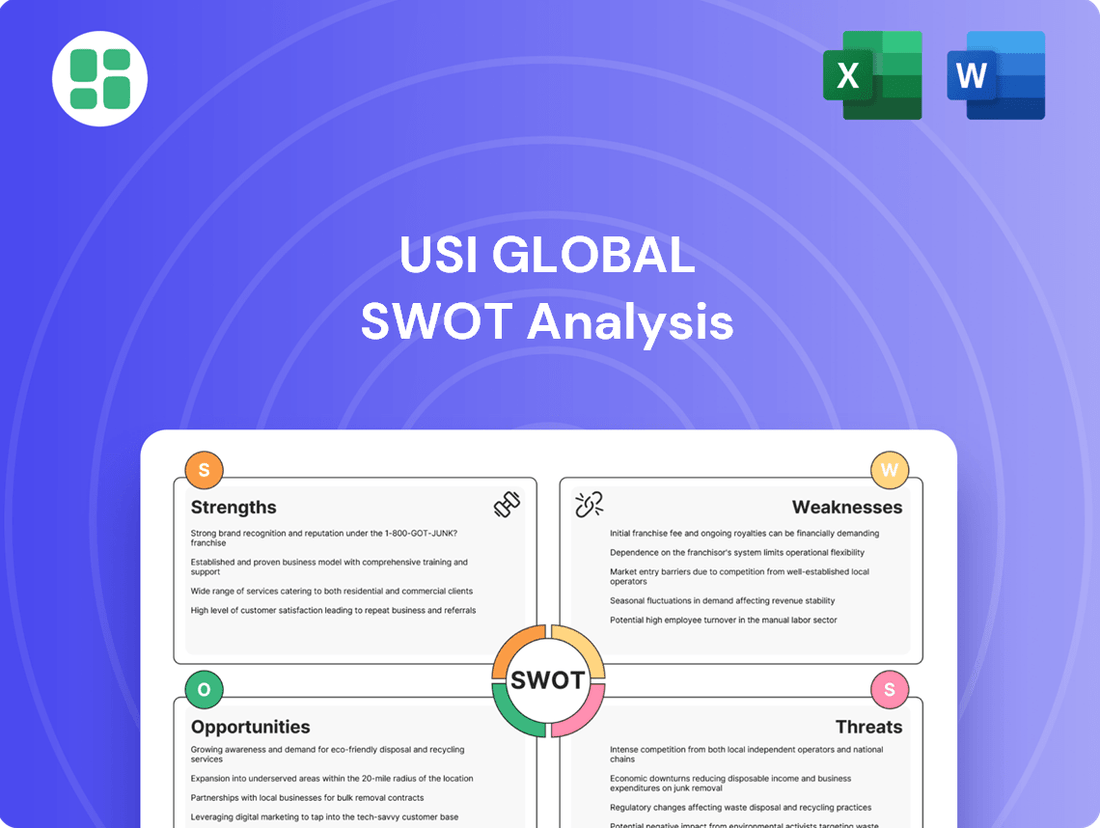

USI Global SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

USI Global Bundle

USI Global's market position is shaped by key strengths like its established network and diverse service offerings, but also faces challenges from evolving industry trends and competitive pressures. Understanding these dynamics is crucial for informed decision-making.

Want the full story behind USI Global's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

USI's global presence is a significant strength, with 27 production bases strategically located across Asia, Europe, the Americas, and Africa. This expansive network allows USI to effectively cater to local supply needs and mitigate risks associated with geopolitical instability. The company's ability to serve a diverse international clientele and adapt to varying regional market demands is a direct benefit of this widespread operational footprint.

The strategic acquisition of Asteelflash in 2020 further bolstered USI's capabilities, particularly by enhancing its presence and operational capacity within the European market. This move underscores USI's commitment to strengthening its global reach and solidifying its position as a key player in international manufacturing and supply chains.

USI Global's comprehensive service model, encompassing product design, material sourcing, manufacturing, logistics, and after-sales support, provides a significant competitive advantage. This integrated D(MS)2 approach, from concept to end-of-life, positions USI as a vital, one-stop partner for brand owners, fostering strong customer loyalty and value.

USI Global's strength lies in its extensive product portfolio and wide industry application, serving critical sectors like communications, computing, consumer electronics, industrial, automotive, and medical devices. This broad reach, as of early 2024, allows the company to tap into various growth avenues, reducing reliance on any single market. For instance, their components are integral to the burgeoning automotive electronics sector, a market projected for significant expansion through 2030.

