USI Global Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

USI Global Bundle

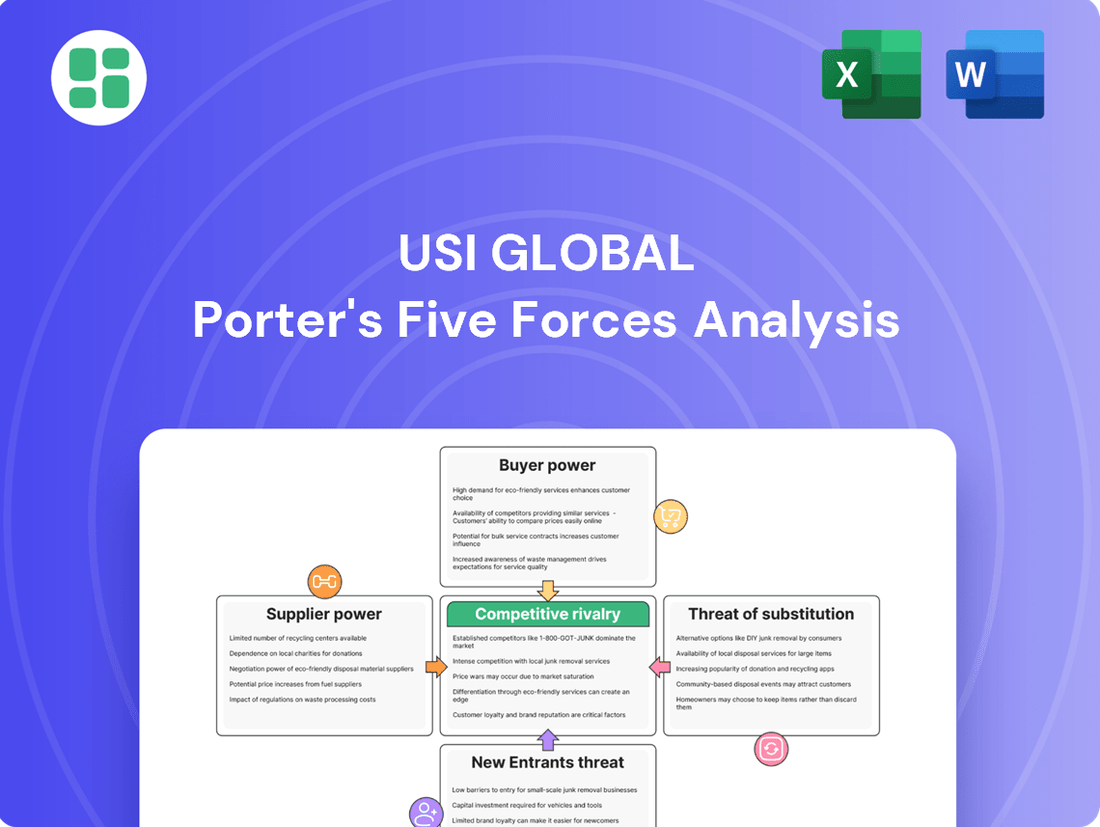

USI Global operates within a dynamic market shaped by significant buyer power and the constant threat of new entrants. Understanding these forces is crucial for navigating its competitive landscape effectively.

The complete report reveals the real forces shaping USI Global’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

USI Global's reliance on a limited number of specialized suppliers for critical electronic components, like advanced semiconductors or unique display technologies, can significantly amplify supplier bargaining power. This concentration means suppliers hold considerable sway over pricing and terms.

However, USI Global actively works to counter this by implementing a dual-sourcing strategy for key materials. This approach ensures they have at least two reliable suppliers for the same component, which not only guarantees supply continuity but also cultivates healthy competition among these suppliers, thereby moderating their individual bargaining leverage.

The availability and price swings of critical raw materials, such as rare earth elements and specific metals essential for electronics, directly influence USI Global's expenses. For instance, the price of lithium, a key component in batteries, saw significant volatility in 2023, with some reports indicating price increases of over 50% year-over-year before stabilizing in late 2023 and early 2024, impacting the cost of electronic goods.

