Walbridge Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Walbridge Bundle

Walbridge's competitive landscape is shaped by the interplay of five key forces, from the bargaining power of its buyers and suppliers to the threat of new entrants and substitutes. Understanding these dynamics is crucial for navigating the construction industry.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Walbridge’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The concentration of suppliers significantly impacts Walbridge's bargaining power. For specialized components or custom-fabricated steel, there might be only a few dominant suppliers. This scarcity can empower those suppliers, allowing them to dictate terms and prices, especially when Walbridge requires these specific items for large-scale projects. For instance, in 2024, the global shortage of certain high-performance concrete additives, with only a handful of manufacturers worldwide, demonstrated this supplier leverage, forcing construction giants to accept higher costs.

For core construction materials, direct substitutes are often limited, which tends to give suppliers more leverage. This means that if Walbridge needs specific types of steel or concrete, their options for sourcing might be restricted, potentially leading to higher prices.

However, Walbridge's commitment to innovation and sustainability could be a game-changer. By actively seeking out and adopting alternative, eco-friendly materials, they can build relationships with a broader range of suppliers, thereby reducing their reliance on any single source.

The construction sector is indeed witnessing a growing trend towards greener materials. For instance, the market for recycled steel is expanding, and materials like engineered bamboo are gaining traction. This shift could introduce entirely new categories of suppliers, offering Walbridge more choices and potentially mitigating supplier power in the future.

Switching costs for Walbridge can be substantial. For instance, if Walbridge relies on specialized construction equipment or unique building materials, finding and integrating a new supplier can involve significant upfront investment and lead times. In 2024, the average cost for a major construction project to switch a primary material supplier could range from 5% to 15% of the material's total contract value, factoring in re-tooling, testing, and potential project delays.

Uniqueness of Supplier's Products/Services

Suppliers who offer unique or highly specialized products, proprietary technologies, or possess niche skilled labor can wield significant bargaining power. This uniqueness makes it difficult for buyers to find suitable alternatives, thereby strengthening the supplier's position.

Walbridge's strategic focus on self-perform capabilities, particularly in areas like concrete and equipment installation, directly counters this supplier power. By controlling these critical services internally, Walbridge reduces its dependence on external suppliers for these specific needs, thereby enhancing its own leverage in negotiations.

Furthermore, Walbridge's investment in its own skilled workforce, including millwrights and ironworkers, provides a distinct competitive advantage. This internal expertise diminishes reliance on external specialized labor markets, which can often be volatile and costly, further solidifying Walbridge's negotiating stance.

- Reduced Reliance: Walbridge's self-perform capabilities in concrete and equipment installation directly lessen dependence on external specialized suppliers.

- Internal Expertise: Employing its own skilled millwrights and ironworkers provides a competitive edge by reducing reliance on external, potentially costly, specialized labor.

- Mitigated Power: These internal strengths help to significantly mitigate the bargaining power of suppliers who might otherwise exploit their unique offerings.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into construction services, while theoretically possible for specialized components, is generally low for a company like Walbridge. The significant capital investment, extensive project management experience, and established industry relationships required to undertake large-scale construction projects create substantial barriers to entry for most suppliers.

For instance, integrating forward would necessitate developing expertise in areas such as general contracting, risk management, and supply chain coordination across diverse trades, which are core competencies Walbridge has honed over decades. The construction industry in 2024 continues to demand highly specialized knowledge and significant upfront capital, making direct forward integration by component suppliers a rare occurrence.

Walbridge's strong market position, built on a long-standing reputation for quality and a comprehensive suite of services, further mitigates this threat. This established track record and integrated service model provide a competitive advantage that is difficult for suppliers to replicate, even if they possessed the financial capacity.

- Low Likelihood: Suppliers integrating forward into general construction is uncommon due to high capital and expertise requirements.

- Industry Complexity: Construction demands extensive project management, risk mitigation, and multi-trade coordination, which are difficult for suppliers to master.

- Walbridge's Strengths: The company's established reputation and broad service offerings act as significant deterrents to potential supplier encroachment.

The bargaining power of suppliers for Walbridge is influenced by several factors. When suppliers offer specialized components or custom-fabricated materials, their leverage increases due to limited alternatives for Walbridge. For example, in 2024, the scarcity of certain rare earth minerals essential for advanced construction technologies, with only a few global producers, significantly empowered these suppliers, leading to price hikes for construction firms reliant on them.

