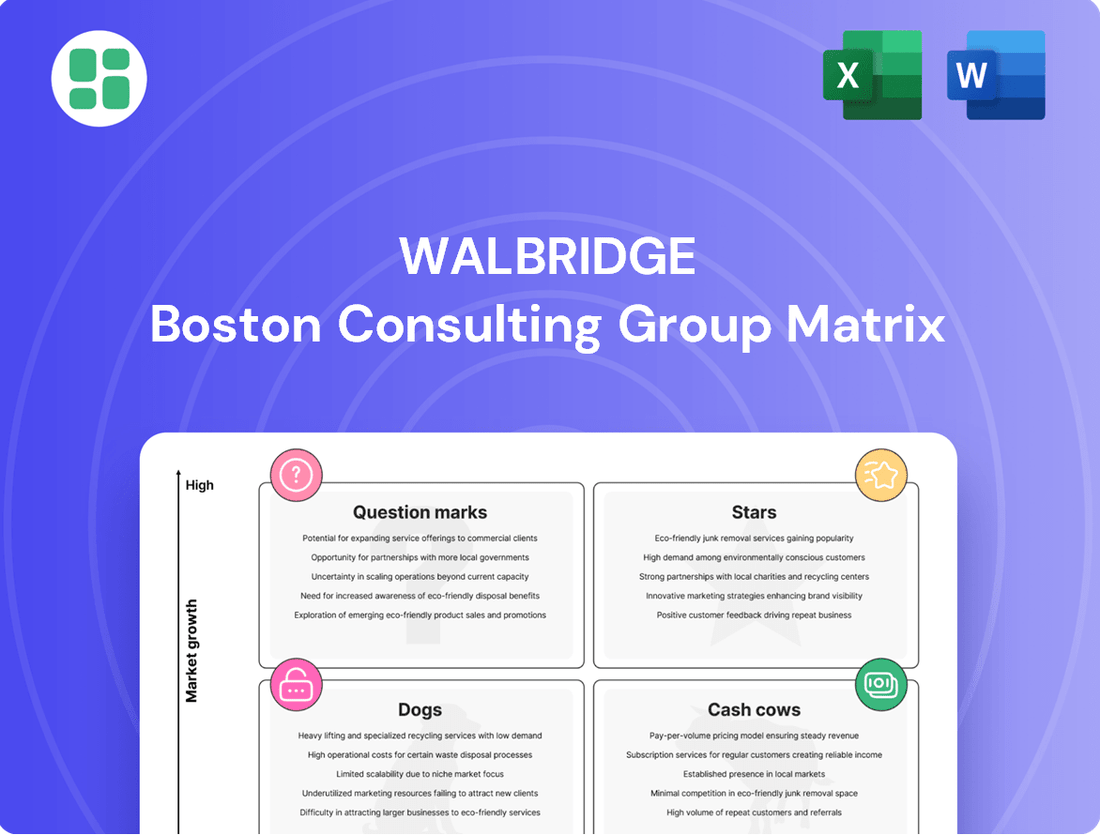

Walbridge Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Walbridge Bundle

Curious about the Walbridge BCG Matrix? This powerful tool categorizes products into Stars, Cash Cows, Dogs, and Question Marks, offering a visual roadmap for strategic decision-making. Understand where Walbridge's resources are best allocated and which products hold the most potential for growth.

To truly unlock the strategic advantage, dive into the full Walbridge BCG Matrix. Gain a comprehensive understanding of each product's market share and growth rate, enabling you to make informed investment choices and optimize your portfolio. Purchase the complete report for actionable insights and a clear path to market leadership.

Stars

Walbridge's significant presence in automotive construction, particularly in the rapidly expanding electric vehicle (EV) sector, positions them strongly within the BCG matrix. Their expertise is evident in landmark projects like Ford's BlueOval Battery Park Michigan, a $3.5 billion investment, and the $5.6 billion BlueOval City complex in Tennessee. These large-scale endeavors highlight Walbridge's substantial market share and capabilities in building the advanced manufacturing facilities crucial for the EV revolution.

The reshoring and expansion of advanced manufacturing, particularly semiconductor fabrication plants, present a significant growth opportunity. This sector is characterized by high complexity and demands specialized construction expertise. Walbridge's established track record in general manufacturing, combined with the national imperative for domestic production, positions them to secure a substantial portion of these cutting-edge projects.

Hyperscale data centers are booming, driven by cloud services, AI, and digital shifts. In 2024, the global data center market was valued at over $240 billion and is projected to reach $360 billion by 2028, showcasing immense growth. Walbridge's increasing prominence in this sector, evident in their rising market share, positions them as a key player.

