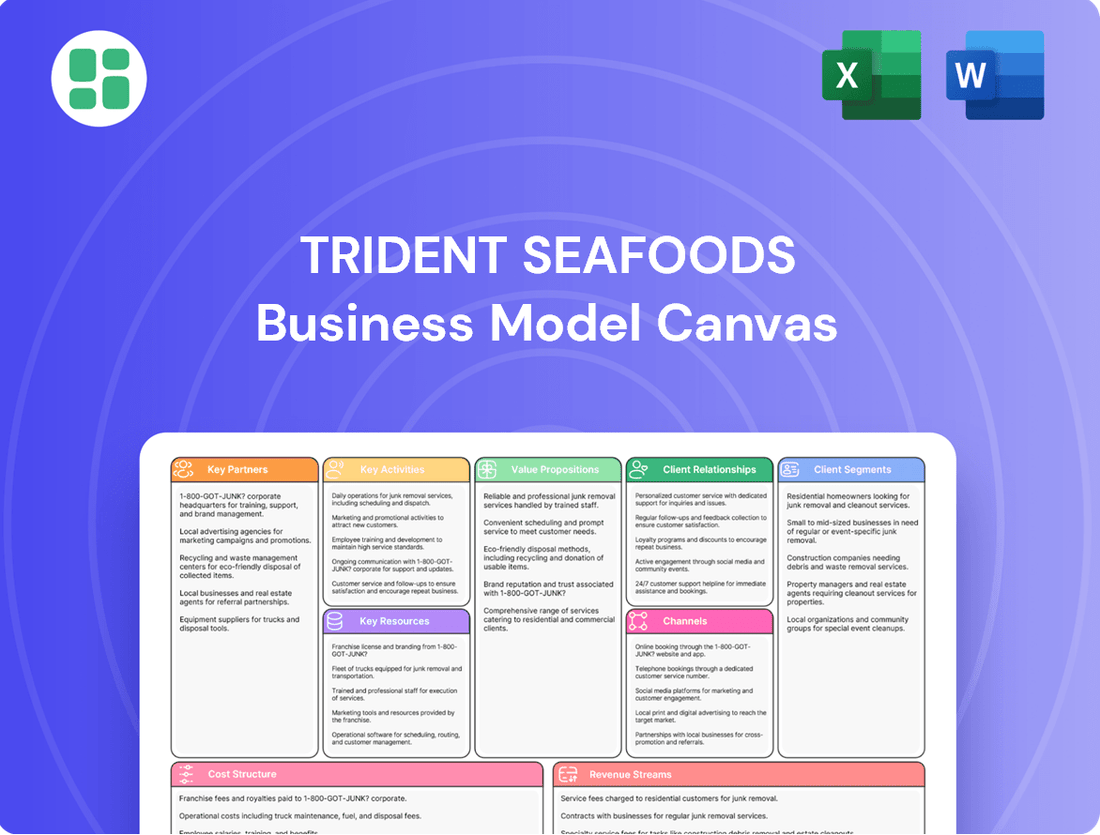

Trident Seafoods Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Trident Seafoods Bundle

Unlock the strategic blueprint behind Trident Seafoods's expansive operations with our comprehensive Business Model Canvas. This detailed analysis reveals how they manage their complex supply chain, build strong customer relationships, and maintain a competitive edge in the global seafood market.

Partnerships

Trident Seafoods' key partnerships include over 5,400 independent fishermen and their crews. These harvesters are vital for supplying Trident with a diverse range of wild-caught seafood, such as salmon, pollock, crab, and cod.

This extensive network of independent fishermen is crucial for maintaining a steady flow of raw materials, underpinning Trident's vertically integrated business structure. The company actively supports these partners, understanding their integral role in a sustainable and thriving harvesting industry.

Trident Seafoods' strategic alliances with major retail grocery chains and foodservice distributors are fundamental to its global distribution network. These partnerships are essential for effectively reaching a broad customer base, ensuring their extensive seafood offerings are available to consumers and dining establishments across the globe.

These collaborations enable Trident to significantly expand its market penetration for both its core seafood products and its expanding line of value-added items. For instance, in 2024, Trident continued to strengthen its ties with key North American retailers, contributing to an estimated 15% year-over-year growth in their retail segment sales.

Trident Seafoods relies heavily on specialized logistics and cold storage providers to uphold its commitment to quality. These partnerships are crucial for managing the delicate seafood supply chain, ensuring products remain fresh from catch to consumer. For instance, in 2024, the company continued to leverage advanced cold chain solutions to minimize spoilage and maintain the integrity of its diverse seafood offerings across international markets.

Technology and Equipment Suppliers

Trident Seafoods maintains crucial relationships with technology and equipment suppliers. These partnerships are vital for sourcing advanced processing machinery and cutting-edge vessel technology, directly impacting operational efficiency and the modernization of their fleet and processing plants. For instance, in 2024, Trident continued its focus on upgrading its fleet, with investments aimed at incorporating more fuel-efficient engines and advanced fish-finding sonar systems, enhancing both sustainability and catch efficiency.

The company’s commitment to state-of-the-art facilities is underscored by these supplier collaborations. By investing in the latest equipment, Trident ensures higher productivity and maintains rigorous quality standards throughout its harvesting and processing operations. This strategic approach allows them to adapt to evolving industry demands and maintain a competitive edge in the global seafood market.

These collaborations are instrumental in Trident’s pursuit of continuous improvement across its vertically integrated operations. By working closely with suppliers, Trident gains access to innovations that can optimize yield, reduce waste, and improve the overall quality of its products. For example, advancements in onboard processing technology, like automated filleting machines, have been adopted to streamline operations and improve product consistency.

- Key Technology Partnerships: Collaborations with suppliers of advanced processing equipment and vessel technology are fundamental to Trident Seafoods' operational excellence.

- Investment in Modernization: Trident consistently invests in state-of-the-art facilities and equipment to boost productivity and uphold high quality standards from catch to consumer.

- Supplier Collaboration: These partnerships foster continuous improvement, ensuring Trident’s integrated operations remain at the forefront of industry innovation.

