VIAVI Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

VIAVI Bundle

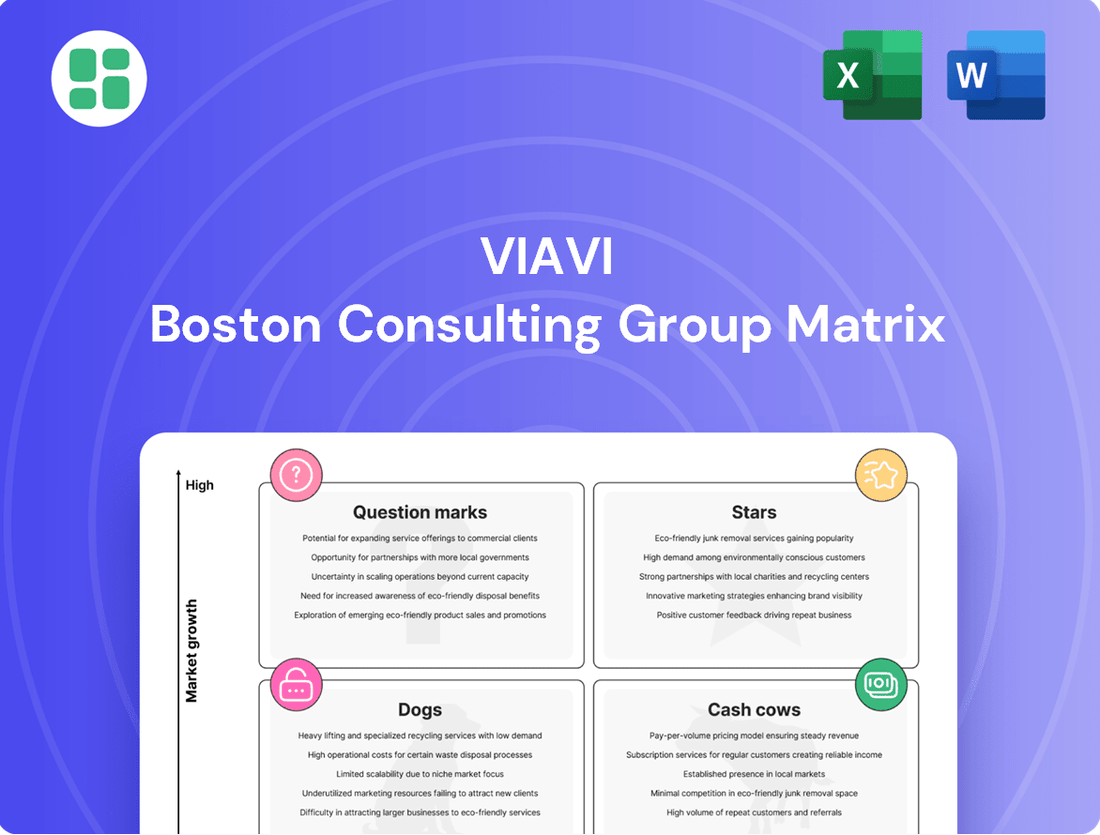

Unlock the strategic potential of VIAVI's product portfolio with our comprehensive BCG Matrix analysis. This preview offers a glimpse into how their offerings are positioned as Stars, Cash Cows, Dogs, or Question Marks, guiding your understanding of market dynamics. Don't miss out on the crucial details that drive informed decisions; purchase the full report for a complete breakdown and actionable insights to optimize your investments and product strategy.

Stars

VIAVI's 5G Network Testing Solutions are firmly positioned as Stars within the BCG Matrix, reflecting their strong presence in a rapidly expanding market. The global market for 5G testing and assurance is expected to reach approximately $10 billion by 2026, with significant growth driven by widespread network deployments.

VIAVI's offerings, including their CellAdvisor 5G handheld analyzer and RF Vision platform, are instrumental for telecom operators navigating the complexities of 5G deployment and optimization. These solutions address the critical need for accurate and efficient testing as 5G infrastructure becomes more sophisticated and widespread.

The relentless growth of AI and hyperscale data centers fuels an urgent demand for robust, high-speed fiber optic networks. VIAVI is strategically positioned to meet this need with its advanced testing solutions for 800G and 1.6Tb optical transceivers.

