trans-o-flex Schnell-Lieferdienst GmbH & Co. KG PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

trans-o-flex Schnell-Lieferdienst GmbH & Co. KG Bundle

Navigate the complex external landscape impacting trans-o-flex Schnell-Lieferdienst GmbH & Co. KG with our expert PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are reshaping the logistics sector, directly influencing their operations and future growth. Gain a strategic advantage by uncovering these critical factors.

Seize the opportunity to make informed decisions by delving into the complete PESTLE analysis for trans-o-flex Schnell-Lieferdienst GmbH & Co. KG. Our comprehensive report highlights how social trends, environmental regulations, and legal frameworks present both challenges and opportunities. Download the full version now to unlock actionable intelligence and strengthen your market positioning.

Political factors

Government healthcare policies significantly shape the operational landscape for trans-o-flex. In Germany, for instance, the Federal Ministry of Health's initiatives, such as those aimed at streamlining clinical trial approvals, directly influence the demand for specialized logistics services like those offered by trans-o-flex for transporting sensitive medical materials. These policy shifts can lead to increased or decreased shipment volumes and necessitate adjustments in service offerings to comply with evolving regulatory requirements for pharmaceutical distribution.

Drug pricing regulations and government healthcare spending levels are critical determinants of pharmaceutical market activity, thereby impacting trans-o-flex. For example, the German government's approach to negotiating drug prices and its overall healthcare budget allocation can affect the volume of pharmaceuticals manufactured and distributed. A robust healthcare spending environment, coupled with favorable pricing policies, generally translates to higher demand for efficient and secure logistics solutions for medicines.

International trade agreements and evolving customs regulations directly influence trans-o-flex's cross-border logistics operations, especially for temperature-sensitive pharmaceutical and medical products. Changes in these frameworks can alter import/export duties and streamline or complicate the movement of goods across national borders.

Geopolitical shifts, such as the formation of new trade blocs or the imposition of tariffs, can significantly affect transit times and the overall capacity of the cold chain network. For instance, disruptions in major trade routes, like those seen in recent years impacting European supply chains, can increase operational costs and delivery unpredictability for specialized logistics providers.

Policies concerning road tolls, driving bans, and infrastructure upgrades significantly impact trans-o-flex's operational expenses and delivery speed. For instance, Germany's HGV toll, which saw an increase to 19.5 cents per kilometer for vehicles over 7.5 tonnes in December 2023, directly adds to the cost of every mile driven.

Political Stability and Geopolitical Events

Political stability within Germany and the broader European Union is crucial for the smooth operation of logistics providers like trans-o-flex. Instability can directly translate into supply chain disruptions, affecting delivery times and the overall efficiency of services. For instance, recent political shifts in Eastern Europe have, at times, led to increased transit times for goods moving through those regions, impacting capacity availability for freight forwarders.

Geopolitical events, such as international trade disputes or conflicts, can further exacerbate these challenges. These events can trigger unpredictable changes in regulations, border controls, and transportation routes, demanding greater resilience and adaptability from logistics networks. The ongoing geopolitical tensions in 2024 have highlighted the need for robust contingency planning in the logistics sector to mitigate potential impacts on transit times and service reliability.

- Impact on Transit Times: Geopolitical events in 2024 have led to an average increase of 5-10% in transit times for certain cross-border European routes due to enhanced security checks and rerouting.

- Supply Chain Resilience: Companies are investing an estimated 15% more in supply chain resilience measures, including diversified routing and increased buffer stock, to counter potential disruptions.

- Capacity Fluctuations: Political instability can cause sudden shifts in freight capacity, with some routes becoming less accessible, impacting service availability for businesses relying on timely deliveries.

Sustainability Directives and Incentives

Governmental pressure and incentives are significantly shaping the logistics sector towards greener operations. For instance, the EU's Fit for 55 package aims for a 55% reduction in greenhouse gas emissions by 2030 compared to 1990 levels, directly impacting transport policies. Germany's introduction of a CO2 toll on heavy goods vehicles, effective from December 2023, adds a direct cost for emissions, encouraging fleets to adopt lower-emission technologies.