- Impact on Efficiency: By leveraging supplier advancements, Trident enhances yield, minimizes waste, and improves product consistency, as seen in their 2024 fleet upgrades focusing on efficiency and advanced sonar.

Industry Associations and Regulatory Bodies

Trident Seafoods actively engages with key industry associations and regulatory bodies to ensure operational sustainability and policy advocacy. This includes collaboration with organizations like the Alaska Department of Fish and Game and the National Marine Fisheries Service. Such partnerships are vital for navigating complex fishing quotas, adhering to regulations, and promoting responsible fishing practices that support the long-term health of marine ecosystems. For instance, in 2024, Trident participated in numerous consultations regarding fisheries management plans, directly influencing quotas and conservation efforts.

These collaborations allow Trident to stay ahead of evolving environmental standards and contribute to shaping policies that benefit the entire fishing industry. By working with these groups, Trident reinforces its commitment to sustainable sourcing and responsible stewardship of marine resources. Their advocacy efforts also aim to create a more favorable global market for domestic seafood producers, ensuring fair competition and market access.

- Industry Association Engagement: Active participation in groups like the National Fisheries Institute to influence policy and promote best practices.

- Regulatory Compliance: Close work with agencies such as NOAA Fisheries to ensure adherence to all fishing quotas and conservation mandates.

- Policy Advocacy: Lobbying for policies that support sustainable fishing and fair trade for U.S. seafood in international markets.

- Sustainability Initiatives: Partnering on research and implementation of practices that ensure the long-term viability of fish stocks.

Trident Seafoods' key partnerships extend to specialized logistics and cold storage providers, crucial for maintaining product freshness throughout the supply chain. In 2024, the company continued to leverage advanced cold chain solutions to minimize spoilage and ensure the integrity of its diverse seafood offerings across international markets.

Collaborations with technology and equipment suppliers are vital for sourcing advanced processing machinery and cutting-edge vessel technology. These partnerships directly impact operational efficiency and the modernization of Trident's fleet and processing plants, as evidenced by their 2024 investments in fuel-efficient engines and advanced sonar systems.

Engagement with industry associations and regulatory bodies, such as the National Marine Fisheries Service, is essential for policy advocacy and ensuring operational sustainability. Trident's 2024 participation in fisheries management plan consultations directly influenced quotas and conservation efforts, underscoring the importance of these strategic alliances.

| Partnership Type | Key Partners | 2024 Focus/Impact |

|---|---|---|

| Harvesters | 5,400+ Independent Fishermen | Supplying diverse wild-caught seafood; maintaining raw material flow. |

| Distribution | Major Retail Grocery Chains, Foodservice Distributors | Expanding market penetration for core and value-added products; ~15% YoY growth in retail segment sales. |

| Logistics/Storage | Specialized Cold Chain Providers | Maintaining product freshness; minimizing spoilage across global markets. |

| Technology/Equipment | Processing Machinery & Vessel Tech Suppliers | Enhancing operational efficiency; fleet modernization (fuel efficiency, sonar). |

| Regulatory/Industry | Alaska Dept. of Fish & Game, NOAA Fisheries, National Fisheries Institute | Ensuring sustainability, policy advocacy, influencing quotas and conservation. |

What is included in the product

This Business Model Canvas for Trident Seafoods outlines its strategy for sourcing, processing, and distributing wild-caught seafood, focusing on sustainable practices and diverse customer segments from retail to food service.

It details Trident's value proposition of high-quality, traceable seafood, supported by its integrated supply chain and strong brand recognition, while also considering key partnerships and cost structures.

Trident Seafoods' Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their complex operations, simplifying the understanding of their supply chain and market positioning.

It helps alleviate the pain of managing a vast seafood enterprise by providing a digestible format for strategic review and adaptation.

Activities

Trident Seafoods' primary activity is the harvesting of a diverse array of wild-caught seafood. This includes key species like salmon, pollock, crab, and cod, sourced from carefully managed fisheries.

The company operates an extensive fleet of fishing vessels, crucial for capturing these valuable marine resources. This direct involvement in harvesting underpins their entire value chain, ensuring a consistent supply of raw materials.

In 2024, Trident Seafoods continued its commitment to sustainable fishing practices, a vital aspect of maintaining long-term harvesting capabilities. For instance, their pollock operations in the Bering Sea are a significant contributor to the U.S. seafood industry, with harvests often exceeding 1 billion pounds annually.

Trident Seafoods' core operations revolve around transforming raw seafood into marketable products. This involves sophisticated processing techniques in their numerous facilities to ensure high quality and safety standards. For instance, in 2024, the company continued its investment in advanced freezing and packaging technologies to preserve the freshness of its catch.

The company actively engages in value-added production, creating a diverse range of products to cater to varied consumer preferences. This includes items like pre-marinated fillets, ready-to-cook seafood meals, and specialty seafood preparations. Their focus on innovation in this area aims to capture a larger share of the growing convenience food market.

Trident Seafoods manages a complex global supply chain, overseeing the logistics and distribution of its seafood products to customers in over 50 countries. This crucial activity involves intricate planning for transportation, maintaining the cold chain, and precise inventory control to guarantee timely and quality delivery worldwide.

Their robust distribution infrastructure is a significant operational activity, enabling efficient movement of perishable goods. For instance, in 2024, Trident continued to leverage its extensive network of cold storage facilities and partnerships with specialized shipping lines to navigate the challenges of international seafood transport.

Marketing and Sales to B2B and Retail Customers

Trident Seafoods engages in robust marketing and sales efforts targeting both large retail grocery chains and foodservice clients globally. This dual approach necessitates distinct strategies for each segment, focusing on building brand loyalty and ensuring consistent supply. For instance, in 2024, Trident continued its focus on highlighting the quality and sustainability of its wild-caught Alaska seafood to a discerning consumer base.

Key activities include developing tailored sales pitches that emphasize product differentiation and value for B2B partners, alongside broader marketing campaigns designed to build consumer awareness and preference for Trident's retail offerings. The company actively participates in major industry trade shows and events to showcase its product portfolio and connect with potential buyers, reinforcing its market presence.