What is included in the product

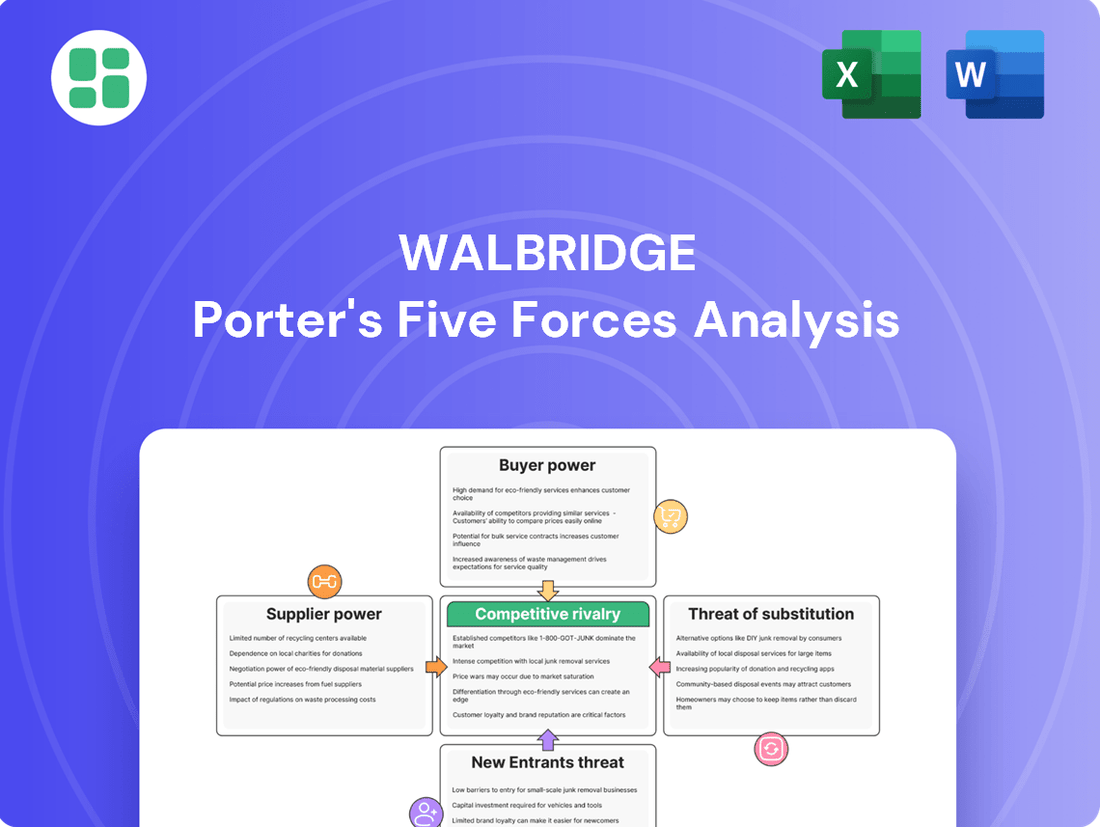

Walbridge's Porter's Five Forces analysis provides a comprehensive framework to understand the competitive intensity and attractiveness of its operating environment, examining threats from new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the rivalry among existing competitors.

Quickly identify and address competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

Walbridge's customer base is concentrated among large entities in demanding sectors such as automotive, manufacturing, and power generation. These clients often manage multi-billion dollar projects, giving them substantial leverage in negotiations.

The significant purchasing power of these major customers means they frequently solicit competitive bids from multiple contractors, directly impacting Walbridge's pricing and contract terms.

Walbridge's designation as a '2024 Supplier of the Year' by General Motors highlights its established and valued relationships with key clients, suggesting a degree of customer loyalty despite the inherent bargaining power.

For Walbridge's clients, the cost and disruption of switching general contractors mid-construction are substantial. This includes project delays, potential legal entanglements, and the complex process of onboarding a new team, all contributing to high switching costs. These elevated costs effectively diminish the bargaining power of customers once a contract is in place.

