Walbridge PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Walbridge Bundle

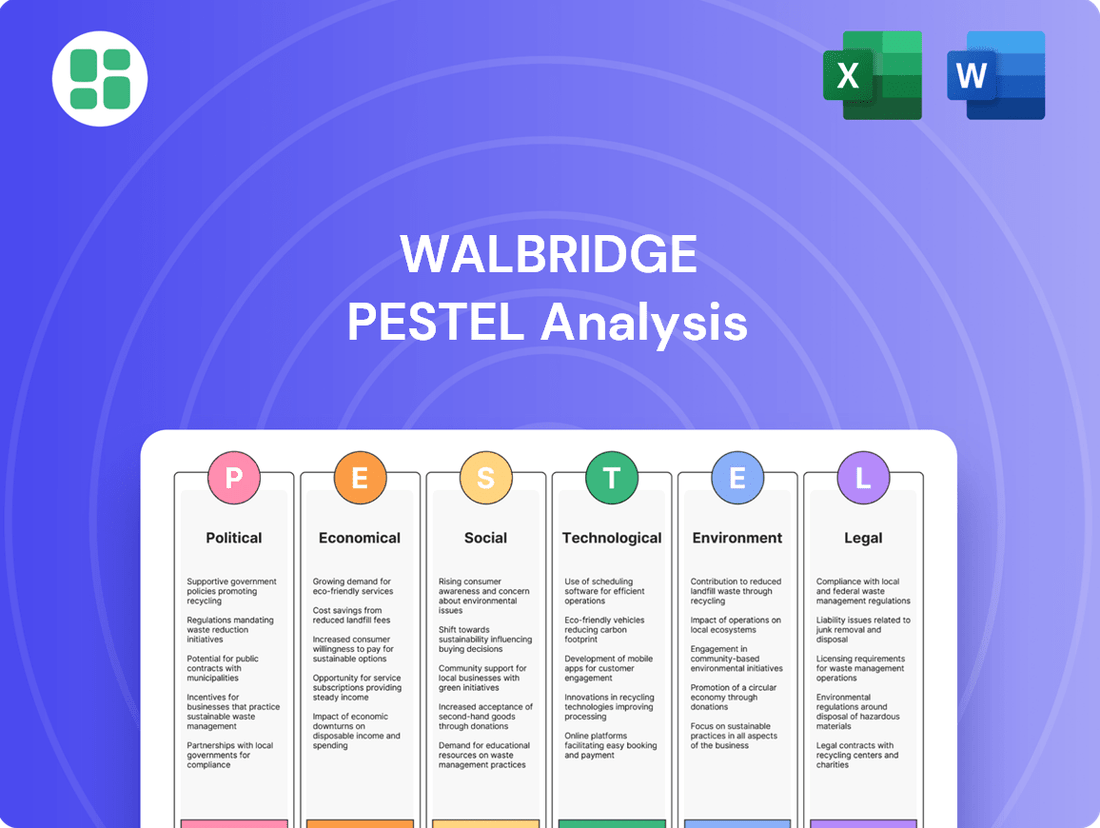

Unlock the strategic advantages Walbridge holds by understanding the critical external forces at play. Our PESTLE analysis delves into political shifts, economic fluctuations, and technological advancements that are shaping the construction industry. Gain actionable intelligence to inform your own business strategy and identify potential opportunities or threats. Download the full PESTLE analysis now for a comprehensive overview.

Political factors

Government investment in infrastructure, like roads and public facilities, directly shapes Walbridge's project opportunities and revenue streams. For instance, the U.S. Bipartisan Infrastructure Law, enacted in 2021 and continuing its impact through 2024 and beyond, allocates over $1.2 trillion to modernize infrastructure, creating a robust pipeline for general contractors.

Changes in federal and state construction budgets can significantly impact demand for large projects, especially in areas like power and manufacturing, where government incentives and regulations are key drivers. In 2023, U.S. federal infrastructure spending saw a notable increase, supporting sectors vital to Walbridge's operations.

As a major general contractor, Walbridge thrives on consistent and growing public works expenditures. The projected increase in state and local government construction spending for 2024, estimated by some industry reports to be in the high single digits, indicates a favorable environment for companies like Walbridge.

Changes in building codes, zoning laws, and permitting processes across local, state, and federal levels directly influence Walbridge's project execution. For instance, in 2024, several states, including California and Texas, have seen updates to seismic building codes, potentially increasing material and labor costs for construction projects. Navigating these evolving regulations is critical for maintaining competitive bidding and efficient project delivery.

International trade policies, such as those impacting steel and lumber, directly influence the cost of construction materials for Walbridge. For instance, in early 2024, lumber prices saw volatility, with futures trading around $450 per thousand board feet, a significant factor for projects relying on timber.

Tariffs imposed on key construction inputs like steel can escalate project budgets. In 2024, the U.S. maintained Section 232 tariffs on steel, contributing to higher material costs that require careful management.