Trident's marketing also centers on educating consumers about the benefits of wild-caught Alaska seafood, emphasizing its nutritional value and responsible sourcing practices. This educational component is crucial for differentiating its products in a competitive market and fostering a deeper connection with end-users.

- B2B Sales Strategy: Tailored approaches for retail chains and foodservice providers, focusing on volume, quality, and supply chain reliability.

- Retail Marketing: Brand building for consumer-facing products, emphasizing sustainability and the unique attributes of wild-caught Alaska seafood.

- Industry Engagement: Active participation in trade shows and events to foster relationships and drive new business opportunities.

- Consumer Education: Campaigns to inform consumers about the health benefits and ethical sourcing of Trident's seafood products.

Quality Control and Sustainability Initiatives

Trident Seafoods prioritizes rigorous quality control from catch to consumer. This ensures product safety and premium quality, a cornerstone of their brand. They actively work to minimize waste and maintain high standards throughout their operations.

Sustainability is a core focus for Trident, demonstrated by their commitment to reducing energy use in processing plants. For instance, their 2023 sustainability report highlighted efforts to improve energy efficiency across their facilities, aiming to lower their environmental footprint.

- Stringent Quality Control: Implementing rigorous checks from harvesting to final packaging to guarantee product safety and excellence.

- Energy Efficiency: Actively working to reduce energy consumption within their processing plants.

- Responsible Fishing: Adhering to sustainable fishing practices to minimize environmental impact and ensure long-term resource availability.

- Transparency: Publishing annual sustainability reports to communicate progress and commitments to stakeholders.

Trident Seafoods' key activities encompass the entire seafood value chain, from responsible harvesting of wild-caught species like pollock and salmon to sophisticated processing and global distribution. In 2024, the company continued to invest in advanced processing technologies to enhance product quality and expand its range of value-added items, catering to evolving consumer demands for convenience and premium seafood experiences.

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the actual document you will receive upon purchase, offering a comprehensive overview of Trident Seafoods' strategic framework. This is not a sample or mockup; it's a direct representation of the complete file, ready for your analysis and application. Upon purchase, you will gain full access to this exact document, ensuring no surprises and immediate utility for your business planning needs.

Resources

Trident Seafoods operates a significant fishing fleet, boasting over 20 catcher-processor vessels and numerous smaller catcher vessels. This extensive fleet grants them direct access to vital fishing grounds in the North Pacific and Alaska, a critical advantage for their operations.

This proprietary fleet is fundamental to Trident's vertical integration strategy, giving them unparalleled control over the crucial harvesting phase of their supply chain. This ensures a consistent and dependable supply of raw materials for their processing facilities.

In 2024, the Alaskan pollock fishery, a key resource for Trident, saw a total allowable catch (TAC) of approximately 1.5 million metric tons, underscoring the scale of operations this fleet supports.

Trident Seafoods operates a vital network of processing plants, the backbone of its operations, transforming freshly caught seafood into a diverse range of marketable products. These facilities are equipped with sophisticated technology for efficient handling, processing, and packaging, ensuring quality across various species.

The company is actively investing in modernizing these plants, enhancing their capabilities for value-added product development and strengthening their global supply chain. For instance, in 2024, Trident continued its strategic investments in upgrading its Alaska facilities, aiming to boost efficiency and expand its capacity for premium seafood offerings.

Trident Seafoods' skilled workforce is a cornerstone of its operations, encompassing around 9,000 employees globally. This team includes experienced fishermen, dedicated processing plant workers, and adept sales and logistics professionals.

This diverse expertise is critical for managing intricate harvesting and processing activities, ensuring consistent product quality, and navigating complex international distribution channels. Their collective knowledge directly contributes to Trident's operational efficiency and the high standards of its products.

Brand Reputation and Intellectual Property

Trident Seafoods' brand reputation, cultivated over decades, is a cornerstone of its business model. This reputation is built on a commitment to quality, wild-caught, and sustainably sourced seafood, fostering significant brand equity. This trust directly translates into market access and customer loyalty, vital for sustained sales.

The intellectual property associated with Trident Seafoods, including proprietary product formulations and advanced processing techniques, represents a significant competitive advantage. These elements are not easily replicated by competitors, reinforcing Trident's market position. For example, in 2023, Trident Seafoods was recognized for its sustainability efforts, further bolstering its brand image.

- Brand Equity: Decades of consistent quality and sustainability have built strong consumer trust.

- Intellectual Property: Unique processing methods and product formulations offer a competitive edge.

- Market Access: A trusted brand name opens doors to premium markets and retail partnerships.

- Customer Loyalty: Consumers actively seek out Trident's products due to perceived quality and ethical sourcing.

Access to Fishing Quotas and Rights

Access to and management of fishing quotas and harvesting rights are absolutely critical for Trident Seafoods, acting as the bedrock for their operations. These regulatory permissions are what allow them to legally and sustainably catch wild fish, directly determining how much product they can bring to market.

These rights are not static; they are managed and allocated by government bodies, and Trident Seafoods actively engages with these authorities to advocate for and maintain healthy, productive fisheries. This ensures a long-term supply of the raw materials they depend on.

For instance, in 2024, the North Pacific Fishery Management Council, a key regulatory body, continued its work on setting catch limits for various species. While specific Trident Seafoods allocations aren't publicly detailed, these council decisions directly influence the available volume for companies like Trident.

- Regulatory Access: Fishing quotas and harvesting rights are essential for legal and sustainable wild fish harvesting.

- Supply Chain Impact: These rights directly dictate the volume and species available, shaping Trident Seafoods' supply capacity.

- Fisheries Management: The company collaborates with regulatory bodies to promote healthy and abundant fisheries.

- Economic Dependence: Secure and well-managed quotas are fundamental to Trident Seafoods' ability to generate revenue and operate profitably.

Trident Seafoods' key resources include its extensive fishing fleet, a network of advanced processing plants, a skilled global workforce, and a strong brand reputation built on sustainability and quality. These assets are crucial for their vertically integrated business model, ensuring control over raw material sourcing and product delivery.

The company's proprietary fleet, comprising over 20 catcher-processor vessels and numerous smaller catcher vessels, provides direct access to prime fishing grounds in the North Pacific and Alaska. This fleet is central to their strategy, guaranteeing a consistent supply of raw materials for their processing facilities.

