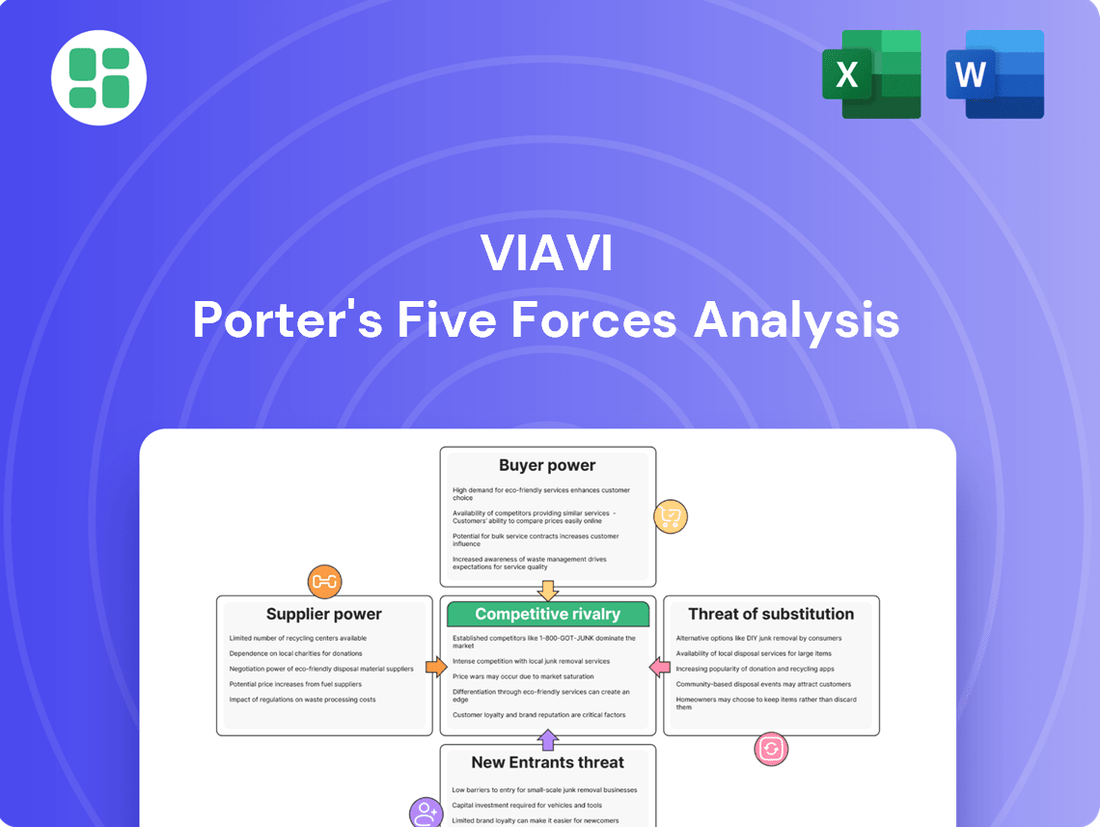

VIAVI Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

VIAVI Bundle

VIAVI operates in a dynamic market shaped by intense competition, the bargaining power of buyers and suppliers, and the ever-present threat of new entrants and substitutes. Understanding these forces is crucial for navigating its strategic landscape.

The complete report reveals the real forces shaping VIAVI’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

VIAVI Solutions depends on a limited number of suppliers for highly specialized components crucial for its advanced network test and measurement gear, especially for 5G, fiber optics, and high-speed networking. When the supply of these critical parts is concentrated among just a few providers, their ability to influence pricing and terms significantly grows.

This concentration can translate into higher input costs for VIAVI, directly impacting its profitability. For instance, if a single supplier of a critical optical transceiver experiences production issues, it could lead to shortages and price hikes, affecting VIAVI's ability to fulfill orders and maintain competitive pricing. In 2023, the semiconductor industry, a key supplier for such components, saw continued supply chain volatility, with lead times for certain advanced chips extending, underscoring this risk.

