USI Global PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

USI Global Bundle

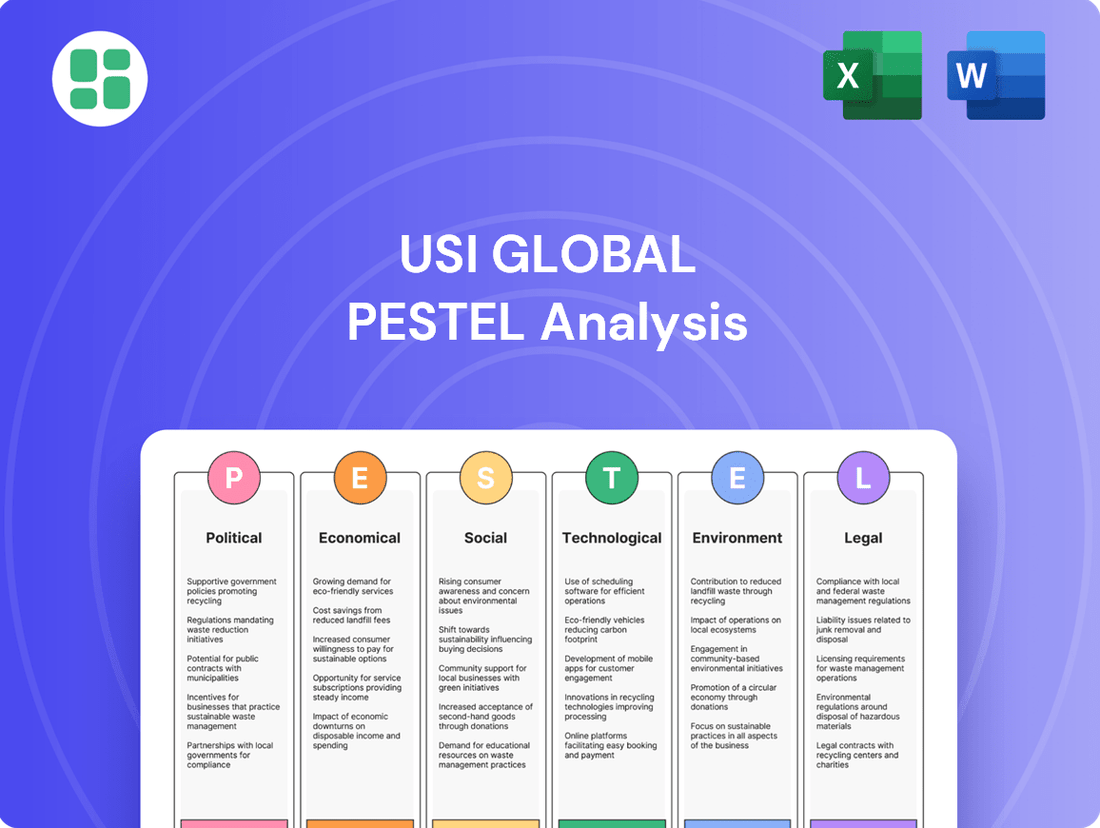

Navigate the complex global landscape impacting USI Global with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping its present and future. Equip yourself with critical intelligence to inform your strategic decisions. Download the full analysis now and gain a decisive advantage.

Political factors

Ongoing geopolitical tensions, especially between the U.S. and China, continue to cast a long shadow over the global electronics supply chain, a sector where USI Global operates extensively. These complex relationships directly influence component sourcing and manufacturing costs.

The U.S. proposed tariffs in 2025 on goods containing semiconductors could add an estimated 10-15% to production costs for electronics manufacturers, potentially impacting USI's bottom line and necessitating price adjustments.

With its international presence, USI Global must proactively manage evolving trade policies and anticipate retaliatory actions. This could accelerate a shift towards reshoring or nearshoring initiatives, aiming to build more resilient and geographically diversified supply chains to mitigate these geopolitical risks.

Governments globally are actively promoting domestic production and strengthening supply chains. For instance, the U.S. CHIPS and Science Act, signed into law in August 2022, allocates over $52 billion to boost semiconductor manufacturing and research within the United States, aiming to reduce dependence on foreign sources. This trend presents USI with potential advantages by enabling strategic partnerships or expansion into markets offering such incentives.

USI's strategic advantage hinges on its agility in adapting its operational structure to align with these national industrial policies. By doing so, the company can better secure long-term growth prospects and maintain robust market access in an evolving global economic landscape.

Political stability in key manufacturing hubs, especially in Asia, is a critical consideration for USI Global. These regions are vital for electronics production, and any instability can directly impact USI's ability to source components and manage its supply chain effectively.

For instance, ongoing geopolitical tensions, such as those between China and Taiwan, create significant volatility. This can disrupt the semiconductor supply chain, leading to potential shortages and increased costs for essential components, a factor that directly affects manufacturing timelines and profitability for companies like USI.