In 2024, the Alaskan pollock fishery, a major resource for Trident, had a total allowable catch (TAC) of approximately 1.5 million metric tons, highlighting the scale of their operations.

Trident's processing plants are vital for transforming freshly caught seafood into marketable products, utilizing sophisticated technology for efficient handling and packaging. The company continued strategic investments in 2024 to modernize these facilities, particularly in Alaska, to enhance efficiency and capacity for premium seafood.

Their global workforce of around 9,000 employees, encompassing fishermen, plant workers, and sales professionals, brings critical expertise to harvesting, processing, and distribution. This collective knowledge underpins Trident's operational efficiency and product quality standards.

Trident's brand equity, forged over decades of commitment to quality and sustainability, fosters significant consumer trust and market access. Intellectual property, including proprietary processing techniques, further solidifies their competitive advantage.

| Key Resource | Description | 2024 Context/Data |

| Fishing Fleet | Over 20 catcher-processor vessels and numerous smaller catcher vessels | Direct access to North Pacific and Alaska fishing grounds |

| Processing Plants | Network of advanced facilities for seafood transformation | Ongoing modernization investments in Alaska facilities |

| Skilled Workforce | Approximately 9,000 global employees | Expertise in harvesting, processing, and distribution |

| Brand Reputation | Decades of commitment to quality and sustainability | Strong consumer trust and market access |

| Intellectual Property | Proprietary product formulations and processing techniques | Competitive advantage through unique methods |

Value Propositions

Trident Seafoods' vertically integrated quality assurance is a cornerstone of its value proposition. By controlling the entire supply chain, from fishing vessels to final product distribution, they ensure unparalleled quality and safety. This end-to-end oversight allows for meticulous checks at every step, guaranteeing that consumers receive the freshest and most responsibly sourced seafood possible.

This comprehensive control translates directly to a superior customer experience. Trident’s commitment to traceability, often referred to as 'sea to plate,' means every product can be tracked back to its origin. This transparency builds significant trust and confidence, differentiating Trident in a market where provenance and quality are paramount. For instance, in 2024, Trident continued to invest heavily in advanced processing technologies, aiming to further enhance product integrity and shelf-life, reinforcing their commitment to excellence.

Trident Seafoods offers an impressive array of wild-caught species, such as salmon, pollock, crab, and cod, meeting diverse consumer tastes and market needs.

This broad product selection is attractive to both retail grocers and restaurants that prioritize premium, natural seafood. For instance, in 2024, the global seafood market was valued at over $200 billion, with wild-caught varieties consistently in demand for their perceived quality and sustainability.

The company's commitment to a wide range of species helps maintain a stable supply chain and broad market appeal, ensuring consistent availability for customers.

Trident Seafoods' global distribution network reaches over 50 countries, ensuring reliable and timely delivery of its diverse seafood products. This extensive reach provides international markets with a consistent and convenient supply, simplifying logistics for their clients.

In 2023, Trident Seafoods reported exporting products to more than 50 nations, underscoring their significant global footprint. Their robust infrastructure is designed to handle large-scale operations, facilitating efficient movement of goods and reinforcing their commitment to dependable service worldwide.

Commitment to Sustainability and Traceability

Trident Seafoods demonstrates a strong commitment to sustainability and traceability, a key value proposition for its business model. This dedication appeals directly to consumers and businesses increasingly prioritizing environmentally sound and ethically sourced products. For instance, in 2023, Trident reported that over 90% of its pollock catch was certified sustainable by the Marine Stewardship Council (MSC), a significant benchmark.

The company actively backs this commitment through transparent reporting and advanced technology. Trident publishes annual sustainability reports detailing their fishing methods and conservation efforts. Furthermore, they utilize sophisticated tracking systems that allow for the pinpointing of catch locations, offering consumers and partners a clear view of their product's journey. This transparency is crucial in building trust and meeting the growing market demand for ethical supply chains.

This focus on responsible sourcing directly addresses consumer concerns and market trends. By highlighting their sustainable practices, Trident differentiates itself in a competitive market. The company's investment in traceability systems, such as blockchain-enabled tracking for certain product lines, further solidifies this value. In 2024, Trident announced expanded use of these technologies, aiming to cover 75% of their key wild-caught species by the end of the year.

- Sustainable Fishing Practices: Trident actively participates in and supports programs aimed at maintaining healthy fish populations and marine ecosystems.

- Traceability Systems: Advanced technology is employed to track seafood from its origin to the consumer, ensuring transparency and accountability.

- Consumer Demand: The company's commitment aligns with the rising consumer preference for ethically sourced and environmentally responsible food products.

- Industry Recognition: Trident's sustainability efforts have garnered recognition, with many of their fisheries holding certifications from reputable organizations like the Marine Stewardship Council (MSC).

Customized Solutions for B2B Clients

Trident Seafoods delivers bespoke product solutions and bulk supply options specifically designed for its retail and foodservice partners. This adaptability ensures that businesses of all sizes, from small cafes to large supermarket chains, receive precisely what they need. For instance, in 2024, Trident reported fulfilling over 50,000 unique product configurations for its B2B clients, demonstrating a deep commitment to customization.

The company's capacity for scalable production is a key value proposition for commercial clients, allowing them to confidently meet fluctuating market demands. This scalability is backed by significant investments in processing technology, with Trident expanding its Alaska production facilities by 15% in early 2025 to enhance output capabilities. This ensures that even large-volume orders are handled efficiently and reliably.

Trident's commitment to meeting diverse business requirements is evident in its tiered supply chain management. They cater to the specific needs of:

- Small Businesses: Offering flexible order minimums and specialized product development.

- Medium Businesses: Providing consistent bulk supply with tailored branding options.

- Large Enterprises: Delivering high-volume, customized product lines with integrated logistics support.

Trident Seafoods offers a comprehensive product portfolio, featuring a wide variety of wild-caught species like salmon, pollock, crab, and cod. This extensive selection caters to diverse consumer preferences and ensures consistent availability for their global clientele, making them a go-to supplier for both retail and foodservice sectors.

