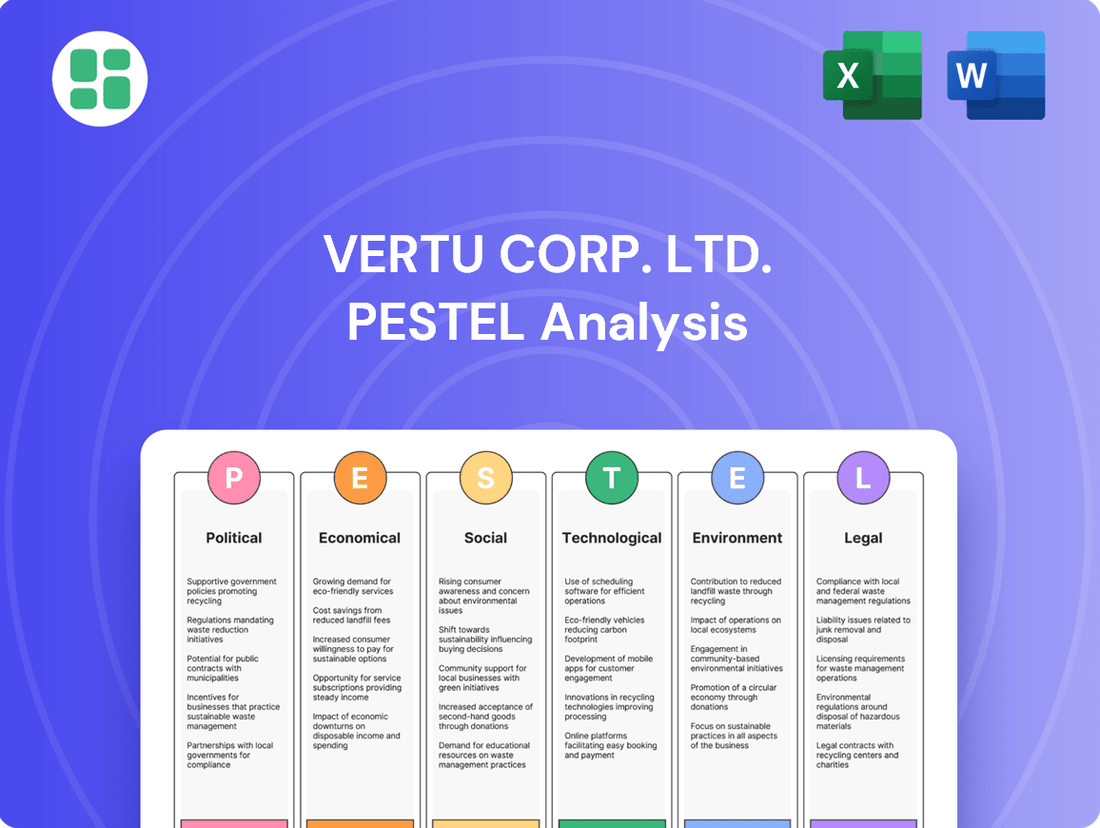

Vertu Corp. Ltd. PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vertu Corp. Ltd. Bundle

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors impacting Vertu Corp. Ltd.'s strategic direction. This analysis provides a vital framework for understanding market dynamics and potential challenges. Gain a competitive edge by downloading the full PESTLE analysis, equipping you with actionable intelligence for informed decision-making.

Political factors

Political stability in key markets is crucial for Vertu. For instance, a stable political environment in China, a significant market for luxury goods, supports consistent demand and operational continuity. Conversely, political unrest in a manufacturing hub could disrupt the supply of high-end materials, impacting production timelines and costs.

Trade policies directly influence Vertu's cost structure and market reach. In 2024, for example, potential adjustments to import duties on luxury components in the European Union could increase manufacturing expenses. Similarly, changes in export regulations for finished goods in emerging markets might affect Vertu's ability to access new customer bases, with some countries implementing stricter import quotas.

Shifting trade agreements and tariffs can present both opportunities and challenges. A favorable trade pact, perhaps one that reduces tariffs on luxury electronics components entering the UK by mid-2025, could lower Vertu's production costs and boost competitiveness. Conversely, increased tariffs on finished luxury products in a major Asian market could lead to higher retail prices, potentially dampening consumer demand for Vertu's offerings.

Governments worldwide are increasingly scrutinizing the luxury goods sector, potentially impacting Vertu Corp. Ltd. For instance, in 2024, several European nations considered or implemented new luxury taxes, with some proposals targeting high-end electronics, a category Vertu operates within. These regulations can range from specific sales taxes to stringent labeling requirements concerning the origin and ethical sourcing of materials, such as precious metals or exotic leathers, which are core to Vertu's product appeal.

