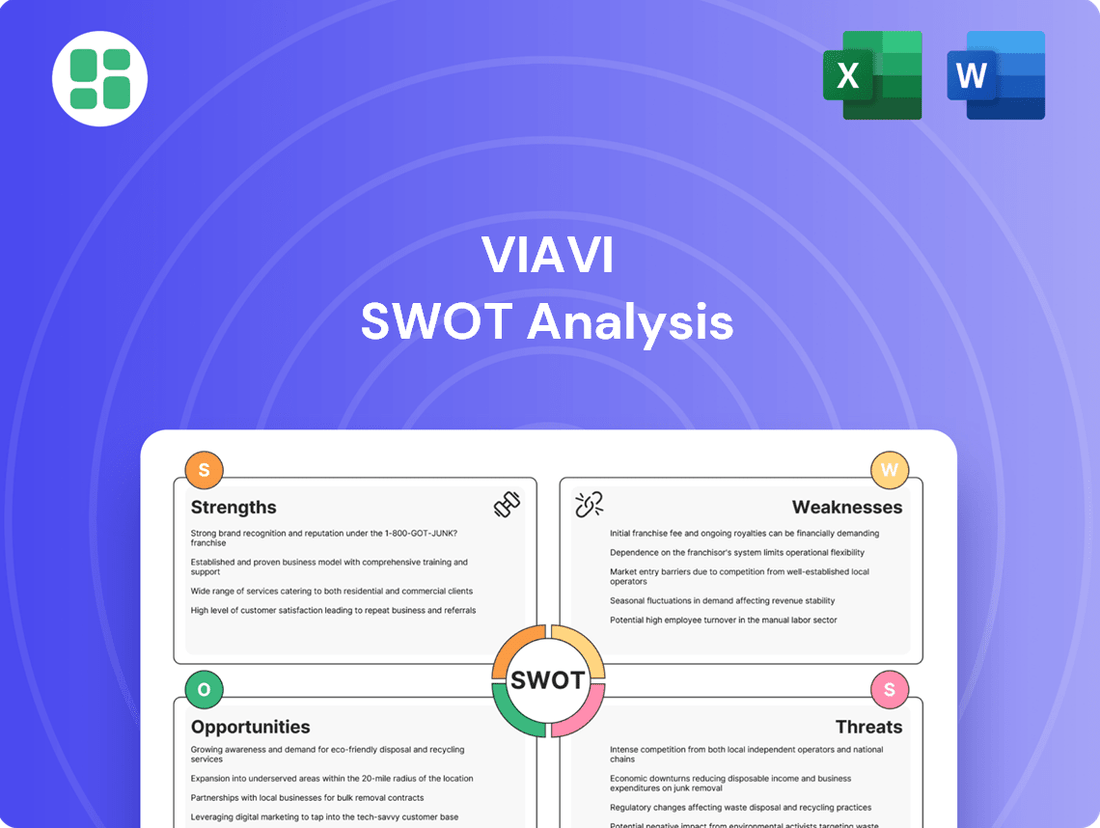

VIAVI SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

VIAVI Bundle

VIAVI's market position is shaped by its robust technological innovation and strong customer relationships, but it also faces intense competition and evolving industry demands. Understanding these dynamics is crucial for navigating the future.

Want the full story behind VIAVI's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

VIAVI Solutions boasts a broad portfolio covering the entire network lifecycle, from initial lab validation and field deployment to continuous monitoring and proactive troubleshooting. This end-to-end approach, spanning technologies like 5G and fiber optics, offers customers a unified solution for optimizing network performance and ensuring service quality.

VIAVI demonstrates leadership in critical growth technologies, holding significant market share in 5G and fiber optics. These sectors are vital for building today's and tomorrow's communication infrastructure.

The company's commitment to advanced fiber solutions, such as those supporting 800G and 1.6Tb speeds, and its active role in the 5G ecosystem, including Open RAN initiatives, are key strengths. This strategic positioning allows VIAVI to benefit from the continuous global investment in network upgrades and the rollout of next-generation technologies.

VIAVI's global footprint is a significant strength, allowing it to serve a diverse clientele that includes major communications service providers, large enterprises, and government entities across various continents. This wide reach insulates the company from localized economic downturns and sector-specific challenges, fostering a more stable revenue stream.

