant majority of B2B buyers now considering a supplier's sustainability practices. Wallstein's expertise directly aligns with these evolving societal values, providing a competitive edge.

The availability of skilled labor, particularly in engineering and technical fields, is crucial for Wallstein's operations. Demographic shifts and the need for digital skills in manufacturing present recruitment challenges, necessitating ongoing investment in training and development to maintain a proficient workforce. Germany's engineering graduate numbers, around 38,000 in 2023, indicate a competitive talent market.

Worker well-being and stringent occupational health and safety (OHS) standards are paramount. Compliance with regulations, such as those from Germany's DGUV, which reported 783,000 workplace accidents in 2023, is essential for legal adherence, employee morale, and client confidence. A strong safety culture is a key differentiator in securing business.

| Societal Factor | Impact on Wallstein | Supporting Data (2023/2024) |

|---|---|---|

| Environmental Consciousness | Increased demand for emission reduction solutions; preference for sustainable partners. | 78% of B2B buyers consider supplier sustainability (2024). |

| Skilled Labor Availability | Challenges in recruiting and retaining specialized talent; need for continuous training. | ~38,000 engineering graduates in Germany (2023). |

| Occupational Health & Safety (OHS) | Requirement for strict compliance; positive impact on reputation and client trust. | 783,000 workplace accidents reported by DGUV (2023). |

Technological factors

Continuous innovation in materials science, fluid dynamics, and heat transfer mechanisms directly impacts the efficiency and performance of Wallstein's heat exchangers. For instance, advancements in ceramic composites and porous metals, explored in research through 2024, promise higher temperature resistance and improved thermal conductivity, directly benefiting industrial applications requiring extreme heat management.

Developing and integrating cutting-edge technologies, such as advanced heat pipe designs or compact heat exchangers, allows Wallstein to offer superior energy efficiency solutions. The global market for industrial heat exchangers, valued at approximately $25 billion in 2023 and projected to grow at a CAGR of 4.5% through 2030, highlights the demand for such efficiency gains, which reduce operational costs and carbon footprints for clients.

Staying ahead in these technological advancements is crucial for competitive differentiation. Companies investing in R&D for enhanced heat recovery systems, like those incorporating phase-change materials or novel fin geometries, are expected to capture a larger market share. Wallstein's commitment to integrating these innovations ensures its offerings remain at the forefront of industrial energy efficiency solutions.

Wallstein's core business revolves around advanced flue gas treatment technologies like Selective Catalytic Reduction (SCR) and Selective Non-Catalytic Reduction (SNCR), alongside sophisticated dust removal systems. These technologies are crucial for clients aiming to comply with tightening environmental standards.

Continuous investment in R&D for more efficient, cost-effective, and smaller emission control systems allows Wallstein to stay ahead of evolving regulations and provide cutting-edge solutions. For instance, the company actively explores and integrates emerging technologies such as carbon capture, broadening its product and service portfolio to address a wider range of environmental challenges.

Wallstein Holding GmbH & Co. KG is significantly benefiting from the integration of Industry 4.0 technologies. The adoption of IoT sensors and real-time data analytics allows for the optimization of their installed systems, extending their operational lifespan. For instance, predictive maintenance, a core tenet of Industry 4.0, is projected to reduce unexpected equipment failures by up to 30% in industrial settings by 2025, a trend Wallstein is actively leveraging.

By embedding smart monitoring and control systems into their solutions, Wallstein provides clients with invaluable operational insights. This enhances efficiency and minimizes downtime, delivering value that extends beyond the initial equipment purchase. The ability to perform remote diagnostics and service, a direct result of this digitalization, streamlines maintenance processes and reduces on-site intervention costs for their customers.

Automation and Manufacturing Processes

Technological advancements in manufacturing automation, such as robotic welding and automated assembly lines, can significantly enhance the precision, speed, and cost-effectiveness of Wallstein's production of heat exchangers and flue gas components. Embracing these technologies can lead to higher quality products, reduced lead times, and improved competitive pricing, directly impacting Wallstein's operational efficiency and market position. Automation also supports scaling production to meet demand, a crucial factor in today's dynamic markets.