These trade dynamics demand that Walbridge employs agile procurement and robust risk management to safeguard project profitability. Adapting to global economic shifts is crucial for their extensive supply chain operations.

Political Stability and Elections

Walbridge's operations are significantly shaped by the political stability of the regions where it undertakes projects. For instance, in the United States, where Walbridge has a substantial presence, the upcoming 2024 and 2025 election cycles could introduce policy shifts impacting infrastructure spending. A stable political environment fosters greater investor confidence, crucial for securing the long-term capital needed for large-scale construction ventures.

Major elections and potential changes in government priorities can create uncertainty. For example, shifts in federal or state infrastructure funding priorities, potentially influenced by election outcomes, directly affect the pipeline of projects available to construction firms like Walbridge. The predictability offered by a stable political climate is a key enabler for Walbridge's strategic planning and investment decisions, allowing for more accurate forecasting of market opportunities and regulatory landscapes.

Consider the impact of government spending on infrastructure. In the US, the Infrastructure Investment and Jobs Act (IIJA), enacted in 2021, allocated approximately $1.2 trillion, with a significant portion dedicated to transportation and broadband. The continuity of such programs, often influenced by political stability and election results, is vital for companies like Walbridge that rely on public sector contracts. Any disruption or re-prioritization stemming from political shifts can alter market dynamics.

- Political Stability: Regions with consistent governance and low political risk offer a more predictable environment for Walbridge's long-term project commitments and capital investments.

- Election Cycles: Upcoming elections in key operating markets, such as the United States in 2024 and 2025, can lead to shifts in public spending priorities and regulatory frameworks affecting the construction sector.

- Investor Confidence: A stable political climate directly correlates with higher investor confidence, which is essential for securing financing for large-scale infrastructure and industrial projects undertaken by Walbridge.

- Policy Uncertainty: Changes in government administrations can introduce uncertainty regarding public infrastructure funding levels and the pace of project approvals, impacting Walbridge's project pipeline and revenue forecasts.

Government Incentives and Subsidies

Government programs offering tax credits, subsidies, or grants for specific construction types, like green buildings or advanced manufacturing facilities, can significantly boost market opportunities for Walbridge. For instance, the Inflation Reduction Act of 2022 in the US provides substantial tax credits for clean energy and energy-efficient construction, potentially driving demand for Walbridge's expertise in these areas. These incentives encourage clients to pursue projects that align with Walbridge's capabilities, thereby increasing demand and fostering innovation.

These incentives can translate into tangible benefits for companies like Walbridge. For example, a 30% investment tax credit for solar projects under the IRA can make previously marginal projects financially viable for clients, directly leading to more contract opportunities. Similarly, state-level programs, such as those in California promoting affordable housing or New York's support for semiconductor manufacturing, create targeted demand that Walbridge can capitalize on.

- Tax Credits: The US federal government offers tax credits for renewable energy installations and energy-efficient building upgrades, directly impacting project feasibility.

- Subsidies: Various state and local governments provide direct subsidies for infrastructure development, particularly in areas like public transit and broadband expansion.

- Grants: Programs like the Bipartisan Infrastructure Law allocate significant grant funding for transportation and environmental remediation projects, creating new avenues for construction firms.

- Green Building Initiatives: Incentives for LEED certification or net-zero energy construction encourage clients to invest in sustainable building practices, aligning with Walbridge's potential specialization.

Government investment in infrastructure, a key driver for Walbridge, is set to see continued robust activity. The U.S. Bipartisan Infrastructure Law, with its over $1.2 trillion allocation, is actively stimulating projects through 2024 and beyond. This sustained funding directly translates into a healthy pipeline of opportunities for general contractors like Walbridge, particularly in transportation and energy sectors.

Political stability is paramount for Walbridge's long-term project planning and capital acquisition. Upcoming election cycles in the U.S. (2024-2025) could influence public spending priorities and regulatory landscapes, potentially altering market dynamics. A stable political environment bolsters investor confidence, which is crucial for financing large-scale construction ventures.

Government incentives, such as tax credits and subsidies, are increasingly shaping project feasibility and demand. The Inflation Reduction Act of 2022, for instance, offers substantial credits for clean energy and energy-efficient construction. These incentives, like the 30% investment tax credit for solar projects, are making previously marginal projects financially viable, directly expanding Walbridge's potential contract base.

| Factor | Impact on Walbridge | Data/Example (2024-2025 Focus) |

|---|---|---|

| Infrastructure Spending | Directly drives project pipeline and revenue. | U.S. Bipartisan Infrastructure Law: ~$1.2 trillion allocated; significant portion for transportation and broadband. |

| Political Stability & Elections | Affects policy continuity, investor confidence, and project forecasting. | U.S. 2024-2025 election cycles may lead to shifts in infrastructure funding priorities. |

| Government Incentives (Tax Credits/Subsidies) | Enhances project viability and creates demand for specialized construction. | Inflation Reduction Act (IRA) 2022: 30% investment tax credit for solar projects. |

| Regulatory Changes (Building Codes) | Influences project execution costs and timelines. | Updates to seismic building codes in states like California and Texas in 2024. |

What is included in the product

This Walbridge PESTLE Analysis provides a comprehensive examination of the external macro-environmental factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to aid in strategic decision-making and capitalize on emerging opportunities within Walbridge's operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, streamlining strategic discussions by highlighting key external factors impacting Walbridge.

