Trident Seafoods Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Trident Seafoods Bundle

Trident Seafoods operates in a dynamic industry where buyer power can be significant due to the commoditized nature of some seafood products. The threat of new entrants, while present, is somewhat mitigated by high capital requirements and established distribution networks. Understanding these forces is crucial for navigating the competitive landscape.

The complete report reveals the real forces shaping Trident Seafoods’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Trident Seafoods' internal fleet dominance significantly curtails the bargaining power of external suppliers. By owning and operating a vast number of fishing vessels, Trident secures a substantial portion of its raw fish needs internally, effectively becoming its own supplier for many key inputs.

This vertical integration strategy, a cornerstone of their operations, directly limits the leverage independent fishermen or other external raw material providers can exert. For instance, in 2024, Trident's fleet was responsible for harvesting a significant percentage of the pollock and salmon that enter their processing plants, reducing their dependence on the spot market and associated price fluctuations.

This control over a primary input not only ensures a more consistent supply but also allows Trident to better manage costs and quality, thereby diminishing the bargaining power of any remaining external suppliers for those specific species.

Strict fishing quotas, like those for groundfish in the Gulf of Alaska, directly limit the available supply of wild-caught seafood. For instance, the total allowable catch for Pacific cod in the Gulf of Alaska for 2024 is set at 17,000 metric tons, a figure that directly impacts the raw material available to processors.

This scarcity gives an edge to independent fishermen who possess crucial quotas or access to prime fishing grounds. Their limited supply makes them more valuable to companies like Trident Seafoods, who rely on these harvesters for their core products.

Trident's established relationships with these independent fishermen are vital for managing and securing supply amidst these regulatory limitations. These partnerships are key to navigating the challenges posed by restricted fishing seasons and catch limits.

Trident Seafoods, while managing its own fishing fleets, still depends on external suppliers for critical specialized equipment and services. This includes advanced fishing gear, processing machinery, and packaging solutions. For instance, in 2024, the global market for industrial fishing equipment saw continued innovation, with suppliers of advanced sonar and automated processing lines commanding premium prices due to their unique technological offerings.

The bargaining power of these specialized suppliers can be significant, particularly when Trident faces high switching costs or limited alternative providers for proprietary technologies or essential maintenance services. For example, a supplier of a unique, high-efficiency fish sorting machine might have considerable leverage if replacing it would involve substantial retooling and training expenses for Trident's processing plants.

Maintaining robust relationships with these key equipment and service providers is therefore crucial for Trident Seafoods. This ensures operational continuity and access to the latest technological advancements, which can directly impact processing efficiency and product quality. In 2023, companies that invested in long-term supplier partnerships often experienced fewer disruptions and better pricing compared to those with more transactional relationships.

Labor Market Dynamics

The availability and cost of skilled labor significantly influence Trident Seafoods' operational expenses and efficiency. In remote locations like Alaska, where many of Trident's fishing and processing operations are situated, finding and keeping qualified workers can be a persistent challenge.

This scarcity can empower labor as a critical input, giving workers greater bargaining power, especially for specialized roles on fishing vessels and in processing plants. For instance, shortages in experienced deckhands or specialized processing technicians can drive up wages and benefits, impacting Trident's cost structure.

- Skilled Labor Shortages: Remote Alaskan operations often face difficulties in attracting and retaining skilled labor, increasing labor costs.

- Wage Pressures: Limited availability of experienced fishing crews and processing plant workers can lead to upward pressure on wages.

- Operational Impact: Labor availability directly affects Trident's capacity to harvest, process, and deliver its products efficiently.

Sustainability Certifications and Standards

The increasing emphasis on sustainability certifications for seafood, driven by both consumers and regulators, is a notable factor influencing supplier power. Suppliers, whether Trident's own fishing operations or external partners, who meet stringent environmental and social standards can leverage these credentials to negotiate better terms or secure preferred sourcing agreements. This elevates the bargaining position of compliant suppliers, directly impacting Trident's procurement strategies and overall costs.

