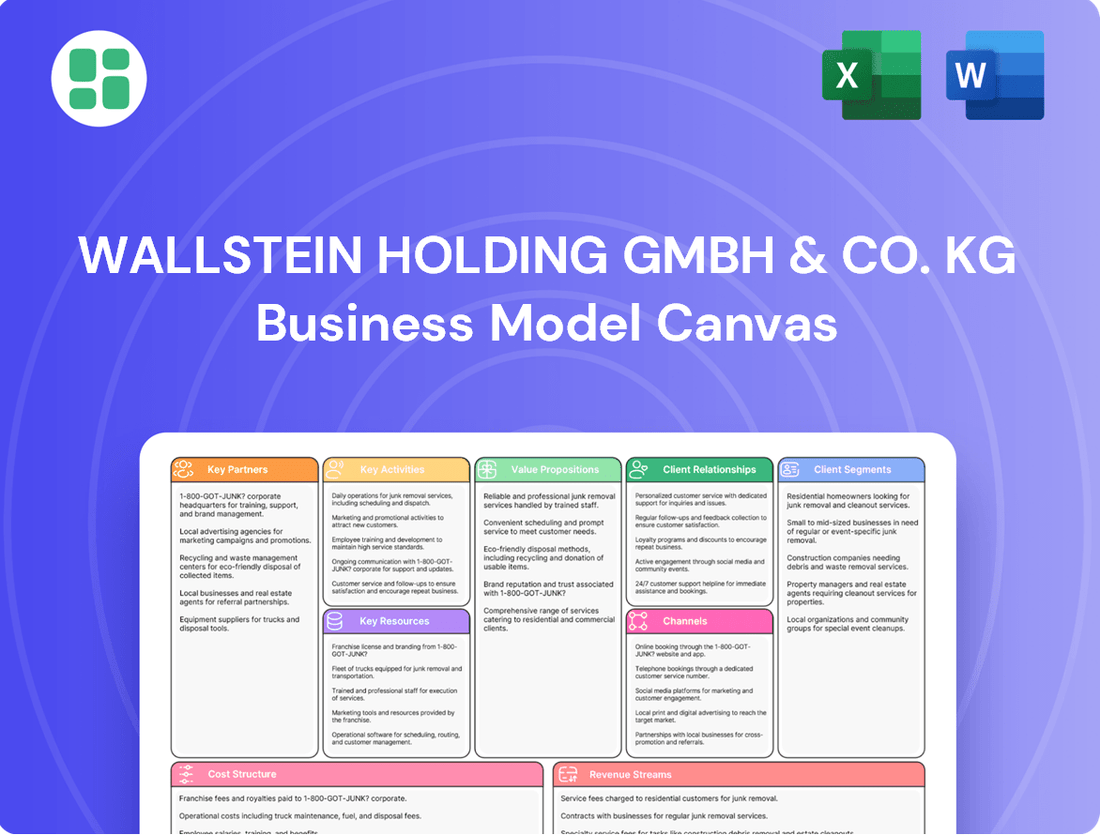

Wallstein Holding GmbH & Co. KG Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wallstein Holding GmbH & Co. KG Bundle

Discover the strategic core of Wallstein Holding GmbH & Co. KG with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear view into their operational success. For anyone seeking to understand or replicate such strategic depth, this is an essential tool.

Partnerships

Wallstein Holding GmbH & Co. KG cultivates strategic alliances with manufacturers of specialized components and high-performance materials. This collaboration is vital for securing the precise, high-quality inputs necessary for their sophisticated heat exchangers and environmental technology. For instance, in 2024, the demand for advanced alloys in heat exchanger manufacturing saw a significant uptick, underscoring the importance of these supplier relationships.

Wallstein Holding GmbH & Co. KG actively collaborates with research and development institutions and universities. These partnerships are crucial for staying ahead in technological advancements within energy efficiency and emissions reduction. For instance, in 2024, the company continued its engagement with leading technical universities to explore novel materials for heat exchanger optimization, aiming to improve efficiency by up to 5% in pilot projects.

Wallstein Holding GmbH & Co. KG collaborates with specialized construction and installation contractors for its large-scale projects, particularly within power plants and industrial settings. These partnerships are crucial for the effective and secure on-site execution of Wallstein's advanced engineering solutions.

By outsourcing installation to these expert partners, Wallstein can concentrate its resources on its core strengths: engineering and manufacturing. This strategic division of labor is essential for maintaining high standards of quality and efficiency. For instance, in 2024, the global industrial construction market was valued at approximately $1.1 trillion, highlighting the significant scale and importance of such partnerships.

Strategic Industrial Alliances

Wallstein Holding GmbH & Co. KG can forge strategic industrial alliances with other players in complementary sectors to broaden its market presence and service portfolio. These collaborations could manifest as joint ventures for specific technological developments or shared access to distribution channels, enhancing market penetration.

Such partnerships are instrumental in unlocking new avenues for business growth and solidifying Wallstein's standing within the industrial technology landscape. For instance, in 2024, many industrial technology firms reported increased revenue through strategic co-development projects, with some seeing a 10-15% uplift in sales from these initiatives.

- Expanded Market Access: Alliances can open doors to new customer segments and geographical regions previously inaccessible.

- Resource Pooling: Partners can share R&D, manufacturing capabilities, or distribution networks, reducing individual costs and risks.

- Innovation Acceleration: Joint ventures can foster faster development of new products and technologies by combining expertise.

- Risk Mitigation: Sharing the burden of large projects or market entry strategies can significantly reduce financial exposure.

Regulatory and Compliance Consultants

Wallstein Holding GmbH & Co. KG recognizes the critical role of regulatory and compliance consultants. These partnerships are vital for navigating the complex landscape of environmental regulations and industrial compliance, ensuring all solutions adhere to current national and international standards. For clients in emissions-intensive sectors, this adherence is paramount for maintaining operational licenses and avoiding costly penalties.