This focus on critical AI infrastructure manufacturing and deployment places VIAVI in a rapidly expanding, high-demand market segment. Ensuring the performance and capacity of these networks is paramount for the success of today's data-intensive applications.

Open RAN testing and validation are critical for the successful adoption of this transformative technology. VIAVI is a key player, actively participating in initiatives like the VALOR Lab to ensure interoperability and performance in these disaggregated networks. Their solutions are designed to address the complexities of Open RAN, which is experiencing significant growth as the telecom industry shifts towards more flexible architectures.

Network Observability and Performance Monitoring for Hybrid/Cloud Networks

The increasing complexity of hybrid and cloud networks, driven by IoT and remote work, fuels a significant demand for robust network observability solutions. VIAVI’s Observer Platform directly addresses this by offering AI-driven insights, end-user experience scoring, and continuous threat exposure management, positioning it strongly within this expanding market for network performance and security tools.

This strategic alignment is crucial as IT infrastructures grow in scale and intricacy. For instance, the global network performance monitoring market was valued at approximately $3.5 billion in 2023 and is projected to reach over $6.8 billion by 2028, growing at a CAGR of around 14%. VIAVI’s focus on these critical areas taps into this substantial growth trajectory.

- Market Growth: The network performance monitoring market is experiencing robust expansion, with significant projected growth through 2028.

- Key Features: VIAVI's Observer Platform emphasizes AI-driven insights, end-user experience scoring, and threat exposure management, directly addressing market needs.

- Addressing Complexity: These capabilities are vital for managing the intricate demands of hybrid and cloud network environments.

- Demand Drivers: IoT adoption and the prevalence of remote work are key factors increasing the need for comprehensive network observability.

6G Research and Development Solutions

VIAVI is making substantial investments in 6G research and development, actively participating in 6G Forward initiatives. This includes crucial collaborations with universities and key industry players focused on pioneering next-generation communication technologies. Their work spans areas like AI-RAN (Artificial Intelligence for Radio Access Networks) and the integration of quantum technologies.

Although 6G is still in its early stages, VIAVI's proactive and considerable investment in developing robust testing and validation solutions places them in a prime position for this emerging, high-potential market. This early engagement allows VIAVI to influence the development of future 6G standards and secure a significant early market share.

- Early Investment: VIAVI's commitment to 6G R&D, particularly in testing solutions, anticipates future market needs.

- Collaborative Approach: Partnerships with academic and industry leaders foster innovation in areas like AI-RAN and quantum tech.

- Market Shaping: Early involvement enables VIAVI to influence 6G standards and capture initial market opportunities.

- Future Growth: Positioning in the nascent 6G market is expected to drive significant long-term revenue growth.

VIAVI's 5G Network Testing Solutions are Stars, capitalizing on the booming 5G market which is projected to see significant expansion in the coming years. Their advanced analyzers and platforms are essential for operators deploying and optimizing complex 5G networks, a sector experiencing rapid growth driven by global infrastructure build-outs.

The demand for high-speed fiber optics, crucial for AI and data centers, positions VIAVI's 800G and 1.6Tb transceiver testing solutions as Stars. This segment benefits from the insatiable appetite for data processing and connectivity, making VIAVI's contributions vital for performance assurance.

VIAVI's engagement in Open RAN, including participation in initiatives like the VALOR Lab, solidifies its Star status. As the telecom industry embraces disaggregated network architectures, VIAVI's interoperability and performance validation tools are in high demand, reflecting the accelerating adoption of Open RAN.

The increasing complexity of hybrid and cloud networks, fueled by IoT and remote work, makes VIAVI's AI-driven network observability solutions, like the Observer Platform, Stars. The network performance monitoring market, valued at approximately $3.5 billion in 2023 and expected to grow significantly, highlights the critical need for these advanced tools.

| Solution Area | BCG Matrix Category | Key Market Drivers | 2024 Relevance |

| 5G Network Testing | Stars | Global 5G deployment, network densification | High demand for optimization and assurance tools |

| Optical Transceiver Testing (800G/1.6Tb) | Stars | AI, hyperscale data centers, increased data traffic | Critical for ensuring high-speed network performance |

| Open RAN Testing | Stars | Telecom network disaggregation, flexibility | Essential for interoperability and validation |

| Network Observability (Hybrid/Cloud) | Stars | IoT, remote work, network complexity | Vital for performance monitoring and security |

What is included in the product

The VIAVI BCG Matrix offers a strategic overview of its product portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

A clear, visual BCG Matrix that instantly highlights strategic positioning, alleviating the pain of complex data interpretation.