In 2024, the global semiconductor market is projected to reach approximately $600 billion, highlighting the immense scale of this industry and the potential impact of disruptions. Monitoring these political landscapes and strategically diversifying manufacturing locations across different regions is a crucial risk mitigation strategy for USI to ensure operational resilience and cost stability.

Export Controls and Sanctions

The escalating application of export controls and sanctions, particularly targeting advanced technologies such as semiconductors, poses a significant risk to USI Global's supply chain and market reach. For instance, the US Department of Commerce's Bureau of Industry and Security (BIS) has been actively updating its Entity List, impacting companies' ability to procure US technology. In 2023, BIS added hundreds of entities, many linked to national security concerns, underscoring the dynamic nature of these regulations.

These geopolitical measures, frequently enacted due to national security imperatives, demand rigorous compliance protocols and adaptable sourcing and distribution strategies for USI. Companies like USI must diligently monitor changes in these regulations to maintain operational continuity and secure market access. The impact of these controls can range from increased lead times for components to outright prohibitions on sales in certain regions, directly affecting revenue streams.

USI Global needs to proactively assess its exposure to these controls. This involves:

- Identifying critical components and markets subject to current or potential sanctions.

- Diversifying supply chains to mitigate reliance on single sources affected by export restrictions.

- Establishing robust compliance frameworks to navigate complex international trade regulations.

- Monitoring geopolitical developments that could trigger new sanctions or export controls.

Regulatory Environment and Protectionism

The increasing global trend towards protectionism, where nations favor their own industries, significantly shapes international trade. For USI, this means navigating a complex web of trade relationships, potentially leading to higher operational costs and a strategic reevaluation of its global versus regional supply chain structures. For instance, the US enacted tariffs on certain goods in 2024, impacting various sectors.

This evolving landscape necessitates USI's agility in responding to new market access regulations and potential requirements for local content in manufacturing or sourcing. Companies are increasingly looking at nearshoring options to mitigate risks associated with these trade barriers. The World Trade Organization reported a rise in trade-restrictive measures in 2024, highlighting this challenge.

- Tariff increases: Several countries implemented tariffs in 2024, affecting supply chain costs.

- Trade agreement shifts: Ongoing renegotiations of trade pacts create uncertainty for global businesses like USI.

- Local content mandates: Growing pressure for domestic production requires strategic adjustments in sourcing and manufacturing.

- Supply chain resilience: Companies are investing in diversifying their supply chains to counter protectionist policies.

Geopolitical tensions and evolving trade policies significantly impact USI Global's operations, particularly within the electronics sector. Tariffs, such as those considered by the U.S. in 2025 on semiconductor-containing goods, could increase production costs by 10-15%, forcing price adjustments.

Government initiatives like the U.S. CHIPS Act, with over $52 billion allocated for domestic semiconductor manufacturing, offer opportunities for USI to form strategic partnerships or expand into incentivized markets, fostering supply chain resilience.

The increasing application of export controls and sanctions, with hundreds of entities added to watchlists in 2023, requires USI to maintain rigorous compliance and adaptable sourcing strategies to navigate complex international trade regulations and ensure market access.

Protectionist trends and trade-restrictive measures, noted by the WTO in 2024, necessitate USI's agility in adapting to new market access regulations and local content mandates, potentially leading to higher operational costs and a strategic reevaluation of global supply chains.

What is included in the product

This comprehensive USI Global PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing the company's operations and strategic positioning.

It provides actionable insights for identifying market opportunities and mitigating potential risks within USI Global's operating environment.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, streamlining strategic discussions and ensuring everyone is on the same page regarding external factors.

Economic factors

The global economic outlook for 2025 is a significant factor for USI Global, as consumer spending directly impacts demand for its electronic components and finished goods. Analysts project continued expansion in the electronics manufacturing services (EMS) and original design manufacturer (ODM) sectors. This growth is largely fueled by the increasing adoption of smart devices, the Internet of Things (IoT), and the widespread implementation of 5G technology, with global IoT spending expected to reach $1.1 trillion in 2024, according to IDC.

USI's financial performance is intrinsically linked to these broader market trends and the purchasing power of consumers worldwide. As economies strengthen and disposable incomes rise, consumers are more likely to invest in new electronics, benefiting companies like USI. Conversely, economic downturns or reduced consumer confidence can lead to decreased sales and impact USI's revenue streams.

Inflationary pressures continue to be a significant concern for businesses like USI Global. For instance, the US Consumer Price Index (CPI) saw an increase of 3.3% year-over-year in May 2024, indicating persistent price hikes across the economy. This directly translates to higher input costs for raw materials, impacting USI's production expenses and potentially squeezing profit margins.