For instance, by mid-2024, a significant portion of the global seafood market is increasingly prioritizing products with credible sustainability certifications. Studies indicate that consumers are willing to pay a premium for seafood that is verifiably sourced responsibly. This trend means that suppliers who have invested in and achieved certifications like the Marine Stewardship Council (MSC) or Aquaculture Stewardship Council (ASC) can hold more sway in price negotiations and supply commitments.

- Supplier Differentiation: Sustainability certifications act as a key differentiator, allowing suppliers to command higher prices or secure exclusive contracts.

- Market Access: Adherence to recognized standards can unlock access to premium markets and retailers with strict sourcing policies.

- Cost Implications: For Trident, sourcing from certified sustainable suppliers may involve higher initial costs, but it can also mitigate reputational risks and ensure long-term supply chain stability.

Trident Seafoods' internal fleet and vertical integration significantly reduce its reliance on external raw material suppliers, thereby limiting their bargaining power. However, specialized equipment and skilled labor shortages can empower certain suppliers. Sustainability certifications are also increasingly giving compliant suppliers leverage.

| Supplier Type | Bargaining Power Factor | Impact on Trident | 2024 Data/Example |

|---|---|---|---|

| Raw Fish (Internal Fleet) | Low | Reduced dependence, cost control | Trident's fleet harvests a significant portion of its pollock and salmon needs. |

| Specialized Equipment | High | Potential for premium pricing, switching costs | Suppliers of advanced sonar and automated processing lines command higher prices. |

| Skilled Labor | Moderate to High | Upward wage pressure, operational capacity | Shortages in experienced crews in Alaska drive up labor costs. |

| Sustainability Certified Suppliers | Moderate to High | Premium pricing, market access | MSC/ASC certified suppliers can negotiate better terms due to consumer demand. |

