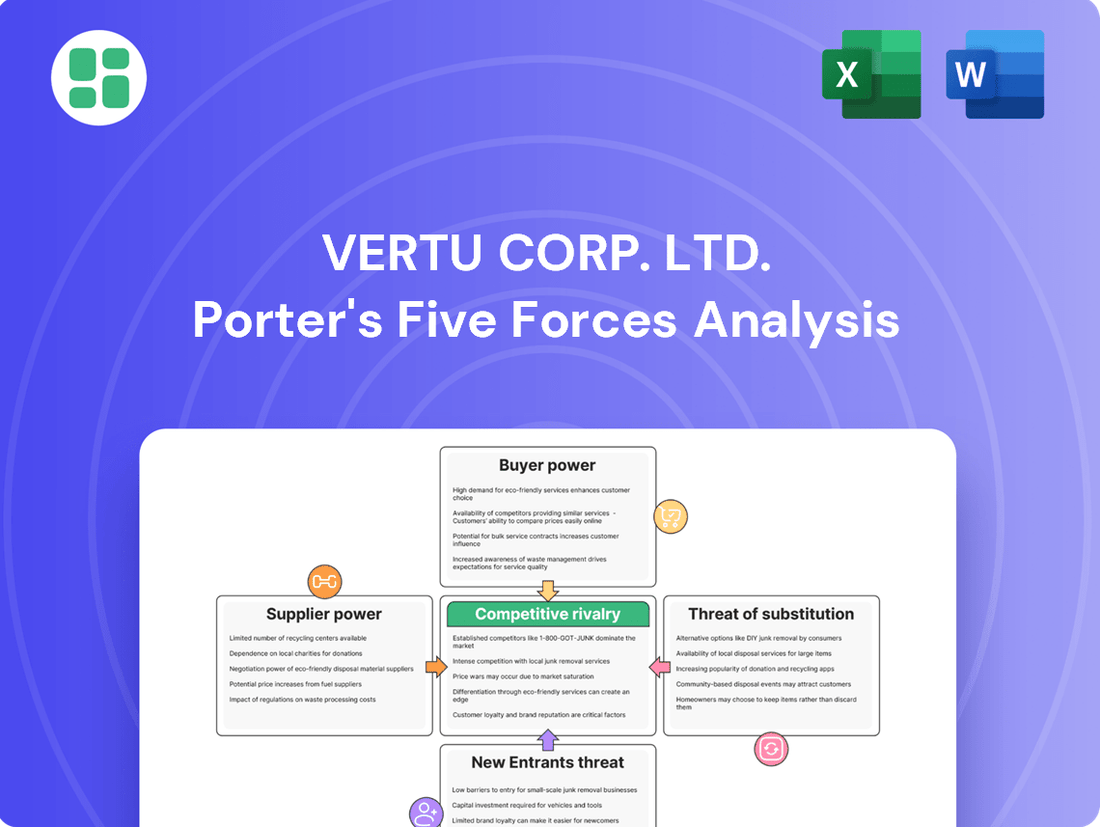

Vertu Corp. Ltd. Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vertu Corp. Ltd. Bundle

Vertu Corp. Ltd. operates in a market characterized by moderate to high bargaining power of buyers, particularly for its luxury segment, and a significant threat from substitutes offering similar functionality at lower price points. The intensity of rivalry among existing competitors, while present, is somewhat mitigated by Vertu's niche positioning. However, the threat of new entrants, though potentially high due to lower capital requirements in some segments, is tempered by brand loyalty and established distribution networks.

The complete report reveals the real forces shaping Vertu Corp. Ltd.’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Vertu's reliance on specialized material suppliers for components like sapphire crystal and aerospace-grade titanium significantly enhances supplier bargaining power. These unique materials, often sourced from a select few vendors with proprietary processes, mean Vertu faces substantial switching costs. In 2024, the luxury goods market saw continued demand for premium materials, reinforcing the leverage of these specialized suppliers.

Suppliers offering Vertu's signature meticulous craftsmanship and specialized manufacturing expertise wield significant bargaining power. This includes highly skilled artisans for hand-finishing and assembly, as well as firms providing the precision-engineered components that define Vertu's luxury devices. The scarcity of such specialized skills and suppliers means Vertu often relies heavily on established relationships, as finding comparable alternatives is challenging.