Walbridge's capacity to manage and construct these highly complex, critical facilities is a significant advantage. Their expertise ensures the reliable delivery of infrastructure essential for the digital economy, making them a go-to contractor for hyperscale development.

Large-Scale Renewable Energy Infrastructure

The global shift towards clean energy, encompassing massive solar farms, wind power initiatives, and battery storage, represents a rapidly expanding market. This growth is fueled by worldwide sustainability objectives and supportive government policies.

Walbridge, while established in conventional power, is strategically increasing its involvement and expertise in large-scale renewable energy projects. This positions the company to capture a substantial portion of this burgeoning market segment.

- Market Growth: The renewable energy sector is projected to see significant investment, with global renewable energy capacity expected to increase by over 2,400 gigawatts (GW) between 2022 and 2027, according to the International Energy Agency (IEA).

- Government Support: Initiatives like the Inflation Reduction Act in the United States, enacted in 2022, provide substantial tax credits and incentives, driving investment in renewable infrastructure.

- Walbridge's Position: As of 2024, Walbridge's project pipeline in renewable energy infrastructure is expanding, reflecting a deliberate strategy to capitalize on this demand.

- Technological Advancements: Innovations in solar panel efficiency and wind turbine technology continue to lower costs, making large-scale projects more economically viable.

Complex Industrial Revitalization Projects

As industries embrace automation and robotics, the demand for revitalizing aging industrial facilities is surging. Walbridge excels in these complex projects, integrating cutting-edge technologies into existing structures. This positions them strongly in a high-value, high-growth segment of manufacturing construction.

These projects often involve significant capital investment. For instance, a major automotive plant modernization in 2024 might see investments exceeding $500 million to incorporate advanced robotics and AI-driven quality control systems. Walbridge's proven track record in managing such intricate undertakings, often within active operational environments, is a key differentiator.

- Dominant Niche: Walbridge's specialization in complex industrial revitalization places them in a lucrative market segment.

- Technological Integration: Their ability to seamlessly blend new technologies into existing infrastructure is crucial for modernizing manufacturing.

- High-Value Projects: These revitalization efforts represent substantial construction contracts, often in the hundreds of millions of dollars.

- Market Growth: The ongoing industrial shift towards Industry 4.0 fuels a consistent demand for these specialized services.

Walbridge's significant investments and market share in the burgeoning electric vehicle (EV) manufacturing sector, exemplified by projects like Ford's BlueOval City, firmly place them in the Stars quadrant of the BCG matrix. Their expertise in constructing advanced manufacturing facilities for semiconductors and hyperscale data centers also aligns with high-growth, high-market-share characteristics, indicating strong potential for continued success and leadership in these areas.

| Market Segment | Walbridge's Position | Growth Potential | Market Share |

|---|---|---|---|

| EV Manufacturing | Star | High | High |

| Semiconductor Fabrication | Star | High | High |

| Hyperscale Data Centers | Star | High | High |

| Industrial Revitalization (Industry 4.0) | Star | High | High |

| Renewable Energy Infrastructure | Question Mark/Star (Emerging) | High | Growing |

What is included in the product

Highlights which units to invest in, hold, or divest based on market growth and share.

Visualize your portfolio's health with a clear, actionable Walbridge BCG Matrix, eliminating the pain of strategic uncertainty.

Cash Cows

Traditional automotive assembly plant expansions and upgrades represent a solid cash cow for Walbridge. Their undisputed position as the top contractor in this sector since 2020, with significant market share, ensures a steady flow of business. This mature market, while not experiencing explosive growth, provides consistent, high-volume revenue due to ongoing retooling and maintenance needs.

General Manufacturing Facility Construction & Maintenance is a strong Cash Cow for Walbridge, reflecting its number one ranking in manufacturing construction within the United States. This sector represents a mature, stable market where Walbridge's established reputation allows for consistent, significant cash flow generation with minimal need for increased promotional spending.

Walbridge's in-house expertise in concrete, structural steel, and equipment installation serves as a robust internal cash cow. These self-perform capabilities offer a dependable and cost-effective solution for numerous projects, directly contributing to the company's financial stability.

By controlling these critical construction phases internally, Walbridge can better manage expenses and uphold stringent quality standards. This operational efficiency translates into potentially higher profit margins, solidifying these activities as a consistent revenue stream within the mature construction services sector.

Long-Term Client Relationships & Recurring Contracts

Walbridge's deep, long-standing relationships with major clients are a significant strength, acting as a cornerstone for its Cash Cows. A prime example is their consistent recognition as a top supplier by General Motors, a testament to the trust and reliability they've built over years of collaboration.