In 2024, the global industrial automation market was projected to reach over $300 billion, with significant growth driven by adoption in manufacturing sectors. For Wallstein, integrating advanced robotics could streamline their production of complex heat exchanger designs, potentially reducing assembly time by up to 30% and improving weld integrity, a critical aspect for high-pressure applications.

- Robotic Welding: Enhances precision and consistency in joining metal components, crucial for leak-proof heat exchangers.

- Automated Assembly Lines: Accelerates the overall production cycle, allowing for higher output volumes.

- Digital Twin Technology: Enables virtual simulation and optimization of manufacturing processes before physical implementation, reducing costly errors.

- Predictive Maintenance: Utilizes AI to forecast equipment failures, minimizing downtime and ensuring continuous production flow.

Material Science Innovations

Breakthroughs in material science are directly impacting Wallstein's operational capabilities. Innovations in corrosion-resistant alloys and high-temperature ceramics are crucial for enhancing the durability and performance of their equipment, especially in demanding industrial settings. For instance, advancements in nickel-based superalloys are extending the lifespan of components exposed to extreme heat and corrosive agents, a key factor for Wallstein's industrial clients.

The adoption of specialized coatings can further improve equipment longevity and reduce maintenance needs. These materials allow for more resilient designs, contributing to extended service life and operational efficiencies. This translates into significant long-term cost savings and improved performance for customers operating in sectors like chemical processing and power generation.

- Corrosion-Resistant Alloys: Development of advanced alloys capable of withstanding aggressive chemical environments, reducing degradation and extending equipment life.

- High-Temperature Ceramics: Integration of ceramics for components requiring extreme heat resistance, enabling higher operational temperatures and improved thermal management.

- Specialized Coatings: Application of protective coatings to enhance wear resistance, reduce friction, and prevent material fatigue in critical equipment parts.

- Material Efficiency: Innovations leading to lighter yet stronger materials, potentially reducing energy consumption during operation and manufacturing.

Technological advancements are central to Wallstein's competitive edge, particularly in materials science and heat transfer. Innovations in ceramic composites and porous metals, actively researched in 2024, promise enhanced thermal conductivity and temperature resistance, directly benefiting industrial applications. The global industrial heat exchanger market, valued at approximately $25 billion in 2023, underscores the demand for the energy efficiency solutions Wallstein provides through cutting-edge designs.

Wallstein is leveraging Industry 4.0 technologies like IoT sensors and predictive maintenance, which is expected to cut unexpected equipment failures by up to 30% by 2025. This digitalization allows for optimized system performance and remote diagnostics, enhancing client operational efficiency and reducing downtime. Furthermore, advancements in manufacturing automation, with the global industrial automation market exceeding $300 billion in 2024, enable Wallstein to produce higher quality, more cost-effective components with improved precision.

| Technological Area | Impact on Wallstein | Key Innovations/Trends | Market Relevance (2023-2025) |

| Materials Science | Enhanced durability, performance, and efficiency of heat exchangers and flue gas components. | Corrosion-resistant alloys, high-temperature ceramics, advanced coatings. | Extended equipment lifespan, reduced maintenance, higher operational temperatures. |

| Industry 4.0 / Digitalization | Optimized operations, predictive maintenance, remote diagnostics, improved customer service. | IoT sensors, AI for predictive maintenance, real-time data analytics. | Up to 30% reduction in unexpected failures by 2025, streamlined maintenance. |

| Manufacturing Automation | Increased precision, speed, cost-effectiveness, and scalability of production. | Robotic welding, automated assembly lines, digital twin technology. | Potential 30% reduction in assembly time, improved weld integrity, higher output volumes. |

Legal factors

National and international environmental legislation, like the EU Industrial Emissions Directive (IED) and Germany's Federal Immission Control Act (Bundes-Immissionsschutzgesetz), set strict limits on industrial emissions. These laws directly influence the operational parameters for sectors that Wallstein serves, requiring advanced environmental technology to meet air quality, water discharge, and waste management standards.