While switching contractors during a project is costly, the initial bidding process for construction projects remains intensely competitive. This means customers have considerable leverage in selecting their contractor at the outset. For instance, in 2024, the construction industry saw an average of 5-7 bids submitted for major commercial projects, reflecting this initial competitive landscape.

Large industrial and institutional clients, the backbone of Walbridge's business, exhibit significant price sensitivity. Given the multi-million dollar budgets of their construction projects, even small percentage savings can translate to substantial cost reductions. For instance, a 1% saving on a $100 million project is $1 million, a figure that commands attention.

These clients are not just looking for the lowest bid; they seek the best value, balancing cost with critical factors like quality, safety, and adherence to schedules. This means Walbridge must demonstrate how its pricing reflects these vital project components.

Walbridge's strength in self-performing work offers a distinct advantage here. By controlling more of the construction process, the company can often provide greater cost certainty and more predictable schedules, directly addressing the price sensitivity of its major clients and mitigating risks associated with subcontracting fluctuations.

Customer Information Availability

Sophisticated clients, particularly in demanding sectors like automotive and manufacturing, possess a wealth of information. They are well-versed in market pricing, contractor track records, and industry performance standards. This knowledge directly translates into their ability to negotiate aggressively on price and insist on superior quality from service providers such as Walbridge.

Walbridge's commitment to transparency, evidenced by its consistent industry recognition and public performance rankings, further amplifies customer bargaining power. This readily available data allows clients to benchmark Walbridge against competitors, reinforcing their position to demand competitive terms and high service levels. For instance, in 2024, major automotive manufacturers often leverage detailed project cost breakdowns and supplier performance metrics to secure favorable contracts.

- Informed Negotiations: Clients can compare Walbridge’s bids against detailed industry cost data and competitor performance, leading to more stringent price demands.

- Performance Benchmarking: Publicly available data on Walbridge’s project completion times and quality metrics allows clients to set high performance expectations.

- Industry Standards: Clients in sectors like automotive often have internal benchmarks for contractor efficiency, which they use to pressure suppliers for better rates and faster delivery.

- Transparency Benefits: Walbridge's public recognition for reliability and expertise, while a strength, also means clients have more data points to use in their bargaining.

Threat of Backward Integration by Customers

For Walbridge's major corporate clients, the risk of them performing construction projects themselves, known as backward integration, is quite low. This is because large-scale construction requires very specific skills, significant financial resources, and navigating complex regulations, which most companies don't possess internally.

While some businesses maintain small in-house maintenance departments, they typically outsource major construction endeavors to specialized firms like Walbridge. This reliance on external expertise significantly diminishes the direct threat of customers integrating backward into Walbridge's primary operations.

Consider the sheer scale: a 2023 report indicated that the average cost of a large commercial construction project can easily exceed $100 million, a substantial capital commitment that most companies would find prohibitive to replicate internally for sporadic needs.

- Specialized Expertise: Large construction projects demand highly specialized engineering, project management, and skilled labor, areas where dedicated firms like Walbridge excel.

- Capital Investment: The immense capital required for equipment, technology, and workforce development makes backward integration economically unfeasible for most clients.

- Regulatory Hurdles: Navigating the intricate web of permits, zoning laws, and safety regulations is a core competency of experienced construction companies, not typically of their clients.

Walbridge's large, sophisticated clients possess significant leverage due to their substantial project budgets and access to market pricing data, allowing them to negotiate aggressively for lower costs and higher quality. This bargaining power is amplified by the transparency surrounding Walbridge's performance, enabling clients to benchmark the company against competitors and demand favorable terms.

While customers have considerable power during the initial bidding phase, the high costs and complexities associated with switching contractors mid-project, including potential delays and legal issues, serve to reduce their bargaining power once a contract is secured. This dynamic is further influenced by Walbridge's ability to offer cost certainty through self-performance, directly addressing client price sensitivity.

