Wallstein Holding GmbH & Co. KG Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wallstein Holding GmbH & Co. KG Bundle

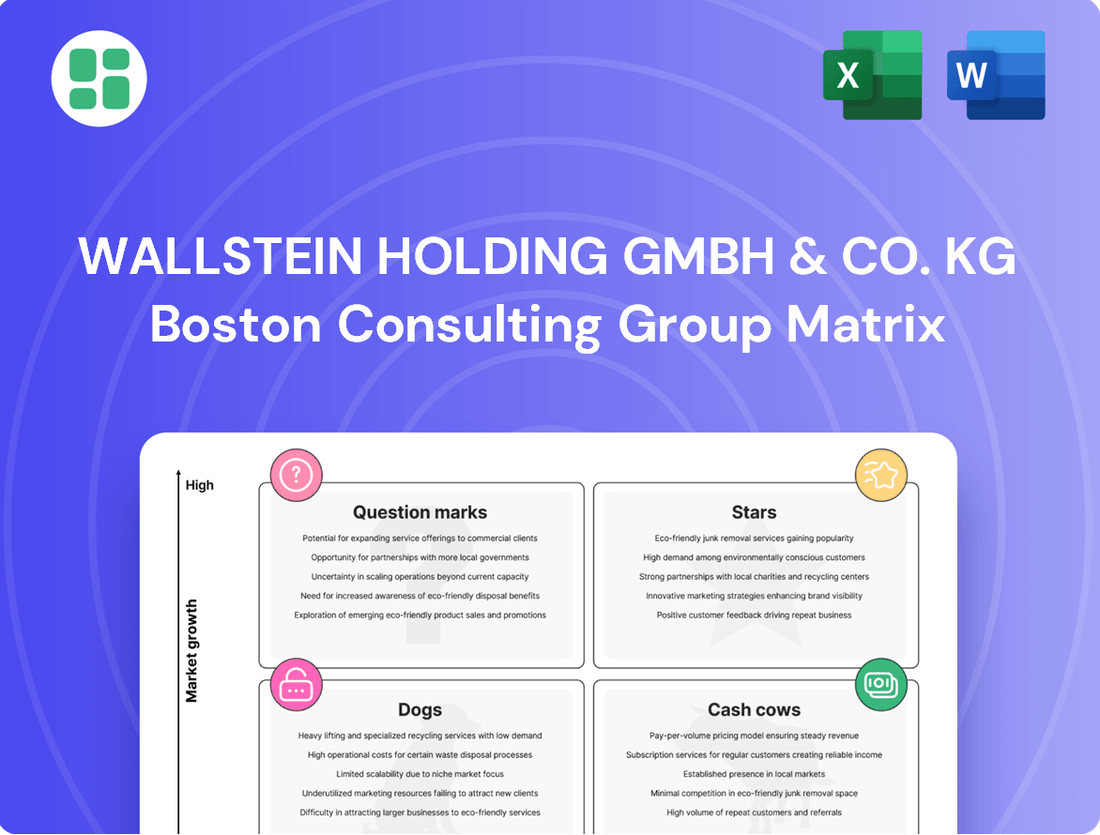

Unlock the strategic potential of Wallstein Holding GmbH & Co. KG's product portfolio with our comprehensive BCG Matrix analysis. Understand which products are driving growth and which require careful consideration to optimize resource allocation.

This preview offers a glimpse into the core of Wallstein's market positioning, highlighting their Stars, Cash Cows, Dogs, and Question Marks. Equip yourself with actionable insights to make informed decisions and secure future success.

Don't miss out on the full picture! Purchase the complete BCG Matrix report to gain in-depth analysis, data-driven strategies, and a clear roadmap for navigating Wallstein's competitive landscape.

Stars

Wallstein's AlWaFlon® heat exchanger systems are a prime example of a question mark in the BCG matrix, exhibiting high growth potential due to their innovative design for flue gas heat recovery below the acid dew point.

These advanced systems maximize energy yield, translating into substantial fuel savings and reduced CO2 emissions, a critical factor in today's sustainability-focused market.

Their superior corrosion protection ensures long-term durability, positioning them as a highly competitive solution amidst increasing environmental regulations and the persistent demand for energy efficiency.

Wallstein's innovative solutions for waste-to-energy plants position them strongly in a high-growth market driven by global environmental concerns. Their advanced flue gas treatment systems are particularly sought after as countries increasingly invest in sustainable waste management. This focus aligns perfectly with circular economy principles, making Wallstein a key player in developing eco-friendly infrastructure.