Cash Cows

VIAVI holds a strong position in the mature but growing Fiber Optic Test Equipment (FOTE) market, with its OTDRs and OPMs being key revenue generators. This segment benefits from continuous fiber network expansion and upkeep, particularly within the telecommunications sector. In 2024, the global FOTE market was valued at approximately $1.5 billion, with VIAVI capturing a significant share.

VIAVI's cable and broadband network testing solutions are firmly positioned as cash cows within its portfolio. These mature markets, characterized by established infrastructure, benefit from VIAVI's significant market share and long-standing customer relationships. This translates into a consistent and reliable demand for their maintenance, troubleshooting, and quality assurance tools.

The low growth environment in traditional cable and broadband segments means that substantial investment in expansion or aggressive marketing is not required. This allows VIAVI to leverage its strong market position to generate substantial cash flow with minimal incremental investment, effectively milking these established revenue streams.

For instance, the global broadband test and measurement market, while not solely comprised of traditional cable, saw steady growth, with projections indicating continued stability. VIAVI's extensive product suite, covering everything from fiber optic testing to cable modem analysis, ensures they remain a critical partner for service providers in these essential, yet mature, segments.

VIAVI's Optical Security and Performance Products (OSP) segment, a key player in anti-counterfeiting, leverages its light management expertise in a stable, mature market. This business is vital for sectors like aerospace, defense, and luxury goods, where robust security features are non-negotiable.

The OSP segment is characterized by consistent demand, offering VIAVI reliable revenue streams. While growth prospects are moderate, the segment boasts high profitability, contributing significantly to VIAVI's overall financial health.

Lab & Production Test Systems for Legacy Network Equipment Manufacturers

VIAVI's lab and production test systems for legacy network equipment manufacturers represent a significant cash cow. These systems are essential for ongoing product development and quality control for many established network equipment manufacturers (NEMs). Even as some NEMs pivot, the persistent demand for reliable testing in mature product lifecycles ensures VIAVI maintains a strong market share in this segment, leading to predictable and stable cash flow generation.

This business unit benefits from a mature market where established players continue to rely on these critical testing solutions. The consistent revenue stream, driven by the ongoing need for validation and maintenance of existing network infrastructure, allows VIAVI to fund investments in other, more dynamic areas of its portfolio. For instance, in fiscal year 2023, VIAVI reported strong performance in its Network and Service Enablement segment, which encompasses these types of solutions, indicating continued market relevance and profitability.

- Stable Revenue: Legacy systems require continuous testing and validation, providing a predictable revenue stream for VIAVI.

- High Market Share: VIAVI's established reputation and comprehensive solutions give it a dominant position in this niche.

- Cash Generation: The mature nature of the market and strong market share translate into consistent, high-margin cash flow.

- Funding Growth: Profits from these cash cows can be reinvested into research and development for emerging technologies.

Professional Services and Support for Mature Products

VIAVI's mature product portfolio is supported by a robust professional services division. This segment focuses on providing essential services like calibration, repair, and ongoing technical support for their installed base of test and measurement equipment. These high-margin, recurring revenue streams are crucial for maintaining profitability and customer retention.

The company leverages its established market share in these mature product categories to offer these crucial support services. This strategy ensures continued customer loyalty by providing reliable upkeep for their existing VIAVI investments, thereby generating a steady and predictable cash flow for the organization.

- High-Margin Revenue: Professional services, including calibration and repair, contribute significantly to VIAVI's profitability due to their high-margin nature.

- Recurring Revenue Stream: Long-term customer relationships and ongoing support contracts create a predictable and recurring revenue base.

- Customer Loyalty: Comprehensive support for mature products fosters strong customer loyalty, reducing churn and increasing lifetime customer value.

- Market Share Leverage: VIAVI capitalizes on its existing market dominance in mature product segments to drive service adoption and revenue.