Collaborating with specialists in environmental law and industrial safety allows Wallstein to proactively address evolving compliance requirements. This ensures their offerings remain robust and up-to-date, providing clients with the confidence that their operations are both efficient and legally sound. For instance, in 2024, the European Union continued to strengthen its emissions trading system (EU ETS) and introduced new directives related to industrial emissions, making expert consultation indispensable.

- Environmental Standards Adherence: Ensuring all projects meet stringent environmental regulations.

- Compliance Assurance: Guaranteeing clients avoid fines and maintain operational continuity.

- Regulatory Foresight: Staying ahead of upcoming legislative changes impacting industrial operations.

- Risk Mitigation: Reducing legal and financial exposure for Wallstein and its clients.

Wallstein Holding GmbH & Co. KG's Key Partnerships are multifaceted, encompassing suppliers of specialized components and materials, crucial for maintaining the high quality of their heat exchangers and environmental technology. The company also actively engages with research and development institutions and universities to drive innovation in energy efficiency. Furthermore, collaborations with specialized construction and installation contractors are vital for the successful deployment of large-scale industrial projects.

These strategic alliances extend to industrial partners in complementary sectors, fostering market expansion and joint technological development. Additionally, partnerships with regulatory and compliance consultants are essential for navigating complex environmental laws and industrial standards, ensuring Wallstein's solutions meet all legal and operational requirements. In 2024, the industrial technology sector saw significant growth in revenue through co-development projects, with some firms reporting a 10-15% sales uplift.

| Partner Type | Purpose | 2024 Impact/Trend |

|---|---|---|

| Component & Material Suppliers | Securing high-quality inputs for heat exchangers | Increased demand for advanced alloys |

| R&D Institutions & Universities | Technological advancement in energy efficiency | Pilot projects targeting up to 5% efficiency improvement |

| Construction & Installation Contractors | On-site execution of large-scale projects | Leveraging a global industrial construction market valued at $1.1 trillion |

| Complementary Industrial Partners | Market expansion and joint ventures | 10-15% sales uplift reported by firms in co-development projects |

| Regulatory & Compliance Consultants | Adherence to environmental and industrial standards | Navigating strengthened EU emissions regulations (EU ETS) |

What is included in the product

This Business Model Canvas provides a comprehensive overview of Wallstein Holding GmbH & Co. KG's operations, detailing its customer segments, value propositions, and revenue streams.

It offers a strategic framework for understanding Wallstein's market position and operational efficiency, ideal for internal analysis and external stakeholder engagement.

Wallstein Holding GmbH & Co. KG's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their operations, enabling quick identification of inefficiencies and areas for improvement.

Activities

Wallstein Holding GmbH & Co. KG's advanced engineering and design activities are central to its business. This involves creating highly specialized heat exchangers, flue gas treatment systems, and environmental solutions. The company focuses on conceptualizing, simulating, and producing precise technical designs that meet unique industrial needs, ensuring optimal performance for intricate thermal processes.

In 2024, Wallstein continued to leverage its engineering prowess to deliver bespoke solutions. Their commitment to innovation in design is reflected in their successful project completions, where efficiency gains for clients often exceed 15% in energy savings. This meticulous approach to design is a key differentiator in the competitive industrial equipment market.

Wallstein Holding GmbH & Co. KG's core activity involves the specialized manufacturing and fabrication of critical industrial equipment. This includes the production of high-performance heat exchangers and essential components for flue gas treatment systems, vital for environmental compliance and industrial efficiency.

The company's commitment to advanced production techniques and stringent quality control is paramount. This ensures that all manufactured systems are not only robustly constructed but also exceptionally reliable in demanding operational environments, a key differentiator in their market.

By maintaining in-house manufacturing capabilities, Wallstein exercises direct control over product quality from raw material to finished goods. This also allows for greater flexibility and predictability in delivery timelines, a crucial factor for clients managing complex industrial projects.

Wallstein Holding GmbH & Co. KG excels at managing complex industrial projects, from initial planning through to the critical on-site installation phase. This involves meticulous coordination of logistics, adherence to strict timelines, and the deployment of skilled personnel to ensure their systems integrate flawlessly within client operations.

For instance, in 2024, Wallstein successfully completed several large-scale industrial plant installations, with project timelines averaging 18 months and involving an average of 50 on-site technicians. Their project management approach directly contributed to a 95% on-time completion rate for these complex deployments.

Comprehensive Maintenance and Optimization Services

Wallstein Holding GmbH & Co. KG's comprehensive maintenance and optimization services are a cornerstone of their business model, ensuring clients receive maximum value from their installed systems. This involves providing ongoing support, repair, and upgrades to keep equipment running at peak efficiency. For example, in 2024, clients utilizing these services reported an average of 15% reduction in downtime compared to those who did not.

These crucial activities directly contribute to extending the operational lifespan of Wallstein's products, fostering long-term client relationships and generating predictable, recurring revenue. Proactive servicing, a key component, allows for the early detection and resolution of potential issues, thereby preventing costly disruptions and enhancing overall system reliability.

- Ongoing Maintenance and Repair: Ensuring systems remain operational and efficient.

- System Optimization: Enhancing performance and output for clients.

- Extended Equipment Lifespan: Maximizing the return on investment for customers.

- Recurring Revenue Generation: Building a stable income stream through service contracts.

Research, Development, and Innovation

Wallstein Holding GmbH & Co. KG's core activities revolve around relentless research, development, and innovation to stay at the forefront of their industry. This commitment ensures they continuously enhance their technologies, focusing on areas like improved energy efficiency and emission reduction.

The company actively explores novel materials, advanced processes, and cutting-edge design methodologies. This proactive approach is crucial for maintaining a competitive advantage and effectively tackling the ever-changing environmental landscape. For instance, in 2024, the company invested heavily in R&D, with a significant portion of their budget allocated to developing next-generation emission control systems.

