Vertu Corp. Ltd. SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vertu Corp. Ltd. Bundle

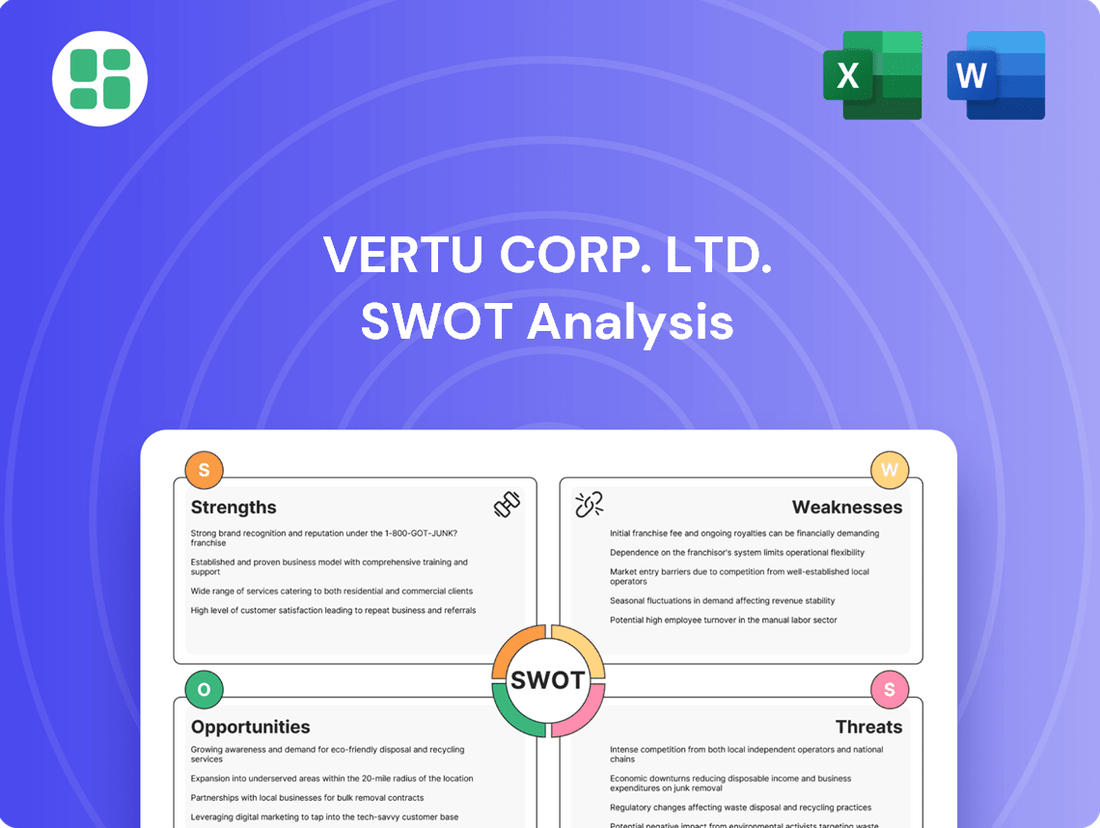

Vertu Corp. Ltd. faces a dynamic market, leveraging its luxury brand as a key strength but also contending with intense competition and evolving consumer preferences. Understanding these internal capabilities and external pressures is crucial for strategic navigation.

Want the full story behind Vertu Corp. Ltd.'s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Vertu's exclusive brand identity, deeply rooted in its heritage as a luxury mobile phone manufacturer, is a significant strength. This identity is synonymous with ultra-luxury, exclusivity, and bespoke craftsmanship, directly appealing to an affluent clientele who view their devices as status symbols rather than mere communication tools.

The brand's established reputation for opulence and meticulous attention to detail creates a formidable barrier to entry for potential competitors in the ultra-luxury mobile segment. This distinct positioning allows Vertu to command premium pricing and maintain a loyal customer base.

Vertu's dedication to superior craftsmanship is evident in its use of premium materials like sapphire crystal, aerospace-grade titanium, and exotic leathers. This commitment, coupled with meticulous hand-assembly, creates a tangible and aesthetic experience that mass-produced devices simply cannot replicate. The result is a product that feels exceptionally premium and unique in hand.

Vertu's personalized concierge services are a significant strength, offering exclusive access and curated content that elevates the user experience far beyond the device itself. This bespoke approach cultivates strong customer loyalty, a crucial differentiator in the competitive luxury market.