Strong R&D and Miniaturization Expertise

USI Global's robust Research and Development (R&D) and miniaturization expertise are significant strengths, allowing them to excel in designing and manufacturing compact, modular electronic products that meet evolving customer demands. This technical prowess is crucial for maintaining a competitive edge in the fast-paced electronics sector, especially for applications needing sophisticated integration and small footprints. For instance, their advanced semiconductor packaging technology is particularly vital for power electronics in high-demand sectors like the electric vehicle (EV) market.

Their commitment to R&D is reflected in continuous innovation. In 2023, USI Global reported significant investment in R&D, focusing on next-generation technologies in areas such as advanced packaging and high-performance computing. This investment underpins their ability to deliver cutting-edge solutions.

- Miniaturization Leadership: USI excels at creating highly integrated and compact electronic solutions.

- Advanced Semiconductor Packaging: Expertise in technologies like fan-out wafer-level packaging (FOWLP) and advanced substrate technologies enhances performance and size reduction.

- EV Power Electronics Focus: Their capabilities are directly applicable to the growing demand for efficient and compact power management systems in electric vehicles.

Commitment to Sustainability and ESG Performance

USI Global's dedication to sustainability and Environmental, Social, and Governance (ESG) performance is a significant strength. The company consistently achieves high marks in assessments like the S&P Global Corporate Sustainability Assessment, reflecting its proactive approach to environmental responsibility and social impact. This focus on low-carbon operations, circular economy principles, and inclusive business practices not only bolsters its brand image but also resonates with an increasing segment of environmentally and socially aware clients and investors.

This robust ESG profile offers tangible benefits:

- Enhanced Reputation: Strong ESG scores elevate USI Global's standing in the market, attracting talent and business partners who prioritize sustainability.

- Client Attraction: Environmentally conscious clients are increasingly selecting service providers with demonstrated ESG commitments, providing a competitive edge for USI.

- Reduced Risk: Proactive management of ESG factors can mitigate regulatory scrutiny and operational disruptions, contributing to long-term stability. For instance, in 2023, companies with high ESG ratings often saw lower volatility in their stock prices compared to those with lower ratings, demonstrating a tangible financial benefit.

USI Global's broad industry reach is a key strength, allowing it to serve diverse sectors like communications, computing, consumer electronics, industrial, automotive, and medical devices. This diversification, as of early 2024, enables the company to capitalize on multiple growth avenues, reducing dependence on any single market. Their components are crucial for the expanding automotive electronics sector, which is projected for substantial growth through 2030.

What is included in the product

Analyzes USI Global’s competitive position through key internal and external factors, identifying strengths, weaknesses, opportunities, and threats.

Simplifies complex SWOT analysis into actionable insights for strategic decision-making.

Weaknesses

USI Global's core operations are deeply intertwined with the overall health of the electronics manufacturing services (EMS) and original design manufacturing (ODM) sectors. This means that when the global demand for electronic gadgets, from smartphones to smart home devices, slows down, USI's revenue and profits can take a direct hit. For instance, the EMS market saw a notable dip in 2023, underscoring this vulnerability.

The EMS and ODM sector is incredibly crowded, featuring many companies worldwide fighting for a bigger piece of the pie. This fierce rivalry often forces companies to lower prices, squeezing their profits. For instance, some leading EMS providers saw their revenues shrink in 2024 due to these pressures.

USI Global, despite its inventory management strategies, faces ongoing vulnerability to global supply chain disruptions. Events like geopolitical tensions, trade disputes, and severe weather can significantly impact operations. For instance, the ongoing semiconductor shortage, which heavily affected electronics manufacturers throughout 2023 and 2024, continues to pose a risk for companies like USI Global, potentially leading to production delays and increased component costs into 2025.

Potential for Declining Profitability

USI Global's financial performance in 2024 showed a year-on-year decrease in net profit attributable to shareholders, accompanied by a slight dip in operating revenue. This trend suggests potential difficulties in sustaining profitability, possibly due to evolving market conditions or rising operational expenses.

Looking ahead, the company's Q2 2025 outlook indicates a projected year-on-year decrease in operating revenue. Furthermore, there's an anticipated decline in the operating profit margin for the same period.

- Year-on-year decrease in net profit attributable to shareholders in 2024.

- Slight decrease in operating revenue reported for 2024.

- Projected YoY decrease in operating revenue for Q2 2025.

- Expected decline in operating profit margin for Q2 2025.