What is included in the product

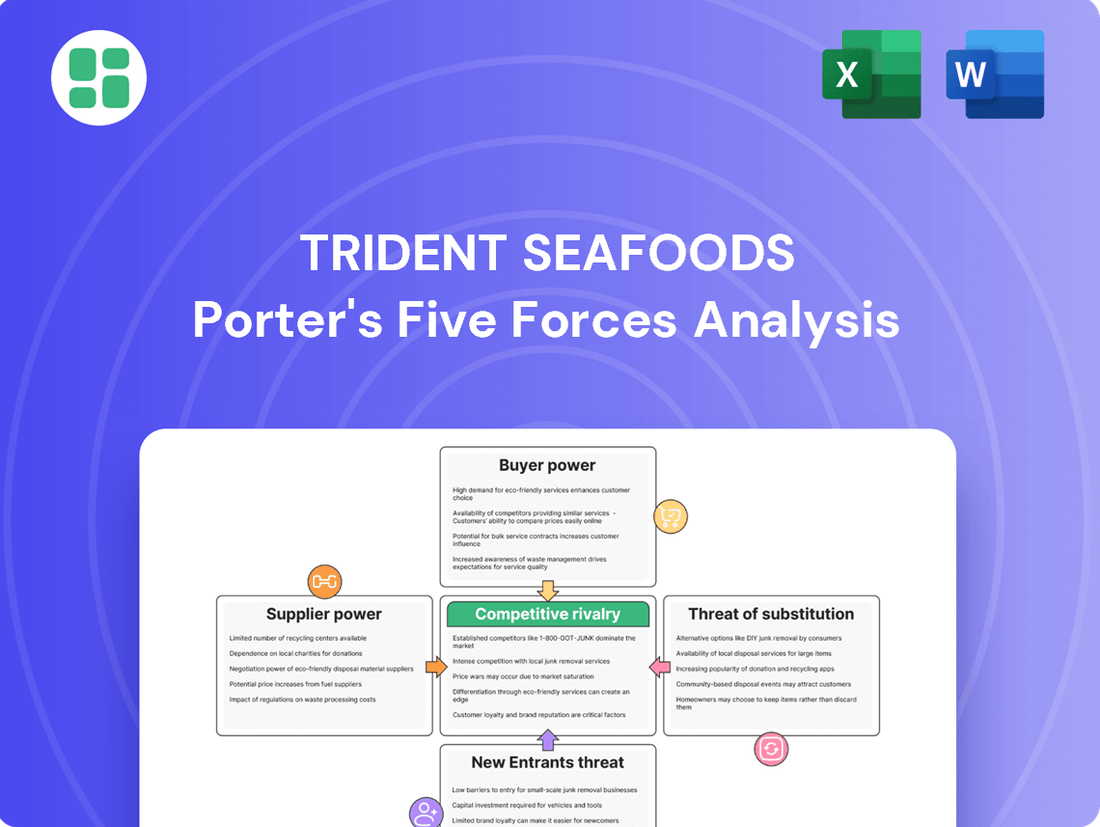

This analysis dissects Trident Seafoods' competitive environment, examining buyer and supplier power, the threat of new entrants and substitutes, and the intensity of rivalry within the seafood industry.

Gain immediate clarity on competitive pressures with a visual breakdown of Trident Seafoods' Porter's Five Forces, enabling faster, more informed strategic adjustments.

Customers Bargaining Power

Trident Seafoods' major customers are global retail chains and large foodservice distributors, who buy seafood in significant quantities. These major buyers wield considerable bargaining power, allowing them to negotiate for competitive prices, specific product formats, and strict quality requirements.

In 2024, major retailers like Walmart and Costco continued to exert pressure on their suppliers, including seafood companies, by demanding lower wholesale prices and efficient supply chains. This concentration of purchasing power among a few large entities means Trident must constantly focus on cost efficiency and product differentiation to maintain favorable terms.

When high-volume seafood species like Alaskan pollock become commoditized, as Trident Seafoods processes, buyers face less differentiation between suppliers. This means customers can readily compare prices and switch to competitors offering similar quality at a lower cost. For instance, in 2024, the global Alaskan pollock market experienced significant price fluctuations, with wholesale prices for frozen pollock fillets dipping by an estimated 5-10% in certain regions due to increased supply from various international producers.

The bargaining power of customers for Trident Seafoods is significantly influenced by global sourcing options. Buyers can easily access a wide array of seafood from numerous regions and producers, particularly from major Asian and European markets. This broad availability means customers can readily switch to alternative suppliers if Trident's pricing, quality, or product availability doesn't meet their expectations. For instance, in 2024, global seafood exports reached an estimated $170 billion, showcasing the vast competitive landscape customers navigate.

Brand Loyalty and Differentiation

Trident Seafoods' brand loyalty, particularly for its wild-caught Alaskan seafood, can reduce customer bargaining power. When consumers perceive unique value, such as stringent sustainability certifications or superior freshness, they are less likely to switch based solely on price. For instance, Trident's commitment to responsible fishing practices, often highlighted in marketing, can foster a dedicated customer base.

However, the degree of differentiation varies across Trident's product lines. While premium wild salmon might command loyalty, more commoditized products like frozen white fish may face stronger price sensitivity from buyers. In these segments, customers, especially large distributors or retailers, can leverage their purchasing volume to negotiate better terms, thereby increasing their bargaining power.

- Brand Strength: Trident's established reputation in wild-caught Alaskan seafood can foster customer loyalty, reducing price sensitivity.

- Product Differentiation: Unique selling propositions like sustainability claims or perceived quality can further mitigate buyer power.

- Commoditization Risk: For less differentiated products, customers' bargaining power increases, driven by price and volume considerations.

- Market Dynamics: The overall competitive landscape and availability of alternative suppliers significantly influence the extent of customer power.

Evolving Consumer Preferences

Evolving consumer preferences significantly shape the bargaining power of customers in the seafood industry. There's a growing demand for convenience, with consumers seeking ready-to-eat meals and pre-portioned seafood. In 2024, the global market for ready-to-eat seafood was valued at approximately $25 billion, indicating a strong consumer pull towards convenience.

Furthermore, sustainability is no longer a niche concern; it's a major driver for many seafood buyers. Consumers are increasingly scrutinizing the sourcing and environmental impact of their seafood purchases. This trend pressures companies like Trident Seafoods to ensure transparent and responsible supply chains, giving informed customers more leverage.