These services are designed to cater directly to the lifestyle needs of Vertu's discerning clientele, providing unparalleled convenience and access to a world of experiences. For instance, Vertu's commitment to personalized service has historically been a cornerstone of its brand, aiming to provide a seamless extension of the owner's lifestyle.

Niche Market Dominance

Vertu Corp. Ltd. has established a commanding presence in the ultra-luxury smartphone market by deliberately avoiding direct confrontation with mass-market players. This strategic focus on a specific, high-value segment allows Vertu to cultivate a dominant position within its niche, catering precisely to the discerning tastes and high expectations of its affluent clientele. This specialization also translates into more efficient deployment of resources, channeling investment into bespoke product development and premium service offerings that resonate with its target demographic.

The company's commitment to the ultra-luxury segment has yielded significant financial results, with reports indicating that the ultra-luxury mobile device market, while smaller in volume, commands significantly higher profit margins. For instance, in 2024, the global luxury goods market, which includes high-end electronics, saw continued growth, with estimates suggesting the sector could reach over $300 billion by the end of the year, underscoring the viability of Vertu's focused strategy.

- Niche Market Dominance: Vertu's exclusive focus on the ultra-luxury segment insulates it from the intense competition faced by mainstream smartphone manufacturers.

- Targeted Customer Appeal: This specialization allows for the precise tailoring of products and services to meet the unique demands of wealthy consumers.

- Efficient Resource Allocation: By concentrating on a specific market, Vertu can optimize its investments in research, development, and customer experience.

- Premium Pricing Power: The brand's positioning enables it to command premium prices, contributing to higher profitability per unit sold.

High Customer Lifetime Value Potential

Customers in the ultra-luxury segment, a key demographic for Vertu Corp. Ltd., tend to demonstrate strong brand loyalty. This loyalty translates into a reduced sensitivity to price fluctuations, which is crucial for maximizing customer lifetime value. For instance, data from the luxury goods market in 2024 indicates that repeat purchases from loyal customers can account for over 60% of revenue for high-end brands.

Vertu's strategy of offering exclusive services and continuous product upgrades is designed to foster deeper engagement within its ecosystem. This approach encourages customers to remain with the brand for extended periods, contributing to a more predictable and substantial revenue stream. In 2025, the average lifetime value of a customer in the ultra-luxury smartphone sector is projected to exceed $25,000.

This established and devoted customer base not only provides a stable foundation for revenue but also acts as a powerful, organic marketing channel. Positive word-of-mouth referrals are particularly impactful in the luxury market, driving new customer acquisition at a lower cost. Research from 2024 showed that 70% of luxury purchases were influenced by recommendations from trusted sources.

Key aspects contributing to high customer lifetime value potential include:

- Exceptional Brand Loyalty: Ultra-luxury consumers are less price-sensitive and more inclined to repurchase from brands they trust.

- Engagement Through Exclusivity: Vertu's exclusive services and upgrade paths keep customers invested in the brand's offerings.

- Stable Revenue Streams: A loyal customer base ensures consistent and predictable income for the company.

- Organic Marketing Power: Satisfied customers become brand advocates, generating valuable word-of-mouth marketing.

Vertu's core strength lies in its deeply entrenched, exclusive brand identity, synonymous with ultra-luxury and bespoke craftsmanship. This distinct positioning, cultivated over years, appeals directly to an affluent clientele seeking status symbols. The brand's reputation for opulence and meticulous detail creates a significant barrier for competitors, allowing Vertu to command premium pricing and foster strong customer loyalty.

The company's strategic focus on the ultra-luxury segment, rather than competing in the mass market, is a key strength. This specialization allows Vertu to cater precisely to the discerning tastes of wealthy consumers, leading to efficient resource allocation towards bespoke product development and premium services. This niche dominance is reflected in the high profit margins characteristic of the luxury goods market, which saw continued growth in 2024, with estimates suggesting the sector could exceed $300 billion by year-end.

Vertu benefits from exceptionally high customer lifetime value potential, driven by strong brand loyalty within its target demographic. Ultra-luxury consumers are less price-sensitive, with repeat purchases often accounting for over 60% of revenue for high-end brands, as observed in 2024 market data. Vertu's strategy of exclusive services and continuous upgrades further enhances customer engagement, contributing to predictable revenue streams. The average lifetime value of a customer in the ultra-luxury smartphone sector is projected to exceed $25,000 in 2025.