Vertu Corp. Ltd.'s reliance on exclusive service providers for its unique concierge and curated content offerings grants these suppliers significant bargaining power. If these providers offer services that are difficult to replicate or are deeply integrated into Vertu's value proposition, they can command higher prices or more favorable terms. For instance, a provider of bespoke luxury travel experiences, a key differentiator for Vertu, would hold considerable sway given the specialized nature of their offerings.

Limited Supplier Base

The market for ultra-luxury components and bespoke services is inherently small, leading to a concentrated supplier base for Vertu Corp. Ltd. When only a few credible suppliers exist for essential, high-end components or specialized services, each gains significant leverage over Vertu. This limited supplier pool can translate into higher input costs or less favorable contract terms, directly impacting Vertu's profit margins.

This concentration of suppliers empowers them to dictate terms, as Vertu has fewer alternatives for critical inputs. For instance, in 2024, the global market for specialized sapphire crystal manufacturing, a key component in luxury phones, saw a significant consolidation. Only a handful of manufacturers possess the advanced technology and quality control necessary for such applications, giving them substantial bargaining power. This can force Vertu to accept higher prices or longer lead times, potentially affecting production schedules and overall cost of goods sold.

- Concentrated Market: The ultra-luxury segment often relies on niche suppliers with specialized capabilities, limiting the number of viable options.

- Increased Leverage: With fewer suppliers, Vertu faces a situation where each supplier holds more power to negotiate prices and terms.

- Cost Implications: This can lead to elevated component costs, directly squeezing Vertu's profitability and potentially impacting its competitive pricing.

- Supplier Dependence: Vertu's reliance on a small group of suppliers creates a dependency that suppliers can exploit.

High Switching Costs for Vertu

Vertu's reliance on highly specialized suppliers creates significant barriers to switching. The intricate nature of the components and materials used in Vertu's luxury mobile phones means that finding and qualifying alternative vendors is a complex and time-consuming process.

Beyond the direct financial outlay for new supplier qualification, Vertu faces substantial risks when considering a change. These include potential compromises in product quality, which is paramount for a luxury brand, and the very real possibility of supply chain disruptions that could halt production. Furthermore, Vertu's brand identity is intrinsically linked to the unique characteristics of its materials, and sourcing equivalent alternatives can be challenging, if not impossible.

- High Qualification Costs: The technical specifications and quality control required for Vertu's components necessitate extensive vetting and auditing of new suppliers, leading to considerable upfront investment.

- Product Quality Risk: Introducing new suppliers carries the inherent risk of variability in material consistency and component performance, potentially impacting the perceived quality and reliability of Vertu devices.

- Supply Chain Disruption: The transition period to new suppliers can lead to stockouts or delays, disrupting Vertu's production schedules and impacting customer delivery commitments.

- Loss of Unique Material Properties: Vertu's brand equity is built on exclusive materials and craftsmanship; finding suppliers who can consistently provide these unique attributes is difficult, thereby strengthening existing supplier leverage.

The bargaining power of Vertu Corp. Ltd.'s suppliers is notably high due to the specialized nature of their components and services. This leverage is amplified by a concentrated supplier market where few entities can meet Vertu's stringent quality and material requirements. In 2024, the luxury electronics sector continued to see demand for unique materials like custom-engineered ceramics and ethically sourced precious metals, further solidifying supplier influence.

| Supplier Characteristic | Impact on Vertu | 2024 Market Trend |

|---|---|---|

| Specialized Materials (e.g., sapphire crystal, titanium) | High dependence, significant switching costs | Continued strong demand for premium materials |

| Exclusive Manufacturing Expertise (e.g., hand-finishing) | Scarcity of skilled labor enhances supplier leverage | Global shortage of highly skilled artisans persists |

| Niche Service Providers (e.g., concierge, curated content) | Difficult to replicate, integrated into value proposition | Increased demand for personalized luxury experiences |

| Concentrated Supplier Base | Limited alternatives lead to dictated terms and higher costs | Consolidation in niche component manufacturing |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Vertu Corp. Ltd.'s ultra-luxury mobile phone market, highlighting the impact of brand loyalty and high switching costs.

Effortlessly identify and mitigate competitive threats with a visual breakdown of Vertu's industry landscape, simplifying complex strategic planning.

