Trident Seafoods Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Trident Seafoods Bundle

Explore Trident Seafoods' strategic positioning through its BCG Matrix, identifying potential Stars, Cash Cows, Dogs, and Question Marks within its diverse product portfolio. This initial glimpse highlights key areas for growth and resource allocation.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix report. Gain access to detailed quadrant placements, actionable insights, and a clear roadmap for optimizing Trident Seafoods' market strategy and investment decisions.

Stars

Trident Seafoods is making significant strides in the value-added wild Alaska pollock market, evidenced by their substantial contracts with the USDA for processed items. This sector is experiencing robust growth, fueled by consumer preferences for convenient, healthy, and sustainably sourced protein. Their introduction of innovative products like 'Wild Alaska Pollock Country Style Bites' highlights a strategic move into categories with high growth and market share potential, leveraging their strong supply chain.

Trident Seafoods' focus on branding its wild Alaska seafood as sustainable and high-quality taps into a significant consumer shift towards ethically sourced food. This strategy positions their products favorably in a market segment that values and is willing to pay more for verified sustainability, a trend that has seen considerable growth in recent years.

The company's investment in a packaging redesign explicitly communicates these sustainable attributes, aiming to capture the attention of conscientious consumers. This move supports their branded sustainable seafood lines, which are likely to be Stars within the BCG matrix due to their strong market position in a growing, premium segment.

Continued investment in marketing and obtaining relevant sustainability certifications will be crucial for Trident to maintain and strengthen its leadership in this expanding market. For instance, the global sustainable seafood market was valued at approximately $20.3 billion in 2023 and is projected to grow, underscoring the strategic importance of Trident's branding efforts.

Trident Seafoods' Wild Alaska Premium Sockeye Salmon products, like the Hatch Chile Burger, represent a strategic move into a high-value niche within the generally robust salmon market. This focus on premium offerings, particularly sockeye from areas like Bristol Bay where Trident has a strong presence, taps into consumer demand for superior quality and taste.

The company's investment in these specialized products is designed to capture a segment of the market that offers higher profit margins and strong growth potential, differentiating Trident from competitors selling more commoditized salmon. This approach aims to bolster its market position by emphasizing unique, quality-driven items rather than simply volume.

Global Foodservice & Institutional Products

Trident Seafoods' Global Foodservice & Institutional Products division is a significant player, offering a wide array of items like heat-and-serve options and pre-portioned fillets. This segment benefits from consistent demand within the foodservice industry, a market that saw global revenue projected to reach approximately $3.5 trillion in 2024, according to industry analysts.

As a vertically integrated company, Trident leverages its control over the supply chain to deliver large volumes of diverse, high-quality seafood to these channels, securing a substantial market share. Their expertise in managing these specialized distribution networks, especially for convenient product formats, positions this segment as a Star in the BCG matrix. The company's commitment to efficient operations and strong client relationships is key to sustaining its growth in this area.

- Market Growth: The global foodservice market is expected to continue its upward trajectory, with convenience and quality being key drivers.

- Trident's Advantage: Vertical integration allows for cost control and consistent quality, vital for institutional buyers.

- Product Focus: Heat-and-serve and portion-controlled items cater directly to the efficiency needs of foodservice operations.

- Strategic Importance: This segment's stable demand and Trident's strong market position make it a core growth engine.

Advanced Processing Technologies for Efficiency

Trident Seafoods is making significant investments in upgrading its Alaska processing plants. These upgrades focus on enhancing efficiency and sustainability by incorporating advanced technology. For instance, the company is exploring cutting-edge freezing methods and environmentally conscious packaging solutions to minimize waste and extract maximum value from its seafood catch.

These technological advancements are not just about improving current operations; they are about positioning Trident at the leading edge of industry innovation. This focus on innovation is crucial for gaining a competitive edge and reducing operational costs in a dynamic market. Such strategic investments in advanced processing capabilities align with the characteristics of a Star in the BCG matrix, signaling strong potential for future growth and market leadership.

- Investment in Modernization: Trident continues to invest in upgrading its Alaska facilities.

- Efficiency and Sustainability Focus: New technologies aim to reduce waste and maximize value.

- Innovation Driver: Advanced processing positions Trident for competitive advantage and cost reduction.