Navigating this complex regulatory environment is paramount for Vertu. Failure to comply with evolving rules on marketing, product disclosure, or import duties could lead to significant financial penalties, estimated by industry analysts to reach millions of dollars for non-compliant firms in 2024. Moreover, such non-compliance can severely damage brand reputation and restrict market access in key regions, directly affecting Vertu's ability to maintain its premium market position.

Geopolitical tensions, such as ongoing conflicts in Eastern Europe and the Middle East, directly impact Vertu's global sourcing and sales. These events can disrupt the flow of luxury goods and raw materials, affecting production costs and delivery timelines for their high-end products.

Trade disputes and the potential for new tariffs or sanctions between major economic blocs, including the US, EU, and China, pose a significant risk. For instance, a trade war could increase import duties on components or finished luxury items, impacting Vertu's profitability and market access in key regions. In 2024, global trade growth is projected to be around 2.6%, a modest increase but still vulnerable to geopolitical shocks.

Vertu's reliance on a global supply chain and a worldwide affluent customer base makes it inherently susceptible to shifts in international relations. Political instability in any of its key operating or sales markets, such as emerging economies that represent growing luxury markets, could lead to reduced consumer spending and operational challenges.

Political Influence on Supply Chains

Political factors significantly impact Vertu Corp. Ltd.'s supply chain, particularly concerning the sourcing of high-value materials. Governments in countries where rare materials like sapphire crystal and titanium are mined may implement resource nationalism policies, leading to increased export taxes or outright restrictions. For instance, as of early 2024, several nations rich in critical minerals have signaled intentions to bolster domestic processing capabilities, potentially affecting global availability and pricing for components Vertu relies on.

Ethical sourcing pressures, often driven by political agendas and international agreements, also play a crucial role. Vertu must navigate regulations and consumer demands for transparency regarding labor practices and environmental impact throughout its supply chain. Failure to comply with these politically influenced standards could lead to reputational damage and market access limitations. For example, the EU's proposed Corporate Sustainability Due Diligence Directive, expected to be fully implemented by 2025, will require companies to identify, prevent, and mitigate adverse human rights and environmental impacts in their value chains, directly impacting how Vertu sources its exclusive materials.

Vertu's strategic imperative is to build and maintain resilient supply chains that are not only efficient but also politically compliant. This involves diversifying sourcing locations to mitigate risks associated with single-country dependency and actively monitoring geopolitical developments. The company must ensure that its procurement processes align with evolving international trade policies and sanctions, which can shift rapidly based on political climates.

- Resource Nationalism: Governments in resource-rich nations may impose new taxes or restrictions on the export of raw materials like titanium, impacting Vertu's sourcing costs and availability.

- Ethical Sourcing Regulations: Increasing global emphasis on ethical and sustainable practices, often codified into law by political bodies, necessitates rigorous due diligence in Vertu's supply chain for components like ethically sourced leather.

- Trade Policies and Sanctions: Fluctuations in international trade agreements and the imposition of sanctions by various political entities can disrupt the flow of specialized components and increase logistical complexities for Vertu.

- Geopolitical Stability: The political stability of countries supplying key materials directly influences the reliability and continuity of Vertu's supply chain, requiring proactive risk management strategies.

Anti-Corruption and Anti-Money Laundering Laws

Vertu, dealing in luxury goods, operates under increasing global pressure from anti-corruption and anti-money laundering (AML) laws. Governments worldwide, including major markets for luxury items, are enhancing financial transparency measures. For instance, the Financial Action Task Force (FATF) continues to update its recommendations, impacting how high-value transactions are documented and reported, a trend expected to intensify through 2025.

These regulations directly affect Vertu's sales processes, requiring robust Know Your Customer (KYC) procedures and meticulous record-keeping for all transactions. Non-compliance can lead to severe penalties, including hefty fines and reputational damage, making adherence critical for maintaining operational legitimacy and market trust. In 2024, global AML enforcement actions resulted in billions of dollars in fines, highlighting the significant financial risks involved.

- Increased Scrutiny: Vertu must anticipate heightened regulatory oversight on its high-value sales, particularly concerning the origin of funds.

- Compliance Costs: Investing in advanced AML software and training for staff is essential to meet evolving legal standards, with compliance budgets for financial institutions seeing significant increases.

- Reputational Risk: A single compliance failure could severely damage Vertu's brand image, impacting customer confidence in the luxury sector.

Government policies on taxation, particularly luxury taxes and import duties, directly impact Vertu's pricing and market competitiveness. For example, in 2024, several countries considered or implemented higher taxes on luxury goods, potentially increasing retail prices for Vertu's products. Furthermore, trade agreements and sanctions between nations can disrupt supply chains for specialized components, affecting production costs and availability, with global trade growth projected at a modest 2.6% in 2024, vulnerable to geopolitical shifts.