Customers Bargaining Power

Vertu's affluent clientele, while less sensitive to price, wield significant bargaining power due to their demand for unparalleled quality and exclusivity. These discerning customers expect top-tier performance and a bespoke luxury experience, making brand prestige and unique offerings paramount in their purchasing decisions.

In the ultra-luxury smartphone market, Vertu faces limited direct competition. While the broader smartphone market offers numerous alternatives, few can match Vertu's unique combination of precious materials, artisanal craftsmanship, and personalized concierge services. This scarcity of comparable products significantly diminishes the bargaining power of customers, as finding an exact substitute with the same value proposition is extremely difficult.

Vertu's niche market means individual sales are infrequent but carry substantial revenue. For instance, in 2024, Vertu's average selling price per unit remained exceptionally high, reflecting the luxury nature of its smartphones. This significant per-unit value could give individual wealthy buyers leverage to request bespoke features or exclusive service packages.

However, Vertu actively cultivates an image of exclusivity and controlled pricing. This strategy limits the extent to which individual customers can dictate terms, as the brand prioritizes maintaining its premium positioning and consistent pricing structure across its limited customer base.

Customer's Access to Information

Affluent customers, a key demographic for Vertu Corp. Ltd., are generally highly informed. They possess access to a wealth of information concerning luxury goods, encompassing detailed reviews and prevailing market trends. This allows them to gauge the perceived value of Vertu products against other premium items or high-end electronics, even if direct price comparisons for Vertu itself are scarce.

This heightened awareness can subtly shape their purchasing decisions and expectations. For instance, in 2024, the luxury goods market saw continued growth, with consumers increasingly prioritizing brand heritage and unique experiences alongside product quality. Vertu's affluent customer base is likely to leverage this broader market understanding when evaluating Vertu's offerings, looking beyond just the handset itself.

- Informed Consumers: Vertu's affluent customer base actively researches luxury market trends and product reviews.

- Perceived Value: Customers assess Vertu's value against other luxury goods and high-end electronics, not just direct competitors.

- Market Awareness: Knowledge of broader luxury market dynamics influences customer expectations and purchasing behavior.

- 2024 Trends: The luxury sector's focus on heritage and experience in 2024 reinforces the need for Vertu to highlight these aspects to its informed clientele.

Status and Exclusivity as Drivers

For Vertu's discerning clientele, a Vertu phone transcends mere functionality; it serves as a potent status symbol and a tangible expression of their personal brand. This inherent desire for exclusivity and the unique social cachet associated with owning a Vertu device significantly dilutes the customers' bargaining power, rendering minor price fluctuations or functional compromises largely irrelevant.

Customers are not simply purchasing a piece of technology; they are investing in an elite ecosystem that signifies achievement and belonging. This psychological investment, coupled with the aspirational nature of the brand, creates a strong customer loyalty that further insulates Vertu from price-sensitive demands.

- Status Symbol: Vertu phones are positioned as luxury goods, with ownership often signaling wealth and social standing.

- Exclusivity: Limited production runs and high price points create an aura of exclusivity that appeals to a specific customer segment.

- Brand Expression: For many customers, a Vertu phone is an extension of their personal identity and a statement of their refined taste.

- Reduced Price Sensitivity: The perceived value derived from status and exclusivity outweighs the importance of price in the purchasing decision for many Vertu buyers.

Vertu's affluent customers, while informed, have limited bargaining power due to the brand's unique value proposition and scarcity of direct substitutes. Their focus on exclusivity and status, rather than price, further reduces their leverage. In 2024, the luxury market's emphasis on heritage and experience meant Vertu's customers were more influenced by brand narrative than cost.

| Factor | Impact on Vertu's Customer Bargaining Power | 2024 Relevance |

|---|---|---|

| Customer Information Level | High; customers research trends and reviews. | Customers assess Vertu against broader luxury market trends. |

| Availability of Substitutes | Low; few direct competitors offer similar luxury and service. | Limited alternatives strengthen Vertu's pricing power. |

| Product Differentiation | High; Vertu offers unique materials, craftsmanship, and concierge services. | These unique features reduce customer price sensitivity. |

| Customer Loyalty & Brand Image | Strong; Vertu is a status symbol and aspirational brand. | Ownership signifies achievement, fostering loyalty and reducing demands. |

Full Version Awaits

Vertu Corp. Ltd. Porter's Five Forces Analysis

This preview shows the exact Vertu Corp. Ltd. Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the luxury mobile phone market. This detailed analysis is ready for your strategic decision-making the moment you buy.