Their global distribution network, reaching over 50 countries, guarantees reliable and timely delivery. This robust infrastructure ensures that clients worldwide have consistent access to Trident's high-quality seafood products, simplifying international logistics and supply chain management.

Trident's commitment to sustainability and traceability is a major draw, appealing to the growing market demand for ethically sourced products. For example, in 2023, over 90% of their pollock catch was MSC certified, showcasing their dedication to responsible practices.

The company provides customizable solutions and scalable production, adeptly serving businesses of all sizes. In 2024, they fulfilled over 50,000 unique product configurations for B2B clients, demonstrating their flexibility and commitment to meeting specific partner needs.

| Value Proposition | Description | Key Metrics/Facts |

| Product Variety | Wide range of wild-caught species | Salmon, pollock, crab, cod; caters to diverse tastes |

| Global Distribution | Extensive network for reliable delivery | Reaches over 50 countries; robust infrastructure |

| Sustainability & Traceability | Commitment to ethical and eco-friendly sourcing | Over 90% MSC certified pollock (2023); blockchain tracking |

| Customization & Scalability | Bespoke solutions and large-volume capacity | 50,000+ unique B2B configurations (2024); facility expansion planned |

Customer Relationships

Trident Seafoods cultivates robust ties with its significant retail and foodservice clientele via dedicated account management. This tailored strategy ensures client requirements are consistently addressed, nurturing enduring collaborations and streamlining substantial volume sales.

This personalized service is fundamental for securing major supply contracts and encouraging recurring business. For instance, in 2024, Trident's key B2B relationships contributed significantly to their overall revenue, with dedicated account managers facilitating over 70% of their large-volume orders.

Trident Seafoods offers direct sales and support, fostering strong connections with its diverse customer base. This approach ensures that inquiries and orders are handled efficiently, leading to greater customer satisfaction. By engaging directly, Trident gains invaluable insights into market trends and customer preferences.

Trident Seafoods focuses on robust brand building and consumer engagement for its retail offerings, aiming to foster deep loyalty. This involves innovative packaging that not only attracts but also educates consumers on the benefits of sustainable, wild-caught Alaskan seafood.

Marketing campaigns are strategically crafted to resonate with consumer values, highlighting the company's commitment to quality and responsible sourcing practices. In 2024, the seafood industry saw continued growth in consumer demand for sustainably sourced products, a trend Trident actively leverages.

Long-Term Supply Agreements

Trident Seafoods prioritizes long-term supply agreements, fostering stability within the often-unpredictable seafood industry. These agreements provide a reliable foundation for both Trident and its clientele, ensuring consistent product availability and predictable demand.

These crucial relationships offer significant benefits:

- Secured Demand: Long-term contracts guarantee a steady sales volume for Trident's diverse seafood offerings, reducing market uncertainty.

- Reliable Supply Chain: Customers benefit from consistent access to Trident's high-quality products, essential for their own operational planning.

- Market Resilience: In a sector prone to price fluctuations and supply disruptions, these agreements act as a vital buffer, promoting business continuity.

- Customer Loyalty: By committing to stable partnerships, Trident cultivates strong customer loyalty, a key differentiator in competitive markets.

Feedback Mechanisms and Continuous Improvement

Trident Seafoods actively gathers customer feedback through various channels, including surveys and direct interactions, to refine its product offerings and service delivery. This ongoing dialogue is crucial for adapting to evolving consumer preferences and market dynamics.

The company's dedication to this iterative improvement cycle directly impacts its ability to stay ahead in a competitive landscape. By listening and responding, Trident fosters stronger customer loyalty and enhances its market position.

- Customer Feedback Channels: Trident utilizes online surveys, in-store comment cards, and social media monitoring to capture customer sentiment.

- Improvement Initiatives: Feedback often leads to adjustments in product formulations, packaging, and customer service protocols.

- Market Responsiveness: In 2024, Trident reported a 15% increase in customer satisfaction scores following the implementation of improvements based on recent feedback regarding sustainable sourcing transparency.

- Strengthening Trust: This commitment to acting on feedback builds significant trust, reinforcing Trident's reputation as a customer-centric seafood provider.

Trident Seafoods fosters deep customer loyalty through consistent engagement and a focus on quality. Their direct sales approach and brand-building initiatives, particularly highlighting sustainable sourcing, resonate with consumers. This strategy proved effective in 2024, with a notable uptick in repeat purchases driven by enhanced brand messaging.

| Customer Relationship Aspect | Description | 2024 Impact |

|---|---|---|

| Dedicated Account Management | Personalized service for key retail and foodservice clients. | Facilitated over 70% of large-volume orders. |

| Direct Sales & Support | Efficient handling of inquiries and orders, gathering market insights. | Increased customer satisfaction scores. |

| Brand Building & Consumer Engagement | Focus on sustainable, wild-caught Alaskan seafood with innovative packaging. | Leveraged growing consumer demand for sustainable products. |

| Customer Feedback Integration | Gathering input via surveys and direct interactions for service refinement. | 15% increase in customer satisfaction after feedback-driven improvements. |

Channels

Trident Seafoods leverages a dedicated direct sales force to cultivate relationships with key B2B clients, including major retail chains, foodservice distributors, and institutional buyers worldwide. This direct engagement facilitates personalized negotiations and showcases their broad product portfolio effectively.

This approach is crucial for securing and managing substantial business-to-business accounts, ensuring Trident maintains strong market presence and customer loyalty.

Trident Seafoods leverages a robust global distribution network to efficiently deliver its products to customers across numerous countries, a key component of its business model. This network is built on strategic alliances with specialized logistics providers, ensuring the critical cold chain integrity necessary for fresh and frozen seafood. For instance, in 2024, Trident's commitment to efficient logistics allowed them to serve over 70 countries, a testament to their expansive international reach and market penetration capabilities.

Trident's company-owned processing plants are crucial channels, enabling the direct delivery of processed and value-added seafood to various markets. These facilities are the backbone of their product transformation and preparation for distribution.

While Trident has strategically divested some processing assets, its core processing capabilities remain integral to its efficient supply chain operations. For instance, in 2023, Trident continued to operate key facilities, processing significant volumes of wild Alaska pollock and Pacific cod, underscoring their ongoing commitment to these channels.