- Demand for Convenience: The market for ready-to-eat seafood products continues to expand, reflecting a consumer desire for quick and easy meal solutions.

- Sustainability Focus: Buyers are actively seeking seafood that is responsibly sourced, driving demand for certifications and transparent supply chains.

- Influence on Suppliers: These evolving preferences empower customers to dictate terms, pushing seafood companies to innovate and adapt their product lines to meet new market expectations.

The bargaining power of Trident Seafoods' customers remains substantial, driven by the concentration of buyers and the commoditized nature of many seafood products. In 2024, major retailers continued to leverage their purchasing volume to negotiate lower prices, as evidenced by the estimated 5-10% dip in wholesale prices for Alaskan pollock in certain regions. This dynamic forces Trident to prioritize cost efficiency and product differentiation to maintain favorable terms.

The global sourcing options available to buyers further amplify their power. With an estimated $170 billion global seafood export market in 2024, customers can easily switch to alternative suppliers if Trident's offerings do not meet their price, quality, or availability expectations.

While brand loyalty and product differentiation, such as sustainability certifications, can mitigate this power for premium products, commoditized offerings face heightened price sensitivity. The increasing consumer demand for convenience, with the ready-to-eat seafood market valued at approximately $25 billion in 2024, also empowers customers to dictate terms, pushing companies like Trident to adapt.

| Customer Segment | Key Bargaining Tactics | Impact on Trident Seafoods | 2024 Market Data Point |

| Global Retail Chains (e.g., Walmart, Costco) | Price negotiation, volume commitments, strict quality standards | Pressure on profit margins, need for supply chain efficiency | Continued demand for lower wholesale prices |

| Large Foodservice Distributors | Price competition, product specifications, delivery reliability | Need for competitive pricing on commoditized products, operational excellence | Significant buyers in the global seafood market |

| End Consumers (influenced by retailers/distributors) | Demand for sustainability, convenience, and perceived quality | Drives product innovation and supply chain transparency | Ready-to-eat seafood market valued at ~$25 billion in 2024 |

Preview Before You Purchase

Trident Seafoods Porter's Five Forces Analysis

This preview showcases the comprehensive Trident Seafoods Porter's Five Forces Analysis, detailing competitive rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. You can trust that the insights and formatting you see are precisely what you will receive, providing immediate value for your strategic planning.

Rivalry Among Competitors

The global seafood market is a fiercely competitive arena, characterized by a wide array of participants. While the overall market is substantial, certain segments exhibit fragmentation, featuring a mix of large, vertically integrated companies such as Trident Seafoods, alongside numerous smaller, niche operators. This dynamic creates intense rivalry across different product types and geographical regions, pushing companies to constantly innovate and optimize their operations.

Competitive rivalry in the seafood industry is intense, especially for commodity products where price wars are frequent. This is often driven by high inventory levels and periods of weak consumer demand, which directly impacts companies like Trident Seafoods. For instance, recent market conditions in late 2024 saw a reported decline in U.S. retail seafood sales, intensifying pressure on pricing strategies.

Competitive rivalry in the seafood industry is intense, with companies like Trident Seafoods differentiating themselves beyond just price. They compete on a wide range of factors including the variety of species offered, the perceived quality of their products, and crucially, sustainability certifications which are increasingly important to consumers. For instance, many companies are investing in traceability systems and eco-labels to build consumer trust and command premium pricing.

Innovation plays a key role in standing out. Trident Seafoods and its competitors are developing value-added products, such as pre-seasoned or pre-cooked seafood meals, to cater to convenience-seeking consumers. This focus on innovation allows companies to capture market share by offering unique solutions that simplify meal preparation and enhance customer experience in a crowded marketplace.

Vertical Integration vs. Specialization

Trident Seafoods benefits from its vertical integration, controlling everything from fishing to processing and distribution. This integration allows for greater supply chain stability and cost management. For instance, in 2024, Trident's ability to manage its own fleet and processing facilities likely contributed to its resilience amidst fluctuating global seafood prices.