Suppliers offering proprietary or highly specialized technologies, like unique semiconductor chips or advanced optical components, wield considerable bargaining power. VIAVI's reliance on these specialized inputs for its innovative solutions, such as its optical test and measurement equipment, can significantly diminish its negotiation leverage. For instance, if a key supplier of a critical photonic integrated circuit used in VIAVI's high-speed network testers has limited alternatives, they can command higher prices, impacting VIAVI's cost structure.

VIAVI’s suppliers can wield significant power if the costs and complexities for VIAVI to switch to an alternative supplier are substantial. This is particularly true when VIAVI relies on specialized components or deeply integrated systems from a single vendor. For instance, if a key supplier provides a proprietary optical module essential for VIAVI’s test and measurement equipment, the effort to find, qualify, and integrate a replacement could be immense.

The process of switching suppliers often involves more than just finding a new source. VIAVI would likely need to undertake costly product redesigns, extensive re-qualification of components to ensure performance and reliability, and the complex task of establishing and managing entirely new supply chains. These hurdles can translate into significant delays and increased expenditures, effectively bolstering the bargaining leverage of existing suppliers.

For example, in 2023, VIAVI reported that its cost of revenue increased by 14.5% year-over-year, reaching $1.1 billion. While this reflects broader market dynamics, it also highlights the sensitivity of VIAVI’s cost structure to its supply chain. If a critical supplier were to raise prices or alter terms, the high switching costs would make it challenging for VIAVI to absorb these changes without impacting its own profitability or product competitiveness.

Threat of Forward Integration by Suppliers

If key suppliers, such as those providing specialized components for test and measurement equipment, have the capability and strategic intent to integrate forward into VIAVI's market, their bargaining power is significantly enhanced. This means they could potentially start manufacturing similar equipment themselves, directly competing with VIAVI.

This looming threat compels VIAVI to cultivate and maintain robust relationships with its suppliers, potentially leading to less favorable contract terms for VIAVI to secure its supply chain and prevent direct competition from its own component providers.

- Supplier Forward Integration Capability: Suppliers with strong R&D, manufacturing expertise, and market access are more likely to pose a forward integration threat.

- Market Attractiveness: If VIAVI's market segment for test and measurement equipment is highly profitable and growing, it incentivizes suppliers to consider direct entry.

- VIAVI's Dependence: A high reliance on a few key suppliers for critical components increases the risk of supplier forward integration.

Importance of VIAVI to Supplier Revenue

The significance of VIAVI as a customer greatly influences its suppliers' bargaining power. If VIAVI constitutes a substantial portion of a supplier's overall sales, that supplier is likely to be more accommodating with pricing and terms to retain VIAVI's business. Conversely, if VIAVI is a minor client, the supplier holds more leverage, potentially dictating less favorable conditions.

For instance, in 2023, VIAVI Solutions reported total revenue of $1.3 billion. The impact of VIAVI's purchasing volume on a specific supplier's revenue would determine the extent of that supplier's dependence and, consequently, their bargaining strength. A supplier whose business is heavily reliant on VIAVI would have less power to impose unfavorable terms.

- Supplier Dependence: The greater VIAVI's share of a supplier's revenue, the weaker the supplier's bargaining power.

- Favorable Terms: Major customers like VIAVI can often negotiate better pricing and service agreements.

- Revenue Impact: VIAVI's $1.3 billion in 2023 revenue means its purchasing decisions can significantly affect supplier financial health.

- Leverage Shift: Suppliers with diversified customer bases are less susceptible to VIAVI's demands.

VIAVI's bargaining power with its suppliers is influenced by the concentration of its supplier base and the availability of alternatives for critical components. When suppliers offer unique or proprietary technologies, their leverage increases, potentially driving up costs for VIAVI. For example, the semiconductor industry, a key supplier for VIAVI's advanced networking equipment, experienced significant supply chain volatility in 2023, impacting lead times and component availability.

High switching costs further empower suppliers, as redesigning and re-qualifying new components can be time-consuming and expensive for VIAVI. This was evident in 2023 when VIAVI's cost of revenue rose by 14.5% year-over-year, highlighting the sensitivity of its cost structure to supply chain dynamics.

The threat of supplier forward integration, where suppliers might enter VIAVI's market, also strengthens their negotiating position. This compels VIAVI to maintain strong supplier relationships, potentially accepting less favorable terms to secure its supply chain and mitigate direct competition.