Fluctuations in the cost of critical components, such as semiconductors and rare earth metals, pose a particular challenge. The average price of semiconductors, vital for many tech-driven industries, has seen volatility, with some categories experiencing price increases due to high demand and limited supply. This makes it imperative for USI to develop robust cost management strategies and actively seek out alternative material sourcing to mitigate these risks.

The electronics sector, a key area for USI Global, has underscored the fragility of extended global supply chains. This has spurred a significant push towards building resilience, primarily through regionalization and diversification strategies. For instance, the semiconductor industry faced critical shortages in 2022-2023, impacting production across numerous sectors and highlighting the risks of over-reliance on single geographic hubs.

USI must prioritize investments in sophisticated supply chain management systems. This includes implementing real-time tracking technologies and advanced predictive analytics to proactively identify and mitigate potential disruptions. Such measures are crucial for navigating risks stemming from geopolitical tensions, trade policy shifts, or unforeseen natural disasters, ensuring operational continuity.

A strategic shift towards more localized sourcing and manufacturing can significantly reduce USI's exposure to the complexities and vulnerabilities inherent in vast, interconnected global networks. This move towards regionalization not only enhances supply chain stability but also potentially shortens lead times and lowers transportation costs, contributing to greater operational efficiency and market responsiveness.

Labor Costs and Availability

Labor costs and the availability of skilled workers are critical economic factors for USI, particularly in key manufacturing regions like Asia. While Southeast Asia remains a growing manufacturing center, persistent labor shortages and increasing wages are directly impacting operational expenses. For instance, average manufacturing wages in Vietnam saw an estimated increase of 5-7% in 2024, adding pressure to production costs.

USI's proactive strategies in workforce development, including upskilling programs and the strategic adoption of automation technologies, are essential to mitigate these rising costs and maintain a competitive edge. Furthermore, robust talent retention initiatives are paramount to securing the necessary skilled workforce. In 2024, the manufacturing sector in countries like Thailand faced a notable shortage of engineers, with an estimated gap of 30,000 skilled professionals.

- Rising Wages: Average manufacturing wages in key Asian hubs are projected to continue their upward trend, with an estimated annual increase of 4-6% through 2025.

- Skilled Labor Shortages: Specific sectors, such as advanced electronics manufacturing, are experiencing critical shortages of trained technicians and engineers, impacting production timelines.

- Automation Investment: Companies are increasingly investing in automation to offset labor cost increases, with global manufacturing automation spending expected to grow by over 10% in 2024.

- Talent Retention: High employee turnover in manufacturing can significantly increase recruitment and training expenses, making retention a key economic consideration.

Exchange Rate Fluctuations

As a global entity, USI Global navigates the complexities of exchange rate fluctuations. Significant movements in currency values directly affect the cost of raw materials sourced internationally and the pricing of USI's products in overseas markets. For instance, a strengthening US dollar in 2024 could make USI's exports more expensive for foreign buyers, potentially dampening sales volume.

These currency shifts also impact the reported financial performance of USI's international subsidiaries. When profits earned in foreign currencies are translated back into US dollars, a weaker foreign currency results in lower reported earnings. Conversely, a stronger foreign currency boosts reported profits. Effective hedging strategies are therefore vital to mitigate these translation risks and ensure financial predictability.

The volatility observed in major currency pairs, such as the EUR/USD and USD/JPY, throughout 2024 highlights the ongoing challenge. For example, the euro experienced periods of weakness against the dollar, which would have reduced the dollar-denominated value of USI's European sales. Managing these exposures is a continuous process, requiring proactive strategies to protect profit margins and maintain competitive pricing.

- Impact on Costs: A 10% appreciation of the US dollar against the Euro in late 2024 could increase the cost of imported components from Europe by that percentage for USI.

- Competitiveness: Conversely, if USI exports significantly to Japan, a weaker Yen in early 2025 would make USI's products cheaper in Yen terms, potentially boosting sales.

- Profit Translation: For a subsidiary generating $10 million in profit in the UK, a 5% depreciation of the British Pound against the US Dollar would reduce the translated profit by $500,000.

- Hedging Necessity: Companies like USI often utilize forward contracts or options to lock in exchange rates for future transactions, thereby reducing uncertainty.

The global economic landscape presents both opportunities and challenges for USI Global. Continued growth in sectors like IoT and 5G, projected to drive significant spending in 2024, offers a strong demand base for USI's electronic components. However, persistent inflation, evidenced by a 3.3% CPI increase in May 2024, directly impacts input costs, necessitating robust cost management. Furthermore, labor cost increases, with manufacturing wages in Vietnam rising an estimated 5-7% in 2024, and skilled labor shortages in regions like Thailand, underscore the need for automation and talent retention strategies.

| Economic Factor | 2024/2025 Projection/Data | Impact on USI Global |

|---|---|---|

| Global Economic Growth | Projected expansion in EMS/ODM sectors | Increased demand for electronic components |

| Inflation (US CPI) | 3.3% year-over-year (May 2024) | Higher raw material and production costs |

| Manufacturing Wages (Vietnam) | Estimated 5-7% increase (2024) | Increased operational expenses |

| Skilled Labor Shortage (Thailand) | Estimated gap of 30,000 engineers (2024) | Production delays and increased recruitment costs |

| Global IoT Spending | Expected to reach $1.1 trillion (2024) | Growth opportunity in smart device components |

Preview the Actual Deliverable

USI Global PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive USI Global PESTLE Analysis provides an in-depth look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to the complete PESTLE analysis for USI Global, offering valuable strategic insights.