VIAVI's cable and broadband network testing solutions are firmly positioned as cash cows. These mature markets, characterized by established infrastructure, benefit from VIAVI's significant market share and long-standing customer relationships, ensuring consistent demand for maintenance and troubleshooting tools.

The low growth in traditional cable segments means minimal investment is needed, allowing VIAVI to generate substantial cash flow from these established revenue streams. For example, the global broadband test and measurement market showed steady growth in 2024, with VIAVI's comprehensive product suite cementing its role for service providers.

VIAVI's Optical Security and Performance Products (OSP) segment, a key player in anti-counterfeiting, leverages light management expertise in a stable, mature market. This business provides consistent demand and reliable revenue streams, contributing significantly to VIAVI's financial health with high profitability, despite moderate growth prospects.

VIAVI's lab and production test systems for legacy network equipment manufacturers also act as cash cows. These systems are crucial for ongoing product development and quality control for established manufacturers, ensuring predictable and stable cash flow generation even as some pivot to new technologies.

| Segment | Market Position | Cash Flow Generation | Growth Outlook |

| Fiber Optic Test Equipment (FOTE) | Strong, significant share in a $1.5 billion market (2024) | Consistent revenue from network expansion and upkeep | Mature but growing |

| Cable and Broadband Network Testing | Dominant, long-standing customer relationships | Reliable demand for maintenance and troubleshooting tools | Low growth, stable |

| Optical Security and Performance Products (OSP) | Key player in anti-counterfeiting | Consistent demand, high profitability | Moderate growth, stable |

| Lab and Production Test Systems (Legacy NEMs) | Strong market share in niche | Predictable, stable cash flow from ongoing product lifecycles | Mature, stable |

What You See Is What You Get

VIAVI BCG Matrix

The VIAVI BCG Matrix preview you are viewing is the identical, fully formatted document you will receive upon purchase. This ensures complete transparency; what you see is precisely what you get, ready for immediate strategic application. You can confidently proceed with your purchase, knowing you'll obtain an unwatermarked, professionally designed report for your business analysis. This preview guarantees the quality and completeness of the final VIAVI BCG Matrix you will download.

Dogs

VIAVI's legacy copper network testing solutions likely reside in the Dogs quadrant of the BCG Matrix. While VIAVI strategically emphasizes advanced fiber and wireless, the market for copper-based testing is shrinking as the industry moves towards newer technologies.

The demand for copper testing equipment is experiencing low growth, and VIAVI's market share in this niche may be decreasing. This segment could demand significant resources for maintenance and support relative to its revenue generation potential.

Outdated network performance monitoring software versions often find themselves in the Dogs quadrant of the BCG Matrix. These legacy systems, while perhaps once dominant, now struggle to keep pace with the rapid advancements in technology, such as AI-driven analytics and cloud-native architectures.

Customers are increasingly migrating to newer, more capable platforms, leading to a decline in market share for these older solutions. For instance, a significant portion of network monitoring tools deployed before 2020 may lack the sophisticated troubleshooting capabilities demanded today, impacting their relevance and revenue potential.

Continued investment in maintaining these outdated versions offers diminishing returns. Companies are better served by focusing resources on developing and promoting next-generation solutions, like VIAVI's ObserverONE, which are designed to meet the evolving needs of modern network management and deliver superior performance and insights.

Niche or highly specialized test equipment with limited market demand often falls into the 'Dog' category within the VIAVI BCG Matrix. These products serve very specific, sometimes declining, market segments. For instance, equipment designed for legacy telecommunications systems might see its demand shrink as newer technologies take over.

While these items may still be technically sound, their sales volume is often insufficient to justify ongoing investment. Consider test equipment for older analog radio systems; the market for these is significantly smaller than for modern digital or 5G infrastructure testing. This low demand, coupled with potentially high development or maintenance costs, can make them cash traps, draining resources without generating substantial returns.

Basic, Undifferentiated Test Probes and Tools

In the crowded landscape of network testing, basic, undifferentiated probes and tools often find themselves in a challenging position. These are the workhorse items that perform essential functions but don't offer anything particularly special. Think of them as the digital equivalent of a standard screwdriver – it gets the job done, but there's nothing innovative about it.

When a market is saturated with similar products, those that don't stand out can struggle to gain significant traction. This lack of differentiation often translates to a low market share. For instance, in the broader test and measurement equipment market, which includes these basic tools, growth rates can be modest, often in the single digits, especially for mature product categories without technological advancements. This means companies offering these undifferentiated products might see very little market expansion.