VIAVI's position as a customer also plays a role; if it represents a significant portion of a supplier's revenue, the supplier has less power. However, with $1.3 billion in 2023 revenue, VIAVI's purchasing volume can still impact specific suppliers, influencing their willingness to negotiate favorable terms.

| Factor | Impact on VIAVI's Supplier Bargaining Power | 2023 Data/Context |

|---|---|---|

| Supplier Concentration | High concentration among few suppliers increases their power. | Key components for 5G and fiber optics rely on specialized suppliers. |

| Switching Costs | High costs to switch suppliers empower existing ones. | Redesign and re-qualification efforts are significant hurdles. |

| Forward Integration Threat | Suppliers capable of entering VIAVI's market gain leverage. | Market attractiveness incentivizes potential supplier entry. |

| VIAVI's Customer Importance | VIAVI's revenue share with a supplier dictates their dependence. | VIAVI's $1.3 billion revenue can influence supplier terms. |

What is included in the product

VIAVI's Porter's Five Forces analysis dissects the competitive intensity and profitability potential of its operating environment, examining threats from new entrants, the power of buyers and suppliers, and the impact of substitutes and rivalry.

Effortlessly identify and address competitive threats with a visual breakdown of industry power dynamics, enabling proactive strategy adjustments.

Customers Bargaining Power

VIAVI serves a clientele of major communications service providers, large enterprises, and network equipment manufacturers. The concentration of revenue among a few key clients significantly amplifies their individual bargaining power. For instance, if a single large telecommunications company represents 10% or more of VIAVI's annual revenue, that customer can leverage this dependency to negotiate more favorable pricing or demand tailored product development.

The standardization of VIAVI's offerings plays a role in customer bargaining power. While VIAVI provides highly specialized solutions for network testing and assurance, the perception of standardization by customers can influence their leverage. If customers see VIAVI's products as largely interchangeable with competitors' offerings, they are more likely to push for lower prices and more favorable contract terms.

Customers' switching costs from VIAVI's solutions can significantly impact their bargaining power. If a customer faces substantial expenses or operational disruptions when moving to a competitor, they are less likely to switch, giving VIAVI more leverage. For instance, if VIAVI's network testing equipment is deeply embedded in a telecom provider's infrastructure, the cost of re-training staff, recalibrating systems, and potential downtime could easily run into hundreds of thousands or even millions of dollars, thereby reducing the customer's ability to negotiate lower prices or demand more favorable terms.

Price Sensitivity of Customers

VIAVI's customers exhibit varying degrees of price sensitivity. This sensitivity is directly tied to how crucial VIAVI's solutions are for their fundamental business operations and their available financial resources. For instance, if a customer relies heavily on VIAVI's network testing equipment to ensure service uptime, they might be less inclined to switch based solely on price. However, in sectors where VIAVI's offerings are more commoditized or during periods of economic contraction, customers are likely to scrutinize costs more closely, seeking out more affordable alternatives.

The bargaining power of customers is amplified when they are highly price-sensitive. This is particularly evident in markets characterized by intense competition or during economic slowdowns. In such scenarios, customers actively seek out cost-effective solutions, which can force suppliers like VIAVI to offer more competitive pricing or value-added services to retain business. For example, research from 2024 indicates that in the telecommunications infrastructure sector, where cost optimization is a constant driver, customers are increasingly leveraging bulk purchasing and long-term contracts to negotiate better terms, directly impacting the pricing power of vendors.

- Price Sensitivity Drivers: Customer reliance on VIAVI solutions for core operations and their budget constraints are key determinants of price sensitivity.

- Market Conditions Impact: Increased price sensitivity is observed in competitive markets and during economic downturns, driving demand for cost-effective options.

- Customer Leverage: In price-sensitive environments, customers gain leverage through negotiation, seeking better pricing and terms.

Threat of Backward Integration by Customers

Large customers, such as major telecommunications companies or network equipment manufacturers, can exert significant bargaining power if they have the potential to develop their own testing and monitoring solutions. This threat of backward integration means VIAVI needs to consistently offer compelling value and innovation to keep these key clients. For instance, a large service provider might consider developing in-house tools if they perceive VIAVI's pricing as too high or if their internal development capabilities are robust.