The company's market position is underscored by significant project wins, including a notable contract for Singapore's Integrated Waste Management Facility, with initial phases expected to be completed by 2025. This success highlights Wallstein's capability to secure and execute large-scale projects in the burgeoning waste-to-energy sector, demonstrating their expertise and reliability in delivering cutting-edge environmental technology.

Wallstein Holding GmbH & Co. KG excels in providing bespoke industrial energy optimization solutions, particularly for power plants and refineries. This specialization places them in a strong position within a market that is increasingly focused on efficiency and sustainability.

The global industrial heat exchanger market, a key area for Wallstein's services, is expected to see robust growth. Projections indicate a significant expansion, fueled by the ongoing need to boost operational efficiency and lower maintenance expenses across various industries.

Wallstein's custom-engineered systems are designed to tackle intricate thermal management issues. By offering tailored solutions, they empower clients to improve their competitive standing through enhanced performance and resource utilization.

Electromobility and Emerging Industrial Applications

Wallstein is actively pursuing electromobility, a sector experiencing rapid growth. Their expertise in heat exchangers is directly applicable to battery cooling systems and thermal management in electric vehicles, positioning them to capture a share of this expanding market. This strategic pivot into emerging industrial applications demonstrates their commitment to innovation and future revenue streams.

The electromobility market is a prime example of a potential 'Star' for Wallstein. Global EV sales continued their upward trajectory in 2024, with projections indicating sustained double-digit growth for the foreseeable future. For instance, the International Energy Agency reported that global electric car sales surpassed 10 million in 2023, and this trend is expected to accelerate. Wallstein's ability to adapt its established technologies to these new demands is crucial.

- Market Growth: The global electric vehicle market is projected to reach over $800 billion by 2025, showcasing substantial expansion opportunities.

- Technological Relevance: Wallstein's core competencies in thermal management are critical for the efficiency and longevity of EV batteries and powertrains.

- Investment Potential: Early investment in these burgeoning segments can lead to significant market share and profitability as the technology matures and adoption rates increase.

- Diversification: Expanding into electromobility diversifies Wallstein's revenue base, reducing reliance on traditional heavy industries.

CO2 Emission Reduction Projects

Wallstein Holding GmbH & Co. KG's commitment to CO2 emission reduction projects, particularly through industrial heat recovery, positions them in a burgeoning global market. This sector is experiencing significant growth, fueled by increasing climate action and more stringent environmental regulations worldwide. For instance, the global industrial heat recovery market was valued at approximately USD 18.5 billion in 2023 and is projected to reach USD 32.7 billion by 2030, exhibiting a compound annual growth rate of around 8.5%.

These initiatives represent a high-growth area where Wallstein's specialized engineering expertise is highly sought after. Their success in securing substantial contracts within this critical environmental sector highlights their robust market standing. In 2024, Wallstein reported a significant increase in orders related to sustainable solutions, contributing to their overall revenue growth.

- Market Growth: The industrial heat recovery market is expanding rapidly due to environmental mandates.

- Demand for Expertise: Wallstein's specialized engineering is crucial for these high-growth projects.

- Contract Wins: Securing major contracts validates their strong position in the environmental sector.

- Financial Impact: Sustainable projects are increasingly contributing to Wallstein's financial performance.

Wallstein's strategic focus on electromobility and industrial heat recovery positions them with strong 'Star' potential within the BCG matrix. These sectors are experiencing significant global growth, driven by sustainability initiatives and technological advancements. The company's established expertise in thermal management directly addresses the critical needs of EV battery cooling and energy efficiency in industrial processes.

The electromobility market, for instance, saw global EV sales exceed 10 million units in 2023, with continued strong growth anticipated through 2024 and beyond. Similarly, the industrial heat recovery market, valued at approximately $18.5 billion in 2023, is projected to expand to $32.7 billion by 2030. Wallstein's proactive engagement in these high-growth segments, evidenced by securing key projects, underscores their potential to capture substantial market share and drive future profitability.

| Segment | Market Growth Driver | Wallstein's Relevance | 2024 Outlook |

|---|---|---|---|

| Electromobility | EV adoption, battery thermal management | Heat exchanger expertise for battery cooling | Continued double-digit sales growth |

| Industrial Heat Recovery | Environmental regulations, energy efficiency | Flue gas heat recovery, CO2 reduction | Projected 8.5% CAGR |

What is included in the product

The Wallstein Holding GmbH & Co. KG BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

The Wallstein Holding GmbH & Co. KG BCG Matrix offers a clear, one-page overview of business units, simplifying strategic decision-making and alleviating the pain of complex portfolio analysis.