These enduring partnerships frequently lead to recurring contracts for substantial projects, ongoing maintenance, and crucial capital improvements. This creates a stable and predictable revenue stream, particularly within established industrial and commercial sectors where Walbridge has a proven track record.

- Client Loyalty: General Motors' repeated top supplier recognition highlights the depth of Walbridge's client relationships.

- Revenue Stability: Recurring contracts for large-scale projects and maintenance ensure a consistent income flow.

- Sector Dominance: Walbridge leverages its expertise in established industrial and commercial markets for predictable returns.

- Predictable Growth: The nature of these long-term contracts allows for reliable financial forecasting and resource allocation.

General Contracting for Large-Scale Industrial & Commercial Projects

Walbridge's general contracting for large-scale industrial and commercial projects fits the Cash Cow quadrant of the BCG Matrix. As one of the largest privately held construction firms in the U.S., Walbridge commands a significant market share in this sector, generating substantial and stable revenues.

These mature markets, while not experiencing rapid growth, allow Walbridge to capitalize on its extensive experience, operational efficiency, and economies of scale. This translates into consistent, high profit margins, making these projects a reliable source of cash flow for the company.

For instance, in 2024, the industrial construction sector, a key area for Walbridge, saw continued investment in manufacturing and infrastructure, although growth rates moderated compared to previous years. Despite this, Walbridge's established relationships and proven track record in delivering complex projects ensure sustained demand.

- Market Position: Walbridge is a leader in U.S. general contracting for large industrial and commercial projects.

- Revenue Generation: These projects consistently deliver high revenue due to the scale and scope of undertakings.

- Profitability: Leveraging experience and scale allows for strong, stable profit margins in a competitive but mature market.

- Cash Flow: The business unit acts as a significant generator of cash for Walbridge, funding other strategic initiatives.

Walbridge's expertise in automotive plant construction and upgrades solidifies its position as a cash cow. The company's consistent ranking as the top contractor in this sector since 2020 guarantees a steady revenue stream from ongoing retooling and maintenance needs in this mature market.

General manufacturing facility construction and maintenance also represent a significant cash cow for Walbridge, reinforcing its number one U.S. ranking. This stable, mature market allows Walbridge to leverage its strong reputation for consistent, high cash flow generation with minimal marketing investment.

The consistent demand for industrial construction services in 2024, despite moderated growth, underscores Walbridge's cash cow status in this sector. Their established client relationships and proven project delivery capabilities ensure sustained demand, contributing to stable revenue and profitability.

| Business Segment | BCG Quadrant | Key Strengths | 2024 Market Insight |

| Automotive Plant Construction | Cash Cow | Market leadership, consistent demand for upgrades and maintenance | Steady revenue from mature market needs |

| General Manufacturing Construction | Cash Cow | Top U.S. ranking, strong reputation, mature market stability | Reliable cash flow with low promotional spending |

| Large-Scale Industrial/Commercial Projects | Cash Cow | Significant market share, operational efficiency, economies of scale | Continued investment in infrastructure and manufacturing |

Preview = Final Product

Walbridge BCG Matrix

The Walbridge BCG Matrix preview you are viewing is the complete, unwatermarked document you will receive immediately after purchase. This means the strategic framework, analysis, and visual representation are exactly as presented, ready for your direct application in business planning. You can confidently use this preview as a true representation of the professional-grade BCG Matrix report you'll acquire.

Dogs

For Walbridge, small-scale, highly commoditized general building projects represent a "Dog" in the BCG matrix. These projects typically offer slim profit margins due to intense competition from numerous smaller, more agile contractors. Walbridge's extensive overhead and specialization in large, complex industrial endeavors make it challenging to achieve profitability here.

The market for these types of projects is often characterized by low growth and a fragmented landscape, meaning Walbridge would likely hold a very small market share. Their operational model, built for massive infrastructure and manufacturing facilities, is not cost-effective for smaller, simpler builds.

In 2024, the construction industry saw continued demand for specialized industrial and infrastructure projects, where Walbridge excels. However, the general building sector, especially for smaller projects, faced pressures from rising material costs and labor shortages, further diminishing potential returns for large-scale players like Walbridge.