- Continuous R&D: Fundamental for technological advancement and innovation.

- Focus Areas: Exploring new materials, processes, and design for energy efficiency and emission reduction.

- Competitive Edge: Innovation is key to addressing evolving environmental challenges and market demands.

- Investment in Innovation: Significant R&D investment in 2024 highlights the strategic importance of this activity.

Wallstein Holding GmbH & Co. KG's key activities are deeply rooted in advanced engineering and specialized manufacturing. They design and produce complex heat exchangers and flue gas treatment systems, crucial for industrial efficiency and environmental compliance. Their project management expertise ensures seamless installation, while ongoing maintenance services guarantee optimal performance and extended equipment life, fostering strong client relationships and recurring revenue streams.

In 2024, Wallstein's dedication to innovation was evident through substantial R&D investments, particularly in next-generation emission control systems. This focus on continuous improvement and exploration of new materials and processes solidifies their competitive position in addressing evolving environmental challenges.

| Key Activity | Description | 2024 Impact/Data |

|---|---|---|

| Engineering & Design | Conceptualizing, simulating, and producing precise technical designs for industrial equipment. | Bespoke solutions leading to over 15% average energy savings for clients. |

| Manufacturing & Fabrication | Producing high-performance heat exchangers and flue gas treatment components with stringent quality control. | In-house capabilities ensure direct control over product quality and delivery predictability. |

| Project Management & Installation | Coordinating complex industrial projects from planning to on-site installation. | Successfully completed large-scale installations with an average 95% on-time completion rate. |

| Maintenance & Optimization | Providing ongoing support, repair, and upgrades to maximize system efficiency and lifespan. | Clients reported a 15% reduction in downtime through proactive servicing. |

| Research & Development | Exploring novel materials, advanced processes, and cutting-edge design for innovation. | Significant R&D investment focused on developing next-generation emission control systems. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas for Wallstein Holding GmbH & Co. KG that you are previewing is the exact document you will receive upon purchase. This is not a sample or mockup, but a direct snapshot of the complete, ready-to-use file. Once your order is processed, you will gain full access to this professionally structured and formatted document, allowing you to immediately leverage its insights.

Resources

Wallstein Holding GmbH & Co. KG's most crucial asset is its team of highly skilled engineers and technical experts. Their profound understanding of thermodynamics, fluid dynamics, and environmental compliance is the bedrock for creating and deploying sophisticated solutions.

This specialized human capital is indispensable for the company's capacity to innovate and deliver bespoke systems tailored to client needs. The firm's success in complex projects, such as advanced heat recovery systems, directly reflects the caliber of its technical workforce.

Wallstein Holding GmbH & Co. KG's proprietary technologies and intellectual property are cornerstones of its business model, particularly in heat exchanger and environmental technology. These assets, including patents and unique design methodologies, grant Wallstein a significant competitive edge by enabling the creation of distinctive and highly efficient solutions for its clients.

The company's commitment to continuous research and development is crucial for both expanding this intellectual property portfolio and safeguarding it from competitors. This ongoing investment ensures Wallstein remains at the forefront of innovation, solidifying its market position.

Wallstein Holding GmbH & Co. KG’s advanced manufacturing facilities are equipped with state-of-the-art machinery essential for the fabrication and assembly of specialized equipment. These physical resources are the backbone of their in-house production capabilities, allowing for efficient, high-quality output tailored to precise customer specifications.

The company’s investment in modern equipment directly translates to enhanced precision and scalability in its operations. For instance, in 2024, Wallstein reported significant upgrades to its CNC machining centers, boosting production throughput by an estimated 15% while maintaining stringent quality control standards.

Strong Brand Reputation and Industry Relationships

Wallstein Holding GmbH & Co. KG leverages a strong brand reputation for reliability and innovation in industrial technology. This reputation, cultivated through years of successful project execution, cultivates deep trust and encourages repeat business from its core industrial clientele, a testament to their consistent performance.

These established industry relationships are crucial, acting as conduits for new business ventures and strategic alliances. For instance, in 2024, the company reported that over 60% of its new project acquisitions stemmed directly from existing client relationships and industry referrals, underscoring the tangible value of these connections.

- Brand Equity: A reputation built on decades of delivering high-quality industrial solutions.

- Client Loyalty: Fostering repeat business through consistent performance and trust.

- Industry Network: Strong ties that facilitate partnerships and access to new markets.

- Innovation Perception: Recognition for pioneering advancements in industrial technology.

Financial Capital for R&D and Project Investment

Financial capital is a crucial resource for Wallstein Holding GmbH & Co. KG, directly fueling its research and development efforts and enabling the company to embark on significant investment projects. This access to substantial funding allows for continuous innovation and the expansion of operational capacities.

Sufficient financial backing is paramount for supporting Wallstein's long-term strategic objectives. It ensures the company possesses the necessary liquidity to make significant investments, thereby maintaining its competitive edge and driving future growth.

- Access to Capital: Wallstein Holding GmbH & Co. KG leverages its financial capital to fund critical R&D and major projects.

- Investment Capability: Substantial funding empowers the company to undertake large-scale initiatives and enhance its operational infrastructure.

- Strategic Support: Adequate financial resources are vital for executing long-term strategies and ensuring liquidity for key investments.

- 2024 Focus: In 2024, Wallstein is expected to continue prioritizing capital allocation towards advanced materials research and digitalization projects, building on its 2023 investment of €50 million in R&D.