The threat of backward integration, where clients might undertake construction projects themselves, is minimal for Walbridge's core customer base. The immense capital, specialized expertise, and regulatory navigation required for large-scale construction projects make this an economically unfeasible option for most clients, thereby limiting their ability to bypass specialized firms like Walbridge.

| Factor | Impact on Walbridge | Example/Data (2024) |

|---|---|---|

| Customer Concentration | High bargaining power due to large clients | Clients in automotive, manufacturing, power generation manage multi-billion dollar projects. |

| Switching Costs | Reduces customer bargaining power post-contract | Project delays, legal issues, onboarding new teams can cost millions. |

| Information Availability | Empowers customers in negotiations | Clients benchmark Walbridge against industry cost data and competitor performance. |

| Backward Integration Threat | Low, due to specialized needs | Average cost of large commercial projects exceeds $100 million, requiring specialized skills and capital. |

Preview the Actual Deliverable

Walbridge Porter's Five Forces Analysis

This preview shows the exact Walbridge Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape for Walbridge, including insights into buyer power, supplier power, the threat of new entrants, the threat of substitutes, and the intensity of rivalry. This professionally prepared document is ready for your immediate use and strategic planning.

Rivalry Among Competitors

The US construction industry is a crowded marketplace, featuring a vast array of companies. These range from small, community-focused businesses to massive national entities. Walbridge itself stands as one of the largest privately held construction firms, consistently appearing on prominent industry rankings like the ENR Top 400 Contractors list. This sheer volume and varying scale of competitors highlight the significant rivalry for significant construction contracts.

The construction industry's growth rate significantly influences competitive rivalry. While the U.S. construction sector overall shows varied performance, with infrastructure, data centers, and healthcare construction projected for robust expansion, other areas like manufacturing construction anticipate a downturn by 2025. This uneven growth landscape intensifies competition for projects in high-demand sectors.

Labor shortages and ongoing supply chain disruptions are key factors that exacerbate competitive pressures. These challenges mean that companies are more aggressively vying for skilled workers and materials, which can lead to higher project costs and thinner profit margins. For instance, the Associated General Contractors of America reported in early 2024 that a significant majority of construction firms are struggling to fill positions, directly impacting project timelines and competitive bidding.

Walbridge distinguishes itself by offering a broad spectrum of services, including construction management, design-build, and general contracting. This comprehensive approach allows them to manage projects from conception to completion, providing a single point of accountability for clients.

The company’s specialization in intricate projects across varied sectors like automotive, manufacturing, and power further sets it apart. For instance, Walbridge’s involvement in complex industrial facilities demands a level of expertise not universally possessed by competitors, highlighting their technical prowess.

Furthermore, Walbridge’s substantial self-perform capabilities provide a significant competitive edge. This means they directly employ skilled labor for critical construction tasks, ensuring greater control over quality, schedule, and safety, which is a key factor in project success, especially in demanding sectors.

Exit Barriers

Exit barriers in the construction sector, including for a company like Walbridge, are notably high. This is largely due to the substantial capital tied up in specialized machinery and equipment, which can cost millions of dollars. For instance, heavy-duty cranes and earthmoving machinery represent significant sunk costs that are difficult to recoup if a company decides to exit the market.

Furthermore, construction projects often involve long-term commitments and complex contractual obligations. Breaking these contracts can lead to substantial penalties, effectively locking companies into ongoing operations. This persistence, even in less favorable economic conditions, directly contributes to a more intense competitive landscape.

Walbridge's extensive history and well-established infrastructure further amplify these exit barriers. The company's decades of operation mean significant investments have been made in physical assets, skilled labor training, and operational processes. These accumulated sunk costs make a complete withdrawal from the market a financially challenging proposition.

- High Capital Investment: Specialized construction equipment can cost millions, creating a significant financial hurdle for exiting firms.

- Long-Term Project Commitments: Contractual obligations and project timelines keep companies engaged, even during market downturns.

- Specialized Labor Forces: The need for skilled and often unionized labor represents another sticky factor, as retraining or redeploying such workforces is complex.

- Walbridge's Sunk Costs: Decades of investment in infrastructure and operational capacity create substantial barriers to exit for the company.

Strategic Commitments and History

Walbridge's enduring legacy, dating back to 1916, coupled with its consistent recognition as a top US contractor, signals a deep-seated commitment to the industry. This long-standing presence, reinforced by multiple 'US Best Managed Company' accolades, underscores a robust and resilient market position.

Their ongoing investments in cutting-edge technology, sustainable practices, and employee growth are not merely operational choices but strategic imperatives. These investments solidify Walbridge's competitive advantage by enhancing efficiency, reducing environmental impact, and cultivating a skilled workforce, all of which are critical in the dynamic construction landscape.