Cash Cows

Wallstein's established industrial flue gas treatment services are a prime example of a cash cow within their portfolio. Their decades of experience serving traditional power plants and waste incineration facilities have built a strong, reliable revenue base. These essential services, encompassing everything from initial engineering to ongoing maintenance, are crucial for regulatory compliance, ensuring consistent demand.

The global flue gas treatment market is projected to reach approximately USD 45 billion by 2024, demonstrating its substantial size and continued relevance. Wallstein's deep expertise in this mature sector allows them to capitalize on this steady demand, generating significant and predictable cash flows for the company.

Maintenance and long-term service contracts for Wallstein's heat exchanger and environmental technology systems are a prime example of a Cash Cow. This segment provides a stable, high-margin revenue stream with minimal need for further investment in marketing or development.

The recurring nature of these service agreements ensures predictable cash flow for Wallstein. Customer loyalty is high, as these contracts are essential for the ongoing optimal performance of their installed systems, creating a consistent and reliable income base.

Wallstein's established range of gas-water heat exchangers, particularly those in tube bundle design for industrial flue and process gas below 300 °C, are strong contenders as cash cows. These are widely utilized in power plants and waste incineration facilities.

With more than 250 successful references and decades of operational experience, Wallstein has secured a significant market share within this mature segment. This strong market position translates into reliable profit generation with relatively low requirements for new investment, a hallmark of cash cow businesses.

For instance, the global power plant market, a key sector for these heat exchangers, saw significant activity in 2024 with new capacity additions and upgrades. While specific revenue figures for this product line are proprietary, the consistent demand in established industrial sectors supports their cash cow status.

Solutions for Traditional Waste Incineration Plants

Wallstein's established business providing environmental technology solutions for traditional waste incineration plants falls into the Cash Cows category. This segment benefits from consistent demand due to ongoing regulatory requirements for emission control in existing facilities, a market where Wallstein has likely secured a strong position.

Their proven technologies and services in managing emissions generate stable and predictable cash flows. For instance, the European waste-to-energy market, while mature, continues to see investment in upgrading existing plants to meet stricter environmental standards. In 2024, the global waste-to-energy market was valued at approximately USD 45 billion, with a significant portion attributed to the operational and maintenance services for existing infrastructure.

- Mature Market Presence: Wallstein's long-standing expertise in environmental solutions for traditional incineration plants positions them as a leader in a stable, albeit mature, market segment.

- Consistent Revenue Streams: The ongoing need for emission control and plant upgrades ensures a steady demand for their proven technologies and services, contributing to reliable cash flow generation.

- Regulatory Driven Demand: Stricter environmental regulations across Europe and globally continue to drive demand for retrofitting and maintaining existing waste incineration facilities.

- Strong Market Share: Wallstein's established reputation and deep technical knowledge likely translate into a significant market share within this specific niche, solidifying its Cash Cow status.

Retrofit and Optimization Projects for Existing Infrastructure

Retrofit and optimization projects for existing infrastructure represent a solid Cash Cow for Wallstein Holding GmbH & Co. KG. These services focus on enhancing energy efficiency and lowering emissions in industrial facilities, generating a consistent revenue stream.

The demand for these upgrades is sustained because many older plants need modernization to comply with new environmental regulations and to boost operational performance. This continuous need leverages Wallstein's specialized engineering expertise without requiring entry into entirely new market segments.

- Stable Revenue: Projects focused on retrofitting and optimizing existing industrial infrastructure provide a reliable income source.

- Ongoing Demand: Older plants frequently require upgrades to meet evolving environmental standards and improve efficiency, ensuring continuous business.

- Leveraging Expertise: Wallstein's specialized engineering capabilities are well-suited to address these ongoing needs, reinforcing its market position.

- Market Maturity: This segment benefits from a mature market where existing infrastructure necessitates ongoing improvements, rather than relying on rapid growth from new markets.