Dependency on Key Client Relationships

A significant vulnerability for USI Global, common among Electronics Manufacturing Services (EMS) and Original Design Manufacturers (ODM) providers, is a pronounced dependence on a limited number of major clients. This concentration creates substantial risk, as the loss of even one key customer can trigger sharp revenue downturns. For instance, the EMS sector has witnessed instances where the termination of a major partnership led to considerable financial setbacks for the affected companies.

The potential impact of such client concentration is underscored by industry trends. While specific data for USI Global's client breakdown isn't publicly detailed for 2024/2025, the broader EMS market often sees top clients contributing a substantial portion of revenue. For example, in prior years, some leading EMS players have reported that their top five customers accounted for over 50% of their total sales, highlighting the inherent risk in such relationships.

- Client Concentration Risk: USI Global may face significant revenue volatility if a few large clients reduce or cease their business.

- Impact of Partnership Discontinuation: The loss of a key customer, a scenario observed in the EMS industry, could directly and negatively affect USI Global's financial performance.

- Need for Diversification: A critical strategic imperative for USI Global is to actively cultivate and expand its client portfolio to dilute reliance on any single entity.

USI Global's reliance on a concentrated client base presents a significant weakness. The loss of a major customer, a scenario that has impacted other EMS providers, could lead to sharp revenue declines. For instance, in the broader EMS market, top clients have historically accounted for over 50% of sales for some firms, highlighting this inherent risk.

The company's financial performance in 2024 indicated a year-on-year decrease in net profit and a slight dip in operating revenue. This trend, coupled with a projected year-on-year decrease in operating revenue and an anticipated decline in operating profit margin for Q2 2025, points to potential challenges in maintaining profitability and revenue growth.

Furthermore, USI Global operates within a highly competitive EMS and ODM landscape. This intense rivalry can pressure pricing, potentially squeezing profit margins, as evidenced by revenue declines experienced by some competitors in 2024 due to these market dynamics.

Supply chain disruptions, such as the ongoing semiconductor shortage that affected the electronics industry throughout 2023 and 2024, continue to pose a risk. These disruptions can lead to production delays and increased component costs, impacting USI Global's operational efficiency and financial results into 2025.

| Metric | 2024 (Actual) | Q2 2025 (Projected) |

|---|---|---|

| Net Profit Attributable to Shareholders | Decrease YoY | N/A |

| Operating Revenue | Slight Decrease YoY | Decrease YoY |

| Operating Profit Margin | N/A | Decline |

Same Document Delivered

USI Global SWOT Analysis

The preview you see is the actual USI Global SWOT Analysis document you’ll receive upon purchase. This ensures you know exactly what you're getting—a comprehensive and professionally structured report.

Rest assured, the content displayed here is pulled directly from the full SWOT analysis. Purchasing unlocks the entire, detailed version of this valuable business intelligence.

Opportunities

The rapid advancement and adoption of Artificial Intelligence (AI), the Internet of Things (IoT), and 5G networks are creating a substantial surge in demand for sophisticated electronic components. USI Global, with its expertise in electronics manufacturing services (EMS) and original design manufacturing (ODM), is well-positioned to capitalize on this trend. The global EMS market alone was valued at approximately $680 billion in 2023 and is anticipated to expand considerably in the coming years, fueled by these technological innovations.

These emerging technologies necessitate advanced, high-performance electronic modules and intricate designs, areas where USI Global excels. For instance, AI applications often require specialized processors and memory solutions, while IoT devices demand miniaturized and power-efficient components. The rollout of 5G infrastructure and devices further drives the need for high-frequency and advanced connectivity modules, all of which align with USI's core competencies and service offerings, presenting a clear avenue for revenue growth and market share expansion.

The automotive and industrial sectors are showing significant promise for Electronics Manufacturing Services (EMS) and Original Design Manufacturer (ODM) companies. USI, with its established footprint in automotive electronics, particularly in areas like xEV powertrain systems and power electronic units, is well-positioned to capitalize on this expanding demand.

This strategic focus on less volatile markets like automotive and industrial is expected to bolster USI's overall financial stability and resilience. For instance, the global automotive electronics market was valued at approximately USD 400 billion in 2023 and is projected to reach over USD 600 billion by 2028, indicating substantial growth opportunities for players like USI.

USI Global can significantly boost its market presence and technological prowess by forging strategic partnerships and pursuing further acquisitions. These moves are crucial for expanding its capabilities and reach.

Collaborations with Original Equipment Manufacturers (OEMs) and other tech companies offer a pathway to developing integrated solutions, thereby strengthening USI's value proposition to its customers. For instance, the acquisition of Asteelflash in 2021, which bolstered USI's EMS capabilities, serves as a prime example of successful inorganic growth.