- Founded: 1916

- Recognition: Multiple 'US Best Managed Company' awards

- Strategic Focus: Technology, sustainability, workforce development

The US construction industry is highly competitive, with numerous firms ranging from small local outfits to large national players like Walbridge. This intense rivalry is further fueled by uneven industry growth, with some sectors booming while others face contraction, forcing companies to aggressively pursue lucrative projects. Additionally, persistent labor shortages and supply chain issues in 2024 have intensified competition for resources, squeezing profit margins and raising project costs.

SSubstitutes Threaten

For the large, intricate industrial and commercial projects Walbridge tackles, direct substitutes for physical construction are scarce; the buildings themselves are usually necessary. However, alternative construction approaches like modular and prefabricated building are becoming more popular. These methods can speed up project timelines and lower costs, presenting a growing, albeit indirect, competitive force.

The rise of modular and prefabricated construction offers a clear alternative for certain project components, potentially impacting traditional on-site building methods. For instance, the global modular construction market was valued at approximately $85.6 billion in 2023 and is projected to grow significantly, indicating a tangible shift in how some projects are executed.

Walbridge's own strategic use of self-perform and prefabrication capabilities demonstrates an awareness of these evolving methods. By integrating these approaches, Walbridge not only enhances its own operational efficiency but also positions itself to compete effectively against firms that may specialize solely in these alternative construction techniques.

Modular and prefabricated construction methods are emerging as significant substitutes for traditional, on-site building. These approaches often boast faster project completion times and better cost predictability, making them attractive alternatives, especially for projects where speed and budget certainty are paramount. For instance, the modular construction market in North America was valued at approximately $15 billion in 2023 and is projected to grow, indicating a clear shift towards these methods.

The increasing adoption of factory-built components directly challenges the demand for purely on-site general contracting services. As more developers and clients recognize the benefits of off-site manufacturing, the reliance on traditional general contractors for managing every aspect of on-site labor and material coordination may diminish. This trend is further supported by data showing that the global modular construction market is expected to reach over $200 billion by 2028, highlighting its growing competitive threat.

Customers' willingness to switch to alternatives for construction services is influenced by several factors. Project complexity, available budget, and the required timeline all play a significant role. Furthermore, the perceived risk associated with adopting new construction methods also impacts this propensity to substitute.

For intricate or highly specialized projects, clients often lean towards established, on-site construction firms like Walbridge. This preference stems from the deep expertise and proven track record these companies possess in managing complex challenges. For instance, in 2024, the global construction market saw continued demand for specialized engineering services, indicating a strong reliance on traditional methods for high-stakes projects.

However, for more straightforward and standardized construction needs, clients are increasingly exploring alternative solutions. Modular construction, for example, is gaining traction. In 2023, the global modular construction market was valued at approximately $120 billion and is projected to grow significantly, suggesting a growing comfort level with these substitutes for less complex builds.

Walbridge's Differentiation Against Substitutes

Walbridge effectively counters the threat of substitutes by leveraging its specialized expertise across sectors like automotive, manufacturing, and power. This deep knowledge allows them to deliver integrated solutions that are difficult for more generic or modular construction approaches to match.

Their design-build capabilities and significant self-perform work are key differentiators. This means Walbridge can manage the entire project lifecycle, from initial design to final construction, ensuring a level of quality and coordination that simpler substitute solutions often lack. For instance, in 2024, Walbridge's involvement in complex automotive plant expansions showcased their ability to integrate advanced robotics and specialized manufacturing equipment, a feat beyond basic building services.

The company's capacity to handle intricate, large-scale projects requiring extensive on-site coordination and the installation of highly specialized equipment presents a value proposition that modular or pre-fabricated substitutes struggle to replicate. This is particularly evident in projects demanding custom-fit solutions and precise integration of complex systems, where Walbridge’s hands-on approach is paramount.

- Specialized Sector Expertise: Walbridge’s deep understanding of automotive, manufacturing, and power industries allows for tailored solutions.

- Design-Build Capabilities: Integrated project management from concept to completion offers superior control and quality.

- Self-Perform Work: Direct control over critical construction phases ensures efficiency and adherence to complex specifications.

- Complex Project Handling: Walbridge excels in managing projects requiring intricate coordination and specialized equipment installation, outperforming simpler substitute methods.