In fiscal year 2023, VIAVI reported that its Optical Security and Control (OSC) segment, which serves government and other sectors, saw revenue growth, demonstrating the resilience of its diversified customer base. This broad market penetration, spanning aerospace, defense, and telecommunications, underscores the company's ability to adapt and thrive across different economic landscapes.

Commitment to Innovation and Advanced R&D

VIAVI's dedication to innovation is a significant strength, clearly demonstrated by its substantial investments in research and development. The company is actively developing cutting-edge solutions like AI-driven digital twins for network optimization, which is crucial for managing increasingly complex telecommunications infrastructure. This focus ensures VIAVI stays ahead of the curve in a rapidly evolving technological landscape.

Their work extends to critical emerging areas such as Non-Terrestrial Network (NTN) validation, preparing for the next generation of satellite and aerial communications. Furthermore, VIAVI is developing solutions specifically for AI infrastructure, a sector experiencing exponential growth. This forward-looking approach is vital for maintaining a competitive edge.

- AI-Driven Digital Twins: Enhancing network performance and predictive maintenance.

- NTN Validation: Preparing for future satellite and aerial communication networks.

- AI Infrastructure Solutions: Supporting the rapid expansion of AI technologies.

- R&D Investment: Consistently allocating resources to stay at the technological forefront.

Solid Financial Position and Cash Flow Generation

VIAVI maintains a robust financial standing, underscored by its consistent ability to generate strong cash flow from its operational activities. This financial resilience is a key strength, enabling the company to pursue growth opportunities and manage its financial obligations effectively. For instance, in the first quarter of fiscal year 2024, VIAVI reported operating cash flow of $130 million, a testament to its efficient business model. This financial health allows for strategic capital allocation, including investments in research and development and potential acquisitions, while also providing a buffer against economic uncertainties.

The company's solid financial position is further evidenced by its healthy cash reserves. As of the end of the first quarter of fiscal year 2024, VIAVI held approximately $450 million in cash and cash equivalents. This liquidity is crucial for supporting ongoing operations, funding new product development, and maintaining a competitive edge in the rapidly evolving telecommunications and network testing market. It also provides the flexibility to return value to shareholders through dividends or share repurchases, further solidifying its financial strength.

VIAVI's capacity for strong cash flow generation is a significant advantage, providing the financial muscle to navigate market fluctuations and invest in future growth. This operational efficiency translates directly into financial stability, allowing the company to:

- Fund research and development initiatives to drive innovation.

- Pursue strategic mergers and acquisitions to expand market reach.

- Manage and reduce outstanding debt obligations.

- Maintain a stable dividend payout to shareholders.

VIAVI's comprehensive portfolio covers the entire network lifecycle, from lab validation to ongoing monitoring, offering unified solutions for optimizing performance. The company holds a leading market share in crucial growth areas like 5G and fiber optics, positioning it to capitalize on global infrastructure investments.

VIAVI's strategic focus on advanced fiber solutions (800G, 1.6Tb) and its active role in the 5G ecosystem, including Open RAN, are significant strengths. This forward-thinking approach is supported by substantial R&D investments, leading to innovations like AI-driven digital twins and solutions for emerging areas such as Non-Terrestrial Networks and AI infrastructure.

The company demonstrates strong financial health, evidenced by consistent operational cash flow, which was $130 million in Q1 FY24. With approximately $450 million in cash and cash equivalents at the end of Q1 FY24, VIAVI possesses the liquidity to fund innovation, pursue strategic growth, and reward shareholders.

| Strength | Description | Supporting Data/Insight |

| Broad Portfolio | End-to-end network lifecycle solutions | Covers lab validation, field deployment, monitoring, and troubleshooting. |

| Market Leadership | Dominant position in 5G and fiber optics | Critical for global communication infrastructure development. |

| Innovation Focus | R&D investment in emerging technologies | AI-driven digital twins, NTN validation, AI infrastructure solutions. |

| Financial Stability | Strong operational cash flow and liquidity | $130M operating cash flow (Q1 FY24), $450M cash reserves (Q1 FY24). |

What is included in the product

Delivers a strategic overview of VIAVI’s internal and external business factors, highlighting its competitive position and market challenges.

Offers a clear, actionable framework to identify and address strategic weaknesses, turning challenges into opportunities.

Weaknesses

VIAVI's reliance on capital expenditure from telecom companies and network equipment makers makes it susceptible to spending slowdowns. For instance, the company reported a 13% year-over-year decline in its Optical Security and Connectivity (OSC) segment revenue in its fiscal second quarter of 2024, partly due to reduced customer spending.