Supply chain disruptions, whether due to geopolitical events or natural disasters, can empower suppliers by limiting options for manufacturers like USI. Furthermore, if a few dominant producers control the supply of a crucial material, they may exhibit cartel-like behavior, dictating terms and driving up costs for their customers.

USI faces significant switching costs when changing major suppliers. These costs can include substantial re-tooling of manufacturing equipment, lengthy re-qualification processes for new components, or even fundamental design changes to their products. For instance, in the semiconductor industry, a sector where USI operates, the lead time for qualifying a new chip supplier can extend to 12-18 months, involving extensive testing and validation.

The presence of long-term contracts with current suppliers and the deep integration of their systems into USI's supply chain further solidify these switching costs. This integration might involve proprietary software interfaces or specialized logistical arrangements that are difficult and expensive to replicate with a new partner.

Supplier Differentiation

Supplier differentiation significantly impacts USI Global's bargaining power. If suppliers offer unique, patented technologies essential for USI's cutting-edge System-in-Package (SiP) solutions, especially those critical for miniaturization and performance, their leverage increases. For instance, a supplier holding exclusive rights to a novel semiconductor material or a specialized manufacturing process that USI cannot easily replicate elsewhere would command higher prices and more favorable terms.

USI's commitment to innovation in advanced SiP technology inherently creates a reliance on specialized suppliers. These suppliers often operate in niche markets, making it challenging for USI to find alternative sources for critical components or intellectual property. This reliance can be seen in the semiconductor industry where access to advanced fabrication facilities or proprietary chip designs can be concentrated among a few key players.

- Supplier Differentiation: Suppliers with unique, proprietary technologies crucial for USI's advanced SiP solutions gain significant bargaining power.

- Reliance on Niche Suppliers: USI's focus on innovation, particularly in miniaturization, often necessitates dependence on specialized suppliers with limited alternatives.

- Impact on Costs: This dependence can lead to higher component costs for USI if suppliers can dictate terms due to their differentiated offerings.

- Strategic Sourcing: USI must actively manage these relationships and explore dual-sourcing or in-house development where feasible to mitigate supplier power.

Forward Integration Threat

The threat of suppliers engaging in forward integration, meaning they start offering Electronic Manufacturing Services (EMS) or Original Design Manufacturing (ODM) themselves, could indeed boost their bargaining power against USI Global. If a key supplier were to directly compete, it would create a significant challenge for USI's existing business model.

However, this particular threat is generally considered low for USI. The significant capital investment required to establish robust EMS or ODM operations, coupled with the complex customer relationships and trust needed in this sector, often acts as a substantial barrier for suppliers looking to make such a transition. For instance, setting up a state-of-the-art EMS facility can easily run into hundreds of millions of dollars, a cost many raw material or component suppliers might not be willing or able to bear.

- Low Likelihood of Supplier Forward Integration: Suppliers typically lack the capital and established customer networks necessary to effectively compete in the EMS/ODM space against established players like USI.

- High Barriers to Entry for Suppliers: The substantial capital expenditure and deep customer relationships inherent in EMS and ODM services present significant hurdles for component or raw material providers.

- Focus on Core Competencies: Most suppliers are focused on their primary business of manufacturing components, not on the complex assembly and design services that USI provides.

USI Global's bargaining power with suppliers is influenced by several factors. When suppliers offer unique, proprietary technologies, especially for advanced System-in-Package (SiP) solutions, their leverage increases significantly. This is particularly true for components critical for miniaturization and high performance, where alternatives are scarce. For example, a supplier with exclusive rights to a novel semiconductor material or a specialized manufacturing process that USI cannot easily replicate would command higher prices and more favorable terms.