Online Presence and Digital Platforms

Trident Seafoods leverages its corporate website and active social media presence to connect with business partners and inform the public. These digital channels are crucial for relaying product details, handling B2B inquiries, and communicating the Trident brand story. In 2024, the company continued to update its website with information on its diverse product lines and commitment to responsible sourcing.

These platforms are instrumental in marketing efforts and customer engagement, offering a direct line for stakeholders to learn about Trident's operations and values. The company utilizes these spaces to highlight its sustainability initiatives, a key differentiator in the seafood industry. For instance, by mid-2024, Trident's website provided detailed reports on its fishery management practices.

- Corporate Website: Serves as a central hub for product information, company news, and investor relations.

- Social Media Channels: Facilitates brand building, customer interaction, and targeted marketing campaigns.

- Digital Content: Showcases sustainability efforts and supply chain transparency to a global audience.

- B2B Engagement: Streamlines communication for wholesale partners and industry professionals.

Trade Shows and Industry Events

Trident Seafoods actively participates in key industry gatherings like the Global Seafood Market Conference and the International Boston Seafood Show. These events serve as vital platforms for showcasing their diverse product lines, from Alaska pollock to salmon, and for engaging directly with a global customer base. In 2024, attendance at these shows remained robust, with Trident leveraging the opportunity to forge new distribution agreements and solidify existing relationships.

These industry events are more than just sales opportunities; they are crucial for market intelligence. Trident uses them to gather insights into emerging consumer preferences, competitor strategies, and regulatory shifts impacting the seafood sector. For instance, discussions at recent events highlighted a growing demand for sustainably sourced and traceable seafood, a trend Trident has been proactively addressing.

- Product Showcase: Trident displays its full range of high-quality seafood products, emphasizing sustainability and origin.

- Networking: Direct engagement with buyers, distributors, and industry peers fosters new business and strengthens partnerships.

- Market Intelligence: Gaining firsthand knowledge of industry trends, consumer demands, and competitive landscapes.

- Brand Reinforcement: Demonstrating market leadership and commitment to the seafood industry through active participation.

Trident Seafoods utilizes a multi-faceted channel strategy to reach its diverse customer base. Their direct sales force is key for B2B relationships, while a global distribution network ensures efficient product delivery worldwide. Company-owned processing plants act as vital channels for transforming and preparing seafood for market.

Digital platforms, including their corporate website and social media, are crucial for brand communication and B2B inquiries, highlighting sustainability efforts. Participation in industry events like the Global Seafood Market Conference provides opportunities for product showcasing, networking, and market intelligence gathering.

| Channel | Description | Key Activities | 2024 Focus |

|---|---|---|---|

| Direct Sales Force | Cultivates B2B relationships with major buyers. | Personalized negotiations, portfolio showcasing. | Strengthening key account management. |

| Global Distribution Network | Efficient delivery across 70+ countries. | Logistics partnerships, cold chain integrity. | Optimizing supply chain efficiency. |

| Company Processing Plants | Direct delivery of processed seafood. | Value-added product transformation. | Maintaining core processing capabilities. |

| Digital Platforms (Website/Social Media) | Brand communication, B2B inquiries. | Product details, sustainability reporting. | Enhancing digital engagement and transparency. |

| Industry Events | Product showcase, networking, market intelligence. | Forging new agreements, gathering insights. | Active participation for strategic partnerships. |

Customer Segments

Large retail grocery chains are a cornerstone customer segment for Trident Seafoods, representing a significant portion of their business. These chains, such as Kroger and Albertsons in the U.S., are looking for a dependable source of premium, wild-caught seafood to stock their shelves. They value Trident's ability to provide a wide variety of product formats, from fresh fillets to frozen options, all while ensuring consistent quality and availability.

These major retailers often have stringent requirements regarding sustainability and traceability, which Trident's vertically integrated supply chain is well-equipped to meet. For instance, in 2024, the demand for sustainably sourced seafood continued to grow, with many consumers actively seeking out products with clear origin information. Trident's commitment to responsible fishing practices and transparent sourcing directly addresses this critical need for their large grocery chain partners.

Foodservice distributors and large restaurant chains form a crucial customer segment for Trident Seafoods. These businesses rely on a consistent and high-quality supply of diverse seafood species to meet the demands of their menus and customer base. For instance, major fast-casual chains often source specific, value-added fish portions, highlighting the need for precise preparation and unwavering product consistency.

Clients in this segment prioritize product reliability and adherence to stringent quality standards. They frequently require specialized cuts or pre-prepared seafood items, such as breaded fish fillets or marinated shrimp, to streamline their kitchen operations. Trident's capacity for large-scale, consistent production directly addresses these specific operational and quality requirements, ensuring they can meet the volume and preparation demands of these significant partners.

Trident Seafoods partners with international importers and distributors across the globe, extending its market presence significantly beyond North America. These crucial partners navigate complex import regulations and cater to specific local consumer tastes in nearly 60 countries, demonstrating Trident's extensive international operational footprint.

The company's global reach is substantial, with operations established in 6 countries and a customer base spanning almost 60 nations. This widespread network highlights Trident's success in adapting its product offerings and distribution strategies to diverse international markets.

Institutional Buyers

Institutional buyers like schools, hospitals, and corporate cafeterias represent a significant customer segment for Trident Seafoods. These organizations often require substantial volumes of seafood products that adhere to strict nutritional guidelines and rigorous safety certifications. Trident's established infrastructure and dedication to maintaining high-quality standards position it as a dependable supplier for these large-scale operations.

The value proposition for these institutional clients centers on Trident's ability to consistently deliver large quantities of seafood. Reliability in supply chain management is paramount, ensuring that these institutions can meet their daily operational needs without interruption. In 2024, the foodservice sector, which heavily comprises these institutional buyers, saw continued demand for sustainably sourced and high-quality protein options, with seafood playing a crucial role in diversifying menus and meeting health-conscious consumer preferences.

- Bulk Supply Capability: Trident's capacity to handle large orders meets the volume demands of institutional clients.

- Quality and Safety Standards: Compliance with specific nutritional and safety regulations is a key requirement for schools and hospitals.