Rivalry Among Competitors

Vertu faces fierce rivalry not just from other luxury mobile device manufacturers, but also from a vast spectrum of luxury goods and services competing for the same affluent consumer's discretionary funds. This includes everything from high-end timepieces and premium automobiles to bespoke fashion and exclusive travel experiences.

The battleground for Vertu is not primarily price, but rather the cultivation of brand prestige, the delivery of exceptional perceived value, and the uniqueness of its product and service offerings. For instance, the global luxury goods market was projected to reach approximately $354 billion in 2024, highlighting the sheer scale of competition for consumer attention and spending.

The ultra-luxury mobile phone market is inherently small, with limited growth potential compared to the broader smartphone sector. This constrained size intensifies rivalry as companies fight for a larger slice of a finite customer base. For instance, while the global smartphone market shipped over 1.17 billion units in 2023, the ultra-luxury segment, where Vertu operates, represents a tiny fraction of this volume, estimated in the tens of thousands of units annually.

This intense competition within the niche forces players like Vertu to pursue aggressive differentiation strategies to capture market share. Growth opportunities are scarce, meaning any gains must be directly at the expense of competitors. This dynamic creates a high-stakes environment where innovation and brand positioning are paramount for survival and success.

Vertu Corp. Ltd. operates in an industry characterized by significant fixed costs. The design, research and development, and manufacturing of luxury mobile phones demand substantial investment in specialized equipment and skilled labor. For instance, the intricate craftsmanship and premium materials used in devices like Vertu’s require dedicated production lines and rigorous quality control, contributing to high overheads.

These substantial fixed costs, coupled with the considerable brand equity Vertu has cultivated over years of operation, erect significant exit barriers. It becomes economically challenging for existing players to simply cease operations and recoup their investments. This situation compels companies to remain active in the market, fostering an environment where intense competition is the norm rather than the exception.

Product Differentiation and Brand Loyalty

Vertu's strategy hinges on extreme product differentiation, utilizing unique materials, meticulous craftsmanship, and exclusive services. This approach, combined with targeted efforts to cultivate strong brand loyalty among its affluent customer base, serves to lessen the intensity of direct price competition.

Despite these efforts, the luxury mobile market sees competitors constantly striving to match or exceed Vertu's distinctive luxury features, fueling an ongoing innovation race. For instance, in 2024, the global luxury goods market, including high-end electronics, continued to show resilience, with brands investing heavily in unique experiences and bespoke offerings to retain their discerning clientele.

- Extreme Product Differentiation: Vertu's focus on rare materials and bespoke design creates a unique market position.

- Brand Loyalty: Cultivating loyalty among elite customers is key to mitigating direct rivalry.

- Innovation Race: Competitors actively seek to replicate or surpass Vertu's luxury attributes.

- Market Resilience: The luxury sector, including high-end electronics, demonstrated continued strength in 2024, emphasizing experiential value.

Indirect Competition from Mainstream Premium Brands

Mainstream premium brands, such as Apple's iPhone Pro Max series and Samsung's Galaxy Ultra line, present an indirect competitive challenge to Vertu. While not direct luxury phone competitors, their high-end devices deliver advanced technology and superior design, appealing to affluent consumers seeking a premium mobile experience. For instance, in early 2024, the iPhone 15 Pro Max started at $1,199, and the Samsung Galaxy S24 Ultra at $1,299, offering significant technological capabilities at a fraction of Vertu's typical price points.

These mainstream flagships can siphon off potential customers who prioritize cutting-edge features and a high-quality build over the bespoke craftsmanship and exclusivity offered by Vertu. This segment of the market might find the technological prowess and brand prestige of Apple or Samsung sufficient for their premium needs, thus limiting Vertu's addressable market.

- Indirect Threat: Mainstream premium smartphones offer advanced technology and design.

- Price Sensitivity: High-end models from Apple and Samsung are significantly more affordable than Vertu phones.