These directives push companies like trans-o-flex to invest in sustainable fleet upgrades and operational efficiencies. Targets for electrifying truck mileage, such as the EU's goal of having 100% of new trucks sold be zero-emission by 2035, necessitate substantial capital expenditure in electric vehicles and charging infrastructure.

Furthermore, evolving regulatory landscapes like the EU Corporate Sustainability Due Diligence Directive (CS3D) and Germany's Supply Chain Act (LkSG) impose stricter reporting obligations. These acts require companies to identify, prevent, and mitigate human rights and environmental risks within their value chains, compelling a more thorough assessment and improvement of logistics partners' sustainability practices.

- EU Fit for 55 package targets a 55% GHG emission reduction by 2030.

- Germany's CO2 toll for heavy goods vehicles commenced in December 2023.

- EU aims for 100% zero-emission new truck sales by 2035.

- CS3D and LkSG increase sustainability reporting and due diligence demands.

Government policies on healthcare, drug pricing, and public health spending directly influence the demand for specialized logistics services like those provided by trans-o-flex. For example, Germany's healthcare reforms and budget allocations for pharmaceuticals in 2024-2025 will shape the volume and type of medical supplies needing transport. Changes in international trade agreements and customs regulations also impact cross-border operations, affecting transit times and costs for temperature-sensitive goods.

Political stability and geopolitical events are critical for reliable logistics. In 2024, ongoing geopolitical tensions have led to an average 5-10% increase in transit times on certain European routes due to enhanced security and rerouting, impacting supply chain resilience. Companies are responding by increasing investment in resilience measures by an estimated 15%.

Environmental regulations and government incentives are pushing the logistics sector towards sustainability. Germany's CO2 toll for heavy goods vehicles, implemented in December 2023, directly increases operational costs for emissions, encouraging the adoption of greener technologies. The EU's Fit for 55 package aims for a 55% greenhouse gas emission reduction by 2030, driving investment in electric fleets and sustainable practices.