Wallstein's established flue gas treatment services, particularly for traditional power plants and waste incineration, are strong cash cows. These mature markets offer consistent demand driven by regulatory compliance and the need for ongoing maintenance. The company's decades of experience and proven technologies in this sector generate predictable, high-margin revenue with minimal reinvestment.

The global flue gas treatment market was valued at approximately USD 45 billion in 2024, highlighting the sustained demand in this sector. Wallstein's significant market share, built on a foundation of over 250 successful references in areas like heat exchangers and environmental technology, ensures a steady flow of income. These services, often secured through long-term maintenance contracts, represent a stable and profitable segment for the company.

Retrofit and optimization projects for existing industrial facilities also function as cash cows for Wallstein. These services address the ongoing need for plants to meet stricter environmental regulations and improve operational efficiency. By leveraging their specialized engineering expertise in a mature market, Wallstein secures consistent business without the high risk associated with entering new growth areas.

| Business Segment | BCG Category | Key Characteristics | Market Data (2024) | Wallstein's Position |

| Industrial Flue Gas Treatment | Cash Cow | Mature market, regulatory driven demand, high maintenance revenue | Global market ~USD 45 billion | Strong market share, extensive experience |

| Heat Exchanger & Environmental Tech Services | Cash Cow | Recurring revenue from long-term contracts, high customer loyalty | N/A (Specific service revenue) | Established player, proven technology |

| Retrofit & Optimization Projects | Cash Cow | Demand for upgrades, efficiency improvements, regulatory compliance | N/A (Specific project revenue) | Leverages specialized engineering expertise |

Delivered as Shown

Wallstein Holding GmbH & Co. KG BCG Matrix

The BCG Matrix for Wallstein Holding GmbH & Co. KG that you are previewing is the definitive document you will receive upon purchase, offering a complete and unwatermarked strategic analysis. This comprehensive report has been meticulously prepared by industry experts, ensuring it is ready for immediate integration into your business planning and decision-making processes without any need for further editing or revision. You can confidently use this preview as a direct representation of the high-quality, actionable insights contained within the final downloadable file.

Dogs

Older heat exchanger designs or environmental control systems that fall short of current stringent regulations and energy efficiency standards would be classified as dogs within the Wallstein Holding GmbH & Co. KG BCG Matrix. These legacy products likely hold a small market share in segments experiencing low or negative growth, contributing little profit and potentially consuming valuable resources. For instance, if a specific older model heat exchanger saw a 5% year-over-year decline in orders in 2024, it would exemplify this category.

Highly niche or outdated Flue Gas Desulfurization (FGD) technologies within Wallstein Holding GmbH & Co. KG's portfolio would likely be categorized as Dogs in the BCG Matrix. These might include older wet scrubbing systems with lower sulfur dioxide (SO2) removal efficiencies compared to modern dry sorbent injection or advanced wet scrubbers.

If Wallstein continues to operate or support these legacy systems, particularly in markets where environmental regulations have tightened and newer, more effective technologies are prevalent, they would likely exhibit low market share and low growth. For instance, if a specific older FGD unit has a market share of less than 5% in its niche segment and that segment is projected to shrink by 2% annually due to the adoption of cleaner technologies, it fits the Dog profile.

Geographical markets with stagnant industrial activity and intense local competition, where Wallstein Holding GmbH & Co. KG lacks a distinct competitive advantage, can be classified as 'dogs' in the BCG Matrix. These segments offer limited growth potential and a low market share, hindering profitability. For instance, if Wallstein operates in a European region with declining manufacturing output, say a 2% annual contraction observed in industrial production data for 2024, and faces established local players with lower cost structures, the outlook for these units would be bleak.

Services for Industries Facing Significant Long-Term Decline

Wallstein Holding GmbH & Co. KG might have service offerings catering to industries experiencing irreversible long-term decline. If these legacy services lack new applications and their primary client base, such as certain fossil fuel-based power plants, undergoes a significant shift away from these technologies, these offerings could be classified as dogs in the BCG matrix.

For instance, services specifically tied to the maintenance or component supply for older, less efficient coal-fired power plants could fall into this category. As global energy policies increasingly favor renewable sources and cleaner technologies, the demand for such specialized services naturally diminishes.

- Legacy Power Plant Services: Specialized maintenance, repair, or component supply for older fossil fuel power plants, particularly those facing decommissioning or reduced operational capacity due to environmental regulations or market shifts.

- Impact of Energy Transition: The ongoing global energy transition away from coal and to a lesser extent, natural gas, directly impacts the long-term viability of services solely focused on these legacy infrastructure types.