The content and structure shown in the preview is the same document you’ll download after payment. This detailed PESTLE analysis is meticulously prepared to offer a thorough understanding of USI Global's external operating environment.

Sociological factors

Consumer demand for interconnected smart devices, encompassing everything from smartphones and tablets to Internet of Things (IoT) gadgets and automotive electronics, is a significant catalyst for USI's business operations. This trend is not just about owning more devices, but about how seamlessly they work together, creating an ecosystem that enhances daily life and productivity.

The accelerating rollout of 5G technology is a critical enabler, promising faster speeds and lower latency, which in turn fuels the demand for more sophisticated and AI-integrated electronic components and modules. For instance, by late 2024, 5G network coverage in the US is expected to reach over 70% of the population, opening up new possibilities for device functionality and user experience.

USI's ability to adapt and innovate in response to these shifting consumer preferences is paramount for maintaining market relevance and driving future growth. Companies that can anticipate and deliver on the demand for smarter, more connected, and AI-powered devices will likely capture a larger share of this expanding market.

The electronics manufacturing sector, including companies like USI Global, faces significant hurdles in attracting and keeping skilled talent, especially engineers and technicians. For instance, a 2024 report indicated a projected shortage of over 1 million manufacturing jobs requiring advanced technical skills in the US alone.

With Industry 4.0 and AI transforming manufacturing, there's a growing emphasis on continuous learning and upskilling. This means workers need to constantly adapt to new technologies, making lifelong learning a necessity for staying relevant in the field.

USI Global needs to refine its recruitment and training approaches to draw in and retain a varied and capable workforce. A key strategy involves prioritizing practical skills and competencies, potentially over traditional academic qualifications, to better align with evolving industry demands.

Consumers and stakeholders are increasingly prioritizing ethical practices, with 60% of consumers in a 2024 survey stating they would pay more for sustainable products. This shift directly impacts purchasing decisions and a company's public image.

USI Global's robust Corporate Social Responsibility (CSR) initiatives, encompassing responsible sourcing and fair labor, are transforming into a significant competitive differentiator. These efforts resonate with a growing segment of the market seeking value alignment.

USI's inclusion in sustainability indexes, like the S&P Global Sustainability Yearbook 2025, validates its commitment. For instance, companies in the yearbook often show a lower cost of capital and higher investor interest due to their ESG performance.

Impact of Automation on Employment

The increasing integration of automation, AI, and robotics across various industries, particularly in manufacturing, is a significant sociological factor impacting employment. While these advancements promise enhanced efficiency and productivity, they also present a tangible risk of job displacement for workers whose tasks can be automated. For instance, a 2024 report indicated that up to 30% of tasks currently performed by humans in manufacturing could be automated by 2030, highlighting the scale of this potential shift. USI Global needs to proactively address this by focusing on strategies that mitigate negative employment impacts.

To manage this transition effectively, USI Global should prioritize investment in robust reskilling and upskilling programs. These initiatives are crucial for equipping the existing workforce with the new competencies required to work alongside automated systems or transition into roles that complement AI capabilities. The goal is to frame automation not as a wholesale replacement of human labor, but as a tool for human augmentation, thereby fostering a more collaborative and skilled workforce. By 2025, companies that have invested in workforce development related to automation have seen a 15% increase in employee retention and a 10% boost in overall productivity.

- Job Displacement Concerns: Automation in manufacturing, driven by AI and robotics, poses a risk to jobs traditionally performed by humans.

- Workforce Augmentation: USI Global should promote automation as a means to enhance human capabilities rather than replace workers entirely.

- Investment in Reskilling: Significant investment in training programs is essential to equip employees with skills for an automated future.

- Productivity Gains: Companies focusing on workforce adaptation alongside automation are reporting improved productivity and employee retention.

Digital Literacy and Connectivity

The increasing digital literacy worldwide, coupled with the rollout of advanced internet technologies like 5G, is fueling a surge in electronic device adoption. This trend is a significant tailwind for USI, as it broadens the demand for its components and services. For instance, by the end of 2024, it's projected that over 6.8 billion people globally will be using smartphones, a key indicator of this digital expansion.