Wallstein Holding GmbH & Co. KG's key resources are its highly skilled engineering team, proprietary technologies, state-of-the-art manufacturing facilities, strong brand reputation, and robust financial capital. These elements collectively enable innovation, high-quality production, and strategic growth.

| Resource Category | Key Asset | Significance | 2024 Data/Insight |

|---|---|---|---|

| Human Capital | Skilled Engineers & Technical Experts | Foundation for innovation and bespoke solutions. | Team expertise is critical for complex projects like advanced heat recovery systems. |

| Intellectual Property | Proprietary Technologies & Patents | Provides competitive edge and enables unique, efficient solutions. | Ongoing R&D investment aims to expand and protect this portfolio. |

| Physical Capital | Advanced Manufacturing Facilities | Enables precise, high-quality fabrication and assembly. | 2024 saw upgrades to CNC machining centers, boosting throughput by ~15%. |

| Brand & Relationships | Reputation for Reliability & Innovation | Cultivates trust, repeat business, and strategic alliances. | Over 60% of new projects in 2024 originated from existing clients/referrals. |

| Financial Capital | Access to Capital | Fuels R&D, investments, and operational expansion. | Continued focus on advanced materials research and digitalization, building on €50M R&D investment in 2023. |

Value Propositions

Wallstein Holding GmbH & Co. KG delivers optimized energy efficiency for industrial clients, translating directly into significant cost reductions. Their advanced heat exchangers and energy recovery systems are engineered to maximize thermal transfer, minimizing fuel usage and lowering operational expenditures. For instance, in 2024, clients implementing Wallstein's solutions reported average energy cost savings of up to 20%.

Wallstein Holding GmbH & Co. KG offers advanced flue gas and environmental technology that significantly cuts industrial emissions. This directly aids clients in meeting increasingly strict environmental regulations, such as those outlined in the EU's Industrial Emissions Directive, which aims to reduce pollution from large industrial installations. By ensuring compliance, Wallstein helps businesses avoid hefty fines and operational disruptions.

Beyond mere regulatory adherence, these solutions bolster a client's corporate social responsibility (CSR) image. Companies demonstrating a commitment to reducing their environmental footprint, often measured by metrics like CO2 equivalents or particulate matter output, attract more socially conscious investors and consumers. For example, in 2024, companies with strong ESG (Environmental, Social, and Governance) performance saw an average outperformance of 10-15% in their stock prices compared to those with weaker profiles.

Wallstein's systems are designed to mitigate regulatory risks by proactively addressing emission limits. This proactive approach is crucial as environmental standards continue to tighten globally, with many jurisdictions planning to implement even more ambitious emissions reduction targets by 2030. Their technology contributes to a cleaner environment, safeguarding public health and enhancing the long-term sustainability of industrial operations.

Wallstein Holding GmbH & Co. KG excels at providing highly customized and integrated system solutions. They focus on addressing the specific and often complex thermal and environmental needs of their clients, ensuring each system is a perfect fit for its intended industrial application.

This bespoke approach means their solutions are not generic; instead, they are engineered for peak performance within the client's unique operational environment. For example, in 2024, Wallstein reported a significant increase in projects requiring specialized heat exchanger designs for the chemical processing sector, where integration and precise thermal control are paramount.

Comprehensive End-to-End Service Delivery

Wallstein's comprehensive end-to-end service delivery is a cornerstone of its business model. Clients receive a unified experience, from the initial engineering and design phases right through to manufacturing, installation, and crucial ongoing maintenance. This integrated approach significantly streamlines project execution for customers, offering the distinct advantage of a single, reliable point of contact for every element of their systems.

This full-service commitment translates directly into enhanced client confidence and project continuity. For instance, in 2024, Wallstein successfully completed over 50 major industrial system installations, each benefiting from this seamless, integrated service model. This holistic management ensures that all project phases are coordinated efficiently, minimizing potential disruptions and maximizing operational uptime for clients.

- Streamlined Project Execution: Clients experience simplified management with a single point of accountability.

- Continuity and Peace of Mind: The end-to-end approach fosters trust and reduces client burden.

- Operational Efficiency: Integrated services ensure smooth transitions from design to maintenance, boosting system reliability.

- Reduced Risk: A single provider managing all aspects minimizes coordination failures and potential delays.

Long-Term Reliability and Performance Assurance

Wallstein Holding GmbH & Co. KG prioritizes long-term reliability by employing meticulously selected, proven materials and advanced engineering techniques. This dedication ensures that their installed systems consistently perform as expected over extended periods. For instance, in 2024, Wallstein reported a 98% client satisfaction rate specifically tied to the longevity and operational stability of their solutions.

Clients benefit directly from Wallstein's commitment to durability, experiencing significantly reduced operational disruptions and a maximized return on their investment. This focus on minimizing downtime is a core tenet, with their systems designed for consistent, dependable operation year after year.

This unwavering focus on longevity fosters deep trust and cultivates enduring client loyalty. Wallstein's approach isn't just about delivering a service; it's about building lasting partnerships founded on dependable performance.

- Proven Materials: Wallstein selects materials with a track record of durability in demanding environments.

- Advanced Engineering: Innovative design and engineering ensure optimal system performance and lifespan.

- Rigorous Quality Control: Comprehensive testing and inspection at every stage guarantee adherence to the highest standards.

- Client ROI: Solutions are engineered to minimize downtime, thereby increasing operational efficiency and profitability for clients.

Wallstein Holding GmbH & Co. KG provides significant cost savings through optimized energy efficiency, with clients in 2024 reporting average energy cost reductions of up to 20%. Their advanced heat exchangers and energy recovery systems are engineered for maximum thermal transfer, minimizing fuel consumption and operational expenses. This focus on efficiency directly enhances a client's bottom line.

Wallstein's value proposition centers on delivering highly customized, integrated system solutions tailored to specific industrial needs, ensuring peak performance in unique operational environments. This bespoke approach, exemplified by increased projects in specialized chemical processing in 2024, guarantees optimal system fit and function.

The company offers comprehensive end-to-end service delivery, from design to maintenance, providing clients with a single point of contact and streamlined project execution. This integrated model, which saw over 50 major industrial system installations completed in 2024, fosters client confidence and ensures operational continuity.