However, the competitive landscape is dynamic. Rivals might achieve similar advantages through deep specialization in niche areas. For example, some competitors focus solely on advanced aquaculture techniques for salmon, potentially achieving higher yields or specific market segments. Others might excel in the processing of particular species, like pollock or crab, developing specialized efficiencies that rival Trident's broader model.

- Trident's vertical integration offers significant control over its supply chain, leading to enhanced cost efficiency and quality assurance.

- Competitors may counter this by specializing in specific value chain segments, such as advanced aquaculture or niche species processing.

- In 2024, the seafood industry saw continued investment in both integrated models and specialized operations, highlighting the diverse strategies employed by major players.

- The intensity of rivalry is influenced by how effectively companies leverage either integration or specialization to differentiate and capture market share.

Trade Policies and Global Supply

International trade policies and the global supply of seafood are major drivers of competitive rivalry for companies like Trident Seafoods. The influx of lower-cost imports from countries such as China, Ecuador, and Vietnam directly challenges U.S. producers by increasing price pressure and market saturation.

This dynamic intensifies competition, forcing domestic players to focus on differentiation, efficiency, or niche markets to maintain their standing. For instance, in 2024, the U.S. imported billions of pounds of fish and shellfish, with key origins often benefiting from different trade agreements or production costs.

- Global Sourcing Impact: Companies that can effectively navigate global supply chains and leverage lower production costs abroad gain a competitive edge.

- Trade Policy Influence: Tariffs, quotas, and trade agreements directly impact the landed cost of imported seafood, influencing pricing strategies for all market participants.

- Price Sensitivity: A significant portion of the seafood market is price-sensitive, making low-cost imports a constant competitive threat to higher-cost domestic producers.

The seafood industry is characterized by significant competitive rivalry, with numerous players vying for market share. This intensity is amplified by factors like price sensitivity, the impact of imports, and the strategic choices companies make regarding vertical integration versus specialization. Companies like Trident Seafoods must continually adapt to these pressures to remain competitive.

In 2024, the U.S. seafood market continued to see robust competition, with import volumes remaining a key factor. For example, U.S. seafood imports in the first half of 2024 reached approximately $10.5 billion, underscoring the significant presence of international suppliers and the resulting price competition faced by domestic producers.

| Competitive Factor | Impact on Rivalry | Trident Seafoods' Position |

|---|---|---|

| Price Competition | High, especially for commodity products | Managed through vertical integration and efficiency |

| Product Differentiation | Key for premium segments | Focus on value-added products and sustainability |

| Import Competition | Significant, due to lower production costs abroad | Mitigated by supply chain control and domestic sourcing |

| Innovation | Drives market share gains | Investment in new product development and processing technologies |

SSubstitutes Threaten

The most significant substitutes for Trident Seafoods' products are other animal proteins like chicken, beef, and pork. These alternatives vie for consumer attention based on price, convenience, and perceived health advantages, particularly when seafood prices fluctuate or are elevated. For instance, in 2024, while beef prices saw some volatility, chicken remained a consistently affordable option for many households, directly impacting consumer choices away from seafood.

The burgeoning plant-based movement is significantly impacting the seafood industry, with substitutes like algae, soy, and pea protein gaining considerable traction. In 2024, sales of plant-based tuna, crab cakes, and shrimp alternatives have witnessed robust growth, presenting a direct competitive threat to traditional seafood products.

Furthermore, cultivated seafood is emerging as a potent future substitute. This innovative approach promises a consistent and sustainable protein source, potentially disrupting the market by offering an alternative that bypasses traditional fishing and farming methods.

Farmed seafood, particularly salmon and shrimp, presents a substantial threat to Trident Seafoods' wild-caught products. Aquaculture operations can provide a more predictable supply and often at a more competitive price point, making them attractive alternatives for consumers and restaurants. For instance, global aquaculture production reached approximately 132 million metric tons in 2022, a significant portion of which directly competes with wild fisheries.