Economic factors

Interest rate fluctuations significantly impact Walbridge's business. For instance, if the Federal Reserve maintains its target federal funds rate at 5.25% to 5.50% as seen in late 2023 and early 2024, the cost of capital for construction projects rises. This increase in borrowing costs can make potential clients more hesitant to undertake large-scale developments, potentially slowing down project pipelines and intensifying competition for available work.

Rising inflation, particularly for key construction inputs like steel, concrete, and fuel, directly impacts Walbridge's project expenses and overall profitability. For instance, the Producer Price Index for construction materials saw a notable increase in late 2024 and early 2025, putting pressure on project budgets.

Effectively managing these fluctuating material costs through strong procurement and smart contractual agreements is paramount for Walbridge. Failing to anticipate and absorb price hikes can significantly reduce the profit margins on secured projects, especially if bids were finalized before major cost escalations occurred.

The overall health of the economy, mirrored in Gross Domestic Product (GDP) growth, directly impacts Walbridge's construction business. A strong economy generally means more investment in manufacturing, automotive, and power sectors, leading to more construction opportunities. For instance, in 2023, the US GDP grew by 2.5%, indicating a generally favorable environment for infrastructure and industrial development.

Economic downturns, however, can cause delays or cancellations of construction projects. If businesses become hesitant to invest due to economic uncertainty, demand for Walbridge's services in building new facilities or upgrading existing ones can significantly decrease. This was seen during periods of economic contraction where capital expenditure by companies often shrinks.

Labor Market Conditions and Wages

The construction sector's reliance on skilled labor means that labor market conditions directly influence Walbridge's operational efficiency and profitability. A shortage of qualified workers, a persistent issue in recent years, can drive up wage demands. For instance, the U.S. Bureau of Labor Statistics reported that construction wages increased by approximately 5.1% year-over-year as of early 2024, reflecting this scarcity.

These rising labor costs, coupled with potential project delays due to staffing challenges, pose significant economic headwinds. Walbridge's ability to self-perform certain tasks offers a degree of control over labor, but broader industry trends in labor availability and compensation remain a critical factor. The unemployment rate for construction occupations hovered around 3.5% in early 2024, indicating a tight market.

- Skilled Labor Availability: A persistent shortage of skilled tradespeople impacts project staffing and timelines.

- Wage Inflation: Rising wages, driven by labor scarcity, increase overall project costs.

- Impact on Budgets: Increased labor expenses can strain project budgets and affect profitability.

- Self-Perform Advantage: Walbridge's internal capabilities offer some mitigation against external labor market volatility.

Supply Chain Disruptions

Global and regional supply chain stability is a critical factor for Walbridge, impacting its efficiency in sourcing materials and equipment. For instance, the lingering effects of the COVID-19 pandemic continued to create volatility in 2024, with some sectors experiencing lead time extensions of up to 20% for key construction components compared to pre-pandemic levels. Geopolitical tensions, such as ongoing trade disputes and regional conflicts, further exacerbate these issues, leading to potential delays and increased costs. These disruptions can stem from material shortages, like the persistent scarcity of certain microchips essential for advanced building systems, or from transportation bottlenecks, as seen with port congestion impacting the movement of goods worldwide.

Effective supply chain management and diversification are paramount for Walbridge to navigate these challenges. Strategies to mitigate risks include building stronger relationships with multiple suppliers across different geographic regions. For example, by diversifying sourcing for steel, a fundamental material in many construction projects, Walbridge can reduce its reliance on any single supplier or region. This proactive approach helps ensure project continuity and cost predictability, even amidst unforeseen global events.

- Impact on Sourcing: Supply chain disruptions directly affect Walbridge's ability to procure necessary materials and equipment on time and within budget.

- Cost Increases: Material shortages and transportation delays, such as those experienced in the global logistics network throughout 2024, can drive up the cost of projects.

- Risk Mitigation: Diversifying suppliers and building resilient supply chains are crucial for Walbridge to maintain operational stability and project delivery timelines.

- Geopolitical Influence: Events like international trade disputes or regional conflicts can create significant ripple effects on material availability and pricing for construction firms.

Economic factors significantly shape Walbridge's operational landscape. Interest rate decisions by institutions like the Federal Reserve, which maintained its target rate between 5.25% and 5.50% through early 2024, directly influence the cost of capital for clients, potentially dampening demand for large construction projects. Inflationary pressures, particularly on construction materials like steel and concrete, saw producer prices for these items rise notably in late 2024, impacting project budgets and Walbridge's profit margins if not managed proactively through procurement strategies.