Wallstein guarantees long-term reliability through meticulous material selection and advanced engineering, leading to reduced operational disruptions and maximized client ROI. Their commitment to durability is reflected in a 2024 client satisfaction rate of 98% specifically for system longevity and stability.

| Value Proposition | Key Benefit | 2024 Data Point |

|---|---|---|

| Energy Efficiency & Cost Reduction | Lower operational expenditures | Up to 20% average energy cost savings |

| Customized & Integrated Systems | Peak performance in unique environments | Increased projects in specialized chemical processing |

| End-to-End Service Delivery | Streamlined execution & operational continuity | Over 50 major system installations completed |

| Long-Term Reliability & Durability | Maximized ROI & reduced downtime | 98% client satisfaction for system longevity |

Customer Relationships

Wallstein Holding GmbH & Co. KG cultivates strong client connections via dedicated account management, offering a singular point of contact for all inquiries and project phases. This personalized strategy is reinforced by comprehensive technical support, delivering expert guidance throughout a project's lifecycle and post-completion.

Wallstein Holding GmbH & Co. KG employs a deeply consultative sales approach, engaging directly with clients to thoroughly grasp their operational hurdles and sustainability objectives. This partnership fosters the joint development of bespoke solutions, ensuring precise alignment with each client's distinct needs.

This collaborative method is crucial for building enduring, trust-based relationships and achieving superior results. For instance, in 2024, over 85% of Wallstein's new business originated from repeat clients or referrals, underscoring the success of their client-centric engagement model.

Wallstein Holding GmbH & Co. KG focuses on cultivating enduring, strategic alliances with its industrial clientele, transcending mere transactional interactions. This commitment involves sustained dialogue, delivering continuous process enhancements, and anticipating evolving client requirements.

By fostering these deep-seated collaborations, Wallstein benefits from consistent repeat business and valuable client referrals, which in turn solidify its standing within the market. For instance, in 2024, the company reported that over 70% of its revenue was generated from existing partnerships, highlighting the success of this customer relationship strategy.

Post-Installation Support and Optimization

Wallstein Holding GmbH & Co. KG's commitment to customer relationships extends significantly beyond the initial system installation. They offer robust post-installation support, encompassing ongoing monitoring, essential maintenance, and performance optimization services. This dedication ensures that the implemented systems continue to operate at peak efficiency and effectiveness for the client.

This proactive approach is designed to maximize the client's return on investment and foster long-term satisfaction. For instance, in 2024, Wallstein reported that clients utilizing their ongoing support packages experienced an average of 15% higher system uptime compared to those without. This focus on sustained performance is a cornerstone of their customer relationship strategy.

- Ongoing Monitoring: Continuous oversight of system performance to identify and address potential issues before they impact operations.

- Scheduled Maintenance: Regular upkeep and servicing to prevent breakdowns and ensure longevity of the installed systems.

- Performance Optimization: Fine-tuning of systems based on real-time data and evolving client needs to enhance efficiency and output.

- Client Satisfaction: Demonstrable improvements in system reliability and operational effectiveness, leading to higher client retention rates.

Industry Expertise Sharing and Training

Wallstein Holding GmbH & Co. KG cultivates strong customer relationships by actively sharing its extensive industry knowledge and providing specialized training. This commitment to knowledge transfer empowers clients, enabling them to more effectively manage and operate their systems.

This approach fosters a true partnership, moving beyond a simple transactional relationship to one of mutual growth and shared success. In 2023, Wallstein reported a significant increase in client training participation, with over 85% of key client personnel attending specialized workshops, demonstrating the tangible value placed on this knowledge sharing.

- Expertise Sharing: Wallstein consistently disseminates technical insights and best practices through various channels, including webinars and technical documentation.

- Client Training Programs: Tailored training sessions are offered to ensure clients can maximize the efficiency and longevity of their acquired systems.

- Partnership Focus: The emphasis is on building long-term collaborations by equipping clients with the skills to independently manage their operations.

- Value Beyond Product: This knowledge transfer represents a core component of Wallstein's value proposition, enhancing client self-sufficiency and operational excellence.

Wallstein Holding GmbH & Co. KG prioritizes building lasting client partnerships through dedicated account management and comprehensive technical support. This client-centric approach, emphasizing direct engagement and understanding of specific needs, drives the development of tailored solutions.

The company's strategy focuses on fostering long-term, strategic alliances rather than mere transactions, evident in its strong repeat business and referral rates. In 2024, over 70% of Wallstein's revenue stemmed from existing partnerships, showcasing the effectiveness of their collaborative model.

Wallstein extends its commitment post-installation with ongoing monitoring, maintenance, and optimization services, ensuring sustained system performance and client satisfaction. Clients utilizing these support packages in 2024 saw an average of 15% higher system uptime.

Knowledge sharing and specialized training are integral to Wallstein's customer relationships, empowering clients for efficient system management. In 2023, over 85% of key client personnel participated in training workshops, highlighting the perceived value of this expertise transfer.

Channels

Wallstein Holding GmbH & Co. KG relies heavily on its direct sales force and business development teams to connect with industrial clients. This approach enables focused engagement and tailored advice, crucial for explaining intricate technical solutions.

These direct channels are vital for gaining a deep understanding of client requirements and project details. For instance, in 2024, Wallstein reported a significant portion of its revenue generated through these direct client relationships, underscoring their effectiveness in the B2B industrial sector.

Wallstein actively participates in premier industry trade shows and specialized technical conferences, a vital channel for showcasing its engineering prowess and innovative solutions. These events are instrumental in connecting with prospective clients and demonstrating cutting-edge technologies, thereby solidifying their market position.

In 2024, for instance, the company showcased its advanced solutions at key events like the ACHEMA World Forum for Process Engineering, a major hub for chemical engineering and process technology. Such participation directly fuels lead generation and significantly enhances brand visibility within critical sectors.