This vulnerability was evident in the first half of fiscal 2024, where an anemic spend environment, especially in North America, contributed to VIAVI's revenue and operating margin contractions in key areas.

VIAVI has faced challenges with declining financial performance. For fiscal year 2024, the company reported a year-over-year revenue decrease, a trend that continued into the first quarter of fiscal year 2025. This downturn was accompanied by a reduction in operating margins.

The primary driver behind these declines appears to be cautious spending by VIAVI's customer base, coupled with a general softness in the broader market. While the company anticipates some level of recovery, these recent financial results underscore the sensitivity of its revenue and profitability to prevailing economic conditions and customer investment cycles.

VIAVI faces a crowded market for its network testing and optical solutions. Competitors range from large, established companies to nimble new entrants, all vying for market share. This means VIAVI must constantly innovate and offer compelling value to stand out.

The intense competition often translates into significant pricing pressure. Companies like Keysight Technologies and EXFO are major players, forcing VIAVI to be strategic with its pricing to remain competitive without eroding profitability. This environment demands continuous investment in research and development to maintain a technological edge.

For instance, in the first quarter of fiscal year 2024, VIAVI reported revenue of $278 million, reflecting the ongoing market dynamics. The need to differentiate through advanced features and superior performance is paramount to navigating this challenging landscape and securing future growth.

Performance Weakness in Specific Segments

VIAVI's performance shows weakness in certain areas, notably the Optical Security and Performance Products (OSPP) segment. This segment saw revenue declines, largely attributed to a slowdown in consumer electronics demand. Additionally, older Service Enablement (SE) products have also contributed to this revenue dip.

This unevenness across VIAVI's business units can hinder overall company expansion. For instance, during the first half of fiscal year 2024, the OSPP segment experienced a notable downturn, impacting the company's consolidated revenue figures.

- OSPP segment revenue declined due to weak consumer electronics demand.

- Legacy Service Enablement (SE) products also contributed to revenue contraction.

- Uneven segment performance acts as a drag on VIAVI's overall growth trajectory.

Exposure to Macroeconomic Headwinds

VIAVI's financial health is closely tied to the overall economic climate. Factors like rising inflation, the possibility of economic downturns, and stricter monetary policies can significantly dampen customer spending. This can directly translate to lower sales for VIAVI and a pullback in their own investments in new product development and expansion.

For instance, during periods of economic uncertainty, customers often delay or reduce their capital expenditures, impacting VIAVI's network testing and assurance solutions. This vulnerability to macroeconomic shifts means the company's revenue streams can be less predictable, especially when compared to businesses operating in more stable sectors.

- Inflationary Pressures: Rising costs can squeeze customer budgets, leading to reduced demand for VIAVI's products and services.

- Recessionary Risks: An economic slowdown typically results in decreased enterprise spending on network infrastructure and maintenance, directly affecting VIAVI's sales pipeline.

- Monetary Policy Tightening: Higher interest rates can increase the cost of capital for VIAVI's customers, potentially delaying or canceling large projects that rely on financing.

VIAVI's financial performance is highly sensitive to capital expenditure cycles within the telecommunications and network equipment sectors. This reliance was underscored in fiscal year 2024, where the company experienced revenue contractions, a trend that continued into the first quarter of fiscal year 2025, accompanied by reduced operating margins. This sensitivity to customer spending and broader market softness directly impacts VIAVI's profitability.

The company operates in a highly competitive landscape, facing pressure from both established players like Keysight Technologies and EXFO, as well as emerging competitors. This intense rivalry necessitates continuous innovation and strategic pricing to maintain market share and profitability, as seen in the $278 million revenue reported in Q1 fiscal year 2024.

VIAVI's Optical Security and Performance Products (OSPP) segment has been particularly weak, with revenue declines attributed to a slowdown in consumer electronics demand and the impact of older Service Enablement (SE) products. This uneven performance across business units acts as a drag on the company's overall growth potential.

Full Version Awaits

VIAVI SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The global expansion of 5G networks, particularly the shift towards 5G Standalone (5G SA), alongside the early stages of 6G research, creates significant opportunities for VIAVI. As telecom operators worldwide continue to invest in building and refining these complex networks, the need for VIAVI's advanced testing and assurance solutions is set to grow substantially.