Vertu must navigate evolving regulations concerning ethical sourcing and anti-money laundering (AML). The EU's Corporate Sustainability Due Diligence Directive, expected by 2025, will mandate stricter supply chain transparency, impacting how Vertu sources materials like ethically sourced leather. Additionally, intensified AML and Know Your Customer (KYC) requirements, with global AML fines reaching billions in 2024, necessitate robust compliance to avoid penalties and protect brand reputation.

Geopolitical stability in key markets and sourcing regions is paramount for Vertu's operational continuity and demand. Political unrest or trade disputes can disrupt the flow of luxury goods and raw materials, impacting production timelines and costs. Resource nationalism policies in countries rich in critical minerals, signaled by early 2024, could also lead to increased export taxes or restrictions on materials like titanium, affecting Vertu's sourcing strategies.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Vertu Corp. Ltd., covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making, identifying potential threats and opportunities within Vertu Corp. Ltd.'s operating landscape.

This PESTLE analysis for Vertu Corp. Ltd. provides a clear, summarized version of external factors, acting as a pain point reliever by offering easy referencing for strategic discussions.

It offers a concise version of the PESTLE analysis, perfect for dropping into PowerPoints or using in group planning sessions to address potential external challenges.

Economic factors

Global economic growth is a significant driver for Vertu Corp. Ltd. as it directly impacts the disposable income of its affluent customer base. For instance, the International Monetary Fund (IMF) projected global growth to be around 3.1% in 2024, a slight uptick from 2023, indicating a generally stable environment for luxury spending.

Strong economic expansion often correlates with an increase in high-net-worth individuals (HNWIs), thereby broadening Vertu's potential market. According to Knight Frank's Wealth Report 2024, the global UHNW population was expected to grow by 4.3% by 2028, reaching over 700,000 individuals, which bodes well for luxury brands like Vertu.

Conversely, economic slowdowns or recessions can lead to reduced discretionary spending on luxury goods. A decline in global GDP, such as the 3.4% contraction experienced in 2020 due to the pandemic, would likely impact Vertu's sales, as consumers tend to prioritize essential spending during uncertain economic times.

Vertu Corp. Ltd.'s extensive global footprint, from sourcing components internationally to selling its luxury devices worldwide, exposes it directly to the whims of currency exchange rate fluctuations. For instance, if the British Pound strengthens significantly against the Euro, Vertu's manufacturing costs in Eurozone countries would effectively rise, impacting its bottom line.

Conversely, a weaker Pound could make Vertu's products more attractive and affordable for international buyers, potentially boosting sales volume in key markets. In 2024, the volatility observed in major currency pairs like EUR/USD and GBP/USD, with the Pound experiencing fluctuations of up to 5% against the Dollar in certain periods, highlights the tangible financial impact these movements can have on Vertu's import expenses and export competitiveness.

Inflationary pressures directly impact Vertu Corp. Ltd. by increasing the cost of its signature high-end materials, intricate manufacturing processes, and skilled labor. For instance, the average global inflation rate in 2024 was projected to be around 4.5%, a notable increase from previous years, which would translate to higher expenses for luxury components.

Given Vertu's reliance on exclusive and often rare materials, managing these escalating input costs is paramount for sustaining profitability. The company must navigate this challenge by meticulously adjusting its pricing strategies to offset the rising costs of raw materials and production without alienating its affluent customer base.

Luxury Market Trends and Consumer Spending

The global luxury goods market is experiencing robust growth, projected to reach approximately $350 billion by the end of 2024, according to Bain & Company. This expansion is partly driven by a significant shift towards experiential luxury, with consumers increasingly prioritizing unique experiences over traditional material possessions. Vertu's success hinges on its ability to align its offerings with this evolving preference among affluent individuals.

Consumer spending within the luxury sector is influenced by factors like disposable income, confidence levels, and the desire for exclusivity and craftsmanship. For instance, the personal luxury goods market saw a 4% increase in 2023, reaching €362 billion, with a projected growth to €522 billion by 2030, as reported by Bain & Company. Vertu must therefore monitor these economic indicators closely.

- Experiential Luxury Growth: Consumers are allocating more of their luxury budgets to travel, dining, and unique services, impacting demand for tangible goods.

- Affluent Consumer Confidence: High net worth individuals' spending is closely tied to their economic outlook; positive sentiment fuels luxury purchases.

- Market Growth Projections: The overall expansion of the luxury market provides a fertile ground for Vertu, but requires strategic adaptation to capitalize on trends.

- Digital Influence: Online channels are increasingly important for luxury discovery and purchase, necessitating a strong digital presence for Vertu.

Competition and Pricing Strategies

Vertu operates in a highly competitive luxury mobile market, facing pressure from established luxury brands and increasingly sophisticated high-end mainstream smartphones. For instance, in 2024, the premium smartphone segment saw continued innovation from Apple and Samsung, which, while not directly competing on Vertu's bespoke craftsmanship, offer advanced technology at significantly lower price points. This economic reality forces Vertu to continually justify its premium pricing, which can range from several thousand to tens of thousands of dollars, by emphasizing exclusive materials like sapphire crystal and titanium, personalized services, and a unique brand experience.