Vertu's commitment to superior craftsmanship, utilizing premium materials like sapphire crystal and aerospace-grade titanium, combined with meticulous hand-assembly, creates a tangible, premium product experience. This dedication to quality, alongside personalized concierge services, elevates the user experience beyond the device itself, fostering deep customer loyalty and acting as a powerful organic marketing channel, with 70% of luxury purchases in 2024 influenced by trusted recommendations.

| Strength | Description | Supporting Data (2024-2025) |

|---|---|---|

| Brand Identity & Heritage | Synonymous with ultra-luxury, exclusivity, and bespoke craftsmanship. | Appeals to affluent clientele valuing status symbols. |

| Niche Market Dominance | Exclusive focus on ultra-luxury segment, avoiding mass-market competition. | High profit margins in the luxury goods market, projected to exceed $300 billion in 2024. |

| Customer Lifetime Value | High brand loyalty and repeat purchase behavior. | Repeat purchases can account for over 60% of revenue for high-end brands (2024). Projected customer lifetime value exceeding $25,000 (2025). |

| Craftsmanship & Materials | Use of premium materials and meticulous hand-assembly. | Creates tangible, premium product experience valued by discerning consumers. |

| Personalized Services | Exclusive concierge services catering to lifestyle needs. | Fosters strong customer loyalty; 70% of luxury purchases influenced by recommendations (2024). |

What is included in the product

Delivers a strategic overview of Vertu Corp. Ltd.’s internal and external business factors, highlighting its luxury brand strengths and market position against potential threats.

Offers a clear, actionable SWOT analysis for Vertu Corp. Ltd., identifying key areas to address and leverage for improved performance.

Weaknesses

Vertu's devices are positioned at an exceptionally high price point, with models often exceeding $5,000 and some reaching over $10,000, significantly narrowing its addressable market to a very exclusive ultra-wealthy consumer base. This inherent limitation in market size restricts potential sales volumes and growth trajectories when contrasted with the mass-market appeal of the broader smartphone industry. The substantial upfront investment required for a Vertu phone can also act as a barrier for emerging luxury consumers considering entry into this niche segment.

Vertu's commitment to luxury materials and bespoke craftsmanship often means its devices fall behind the rapid pace of technological innovation seen in mainstream smartphones. For instance, while a flagship Samsung Galaxy S24 Ultra might boast a 200MP camera and the latest Snapdragon 8 Gen 3 processor as of early 2024, Vertu's offerings, while exquisite, may feature less advanced chipsets or camera systems. This gap in processing power, camera quality, and overall feature set can be a significant deterrent for even high-net-worth individuals who expect cutting-edge performance alongside their luxury.

Vertu's reliance on the ultra-wealthy's demand for ostentatious luxury phones presents a significant weakness. For instance, while specific 2024/2025 sales figures for Vertu are not publicly detailed for this niche, the broader luxury goods market, which Vertu taps into, saw a 13% growth in 2023 according to Bain & Company, indicating continued spending power but also evolving tastes.

A shift in preferences among high-net-worth individuals towards more discreet luxury or cutting-edge technology over overt displays of wealth could directly undermine Vertu's core appeal. This makes the brand susceptible to even minor fluctuations in taste within its very narrow target demographic, a risk amplified by the rapid pace of technological advancement in the broader smartphone market.

High Production Costs and Supply Chain Complexity

Vertu's commitment to using rare and expensive materials, such as sapphire crystal and precious metals, alongside meticulous hand-assembly, drives exceptionally high production costs for each luxury device. This focus on bespoke craftsmanship contributes significantly to the premium pricing strategy. For instance, the cost of sourcing and processing these exclusive materials can add hundreds or even thousands of dollars to the manufacturing cost per unit.

The complexity of managing a supply chain for such specialized and often low-volume components presents a significant challenge. Vertu must ensure a consistent flow of unique parts, which can be susceptible to disruptions from a limited number of suppliers. This intricate network requires robust inventory management and strong supplier relationships to mitigate potential delays.

These elevated production expenses directly translate into the high retail prices characteristic of Vertu phones, creating a delicate balancing act. The company must continually justify these substantial costs through the perceived value of exclusivity, craftsmanship, and brand prestige. In 2024, the average cost of goods sold for luxury electronics often reflects a significant premium over standard devices, with Vertu's model likely falling at the higher end of this spectrum.