- Star Classification: These investments indicate a strategic move towards a high-growth, market-leading position.

Trident Seafoods' branded Wild Alaska Pollock products are a prime example of a Star in their BCG matrix. This segment benefits from high market growth driven by consumer demand for convenient, sustainable, and healthy protein options. Their strategic focus on innovative products like Country Style Bites and USDA contracts solidifies their strong market share in this expanding category.

The company's premium Wild Alaska Sockeye Salmon offerings, such as the Hatch Chile Burger, also represent Stars. These high-value niche products tap into a growing consumer preference for superior quality and taste, allowing Trident to command higher profit margins and differentiate itself from commoditized alternatives.

Trident's Global Foodservice & Institutional Products division is another Star. This segment enjoys consistent demand within the large foodservice market, projected to reach approximately $3.5 trillion globally in 2024. Trident's vertical integration and expertise in delivering diverse, high-quality seafood efficiently to these channels secure its substantial market share.

Furthermore, Trident's ongoing investments in upgrading its Alaska processing plants with advanced technology for efficiency and sustainability position its processing capabilities as Stars. These strategic moves are crucial for gaining a competitive edge and reducing operational costs in a dynamic market.

| Trident Seafoods' Stars (BCG Matrix) | Market Growth | Market Share | Trident's Position | Key Drivers |

|---|---|---|---|---|

| Wild Alaska Pollock (Branded) | High | Strong | Market Leader | Consumer demand for convenience, sustainability, health |

| Wild Alaska Sockeye Salmon (Premium) | High | Growing | Differentiated Player | Demand for premium quality, taste, niche products |

| Global Foodservice & Institutional | Moderate to High | Substantial | Key Supplier | Consistent demand, vertical integration, efficient delivery |

| Advanced Processing Capabilities | High | Emerging | Innovator | Investment in technology, efficiency, sustainability |