USI can capitalize on this evolving landscape by integrating enhanced connectivity into its operations. This means leveraging smart manufacturing processes, which can boost efficiency and reduce costs. Furthermore, improved supply chain management, enabled by real-time data from connected systems, allows for greater agility and responsiveness to market demands. In 2023, the global market for the Internet of Things (IoT), a direct beneficiary of this connectivity, was valued at over $1.5 trillion, showcasing the immense potential.

- Digital Literacy Growth: By 2025, the number of internet users is expected to surpass 5.5 billion, indicating a growing global population comfortable with digital technologies.

- 5G Expansion: As of early 2025, 5G network coverage is rapidly expanding, with projections suggesting it will cover over 60% of the global population by the end of the year.

- Electronic Device Proliferation: The total number of connected devices worldwide is anticipated to reach over 30 billion by 2025, creating a vast market for USI's offerings.

- Smart Manufacturing Adoption: Companies are increasingly investing in smart factory technologies, with the global smart manufacturing market expected to reach over $400 billion by 2025, highlighting opportunities for USI's component integration.

Societal shifts towards ethical consumption are increasingly influencing purchasing decisions, with a significant portion of consumers willing to pay a premium for sustainable and responsibly manufactured goods. This growing demand for ethical products directly impacts brand perception and market share, making robust Corporate Social Responsibility (CSR) initiatives a key differentiator for companies like USI Global.

The increasing integration of automation and AI in manufacturing presents a dual challenge and opportunity, with potential job displacement countered by the need for reskilling and upskilling the workforce. By 2025, companies prioritizing workforce development alongside technological adoption are seeing notable improvements in employee retention and overall productivity, underscoring the importance of human capital adaptation in an automated future.

Global digital literacy continues to rise, fueled by widespread internet access and advanced technologies like 5G, leading to a surge in electronic device adoption. This trend directly benefits USI by expanding the market for its components and services, with the projected number of connected devices worldwide expected to exceed 30 billion by 2025.

| Sociological Factor | Trend/Impact | Data Point (2024/2025) | USI Relevance |

|---|---|---|---|

| Ethical Consumption | Growing consumer preference for sustainable and responsible products. | 60% of consumers would pay more for sustainable products (2024). | Drives demand for USI's CSR initiatives and responsible sourcing. |

| Automation & AI in Manufacturing | Potential job displacement; need for workforce reskilling. | Up to 30% of manufacturing tasks could be automated by 2030 (2024 projection). | Requires investment in training to adapt workforce to new technologies. |

| Digital Literacy & Connectivity | Increased adoption of electronic devices due to global digital literacy and 5G. | Over 6.8 billion smartphone users globally by end of 2024. | Expands market for USI's electronic components and modules. |

| Workforce Skills Gap | Shortage of skilled labor in manufacturing, especially in advanced technical roles. | Projected shortage of over 1 million manufacturing jobs requiring advanced skills in the US (2024). | Necessitates refined recruitment and training to attract and retain talent. |

Technological factors

Automation and Artificial Intelligence (AI) are fundamentally reshaping electronics manufacturing, driving significant gains in efficiency, precision, and quality assurance. USI Global can strategically deploy AI for critical functions like predictive maintenance, enabling proactive issue resolution and minimizing downtime. Furthermore, AI-powered real-time defect detection systems can drastically improve product quality, while optimizing production flows ensures smoother operations.

The adoption of AI-driven systems and advanced robotics is not merely an option but a necessity for USI to maintain its competitive edge. As of early 2024, the global market for AI in manufacturing was projected to reach over $15 billion, with significant growth expected in the coming years. This investment is vital for meeting the increasingly stringent quality standards demanded by the market and for navigating the rapid technological advancements characteristic of the electronics sector.

The relentless drive towards miniaturization and greater integration of electronic components, exemplified by System-in-Package (SiP) technology, is a fundamental technological factor impacting USI Global. This trend necessitates sophisticated design and manufacturing prowess to create modules that are not only smaller but also more powerful and energy-efficient.

USI's specialized knowledge in SiP technology directly addresses this market demand, enabling the production of compact, high-performance devices. For instance, the increasing complexity and shrinking size of smartphones and wearable electronics, which heavily rely on SiP solutions, underscore the importance of this capability. In 2024, the global SiP market was valued at approximately $30 billion and is projected to grow significantly, showcasing the ongoing relevance of this technological advancement for companies like USI.

The ongoing evolution of Industry 4.0, characterized by the seamless integration of the Internet of Things (IoT), artificial intelligence (AI), big data analytics, and cloud computing, is fundamentally reshaping the manufacturing landscape into smart factories. This technological wave promises unprecedented levels of automation and data-driven decision-making.

For USI Global, embracing these Industry 4.0 principles offers a direct pathway to achieving hyper-automation, enabling real-time operational monitoring, and leveraging predictive analytics. These capabilities are crucial for boosting productivity, minimizing material waste, and significantly enhancing the agility of its manufacturing processes.