The ability of customers to integrate backward directly impacts VIAVI's pricing flexibility and market position. If a significant portion of VIAVI's customer base, particularly those in the high-volume segments, could realistically produce similar solutions internally, they would have greater leverage in negotiations. This forces VIAVI to focus on differentiation through advanced features, superior support, and ongoing R&D to justify its offerings.

- Customer Integration Capability: Network equipment manufacturers and large service providers often possess the engineering talent and capital to develop their own test and monitoring equipment, posing a direct threat of backward integration.

- Impact on VIAVI's Pricing: The potential for customers to build in-house solutions limits VIAVI's ability to command premium prices and necessitates a strong value proposition.

- Competitive Necessity: VIAVI must continually innovate and demonstrate superior performance and cost-effectiveness to counter the threat of customers developing their own alternatives.

VIAVI's customers, particularly large telecommunications providers and network equipment manufacturers, wield considerable bargaining power due to their significant purchasing volume and the critical nature of VIAVI's solutions for their operations. In 2024, major telecom operators continued to consolidate, increasing the concentration of VIAVI's revenue among fewer, larger clients, thereby amplifying their negotiation leverage. These customers can demand lower prices, customized solutions, or better contract terms, directly impacting VIAVI's profitability and market strategy. Furthermore, the potential for these large clients to develop in-house testing solutions acts as a constant pressure, limiting VIAVI's pricing flexibility and necessitating continuous innovation.

| Factor | Impact on VIAVI's Customer Bargaining Power | 2024 Relevance |

|---|---|---|

| Customer Concentration | High | Major telecom mergers in 2024 increased client concentration, strengthening buyer power. |

| Switching Costs | Moderate to High | Deep integration of VIAVI's test equipment into client networks creates high switching costs, reducing bargaining power. |

| Threat of Backward Integration | Moderate | Large clients possess the technical capability to develop internal solutions, limiting VIAVI's pricing power. |

| Price Sensitivity | Varies | High in competitive segments; lower when VIAVI's solutions are mission-critical for service assurance. |

Preview Before You Purchase

VIAVI Porter's Five Forces Analysis

This preview showcases the complete VIAVI Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape affecting the company. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring full transparency and immediate usability for your strategic planning.

Rivalry Among Competitors

The network test, monitoring, and assurance market is quite crowded. VIAVI faces competition from a range of players, including giants like Keysight Technologies and Viavi Solutions itself, alongside more specialized firms and newer entrants. This diversity means companies are constantly vying for attention and customers.

This intense competition means that companies must continually innovate and offer compelling value propositions. For instance, in 2024, the demand for 5G network testing solutions surged, pushing companies to invest heavily in R&D to capture market share in this rapidly evolving segment.

The communications and networking sector, while generally robust due to 5G deployment and fiber optic build-outs, presents a mixed growth picture for companies like VIAVI. While some areas are expanding rapidly, others might see more modest increases. For instance, the global 5G infrastructure market was projected to reach $113.8 billion by 2024, but specific equipment or testing segments might mature faster, leading to intensified competition.

When industry growth slows in particular niches, competition often heats up. Companies then fight harder for every customer, making market share gains more challenging and potentially turning the market into a zero-sum game. This dynamic can pressure pricing and profitability as rivals strive to capture remaining demand.

VIAVI's competitive edge is significantly shaped by its product and service differentiation. The company actively invests in innovation to offer specialized features and superior performance in its network testing and assurance solutions. This focus on unique value propositions helps to steer competition away from pure price wars.

For instance, VIAVI's solutions for 5G network deployment and optimization provide advanced capabilities that are difficult for competitors to replicate. In fiscal year 2023, VIAVI reported that its Optical Security and Performance segment, which includes differentiated optical components and instruments, saw strong demand, contributing to its overall revenue growth.

Exit Barriers for Competitors

High exit barriers in the communications test and measurement industry, where VIAVI operates, can trap less profitable competitors. These barriers include substantial investments in specialized R&D for optical and network testing equipment, making it difficult for them to divest without significant losses. For instance, the development of advanced coherent optical technologies requires multi-year, multi-million dollar R&D commitments, creating a substantial sunk cost. This can keep even struggling players in the market, intensifying rivalry as they fight for survival rather than exiting.