What is included in the product

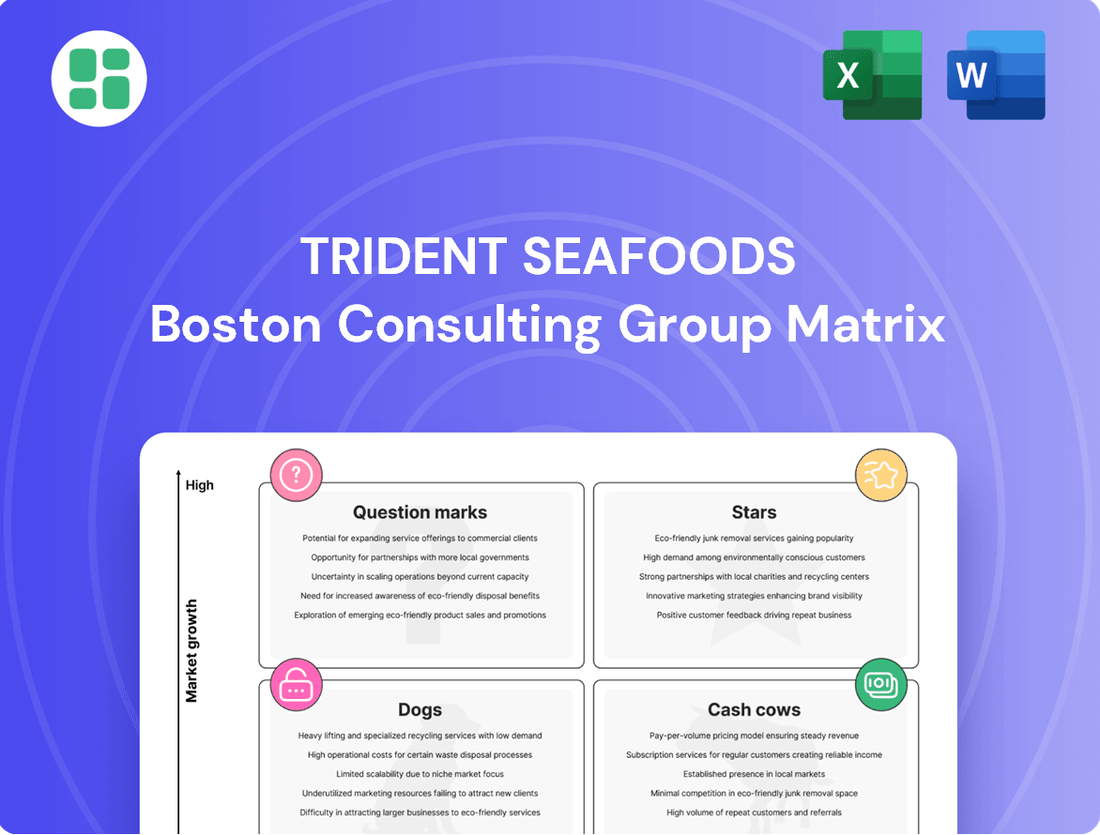

Trident Seafoods' BCG Matrix showcases its product portfolio, identifying high-growth, high-share Stars and stable Cash Cows, alongside low-share Question Marks and Dogs.

The analysis guides strategic decisions on investing in Stars, milking Cash Cows, developing Question Marks, or divesting Dogs.

A clear BCG Matrix visual for Trident Seafoods simplifies strategic decisions, easing the pain of resource allocation by highlighting Stars, Cash Cows, Question Marks, and Dogs.

Cash Cows

Trident Seafoods is a major player in the wild Alaska pollock market, especially with its fillets and blocks. These are considered commodity products, meaning they are largely undifferentiated and sold based on price and volume. The company's facilities, like the massive Akutan plant, process enormous quantities of pollock, making it a cornerstone of their business.

This segment is a classic cash cow for Trident Seafoods. The market for pollock fillets and blocks is mature, with demand remaining strong and predictable, particularly from institutional buyers and wholesalers. Trident's significant market share and efficient, large-scale processing operations allow them to generate consistent, high cash flow from these products.

Because wild Alaska pollock fillets and blocks are established products with a steady customer base, they don't require heavy marketing or promotional spending. This reliability makes them a dependable source of capital, funding other ventures within Trident Seafoods. In 2023, Alaska pollock remained a significant portion of the U.S. seafood market, with production volumes consistently high.

Trident Seafoods' canned wild Alaska salmon, with significant production historically in places like Cordova, falls into the cash cow category of the BCG matrix. This product line benefits from a well-established market and consistent consumer demand, ensuring stable and predictable revenue streams for the company. While the growth potential for canned salmon is modest, its mature status means it generates substantial profits with minimal investment.

Trident Seafoods' surimi seafood products, exemplified by the Louis Kemp brand, represent a classic Cash Cow within their BCG Matrix. As North America's largest producer, Trident holds a significant market share in this mature, low-growth segment.

The consistent demand for brands like Louis Kemp Crab Delights, backed by a loyal consumer base, ensures a steady revenue stream. In 2024, the surimi seafood market, while not experiencing explosive growth, continued to offer stable demand, with industry reports indicating a steady, albeit modest, annual growth rate of around 2-3% for value-added seafood products.

The high annual capacity and operational efficiency of Trident's surimi facilities, particularly the Motley, MN plant, translate into substantial and reliable cash flow. This generated income is crucial for funding investments in other, more dynamic parts of Trident's broader seafood portfolio.

Primary Processed Wild Alaska Cod

Trident Seafoods processes substantial quantities of wild Alaska cod, a well-established whitefish with steady demand in mature markets.

Their fully integrated model, covering everything from catching the fish to initial processing, secures a strong position in this commodity sector. This means they have a significant slice of the pie when it comes to basic cod products.

The cod segment is a reliable generator of funds for Trident. Because the market is stable and their production of standard cod items is efficient, they don't need to spend a lot on expanding their reach. This consistent cash flow is vital for supporting the company's broader business activities and overall financial health.

Here's a snapshot of why cod is a cash cow:

- Consistent Demand: Wild Alaska cod is a staple, ensuring a predictable sales volume.

- Vertical Integration: Trident's control over the supply chain leads to cost efficiencies and a higher market share.

- Mature Market: The established nature of the cod market means lower marketing costs and predictable revenue streams.

- Cash Generation: This segment provides a stable, reliable source of cash flow with minimal investment required for growth.