Price Sensitivity and Volatility

The threat of substitutes for Trident Seafoods is amplified by significant price sensitivity and inherent volatility in wild-caught seafood markets. Prices can fluctuate dramatically based on seasonal availability, fishing quotas set by regulatory bodies, and even unpredictable environmental factors impacting catch sizes. For instance, a poor salmon run in 2023 led to higher prices for consumers and commercial buyers alike.

This price instability makes alternative protein sources, such as poultry, beef, or plant-based options, increasingly appealing, especially for budget-conscious consumers and large-scale food service providers. Furthermore, the growing availability and consistent pricing of frozen or shelf-stable seafood products present a direct substitute that bypasses the supply chain risks associated with fresh, wild-caught varieties.

- Price Volatility: Wild-caught seafood prices are subject to sharp swings due to seasonality and regulation.

- Substitute Attractiveness: Stable-priced alternatives like poultry, beef, and plant-based proteins gain appeal.

- Frozen/Shelf-Stable Seafood: These offer a consistent price point and reduced supply chain risk compared to fresh wild-caught options.

- Consumer Behavior: Cost-conscious buyers and large purchasers are more likely to switch to substitutes when prices rise.

Convenience and Product Form

The rise of convenient protein options presents a significant threat. Ready-to-cook or shelf-stable seafood and non-seafood items cater to consumers seeking quick meal solutions. For instance, the global ready-to-eat food market was projected to reach over $200 billion by 2024, highlighting this trend.

This shift away from fresh seafood, which demands more preparation time, means consumers might opt for alternatives that fit busy lifestyles. The convenience factor can outweigh the perceived benefits of fresh seafood for a growing segment of the population.

- Convenient Protein Market Growth: The global market for convenient protein products is expanding rapidly, driven by consumer demand for ease and speed in meal preparation.

- Consumer Preference Shift: An increasing number of consumers are prioritizing quick and nutritious meal solutions, favoring pre-packaged and ready-to-cook options over those requiring extensive preparation.

- Impact on Fresh Seafood: This trend directly impacts traditional fresh seafood sales, as consumers may switch to more convenient substitutes, potentially reducing demand for less processed options.

The threat of substitutes for Trident Seafoods is substantial, encompassing other animal proteins, plant-based alternatives, and even cultivated seafood. Price volatility in wild-caught seafood, driven by factors like seasonal availability and fishing quotas, makes alternatives like chicken and beef more appealing, especially in 2024 when chicken remained a cost-effective choice for many. The growing plant-based movement is also a significant factor, with products mimicking seafood experiencing robust growth. Furthermore, farmed seafood, offering predictable supply and competitive pricing, directly challenges Trident's wild-caught offerings.

| Substitute Category | Key Characteristics | Competitive Impact | 2024 Relevance |

|---|---|---|---|

| Other Animal Proteins | Price, convenience, perceived health benefits | Direct competition for consumer protein spend | Chicken remained affordable, impacting seafood choice |

| Plant-Based Alternatives | Mimicry of seafood, sustainability appeal | Growing market share, direct threat to traditional seafood | Robust growth in plant-based tuna, crab cakes, shrimp |

| Farmed Seafood | Predictable supply, competitive pricing | Challenges wild-caught products on consistency and cost | Global aquaculture production significant and growing |

| Convenience Foods | Ready-to-cook/eat, time-saving | Appeals to busy lifestyles, reducing demand for fresh seafood prep | Global ready-to-eat market projected over $200 billion by 2024 |

Entrants Threaten

Entering the wild-caught seafood industry, especially for a vertically integrated operation like Trident Seafoods, demands immense capital. Think about the cost of specialized fishing vessels, state-of-the-art processing facilities, and an extensive cold chain network for global distribution. These upfront expenses create a formidable barrier for any new player looking to compete.

New entrants in the seafood industry, particularly for companies like Trident Seafoods, face significant barriers due to strict regulatory and quota systems. These include complex and constantly evolving fishing quotas, stringent environmental regulations, and rigorous food safety standards that require substantial investment and expertise to navigate. For instance, in 2024, the total allowable catch (TAC) for many key species remains tightly controlled, with a significant portion already allocated to established players.