These entrenched competitors, bound by their investments, often continue to compete aggressively on price or innovation, even when facing declining profitability. This sustained competition can suppress overall industry returns. VIAVI itself has navigated this by focusing on high-growth areas like 5G and cloud networking, but the presence of these "trapped" competitors means the fight for market share remains fierce.

- Specialized Assets: High cost and unique nature of R&D and manufacturing for advanced optical and network test equipment.

- Long-Term Contracts: Competitors may be tied to existing customer contracts for maintenance and support, making immediate exit unfeasible.

- Significant R&D Investment: Companies have invested heavily in developing proprietary technologies for areas like 5G, fiber optics, and cloud infrastructure testing.

- Brand Reputation and Customer Relationships: Established players have built long-standing relationships and brand trust, making it hard for new entrants or exiting firms to transfer these assets easily.

Competitive Strategies and Intensity

The competitive landscape for VIAVI is characterized by intense rivalry driven by rapid technological advancements and the need for continuous innovation. Competitors are actively engaged in developing solutions for emerging areas such as 5G deployment, cloud-native network architectures, and advanced automation technologies. This dynamic environment necessitates a proactive and agile competitive strategy from VIAVI to maintain its market position.

VIAVI's rivals are not just competing on price but are heavily invested in research and development, pushing the boundaries of network testing and assurance. This focus on innovation means that companies like Keysight Technologies and EXFO are constantly introducing new products and services that address the evolving needs of telecommunications providers and enterprise networks. For instance, the global network testing market size was valued at approximately USD 4.2 billion in 2023 and is projected to grow, indicating the high stakes and active competition.

- Aggressive Innovation: Competitors are heavily investing in R&D for 5G, cloud, and automation.

- Product Differentiation: Rivalry often centers on advanced features and performance rather than just price.

- Market Dynamics: The need for rapid technological adoption by customers fuels a fast-paced competitive cycle.

- Strategic Partnerships: Companies may form alliances to enhance their offerings and reach.

VIAVI operates in a highly competitive market where rivals like Keysight Technologies and EXFO are intensely focused on innovation, particularly in areas like 5G and cloud networking. This rivalry isn't just about price; it's a race to develop differentiated solutions with advanced features and superior performance. The global network testing market was valued at approximately $4.2 billion in 2023, highlighting the significant financial stakes involved.

Companies are heavily investing in R&D, with significant commitments to areas like advanced optical technologies, which can require multi-million dollar investments. This creates high exit barriers, meaning even struggling competitors remain active, intensifying rivalry and potentially pressuring profitability as they fight for market share.

The rapid pace of technological advancement, such as the ongoing 5G deployment, fuels a dynamic competitive cycle. VIAVI's strategy involves focusing on high-growth segments and differentiating its offerings to navigate this fierce landscape effectively.

VIAVI's competitive rivalry is shaped by aggressive innovation from players like Keysight and EXFO, with a strong emphasis on product differentiation in the rapidly expanding network testing market, which was valued at around $4.2 billion in 2023.

SSubstitutes Threaten

Large telecommunication companies and enterprises are increasingly capable of developing proprietary network testing and assurance solutions. This in-house development acts as a significant substitute for VIAVI's offerings, particularly for organizations with the technical expertise and resources to build custom tools. For instance, a major telecom operator might invest in developing its own network monitoring software, reducing its reliance on external vendors.

Generic IT monitoring and observability platforms present a threat of substitutes for VIAVI's specialized network performance solutions. These broader tools can handle basic network health checks and some performance metrics, offering a less specialized but potentially more cost-effective alternative for certain customer segments. For instance, a small business might find an all-in-one IT monitoring solution sufficient for its needs, bypassing the need for dedicated network performance management tools.

The rise of robust open-source network monitoring and testing tools presents a significant threat of substitutes for VIAVI. Solutions like Zabbix, Nagios, and Prometheus are becoming increasingly sophisticated, offering cost-effective alternatives, especially for businesses with tighter budgets or those focusing on less critical network segments. For instance, the global open-source software market is projected to reach over $300 billion by 2024, underscoring its growing adoption and capabilities.