- Market Capture: These brands satisfy the 'premium mobile experience' for a broader affluent customer base.

Vertu contends with intense rivalry from both direct luxury mobile competitors and broader luxury sectors, vying for affluent consumers' spending. The competition centers on brand prestige and unique offerings rather than price, as the global luxury goods market approached $354 billion in 2024.

The ultra-luxury mobile segment is small, intensifying competition for a limited customer base, unlike the over 1.17 billion smartphones shipped globally in 2023.

Vertu differentiates through rare materials and craftsmanship, aiming to build loyalty and reduce direct price competition, though rivals continually innovate to match its luxury features.

Mainstream premium brands like Apple and Samsung, with models like the iPhone 15 Pro Max starting at $1,199 in early 2024, pose an indirect threat by offering advanced technology and design at lower price points, potentially capturing customers who prioritize features over bespoke exclusivity.

SSubstitutes Threaten

The primary substitutes for Vertu's ultra-luxury phones are the high-end offerings from mainstream smartphone giants like Apple and Samsung. Their premium models, such as the latest iPhone Pro Max or Samsung Galaxy S Ultra series, deliver advanced technology, robust performance, and sleek designs that cater to the sophisticated needs of affluent consumers. These devices, while not featuring Vertu's signature exotic materials or personalized concierge services, present a compelling, highly functional, and often visually appealing alternative at a substantially more accessible price point. For instance, in 2024, the average selling price for a flagship smartphone remained well below the several thousand dollars typically associated with Vertu devices, highlighting the significant price differential.

Luxury smartwatches from brands such as Tag Heuer, Montblanc, and Apple Watch Hermès present a significant threat of substitution for Vertu's ultra-luxury phones. These devices offer a blend of status symbol appeal, advanced connectivity, and premium design, directly competing for the affluent consumer's discretionary spending on high-end tech accessories. For instance, the global smartwatch market was valued at approximately $45.5 billion in 2023 and is projected to grow substantially, indicating a strong consumer appetite for sophisticated wearable technology.

Affluent consumers often seek status and exclusivity, making other luxury goods direct substitutes for a Vertu phone. High-end watches, designer jewelry, and luxury cars can fulfill this desire just as effectively. For instance, the global luxury goods market reached an estimated $350 billion in 2024, indicating substantial consumer spending on items that signify wealth and social standing.

Standard Smartphones with Premium Customization

A significant emerging substitute for Vertu's luxury smartphones is the trend of consumers customizing standard high-end devices. This involves purchasing premium smartphones, like those from Apple or Samsung, and then accessorizing them with luxury third-party items. For instance, bespoke cases crafted from exotic leathers or precious metals can be sourced, offering a similar aesthetic and exclusivity.

This approach allows consumers to achieve a personalized, high-end look and feel at a considerably lower price point than a full Vertu device. It taps into the desire for personalization and luxury without the substantial investment required for a dedicated luxury smartphone brand. The global smartphone market saw shipments of over 1.17 billion units in 2023, indicating a vast pool of potential customers for these customization options.

This trend presents a direct threat by offering a more accessible path to perceived luxury and personalization. Consumers can leverage the advanced technology and widespread compatibility of mainstream smartphones while still expressing individuality through high-quality, custom accessories.

Key aspects of this substitute threat include:

- Cost-Effectiveness: Consumers can achieve a luxury aesthetic for a fraction of the cost of a Vertu phone.

- Personalization and Flexibility: Users can mix and match accessories to create a unique device that reflects their style.

- Leveraging Mainstream Technology: Consumers benefit from the continuous innovation and ecosystem of popular smartphone brands.

- Accessibility: High-quality customization options are increasingly available through online marketplaces and specialized accessory makers.

Exclusive Digital Services and Experiences

The threat of substitutes for Vertu Corp. Ltd.'s exclusive digital services and experiences is significant. Affluent consumers, the primary target for Vertu, have numerous alternative avenues for curated content and concierge services. These can range from specialized digital platforms focusing on luxury travel or fine dining to high-end private membership clubs and bespoke lifestyle management companies.

These independent providers often offer a more focused and potentially deeper level of specialization than a phone manufacturer can. For instance, a dedicated luxury travel concierge might have established relationships and access to experiences that a general phone-based service simply cannot match. This unbundling of services means that the unique appeal of Vertu's integrated offering is diminished, as customers can often source similar or superior benefits elsewhere.