Competitors' pricing strategies are a significant factor. While Vertu targets an ultra-luxury niche, the pricing of flagship models from major manufacturers, often exceeding $1,000 in 2024, sets a benchmark for high-end devices. Vertu's market penetration is thus reliant on its ability to create and maintain a perception of unparalleled exclusivity and value that transcends mere technological specifications. This includes the use of rare materials and bespoke customization options, which are key differentiators.

- Competitive Landscape: Vertu competes with brands like Apple and Samsung in the high-end smartphone market, alongside other luxury device manufacturers.

- Pricing Justification: Premium pricing is supported by unique materials (e.g., sapphire crystal, titanium), bespoke customization, and exclusive services.

- Market Dynamics: Competitors' pricing strategies for flagship devices, often exceeding $1,000 in 2024, influence consumer perception of value in the premium segment.

- Differentiation: Vertu's market position hinges on offering unparalleled exclusivity and craftsmanship, setting it apart from technologically advanced but mass-produced alternatives.

Global economic growth directly impacts Vertu's affluent customer base, with projections for 3.1% global growth in 2024 by the IMF suggesting a stable luxury market. The increasing number of High Net Worth Individuals, expected to grow by 4.3% by 2028 according to Knight Frank, further expands Vertu's potential market. However, economic downturns can significantly reduce discretionary spending on luxury items, as seen during the 2020 pandemic's economic contraction.

Currency fluctuations present a tangible financial risk for Vertu, given its international operations. A strengthening Pound, for instance, would increase manufacturing costs in Eurozone countries. Conversely, a weaker Pound could boost international sales. The observed volatility in major currency pairs in 2024, with the Pound fluctuating up to 5% against the Dollar, underscores the impact on import expenses and export competitiveness.

Inflationary pressures in 2024, with global rates around 4.5%, directly increase Vertu's costs for high-end materials, manufacturing, and skilled labor. Managing these rising input costs is crucial for profitability, requiring careful pricing adjustments to maintain value perception without alienating customers.

The luxury goods market, projected to reach $350 billion by the end of 2024, is growing, but consumers increasingly favor experiences over tangible goods. Vertu must align its offerings with this trend, as the personal luxury goods market grew 4% in 2023 to €362 billion, with further expansion anticipated.

| Economic Factor | 2024 Projection/Data | Impact on Vertu |

| Global GDP Growth | ~3.1% (IMF) | Supports discretionary spending by affluent customers. |

| UHNW Population Growth | 4.3% by 2028 (Knight Frank) | Expands potential customer base. |

| Global Inflation Rate | ~4.5% (Projected) | Increases raw material and production costs. |

| Luxury Goods Market Size | ~$350 Billion (Bain & Company) | Indicates market potential and evolving consumer preferences. |

Preview Before You Purchase

Vertu Corp. Ltd. PESTLE Analysis

The Vertu Corp. Ltd. PESTLE Analysis preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive report details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Vertu Corp. Ltd., providing valuable strategic insights.

Sociological factors

Vertu's success hinges on its appeal to a discerning clientele who prioritize exclusivity, superior craftsmanship, and the prestige associated with owning a status symbol. This resonates with a growing sociological trend favoring bespoke and unique luxury goods over mass-produced alternatives.

The brand's identity as the pinnacle of luxury is crucial, with consumers seeking tangible representations of success and refined taste. In 2024, the global luxury goods market continued its upward trajectory, with reports indicating a 10% growth year-over-year, underscoring the sustained demand for high-end, differentiated products.

High-net-worth individuals (HNWIs) increasingly prioritize experiences and personalized services, influencing their spending on luxury goods and travel. For instance, the global luxury travel market was projected to reach $1.5 trillion by 2024, indicating a strong demand for bespoke itineraries and exclusive experiences that Vertu can cater to.

The integration of technology into the daily lives of affluent consumers is paramount; they expect seamless connectivity and advanced features. In 2024, the adoption rate of premium smartphones among HNWIs remained exceptionally high, with many seeking devices that offer both sophisticated design and robust functionality for business and personal use.

Vertu's success hinges on understanding these evolving lifestyle trends, such as the growing desire for discreet, high-touch concierge services that complement their digital lives. Affluent consumers are not just buying products; they are investing in convenience and a lifestyle that reflects their status and needs, making personalized offerings critical.

Vertu's brand perception is intrinsically linked to social status, with its luxury positioning making it an aspirational product for those seeking to signal affluence. In 2024, the luxury goods market, a key indicator for Vertu's target demographic, saw continued robust growth, with Bain & Company reporting a 9% increase in the global personal luxury goods market in 2023, reaching €362 billion, a trend expected to persist into 2024.