The broader economic climate, as indicated by GDP growth, also plays a crucial role. The US experienced a 2.5% GDP growth in 2023, generally supporting infrastructure and industrial development. However, economic downturns can lead to project cancellations or delays as businesses curb capital expenditures. Furthermore, the construction labor market remained tight in early 2024, with unemployment in construction occupations around 3.5% and wages increasing by approximately 5.1% year-over-year, according to the U.S. Bureau of Labor Statistics, directly affecting Walbridge's labor costs.

| Economic Factor | Impact on Walbridge | Data Point (2023-2024) |

| Interest Rates | Increases cost of capital for clients, potentially reducing project demand. | Federal Funds Rate: 5.25%-5.50% (late 2023-early 2024) |

| Inflation | Raises material and operating costs, squeezing profit margins. | Producer Price Index for construction materials saw notable increases (late 2024). |

| GDP Growth | Strong GDP supports project pipelines; downturns lead to project delays/cancellations. | US GDP Growth: 2.5% (2023) |

| Labor Market | Shortages drive up wages and can impact project timelines. | Construction wages increased ~5.1% YoY; Construction unemployment ~3.5% (early 2024). |

What You See Is What You Get

Walbridge PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Walbridge PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It offers a strategic overview for informed decision-making.

Sociological factors

Changes in workforce demographics, such as an aging construction workforce and a growing demand for specialized digital skills, present a dual challenge for Walbridge. For instance, the U.S. Bureau of Labor Statistics projected a shortage of over 400,000 skilled construction workers in 2024. This demographic shift necessitates innovative approaches to talent acquisition.

Attracting and retaining a new generation of skilled tradespeople and project managers is crucial for Walbridge's sustained growth. This requires competitive compensation packages, robust training programs, and a commitment to fostering an inclusive and forward-thinking workplace culture. Companies like Walbridge are increasingly investing in apprenticeships and partnerships with technical schools to build a future talent pipeline.

Walbridge's unwavering commitment to safety is a cornerstone of its sociological impact, directly shaping how employees and the public view the company. A stellar safety record, such as maintaining a Total Recordable Incident Rate (TRIR) significantly below industry averages, like the 2023 construction industry average of 2.5, bolsters Walbridge's image, attracting top talent and clients who value a secure work environment.

This dedication to safety not only fosters positive employee morale but also cultivates public trust, crucial for securing large-scale projects. A strong safety culture can translate into tangible benefits, with companies often reporting lower insurance premiums and reduced project delays stemming from fewer accidents.

Conversely, any lapse in safety protocols can have severe repercussions. A prominent safety incident could tarnish Walbridge's hard-earned reputation, potentially leading to increased regulatory oversight and a decline in new business opportunities, highlighting the critical need for ongoing investment in safety training and technology.

Societal expectations for companies like Walbridge to actively engage with local communities and uphold corporate social responsibility (CSR) are growing. In 2024, a significant majority of consumers indicated they would favor brands demonstrating strong CSR initiatives. Walbridge's commitment to local hiring, for example, can directly benefit communities, fostering goodwill and a stronger social license to operate.

Active community involvement and responsible construction practices are crucial for Walbridge's long-term success. By prioritizing local employment and minimizing environmental impact, Walbridge can build trust and positive relationships with stakeholders, leading to smoother project execution and a more robust brand image. This approach also aligns with the increasing investor focus on ESG (Environmental, Social, and Governance) factors in their 2025 investment decisions.

Changing Client Demands and Lifestyle Trends

Societal shifts are significantly reshaping client expectations in the construction sector. There's a marked increase in demand for sustainable, healthy, and adaptable building designs. For instance, a 2024 survey indicated that over 60% of commercial real estate investors prioritize green building certifications, reflecting a growing commitment to environmental, social, and governance (ESG) principles.

Walbridge needs to actively integrate features that cater to these evolving client needs. This includes incorporating superior indoor air quality systems, designing flexible workspaces that can be reconfigured easily, and implementing smart building technologies for greater efficiency and occupant comfort. These adaptations are crucial for maintaining a competitive edge and fostering innovation in service delivery.

Understanding these dynamic lifestyle trends is paramount for Walbridge's continued success. For example, the rise of remote and hybrid work models, which accelerated in 2024, necessitates buildings that can accommodate diverse work arrangements and promote well-being.

- Growing demand for sustainability: Over 60% of commercial real estate investors prioritize green building certifications in 2024.

- Focus on health and well-being: Increased client interest in features like enhanced indoor air quality and biophilic design.

- Adaptability in design: The need for flexible spaces to accommodate changing work and living patterns, driven by trends like hybrid work.

- Integration of smart technologies: Clients expect buildings to be equipped with IoT devices and smart systems for operational efficiency and user experience.

Diversity, Equity, and Inclusion (DEI)

The growing societal emphasis on diversity, equity, and inclusion (DEI) is a crucial sociological factor for Walbridge. Companies that actively promote DEI benefit from a wider range of perspectives, leading to enhanced innovation and problem-solving. For instance, a 2024 report by McKinsey & Company found that companies in the top quartile for ethnic and cultural diversity on executive teams were 39% more likely to outperform on profitability than those in the bottom quartile.