USI’s reliance on niche suppliers, driven by its focus on innovation in areas like advanced SiP technology, creates a dependence that empowers these suppliers. These suppliers often operate in specialized markets, making it difficult for USI to find alternative sources for critical components or intellectual property. The semiconductor industry, a key area for USI, exemplifies this, with access to advanced fabrication facilities or proprietary chip designs often concentrated among a few key players.

The cost of switching suppliers for USI can be substantial. These costs include re-tooling manufacturing equipment, lengthy re-qualification processes for new components, and potential product redesigns. In the semiconductor sector, qualifying a new chip supplier can take 12-18 months, involving extensive testing and validation. Long-term contracts and deep system integration further solidify these switching costs, often involving proprietary software or specialized logistics that are expensive to replicate.

While suppliers might consider forward integration into Electronic Manufacturing Services (EMS) or Original Design Manufacturing (ODM), this is generally a low threat for USI. The immense capital investment, estimated in the hundreds of millions of dollars for state-of-the-art facilities, and the need for complex customer relationships act as significant barriers for most component or raw material suppliers.

| Factor | Impact on Supplier Bargaining Power | USI Global's Mitigation Strategy | Example Data/Context |

| Supplier Differentiation | High (Unique/Proprietary Tech) | Dual-sourcing, exploring in-house development | Exclusive rights to novel semiconductor materials |

| Reliance on Niche Suppliers | High (Limited Alternatives) | Strategic relationship management, R&D investment | Specialized components for advanced SiP solutions |

| Switching Costs | High (Capital, Time, Redesign) | Supplier diversification, long-term contracts | 12-18 month qualification for new chip suppliers |

| Threat of Forward Integration | Low (High Barriers to Entry) | Focus on core EMS/ODM competencies | Hundreds of millions in capital for EMS facilities |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to USI Global's specific operating environment.

Pinpoint and neutralize competitive threats with a visual breakdown of each force, empowering proactive strategy development.

Customers Bargaining Power

USI Global operates across various sectors, but a key factor influencing customer bargaining power is customer concentration. If a substantial portion of USI's revenue is derived from a small number of large Original Equipment Manufacturers (OEMs), these major clients can wield significant influence.

These large OEMs, due to their substantial order volumes, are in a strong position to negotiate for better pricing, more favorable payment terms, and customized service agreements. For instance, if a single OEM accounted for over 10% of USI Global's revenue in 2024, their ability to switch suppliers or consolidate their needs would give them considerable leverage.

Customer switching costs are a significant factor in the bargaining power of customers for EMS/ODM providers like USI Global. When a customer decides to switch from one provider to another, they often incur substantial expenses and face operational hurdles. These can include the cost of re-designing products, conducting new validation and testing procedures, and potentially managing disruptions to their existing supply chains. For instance, a company relying on a specific EMS for intricate electronics might spend hundreds of thousands, if not millions, on re-tooling and certification processes when changing partners.

The magnitude of these switching costs directly influences how much leverage customers have over USI. If switching is relatively easy and inexpensive, customers can more readily demand lower prices or better terms, knowing they have viable alternatives readily available. Conversely, high switching costs tend to lock customers into their current relationships, diminishing their bargaining power. While specific figures for USI's customer switching costs aren't publicly detailed, industry benchmarks suggest that for complex manufacturing, these costs can represent a significant percentage of the total project value, often ranging from 5% to 15% or more.

When the electronic components and modules USI Global manufactures are largely interchangeable, meaning they are commoditized, customers gain significant leverage. This commoditization allows buyers to easily switch to a competitor if USI's pricing isn't competitive, directly impacting USI's pricing power. For instance, in 2023, the global semiconductor market, a key area for USI, saw intense price competition in certain segments.

However, USI Global actively mitigates this by specializing in sophisticated and complex modules, such as System-in-Package (SiP) solutions. This specialization creates a degree of differentiation, making it harder for customers to find direct substitutes and thus reducing their bargaining power. The demand for advanced packaging solutions, like SiP, continued to grow through 2024, driven by the need for miniaturization and higher performance in consumer electronics and automotive sectors.