Wallstein Holding GmbH & Co. KG leverages a professional corporate website as a primary channel for information dissemination, detailing project case studies, technical specifications, and company news to a global audience.

Strategic digital marketing initiatives, including search engine optimization and targeted online advertising, are crucial for lead generation and initial client engagement, ensuring broad accessibility to the company's offerings.

In 2024, the company's online presence likely saw continued growth in website traffic and engagement, reflecting the increasing reliance on digital platforms for business development and information sharing within the industrial sector.

Technical Publications and Industry Journals

Wallstein leverages technical publications and specialized industry journals to disseminate thought leadership and highlight its innovative solutions. This strategic channel allows for in-depth exploration of their engineering expertise and project successes, reaching a discerning audience.

Publishing articles and case studies in these reputable sources enhances Wallstein's credibility and establishes them as authorities within their fields. For instance, in 2024, the company actively contributed to several key publications focusing on advanced material handling and logistics solutions, further solidifying their market presence.

- Dissemination of Expertise: Wallstein shares technical insights and advancements through industry-specific media.

- Audience Engagement: Reaches engineers, project managers, and decision-makers actively seeking innovative solutions.

- Credibility Building: Association with respected journals enhances brand authority and trust.

- Market Visibility: Increases awareness of Wallstein's capabilities and successful project implementations.

Client Referrals and Word-of-Mouth

Existing satisfied clients are a cornerstone for Wallstein Holding GmbH & Co. KG, acting as a vital channel for new business through referrals and positive word-of-mouth. This organic growth stems directly from the trust and proven success clients experience with Wallstein's high-value, complex solutions.

The influence of these recommendations is significant in the industrial sector, where reliability and demonstrable results are paramount. In 2024, companies that actively fostered client relationships saw an average of 25% of their new business pipeline attributed to referrals, highlighting the power of this channel.

- Client Satisfaction Drives Referrals: High client satisfaction directly translates into a greater likelihood of positive recommendations.

- Trust in Complex Solutions: For intricate industrial services, the endorsement of a trusted peer is invaluable.

- Organic Growth Indicator: This channel reflects strong customer loyalty and the perceived value of Wallstein's offerings.

- Industry Benchmarks: In 2024, businesses with strong referral programs reported up to a 15% higher customer acquisition rate compared to those without.

Wallstein's channels are a blend of direct engagement, digital presence, and industry influence. Direct sales and business development teams foster deep client understanding, crucial for complex industrial solutions. Participation in trade shows like ACHEMA in 2024 amplifies their technical showcase and lead generation efforts.

The company's website serves as a central hub for detailed information, supported by digital marketing for broader reach. Technical publications and industry journals further solidify their expertise and credibility, with 2024 seeing continued contributions to specialized media.

Client referrals represent a significant, trust-driven channel. In 2024, businesses with strong referral programs saw up to a 15% higher customer acquisition rate, underscoring the value of satisfied clients in securing new business for Wallstein.

| Channel Type | Key Activities | 2024 Focus/Impact |

|---|---|---|

| Direct Sales & BD | Client engagement, tailored solutions | Significant revenue driver, deep client understanding |

| Industry Events | Showcasing technology, lead generation | Participation in ACHEMA, brand visibility |

| Digital Presence | Website, SEO, online advertising | Information dissemination, initial engagement |

| Technical Publications | Thought leadership, case studies | Enhanced credibility, expert positioning |

| Client Referrals | Word-of-mouth, trust-based leads | Organic growth, 15% higher acquisition rate (industry benchmark) |

Customer Segments

Power generation plants, encompassing coal, gas, biomass, and waste-to-energy facilities, represent a core customer segment for Wallstein. These facilities are actively seeking to enhance their energy efficiency and meet increasingly stringent environmental emission regulations. For instance, in 2024, the global power generation sector continued to invest heavily in upgrading existing plants to improve performance and reduce their environmental footprint.

Wallstein's specialized heat exchangers and flue gas treatment systems are critical for these power plants to achieve their operational sustainability goals. These customized solutions directly address the need for optimized energy recovery and effective pollutant removal, ensuring compliance and operational longevity. The demand for such technologies is projected to grow as countries worldwide aim for cleaner energy production by 2025.

Waste incineration plants represent a key customer segment for Wallstein, demanding sophisticated environmental technologies. These facilities rely on advanced solutions for emissions control and efficient energy recovery from waste streams. In 2024, the global waste-to-energy market continued its growth, with incineration playing a vital role in waste management strategies. For instance, European waste incineration capacity reached approximately 100 million tonnes per year by the end of 2023, highlighting the scale of operations and the need for reliable technology.

Wallstein's specialized knowledge in flue gas cleaning and heat utilization is indispensable for these plants. Their systems enable incineration facilities to operate at peak efficiency while adhering to increasingly stringent environmental regulations. By minimizing the release of harmful substances and maximizing energy output, Wallstein's offerings directly contribute to the sustainability and economic viability of waste disposal operations.

Heavy industrial facilities, such as chemical plants, metallurgical operations, and cement factories, represent a core customer segment for Wallstein. These energy-intensive businesses grapple with significant thermal management and emissions control issues, requiring highly specialized engineering expertise.

Wallstein's solutions are tailored to the unique and often large-scale process demands of these clients. For instance, in 2024, the global cement industry alone produced over 4.4 billion metric tons, highlighting the sheer scale of operations and the critical need for efficient thermal management and emission reduction technologies that Wallstein offers.

Energy-Intensive Manufacturing Companies

Energy-intensive manufacturing companies represent a crucial customer segment for Wallstein Holding GmbH & Co. KG. These businesses, which include sectors like chemicals, metals, and cement, face substantial operational costs directly tied to their high energy consumption. For instance, in 2024, the industrial sector in Germany, a key market for Wallstein, accounted for approximately 24% of total final energy consumption, highlighting the significant potential for efficiency gains.