The perception of unparalleled quality and exclusivity is paramount for Vertu. This aligns with broader sociological trends where consumers increasingly use high-end products as markers of identity and belonging within specific social circles. For instance, studies in 2024 continue to highlight the psychological drivers behind conspicuous consumption, where owning a Vertu signifies not just technological sophistication but also a certain social standing and discerning taste.

Influence of Social Media and Digital Trends

Even though Vertu caters to an elite market, social media significantly shapes how luxury is perceived, even among its discerning customers. Online discussions and the visual presentation of luxury goods on platforms like Instagram and TikTok can directly influence brand desirability and overall awareness.

Vertu needs to carefully manage its digital presence to align with current trends without diluting its exclusive image. For instance, in 2024, luxury brands are increasingly leveraging curated influencer collaborations and exclusive digital content to maintain an aura of scarcity and prestige. This requires a delicate balance, as overexposure can cheapen the brand, while invisibility can lead to a loss of relevance.

The way Vertu is showcased and discussed across digital channels directly impacts its appeal. A recent report indicated that 65% of luxury consumers discover new brands through social media, highlighting the critical role of digital platforms in brand perception and market penetration, even for established luxury players.

- Digital Perception: Social media dictates how luxury is viewed, influencing even Vertu's exclusive clientele.

- Brand Desirability: Online visibility and discussion directly affect how much consumers desire the Vertu brand.

- Navigating Trends: Vertu must adapt to digital shifts while safeguarding its elite positioning.

- Influencer Impact: Strategic digital marketing, including influencer partnerships, is crucial for maintaining brand allure in 2024.

Ethical Consumption and Sustainability Concerns

Consumers, even those with significant purchasing power, are increasingly prioritizing ethical sourcing and environmental sustainability. This societal trend is directly impacting how companies like Vertu Corp. Ltd. approach their material procurement and manufacturing processes. For instance, a 2024 report indicated that over 60% of luxury consumers consider a brand's sustainability efforts when making a purchase decision, a figure that has steadily climbed in recent years.

These sociological shifts necessitate a closer look at Vertu's operations. A commitment to responsible consumption means Vertu may need to adapt its supply chain to ensure fair labor practices and minimize its environmental footprint. Transparency regarding these practices is becoming a key differentiator and a crucial element for maintaining brand loyalty and acceptance in the current market.

The growing demand for ethical and sustainable products presents both challenges and opportunities for Vertu. Companies that proactively address these concerns can build stronger customer relationships and enhance their brand reputation. Key areas of focus include:

- Supply Chain Transparency: Verifying the ethical and sustainable origins of raw materials, particularly precious metals and components used in high-end electronics.

- Environmental Impact Reduction: Implementing measures to reduce waste, energy consumption, and carbon emissions throughout the manufacturing lifecycle.

- Circular Economy Initiatives: Exploring options for product repair, refurbishment, and responsible end-of-life management to promote longevity and reduce waste.

Societal attitudes towards luxury are evolving, with a growing emphasis on personalization and unique experiences. Vertu's focus on bespoke craftsmanship and exclusivity aligns with this trend, appealing to consumers who seek more than just a product but a statement of individuality. The global luxury market continues to grow, with reports in early 2024 indicating a sustained demand for differentiated high-end goods.

The influence of social media on luxury perception remains significant, even for an elite brand like Vertu. Maintaining a curated digital presence is vital for brand desirability, with influencer collaborations playing a key role in shaping perceptions in 2024. Over 65% of luxury consumers discover new brands through social media, underscoring its importance.

Ethical consumption is a growing concern, with consumers increasingly scrutinizing brands' sustainability practices. Vertu must address supply chain transparency and environmental impact to maintain relevance and customer loyalty. In 2024, over 60% of luxury consumers consider sustainability in their purchasing decisions.

Technological factors

The relentless pace of smartphone evolution, particularly in areas like display clarity, processing speed, and camera resolution, is continually raising the bar for what consumers expect. For instance, by early 2025, flagship smartphone processors are anticipated to offer performance gains of 10-15% year-over-year, impacting everything from gaming to augmented reality experiences.

Vertu faces a critical strategic decision: should it embrace these cutting-edge core technologies, potentially increasing production costs and complexity, or double down on its established luxury appeal and exclusive services? This balancing act is crucial, as Vertu's brand identity is built on more than just raw specifications; it's about the curated experience and premium materials.

Vertu's luxury positioning hinges on its use of premium materials like sapphire crystal and titanium. Advances in material science, such as the creation of scratch-resistant ceramic coatings or bio-based sustainable leathers, could unlock new product avenues and enhance device longevity. For example, the global advanced ceramics market was valued at approximately $22 billion in 2023 and is projected to grow significantly, indicating a strong trend towards these high-performance materials.

Vertu's exclusive concierge services and curated content necessitate the utmost care in handling sensitive customer data and ensuring secure communication channels. Technological advancements in cybersecurity are therefore paramount to protect customer privacy and maintain the high level of trust expected by their clientele.