Customer's Backward Integration Threat

The threat of backward integration by customers is a significant factor influencing USI Global's bargaining power. Large Original Equipment Manufacturers (OEMs) might consider developing their own in-house manufacturing capabilities if USI's pricing becomes uncompetitive or their service offerings lack flexibility. This could occur if USI's service fees, for instance, represent a substantial portion of an OEM's cost structure, making self-sufficiency economically attractive.

However, the practicalities of backward integration present substantial hurdles. The immense capital outlay required for establishing and maintaining advanced manufacturing facilities, coupled with the operational expertise and supply chain management necessary, often renders this strategy unfeasible for many OEMs. For example, the semiconductor manufacturing industry, a potential area for USI's services, requires billions of dollars in investment for a single fabrication plant, a barrier that few companies can overcome easily.

- Customer Leverage: Large OEMs can exert pressure on USI Global by threatening to bring manufacturing in-house if costs rise or flexibility diminishes.

- Integration Costs: The substantial capital investment and operational complexity of backward integration often deter customers, mitigating the threat for USI.

- Industry Specifics: In sectors like advanced electronics or automotive, where specialized equipment and processes are critical, the cost of replicating USI's services can be prohibitively high.

- Strategic Focus: Many OEMs prefer to concentrate on their core competencies, such as design and marketing, rather than investing in manufacturing infrastructure that USI already provides.

Price Sensitivity of Customers

Customers in highly competitive sectors, such as the consumer electronics market, often exhibit significant price sensitivity. This means they actively compare prices and are inclined to switch to competitors offering lower costs, directly impacting USI Global's pricing strategies and its ability to maintain healthy profit margins.

For instance, in 2024, the average consumer electronics retailer faced a margin squeeze, with some categories seeing gross margins dip below 20% due to intense promotional activity. This pressure forces companies like USI Global to constantly evaluate their pricing to remain competitive, potentially sacrificing higher profit per unit for increased sales volume.

- Price Sensitivity Impact: In 2024, the average consumer electronics retailer experienced gross margins below 20% in certain product categories.

- Competitive Pressure: This forces USI Global to offer competitive pricing to attract and retain customers.

- Margin Influence: Customer price sensitivity directly influences USI Global's overall profitability and financial performance.

The bargaining power of USI Global's customers is influenced by several factors, including customer concentration, switching costs, product differentiation, and the threat of backward integration.

High customer concentration, where a few large clients account for a significant portion of revenue, grants them considerable leverage. For example, if a single OEM represented over 10% of USI's 2024 sales, their ability to negotiate favorable terms would be substantial.

Switching costs for customers, which can include re-design and validation expenses, can range from 5% to 15% of project value, thereby reducing their leverage. Commoditized products also empower customers to demand lower prices, as seen in price competition within certain semiconductor segments in 2023.

However, USI's specialization in complex solutions like SiP, which saw growing demand in 2024, creates differentiation and limits customer options. The threat of backward integration is often mitigated by the immense capital and expertise required, with semiconductor fabrication plants alone costing billions.

| Factor | Impact on Customer Bargaining Power | Example/Data Point |

| Customer Concentration | High | Single OEM accounting for >10% of 2024 revenue |

| Switching Costs | Lowers Power (if high) | 5-15% of project value for complex manufacturing |

| Product Differentiation | Lowers Power (if differentiated) | Growing demand for SiP solutions in 2024 |

| Backward Integration Threat | Lowers Power (if difficult) | Billions in capital for semiconductor fabrication |

Same Document Delivered

USI Global Porter's Five Forces Analysis

The document you see here is the complete USI Global Porter's Five Forces analysis, exactly as you will receive it upon purchase. This comprehensive breakdown meticulously evaluates the competitive landscape, providing actionable insights into industry structure and profitability. You can trust that the detailed examination of bargaining power of buyers and suppliers, threat of new entrants and substitute products, and the intensity of rivalry among existing competitors is precisely what you'll download.