Walbridge's legacy infrastructure in declining industries, such as those tied to outdated fossil fuel facilities or heavy industries facing obsolescence, would be categorized as Dogs. These segments typically exhibit low growth prospects and Walbridge's market share within them is likely to be small or shrinking. For instance, a segment of the construction market focused on maintaining aging coal-fired power plants, which saw a significant decline in new builds and operational capacity in recent years, exemplifies this. The U.S. Energy Information Administration reported that coal's share of electricity generation fell to approximately 16% in 2023, down from over 40% a decade prior, highlighting the shrinking market for such legacy infrastructure services.

Walbridge's involvement in residential construction, if any, would likely be categorized as a 'Dog' within the BCG Matrix. This sector is characterized by intense competition and fragmentation, with many smaller players. Walbridge's core strengths and operational scale are better suited for larger industrial and commercial ventures, not typically for individual home building.

The residential construction market often presents lower profit margins and different project management demands compared to Walbridge's primary focus areas. For instance, in 2024, the U.S. housing market, while showing some resilience, faces ongoing challenges like affordability and labor shortages, which can hinder growth for companies not specifically geared towards this segment.

Consequently, any niche involvement in residential construction would likely result in a low market share and minimal growth potential for Walbridge, aligning with the characteristics of a 'Dog' in the BCG framework. This means it generates little profit and is unlikely to become a star performer without significant strategic shifts.

Outdated Internal Technology Adoption for Non-Core Operations

If Walbridge lags in adopting cutting-edge digital tools for administrative and non-core operational processes, these areas could be considered Dogs. For instance, if their human resources or accounting departments still rely on manual data entry and outdated software, these functions become inefficient.

Inefficiencies in these non-core areas consume valuable resources without contributing to market share or growth, effectively acting as cash traps. For example, a construction firm like Walbridge might experience significant overhead costs due to slow, paper-based procurement systems, diverting funds that could be invested in more productive ventures.

- Lagging adoption of cloud-based HR and finance platforms

- Manual data processing in back-office functions leading to higher administrative costs

- Potential for increased error rates and compliance issues with legacy systems

- Underutilization of digital tools for internal communication and knowledge management

Niche Geographic Markets Without Strategic Focus

Operating in niche geographic markets where Walbridge lacks a strong presence, strategic partnerships, or a clear competitive edge can be a significant drain. These ventures often demand substantial resources with little prospect of high returns, leading to a low market share and stunted growth.

For instance, if Walbridge were to enter a small, underdeveloped market in Southeast Asia without prior experience or local alliances, the investment required for market entry, regulatory navigation, and building brand recognition would be immense. The potential for significant revenue generation in such a scenario is often limited, making it a classic example of a Dog in the BCG Matrix.

- Low Market Share: In these underserved niche geographies, Walbridge's market share would likely remain minimal due to a lack of established infrastructure and brand loyalty.

- Limited Growth Potential: The inherent characteristics of such markets often restrict rapid expansion, leading to stagnant or very slow revenue growth.

- Resource Drain: Significant capital and management attention would be diverted to these low-yield operations, detracting from more promising business areas.

- High Risk, Low Reward: The combination of substantial investment and poor expected returns classifies these ventures as high-risk, low-reward propositions.

Projects in highly commoditized, low-margin sectors, such as small-scale general building, represent 'Dogs' for Walbridge. These segments are characterized by intense competition and low growth, where Walbridge's specialized, large-scale operational model struggles to achieve profitability and maintain a significant market share.

The construction industry in 2024 continued to favor specialized infrastructure and industrial projects, areas where Walbridge excels. However, smaller general building projects faced persistent challenges including rising material costs and labor shortages, further impacting profitability for firms not optimized for this segment.

Walbridge's involvement in segments like maintaining aging, less efficient industrial facilities, or any limited engagement in the residential construction market, would also fall into the 'Dog' category. These areas typically exhibit low growth prospects and a fragmented competitive landscape, resulting in a small or declining market share for Walbridge.

Legacy infrastructure in declining industries, such as those tied to outdated fossil fuel facilities, exemplifies 'Dogs' for Walbridge. The U.S. Energy Information Administration reported coal's share of electricity generation fell to approximately 16% in 2023, highlighting a shrinking market for such services.

Question Marks

The burgeoning hydrogen economy, covering everything from production to distribution, is a sector poised for substantial growth. As of early 2024, global investment in hydrogen infrastructure is accelerating, with projections suggesting the market could reach hundreds of billions of dollars by 2030. Walbridge's involvement, if any, is likely in its early stages, reflecting the nascent nature of this industry.

Given the early-stage development and Walbridge's potentially small current market share in this new field, hydrogen economy infrastructure fits the profile of a 'Question Mark' in the BCG matrix. Significant investment is required to build out production facilities, storage solutions, and transportation networks. For instance, the U.S. Department of Energy announced over $7 billion in funding for hydrogen hubs in late 2023, signaling substantial government backing and market opportunity.