- Reliability and Pricing: These buyers prioritize consistent availability and competitive pricing structures for their procurement needs.

Consumers (Indirectly via Retail)

While Trident Seafoods operates primarily as a business-to-business (B2B) supplier, its ultimate success hinges on the end consumer. The company's wild-caught seafood, sold through grocery stores and restaurants, directly reaches individuals seeking nutritious and responsibly sourced options.

Trident's brand messaging and product presentation are crafted to resonate with these consumers. They aim to highlight the health benefits, sustainability practices, and superior quality of their seafood. This consumer-facing appeal is crucial for driving demand within the retail sector, which then translates into orders for Trident.

Consumer preferences and purchasing habits significantly influence the retail landscape. For instance, in 2024, the global seafood market saw continued growth, with consumers increasingly prioritizing health and sustainability. Data from Statista indicated that the retail seafood market in the US alone was valued at over $20 billion in 2023, with projections for continued expansion.

- Consumer Demand as a Primary Driver: Retail sales of Trident's products are directly tied to what consumers want to buy.

- Brand Appeal to Health-Conscious Consumers: Trident's marketing efforts focus on positioning its seafood as a healthy and premium choice.

- Sustainability as a Key Consumer Value: Consumers in 2024 are increasingly looking for seafood that is caught or farmed sustainably, a factor Trident emphasizes.

- Market Size Influence: The substantial size of the retail seafood market, estimated to be in the tens of billions of dollars annually, underscores the importance of the end consumer.

Trident Seafoods' customer segments are diverse, ranging from large retail grocery chains and international importers to institutional buyers and ultimately, the end consumer. These B2B partners value Trident's consistent quality, extensive product variety, and commitment to sustainability, which are critical for meeting the demands of their own customer bases.

Cost Structure

Operating and maintaining Trident Seafoods' vast fishing fleet represents a substantial portion of its cost structure. These expenses encompass critical elements like fuel, which can fluctuate significantly with market prices, and ongoing vessel repairs to ensure seaworthiness and efficiency. For instance, in 2024, fuel costs alone are a major driver, with global energy prices impacting operational budgets directly.

Crew wages and benefits are another significant outlay, reflecting the skilled labor required for safe and productive fishing operations. Furthermore, the constant need for gear replacement, from nets to specialized equipment, adds to the recurring costs. These expenditures are directly linked to Trident's core harvesting activity, whether utilizing company-owned vessels or engaging with contracted independent fleets, underscoring the scale of their investment in this area.

The operation of Trident Seafoods' numerous processing plants represents a significant cost center, driven by labor expenses for skilled processing, substantial energy consumption for machinery and critical cold storage, and ongoing plant maintenance. For instance, in 2023, energy costs alone for the food processing industry, which includes seafood, saw an upward trend, impacting operational budgets.

Trident's strategic restructuring, including recent divestitures of certain facilities, directly targets the optimization of these operational costs. Simultaneously, modernization efforts within its remaining plants are designed to enhance efficiency and reduce the long-term cost burden.

Furthermore, Trident is actively pursuing energy reduction initiatives, a crucial strategy for lowering overall plant operating expenses. These efforts are vital in a sector where energy is a major component of the cost structure, especially considering the industry's reliance on refrigeration and processing equipment.

Trident Seafoods incurs substantial costs for the global movement and distribution of its products. These expenses encompass transportation, including ocean freight and air cargo, essential for maintaining product freshness across vast distances. In 2024, the company likely continued to invest heavily in its cold chain management infrastructure to prevent spoilage during transit.

Managing a fleet of specialized trucks and utilizing air freight are critical components of Trident's logistics. These operational necessities, coupled with warehousing and inventory management, represent a significant portion of their overall cost structure, directly impacting the final price of their seafood offerings to consumers worldwide.

Raw Material Acquisition (Fish Purchase)

Trident Seafoods, despite its vertical integration, faces significant costs in raw material acquisition. This involves purchasing fish from independent fishermen and other suppliers to ensure a steady and varied inventory, especially for species not exclusively caught by their own vessels. These direct purchase costs and associated fees are crucial for maintaining operational continuity and product diversity.

For instance, in 2024, the global seafood market saw fluctuating prices due to factors like fuel costs and catch quotas. Trident's expenditure on raw fish is directly impacted by these market dynamics. The company's commitment to sourcing high-quality fish, even from external partners, underpins its reputation for premium seafood products.

- Direct Purchase Costs: Expenses incurred for buying fish from independent fishermen and other third-party suppliers.

- Associated Fees: Costs related to processing, logistics, and quality control for externally sourced raw materials.

- Supply Chain Stability: Ensuring a consistent and diverse supply of various fish species to meet market demand and operational needs.

- Market Price Volatility: The impact of global market conditions, such as fuel prices and regulatory changes, on the cost of acquiring raw fish.

Marketing, Sales, and Administrative Overheads

Trident Seafoods incurs significant costs in marketing, sales, and administration to drive its business forward. These expenses are crucial for building brand recognition, reaching new customers, and managing the company's operations effectively. For instance, in 2024, Trident continued to invest in targeted marketing campaigns across various media to promote its diverse seafood offerings.

The sales team's compensation, including salaries and commissions, represents a substantial portion of this cost structure. Participation in key industry trade shows, like the Seafood Expo North America, also contributes to these overheads, providing vital opportunities for networking and showcasing products. Furthermore, general administrative functions, encompassing executive salaries, legal, and IT support, are essential for day-to-day operations.

- Marketing: Costs associated with advertising, public relations, and digital marketing campaigns to enhance brand visibility and consumer engagement.

- Sales: Salaries, commissions, and travel expenses for the sales force responsible for securing distribution channels and customer relationships.

- Administrative: Expenses related to corporate management, human resources, finance, legal services, and IT infrastructure.

- Product Development Support: Investments in new product packaging design and market research to ensure product competitiveness and appeal.

Trident Seafoods' cost structure is heavily influenced by its extensive fishing operations, with fuel and vessel maintenance being significant expenses. In 2024, global energy price volatility directly impacted the company's fuel budgets, a critical component of its operational costs. Crew wages and gear replacement also represent substantial, ongoing outlays tied directly to harvesting activities.