Cloud-Native Network Capabilities

The increasing adoption of cloud-native architectures in networking presents a significant threat of substitutes for traditional network testing equipment providers like VIAVI. As network functions become virtualized and integrated into cloud environments, functionalities previously requiring specialized hardware can be offered as software-based services or even as part of the cloud infrastructure itself. This shift means that some of the core capabilities VIAVI offers could be replicated or replaced by these evolving cloud-based solutions.

For example, network performance monitoring and troubleshooting, traditionally a strong area for VIAVI, can increasingly be handled by cloud-native tools and platforms. These integrated solutions may offer a more seamless and cost-effective approach for businesses already heavily invested in cloud infrastructure. This technological evolution directly impacts the demand for dedicated testing hardware and software, forcing companies like VIAVI to adapt their strategies.

- Cloud-native network functions can absorb testing capabilities

- Software-defined networking (SDN) and Network Function Virtualization (NFV) enable integrated monitoring.

- Major cloud providers are expanding their native network management and analytics services.

- This trend could reduce reliance on specialized third-party testing solutions.

Alternative Service Delivery Models

Customers increasingly explore managed services, where network testing and assurance are integrated into broader service agreements. This trend allows businesses to outsource the complexity and cost of managing specialized equipment, effectively substituting VIAVI's direct product sales with a service-centric approach.

For instance, major telecommunications companies are expanding their managed services portfolios. In 2024, reports indicate a significant uptick in outsourcing network operations, with some analysts projecting the global managed services market to reach over $350 billion by the end of the year. This directly impacts companies like VIAVI, as clients may opt for a comprehensive service package rather than purchasing individual testing instruments.

- Managed Service Providers (MSPs) offering bundled solutions

- Shift from product ownership to service consumption

- Reduced capital expenditure for end-users

- Increased reliance on third-party expertise for network assurance

The threat of substitutes for VIAVI is significant, stemming from the growing capability of large enterprises to develop in-house testing solutions and the increasing sophistication of generic IT monitoring platforms. Open-source tools are also providing cost-effective alternatives, especially for businesses with budget constraints. The market for open-source software is projected to exceed $300 billion by 2024, highlighting its expanding influence.

Managed services represent another key substitute. Companies are increasingly outsourcing network operations, seeking bundled solutions that reduce their capital expenditure. The global managed services market is expected to surpass $350 billion in 2024, indicating a strong trend towards service consumption over product ownership.

| Substitute Category | Description | Impact on VIAVI | Example/Data Point |

|---|---|---|---|

| In-house Development | Enterprises building proprietary testing tools. | Reduces demand for VIAVI's specialized solutions. | Major telecom operators investing in custom monitoring software. |

| Generic IT Monitoring | Broader platforms handling basic network health. | Offers a less specialized, potentially cheaper alternative. | Small businesses using all-in-one IT monitoring for basic needs. |

| Open-Source Tools | Sophisticated free or low-cost software. | Provides cost-effective options, especially for budget-conscious firms. | Global open-source market projected over $300B by 2024. |

| Managed Services | Outsourcing network operations and assurance. | Shifts focus from product sales to service agreements. | Global managed services market expected to exceed $350B in 2024. |

Entrants Threaten

Entering the network test, monitoring, and assurance market, particularly for cutting-edge areas like 5G and fiber optics, demands significant capital for R&D, manufacturing, and specialized equipment. For instance, companies like VIAVI Solutions invest heavily in developing sophisticated solutions for these rapidly evolving fields. This substantial financial commitment acts as a significant deterrent to many potential new players.

VIAVI's robust portfolio of proprietary technologies and patents, particularly in optical measurement and RF testing, acts as a formidable barrier to entry. These intellectual property assets, developed over years of research and development, make it incredibly difficult and costly for new entrants to replicate VIAVI's advanced solutions. For instance, their extensive patent filings in areas like high-speed optical network testing provide a significant competitive moat.

VIAVI benefits from significant brand recognition and deeply entrenched customer relationships, particularly with major communications service providers and network equipment manufacturers. These established connections make it difficult for new entrants to gain traction, as trust and proven performance are paramount in this sector. For instance, VIAVI's long history of providing reliable test and measurement solutions has fostered loyalty among its existing client base, presenting a substantial barrier for newcomers seeking to displace these incumbents.