Rivalry Among Competitors

The electronics manufacturing services (EMS) and original design manufacturing (ODM) sector is intensely competitive, populated by many global giants. Companies like Foxconn, Jabil, and Flex are major players, each vying for significant contracts. This crowded landscape means intense rivalry for business opportunities.

The Electronics Manufacturing Services (EMS) and Original Design Manufacturer (ODM) market is anticipated to expand, but this growth isn't always uniform. When the market experiences slower growth or specific regions lag, competition can intensify as companies vie more aggressively for existing business. This dynamic is crucial for understanding competitive rivalry.

Looking ahead, the broader EMS/ODM market is projected to see a compound annual growth rate (CAGR) of 7.6% between 2025 and 2035. However, it's important to note that 2024 presented a different picture for USI Global specifically, with the company experiencing a slight decrease in its operating revenue during that year. This contrast highlights how industry-wide trends can diverge from individual company performance, potentially increasing pressure on firms like USI Global to secure contracts.

In the EMS/ODM sector, companies can significantly lessen direct price competition by offering specialized services. This includes expertise in areas like miniaturization, advanced design, or catering to specific niche markets such as automotive or medical devices. USI Global, for instance, differentiates itself through its focus on System-in-Package (SiP) technology and a broad spectrum of integrated services, which builds a strong competitive advantage.

Exit Barriers

High fixed costs are a major factor in the electronics manufacturing services (EMS) and original design manufacturing (ODM) sectors, acting as significant exit barriers. Companies invest heavily in specialized manufacturing facilities, advanced equipment, and training a skilled workforce. For instance, setting up a state-of-the-art semiconductor fabrication plant can easily cost billions of dollars, making it incredibly difficult for a company to simply walk away.

These substantial upfront investments mean that even when market demand softens or profitability declines, companies often continue operations to try and recoup their capital expenditure. This persistence, driven by the desire to avoid realizing massive losses on sunk costs, can lead to prolonged periods of intense competition as firms fight for market share, even in challenging economic conditions. In 2023, the global EMS market was valued at approximately $750 billion, demonstrating the scale of investment involved.

- High Capital Investment: The cost of specialized machinery and facilities in EMS/ODM creates a substantial financial hurdle for exiting the market.

- Skilled Workforce Dependency: Companies rely on a trained workforce, and the costs associated with layoffs and severance packages can be considerable.

- Operational Continuation: To avoid significant write-offs on fixed assets, companies may continue production even at low margins, intensifying competition.

- Industry Trends: The increasing complexity of electronics and the need for advanced manufacturing capabilities further elevate these fixed costs.

Economies of Scale

USI Global leverages substantial economies of scale, particularly in procurement and global logistics, giving it a significant cost advantage over smaller rivals. This efficiency makes it challenging for newer or smaller companies to compete on price.

For instance, in 2024, major players in the industry reported operating margins that were, on average, 5-8 percentage points higher than those of mid-sized competitors, directly attributable to their scale. This cost disparity fuels industry consolidation as larger entities absorb or out-compete smaller ones.

- Procurement Savings: Large-scale purchasing power allows USI to negotiate lower prices for raw materials and components.

- Logistical Efficiency: Optimized global supply chains reduce transportation and warehousing costs per unit.

- Manufacturing Throughput: High-volume production lines decrease the per-unit cost of manufacturing.

- Competitive Pricing: These cost efficiencies enable USI to offer more competitive pricing, pressuring less-scaled competitors.