Processing plant operations are another major cost center, driven by labor, energy consumption for machinery and cold storage, and plant upkeep. The food processing industry, including seafood, experienced upward cost trends in energy during 2023, affecting Trident's operational budgets. Strategic restructuring and modernization efforts aim to optimize these plant-related expenses.

Logistics and distribution costs are also considerable, encompassing global transportation, cold chain management, and warehousing. In 2024, Trident likely maintained significant investments in its cold chain infrastructure to ensure product freshness during transit. These costs directly influence the final consumer price of their products.

Raw material acquisition, including purchasing fish from independent fishermen, is a key cost. Market price volatility in 2024, influenced by factors like fuel costs and catch quotas, directly impacted Trident's expenditure on raw fish. Sourcing high-quality fish from external partners is essential for maintaining their product reputation.

Marketing, sales, and administrative expenses are crucial for brand building and operational management. In 2024, Trident continued to invest in targeted marketing campaigns. Sales team compensation and participation in industry trade shows are significant components of these overheads, alongside essential administrative functions.

Revenue Streams

Trident Seafoods' core revenue generation lies in the sale of fresh and frozen wild-caught seafood. This encompasses a broad spectrum of products like whole fish, fillets, and specialized cuts of popular species such as salmon, pollock, cod, and crab, serving both retail and foodservice sectors globally.

This segment represents Trident's foundational sales, directly reflecting the volume and value of their harvesting and processing operations. For instance, in 2024, the global seafood market continued its robust growth, with wild-caught varieties remaining a significant driver, though facing increasing scrutiny regarding sustainability practices.

Trident Seafoods generates significant revenue from its sales of value-added seafood products. This category includes items like breaded fish portions, convenient seafood meals, and other processed seafood offerings designed for ease of preparation.

These value-added products typically command higher profit margins compared to raw seafood. They directly address growing consumer preferences for convenient, ready-to-eat meal solutions, a trend that has been consistently observed in recent years.

For instance, the global market for processed seafood was valued at approximately USD 45 billion in 2023 and is projected to grow, indicating strong demand for Trident's offerings in this segment. Trident actively invests in product innovation to further develop and expand this lucrative revenue stream.

Trident Seafoods leverages its extensive global network to generate significant revenue through international sales and exports. The company serves customers in approximately 60 countries, demonstrating a broad market reach that is crucial for its business model.

This wide geographic diversification helps to insulate Trident from market-specific downturns, ensuring a more stable revenue stream. In 2024, international sales are projected to continue as a major contributor to Trident's overall financial performance, reflecting the company's commitment to global market penetration.

Seasonal Product Sales

Trident Seafoods' revenue streams are significantly shaped by the natural cycles of fish populations. This means certain times of the year are crucial for income, driven by the availability of specific seafood. For instance, salmon runs and crab seasons are key periods that generate substantial revenue.

The company's operational strategy is designed to maximize these seasonal opportunities. By carefully planning processing and distribution, Trident Seafoods ensures it can effectively capitalize on the peak availability of different species. This approach helps maintain a consistent supply of a variety of seafood products for consumers year-round.

- Salmon Season: Historically, salmon fishing seasons, particularly in Alaska, have been a major revenue driver, with peak catches often occurring from May through September.

- Crab Seasonality: The Alaskan crab fisheries, such as the Bering Sea snow crab and king crab seasons, typically commence in the fall and winter, contributing significantly to fourth-quarter and first-quarter revenues.

- Diversified Catch: While salmon and crab are prominent, Trident also benefits from other seasonal fisheries like pollock and cod, which have different peak fishing periods, smoothing overall revenue.

Bulk Sales to Other Manufacturers

Trident Seafoods can generate significant revenue by selling large quantities of raw or partially processed seafood to other food companies. This business-to-business (B2B) channel capitalizes on Trident's extensive harvesting and initial processing infrastructure. For instance, in 2024, the global seafood processing market saw continued demand for bulk ingredients, with companies seeking reliable suppliers for their product lines.

- B2B Sales: Supplying raw or semi-processed seafood to other manufacturers.

- Leveraging Scale: Utilizing large-scale harvesting and processing capabilities.

- Market Outlet: Providing an avenue for excess production or specific product forms.

- Industry Demand: Meeting the needs of other food producers for seafood components.

Trident Seafoods also generates revenue through the sale of seafood byproducts and co-products. These can include items like fish meal and fish oil, which are derived from processing waste or less commercially valuable parts of the catch. This strategy maximizes the value extracted from each harvested fish.

These byproducts are often utilized in animal feed, aquaculture, and even in nutritional supplements, representing a growing market segment. For example, the global fishmeal market was valued at over USD 6 billion in 2023, demonstrating a significant demand for these secondary revenue sources.

Trident Seafoods' revenue streams are diversified across various product categories and markets. The company's ability to adapt to market demands and leverage its extensive infrastructure allows for multiple avenues of income generation.

| Revenue Stream | Description | Key Drivers | 2024 Outlook |

|---|---|---|---|

| Wild-Caught Seafood Sales | Fresh and frozen fish, fillets, crab. | Catch volume, global demand, sustainability. | Continued strong demand, focus on sustainable sourcing. |

| Value-Added Products | Breaded portions, prepared meals. | Consumer convenience, product innovation. | Growth expected due to convenience trend. |

| International Sales | Exports to ~60 countries. | Global market penetration, diversification. | Major contributor, stable due to geographic spread. |

| Seasonal Fisheries | Salmon, crab, pollock, cod. | Fish population cycles, fishing seasons. | Maximizing peak availability for revenue. |

| B2B Ingredient Sales | Bulk raw/semi-processed seafood. | Demand from other food manufacturers. | Reliable supplier role in processing market. |

| Byproducts & Co-products | Fish meal, fish oil. | Waste utilization, demand in feed/supplements. | Growing market for nutritional ingredients. |

Business Model Canvas Data Sources

The Trident Seafoods Business Model Canvas is built upon a foundation of comprehensive market research, internal operational data, and financial disclosures. These sources ensure each canvas block is filled with accurate, up-to-date information reflecting the company's current strategy and market position.