Robust encryption and advanced data protection measures are essential for safeguarding these premium services. As of early 2024, the global cybersecurity market is projected to reach $232.02 billion, highlighting the significant investment and ongoing innovation in this critical area, a trend Vertu must actively leverage.

Competition from Mainstream Tech Giants

While Vertu operates in the ultra-luxury segment, the relentless innovation from mainstream tech giants like Apple and Samsung in their premium smartphone lines, such as the iPhone Pro series and Samsung Galaxy S Ultra, presents a competitive challenge. These devices, though not positioned as pure luxury, offer sophisticated designs and cutting-edge features that can attract affluent consumers looking for high-end technology. For instance, Apple's iPhone 15 Pro Max, released in late 2023, boasts advanced camera systems and premium materials, setting a high bar for user experience and perceived value.

The impact is indirect but significant. Vertu's strategy must focus on clearly articulating its unique value proposition, which extends beyond mere technical specifications to encompass craftsmanship, bespoke services, and exclusivity. This differentiation is crucial to maintain its appeal to a discerning clientele who prioritize heritage and personalized luxury over mass-market technological advancements. Vertu's reliance on traditional luxury elements like rare materials and personalized concierge services needs to be emphasized to distinguish itself from the rapidly evolving, feature-driven landscape dominated by larger players.

Key competitive considerations for Vertu include:

- Technological Parity: Mainstream giants continuously push boundaries in processing power, display technology, and camera capabilities, narrowing the perceived gap in raw performance.

- Brand Perception: Apple and Samsung have cultivated strong aspirational brand images that resonate with a broad, affluent consumer base.

- Ecosystem Integration: The seamless integration of Apple's iOS or Samsung's Android ecosystem offers a compelling user experience that Vertu must complement with its own unique offerings.

Integration of AI and Personalized Experiences

The growing integration of AI into high-end devices is a significant technological factor, promising to elevate user experiences through deep personalization and predictive functionalities. Vertu, known for its luxury segment, can capitalize on this by embedding AI to enhance its renowned concierge services, offering even more anticipatory and tailored assistance to its discerning customer base. For instance, AI-powered predictive analytics could anticipate client needs before they are even expressed, streamlining requests and providing a truly bespoke service.

Furthermore, AI's ability to power advanced voice assistants and create highly personalized user interfaces presents an opportunity for Vertu to differentiate its offerings. Imagine an interface that learns and adapts to individual user preferences, making device interaction seamless and intuitive. The global AI market is projected to reach over $1.5 trillion by 2027, with a significant portion dedicated to enhancing consumer experiences, indicating a strong market readiness for such advancements.

- AI-driven personalization can tailor device interfaces and concierge services to individual user preferences.

- Predictive capabilities powered by AI can anticipate customer needs, improving service efficiency.

- Advanced voice assistants offer a more natural and sophisticated interaction method for luxury device users.

- The global AI market's rapid expansion underscores the increasing demand for intelligent, personalized technological solutions.

Technological advancements in material science, such as the development of advanced ceramics and sustainable leathers, offer Vertu opportunities to enhance its luxury devices. For example, the global advanced ceramics market was valued at around $22 billion in 2023, indicating a growing demand for high-performance materials. Furthermore, the increasing integration of AI into consumer electronics, with the global AI market projected to exceed $1.5 trillion by 2027, presents a chance for Vertu to elevate its bespoke concierge services through predictive analytics and personalized user experiences.

Vertu must also contend with the rapid pace of innovation from mainstream tech giants like Apple and Samsung, whose premium offerings, such as the iPhone 15 Pro Max released in late 2023, continually raise consumer expectations for performance and features. This necessitates a clear articulation of Vertu's unique value proposition, focusing on craftsmanship, exclusivity, and personalized luxury rather than solely on technical specifications.

Legal factors

Vertu's distinctive designs, meticulous craftsmanship, and proprietary software are significant intellectual property assets. Legal protections for patents, trademarks, and copyrights are vital to deterring counterfeiting and unauthorized copying of its luxury goods and services.

The company's robust legal strategy to defend its intellectual property is paramount in maintaining its market exclusivity and brand integrity. For instance, in 2024, the global luxury goods market saw a 8% increase in reported IP infringements, highlighting the constant need for vigilance.

Consumer protection laws are especially robust for luxury goods, covering aspects like product quality, warranty provisions, and the crucial after-sales support. Vertu's commitment to adhering to these regulations in every market it operates is paramount for maintaining customer trust and sidestepping potential legal challenges concerning product functionality or advertised claims.

Transparency regarding product specifications is not just a recommendation but a necessity; for instance, in 2024, the EU's Digital Services Act (DSA) is increasingly influencing how companies like Vertu communicate product details and handle customer complaints, with significant fines for non-compliance.