Competitive rivalry within the EMS/ODM sector is fierce, driven by the presence of numerous global players like Foxconn and Jabil. This intense competition is further amplified by varying market growth rates, where slower expansion can lead companies to aggressively pursue existing contracts. For USI Global, a slight revenue dip in 2024, amidst a projected industry CAGR of 7.6% from 2025-2035, underscores the pressure to secure business in this dynamic environment.

| Metric | 2023 Value (USD Billions) | 2024 Trend (USI Global) | Industry Growth Projection (2025-2035 CAGR) |

|---|---|---|---|

| Global EMS Market Value | ~750 | N/A | N/A |

| USI Global Operating Revenue | N/A | Slight Decrease | N/A |

| EMS/ODM Sector Growth | N/A | N/A | 7.6% |

SSubstitutes Threaten

Original Equipment Manufacturers (OEMs) retain the option to bring electronic manufacturing in-house, bypassing contract manufacturers like USI. This internal approach, while typically incurring higher costs due to smaller production scales and less specialized knowledge, represents a direct substitute for outsourcing, particularly for OEMs prioritizing absolute control over their production processes.

Emerging manufacturing technologies, like advanced 3D printing for electronics and novel additive manufacturing, present a growing threat by offering alternative production methods. These innovations could potentially allow companies to bypass traditional Electronic Manufacturing Services (EMS) and Original Design Manufacturer (ODM) providers for specific product lines.

For instance, the global 3D printing market was valued at approximately $19.9 billion in 2023 and is projected to reach $77.7 billion by 2030, indicating significant investment and development in this area. This rapid growth suggests that more complex and cost-effective manufacturing solutions outside of traditional EMS/ODM models will become increasingly viable.

The increasing industry-wide shift towards software-centric solutions presents a significant threat of substitution for USI Global. As products become more software-defined, the reliance on extensive hardware manufacturing services, a core offering for USI, could diminish. This trend might reduce the complexity and volume of physical electronic components needed, directly impacting demand for USI's traditional manufacturing capabilities.

Standardized Module Availability

The increasing availability of highly standardized, off-the-shelf electronic modules presents a significant threat to USI Global's Original Design Manufacturer (ODM) services. Customers can now easily integrate these pre-made components, bypassing the need for USI's specialized design and manufacturing expertise.

This trend offers a simpler, less specialized alternative for product development. For instance, the consumer electronics market, a key area for ODM providers, saw a substantial increase in the adoption of modular designs in 2024, with many smaller companies leveraging readily available chipsets and display units.

- Standardized Modules: Off-the-shelf electronic components are becoming more sophisticated and easier to integrate.

- Reduced Customization Need: Customers can assemble products using these modules, diminishing reliance on custom ODM solutions.

- Cost and Time Efficiency: This approach offers a faster and potentially cheaper route to market for some businesses.

- Market Impact: In 2024, the market for modular IoT devices grew by an estimated 15%, indicating a strong shift towards easier assembly.

Changes in Customer Business Models

A significant threat to USI Global arises from shifts in customer business models, particularly the move towards subscription services. For instance, if a major client transitions from selling physical devices to offering a service-based model, their need for new hardware manufactured by USI could diminish. This pivot directly impacts demand for USI's core Electronic Manufacturing Services (EMS) and Original Design Manufacturing (ODM) capabilities.

This evolving landscape necessitates that USI Global proactively adapt its service portfolio. Companies increasingly prioritize recurring revenue streams over unit sales, which could lead to a reduced reliance on the traditional manufacturing cycles USI has historically supported. For example, the automotive industry's shift towards software-defined vehicles and subscription features might lessen the demand for complex, hardware-centric manufacturing from EMS providers like USI.

Consider the implications for companies like Apple, a key USI client. If Apple were to further emphasize its services ecosystem, potentially reducing the frequency of major hardware refresh cycles for certain product lines, it would directly influence the volume of manufacturing required from partners such as USI. This trend is already visible as the smartphone market matures, with growth increasingly coming from services and accessories rather than just new device sales.

The impact of these business model changes can be substantial:

- Reduced Demand for Hardware: A customer’s move to subscription services can decrease their need for new physical product units, impacting USI's order volumes.

- Need for Service Integration: USI may need to offer more integrated services, such as software deployment or lifecycle management, to align with new customer models.

- Shifting Revenue Streams: The potential for less hardware-centric revenue for customers means USI must find ways to capture value in these new service-oriented ecosystems.