- Market Data Context: In 2024, the International Energy Agency (IEA) reported a continued decline in coal power generation in many developed economies, signaling a shrinking market for related services.

Undifferentiated Standard Component Sales

Undifferentiated standard component sales represent a potential 'dog' quadrant for Wallstein Holding GmbH & Co. KG within the BCG Matrix. This segment involves selling highly commoditized parts where the company's unique engineering expertise or customized solutions are not a differentiating factor. Consequently, these sales are likely to encounter significant price competition, leading to lower profit margins.

In 2024, the market for standard industrial components experienced continued pressure on pricing due to oversupply in certain sectors and the rise of low-cost manufacturers. For Wallstein, sales in this category would likely contribute minimally to overall growth and profitability when contrasted with their more specialized and engineered system offerings. For instance, if a significant portion of their revenue in 2024 came from basic fasteners or generic metal stampings without added value, this would be a prime example of an undifferentiated standard component sale.

- Low Margins: Standard components often yield gross profit margins below 15% in competitive markets.

- Intense Price Competition: In 2024, many commodity markets saw price wars, eroding profitability for suppliers.

- Limited Differentiation: These products lack unique features that would command premium pricing.

- Low Growth Potential: The market for undifferentiated components typically grows at or below GDP rates.

Products or services that are outdated and no longer meet current market demands or regulatory standards are classified as dogs. These offerings typically have a low market share in slow-growing or declining sectors, generating minimal profit and potentially draining resources. For example, if Wallstein Holding GmbH & Co. KG's sales of a specific legacy component saw a 7% decrease in 2024 due to obsolescence, it would fit this profile.

Highly specialized, niche services that cater to industries facing significant contraction, such as those solely supporting older, less efficient industrial processes, can be considered dogs. These services lack broad applicability and are vulnerable to technological advancements and shifting market preferences. For instance, if a service package for a particular type of outdated industrial machinery experienced a 10% drop in demand in 2024, it would be a clear indicator.

Commoditized product lines where Wallstein Holding GmbH & Co. KG cannot leverage its core engineering strengths face intense price competition and low margins, thus falling into the dog category. These products offer little differentiation, making them susceptible to market saturation and the influx of lower-cost alternatives. A scenario where sales of standard, non-customized parts accounted for only 3% of Wallstein's 2024 revenue, with minimal profit contribution, exemplifies this.

Geographic regions experiencing economic stagnation and intense local competition, where Wallstein Holding GmbH & Co. KG lacks a competitive edge, can also be categorized as dogs. These markets offer limited growth prospects and a minimal market share, hindering profitability. If Wallstein's presence in a specific declining industrial hub saw its market share drop to below 4% in 2024, with the sector itself contracting by 3% annually, it would represent a dog segment.

Question Marks

Wallstein's exploration into Carbon Capture and Storage (CCS) integration, leveraging their flue gas and environmental technology, positions them in a market characterized by significant growth potential due to global climate change initiatives. The CCS sector, while rapidly expanding, is still in its nascent stages for many providers, meaning Wallstein's current market share is likely minimal, necessitating considerable upfront investment to establish a foothold.

Wallstein's expansion into emerging renewable energy sectors like green hydrogen production and advanced geothermal systems would place these ventures firmly in the question mark category of the BCG matrix. These markets exhibit substantial growth potential, with the global green hydrogen market projected to reach USD 150 billion by 2030, according to some industry forecasts.

However, Wallstein's current market share in these nascent fields is likely minimal, necessitating considerable investment in research and development and aggressive market penetration strategies to establish a foothold. For instance, the initial capital expenditure for green hydrogen production facilities can be substantial, requiring innovative financing and technological advancements.

Wallstein's foray into advanced digitalization and IoT integration for its heat exchangers and environmental tech positions it within a burgeoning market. While the potential for smart monitoring, predictive maintenance, and AI optimization is substantial, Wallstein's current market penetration in this niche technological area may be limited, suggesting a potential "Question Mark" in the BCG Matrix.

Significant investment in developing and marketing these digital solutions is crucial. For instance, the global industrial IoT market was valued at approximately $214 billion in 2023 and is projected to grow substantially. Capturing even a small fraction of this growth by enhancing their offerings with remote diagnostics and performance analytics could propel these solutions to become future stars.