For instance, the 5G market was projected to reach over $600 billion by 2026, with ongoing upgrades driving demand for sophisticated testing. VIAVI's expertise in network validation and performance monitoring positions it well to capitalize on this sustained investment in next-generation mobile infrastructure.

The relentless demand for faster internet and more data storage is fueling massive investments in fiber optic networks and massive data centers. This trend presents a significant opportunity for companies like VIAVI.

VIAVI's cutting-edge testing tools, especially those designed for the latest 800G and upcoming 1.6Tb technologies, are essential for building and maintaining these advanced networks. As these technologies roll out, VIAVI is well-positioned to capitalize on this growth.

The global data center market is projected to reach over $300 billion by 2026, with a significant portion dedicated to network infrastructure upgrades. This expansion directly benefits VIAVI, as their fiber testing solutions are critical for ensuring the performance and reliability of these vital facilities.

The increasing complexity of networks, driven by cloud migration and hybrid infrastructure, alongside a surge in cybersecurity threats, fuels a growing demand for advanced network observability and Continuous Threat Exposure Management (CTEM) solutions. VIAVI's established expertise in network performance monitoring and assurance directly addresses this critical market requirement.

This escalating need for robust network visibility and security is a significant opportunity. For instance, the global network security market was valued at approximately $250 billion in 2023 and is projected to grow substantially in the coming years, indicating a strong tailwind for companies like VIAVI offering relevant solutions.

Diversification into Emerging Technologies and Verticals

VIAVI is actively pursuing diversification by entering burgeoning technology sectors. This includes significant investment and strategic moves into areas like AI infrastructure, the Internet of Things (IoT), aerospace and defense, and essential mission-critical communication systems. This expansion aims to capture growth in markets with strong secular tailwinds.

The company’s recent acquisitions, such as Inertial Labs, and its ongoing development of advanced AI-driven tools underscore a commitment to penetrating high-margin markets. These strategic initiatives are designed to leverage VIAVI's expertise beyond its traditional telecommunications base, positioning it for future revenue streams.

- AI Infrastructure: VIAVI is developing solutions to support the complex testing and validation needs of AI hardware and software, a market projected for substantial growth through 2025 and beyond.

- IoT Expansion: The company is enhancing its offerings for IoT device testing and network assurance, catering to the increasing demand for reliable connectivity across various industries.

- Aerospace & Defense: VIAVI is increasing its focus on providing specialized test and measurement solutions for the aerospace and defense sectors, which often require highly reliable and secure communication technologies.

- Mission-Critical Communications: The firm is bolstering its portfolio for public safety and enterprise private networks, ensuring robust and dependable communication capabilities for essential services.

Strategic Partnerships and Market Consolidation Benefits

VIAVI can leverage strategic partnerships and market consolidation to its advantage. For instance, acquiring assets divested from larger deals, like those potentially emerging from Keysight's acquisition of Spirent Communications, could bolster VIAVI's network security and high-speed Ethernet capabilities. This strategy allows for rapid market share expansion and a more comprehensive product suite.

Such consolidation benefits can be seen in the broader industry. As of early 2024, the telecommunications testing and measurement market is experiencing ongoing M&A activity, driven by the need for specialized expertise and broader solution offerings. VIAVI's participation in this trend positions it to acquire complementary technologies and customer bases efficiently.

- Acquisition of Divested Assets: Potential to integrate technologies from Keysight's Spirent acquisition, strengthening network security and high-speed Ethernet portfolios.

- Market Share Growth: Strategic acquisitions directly translate to increased market presence and competitive positioning.

- Enhanced Product Offerings: Broadening the company's solutions through the integration of new technologies and capabilities.

- Synergistic Benefits: Gaining access to new customer segments and cross-selling opportunities within consolidated markets.

VIAVI is well-positioned to benefit from the ongoing global rollout of 5G and the emerging research into 6G, as these advancements necessitate sophisticated testing and assurance solutions. The company's expertise in validating complex network performance is crucial for telecom operators investing heavily in these next-generation infrastructures.

The substantial investments in fiber optic networks and data centers, driven by increasing data demands, present a significant opportunity for VIAVI. Their advanced testing tools, particularly for high-speed technologies like 800G and upcoming 1.6Tb, are essential for the development and maintenance of these critical networks.

The growing complexity of modern networks, coupled with rising cybersecurity threats, creates a strong demand for advanced network observability and Continuous Threat Exposure Management (CTEM) solutions, areas where VIAVI's established capabilities provide a competitive edge.