Walbridge's commitment to DEI can serve as a significant competitive advantage. Clients and partners are increasingly scrutinizing their supply chains and business relationships for alignment with these values. A 2025 survey by Deloitte indicated that over 70% of business leaders believe a strong DEI strategy is essential for attracting and retaining top talent, and for maintaining a positive brand reputation.

- Talent Acquisition: Embracing DEI broadens Walbridge's access to a diverse talent pool, crucial for a skilled workforce in the construction sector.

- Innovation and Performance: Studies, like the aforementioned McKinsey report, consistently link greater diversity to improved financial performance and innovation.

- Client and Partner Relations: Demonstrating a robust DEI commitment can strengthen relationships and attract business from organizations prioritizing these principles.

- Workplace Culture: A focus on equity and inclusion fosters a more positive and productive work environment, boosting employee morale and retention.

Societal expectations for corporate responsibility are intensifying, with a growing emphasis on ethical labor practices and community engagement. In 2024, consumer surveys indicated that over 70% of individuals consider a company's social impact when making purchasing decisions. Walbridge's proactive approach to fair wages and local job creation directly addresses these evolving societal demands.

Furthermore, the construction industry is witnessing a significant shift towards greater transparency and accountability in project execution. Clients and stakeholders increasingly demand clear communication regarding project timelines, budgets, and safety protocols. Walbridge's commitment to open communication and robust reporting mechanisms in 2024-2025 builds trust and strengthens its social license to operate.

The increasing awareness of mental health and well-being among employees is a critical sociological factor. Companies like Walbridge are implementing comprehensive wellness programs and fostering supportive work environments. A 2024 study revealed that organizations with strong mental health support saw a 15% increase in employee productivity and a 20% reduction in absenteeism.

Technological factors

Building Information Modeling (BIM) and digital twin technologies are fundamentally reshaping how Walbridge approaches construction projects. These digital tools streamline design, improve coordination among teams, and enhance the management of a facility throughout its entire life. For instance, BIM adoption in the construction industry has been steadily increasing, with projections suggesting a significant portion of global projects will utilize BIM by 2025, leading to an estimated 10-20% reduction in rework due to better clash detection and visualization.

The integration of digital twins, which are virtual replicas of physical assets, allows Walbridge to gain unprecedented insights into project performance and operational efficiency. This technology enables predictive maintenance and optimized operations, potentially leading to substantial cost savings over the asset's lifecycle. Companies leveraging digital twins have reported improvements in operational efficiency by as much as 15% in the manufacturing sector, a trend expected to translate into construction.

Walbridge's commitment to investing in these advanced digital solutions directly translates to enhanced project delivery and increased value for clients. By fostering better collaboration, minimizing errors through advanced visualization, and enabling superior post-construction facility management, these technologies solidify Walbridge's competitive edge in an increasingly digital construction landscape.

The construction industry is seeing a significant rise in automation and robotics. Autonomous heavy equipment and robotic bricklaying are becoming more common, offering companies like Walbridge a chance to boost productivity, improve safety, and increase precision on job sites.

While widespread adoption is still developing, strategically using these technologies can help address labor shortages and make operations more efficient, especially for intricate projects. For instance, the global construction robotics market was valued at approximately USD 3.5 billion in 2023 and is projected to grow significantly in the coming years.

Walbridge's commitment to innovation means it's well-positioned to investigate and incorporate these advancements. This focus on new technologies can lead to substantial improvements in project timelines and cost-effectiveness.

The increasing adoption of prefabrication and modular construction is a significant technological shift, enabling Walbridge to move more building processes from dynamic job sites to controlled factory settings. This trend, projected to see the global modular construction market reach $257.4 billion by 2027 according to some reports, offers substantial benefits like accelerated project timelines and better quality assurance.

By leveraging these methods, Walbridge can achieve improved waste reduction and enhanced worker safety, critical advantages in today's construction landscape. The company's in-house self-perform capabilities position it favorably to capitalize on the efficiency gains offered by these modern construction techniques.

Data Analytics and Artificial Intelligence (AI)

The integration of data analytics and AI is revolutionizing the construction sector, offering Walbridge significant advantages. By leveraging these technologies, Walbridge can refine project timelines, proactively identify and mitigate risks, streamline supply chain operations, and enhance the accuracy of cost projections. For instance, in 2024, construction firms adopting AI-driven analytics reported an average of 15% improvement in project delivery times and a 10% reduction in cost overruns.

Analyzing extensive historical project data allows Walbridge to uncover valuable patterns and insights, directly informing strategic planning and operational improvements. This data-driven approach fosters more robust decision-making, ultimately boosting overall efficiency and performance. The global AI in construction market was valued at approximately $1.5 billion in 2023 and is projected to reach over $5 billion by 2028, highlighting the rapid adoption and impact of these technologies.

- Optimized Project Scheduling: AI algorithms can dynamically adjust schedules based on real-time data, improving on-time completion rates.

- Predictive Risk Management: Identifying potential issues like material delays or labor shortages before they impact projects.