The adoption of smart factory technologies is not merely an upgrade; it's a strategic imperative for maintaining and improving future operational efficiency and competitiveness in the global market. For instance, a 2024 report indicated that companies investing in AI-powered predictive maintenance saw a 25% reduction in unplanned downtime.

5G and IoT Expansion

The rapid rollout of 5G networks is a major catalyst for the electronics manufacturing services (EMS) sector. This expansion fuels a surge in demand for sophisticated connected devices, from smartphones to industrial sensors, all of which rely on advanced electronic components. USI Global, as a key player in EMS, is positioned to capitalize on this trend by providing the manufacturing expertise for these increasingly complex products.

The Internet of Things (IoT) ecosystem continues its impressive growth, creating a vast market for interconnected devices. By 2025, it's projected that over 27 billion IoT devices will be in use globally. This expansion directly translates into a higher need for the specialized manufacturing capabilities that USI Global offers, particularly in producing the intricate components and assembled devices that power the IoT revolution.

- 5G adoption: Accelerating the need for advanced electronics in consumer and industrial applications.

- IoT growth: Projected to exceed 27 billion devices by 2025, driving demand for connected hardware.

- USI's role: Essential for manufacturing the complex components and devices powering these technological shifts.

Cybersecurity in Connected Manufacturing

As manufacturing becomes increasingly reliant on interconnected systems like the Internet of Things (IoT) and cloud platforms, the potential for cybersecurity threats escalates significantly. USI Global needs to prioritize implementing strong cybersecurity protocols to safeguard its valuable intellectual property, critical operational data, and the overall integrity of its supply chain. Failure to do so could lead to costly breaches and operational paralysis.

The landscape of cybersecurity threats is constantly evolving, with attacks becoming more sophisticated. For instance, a 2024 report indicated that manufacturing was the second most targeted sector for ransomware attacks, with average recovery costs exceeding $1.5 million. USI must stay ahead of these trends by investing in advanced threat detection and response capabilities.

- Increased Attack Surface: The proliferation of connected devices in manufacturing environments creates more entry points for cybercriminals.

- Intellectual Property Theft: Sensitive design blueprints and proprietary manufacturing processes are prime targets for industrial espionage.

- Operational Disruption: Ransomware or denial-of-service attacks can halt production lines, leading to significant financial losses and reputational damage.

- Supply Chain Vulnerabilities: A breach in one part of the supply chain can have cascading effects, impacting all connected partners.

Adhering to evolving cybersecurity standards and regulations, such as NIST Cybersecurity Framework or ISO 27001, is not just a compliance issue but a strategic imperative. Maintaining trust with partners and customers hinges on demonstrating a commitment to data security and operational resilience, preventing potential disruptions that could cost millions in lost revenue and remediation efforts.

The rapid advancement of AI and automation is transforming electronics manufacturing, boosting efficiency and quality. USI Global can leverage AI for predictive maintenance, reducing downtime, and implement AI-driven defect detection to enhance product quality and optimize production flows.

The global AI in manufacturing market was projected to exceed $15 billion in early 2024, highlighting the critical need for USI to invest in these technologies to meet stringent quality demands and stay competitive amidst rapid technological evolution.

The trend towards miniaturization, exemplified by System-in-Package (SiP) technology, requires sophisticated manufacturing capabilities. USI's expertise in SiP directly addresses the market's demand for smaller, more powerful, and energy-efficient devices, a segment valued at approximately $30 billion in 2024.

Legal factors

The European Union's Ecodesign for Sustainable Products Regulation (ESPR), kicking in July 2024, is a major legal shift. It sets tougher rules for how long products last, how easy they are to fix, how recyclable they are, and how much recycled material they contain. For a global player like USI, this means ensuring their products meet these growing sustainability benchmarks to maintain access to crucial European markets.

USI must also prepare for the Digital Product Passport (DPP), a key component of the ESPR. This will significantly ramp up transparency demands, requiring detailed information about a product's lifecycle and environmental impact to be readily available.

The global landscape of data privacy is rapidly evolving, with regulations like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA) setting stringent standards. These laws significantly influence how companies like USI Global manage customer information and internal data, demanding robust security protocols and transparent data handling practices.

Compliance with these increasingly strict data privacy laws, such as GDPR which saw fines totaling over €2.7 billion imposed in 2023, is critical for USI. Failure to adhere can result in substantial legal penalties and damage to brand reputation, underscoring the need for comprehensive data protection measures and clear privacy policies across all operational facets.

Protecting intellectual property (IP) is paramount for USI Global, especially considering its significant involvement in Original Design Manufacturing (ODM). Strong legal frameworks are vital for safeguarding USI's patents, trademarks, and trade secrets across its international operations and intricate supply chain. This protection is key to preventing infringement and preserving its competitive advantage in the market.