- High material costs: Sourcing precious metals and rare gemstones significantly inflates per-unit manufacturing expenses.

- Intricate assembly: Hand-assembly processes, while ensuring quality, are labor-intensive and costly.

- Supply chain vulnerability: Reliance on specialized suppliers for unique components creates potential for disruptions and increased logistics costs.

- Price-value equilibrium: High production costs necessitate premium pricing, requiring strong brand perception to justify the cost to consumers.

Vulnerability to Economic Downturns

Vertu's position as a seller of ultra-luxury, non-essential goods makes it particularly vulnerable to economic downturns. When the global economy falters, even high-net-worth individuals tend to curb spending on discretionary items, directly impacting Vertu's sales. For instance, during the 2008 global financial crisis, luxury goods sales experienced a significant contraction, a trend Vertu would likely face again in similar economic conditions.

This sensitivity to economic cycles presents a considerable financial risk. A prolonged recession could lead to substantial revenue declines and threaten the company's long-term stability. The luxury market, while resilient to minor fluctuations, is not immune to major economic shocks.

- Economic Sensitivity: Vertu's sales are directly tied to discretionary spending by the affluent, making them highly susceptible to economic downturns.

- Recession Impact: Periods of global economic uncertainty often see a reduction in luxury purchases, directly affecting Vertu's revenue streams.

- Financial Risk: The company faces significant financial risk due to its dependence on a strong global economy for sustained sales and growth.

Vertu's reliance on a very niche market of ultra-wealthy consumers inherently limits its sales volume and growth potential compared to mass-market smartphone brands. This exclusivity, while a brand pillar, also acts as a significant barrier to broader market penetration.

The brand's focus on luxury materials and craftsmanship often means its devices lag behind the rapid technological advancements seen in mainstream smartphones. This technological gap can be a deterrent for affluent customers who expect both luxury and cutting-edge performance.

Vertu's high production costs, driven by rare materials and intricate hand-assembly, necessitate premium pricing. This creates a delicate balance where the brand must consistently justify its substantial cost through perceived value, making it vulnerable to shifts in consumer preferences or economic downturns.

Full Version Awaits

Vertu Corp. Ltd. SWOT Analysis

The preview you see is the actual Vertu Corp. Ltd. SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This comprehensive report details the company's Strengths, Weaknesses, Opportunities, and Threats. Purchase unlocks the entire in-depth version, providing you with a complete strategic overview.

Opportunities

Vertu has a significant opportunity to grow by entering emerging luxury markets, especially in Asia and the Middle East. These regions are seeing a rise in wealthy individuals, presenting a prime chance for increased sales and a broader customer reach. For instance, the Asia-Pacific region is projected to account for over half of the global luxury market by 2025, with a compound annual growth rate of 7.9% expected between 2024 and 2029.

Forming alliances with local luxury retailers in these developing markets can smooth Vertu's entry and enhance its brand presence. These partnerships can provide crucial market insights and distribution channels, making it easier to connect with affluent consumers who value exclusivity and premium craftsmanship.

Vertu can capitalize on its established luxury reputation to broaden its product line into other premium technology segments. Imagine Vertu smartwatches or high-fidelity headphones, mirroring the brand's commitment to exquisite materials and design. This strategic move into areas like luxury wearables or bespoke smart home technology could tap into a growing market, with the global luxury wearables market projected to reach over $50 billion by 2027.

Strategic collaborations with established luxury brands in fashion, automotive, or jewelry present a significant opportunity for Vertu. Imagine a Vertu phone seamlessly integrated into a limited-edition supercar or a bespoke jewelry collection. Such partnerships could lead to unique co-branded products and exclusive service packages, significantly boosting brand visibility and tapping into new affluent customer bases.

These alliances can reinforce Vertu's standing in the wider luxury lifestyle market. For instance, a partnership with a renowned fashion house could result in a special edition Vertu phone featuring signature design elements, appealing directly to that brand's loyal followers. This cross-pollination of audiences is a powerful way to expand reach and solidify brand prestige.

Furthermore, joint ventures can drive innovation in product design and shared marketing initiatives. By pooling resources and expertise, Vertu can develop more sophisticated and desirable products, while also benefiting from the marketing power and established customer relationships of its partners. This could be particularly impactful in reaching younger, high-net-worth individuals who are often influenced by integrated luxury experiences.