- Enhanced Supply Chain Efficiency: AI can forecast demand and optimize inventory levels, reducing waste and costs.

- Accurate Cost Estimation: Machine learning models can analyze past project data to provide more precise budget forecasts.

Sustainable Building Technologies and Materials

Advances in sustainable building technologies are reshaping the construction landscape, making high-efficiency HVAC systems, integrated renewable energy solutions, and innovative eco-friendly materials essential for companies like Walbridge. Clients are increasingly prioritizing green building, with the global green building market projected to reach $179.4 billion by 2025, up from $100.7 billion in 2020. This trend allows Walbridge to not only meet stringent environmental regulations, such as the growing adoption of net-zero energy building standards, but also to gain a competitive edge.

Embracing these technologies directly supports Walbridge's sustainability objectives and enhances its service differentiation. For instance, the demand for LEED-certified buildings continues to rise, with over 100,000 LEED-certified projects in 160 countries as of early 2024. By incorporating these advancements, Walbridge can tap into this growing market segment.

- Growing Client Demand: A significant percentage of new construction projects now specify green building certifications.

- Regulatory Compliance: Evolving environmental regulations necessitate the adoption of sustainable building practices.

- Market Differentiation: Offering expertise in sustainable technologies provides a competitive advantage in the construction sector.

- Cost Savings: High-efficiency systems and materials can lead to long-term operational cost reductions for clients.

Technological advancements like Building Information Modeling (BIM) and digital twins are transforming Walbridge's project execution by enhancing design precision and lifecycle management. The construction industry's increasing reliance on these digital tools, with BIM adoption projected for a significant portion of global projects by 2025, promises reduced rework and improved coordination.

The integration of AI and data analytics offers Walbridge a powerful toolkit for optimizing project scheduling and risk management, with early adopters reporting substantial improvements in delivery times and cost control. This data-driven approach is crucial for navigating complex projects and ensuring efficient resource allocation.

Automation and robotics, including autonomous heavy equipment, are emerging as key technologies to boost productivity and safety, especially in addressing labor shortages. The growing construction robotics market, valued at around $3.5 billion in 2023, indicates a strong trend towards embracing these innovations.

Prefabrication and modular construction are also gaining traction, allowing Walbridge to shift building processes to controlled environments for improved efficiency and quality. This trend, with the modular construction market expected to reach significant figures by the late 2020s, supports faster project completion and enhanced worker safety.

| Technology | Impact on Walbridge | Industry Trend/Data |

|---|---|---|

| BIM & Digital Twins | Improved design, coordination, lifecycle management, reduced rework | BIM adoption increasing; projected 10-20% rework reduction |

| AI & Data Analytics | Optimized scheduling, predictive risk management, cost accuracy | AI in construction market projected to exceed $5 billion by 2028; 15% improvement in delivery times reported by users |

| Automation & Robotics | Increased productivity, enhanced safety, addressing labor shortages | Construction robotics market valued at ~$3.5 billion in 2023 |

| Prefabrication & Modular | Faster timelines, better quality control, improved safety | Modular construction market projected for significant growth |

Legal factors

Walbridge operates within a stringent legal framework, necessitating strict adherence to a myriad of building codes and construction standards at local, state, and federal levels. These regulations cover critical aspects such as structural integrity, fire safety protocols, and accessibility requirements for all individuals. For instance, in 2024, the International Building Code (IBC) continues to be a foundational standard, with ongoing updates influencing material specifications and safety measures across the US.

Failure to comply with these evolving legal mandates can result in substantial financial penalties, significant project schedule disruptions, and considerable damage to Walbridge's reputation within the industry. The legal landscape is dynamic; for example, new accessibility standards, like those mandated by the Americans with Disabilities Act (ADA), are frequently updated, requiring constant vigilance and adaptation.

Maintaining up-to-date knowledge of the latest code revisions, such as potential changes in energy efficiency standards impacting construction materials in 2025, and implementing robust compliance mechanisms are therefore absolutely essential for the successful execution of every Walbridge project. This proactive approach mitigates risk and ensures operational integrity.

Walbridge, as a construction firm, must adhere to strict Occupational Safety and Health Administration (OSHA) regulations. These rules, covering areas like fall protection and hazard communication, are vital for preventing workplace accidents and avoiding substantial penalties. In 2023, OSHA reported over 5,000 worker fatalities in private industry, underscoring the critical nature of these mandates.

Maintaining a strong safety record through diligent compliance is not just a legal necessity but a strategic advantage for Walbridge. Non-compliance can lead to significant fines; for instance, willful violations can incur penalties up to $15,625 per violation as of early 2024. Walbridge's proactive approach to safety directly impacts its operational efficiency and reputation.

Walbridge must meticulously adhere to a complex web of labor laws governing wages, working hours, and non-discrimination. As one of the largest US construction firms, this includes compliance with federal statutes like the Fair Labor Standards Act, which sets minimum wage and overtime pay standards. In 2024, the average wage for construction laborers in the US hovered around $20-$22 per hour, a figure that can fluctuate based on location and union contracts.