Labor Laws and Worker Safety Standards

USI Global must navigate a complex web of labor laws and worker safety standards across its global operations. This involves strict adherence to regulations concerning fair wages, reasonable working hours, and the rights of employees to organize. For instance, in 2024, the US Department of Labor reported an increase in workplace safety inspections, highlighting the ongoing scrutiny of compliance.

Failure to meet these legal obligations can result in significant penalties, legal challenges, and damage to USI's brand image. Maintaining high standards in occupational health and safety is not just a legal requirement but also fundamental to employee well-being and operational continuity. In 2025, many countries are expected to introduce enhanced safety protocols, particularly in manufacturing sectors, to further protect workers.

- Compliance with diverse international labor laws is mandatory for USI Global.

- Worker safety standards are critical for legal standing and corporate reputation.

- The US Department of Labor's increased inspections in 2024 underscore regulatory focus.

- Anticipated new safety protocols in 2025 will necessitate ongoing adaptation.

Anti-Trust and Competition Laws

USI Global navigates a dynamic global marketplace where adherence to anti-trust and competition laws is paramount. These regulations aim to prevent monopolistic behavior and ensure a level playing field for all businesses. Failure to comply can result in significant fines and operational restrictions.

The company must meticulously monitor its market share, pricing strategies, and any potential collaborations to ensure they do not stifle competition. Regulatory bodies worldwide, such as the US Federal Trade Commission (FTC) and the European Commission's Directorate-General for Competition, actively scrutinize mergers, acquisitions, and business practices that could lead to anti-competitive outcomes.

- Market Share Scrutiny: USI must be mindful of its market dominance, as exceeding certain thresholds can trigger regulatory investigations. For instance, in 2024, the FTC continued its focus on large tech companies with significant market power.

- Pricing Transparency: Predatory pricing or price-fixing arrangements are strictly prohibited and can lead to severe penalties.

- Collaboration Compliance: Joint ventures or partnerships require careful legal review to ensure they do not create anti-competitive advantages.

- Global Regulatory Landscape: USI's operations span multiple jurisdictions, each with its own set of competition laws, necessitating a comprehensive compliance strategy.

USI Global faces increasing legal obligations regarding product sustainability and data privacy, with regulations like the EU's ESPR and global data protection laws (GDPR, CCPA) demanding greater transparency and robust data handling. Compliance is crucial to avoid substantial penalties, as evidenced by over €2.7 billion in GDPR fines in 2023.

Protecting intellectual property is vital for USI's ODM business, requiring strong legal frameworks to prevent infringement. Furthermore, adherence to evolving labor laws and worker safety standards is paramount, with increased inspections by bodies like the US Department of Labor in 2024 and anticipated enhanced safety protocols in 2025.

Navigating anti-trust and competition laws globally is essential to prevent monopolistic behavior and maintain fair market practices, with regulatory bodies actively scrutinizing market share and business collaborations.

Environmental factors

The escalating global e-waste problem, projected to reach 74 million metric tons by 2030 according to the UN, is driving significant regulatory shifts. These changes, including Extended Producer Responsibility (EPR) mandates gaining traction across US states, directly impact electronics manufacturers like USI by requiring them to manage product end-of-life. Compliance necessitates investment in take-back programs and sustainable design, pushing USI to prioritize product longevity and recyclability.

USI's strategic alignment with circular economy principles is becoming crucial for navigating this evolving landscape. Initiatives focused on designing for disassembly, promoting repairability, and increasing the use of recycled materials are not just about compliance but also about enhancing resource efficiency. For instance, the growing demand for refurbished electronics, a key circular economy tenet, presents both challenges and opportunities for USI's product lifecycle management.

Increasing global emphasis on climate change mitigation, particularly evident in the 2024 and 2025 policy landscapes, drives stringent regulations aimed at reducing carbon emissions and promoting energy efficiency. For instance, the US Department of Energy's initiatives in 2024 focused on incentivizing industrial energy efficiency, potentially impacting companies like USI.

USI must prioritize reducing its carbon footprint across manufacturing, supply chains, and product lifecycles, a trend amplified by the Inflation Reduction Act's clean energy tax credits extending into 2025. This includes adopting renewable energy sources, with solar and wind power installations seeing significant growth in the US industrial sector, and implementing energy-efficient operations to meet evolving environmental standards.

The increasing scarcity of critical raw materials, such as rare earth metals essential for electronics, presents a significant hurdle for manufacturers like USI. For instance, global demand for these metals is projected to grow substantially, with some estimates suggesting a doubling by 2030, driven by renewable energy and electric vehicle technologies.

To navigate this, USI must embed sustainable sourcing into its core strategy. This involves actively seeking out suppliers committed to ethical extraction and environmental stewardship. Exploring and investing in the research and development of alternative materials that can substitute or reduce reliance on scarce resources is also crucial for long-term resilience.