The reality for these commodity-like offerings is intense price competition. Customers looking for basic functionality will naturally gravitate towards the lowest cost option. This pressure on pricing directly impacts profitability, making these products less attractive from a financial standpoint. Consequently, they typically require minimal strategic investment because they aren't driving substantial growth or positioning the company as a market leader. Their contribution to the overall business is often limited, making them candidates for divestment or simply management with a focus on cost efficiency rather than innovation.

Consider these key characteristics:

- Low Market Share: Products lacking unique features struggle to capture a significant portion of the market.

- Limited Growth Potential: Commodity-like offerings in mature markets see minimal expansion.

- Intense Price Competition: Differentiation is key to avoiding a race to the bottom on price.

- Low Profitability: Price wars erode margins, making these products less financially appealing.

Discontinued Product Lines or End-of-Life Equipment Support

Discontinued product lines or end-of-life equipment support within VIAVI's portfolio, particularly those with minimal ongoing support, would likely be categorized as Dogs in the BCG Matrix. These offerings typically exhibit no significant market growth and possess a declining market share.

VIAVI's strategy for these "Dog" products centers on resource optimization. The company aims to reduce investment and operational costs associated with these legacy items, prioritizing the transition of existing customers to more current and revenue-generating solutions. This strategic pivot ensures that capital and attention are directed towards products with higher growth and profitability potential.

- Dwindling Market Share: Products nearing end-of-life often see their market share shrink as newer technologies emerge.

- Limited Growth Potential: With production ceased or support minimal, these products offer little to no opportunity for expansion.

- Resource Reallocation: VIAVI focuses on minimizing investment in these areas to free up resources for strategic growth initiatives.

- Customer Migration: A key objective is to guide customers using these older products to adopt VIAVI's newer, more advanced solutions.

Legacy copper network testing solutions, like those for older DSL technologies, represent a classic 'Dog' in VIAVI's BCG Matrix. The market for these is shrinking rapidly as the world transitions to fiber optics and 5G. VIAVI's focus has shifted to these newer technologies, leaving copper testing with low growth and a potentially declining market share.

These products may require ongoing support and maintenance, consuming resources without delivering substantial returns. For example, the global copper network testing market, while still existing, is projected to see minimal growth, with some estimates suggesting a compound annual growth rate (CAGR) below 2% in the coming years. This contrasts sharply with the double-digit growth expected in fiber optic testing.

VIAVI's strategy for these 'Dog' products involves minimizing investment and encouraging customers to migrate to their more advanced fiber and wireless testing solutions. This approach aims to reallocate resources towards higher-growth areas, ensuring capital is deployed where it can generate greater returns.

Here's a snapshot of why these products fit the 'Dog' category:

| Category | Market Growth | VIAVI Market Share | Strategic Focus |

|---|---|---|---|

| Legacy Copper Testing | Low (sub 2% CAGR projected) | Declining | Minimize investment, customer migration |

| End-of-Life Support | None | Negligible | De-prioritize, focus on newer solutions |

| Undifferentiated Probes | Low (single digits) | Low | Cost efficiency, potential divestment |

Question Marks

VIAVI is highlighting its AI-driven digital twin technology for network optimization, a segment poised for significant growth in how networks are managed. This innovative approach allows for virtual replication of complex networks, enabling sophisticated testing and performance analysis.

While this is a promising, high-growth area, it's still an emerging field, and VIAVI's specific market share in AI-driven digital twins is likely still in its formative stages. The company is investing heavily to build leadership in this cutting-edge application.

The adoption of these advanced digital twins is crucial for operators looking to fine-tune their increasingly complex and dynamic network infrastructures. For instance, the global digital twin market is projected to reach $126 billion by 2029, demonstrating the immense potential for solutions like VIAVI's.

Non-Terrestrial Networks (NTN) represent a burgeoning segment within telecommunications, leveraging satellite and aerial platforms to extend connectivity. VIAVI's commitment to NTN validation solutions, highlighted by their participation in MWC 2025, places them in a rapidly expanding market. However, as NTN technology is still in its nascent stages of broad commercial adoption, VIAVI's current market share in this specific area is relatively low. This strategic positioning necessitates significant investment in research and development, alongside dedicated market cultivation efforts.