- Adaptation Pressure: Failure to adapt to these customer-driven business model transformations could lead to a loss of market share and competitive disadvantage for USI.

The threat of substitutes for USI Global stems from alternative production methods and evolving product architectures. Emerging technologies like advanced 3D printing offer new ways to manufacture electronics, potentially bypassing traditional EMS providers. Furthermore, the increasing use of standardized, off-the-shelf modules allows companies to assemble products more simply, reducing the need for USI's specialized design and manufacturing services.

The shift towards software-defined products also poses a substitution threat, as it can lessen the demand for complex hardware manufacturing. Additionally, changes in customer business models, such as a move to subscription services, can decrease the need for new hardware units, impacting USI's core offerings.

| Threat of Substitution Factor | Description | Potential Impact on USI | 2024 Market Trend/Data |

|---|---|---|---|

| Alternative Manufacturing Technologies | 3D printing, additive manufacturing | Reduced reliance on traditional EMS/ODM for certain product lines | Global 3D printing market projected to reach $77.7 billion by 2030 (from $19.9 billion in 2023) |

| Standardized Electronic Modules | Pre-made components, easier integration | Diminished need for custom ODM solutions, faster time-to-market for clients | Modular IoT device market grew ~15% in 2024 |

| Software-Centric Product Design | Increased focus on software, reduced hardware complexity | Lower demand for extensive hardware manufacturing services | Continued growth in software-defined vehicles impacting automotive hardware needs |

| Customer Business Model Shifts (Subscription Services) | Transition from unit sales to service-based models | Reduced demand for new hardware units, impacting order volumes | Maturing smartphone market sees growth shifting from new devices to services and accessories |

Entrants Threaten

USI Global, as a player in the Electronics Manufacturing Services (EMS) and Original Design Manufacturer (ODM) space, faces a significant threat from new entrants due to the exceptionally high capital investment required to establish a competitive operation. Building modern, efficient manufacturing plants with advanced automation and robust research and development facilities demands hundreds of millions, if not billions, of dollars. For instance, setting up a new semiconductor fabrication plant can easily cost upwards of $10 billion, a figure that immediately erects a formidable barrier for aspiring companies.

Existing players in the market, such as USI Global, often benefit from substantial economies of scale. This means they can produce goods or services at a lower cost per unit because they operate at a larger volume. For instance, in 2024, major players in the financial services sector that leverage scale often reported operating margins that were several percentage points higher than smaller, niche competitors, directly attributable to their ability to spread fixed costs over a larger output.

New entrants would find it incredibly difficult to replicate these cost efficiencies without a significant initial investment to achieve comparable production volumes. This barrier makes it challenging for them to compete on price, a crucial factor for many customers. Without achieving similar scale, a new company might have to accept lower profit margins or charge higher prices, both of which are disadvantageous.

The semiconductor industry, particularly in advanced packaging like System-in-Package (SiP), demands significant technological expertise and ongoing research and development. Companies like USI Global invest heavily in R&D, with a substantial portion of their revenue allocated to innovation. For instance, in 2023, USI Global’s R&D expenditure represented a notable percentage of its sales, underscoring the capital-intensive nature of staying competitive in this field.

New entrants face the daunting task of replicating this deep technological know-how and the continuous investment required. Building a skilled engineering workforce with specialized knowledge in areas such as SiP design and advanced manufacturing processes takes considerable time and resources. Without this foundational expertise, new players would struggle to compete with established firms that have years of accumulated experience and proprietary technologies.

Established Customer Relationships and Certifications

USI Global's established customer relationships, particularly with global Original Equipment Manufacturers (OEMs), present a significant barrier to new entrants. These long-standing partnerships are built on years of trust and proven performance, making it difficult for newcomers to gain a foothold. For instance, in the automotive sector, suppliers often work closely with OEMs from the initial design phase, a process that can take years and requires deep integration into the supply chain.