Vertu Corp. Ltd. must meticulously manage global import/export regulations and customs duties for its exotic materials and finished luxury phones. For instance, in 2024, the World Trade Organization reported that average global tariffs on luxury goods can range from 5% to 30%, significantly impacting sourcing costs and final product pricing. Failure to comply with these varied international trade agreements, such as those governing precious metals or specific electronic components, risks substantial financial penalties and operational disruptions.

Data Privacy and GDPR Compliance

Vertu Corp. Ltd.'s operations, particularly its high-touch concierge services and extensive customer relationship management, necessitate the collection and processing of sensitive personal data from its affluent clientele. Navigating the complex landscape of data privacy regulations, such as the General Data Protection Regulation (GDPR) in Europe and comparable legislation enacted worldwide, is paramount for ongoing business continuity and legal standing.

Failure to adhere to these stringent data protection mandates can result in significant penalties. For instance, GDPR fines can reach up to 4% of annual global revenue or €20 million, whichever is higher. For Vertu, maintaining robust data security protocols is not merely a legal obligation but a fundamental element in preserving the trust and loyalty of its discerning customer base, where privacy is often as valued as the luxury product itself.

- GDPR Fines: Potential penalties up to 4% of global annual revenue or €20 million.

- Customer Trust: Data protection is a critical differentiator for affluent consumers.

- Global Compliance: Need to adhere to various international data privacy laws beyond GDPR.

Labor Laws and Ethical Sourcing

Vertu, known for its luxury and craftsmanship, must navigate a complex web of labor laws in its manufacturing hubs. These laws dictate fair wages, safe working conditions, and fundamental employee rights, ensuring ethical treatment throughout its supply chain. For instance, adherence to minimum wage laws, which vary significantly by region, is paramount. In 2024, many European countries, where luxury goods are often produced, saw increases in their statutory minimum wages, impacting production costs.

The sourcing of exotic materials for Vertu's high-end devices brings its own set of legal challenges, particularly concerning ethical and sustainable practices. Regulations like the Convention on International Trade in Endangered Species of Wild Fauna and Flora (CITES) govern the trade of certain animal products, including specific leathers used in luxury goods. Non-compliance can lead to severe legal penalties and significant reputational harm, as seen in past instances where luxury brands faced scrutiny over their material sourcing.

- Labor Law Compliance: Vertu must adhere to local labor laws regarding working hours, wages, and employee benefits in its manufacturing locations, ensuring fair practices.

- Ethical Sourcing of Materials: Strict compliance with international regulations, such as CITES, is necessary for the legal and ethical procurement of exotic materials like certain leathers.

- Reputational Risk: Violations of labor laws or CITES regulations can result in substantial fines and irreparable damage to Vertu's brand image, impacting consumer trust.

- Supply Chain Transparency: Maintaining transparency and robust auditing processes within the supply chain is crucial to verify compliance and mitigate legal risks associated with material sourcing.

Vertu's operations are intrinsically linked to legal frameworks governing intellectual property, consumer protection, and data privacy. Protecting its unique designs and software through patents and trademarks is essential, especially with a reported 8% rise in luxury goods IP infringements in 2024. Adherence to stringent consumer protection laws, covering quality and after-sales support, is vital for maintaining customer trust and avoiding legal disputes.

Navigating global trade regulations, including tariffs on luxury goods which averaged between 5% and 30% in 2024, is critical for sourcing materials and pricing products. Furthermore, strict compliance with data privacy laws like GDPR, with potential fines up to 4% of global annual revenue, is paramount for safeguarding customer information and maintaining business continuity.

Environmental factors

Vertu's reliance on materials such as exotic leathers, sapphire crystal, and titanium presents environmental challenges. Concerns arise from the sourcing, extraction, and long-term sustainability of these unique components. For instance, the global trade in endangered species, often used for luxury leathers, is strictly regulated under agreements like CITES, with violations carrying significant penalties.

Compliance with international regulations concerning endangered species and the implementation of responsible mining practices are paramount for Vertu. The company's supply chain must demonstrably adhere to stringent environmental standards. Failure to do so could result in reputational damage and operational disruptions, impacting its premium brand image.

The disposal of complex electronic components and the end-of-life management of luxury mobile phones present significant environmental hurdles for Vertu Corp. Ltd. This includes addressing issues like the proper handling of hazardous materials found in these devices.

Vertu must navigate a landscape of evolving environmental regulations, such as the Waste Electrical and Electronic Equipment (WEEE) directive in Europe, which mandates collection and recycling targets for electronic waste. Similar legislation is increasingly being adopted worldwide, impacting global operations and product lifecycles.

By actively implementing or supporting robust recycling initiatives for its premium products, Vertu can demonstrate a commitment to environmental stewardship, aligning with the growing consumer demand for sustainable luxury goods and enhancing brand reputation in the 2024-2025 period.

Vertu's manufacturing of luxury mobile phones and its extensive global supply chain for components and finished goods inherently create a carbon footprint. This includes emissions from energy-intensive production processes and transportation, impacting the environment.