Leveraging Miniaturization for New Applications

USI's expertise in miniaturization opens doors to exciting new markets, particularly in areas where size constraints are paramount. Think about the burgeoning market for advanced wearables, where smaller, more powerful components are constantly in demand. In 2024, the global wearable technology market was valued at over $150 billion, with projections indicating continued strong growth. USI's ability to create highly integrated and compact modules directly addresses this need.

This specialization also positions USI well within the rapidly expanding medical device sector. The demand for smaller, implantable devices or sophisticated diagnostic tools that require minimal invasiveness is significant. For instance, the market for miniaturized medical sensors is expected to reach tens of billions of dollars by 2025, driven by advancements in remote patient monitoring and personalized medicine. USI's core competence in miniaturization is a key differentiator here.

Furthermore, the industrial sector presents substantial opportunities for miniaturized solutions. Specialized industrial sensors, for applications in robotics, automation, or environmental monitoring, often require compact designs to fit into tight spaces or to enable new functionalities. The industrial IoT market, which heavily relies on such sensors, is projected to grow substantially, with some forecasts suggesting it will exceed $400 billion by 2026. USI’s focus on miniaturization can drive innovation and capture market share in these high-growth segments.

- Wearable Technology Market Growth: Valued at over $150 billion in 2024, with consistent expansion expected.

- Miniaturized Medical Sensors: Market projected to reach tens of billions by 2025, fueled by remote patient monitoring.

- Industrial IoT Sensor Demand: Key driver for the industrial IoT market, anticipated to surpass $400 billion by 2026.

Increasing Trend of Outsourcing by OEMs

Original Equipment Manufacturers (OEMs) are increasingly turning to outsourcing for both manufacturing and design services. This growing trend directly benefits companies like USI Global, which offer comprehensive Electronic Manufacturing Services (EMS) and Original Design Manufacturing (ODM) solutions.

This shift is driven by a strategic focus on core competencies and the pursuit of cost efficiencies. For instance, the global electronics manufacturing services market was valued at approximately $577.1 billion in 2023 and is projected to reach $850.3 billion by 2030, indicating a compound annual growth rate (CAGR) of 5.7% according to industry analysts.

- Growing OEM Outsourcing: OEMs are offloading manufacturing and design to specialized EMS and ODM providers.

- Cost and Efficiency Gains: Outsourcing allows OEMs to reduce operational costs and boost overall efficiency.

- Focus on Core Business: Companies can concentrate on their primary strengths, like innovation and marketing, by outsourcing non-core functions.

- Market Growth Projections: The EMS market is expected to see substantial growth, offering significant opportunities for service providers.

The increasing demand for advanced electronics driven by AI, IoT, and 5G presents a significant growth opportunity for USI Global. The company's expertise in high-performance modules and intricate designs aligns perfectly with these technological advancements. Furthermore, the automotive and industrial sectors are expanding rapidly, with USI's established presence in automotive electronics positioning it to benefit from this trend.

USI's focus on miniaturization opens doors to lucrative markets like wearables and medical devices, where compact, powerful components are essential. The growing trend of OEMs outsourcing manufacturing and design also creates a favorable environment for USI to expand its market share and service offerings.

| Opportunity Area | Market Context | USI's Relevance |

| Emerging Technologies (AI, IoT, 5G) | Global EMS market valued at ~$680 billion in 2023, with strong growth expected. | Expertise in advanced modules and intricate designs. |

| Automotive & Industrial Sectors | Global automotive electronics market projected to exceed $600 billion by 2028. | Established footprint in automotive electronics, including xEV systems. |

| Miniaturization | Wearable tech market >$150 billion in 2024; medical sensors market in tens of billions by 2025. | Core competence in creating highly integrated and compact modules. |

| OEM Outsourcing Trend | EMS market projected to reach $850.3 billion by 2030 (5.7% CAGR). | Comprehensive EMS and ODM solutions cater to increasing outsourcing needs. |

Threats

Ongoing geopolitical tensions, particularly between the US and China, continue to pose a significant threat. These disputes can manifest as tariffs and trade barriers, directly impacting the cost of goods and the stability of global supply chains. For USI Global, this means potential increases in operational expenses and the need to adapt sourcing strategies to mitigate these risks, affecting overall profitability.

Global economic slowdowns and persistent inflationary pressures present a significant threat to USI Global's manufacturing operations. While some commodity prices have eased, elevated material costs, particularly for specialized components, continue to impact profitability. Furthermore, rising labor expenses across various regions are squeezing margins.