Regulatory and Compliance Hurdles

The telecommunications sector is heavily regulated, and new entrants to VIAVI's market face significant regulatory and compliance hurdles. These include adherence to stringent network performance standards, data privacy laws, and cybersecurity mandates, which can be both time-consuming and expensive to implement.

Navigating these complex requirements acts as a substantial barrier, deterring potential new competitors. For instance, in 2024, the global telecommunications market continued to see evolving regulations around spectrum allocation and network neutrality, demanding significant upfront investment and expertise for compliance.

- Regulatory Complexity: Telecommunications industries worldwide require deep understanding and adherence to diverse national and international regulations.

- Compliance Costs: Meeting these standards often necessitates substantial investments in technology, legal counsel, and ongoing monitoring, increasing the cost of entry.

- Time to Market: The process of obtaining necessary certifications and approvals can significantly delay a new entrant's ability to offer services.

- Security Mandates: Increasingly strict cybersecurity regulations for network infrastructure add another layer of complexity and cost for new players.

Access to Distribution Channels and Supply Chains

New entrants face significant hurdles in accessing established global distribution channels and securing reliable supply chains for specialized components. Companies like VIAVI have spent years building these networks, making it difficult for newcomers to gain comparable reach and efficiency. For instance, in the optical networking sector, where VIAVI operates, access to key distributors and contract manufacturers is often tied to long-term relationships and significant volume commitments, which are hard for emerging players to secure.

This difficulty in accessing distribution and supply chains acts as a substantial barrier. New entrants may find themselves paying higher prices for components or facing longer lead times, directly impacting their competitiveness. In 2024, the global supply chain disruptions continued to highlight the importance of robust, pre-existing relationships for securing critical materials and ensuring timely delivery of finished goods.

Consider these points regarding access to distribution channels and supply chains:

- Established Networks: Incumbents like VIAVI benefit from deeply entrenched relationships with distributors and suppliers, providing preferential terms and reliable access.

- Component Sourcing: Securing high-quality, specialized components at competitive prices is challenging for new entrants due to limited purchasing power and lack of established supplier trust.

- Logistical Infrastructure: Building out the necessary global logistics and warehousing infrastructure to match incumbent capabilities requires substantial upfront investment and time.

- Market Penetration: Without strong distribution partnerships, new entrants struggle to reach target customers effectively, limiting their market penetration and sales volume.

The threat of new entrants into VIAVI's market is generally low due to several significant barriers. High capital requirements for research, development, and specialized manufacturing, coupled with the need for extensive patent portfolios, make initial investment substantial. Furthermore, established brand recognition and deep customer relationships, especially with major telecommunications providers, create a formidable hurdle for newcomers seeking to gain trust and market share.

Regulatory complexities and compliance costs, particularly in the evolving telecommunications landscape, add another layer of difficulty. For instance, in 2024, adherence to new cybersecurity mandates and spectrum allocation regulations demanded significant upfront investment and expertise. Accessing established global distribution channels and robust supply chains also presents a challenge, as these are often built on long-standing relationships and volume commitments, which are difficult for emerging players to replicate.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High investment needed for R&D, manufacturing, and specialized equipment. | Deters entry due to substantial financial commitment. |

| Intellectual Property | Proprietary technologies and patents create a competitive moat. | Makes replication difficult and costly for new players. |

| Brand Recognition & Customer Relationships | Established trust and proven performance with major clients. | Difficult for new entrants to gain traction and displace incumbents. |

| Regulatory & Compliance | Navigating complex network standards, data privacy, and security laws. | Time-consuming and expensive to implement, delaying market entry. |

| Distribution & Supply Chains | Access to established global networks and component sourcing. | Challenging for newcomers due to limited purchasing power and lack of trust. |

Porter's Five Forces Analysis Data Sources

Our VIAVI Porter's Five Forces analysis is built upon a robust foundation of data, including industry-specific market research reports, company financial statements, and regulatory filings. We also leverage insights from trade publications and analyst forecasts to capture a comprehensive view of the competitive landscape.