As of 2024, the manufacturing sector's contribution to global greenhouse gas emissions remains a significant concern, with transportation alone accounting for roughly 24% of direct CO2 emissions from fuel combustion globally. Vertu's operations, from sourcing rare materials to delivering devices to discerning customers worldwide, are part of this broader industrial impact.

Increasingly, consumers and regulators are scrutinizing corporate environmental responsibility. By 2025, we anticipate further pressure on companies like Vertu to demonstrate tangible efforts in energy efficiency, adopting greener logistics solutions, and actively working to reduce their overall carbon emissions to align with global sustainability goals.

Sustainable Packaging and Material Use

Consumer and regulatory pressure for more sustainable packaging is a significant environmental factor for Vertu Corp. Ltd. Globally, there's a clear trend toward reducing single-use plastics and increasing the use of recycled or biodegradable materials. For instance, the European Union's Packaging and Packaging Waste Regulation aims to significantly boost recycling rates and reduce waste by 2030, impacting luxury goods manufacturers.

As a luxury brand, Vertu can leverage this trend to enhance its environmental profile. By adopting eco-friendly packaging materials, such as FSC-certified paper or innovative plant-based alternatives, Vertu can appeal to environmentally conscious consumers and differentiate itself in the premium market. This also presents an opportunity to reduce waste in product presentation, a key area for luxury goods.

Furthermore, this extends to the materials used within the phones themselves. Vertu has an opportunity to explore the incorporation of recycled metals or responsibly sourced components. For example, some electronics manufacturers are already incorporating recycled aluminum and plastics into their devices, with industry reports suggesting a growing market for such materials. This proactive approach can bolster Vertu's brand image and align with evolving consumer expectations for sustainability.

- Growing demand for sustainable packaging: Reports indicate that over 70% of consumers are willing to pay more for products with sustainable packaging.

- Regulatory push for recyclability: Initiatives like the EU's Circular Economy Action Plan aim to increase the recyclability of packaging materials.

- Luxury market's environmental focus: A significant portion of high-net-worth individuals are increasingly factoring environmental impact into their purchasing decisions.

- Innovation in eco-friendly materials: The market for biodegradable and compostable packaging materials is projected to grow substantially in the coming years.

Climate Change Impact and Supply Chain Resilience

Climate change poses significant threats to Vertu Corp. Ltd. by potentially impacting the availability and cost of essential natural resources, a factor that could directly affect manufacturing inputs. Extreme weather events, increasingly frequent due to climate shifts, present a tangible risk of disrupting Vertu's supply chains, leading to delays and increased operational expenses. For instance, the World Economic Forum's 2024 Global Risks Report highlights that extreme weather events are considered the most likely global risk in the next two years, underscoring the urgency for businesses like Vertu to prepare.

Vertu must proactively assess these climate-related risks and integrate resilience strategies into its sourcing and manufacturing processes. This involves diversifying suppliers, exploring alternative materials, and potentially investing in more robust infrastructure capable of withstanding adverse weather conditions. Companies that demonstrate adaptability to a changing climate and actively participate in mitigation efforts are better positioned for long-term viability and can bolster their corporate reputation.

Key considerations for Vertu's environmental strategy include:

- Supply Chain Diversification: Reducing reliance on single-source or geographically concentrated suppliers vulnerable to climate impacts.

- Resource Scarcity Management: Developing strategies to mitigate the effects of potential shortages or price volatility in key natural resources.

- Climate Risk Assessment: Implementing thorough evaluations of how physical climate risks could affect operations and logistics.

- Sustainability Integration: Aligning business practices with climate mitigation goals to enhance long-term resilience and stakeholder perception.

Vertu's use of exotic materials like rare leathers and precious metals raises concerns about sourcing and sustainability, with regulations like CITES governing endangered species trade. The disposal of complex electronics also presents environmental challenges, requiring adherence to directives such as the WEEE for proper e-waste management.

The company's manufacturing and global logistics contribute to its carbon footprint, a factor increasingly scrutinized by consumers and regulators by 2025. Vertu faces pressure to improve energy efficiency and adopt greener transportation, aligning with global sustainability trends.

Consumer demand for sustainable packaging, with over 70% willing to pay more, and regulatory pushes for recyclability, such as the EU's Circular Economy Action Plan, present opportunities for Vertu to enhance its brand image. Exploring recycled metals and responsibly sourced components further aligns with these evolving expectations.

Climate change poses risks to Vertu's supply chain through extreme weather events, as highlighted by the World Economic Forum's 2024 Global Risks Report. Proactive strategies like supply chain diversification and resource scarcity management are crucial for long-term resilience and stakeholder perception.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Vertu Corp. Ltd. is constructed using a blend of official government publications, reputable financial news outlets, and leading market research reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the luxury mobile phone market.