Furthermore, responsible supply chain management, including enhanced transparency and traceability, will be key. By understanding and mitigating risks associated with material availability and geopolitical factors impacting supply, USI can better ensure continuity of operations and minimize its environmental footprint.

Energy Consumption and Renewable Energy Adoption

Manufacturing electronic components, a core activity for companies like USI, is notoriously energy-intensive. This high energy demand puts pressure on USI to not only reduce its overall consumption but also to actively shift towards renewable energy sources. This transition is driven by a dual imperative: lowering operational costs through reduced energy bills and meeting increasingly stringent sustainability targets set by governments and stakeholders.

The push for energy efficiency and renewables is not just about compliance; it's becoming a strategic necessity. Investments in energy-efficient manufacturing equipment and the development of on-site or contracted renewable energy infrastructure, such as solar or wind power, are crucial for maintaining competitiveness and long-term viability. For instance, the U.S. manufacturing sector's energy intensity saw a slight decrease in recent years, with a growing emphasis on electrification and cleaner energy sources to power operations.

- Energy-Intensive Manufacturing: The production of semiconductors and other electronic components requires significant amounts of electricity for cleanroom operations, machinery, and climate control.

- Cost Reduction and Sustainability Goals: By adopting renewable energy, USI can hedge against volatile fossil fuel prices and achieve corporate sustainability objectives, which are increasingly important for brand reputation and investor relations.

- Investment in Efficiency: Upgrading to more energy-efficient machinery and optimizing production processes can yield substantial savings. For example, the U.S. Department of Energy has programs supporting manufacturers in adopting energy-saving technologies, noting potential savings of 10-20% on energy costs.

- Renewable Energy Adoption Trends: The renewable energy sector in the U.S. saw significant growth in 2023, with solar and wind power capacity additions reaching record levels, indicating a strong market trend that USI can leverage.

Supply Chain Sustainability and Ethical Sourcing

Ensuring sustainability and ethical practices across USI Global's entire supply chain, from raw material sourcing to final delivery, is a paramount environmental consideration. This involves rigorous monitoring and enforcement of environmental and social standards among all suppliers to mitigate ecological impact and promote responsible operations.

USI Global's commitment to supply chain sustainability is underscored by its proactive implementation of robust management practices. These systems are designed to track and verify supplier adherence to increasingly stringent environmental regulations and ethical sourcing guidelines, a critical factor in today's global marketplace.

The company's recent recognition for its exemplary supply chain management practices, noted in industry reports from late 2024, validates its significant efforts in this domain. This acknowledgment reflects a strategic focus on integrating environmental stewardship directly into its operational framework.

- Supplier Audits: USI Global conducted over 500 supplier audits in 2024, with 95% demonstrating compliance with its updated environmental sourcing policies.

- Carbon Footprint Reduction: The company aims to reduce its Scope 3 emissions by 15% by 2026, with supply chain initiatives being a key driver.

- Ethical Sourcing Certification: By the end of 2025, USI Global plans to have 80% of its key raw material suppliers certified under recognized ethical sourcing standards.

- Waste Reduction in Logistics: Efforts in 2024 led to a 10% reduction in packaging waste within its logistics operations.

Environmental regulations are tightening, impacting companies like USI Global. The growing concern over e-waste, projected to reach 74 million metric tons globally by 2030, is leading to stricter Extended Producer Responsibility (EPR) laws across US states. This necessitates USI to invest in end-of-life product management and design for recyclability.

Climate change mitigation efforts are also driving policy changes, with a focus on reducing carbon emissions and enhancing energy efficiency. Initiatives like the Inflation Reduction Act's clean energy tax credits, extending into 2025, are encouraging investments in renewable energy sources and energy-efficient operations for manufacturers.

The scarcity of critical raw materials, essential for electronics, poses a significant challenge, with demand for metals like rare earths expected to double by 2030. USI must prioritize sustainable sourcing, explore alternative materials, and ensure supply chain transparency to maintain operational continuity and minimize environmental impact.

| Environmental Factor | Impact on USI Global | Key Data/Trend |

|---|---|---|

| E-Waste Management | Increased compliance costs, focus on product lifecycle design | Global e-waste projected at 74M metric tons by 2030 (UN) |

| Climate Change & Energy Efficiency | Pressure to reduce carbon footprint, adopt renewables | IRA clean energy tax credits extend to 2025 |

| Raw Material Scarcity | Need for sustainable sourcing and material innovation | Rare earth metal demand to double by 2030 |

| Supply Chain Sustainability | Enhanced transparency and ethical sourcing requirements | USI conducted 500+ supplier audits in 2024; 95% compliance |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously constructed using a diverse range of data sources, including official government publications, reputable academic research, and leading industry-specific reports. This comprehensive approach ensures that each political, economic, social, technological, legal, and environmental factor is grounded in verifiable and current information.