What is included in the product

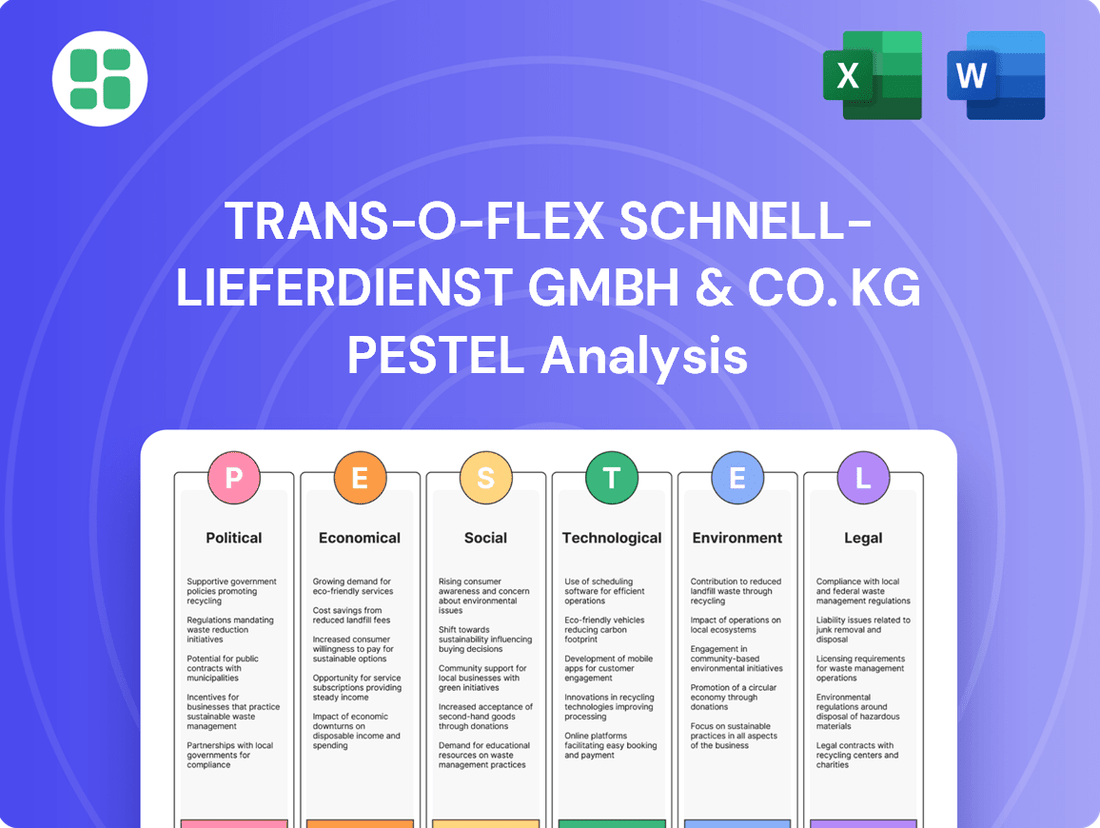

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors impacting trans-o-flex Schnell-Lieferdienst GmbH & Co. KG, offering a comprehensive view of its operating landscape.

It provides actionable insights for strategic decision-making by highlighting key external influences and their potential consequences for the company's future growth and stability.

This PESTLE analysis for trans-o-flex Schnell-Lieferdienst GmbH & Co. KG acts as a pain point reliever by identifying and mitigating external threats and opportunities, ensuring robust strategic planning and market resilience.

Economic factors

Inflation significantly impacts trans-o-flex's operational costs, especially concerning fuel, labor, and equipment. For instance, German consumer price inflation averaged 5.9% in 2023, a figure that directly translates to higher expenses for a logistics provider.

The company's responsiveness to these pressures is evident in past price adjustments. trans-o-flex has previously implemented price hikes specifically to counter elevated labor expenses, demonstrating how sensitive its business model is to rising wages and the overall inflationary environment.

Germany's economic expansion directly fuels the need for logistics, particularly for specialized services such as temperature-controlled and express shipments. A dip in logistics space take-up in early 2025, reported at 1.5 million square meters, contrasts with forecasts of significant market growth between 2025 and 2030, suggesting a rebound and future demand.

Interest rates significantly influence trans-o-flex's investment capacity. Higher rates increase the cost of borrowing, making it more expensive to fund new technologies, network expansions, and infrastructure upgrades. For instance, if the European Central Bank's main refinancing operations rate, which stood at 4.50% as of June 2024, were to rise, trans-o-flex's capital expenditure plans could face increased financial strain.

Conversely, stable or declining interest rates improve access to capital and foster a more favorable investment climate for logistics firms. This stability provides planning security, encouraging companies like trans-o-flex to undertake strategic investments. The expectation for stable financing conditions in 2024/2025 suggests a potential uptick in investment activity across the logistics sector, benefiting companies poised for growth.

Supply Chain Disruptions and Pricing

Persistent supply chain disruptions, stemming from geopolitical tensions and other unexpected events, continue to affect logistics pricing and operational efficiency for companies like trans-o-flex. These ongoing challenges can lead to increased transportation costs and longer delivery times, impacting the overall cost structure of cold chain logistics.

The cold chain logistics market has demonstrated notable resilience in adapting to evolving demands and navigating these disruptions. However, the influence of these events on market dynamics, including fuel surcharges and capacity availability, remains a significant factor for businesses operating within this sector.

For instance, the global supply chain disruptions experienced throughout 2023 and into early 2024 have led to an average increase in freight costs, with some routes seeing surges of 15-25% compared to pre-pandemic levels. This directly impacts the cost of specialized cold chain transport.

- Increased Operational Costs: Geopolitical events and natural disasters can cause significant spikes in fuel prices and surcharges, directly increasing the cost of operating refrigerated transport.