Gaining access to essential fishing rights and quotas is a major hurdle. These rights are often held by incumbent companies with long-standing relationships and substantial capital, making it prohibitively expensive and difficult for newcomers to acquire them. This scarcity and high cost of entry effectively limit new participation and protect existing market share.

Trident Seafoods benefits from deeply entrenched distribution networks, a critical barrier for potential new entrants. These established global supply chains, honed over decades, provide efficient and reliable access to markets worldwide. For instance, in 2024, Trident's extensive logistics infrastructure allows them to service a vast array of retail and foodservice clients, a feat that would demand immense capital and time for any newcomer to replicate.

Furthermore, Trident's recognized brand equity and strong customer loyalty represent a significant hurdle. Building comparable market trust and brand recognition in the competitive seafood industry requires substantial investment in marketing and a proven track record of quality and reliability. New entrants would face the daunting task of not only matching product quality but also overcoming consumer preference for established, trusted brands like Trident's.

Expertise and Experience

The seafood industry requires deep expertise, particularly in areas like wild-catch fishing, advanced processing, and maintaining the cold chain. This specialized knowledge acts as a significant barrier, making it tough for newcomers to compete effectively.

New entrants face a steep learning curve due to the inherent complexities and risks involved in managing wild-caught resources. For instance, understanding and navigating international fishing quotas and regulations, which are constantly evolving, demands significant experience.

Trident Seafoods benefits from decades of accumulated expertise, which translates into operational efficiencies and a strong reputation. This established know-how is not easily replicated by potential new competitors entering the market.

- Specialized Knowledge: Expertise in wild-catch fishing, processing, and cold chain management.

- Operational Challenges: Steep learning curve and risks associated with wild resources.

- Regulatory Navigation: Experience in understanding and complying with international fishing laws.

- Reputational Advantage: Decades of accumulated expertise foster trust and efficiency.

Market Saturation and Competition

The global seafood market is already a crowded space, making it tough for newcomers to break in. Established companies have strong relationships with suppliers and distributors, creating significant barriers for any new entrant trying to gain a foothold.

In 2024, the seafood industry continues to grapple with intense competition. Many companies are operating with high inventory levels, which often leads to aggressive pricing strategies. This environment makes it particularly challenging for new entrants to compete on price and secure profitable market share.

- High Competition: The seafood market is characterized by a large number of existing players, both large multinational corporations and smaller regional businesses.

- Price Sensitivity: Current market conditions, including high inventory levels, often result in price wars, making it difficult for new entrants to establish a profitable pricing structure.

- Established Networks: Existing companies benefit from long-standing relationships with suppliers, retailers, and logistics providers, which are difficult and costly for new entrants to replicate.

- Capital Requirements: Entering the seafood industry often requires substantial capital investment in fishing fleets, processing facilities, cold chain logistics, and regulatory compliance, posing a significant hurdle for potential new competitors.

The threat of new entrants in the wild-caught seafood industry, particularly for a company like Trident Seafoods, is generally low due to significant barriers. These include the immense capital required for specialized vessels and processing facilities, stringent regulatory environments with complex quotas, and the difficulty in acquiring essential fishing rights. Established players also benefit from deeply entrenched distribution networks and strong brand equity, making it challenging for newcomers to gain market access and customer trust.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High costs for vessels, processing plants, and cold chain infrastructure. | Significant financial hurdle, limiting the number of potential entrants. |

| Regulatory Environment | Complex fishing quotas, environmental laws, and food safety standards. | Requires substantial investment in compliance and expertise to navigate. |

| Access to Resources | Difficulty in obtaining fishing rights and quotas, often held by incumbents. | Prohibitively expensive and time-consuming for new players to secure. |

| Distribution & Brand | Established networks and strong customer loyalty built over decades. | New entrants struggle to match market reach and consumer trust. |

Porter's Five Forces Analysis Data Sources

Our Trident Seafoods Porter's Five Forces analysis is built upon a foundation of publicly available financial reports, industry-specific market research from firms like IBISWorld, and news from trade publications to capture the competitive landscape.