Consider the market for exclusive experiences: in 2024, the global luxury travel market was valued at over $1.4 trillion, with a significant portion driven by personalized and curated itineraries. Similarly, the private membership club sector continues to grow, with many clubs offering exclusive digital content and concierge services as core benefits. This demonstrates a robust ecosystem of substitutes already catering to Vertu's target demographic.

- Digital Platforms: Specialized luxury lifestyle apps and websites offer curated content and booking services.

- Private Membership Clubs: Many clubs provide exclusive access to events, networking, and personalized concierge support.

- Bespoke Travel Agencies: These agencies offer highly personalized travel planning and unique experiential opportunities.

- Independent Concierge Services: Dedicated concierge firms focus solely on fulfilling client requests across various lifestyle domains.

The threat of substitutes for Vertu's ultra-luxury phones is substantial, as consumers can opt for highly customized mainstream devices or explore other luxury goods. The increasing availability of premium customization options for standard smartphones, coupled with the broad appeal of luxury watches and jewelry, offers affluent consumers alternative avenues to express status and individuality without exclusively relying on a dedicated luxury phone brand.

The market for luxury tech accessories, including high-end smartwatches, presents a direct substitute threat. These devices offer a blend of connectivity, premium design, and status appeal, competing for the same discretionary spending from affluent consumers. The significant growth in the smartwatch market, projected to continue its upward trajectory, underscores the strong consumer demand for sophisticated wearable technology.

Beyond technology, other luxury goods such as high-end watches, designer jewelry, and luxury vehicles serve as potent substitutes. These items fulfill the affluent consumer's desire for status, exclusivity, and tangible markers of wealth, directly competing with Vertu for a share of the luxury market spending. The sheer size of the global luxury goods market, valued in the hundreds of billions, highlights the breadth of options available to these consumers.

Vertu's exclusive digital services also face substitution threats from specialized platforms and services. Luxury travel agencies, private membership clubs, and independent concierge services often provide more focused and potentially deeper levels of expertise and access, directly catering to the needs of Vertu's target demographic. The substantial valuations in these sectors, such as the multi-trillion dollar luxury travel market, indicate the availability of robust alternative offerings.

| Substitute Category | Examples | Key Value Proposition | Market Data (Approximate 2023/2024) |

|---|---|---|---|

| High-End Mainstream Smartphones | Apple iPhone Pro Max, Samsung Galaxy S Ultra | Advanced technology, performance, design, ecosystem integration | Global smartphone shipments over 1.17 billion units (2023) |

| Luxury Smartwatches | Tag Heuer, Montblanc, Apple Watch Hermès | Status symbol, connectivity, premium design, wearable tech | Global smartwatch market valued at ~$45.5 billion (2023) |

| Other Luxury Goods | High-end watches, designer jewelry, luxury cars | Status, exclusivity, tangible wealth markers | Global luxury goods market ~$350 billion (2024) |

| Specialized Lifestyle Services | Luxury travel agencies, private clubs, concierge firms | Focused expertise, exclusive access, personalized experiences | Global luxury travel market >$1.4 trillion (2024) |

Entrants Threaten

The luxury mobile phone sector, where Vertu Corp. Ltd. operates, demands considerable upfront capital. Newcomers must invest heavily in research and development to create sophisticated devices, establish specialized manufacturing capabilities, and build robust supply chains for unique and high-value components. For instance, in 2024, the global luxury goods market, which includes high-end electronics, saw significant investment, with companies needing millions to even begin product development and market entry.

Building a luxury brand like Vertu takes significant time and investment, making it a substantial barrier for new entrants. It can take decades to cultivate the brand reputation and trust that affluent consumers expect, a hurdle that newcomers must overcome. For instance, in 2024, luxury goods markets continue to show that brand loyalty is paramount, with established players often commanding premium pricing due to their heritage and perceived exclusivity.

Vertu's advantage stems from deeply entrenched relationships with suppliers of high-end, rare materials like sapphire, titanium, and exotic leathers. These aren't commodities readily available to just anyone. Newcomers would face immense difficulty in securing similar quality or even access to these specialized sources, a hurdle that significantly limits their ability to enter the market.