The company's operations are also influenced by union agreements, where applicable, which can dictate terms beyond federal minimums. Navigating these collective bargaining agreements is crucial to prevent costly disputes and maintain a consistent, productive workforce. Failure to comply can lead to significant legal challenges and operational disruptions, impacting project timelines and profitability.

Contract Law and Dispute Resolution

Walbridge's operations are fundamentally built on a foundation of contracts with clients, subcontractors, and suppliers. Navigating these agreements, which detail scope, timelines, payment terms, and liability, is paramount for project success and risk management.

Effective contract management is not just about signing documents; it involves vigilant oversight of compliance and proactive identification of potential issues. For instance, in 2024, the construction industry saw a notable increase in contract disputes, with some reports indicating that over 60% of construction projects experienced some form of legal disagreement, often stemming from unclear contract terms or scope creep.

To address potential conflicts, Walbridge must leverage robust dispute resolution strategies. Mechanisms like mediation and arbitration are critical for efficiently resolving disagreements, minimizing costly litigation, and maintaining project momentum. The use of Alternative Dispute Resolution (ADR) methods can significantly reduce project delays and associated financial losses. For example, a study by the American Arbitration Association in 2023 showed that construction disputes resolved through arbitration were, on average, settled 30% faster than those going through traditional court systems.

- Contractual Foundation: Walbridge's business success hinges on well-defined contracts with all stakeholders.

- Risk Mitigation: Meticulous contract management is essential to avoid disputes and protect project continuity.

- Dispute Resolution: Employing mediation and arbitration can efficiently resolve disagreements and minimize legal risks.

- Industry Trends: The construction sector in 2024 experienced a rise in contract disputes, underscoring the importance of clear agreements and effective resolution processes.

Environmental Regulations and Permitting

Walbridge navigates a complex web of environmental regulations impacting construction. These laws cover crucial areas like stormwater runoff management, proper waste disposal, air quality standards, and the protection of sensitive ecosystems such as wetlands and endangered species habitats. Failure to comply can lead to significant legal penalties and project delays.

Securing the necessary environmental permits is a critical step for Walbridge. This process often involves detailed impact assessments and adherence to strict operational guidelines to minimize ecological footprints. For instance, in 2024, the EPA continued to emphasize stringent enforcement of the Clean Water Act, with fines for stormwater violations reaching substantial figures, underscoring the financial risks associated with non-compliance.

Implementing best management practices (BMPs) is essential for Walbridge to meet these environmental mandates. This commitment to sustainable construction is becoming increasingly vital, not only for legal adherence but also for corporate social responsibility and client expectations. By prioritizing these practices, Walbridge aims to mitigate environmental impact and avoid costly legal repercussions, positioning itself as a responsible industry player.

- Stormwater Runoff: Regulations often require detailed plans for managing water flow at construction sites to prevent pollution of local waterways.

- Waste Disposal: Strict rules govern the handling and disposal of construction debris, including hazardous materials, to protect soil and groundwater.

- Air Quality: Measures to control dust and emissions from equipment are mandated to maintain air quality standards in surrounding communities.

- Habitat Protection: Laws protecting wetlands and endangered species necessitate careful planning to avoid disturbance or destruction of critical habitats.

Walbridge must navigate a complex legal landscape, including adherence to building codes, safety regulations like OSHA, and labor laws governing wages and working conditions. In 2024, OSHA fines for serious violations could reach over $15,000 per incident, highlighting the financial implications of non-compliance. Furthermore, the company must manage contractual obligations, with industry data from 2023 indicating that over 60% of construction projects faced some form of legal dispute, often due to unclear terms.

Environmental factors

Climate change presents significant challenges for Walbridge, with extreme weather events like hurricanes and floods becoming more frequent and intense. For instance, the U.S. experienced 28 separate billion-dollar weather and climate disasters in 2023, totaling over $92.9 billion in damages, a trend expected to continue. This directly affects Walbridge's construction timelines and budgets, necessitating robust resilience strategies.

Walbridge must integrate climate resilience into its project planning and design phases. This means anticipating potential disruptions and building infrastructure that can withstand future environmental shifts, such as elevated foundations in flood-prone areas or reinforced structures against high winds. Adapting construction schedules to account for unpredictable weather patterns is also crucial for project success and cost management.

Clients and regulators are increasingly pushing for sustainable and green building, a trend that directly impacts construction firms like Walbridge. This means incorporating eco-friendly materials, energy-saving designs, and responsible construction methods into every project. For instance, in 2023, the global green building market was valued at approximately $316.5 billion, with projections indicating continued strong growth.

Achieving certifications such as LEED (Leadership in Energy and Environmental Design) or similar green building standards is no longer just a nice-to-have; it's a significant competitive differentiator and often a requirement for securing modern construction contracts. In 2024, projects pursuing LEED certification often see a competitive edge in bidding processes, with many large-scale commercial and public sector projects mandating these credentials.