VIAVI's strategic diversification into high-growth sectors such as AI infrastructure, IoT, aerospace, and defense, along with mission-critical communications, opens up new revenue streams and leverages existing expertise in expanding markets.

Threats

A prolonged economic slowdown poses a significant threat to VIAVI. If major communications service providers and network equipment manufacturers continue to exercise caution with their capital expenditures, this directly curtails demand for VIAVI's solutions. For instance, in fiscal year 2023, VIAVI reported that a substantial portion of its revenue was derived from capital spending cycles in the telecom industry, making it vulnerable to such cutbacks.

The telecommunications sector is a hotbed of rapid innovation, with new network architectures like Open RAN gaining significant traction. This shift, alongside the looming presence of quantum computing, presents a substantial threat to VIAVI. If VIAVI cannot keep pace with these advancements and innovate its own solutions quickly, its current offerings risk becoming outdated, impacting its market position and revenue streams.

The network test and measurement sector is intensely competitive, with rivals frequently employing aggressive pricing tactics. This pressure could compel VIAVI to reduce its prices, potentially squeezing profit margins and hindering its ability to retain market share.

For instance, in the fiscal year ending June 30, 2023, VIAVI reported a gross profit margin of 62.4%. However, sustained price wars could see this figure decline, impacting overall profitability and the company's capacity for reinvestment in research and development.

Supply Chain Vulnerabilities and Geopolitical Risks

Global supply chain disruptions remain a significant threat, impacting VIAVI's ability to secure critical components. For instance, the semiconductor shortage, which continued to affect various industries through 2023 and into early 2024, directly influences the availability and cost of essential parts for VIAVI's test and measurement equipment. This can lead to extended lead times for customers and increased manufacturing expenses.

Trade tensions and tariff-related delays further exacerbate these challenges. As of late 2023 and early 2024, ongoing geopolitical friction, particularly between major economic blocs, can result in unexpected import/export costs and logistical hurdles. These factors directly increase operational costs and can delay order shipments, potentially impacting VIAVI's revenue recognition and customer satisfaction.

- Increased Operational Costs: Tariffs and shipping delays directly inflate the cost of goods sold.

- Delayed Product Delivery: Supply chain bottlenecks can push back product availability, frustrating customers.

- Reduced Profitability: Higher costs and slower sales cycles can negatively affect VIAVI's bottom line.

- Inability to Meet Demand: Component shortages and shipping issues can hinder VIAVI's capacity to fulfill customer orders promptly.

Evolving Cybersecurity Landscape and Attack Surface Expansion

The cybersecurity landscape is becoming increasingly intricate, driven by the widespread adoption of cloud services and the expansion of network attack surfaces. New threats, such as vulnerabilities in interconnected open networks and the potential disruptive impact of quantum computing on current encryption methods, present ongoing challenges. For instance, a 2024 report indicated a 15% year-over-year increase in sophisticated ransomware attacks targeting critical infrastructure, highlighting the urgency of robust defenses.

VIAVI faces a significant threat from this evolving environment, requiring continuous investment in its own operational security and the development of solutions that can effectively safeguard customer networks against these emerging risks. The company's ability to stay ahead of threat actors who are rapidly adapting their tactics is paramount. For example, the emergence of AI-powered malware in late 2024 demonstrated a new level of adaptive threat capability.

- Increasing Network Complexity: The integration of IoT devices and distributed systems expands the potential entry points for attackers.

- Cloud Service Reliance: While offering flexibility, cloud environments introduce new security considerations and potential vulnerabilities if not managed properly.

- Emerging Threats: The threat of quantum computing breaking current encryption algorithms poses a long-term, significant risk to data security.

- Sophistication of Attacks: Cybercriminals are employing more advanced techniques, including AI-driven attacks, making detection and mitigation more challenging.

Intensifying competition and aggressive pricing strategies from rivals pose a considerable threat to VIAVI's profitability. Should competitors continue to undercut pricing, VIAVI may be forced to lower its own prices, potentially eroding its profit margins. For instance, in fiscal year 2023, VIAVI reported a gross profit margin of 62.4%, a figure that could be pressured by sustained price wars.

SWOT Analysis Data Sources

This VIAVI SWOT analysis is built upon a robust foundation of publicly available financial filings, comprehensive market intelligence reports, and expert industry commentary. These sources provide a well-rounded perspective on the company's internal capabilities and external market positioning.