Integrated Fleet Operations & Raw Material Supply

Trident Seafoods' integrated fleet operations and raw material supply function as a significant cash cow. The company's ownership and partnerships with a substantial fleet of fishing vessels, coupled with strategically positioned primary processing plants, guarantee a steady and managed inflow of wild-caught seafood. This vertical integration is a key differentiator, enabling Trident to secure raw materials efficiently and at scale.

While not a direct product, the smooth functioning of this integrated system generates considerable cost efficiencies and supports high-volume processing for Trident's main offerings. This operational strength acts as a vital engine for cash generation within an established industry segment.

Key aspects of this cash cow include:

- Controlled Supply Chain: Ownership of fishing vessels and processing facilities provides direct control over raw material sourcing and quality.

- Economies of Scale: Operating a large, integrated fleet allows for significant cost savings per unit of seafood processed.

- Market Stability: Consistent access to raw materials helps buffer against price volatility and ensures reliable product availability for customers.

- Operational Efficiency: Streamlined logistics from catch to processing minimize waste and maximize throughput, contributing directly to profitability.

Trident Seafoods' wild Alaska pollock fillets and blocks are a prime example of a cash cow. This mature market segment benefits from consistent demand, particularly from institutional buyers. Trident's substantial market share and efficient, large-scale processing, such as at its Akutan plant, ensure high and predictable cash flow with minimal need for increased investment.

The company's surimi seafood products, notably under the Louis Kemp brand, also function as cash cows. As North America's leading producer, Trident dominates this low-growth but stable market. The consistent demand from a loyal consumer base, coupled with high operational efficiency in facilities like Motley, MN, generates substantial, reliable cash flow essential for funding other business areas.

Wild Alaska cod products represent another significant cash cow for Trident Seafoods. The company's vertically integrated model, from catching to processing, secures a strong position in this stable, commodity market. This efficiency translates into predictable revenue streams with low marketing costs, providing vital capital for the company's overall operations.

Trident's integrated fleet operations and raw material supply chain act as a crucial cash cow. By controlling its fishing vessels and processing plants, Trident ensures efficient, scaled raw material sourcing. This operational strength, generating significant cost efficiencies, provides a stable and reliable source of cash flow within established market segments.

| Product Segment | BCG Category | Key Characteristics | Estimated 2024 Contribution (Illustrative) |

| Wild Alaska Pollock Fillets/Blocks | Cash Cow | Mature market, high volume, efficient processing, stable demand | Significant revenue and cash flow generator |

| Surimi Seafood (Louis Kemp) | Cash Cow | Market leader, loyal customer base, stable demand, efficient operations | Reliable cash flow, supports other investments |

| Wild Alaska Cod | Cash Cow | Integrated supply chain, stable commodity market, low marketing costs | Consistent cash generation, essential for operations |

| Integrated Fleet & Supply Chain | Cash Cow | Cost efficiencies, economies of scale, market stability, operational strength | Underpins profitability across product lines |

Preview = Final Product

Trident Seafoods BCG Matrix

The Trident Seafoods BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This comprehensive analysis, meticulously prepared by industry experts, contains no watermarks or demo content, ensuring you get a professional, ready-to-use strategic tool for immediate application in your business planning and decision-making processes.

Dogs

Trident Seafoods divested several seasonal processing plants in Alaska during 2024, including locations in Petersburg, Ketchikan, False Pass, and Kodiak. This strategic move signals that these particular operations were likely underperforming or no longer fit the company's evolving long-term plans.

These divestitures are a direct response to challenging market conditions, characterized by declining demand and an oversupply in the seafood industry. The plants were consuming valuable capital without generating adequate returns, prompting their sale to improve overall financial health.

The primary goal behind selling these seasonal facilities is to streamline Trident Seafoods' operational footprint and significantly reduce associated costs. This allows the company to focus resources on more profitable and strategically aligned ventures.

Trident Seafoods' decision to likely forgo processing crab at its St. Paul facility for both the 2024 and 2025 seasons, even with a surprise snow crab fishery opening, signals significant distress in this niche operation. This move strongly suggests the St. Paul crab processing segment fits the profile of a Dog in the BCG Matrix. The company's withdrawal points to a business unit with low market share and low growth prospects, unable to generate enough profit to warrant continued investment.