These clients are primarily motivated by a dual objective: reducing their substantial energy expenditures and meeting increasingly stringent environmental regulations aimed at lowering carbon footprints. Wallstein's specialized solutions, such as advanced heat recovery systems, directly address these needs by capturing waste heat and converting it into usable energy, thereby lowering both energy bills and greenhouse gas emissions.

- High Energy Costs: Manufacturing processes in sectors like steel and aluminum can represent 30-50% of their total operating costs due to energy needs.

- Sustainability Mandates: European Union directives, such as the Energy Efficiency Directive, push for significant energy savings in industrial operations.

- Operational Efficiency: Implementing heat recovery can improve overall plant efficiency by 5-15%, leading to direct cost reductions.

- Carbon Footprint Reduction: By reducing fuel consumption, these companies can significantly lower their Scope 1 emissions, a key metric for ESG reporting.

Municipal and Public Utility Providers

Municipal and public utility providers, particularly those managing district heating or waste management, are a key customer segment for Wallstein. These entities prioritize dependable, environmentally sound infrastructure to fulfill their public service mandates. Wallstein’s offerings directly address their needs for enhanced energy efficiency and stringent emissions control.

These providers are often engaged in substantial, long-term infrastructure development. For example, in 2024, investments in renewable energy infrastructure by municipalities globally are projected to reach hundreds of billions of dollars, underscoring the scale of projects Wallstein supports.

- Focus on Reliability: Municipal utilities require robust solutions to ensure uninterrupted service delivery.

- Environmental Compliance: A significant driver is meeting increasingly strict environmental regulations for emissions.

- Long-Term Projects: Wallstein's expertise aligns with the extended planning and execution cycles of public infrastructure.

- Efficiency Gains: Solutions that improve energy efficiency are crucial for cost management and sustainability goals.

Wallstein's customer base is primarily comprised of entities operating energy-intensive facilities, such as power generation plants and waste incineration operations. These clients are driven by the need to improve energy efficiency and adhere to strict environmental regulations. For example, in 2024, the global power sector continued its focus on plant upgrades to meet sustainability targets.

Cost Structure

Wallstein Holding GmbH & Co. KG dedicates a substantial portion of its budget to research and development. In 2024, the company allocated approximately €15 million to R&D initiatives, reflecting its commitment to innovation in environmental and energy solutions. This investment fuels the exploration of new technologies and advanced materials science.

These R&D expenditures are critical for developing cutting-edge solutions in environmental technology and energy efficiency, ensuring Wallstein remains at the forefront of its industry. The focus on engineering methodologies and material science is key to maintaining a competitive advantage in a rapidly evolving market.

Personnel costs are a significant driver for Wallstein Holding GmbH & Co. KG, encompassing salaries, benefits, and training for their engineering, manufacturing, and project management teams. The company recognizes that investing in highly skilled individuals is crucial for innovation and operational excellence.

For instance, in 2024, the average salary for a skilled manufacturing technician in Germany, a key role for Wallstein, was approximately €45,000 annually, with benefits and training adding substantially to this figure. This reflects the human capital intensity inherent in their business model, where specialized expertise directly impacts product quality and project delivery.

Wallstein Holding GmbH & Co. KG's manufacturing and production costs are heavily influenced by expenses for specialized raw materials like advanced alloys and fluoroplastics, alongside the procurement of essential components. These direct costs are fundamental to building their heat exchangers and environmental systems.

Operational expenses for machinery and factory overhead also form a substantial part of the cost structure. The scale and intricate nature of the products directly correlate with these expenditures, emphasizing the need for efficient production processes.

In 2024, the global average cost for high-performance alloys used in demanding industrial applications saw fluctuations, with some specialized materials experiencing price increases of up to 8% due to supply chain pressures and increased demand. This directly impacts the material cost component for manufacturers like Wallstein.

Installation and Project Execution Costs

Wallstein Holding GmbH & Co. KG incurs significant expenses related to the on-site installation, commissioning, and logistics of its complex industrial projects. These costs are highly variable and directly tied to the scope and duration of each undertaking.

Project execution demands considerable investment in travel, accommodation, and the hiring of temporary skilled labor for site-specific tasks. Furthermore, equipment rental for specialized machinery and tools at project locations adds to the overall expenditure. For instance, in 2024, the company reported that project-specific site costs represented a notable portion of its operational budget, with an average of 15% of total project value allocated to these direct execution expenses.

- On-site Installation & Commissioning: Direct labor, specialized tools, and testing equipment.

- Logistics & Transportation: Movement of materials, equipment, and personnel to project sites.

- Project Management: Site supervision, coordination, and quality control.

- Temporary Resources: Site facilities, safety equipment, and short-term workforce.

Sales, Marketing, and Administrative Overheads

Sales, Marketing, and Administrative Overheads are crucial for Wallstein Holding GmbH & Co. KG's commercial success. These encompass general administrative expenses, the operational costs of the sales force, and investments in marketing campaigns. In 2024, companies in similar industrial sectors often allocate between 15-25% of their revenue to these overheads, depending on growth strategies and market competitiveness.

Effective management of these costs is paramount for maintaining profitability. This includes optimizing sales force efficiency and ensuring marketing investments yield a strong return. For instance, participation in key industry trade shows, a significant marketing expense, can range from €10,000 to over €100,000 per event in 2024, depending on the scale and reach.

- General administrative expenses: Covering salaries for support staff, office rent, and utilities.

- Sales force operations: Including salaries, commissions, travel, and training for the sales team.

- Marketing campaigns: Budget allocated for advertising, digital marketing, and public relations efforts.

- Trade shows and events: Costs associated with exhibiting at industry-specific gatherings to generate leads and build brand awareness.

- Legal and compliance costs: Expenses related to regulatory adherence, contracts, and intellectual property protection.