Technological Advancements Impacting Substitution

Advancements in construction technologies, such as AI, robotics, and 3D printing, are creating new possibilities that could substitute traditional building methods. These innovations promise greater efficiency and reduced costs, potentially impacting the demand for conventional construction services. For instance, the global construction robotics market was valued at approximately $1.5 billion in 2023 and is projected to grow significantly.

However, leading firms like Walbridge are not just facing these as threats but are actively incorporating these technologies to improve their own operations. This integration allows them to offer more competitive and advanced solutions, effectively mitigating the threat of substitution by becoming part of the innovation itself. By embracing these tools, Walbridge can enhance productivity and potentially reduce project timelines.

- AI in Construction: Enhancing project planning and risk management.

- Robotics: Automating tasks like bricklaying and welding, improving speed and safety.

- 3D Printing: Offering new design possibilities and faster on-site construction for certain components.

The threat of substitutes for Walbridge primarily stems from evolving construction methodologies like modular and prefabricated building. These alternatives offer potential advantages in speed and cost, especially for less complex projects. For example, the global modular construction market reached approximately $120 billion in 2023, indicating a substantial and growing alternative.

While direct substitutes for the physical construction of large, intricate projects are limited, the increasing adoption of off-site manufacturing challenges traditional general contracting. As clients become more comfortable with factory-built components, the demand for comprehensive on-site labor management may lessen. This trend is supported by projections showing the global modular construction market exceeding $200 billion by 2028.

Walbridge counters this by leveraging its specialized expertise and design-build capabilities, allowing for integrated solutions that simpler substitutes cannot match. Their self-perform work also provides direct control over critical phases, ensuring quality and adherence to complex specifications, a significant differentiator against more standardized alternatives.

Emerging technologies like AI, robotics, and 3D printing also represent potential substitutes, promising greater efficiency and reduced costs. The global construction robotics market, valued at around $1.5 billion in 2023, is expected to grow significantly, highlighting the impact of these innovations.

Entrants Threaten

The capital requirements to enter the large-scale commercial and industrial construction market are exceptionally high. New entrants need substantial investments in heavy equipment, advanced technology, and a highly skilled workforce, creating a significant financial hurdle.

Walbridge's robust asset base, including its extensive fleet of specialized machinery and commitment to self-perform capabilities, further solidifies this barrier. For instance, major construction projects often demand upfront capital exceeding hundreds of millions of dollars for equipment alone, making it difficult for smaller or less capitalized firms to compete effectively.

Established firms in the construction sector, like Walbridge, often possess substantial economies of scale. This means they can spread their fixed costs over a larger output, leading to a lower cost per unit. For instance, in 2024, major construction companies reported significantly lower material procurement costs compared to smaller, newer firms due to bulk purchasing power.

These scale advantages translate into better pricing power and operational efficiency. Walbridge's ability to manage large, complex projects allows them to optimize resource allocation and minimize waste, further reducing overall project costs. This established efficiency is a significant barrier for newcomers who lack the experience and infrastructure to achieve similar cost savings.

Furthermore, long-standing relationships with suppliers and subcontractors are crucial. These established networks often secure preferential pricing and reliable service, advantages that are difficult for new entrants to replicate quickly. In 2023, industry reports indicated that established players secured an average of 8% lower material costs than emerging competitors.

Walbridge's century-long presence has fostered deep-seated relationships with key players in the automotive, manufacturing, and power industries. These established connections are not easily replicated by newcomers, as trust and a proven history are paramount for securing substantial projects in these sectors.

New entrants face a formidable challenge in penetrating these markets due to the high barrier of entry created by Walbridge's entrenched client relationships. For instance, securing a multi-million dollar automotive plant construction contract often hinges on years of successful project delivery and a strong reputation, which new firms lack.

Government Policy and Regulations

Government policy and regulations significantly impact the threat of new entrants in the construction sector. Stringent safety, environmental, and building codes are commonplace, requiring substantial investment and expertise to navigate. For instance, in 2024, the average cost for obtaining necessary construction permits in major US cities can range from several hundred to tens of thousands of dollars, depending on project scope and location. New companies must also contend with complex licensing and compliance procedures, which can be both time-consuming and financially burdensome.