Construction and demolition (C&D) waste represents a substantial environmental challenge, with studies indicating it accounts for a significant percentage of total landfill volume in many regions. For a company like Walbridge, effectively managing this waste is not just about compliance but also a strategic imperative.

Walbridge's success hinges on its capacity to implement robust waste reduction strategies. This includes on-site recycling of materials like concrete and wood, prioritizing material reuse in new projects, and ensuring responsible disposal of unavoidable waste. For instance, in 2024, the EPA reported that C&D debris constituted approximately 40% of the total solid waste generated in the United States, highlighting the scale of the issue.

By excelling in waste management, Walbridge can significantly reduce operational costs through lower disposal fees and potentially generate revenue from recycled materials. This commitment also directly supports broader environmental stewardship goals, enhancing the company's reputation and aligning with increasing client and regulatory demands for sustainable practices in the construction sector.

Resource Scarcity and Material Sourcing

The availability and cost of essential construction materials like aggregates, timber, and water are increasingly shaped by environmental regulations and conservation initiatives. These factors directly impact Walbridge's operational expenses and project timelines.

Walbridge must prioritize a sustainable material sourcing strategy, focusing on incorporating recycled content, sourcing materials locally to reduce transportation impacts, and investigating novel alternatives to navigate the risks posed by diminishing resource availability. Responsible sourcing practices are paramount for long-term viability.

- Global construction material prices saw significant volatility in 2024, with lumber prices fluctuating by over 20% due to supply chain disruptions and demand shifts.

- The demand for recycled aggregates in construction projects is projected to grow by an average of 5% annually through 2028, driven by environmental mandates.

- Water scarcity in key construction regions is leading to increased water usage fees, with some areas experiencing a 15% rise in costs for industrial water consumption in the past year.

- The building materials sector is increasingly scrutinizing its supply chains for ethical and sustainable sourcing, with a growing emphasis on materials with lower embodied carbon.

Energy Consumption and Carbon Footprint

The construction sector, a core area for Walbridge, is a substantial energy user. This includes the power needed for on-site operations and the energy embedded within building materials themselves. For instance, cement production alone accounts for approximately 8% of global CO2 emissions, highlighting the energy intensity of common construction inputs.

Walbridge, like others in the industry, is feeling a stronger push to cut its carbon emissions. This involves adopting more energy-saving methods on job sites, switching to cleaner fuels for machinery, and making transportation and logistics more efficient. In 2023, the construction industry's overall energy demand was projected to grow, making these efforts even more critical.

- Energy Intensity: The construction industry's reliance on energy-intensive materials like concrete and steel presents a significant challenge.

- Emissions Reduction Targets: Many governments and clients are setting ambitious emissions reduction targets for construction projects, impacting companies like Walbridge.

- Operational Efficiency: Optimizing the use of heavy machinery and improving site logistics can lead to substantial energy savings and reduced fuel consumption.

- Material Innovation: Exploring and utilizing lower-carbon or recycled materials is becoming increasingly important for reducing the embodied energy of projects.

Environmental regulations and the increasing focus on sustainability significantly influence Walbridge's operations and project viability. The growing demand for green building practices, evidenced by the global market's valuation at approximately $316.5 billion in 2023, necessitates integrating eco-friendly materials and energy-efficient designs into all projects.

Climate change poses direct operational risks, with the U.S. experiencing 28 billion-dollar weather disasters in 2023, costing over $92.9 billion. This trend demands proactive resilience strategies in project planning and construction to mitigate delays and cost overruns.

Effective waste management, particularly of construction and demolition debris which accounted for approximately 40% of U.S. solid waste in 2023, is crucial. Walbridge's ability to implement robust recycling and reuse strategies can reduce costs and enhance its reputation for environmental stewardship.

The availability and cost of construction materials are increasingly tied to environmental conservation and regulations, impacting operational expenses. Sourcing sustainable and recycled materials, such as the projected 5% annual growth in recycled aggregates through 2028, is vital for long-term viability.

| Environmental Factor | Impact on Walbridge | Key Data/Trend (2023-2025) |

|---|---|---|

| Climate Change & Extreme Weather | Project delays, increased costs, need for resilient design | 28 U.S. billion-dollar weather disasters in 2023 ($92.9B+ in damages) |

| Green Building Demand | Competitive advantage, project requirements, market growth | Global green building market valued at ~$316.5B in 2023 |

| Waste Management (C&D Debris) | Operational costs, regulatory compliance, resource efficiency | C&D debris ~40% of U.S. solid waste (2023 EPA data) |

| Material Sourcing & Availability | Input costs, supply chain stability, sustainability mandates | Recycled aggregates demand projected to grow 5% annually through 2028 |

| Energy Consumption & Emissions | Operational efficiency, regulatory pressure, carbon footprint | Cement production ~8% of global CO2 emissions |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Walbridge is informed by a robust blend of public government data, reputable industry-specific reports, and current economic indicators. We meticulously gather information on regulatory changes, market dynamics, and technological advancements to provide a comprehensive view.