Furthermore, the unique manufacturing expertise required for Vertu's luxury devices is a formidable barrier. Replicating the intricate craftsmanship and proprietary processes that define Vertu's product quality is a lengthy and costly endeavor. These established, long-standing agreements and the sheer difficulty in replicating the know-how create a substantial deterrent for potential new entrants.

Challenges in Distribution and Retail Networks

Luxury brands like Vertu Corp. Ltd. heavily depend on exclusive distribution channels. These include prestigious boutiques, high-end department stores, and personalized clienteling, which are challenging for newcomers to penetrate. For instance, securing prime retail space in global luxury hubs like London or Paris involves significant investment and established relationships.

New entrants would struggle to replicate Vertu's bespoke sales infrastructure and the specialized, high-touch customer service that defines the luxury experience. This difficulty in accessing and building comparable distribution networks acts as a significant barrier.

- Exclusive Distribution: Luxury goods require access to curated retail environments, often involving long lead times and significant upfront investment for new players.

- High Capital Requirements: Establishing a global luxury retail presence, including flagship stores and specialized sales training, demands substantial capital, estimated in the tens of millions for a meaningful footprint.

- Brand Reputation and Trust: Gaining consumer trust and the necessary endorsements from luxury retailers takes years, a hurdle that new entrants must overcome to compete.

Proprietary Technology and Service Infrastructure

Vertu's proprietary technology and extensive service infrastructure present a significant threat of new entrants. The company's differentiation hinges on exclusive concierge services and meticulously curated content, demanding substantial capital for advanced technology platforms, specialized staff, and a robust global operational network. For instance, maintaining a 24/7 global concierge service requires significant investment in multilingual personnel and secure communication systems, a cost likely in the tens of millions annually.

A new competitor would face immense hurdles in replicating Vertu's sophisticated service capabilities, which extend far beyond simply manufacturing a luxury handset. Building a comparable service ecosystem, including secure payment gateways and personalized lifestyle management, represents a considerable barrier to entry. Estimates suggest that developing and maintaining such a high-touch service infrastructure could require initial investments exceeding $50 million, with ongoing operational costs adding further complexity.

- High Capital Investment: Replicating Vertu's exclusive concierge and curated content requires massive upfront investment in technology and personnel.

- Service Infrastructure Complexity: Developing a global, 24/7 operational infrastructure for bespoke services is a significant challenge for new entrants.

- Brand Reputation and Trust: Vertu's established reputation in luxury services is difficult for newcomers to quickly build, creating a trust barrier.

The threat of new entrants for Vertu Corp. Ltd. is significantly mitigated by the immense capital requirements and the need for specialized manufacturing expertise. Building a luxury brand requires substantial investment in R&D, high-end materials, and intricate craftsmanship, creating a formidable barrier. For example, in 2024, the luxury technology sector demands millions in upfront investment for product development alone.

Vertu's established brand reputation and exclusive distribution channels further deter new entrants. Cultivating the trust and loyalty of affluent consumers takes decades, and securing prime retail locations in luxury markets is a costly and relationship-driven endeavor. In 2024, brand heritage remains a critical differentiator in luxury goods.

The complexity of Vertu's proprietary technology and its extensive service infrastructure, including 24/7 global concierge services, represent significant barriers. Replicating these advanced capabilities, which likely require tens of millions in annual operational costs for a 24/7 global service, is a substantial challenge for newcomers.

| Barrier Type | Description | Estimated Impact (2024) | Vertu's Advantage |

|---|---|---|---|

| Capital Requirements | High investment in R&D, materials, and manufacturing | Tens of millions for initial product development | Established infrastructure and supplier relationships |

| Brand Reputation | Time and investment to build trust and exclusivity | Decades to cultivate; loyalty commands premium pricing | Long-standing heritage and perceived value |

| Distribution Channels | Access to prestigious boutiques and high-end retailers | Significant investment and relationships needed for prime locations | Exclusive partnerships and established retail presence |

| Service Infrastructure | Complex, 24/7 global concierge and bespoke services | Tens of millions annually for operational costs | Proprietary technology and specialized personnel |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Vertu Corp. Ltd. is built upon a foundation of reliable data, including Vertu's annual reports, industry-specific market research from firms like Statista and IBISWorld, and public financial filings.