Biopharmaceutical and life sciences facilities represent a Stars segment for Walbridge. This sector is booming, fueled by relentless innovation and a surge in research and development spending, which reached an estimated $200 billion globally in 2024. While Walbridge possesses strong healthcare construction experience, the specialized demands of biopharma facilities necessitate unique technical expertise.

This area presents a significant growth opportunity for Walbridge, allowing it to expand its portfolio and client base. Currently, Walbridge likely holds a modest market share in this specialized niche, but the sector's high growth trajectory and increasing demand for advanced manufacturing capabilities position it as a prime area for future expansion and market leadership.

The market for advanced sustainable building technologies, like mass timber, is experiencing significant growth, projected to reach $2.5 billion globally by 2025, up from $1.8 billion in 2022. Walbridge's stated commitment to sustainability positions them to capitalize on this trend, yet their current market penetration in these niche, high-performance material applications is likely still in its nascent stages. This combination of a rapidly expanding market and developing internal capacity places advanced sustainable materials squarely in the Question Mark quadrant of the BCG Matrix for Walbridge.

AI and Robotics Integration in Construction Processes (as a Service)

The integration of AI and robotics in construction, particularly as a service, represents a burgeoning area with immense potential for site optimization, enhanced safety, and increased efficiency. While companies like Walbridge are known for their innovative approaches, if their current market share in offering these specific integrated AI and robotics solutions to clients is relatively low, it would position this segment as a 'Question Mark' within a BCG matrix framework. This classification suggests a high-growth market, but with uncertain future dominance.

Significant strategic investment in developing and deploying these AI and robotics-driven services could transform this 'Question Mark' into a future competitive differentiator for Walbridge. The global construction robotics market was valued at approximately USD 3.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 18% through 2030, indicating substantial market expansion. This growth trajectory underscores the opportunity for early movers to capture significant market share.

- High Growth Potential: The construction industry is increasingly adopting automation, with AI and robotics poised to revolutionize project management and execution.

- Market Share Uncertainty: Walbridge's current position in offering these integrated solutions as a distinct service needs to be assessed to determine if it's a low market share play.

- Investment Opportunity: Strategic capital allocation towards AI and robotics capabilities can foster innovation and create a unique value proposition.

- Future Differentiator: Early investment and successful implementation can establish Walbridge as a leader in technologically advanced construction services.

Specialized Environmental Remediation & Decommissioning Services

Specialized Environmental Remediation & Decommissioning Services would likely be positioned as a Question Mark in Walbridge's BCG Matrix. The market is experiencing significant growth, driven by heightened environmental awareness and the need to manage aging industrial assets.

Walbridge's demonstrated commitment through its GreenWISE 2.0 program and ISO 14001 certification signals a strategic interest in this sector. While these initiatives suggest potential expansion, their current market share in this specialized niche may still be developing, characteristic of a Question Mark.

- Market Growth: The global environmental remediation market was valued at approximately USD 50 billion in 2023 and is projected to grow at a CAGR of over 6% through 2030, indicating a robust expansionary trend.

- Walbridge's Commitment: GreenWISE 2.0 and ISO 14001 certification underscore a proactive approach to environmental management, aligning with the increasing demand for sustainable practices in construction and decommissioning.

- Potential for Market Share: As a relatively nascent area for many general contractors, Walbridge's entry into specialized remediation and decommissioning presents an opportunity to capture market share in a high-growth segment.

Emerging markets for advanced modular construction, particularly for specialized applications like data centers or life sciences facilities, can be classified as Question Marks for Walbridge. These sectors demand high precision and rapid deployment, areas where modularization offers significant advantages.

The global modular construction market is expected to reach $257.4 billion by 2028, growing at a CAGR of 6.2%, according to some reports. Walbridge's current market share in these highly specialized modular applications is likely still developing, given the niche expertise required, positioning it as a Question Mark.

Significant investment in developing specialized modular construction capabilities and securing early projects in these high-demand sectors could transform this Question Mark into a future Star for Walbridge.

| BCG Quadrant | Walbridge Segment | Market Growth | Walbridge Market Share | Strategic Implication |

|---|---|---|---|---|

| Question Mark | Advanced Modular Construction (Data Centers, Life Sciences) | High (Global market projected to exceed $250 billion by 2028) | Developing/Low | Requires significant investment to build expertise and secure market position. Potential to become a future Star. |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, encompassing sales figures, competitor analysis, and industry growth rates to provide a clear strategic roadmap.