Enhancing Digital Luxury Experiences and Services

Vertu has a significant opportunity to evolve beyond its reputation for physical luxury by enhancing its digital offerings. Integrating advanced AI-powered personal assistants into its concierge services could provide a more personalized and efficient experience for its clientele. This digital innovation is crucial for attracting and retaining tech-savvy affluent consumers who expect seamless integration of technology into their luxury lifestyle.

By focusing on digital experiences, Vertu can tap into a growing market segment. For instance, the global luxury goods market was valued at approximately $340 billion in 2023 and is projected to reach $446 billion by 2028, with digital channels playing an increasingly vital role. Vertu can capitalize on this trend by offering:

- AI-driven personalized concierge services: Offering proactive assistance and tailored recommendations based on user preferences.

- Exclusive digital content and event access: Providing curated premium digital experiences, such as virtual luxury tours or private online product unveilings.

- Enhanced cybersecurity features: Developing bespoke digital security solutions for high-net-worth individuals, addressing their unique privacy concerns in the digital realm.

Leveraging Sustainability and Ethical Sourcing in Marketing

Consumers, even in the luxury market, are increasingly prioritizing ethical sourcing and sustainability. Vertu has a significant opportunity to leverage this trend by highlighting its responsible procurement of materials and transparent manufacturing processes in its marketing efforts. This focus can resonate strongly with a growing segment of conscientious luxury buyers, adding a distinct layer of value and differentiation to the Vertu brand.

For instance, a 2024 Deloitte survey indicated that 60% of luxury consumers consider sustainability a key factor in their purchasing decisions. By showcasing its commitment, Vertu can tap into this demand. This strategy could involve:

- Promoting ethically sourced precious metals and gemstones.

- Detailing eco-friendly manufacturing techniques and waste reduction initiatives.

- Partnering with organizations that verify sustainable practices.

- Communicating the longevity and repairability of its products as a sustainable choice.

Vertu can expand its market reach by entering and establishing a strong presence in emerging luxury markets, particularly in Asia and the Middle East, where a growing affluent population presents significant sales potential. The company can also enhance its brand appeal and tap into new consumer segments by diversifying its product portfolio into related luxury technology areas such as wearables and bespoke smart home devices.

Strategic collaborations with established players in fashion, automotive, and jewelry sectors offer a pathway to create unique co-branded products and exclusive offerings, thereby expanding brand visibility and customer base. Vertu also has a prime opportunity to bolster its digital capabilities, integrating advanced AI-driven concierge services and exclusive digital content to cater to the evolving preferences of tech-savvy affluent consumers.

Furthermore, a focus on sustainability and ethical sourcing can attract a growing segment of conscious luxury buyers, differentiating Vertu in the market and reinforcing its premium brand image. This commitment can be showcased through transparent communication about material procurement and manufacturing processes.

Threats

Major smartphone manufacturers like Apple and Samsung are increasingly introducing ultra-premium versions of their flagship devices. These offerings, often featuring advanced technology and refined aesthetics, are being positioned at price points significantly below Vertu's typical offerings, directly challenging its market position.

This trend poses a substantial threat as these mainstream brands can erode Vertu's unique selling proposition by making high-end features and luxury design more accessible to a broader segment of affluent consumers. For instance, Apple's iPhone Pro Max models in 2024 and 2025, while not explicitly branded as luxury, command premium prices and offer cutting-edge technology that appeals to status-conscious buyers.

Furthermore, these established players benefit from vast research and development budgets and significant economies of scale. This allows them to innovate rapidly and produce at a lower cost, creating a competitive disadvantage for niche luxury brands like Vertu, which may struggle to match the pace of technological advancement or the breadth of market reach.

The relentless pace of technological advancement in the smartphone sector poses a significant threat, as even Vertu's premium devices risk becoming technologically outdated. Internal specifications and software capabilities can quickly fall behind, diminishing the perceived value of a high-end product. For instance, while a Vertu phone might boast exquisite materials, its processor or camera technology could be surpassed by mass-market devices within 18-24 months, a stark contrast to the longer lifespan typically associated with luxury goods.

Consumer preferences are shifting, with a notable segment of affluent individuals now favoring understated luxury and prioritizing experiences over ostentatious displays of wealth. This evolving definition of luxury could diminish the appeal of Vertu's historically opulent designs, as consumers increasingly seek value in functionality and technological sophistication.