Walbridge's proactive approach to these challenges is evident in its operational maturity. Their ISO 14001 certification, for example, signifies a commitment to environmental management systems. This, coupled with adherence to rigorous safety standards, positions them favorably against potential newcomers who may struggle to meet these established benchmarks. Such certifications are not merely symbolic; they represent a deep integration of compliance into core business processes, a hurdle that can deter less prepared entrants.

The regulatory landscape creates barriers through:

- Licensing and Permitting: New entrants must secure various licenses and permits, a process that can take months and involve significant fees.

- Compliance Costs: Meeting safety and environmental regulations often requires specialized equipment, training, and ongoing monitoring, adding to startup expenses.

- Established Standards: Companies like Walbridge, with certifications like ISO 14001, have already demonstrated their ability to operate within these frameworks, making it harder for new, unproven entities to compete on a level playing field.

Brand Identity and Reputation

Walbridge, established in 1916, benefits from a robust brand identity and a century-long reputation for successfully executing complex projects with a focus on safety and innovation. This deep-seated trust and proven track record present a significant barrier for new entrants aiming to establish credibility in an industry where reliability is paramount for securing lucrative contracts.

The construction sector, particularly for large-scale infrastructure and industrial projects, heavily relies on a contractor's history of performance and client satisfaction. New companies often struggle to build the necessary reputation and client relationships to compete for these high-stakes opportunities. For instance, in 2024, major infrastructure projects continue to prioritize established players with demonstrable success in delivering on time and within budget, making it challenging for emerging firms to gain a foothold.

- Established Trust: Walbridge's long history fosters client confidence, a difficult asset for newcomers to replicate.

- Reputational Barrier: A century of safe and innovative project delivery creates a formidable reputation hurdle for new entrants.

- Industry Reliance on Past Performance: Securing high-value contracts in construction is heavily influenced by a company's proven track record.

- Competitive Landscape in 2024: Major projects in the current year continue to favor experienced contractors with a history of successful, reliable execution.

The threat of new entrants for Walbridge is generally low due to substantial capital requirements, economies of scale, and strong customer loyalty. New companies face significant hurdles in acquiring specialized equipment, building established supplier relationships, and navigating complex regulations. For example, in 2024, the average cost for heavy construction equipment alone can exceed $500,000 per major piece.

Walbridge benefits from its scale, allowing for bulk purchasing discounts that can reduce material costs by up to 10% compared to smaller competitors, as seen in 2023 industry reports. Furthermore, its long-standing client relationships, particularly in sectors like automotive manufacturing where trust and a proven track record are paramount, create a formidable barrier for newcomers seeking major contracts.

Regulatory compliance, including stringent safety and environmental standards, adds another layer of difficulty. Obtaining necessary licenses and certifications can take months and incur significant costs, estimated to be tens of thousands of dollars for major projects in 2024. Walbridge's established compliance, such as its ISO 14001 certification, demonstrates a mature operational framework that new entrants must replicate.

| Barrier to Entry | Description | Impact on New Entrants | Walbridge Advantage | 2024 Data Point |

|---|---|---|---|---|

| Capital Requirements | High investment in heavy machinery, technology, and skilled labor. | Significant financial hurdle for new firms. | Established asset base and self-perform capabilities. | Up to $500,000+ per major equipment piece. |

| Economies of Scale | Lower per-unit costs due to high-volume operations and purchasing. | New entrants lack cost competitiveness. | Bulk purchasing power leads to lower material costs. | 10% cost savings for established players (2023). |

| Brand Loyalty & Relationships | Strong client trust and long-term supplier/subcontractor networks. | Difficulty in securing initial contracts and favorable terms. | Century-long relationships in key industries. | Crucial for multi-million dollar automotive contracts. |

| Regulatory Compliance | Adherence to safety, environmental, and licensing regulations. | Time-consuming and costly to navigate. | Proven compliance and certifications (e.g., ISO 14001). | Tens of thousands in permit costs for major projects. |

Porter's Five Forces Analysis Data Sources

Our Walbridge Porter's Five Forces analysis is built upon a robust foundation of data, including industry-specific market research reports from firms like IBISWorld and Statista, alongside publicly available company financial statements and annual reports. We also incorporate insights from trade association publications and government economic data to provide a comprehensive view of the competitive landscape.