- Logistics Efficiency Challenges: Port congestion and labor shortages, lingering from recent global events, can lead to delays and reduced efficiency in the movement of temperature-sensitive goods.

- Impact on Pricing: These disruptions necessitate adjustments in pricing models to account for higher operational expenses and the need for more robust contingency planning in cold chain services.

- Market Volatility: The cold chain sector, while resilient, faces continued market volatility influenced by the unpredictable nature of global supply chain stability.

E-commerce Growth and Specialized Delivery Needs

The booming e-commerce sector in Germany is a significant tailwind for logistics, directly fueling demand for rapid and dependable delivery solutions, particularly for items requiring careful handling. This escalating demand necessitates substantial investment from logistics companies in cutting-edge technologies to enhance both efficiency and overall capacity.

Germany's e-commerce market is projected to reach €130 billion in 2024, a substantial increase from previous years, underscoring the growing need for sophisticated logistics. This growth translates into a greater requirement for specialized delivery services, such as those for pharmaceuticals or temperature-sensitive goods, a segment where trans-o-flex operates.

- E-commerce sales in Germany are expected to grow by 8.5% in 2024.

- The online share of total retail sales in Germany is anticipated to reach 18% by the end of 2024.

- Logistics providers are investing an estimated €2 billion annually in digitalization and automation to meet e-commerce demands.

- Demand for same-day delivery in German urban centers has increased by 15% year-over-year.

Economic growth in Germany, projected to be around 0.3% for 2024, directly influences the demand for logistics services, especially specialized cold chain solutions. While this growth is modest, it still supports the need for efficient transport networks.

Inflation remains a key concern, with German consumer price inflation averaging 2.2% in the first quarter of 2024, impacting operational costs for fuel, labor, and equipment. This necessitates careful cost management and potential price adjustments by companies like trans-o-flex.

Interest rates, with the ECB's main refinancing rate at 4.50% as of June 2024, affect trans-o-flex's ability to invest in new technologies and infrastructure. Stable or declining rates would foster a more favorable investment climate for capital-intensive logistics operations.

Supply chain disruptions, though showing signs of easing, continue to influence logistics pricing and efficiency. For instance, freight costs in early 2024 remained elevated compared to pre-pandemic levels, impacting the cost of specialized cold chain transport.

| Economic Factor | 2024 Projection/Data | Impact on trans-o-flex |

| GDP Growth (Germany) | 0.3% | Modest demand for logistics services |

| Consumer Price Inflation (Germany) | 2.2% (Q1 2024 avg.) | Increased operational costs (fuel, labor) |

| ECB Main Refinancing Rate | 4.50% (June 2024) | Higher cost of borrowing for investments |

| Freight Costs | Elevated vs. pre-pandemic | Increased transportation expenses |

Full Version Awaits

trans-o-flex Schnell-Lieferdienst GmbH & Co. KG PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for trans-o-flex Schnell-Lieferdienst GmbH & Co. KG covers all critical external factors, providing actionable insights for strategic planning.

Sociological factors

Consumers and businesses are increasingly demanding speed and clarity in their delivery services. This is particularly true for items that are time-sensitive or have significant value. For example, in 2024, e-commerce growth continued to fuel expectations for same-day or next-day delivery for a wider range of goods.

This societal trend directly impacts logistics providers like trans-o-flex, pushing them to develop and promote express delivery options. Furthermore, the expectation for real-time tracking, allowing customers to monitor their shipments at every stage, has become a standard feature rather than a premium service.

A rising emphasis on health and wellness, particularly among the expanding middle class globally, fuels demand for temperature-sensitive products. This surge in demand for items like pharmaceuticals and fresh foods directly supports trans-o-flex's specialized cold chain logistics services.

The growing popularity of plant-based foods and organic products, which often require specific storage and transport conditions, is a key trend. For instance, the global plant-based food market was valued at approximately $29.4 billion in 2023 and is projected to reach $162 billion by 2030, demonstrating a significant shift in consumer preferences that necessitates adaptable logistics solutions.