Expansion into New Geographic Markets with High Environmental Regulations

Expanding into new geographic markets with stringent environmental regulations and robust industrial growth, where Wallstein currently has a minimal footprint, presents a classic question mark scenario. These regions, such as parts of Southeast Asia experiencing a surge in manufacturing and a corresponding push for greener practices, offer substantial growth prospects for Wallstein's environmental and energy solutions. For instance, in 2024, several countries in this region introduced stricter emissions standards for industrial facilities, creating a demand for advanced pollution control and energy efficiency technologies.

However, the significant upfront investment required for market entry, coupled with the necessity for tailored, market-specific strategies to navigate local business landscapes and regulatory frameworks, introduces considerable uncertainty. Wallstein would need to allocate substantial capital for research and development of region-specific solutions and establish strong local partnerships. Failure to adapt to these unique market dynamics could hinder the company's ability to capture market share, despite the inherent growth potential.

- High Growth Potential: Emerging economies in 2024 are increasingly prioritizing environmental sustainability, creating a burgeoning market for green technologies.

- Substantial Investment Required: Entering these markets necessitates significant capital expenditure for compliance, localization, and market penetration strategies.

- Regulatory Complexity: Navigating diverse and evolving environmental regulations across different geographies demands specialized expertise and adaptable business models.

- Competitive Landscape: Established local players and other international firms may already have a foothold, requiring Wallstein to differentiate its offerings effectively.

Developing Solutions for New or Niche Pharmaceutical Applications

Wallstein Holding GmbH & Co. KG's 'Pharma technology' products, including laminar flow hoods, sterilization tunnels, and isolators, might be categorized as question marks within their BCG matrix. This classification stems from the potential for these offerings to represent a newer or less dominant segment when compared to Wallstein's established industrial operations. While the pharmaceutical industry itself is experiencing robust growth, the market share Wallstein currently holds in these specialized pharmaceutical technology lines would likely necessitate substantial investment to elevate them to star status.

The global pharmaceutical market was valued at approximately USD 1.42 trillion in 2023 and is projected to reach USD 2.25 trillion by 2030, demonstrating significant expansion potential. For Wallstein, this presents an opportunity, but also highlights the challenge of carving out a larger presence in this competitive landscape. Their existing infrastructure and expertise in industrial technology could provide a foundation, but dedicated R&D and market penetration strategies are crucial for these pharma-focused solutions.

- Market Share Growth: Wallstein's pharmaceutical technology segment requires strategic investment to increase its market share from its current position, aiming to transition from a question mark to a star.

- Industry Growth Trajectory: The pharmaceutical sector's expansion provides a favorable backdrop for Wallstein to develop and market its specialized products effectively.

- Investment Requirement: Significant capital infusion is anticipated to be necessary for research, development, sales, and marketing efforts to bolster the performance of these niche applications.

- Competitive Landscape: Wallstein must navigate a competitive market by differentiating its offerings and building brand recognition within the pharmaceutical technology space.

Wallstein's ventures into areas like Carbon Capture and Storage (CCS) and green hydrogen production are classic "Question Marks." These sectors boast high growth potential, driven by global decarbonization efforts, with the green hydrogen market alone anticipated to reach $150 billion by 2030. However, Wallstein's market share in these nascent fields is likely minimal, demanding substantial investment in R&D and aggressive market penetration to gain traction.

Similarly, their expansion into advanced digitalization for industrial equipment, tapping into the industrial IoT market valued at around $214 billion in 2023, also falls into the Question Mark category. While the potential for smart monitoring and AI optimization is immense, Wallstein's current penetration in this tech-focused niche requires significant capital for development and marketing to capitalize on this growth.

Wallstein's pharmaceutical technology products, including laminar flow hoods and sterilization tunnels, also represent Question Marks. Despite the pharmaceutical market's robust growth, projected to hit $2.25 trillion by 2030, Wallstein's market share in these specialized areas is likely small. Substantial investment in R&D, sales, and marketing is essential to elevate these offerings from their current position and compete effectively.

| Business Area | BCG Category | Market Growth | Market Share | Investment Needs |

|---|---|---|---|---|

| Carbon Capture and Storage (CCS) | Question Mark | High | Low | High |

| Green Hydrogen Production | Question Mark | High | Low | High |

| Digitalization/IoT for Industrial Equipment | Question Mark | High | Low | High |

| Pharmaceutical Technology | Question Mark | High | Low | High |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.