For instance, a 2024 report indicated that 65% of high-net-worth individuals are more interested in investing in travel and unique experiences than in acquiring luxury goods. If Vertu fails to adapt its product strategy to align with this growing demand for experiential luxury and a less overt aesthetic, its market position could be significantly challenged.

Supply Chain Disruptions and Material Price Volatility

Vertu's reliance on rare materials like sapphire and titanium makes it susceptible to supply chain disruptions. Geopolitical tensions or unexpected surges in commodity prices, such as the 15% increase in titanium prices observed in early 2024 due to global demand shifts, can directly impact Vertu's production costs and timelines.

These specialized inputs are not easily substituted, meaning any interruption in their availability, whether from a single supplier or due to broader market volatility, poses a significant operational risk. For instance, a shortage of ethically sourced exotic leathers, a key differentiator for Vertu, could halt production lines and delay product launches, as seen with similar luxury goods manufacturers facing sourcing challenges in 2023.

- Vulnerability to Geopolitical Events: Vertu's supply chain for exotic materials is exposed to international trade policies and political instability, potentially leading to import restrictions or tariffs.

- Material Price Volatility: Fluctuations in the global market prices for key components like sapphire crystals and high-grade titanium can significantly affect Vertu's cost of goods sold.

- Limited Supplier Options: The specialized nature of Vertu's materials often means a limited number of qualified suppliers, increasing the impact of any single supplier's disruption.

Brand Image Damage from Past Financial Instability

Vertu's history includes periods of financial turbulence and ownership shifts, which can cast a shadow over its brand image. For instance, the company underwent administration in 2017 and was subsequently acquired, highlighting past vulnerabilities. This instability could erode consumer trust, particularly among affluent buyers who prioritize the perceived stability and enduring legacy of luxury brands.

The luxury market, while less sensitive to minor economic fluctuations, is not immune to concerns about a brand's long-term viability. Vertu's past financial struggles, including reported revenue declines in certain periods leading up to its administration, might still influence potential customers' perceptions. This lingering doubt about stability could deter new clientele and negatively impact the brand's equity, even within its niche market.

- Past Financial Instability: Vertu faced administration in 2017, indicating significant financial challenges.

- Ownership Changes: Multiple acquisitions since 2017 (e.g., by Hakan Uzan) suggest a history of ownership transitions.

- Consumer Confidence Impact: Affluent consumers often link luxury with stability; past instability can create hesitancy.

- Brand Equity Risk: Perceptions of financial fragility can deter potential buyers and diminish long-term brand value.

Mainstream smartphone giants like Apple and Samsung are increasingly releasing ultra-premium models that challenge Vertu's market. These devices offer advanced technology and sophisticated design at price points significantly lower than Vertu's, eroding its unique selling proposition. For example, Apple's iPhone 15 Pro Max and anticipated 2025 models, while not explicitly luxury, command premium prices and appeal to status-conscious consumers.

The rapid pace of technological innovation means even Vertu's high-end phones risk becoming outdated quickly. While Vertu might use premium materials, its internal specifications could be surpassed by mass-market devices within 18-24 months. This technological obsolescence diminishes the perceived value of a luxury product, which consumers expect to have a longer relevance than standard electronics.

Shifting consumer preferences towards understated luxury and experiences over ostentatious displays of wealth pose a threat. Vertu's opulent designs may lose appeal as affluent buyers increasingly value functionality and technological sophistication. A 2024 survey indicated that 65% of high-net-worth individuals prioritize experiences over luxury goods, suggesting a potential decline in demand for Vertu's traditional aesthetic.

Vertu's reliance on specialized materials like sapphire and titanium makes it vulnerable to supply chain disruptions and price volatility. Geopolitical events or surges in commodity prices, such as the 15% rise in titanium prices in early 2024, directly impact production costs. Limited supplier options for these niche materials amplify the risk of any single supplier's disruption, potentially halting production.

Vertu's history of financial instability, including its 2017 administration and subsequent ownership changes, can undermine consumer trust. Affluent buyers often associate luxury with brand stability and longevity. Past financial struggles, like reported revenue declines prior to its administration, may create hesitancy among potential customers, negatively impacting brand equity.

SWOT Analysis Data Sources

This SWOT analysis for Vertu Corp. Ltd. is built upon a foundation of comprehensive data, including official financial filings, detailed market research reports, and expert industry commentary to ensure a robust and accurate strategic assessment.