Wallstein's core business is built upon enabling industrial clients to achieve compliance with these rigorous environmental mandates. Their flue gas and environmental technology solutions are therefore essential for industries to operate legally and sustainably, highlighting compliance as a fundamental market driver for the company's offerings.

Wallstein Holding GmbH & Co. KG operates under stringent health and safety regulations, particularly concerning the design, manufacturing, installation, and maintenance of industrial equipment. Ensuring full compliance with these standards is paramount to safeguarding employees and mitigating legal risks. For instance, in Germany, the Occupational Safety and Health Act (Arbeitsschutzgesetz) mandates comprehensive risk assessments and preventative measures.

Adherence to these safety protocols is not just a legal necessity but a crucial factor in securing new contracts and reinforcing Wallstein's reputation as a dependable and responsible industry player. The company's commitment to safety directly impacts its ability to win bids, as many clients, especially in sectors like energy and infrastructure, prioritize partners with impeccable safety records. Failure to comply can result in significant financial penalties, operational disruptions, and reputational damage, as seen in past cases where companies faced substantial fines for safety breaches.

Industrial projects, particularly new power plants or major upgrades to waste incineration facilities, necessitate comprehensive permitting and licensing from various regulatory bodies. Wallstein's engineering expertise plays a crucial role in ensuring their clients' projects meet these stringent environmental and technical standards, thereby streamlining the approval process.

The time and complexity involved in securing these permits can directly influence project schedules and overall expenses. For instance, in Germany, the average time for obtaining permits for large infrastructure projects can range from several months to over a year, depending on the project's scope and local regulations, impacting project financing and return on investment.

Product Liability and Warranty Laws

Product liability and warranty laws are critical for Wallstein Holding GmbH & Co. KG, as they mandate the company's responsibility for the safety, performance, and reliability of its heat exchangers and environmental systems. Failure to meet these standards can lead to substantial legal and financial repercussions.

For instance, in 2024, the European Union continued to strengthen consumer protection laws, with potential implications for product warranties and liability claims across member states where Wallstein operates. Companies are increasingly held accountable for the entire product lifecycle, from design to disposal.

- Product Safety Standards: Wallstein must adhere to rigorous safety regulations like those outlined in the General Product Safety Regulation (GPSR) in the EU, ensuring heat exchangers and environmental systems pose no unreasonable risk.

- Warranty Obligations: Providing clear and legally compliant warranties is essential. For example, a two-year warranty is standard for many consumer goods in Europe, and industrial warranties must also be clearly defined to manage customer expectations and legal recourse.

- Liability for Defects: If a Wallstein product is found to be defective and causes damage, the company could face claims for compensation. In 2024, class-action lawsuits for product defects remained a significant concern for manufacturers globally, with potential damages running into millions.

- Mitigation Strategies: Implementing robust quality control, comprehensive testing protocols, and transparent warranty terms are key to minimizing these legal risks and fostering customer confidence.

International Trade and Sanctions Laws

As a global player in engineering, Wallstein Holding GmbH & Co. KG must meticulously adhere to international trade laws and sanctions. Navigating varying customs duties and import/export regulations for components and project deliveries worldwide is a constant challenge. For instance, the European Union's trade policies, which impact German companies, are continually evolving. In 2024, the focus remains on managing compliance amidst ongoing geopolitical shifts that can quickly alter trade landscapes.

Failure to comply with these intricate legal frameworks can lead to severe consequences, including significant financial penalties and disruptions to critical supply chains. Reputational damage is also a major concern. For example, in 2023, numerous companies faced scrutiny and fines for inadvertently violating sanctions regimes. Wallstein's proactive approach to understanding and implementing these regulations is therefore paramount for sustained operational integrity.

- Compliance Costs: Companies like Wallstein may incur substantial costs for legal counsel, compliance software, and training to ensure adherence to international trade and sanctions laws.