VIAVI's acquisition of Spirent's high-speed Ethernet and network security business lines in Q2 2025 is a bold move into the burgeoning network security and AI/digital infrastructure sectors. This strategic expansion positions VIAVI to capitalize on the increasing demand for robust cybersecurity solutions, especially with the proliferation of AI-driven technologies. The integration of these capabilities is expected to significantly bolster VIAVI's portfolio, targeting a market segment that saw substantial growth in 2024.

Solutions for Autonomous Air, Land, and Sea Systems (from Inertial Labs Acquisition)

The acquisition of Inertial Labs in late 2024 positions VIAVI to capitalize on the burgeoning autonomous systems market. This strategic move injects VIAVI into high-growth sectors like aerospace, defense, and advanced industrial applications, where demand for precise navigation and control is paramount.

This new business segment, under the VIAVI umbrella, is characterized by significant growth potential, but VIAVI's initial market share in these specialized verticals is modest. Consequently, substantial investment will be necessary to establish a strong foothold and leverage the full opportunity presented by autonomous air, land, and sea systems.

- Market Entry & Investment: VIAVI's late 2024 acquisition of Inertial Labs marks a strategic entry into the autonomous systems market, targeting high-growth aerospace, defense, and industrial sectors.

- Growth Potential: The newly acquired capabilities offer substantial growth prospects, driven by the increasing adoption of autonomous technologies across various demanding applications.

- Market Share & Strategy: While VIAVI's initial market share in these specific verticals is low, the company is poised to invest heavily to build its presence and capture market share in this expanding domain.

- Synergistic Opportunities: The integration of Inertial Labs' expertise in inertial navigation systems is expected to create synergistic opportunities, enhancing VIAVI's existing portfolio and opening new revenue streams.

Advanced Cloud-Based Network Automation and AIOps Solutions

VIAVI is significantly investing in its advanced cloud-based network automation and AIOps solutions, exemplified by NITRO AIOps. This strategic focus aims to equip network operators with the tools for more intelligent and automated cloud operations, a sector experiencing rapid expansion due to escalating network complexity.

The market for AIOps and cloud automation is a high-growth segment, with global AIOps market size projected to reach $10.7 billion by 2028, growing at a CAGR of 28.5% from 2023. VIAVI's commitment here positions them to capture a share of this burgeoning market, though continued investment is crucial as their presence in the broader cloud automation landscape is still developing.

- High Growth Potential: The increasing complexity of modern networks, especially in cloud environments, drives demand for automated and AI-driven solutions.

- Strategic Investment: VIAVI's focus on NITRO AIOps signifies a commitment to this high-growth area, anticipating future market needs.

- Market Traction: While the AIOps market is expanding, VIAVI's market share in the broader cloud automation space is still being established, necessitating ongoing development and market penetration efforts.

- Competitive Landscape: Continued innovation and strategic partnerships will be key for VIAVI to solidify its position against established players in the AIOps and cloud automation sectors.

Question Marks represent business units with low market share in a high-growth industry. VIAVI's AI-driven digital twin technology for network optimization fits this profile, offering advanced capabilities but still in early adoption stages. Similarly, their Non-Terrestrial Networks (NTN) validation solutions are positioned in a burgeoning market where broad commercial adoption is still developing.

The company's strategic acquisitions, like Inertial Labs for autonomous systems and Spirent's business lines for network security and AI infrastructure, also place them in high-potential but initially low-market-share segments. These ventures require significant investment to build presence and capitalize on future growth.

VIAVI's investment in advanced cloud-based network automation and AIOps, such as NITRO AIOps, also falls into the Question Mark category. While the AIOps market is expanding rapidly, VIAVI's share in the broader cloud automation landscape is still being established, necessitating ongoing development and market penetration efforts.

These Question Mark segments, while currently representing smaller market shares for VIAVI, are critical for future growth. The company's strategy involves investing in these areas to build market leadership, leveraging innovation and strategic acquisitions to capture future opportunities in rapidly evolving technological landscapes.

BCG Matrix Data Sources

Our BCG Matrix leverages a comprehensive blend of financial statements, market research reports, and industry expert opinions to provide a robust strategic overview.