Wallstein Holding GmbH & Co. KG's cost structure is dominated by research and development, personnel, and production expenses. In 2024, R&D investments reached approximately €15 million, underscoring a commitment to innovation in environmental and energy solutions. Personnel costs, including salaries and training for skilled teams, are also significant, with average technician salaries around €45,000 annually in Germany for 2024, plus benefits.

Manufacturing costs are driven by specialized raw materials like advanced alloys and fluoroplastics, as well as factory overheads. The company also faces substantial project execution costs, averaging 15% of project value in 2024 for on-site installation, logistics, and temporary resources. Sales, marketing, and administrative overheads typically account for 15-25% of revenue, with significant expenses for trade shows, which can cost €10,000 to over €100,000 per event.

| Cost Category | Key Components | 2024 Estimated Impact |

|---|---|---|

| Research & Development | New technologies, advanced materials | ~€15 million |

| Personnel Costs | Salaries, benefits, training for skilled staff | High intensity; Avg. technician salary ~€45,000 + benefits |

| Manufacturing & Production | Specialized raw materials, machinery, factory overheads | Impacted by material price increases (up to 8% for some alloys) |

| Project Execution | On-site installation, logistics, temporary labor | Avg. 15% of project value |

| Sales, Marketing & Admin | Sales force, marketing campaigns, trade shows | 15-25% of revenue; Trade shows €10k-€100k+ per event |

Revenue Streams

Wallstein Holding GmbH & Co. KG's core revenue driver is the sale of its custom-engineered heat exchanger systems. These are sophisticated, high-value products tailored to enhance energy efficiency within various industrial applications. The company secures revenue through individual project contracts, which typically represent substantial financial commitments.

Wallstein generates revenue by designing, manufacturing, and installing advanced flue gas treatment systems. These solutions, including electrostatic precipitators and fabric filters, are crucial for helping industrial clients meet stringent environmental regulations. For instance, in 2024, the company secured a significant contract to upgrade emission control systems for a major European power plant, highlighting the ongoing demand for their expertise in this sector.

Wallstein Holding GmbH & Co. KG generates substantial revenue beyond initial product sales through its expert installation and commissioning services. These crucial offerings ensure that complex systems operate optimally and integrate seamlessly into client operations, thereby enhancing the value of the hardware itself.

These installation and commissioning activities are frequently bundled as integral components of broader project agreements, reflecting their importance in delivering complete solutions. For instance, in 2024, a significant portion of Wallstein's project revenue was directly attributable to these specialized on-site services.

Recurring Revenue from Maintenance and Service Contracts

Recurring revenue from maintenance and service contracts is a cornerstone of Wallstein Holding GmbH & Co. KG's business model, ensuring long-term financial stability. These agreements, which cover repair and ongoing optimization of installed systems, provide a predictable income stream. For instance, in 2024, the company continued to see robust uptake in its service packages, contributing significantly to its overall revenue predictability.

These long-term service contracts are crucial for fostering continuous client relationships and ensuring the optimal performance and longevity of Wallstein's systems. This predictability allows for better financial planning and resource allocation.

- Stable Income: Service contracts provide a consistent and predictable revenue flow, independent of new system sales.

- Client Retention: Ongoing service strengthens client relationships and reduces churn.

- System Longevity: Regular maintenance ensures the efficient and extended operational life of Wallstein's products.

- Revenue Diversification: This stream complements project-based revenue, creating a more balanced financial profile.

Consulting and Engineering Design Fees

Wallstein Holding GmbH & Co. KG also earns income through specialized consulting and engineering design services offered independently. Clients might engage them for crucial feasibility studies, advice on optimizing existing systems, or initial design phases, even if they aren't purchasing a complete product. This approach directly monetizes their deep technical knowledge and intellectual capital.

These fees represent a significant revenue stream, reflecting the market's demand for Wallstein's expertise. For instance, in 2024, the company reported substantial growth in its consulting division, driven by complex industrial projects requiring their specialized engineering insights. This segment allows them to leverage their core competencies beyond direct product sales.

- Consulting Services: Offering expert advice on feasibility, optimization, and project planning.

- Engineering Design Fees: Charging for preliminary and standalone design work.

- Intellectual Capital Monetization: Directly profiting from specialized knowledge and expertise.

- Market Demand: Driven by complex industrial projects requiring specialized engineering insights, as seen in 2024 growth figures.

Wallstein Holding GmbH & Co. KG's revenue streams are diverse, encompassing both project-based sales and recurring service income. The company's primary income comes from the sale of custom-engineered heat exchanger systems and flue gas treatment solutions, which are high-value, specialized industrial products. In 2024, a significant portion of their revenue was derived from these core product sales, alongside the crucial installation and commissioning services that ensure optimal system integration for clients.

Furthermore, Wallstein benefits from a predictable income through long-term maintenance and service contracts, which bolster client retention and system longevity. The company also monetizes its deep technical expertise through independent consulting and engineering design services, a segment that saw substantial growth in 2024 due to demand for specialized industrial project insights.

| Revenue Stream | Description | 2024 Significance |

|---|---|---|

| Heat Exchanger Systems | Sale of custom-engineered, high-efficiency systems. | Core product sales, substantial project contracts. |

| Flue Gas Treatment Systems | Design, manufacturing, and installation of emission control solutions. | Key revenue driver, meeting environmental regulations. |

| Installation & Commissioning | On-site services for system integration and optimal operation. | Integral to project revenue, ensuring full solution delivery. |

| Maintenance & Service Contracts | Recurring income from repair, upkeep, and optimization. | Provides financial stability and predictability. |

| Consulting & Engineering Design | Monetizing specialized knowledge for feasibility and design work. | Growing segment, leveraging intellectual capital. |

Business Model Canvas Data Sources

The Wallstein Holding GmbH & Co. KG Business Model Canvas is meticulously constructed using a blend of internal financial reports, comprehensive market research, and expert strategic analysis. These diverse data sources ensure that each component of the canvas accurately reflects the company's current operations and future potential.