- Supply Chain Vulnerability: Sudden imposition of sanctions or trade restrictions, as seen in various global conflicts, can immediately halt or complicate the import/export of essential engineering components.

- Geopolitical Impact: The ongoing global political climate means that trade agreements and sanctions lists are subject to frequent updates, requiring continuous monitoring and strategic adjustments by companies operating internationally.

Wallstein Holding GmbH & Co. KG must navigate a complex web of legal requirements, from environmental emissions standards like the EU Industrial Emissions Directive to stringent health and safety regulations such as Germany's Occupational Safety and Health Act. Compliance with product safety standards and warranty obligations, as reinforced by EU consumer protection laws in 2024, is crucial to avoid significant penalties and reputational damage. Furthermore, adherence to international trade laws and sanctions is paramount for maintaining operational integrity and supply chain stability in a dynamic global market.

The company's success hinges on its ability to integrate these legal frameworks into its operations, ensuring clients can meet their own regulatory obligations. For example, the need for permits for industrial projects can add months to timelines, impacting project financing. In 2024, the EU's ongoing focus on strengthening consumer protection laws also means increased scrutiny on product warranties and liability, with potential implications for manufacturers like Wallstein.

Failure to comply with these multifaceted legal requirements can lead to substantial financial penalties and operational disruptions. For instance, product liability claims in 2024 continued to be a significant risk for manufacturers, with potential damages reaching millions. Wallstein's proactive approach to legal compliance, including robust quality control and transparent warranty terms, is therefore essential for its sustained success and market reputation.

Environmental factors

Global efforts to combat climate change are setting ambitious targets for greenhouse gas emission reductions. For instance, the European Union aims to cut emissions by at least 55% by 2030 compared to 1990 levels, a goal that significantly boosts demand for companies like Wallstein offering energy efficiency and emission reduction solutions. These targets are a powerful catalyst for Wallstein's business.

Industrial players face mounting pressure to decarbonize their operations, making advanced heat recovery systems and efficient flue gas treatment technologies essential. As industries strive to meet net-zero commitments, such as those outlined in national climate action plans, the need for Wallstein's specialized equipment becomes paramount, positioning the company for substantial long-term growth.

Deteriorating air quality in many industrial areas is pushing for better pollution control. Wallstein's know-how in cleaning flue gases, specifically cutting down on NOx, SOx, and fine particles, fits perfectly with the growing need to meet stricter air quality rules. This environmental pressure means industries are more likely to invest in and use Wallstein's specialized environmental tech.

Public health concerns are a significant driver for these changes. For instance, the European Environment Agency reported in 2024 that air pollution still causes hundreds of thousands of premature deaths annually across Europe, highlighting the urgency for effective solutions like those Wallstein offers.

Growing concerns about the scarcity of vital natural resources like water and primary energy sources are increasingly highlighting the critical need for resource efficiency in industrial operations. This trend directly supports businesses that can offer solutions for more sustainable resource utilization.

Wallstein's advanced heat exchanger technologies play a crucial role in this environmental shift by facilitating substantial energy savings within industrial facilities. By enabling more efficient resource use, these solutions contribute to broader sustainability objectives, including the reduction of waste heat and the recovery of valuable by-products, which is a key focus for many industries in 2024 and beyond.

Waste Management and Circular Economy

The growing emphasis on sustainable waste management and circular economy principles significantly influences Wallstein's operations, especially within its waste incineration segment. Innovations in energy recovery from waste, residue reduction, and material reclamation from flue gas treatment by-products are gaining traction. For instance, the European Union's Circular Economy Action Plan, updated in 2020, aims to make sustainable products the norm, pushing companies like Wallstein to adopt more resource-efficient technologies.

Wallstein's expertise in waste-to-energy solutions aligns directly with the shift towards a circular economy, transforming waste into valuable energy and potentially recovering materials. This focus is crucial as global waste generation continues to rise; the World Bank estimated in 2023 that global waste generation could increase by 70% by 2050 if no action is taken.