Certain undifferentiated commodity seafood products within Trident's portfolio likely fall into the Dogs category, especially those grappling with intense foreign competition and waning global demand. The company's CEO has highlighted that declining demand, coupled with excess supply and foreign competition, has suppressed prices and eroded profit margins. For instance, in 2024, the global cod market, a commodity seafood, experienced significant price volatility due to increased imports from countries with lower production costs, impacting Trident's potential profitability in this segment.

Aging or Inefficient Processing Lines

Aging or inefficient processing lines represent a significant challenge for Trident Seafoods, potentially categorizing them as Dogs within the BCG Matrix. These are operations that have become outdated, leading to higher operating costs and lower output quality or volume compared to newer facilities. Trident's strategic decision to divest from older facilities and postpone new construction projects suggests a focus on shedding these less productive assets. For instance, a processing line that requires extensive manual intervention or struggles to meet current food safety standards would be a prime example.

These underperforming assets often come with substantial maintenance expenses and a higher susceptibility to breakdowns, directly impacting profitability. In 2023, the seafood processing industry faced increased pressure from rising energy costs and labor shortages, exacerbating the challenges for older, less automated facilities. Trident's approach likely involves identifying these lines and making strategic decisions about their future, which could include modernization, sale, or closure to streamline operations and reallocate capital to more promising ventures.

- High Maintenance Costs: Older machinery often incurs disproportionately high repair and upkeep expenses.

- Lower Yields: Inefficient lines may produce less usable product from the same amount of raw material.

- Increased Labor Requirements: Outdated technology often demands more manual labor, driving up operational costs.

- Reduced Competitiveness: Inability to meet modern processing standards can hinder market access and pricing power.

Underperforming International Market Segments

Underperforming international market segments for Trident Seafoods, likely falling into the Dogs category of the BCG Matrix, represent areas where the company struggles against strong local rivals or has not established a solid foothold. These could include specific regions in Asia or Europe where Trident's market share is minimal and growth prospects are dim due to established competitors or challenging trade environments.

Trident's stated focus on streamlining operations and addressing the realities faced by U.S. seafood producers in global markets directly points to a need to re-evaluate these weaker international segments. For instance, if Trident's presence in a particular European market shows declining sales and a low market share, it would be a prime candidate for divestment or a significant reduction in investment. In 2024, the global seafood market faced continued volatility, with some regions experiencing slower demand growth than others, impacting companies with diversified international portfolios.

- Low Market Share: Segments where Trident holds a negligible percentage of the total market.

- Limited Growth Prospects: Regions with stagnant or declining demand for seafood products, often due to intense local competition.

- Strategic Re-evaluation: These segments may be candidates for divestment or reduced investment to reallocate resources to more promising areas.

- Operational Realities: Trident's acknowledgment of challenges in global markets underscores the need to address underperforming international operations.

Trident Seafoods' seasonal processing plants divested in 2024, like those in Petersburg and Kodiak, likely represent Dog segments. These operations, characterized by low market share and growth, were sold due to underperformance and high costs, aligning with the BCG Matrix definition of Dogs.

The St. Paul crab processing segment, with its potential closure for 2024-2025 seasons, strongly indicates a Dog. This unit struggles with profitability and market prospects, prompting Trident to withdraw investment, a common strategy for such business units.

Undifferentiated commodity seafood products facing intense foreign competition and declining demand also fit the Dog profile. For instance, the cod market's 2024 price volatility due to lower-cost imports highlights the challenges these segments face in generating consistent profits.

Aging, inefficient processing lines and underperforming international market segments are further examples of Trident's potential Dogs. These areas require significant capital for modernization or are candidates for divestment to improve overall financial health and focus on more promising ventures.

Question Marks

Trident Seafoods' Unalaska "Plant of the Future" is currently categorized as a Question Mark in the BCG Matrix. The groundbreaking has been pushed to 2025, with operations slated for 2028, due to challenging global market conditions. This ambitious project, representing a substantial investment in advanced processing, has a zero current market share as it is not yet operational.

The uncertainty surrounding global market recovery and Trident's ability to implement its planned efficiencies positions this high-potential investment as a Question Mark. Its future success will depend heavily on market rebound and the plant’s ability to achieve its projected value creation.