The ongoing economic uncertainty can directly translate into reduced demand for electronic products, as both consumers and businesses may curtail discretionary spending. For instance, forecasts for global GDP growth in 2024 and 2025, while showing some recovery, still indicate potential headwinds that could dampen consumer confidence and corporate investment in new technologies.

The electronics sector moves at lightning speed, making existing technologies and production methods outdated very quickly. This constant need for innovation means USI Global faces significant pressure to invest heavily in research and development to remain competitive.

These R&D expenditures represent a substantial cost, and there's always the risk that newly developed technologies might not resonate with the market, leading to wasted investment. For instance, in 2023, the global semiconductor R&D spending was projected to reach over $100 billion, highlighting the immense scale of investment required in this area.

Supply Chain Complexity and Vulnerability

The intricate nature of global supply chains presents a significant threat, with disruptions arising from events like natural disasters and logistical breakdowns. USI's broad international manufacturing presence, while a strategic advantage, amplifies its susceptibility to these complex interdependencies and potential vulnerabilities.

Ensuring robust supply chain visibility and resilience remains a persistent challenge for USI. For instance, the ongoing geopolitical tensions and trade policy shifts in 2024 continue to create uncertainty, impacting shipping costs and lead times, with some analysts projecting global shipping costs to remain volatile throughout 2025.

- Supply Chain Disruptions: Events like port congestion, labor shortages, and geopolitical conflicts can halt production and delay deliveries.

- Rising Logistics Costs: Increased fuel prices and demand for transportation services in 2024 have driven up shipping expenses, impacting profit margins.

- Geopolitical Instability: Trade wars and regional conflicts can lead to tariffs, sanctions, and the need to reconfigure sourcing strategies.

Cybersecurity Risks and Data Integrity

USI Global, as an electronics manufacturer and design services provider, faces significant cybersecurity risks. Handling sensitive product designs and client data makes the company a prime target for cyber-attacks and data breaches. A successful breach could result in substantial financial losses, severe reputational damage, and a critical erosion of client trust. For instance, in 2023, the global average cost of a data breach reached $4.45 million, according to IBM's Cost of a Data Breach Report.

The growing integration of artificial intelligence (AI) within manufacturing processes, while offering efficiency gains, also introduces novel cybersecurity challenges. AI systems themselves can be vulnerable to attacks, potentially compromising the integrity of designs or operational data. This evolving threat landscape requires continuous investment in advanced security measures to protect intellectual property and client information.

- Cyber-Attack Vulnerability: USI's handling of proprietary product designs and confidential client information exposes it to threats like ransomware, intellectual property theft, and industrial espionage.

- Financial and Reputational Impact: Data breaches can lead to direct financial costs (investigation, recovery, fines) and indirect costs (lost business, damaged brand image). The average cost of a data breach in 2023 was $4.45 million globally.

- AI-Related Security Concerns: The increasing use of AI in design and manufacturing processes introduces new attack vectors, potentially compromising AI models or the data they process, impacting data integrity.

- Client Trust and Data Integrity: Maintaining the security and integrity of client data is paramount for retaining business relationships and ensuring compliance with data protection regulations.

Intensifying global competition, particularly from emerging market players, presents a constant challenge. These competitors often benefit from lower labor costs and less stringent regulatory environments, allowing them to offer products at more aggressive price points. For USI Global, this necessitates a continuous focus on innovation and efficiency to maintain its competitive edge and market share.

The rapid pace of technological change in the electronics industry means that USI Global must constantly invest in research and development to stay ahead. Failure to do so risks obsolescence, as newer, more advanced technologies emerge. For example, the semiconductor industry alone saw R&D spending exceed $100 billion in 2023, underscoring the immense investment required to remain relevant.

Economic volatility, including inflation and potential recessions, can significantly impact consumer and business spending on electronics. Forecasts for global GDP growth in 2024 and 2025 suggest continued uncertainty, which could lead to reduced demand for USI Global's products and services.

Supply chain disruptions, exacerbated by geopolitical tensions and logistical challenges, remain a critical threat. Volatility in shipping costs, projected to continue through 2025, directly impacts operational expenses and delivery timelines. For instance, the average cost of a data breach in 2023 was $4.45 million, highlighting the significant financial risks associated with cybersecurity vulnerabilities.

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of data, incorporating USI Global's official financial statements, comprehensive market research reports, and insights from industry experts to provide a well-rounded perspective.