- Technological Advancements: Wallstein's investment in and development of advanced incineration technologies that maximize energy output and minimize environmental impact are key.

- Regulatory Landscape: Evolving environmental regulations, particularly those promoting waste reduction and material recycling, shape the demand for Wallstein's waste-to-energy services.

- Resource Efficiency: The company's ability to integrate circular economy principles, such as material recovery from waste streams, enhances its value proposition.

- Market Demand: Increasing public and governmental pressure for sustainable waste disposal solutions drives demand for Wallstein's specialized services.

Water Pollution and Treatment Needs

While Wallstein Holding GmbH & Co. KG is widely recognized for its air emission control technologies, its industrial processes can also have implications for water pollution. For instance, wastewater generated from flue gas cleaning systems requires careful management and treatment. The company's extensive environmental technology expertise could be leveraged to develop integrated plant designs that optimize water usage and effectively treat any associated wastewater streams.

The global emphasis on water quality is intensifying, with stricter regulations and growing public awareness driving demand for advanced water treatment solutions. This trend presents a significant opportunity for companies like Wallstein to expand their offerings. For example, in 2023, the global industrial wastewater treatment market was valued at approximately $45 billion, with projections indicating continued growth driven by these environmental concerns.

- Wastewater from Flue Gas Treatment: Industrial processes, particularly those involving flue gas cleaning, can generate wastewater that needs effective treatment to prevent water pollution.

- Integrated Plant Design: Wallstein's expertise in environmental technologies can be applied to design plants that minimize water consumption and incorporate robust wastewater treatment.

- Regulatory and Societal Pressure: Increasing global focus on water quality is creating a stronger market for comprehensive environmental solutions across industries.

- Market Growth: The industrial wastewater treatment market is expanding, with significant investment anticipated in technologies that ensure compliance and environmental protection.

Environmental regulations are increasingly stringent, pushing industries towards cleaner technologies. For example, the EU's Green Deal aims for climate neutrality by 2050, creating a strong market for Wallstein's emission control and energy recovery systems. This regulatory push is a significant driver for Wallstein's business, as companies seek to comply with new standards.

The growing awareness of climate change and its impacts, such as extreme weather events, is fueling demand for sustainable industrial practices. Wallstein's solutions, like advanced heat exchangers that improve energy efficiency, directly address this need by helping industries reduce their carbon footprint. The company's offerings are thus well-aligned with global sustainability goals.

Public health concerns linked to air and water pollution are also a major factor. Stricter air quality standards, driven by the desire to reduce respiratory illnesses, necessitate advanced flue gas treatment technologies. Wallstein's expertise in removing pollutants like NOx and SOx from industrial emissions is crucial in meeting these public health demands.

Resource scarcity, particularly concerning water and energy, is another key environmental consideration. Industries are actively seeking ways to optimize resource usage, making Wallstein's heat recovery and waste-to-energy technologies highly relevant. These solutions contribute to a more circular economy by maximizing the value extracted from industrial processes and minimizing waste.

| Environmental Factor | Impact on Wallstein | Supporting Data/Trend |

|---|---|---|

| Climate Change Mitigation Targets | Increased demand for emission reduction and energy efficiency solutions. | EU aims for 55% emission cut by 2030; global net-zero commitments. |

| Air Quality Regulations | Demand for advanced flue gas cleaning technologies. | Stricter limits on NOx, SOx, and particulate matter emissions. |

| Water Quality Concerns | Opportunity for wastewater treatment integration. | Global industrial wastewater treatment market valued at ~$45 billion in 2023. |

| Resource Scarcity & Circular Economy | Growth in waste-to-energy and heat recovery systems. | World Bank: Global waste generation could rise 70% by 2050 without action. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Wallstein Holding GmbH & Co. KG is grounded in data from reputable sources like the German Federal Statistical Office (Destatis), the European Commission, and industry-specific market research firms. We analyze economic indicators, regulatory updates, and technological advancements to provide a comprehensive overview.