Trident Seafoods is strategically introducing new retail products featuring updated packaging, aligning with a broader industry trend towards convenient and healthier options like ready-to-eat and air-fried seafood. This innovation taps into a high-growth market driven by changing consumer demands for quick meal solutions.

While these new formats represent a promising avenue, they are likely positioned as Question Marks within Trident's BCG Matrix due to their nascent market share. For instance, the global ready-to-eat food market was valued at approximately $177.1 billion in 2023 and is projected to grow significantly, highlighting the potential, but also the competitive landscape.

Significant investment in marketing, brand building, and securing robust distribution channels will be crucial for these product lines. The objective is to increase their market share, transforming them from Question Marks into Stars, thereby capturing a larger portion of this expanding market segment.

Trident Seafoods, while established in salmon, pollock, cod, and crab, possesses the infrastructure to explore niche species markets. These emerging markets, such as certain underutilized whitefish or specialty shellfish, represent potential Question Marks in their BCG matrix. Entering these areas offers significant growth opportunities, but current market share is minimal, demanding careful market research and development investment.

Advanced Sustainability and Traceability Technologies

Trident Seafoods is actively investing in advanced technologies like blockchain to enhance seafood traceability and sustainability. This commitment reflects a growing market demand for ethically sourced and transparently produced seafood, a segment projected for significant expansion. For instance, the global sustainable seafood market was valued at approximately USD 55 billion in 2023 and is expected to grow at a CAGR of over 6% through 2030.

These technological advancements, while crucial for long-term market positioning, represent a nascent stage for Trident's specific offerings. The upfront investment in developing and implementing these sophisticated systems is substantial, impacting immediate returns. However, these initiatives are strategically vital for capturing a larger share of the increasingly eco-conscious consumer base.

- Market Growth: The demand for traceable and sustainable seafood is a rapidly expanding sector, with global market value reaching approximately USD 55 billion in 2023.

- Technological Investment: Implementing blockchain and other advanced data solutions requires significant upfront capital, impacting short-term profitability.

- Strategic Importance: These technologies are essential for Trident to differentiate its products and appeal to environmentally aware consumers, securing future market share.

- Competitive Landscape: While the technology is promising, Trident's current market share derived specifically from these advanced sustainability features is likely modest, indicating a Stars or Question Marks position within the BCG matrix, depending on market growth and relative market share.

Strategic Partnerships for Energy Reduction and Efficiency

Trident Seafoods is actively pursuing strategic partnerships focused on energy reduction and efficiency. A key example is their involvement in demand response programs with major energy providers like Enel North America and Puget Sound Energy (PSE). These collaborations aim to lower overall energy consumption across Trident's operations, directly impacting operational costs and contributing to sustainability targets.

While these energy efficiency initiatives are not directly tied to immediate revenue generation or market share expansion, their strategic importance is growing. For instance, in 2024, demand response programs can offer significant savings; PSE's commercial and industrial customers participating in their programs can earn incentives for reducing energy use during peak demand periods. These savings can improve Trident's bottom line, making them more competitive.

The success of these partnerships, though not immediately visible in market share figures, could lead to substantial indirect advantages. Improved operational efficiency and enhanced sustainability credentials can bolster Trident's brand reputation. This can attract environmentally conscious consumers and investors, potentially opening new avenues for growth and strengthening their position in the market over the long term.

- Demand Response Programs: Partnerships with Enel North America and PSE to reduce energy consumption.

- Cost Reduction: Initiatives directly contribute to lower operational expenses through energy savings.

- Sustainability Goals: Align with broader corporate objectives for environmental responsibility.

- Indirect Market Advantages: Potential for enhanced competitiveness and brand reputation through improved efficiency and sustainability.

New retail products featuring updated packaging, like ready-to-eat and air-fried seafood, are positioned as Question Marks. The global ready-to-eat food market was valued at approximately $177.1 billion in 2023, showing significant growth potential but also intense competition. These innovations require substantial marketing and distribution investment to gain market share and transition from Question Marks to Stars.

BCG Matrix Data Sources

Our Trident Seafoods BCG Matrix is built on a foundation of robust data, incorporating financial performance, market share analysis, and industry growth rates.