Furthermore, stringent industry-specific certifications, such as those required in the automotive and medical device industries, are critical hurdles. Obtaining these certifications involves rigorous testing, audits, and a demonstrated commitment to quality and safety standards. New entrants would need to invest substantial time and resources to achieve these qualifications, a task that established players like USI Global have already accomplished, solidifying their competitive advantage.

- Long-standing relationships with global OEMs: USI Global benefits from deep, trust-based partnerships that are difficult for new companies to replicate.

- Stringent industry-specific certifications: Essential qualifications in sectors like automotive and medical devices require significant investment and time, acting as a barrier.

- High switching costs for customers: OEMs often have integrated processes and supply chains with existing partners, making it costly and disruptive to switch.

- Demonstrated track record: USI Global's history of successful collaborations provides a proven performance record that new entrants lack.

Complex Global Supply Chain Management

The intricate nature of managing a global supply chain, encompassing thousands of diverse components, raw materials, logistics, and after-sales support, presents a significant barrier to entry. New companies struggle to replicate the established networks and deep expertise that incumbents like USI Global have cultivated over years. For instance, in 2024, the average lead time for critical electronic components could extend to several months, a challenge that emerging players without pre-existing supplier relationships would find exceptionally difficult to navigate.

New entrants often face substantial hurdles in establishing reliable and cost-effective supply chains. This includes securing favorable terms with suppliers, managing international shipping complexities, and ensuring quality control across multiple stages. By 2024, global shipping costs saw significant fluctuations, with some routes experiencing increases of over 50% compared to pre-pandemic levels, further amplifying the capital requirements for new entrants to establish a robust supply chain infrastructure.

- Supplier Relationships: Established companies have long-standing, often exclusive, relationships with key suppliers, ensuring preferential pricing and consistent availability of critical inputs.

- Logistical Expertise: Navigating international trade regulations, customs, and diverse transportation modes requires specialized knowledge and infrastructure that new entrants typically lack.

- Economies of Scale: Incumbents benefit from economies of scale in procurement and logistics, allowing them to absorb costs more effectively than smaller, newer operations.

- After-Sales Support: Building a global network for repairs, maintenance, and customer service is a capital-intensive and time-consuming endeavor, deterring potential new entrants.

The threat of new entrants for USI Global in the EMS/ODM sector is moderate to high. While significant capital is required for advanced manufacturing, the increasing demand for specialized electronics and the potential for niche market entry by well-funded startups or established companies diversifying their portfolios present a persistent challenge. For instance, in 2024, the global EMS market was projected to reach over $800 billion, indicating substantial opportunities that could attract new players despite the high initial investment.

New entrants would face substantial hurdles in matching USI Global's economies of scale and technological expertise, particularly in areas like advanced semiconductor packaging. For example, in 2023, USI Global's significant R&D investments demonstrated a commitment to innovation that is difficult for newcomers to replicate quickly. Furthermore, established customer relationships and stringent industry certifications, such as those for automotive or medical devices, act as crucial barriers, requiring considerable time and investment for new companies to overcome.

| Barrier to Entry | Impact on New Entrants | Example (2024 Data/Trends) |

| Capital Requirements | Very High | Setting up advanced semiconductor fabrication facilities can exceed $10 billion. |

| Economies of Scale | High | Larger players in 2024 often reported higher operating margins due to cost efficiencies. |

| Technological Expertise & R&D | High | USI Global's 2023 R&D spending highlights the continuous investment needed for innovation. |

| Customer Relationships & Certifications | High | Long-term OEM partnerships and industry certifications (e.g., automotive) take years to build. |

| Supply Chain Management | High | Navigating global supply chains with fluctuating shipping costs (e.g., 50%+ increases on some routes in 2024) requires established networks. |

Porter's Five Forces Analysis Data Sources

Our USI Global Porter's Five Forces analysis is built upon a robust foundation of data, incorporating annual reports, industry-specific market research from firms like IBISWorld, and publicly available financial filings from regulatory bodies such as the SEC.