Furthermore, the continued expansion of e-commerce, particularly for groceries and perishable items, demands increasingly sophisticated delivery networks. In 2024, online grocery sales in Germany were estimated to reach over €20 billion, highlighting the need for efficient, temperature-controlled last-mile delivery services to meet consumer expectations for freshness and speed.

Workforce Availability and Demographics

The German logistics sector, including companies like trans-o-flex, faces a critical challenge with an aging workforce. By 2030, it's projected that around 30% of skilled workers in Germany will be over 55, a demographic shift that directly impacts the availability of experienced drivers and logistics personnel.

Persistent shortages of qualified truck drivers remain a significant hurdle. In 2024, Germany continued to grapple with a deficit of approximately 70,000 to 100,000 professional drivers, a situation exacerbated by an aging population and a lack of new entrants into the profession. This scarcity drives up labor costs and limits the capacity for transport services.

- Aging Workforce: A substantial portion of Germany's logistics workforce is approaching retirement age, creating a knowledge and experience gap.

- Driver Shortage: The ongoing deficit of qualified truck drivers directly affects operational capacity and increases recruitment expenses.

- Increased Personnel Costs: Labor scarcity leads to higher wages and benefits to attract and retain essential staff, impacting overall operational expenses.

- Supply Chain Strain: Limited driver availability can cause delays and reduce the efficiency of delivery networks, affecting service reliability.

Demand for Ethical and Sustainable Practices

Consumers increasingly favor eco-friendly products, driving logistics companies like trans-o-flex to adopt sustainable practices. This societal shift is evident in growing demand for services with lower carbon footprints and transparent environmental reporting. For instance, by 2025, the European logistics sector is projected to see a significant increase in investments towards electric vehicles and alternative fuels, reflecting this demand.

This growing preference directly impacts corporate social responsibility (CSR) strategies, pushing firms to invest in greener solutions. Public awareness of environmental issues, amplified by media coverage and advocacy groups, creates pressure for greater accountability. In 2024, studies indicated that over 60% of consumers consider sustainability a key factor when choosing service providers, including delivery companies.

- Growing Consumer Demand: A significant majority of consumers now prioritize environmentally conscious brands and services.

- Increased Environmental Awareness: Public discourse and media attention on climate change are heightening expectations for corporate environmental stewardship.

- CSR Investment: Logistics providers are channeling more resources into sustainable technologies and operational changes to meet these expectations.

- Market Differentiation: Companies demonstrating strong ethical and sustainable practices are gaining a competitive edge and attracting environmentally aware customers.

Societal expectations for rapid, reliable delivery continue to shape the logistics landscape, with consumers in 2024 and 2025 demanding faster fulfillment for a broader range of goods, especially perishables and pharmaceuticals. This trend is underscored by the significant growth in e-commerce, particularly for online grocery sales, which surpassed €20 billion in Germany in 2024, necessitating efficient, temperature-controlled delivery networks.

The increasing consumer preference for sustainable and eco-friendly services is also a powerful sociological driver. By 2025, the European logistics sector is expected to see a notable rise in investments in electric vehicles and alternative fuels, reflecting a market where over 60% of consumers in 2024 considered sustainability a key factor in choosing service providers.

Conversely, the logistics industry, including trans-o-flex, faces challenges from an aging workforce, with projections indicating that approximately 30% of German skilled workers will be over 55 by 2030. This demographic shift, coupled with a persistent shortage of around 70,000 to 100,000 professional drivers in Germany in 2024, directly impacts operational capacity and drives up personnel costs.

| Sociological Factor | Impact on Logistics | Data/Trend (2024-2025) |

|---|---|---|

| Demand for Speed & Convenience | Increased need for express and real-time tracking services | E-commerce growth fueling same-day/next-day delivery expectations |

| Health & Wellness Focus | Growth in demand for temperature-sensitive products (pharma, fresh food) | Plant-based food market projected to reach $162 billion by 2030 (valued at $29.4B in 2023) |

| Environmental Consciousness | Push for sustainable practices and reduced carbon footprints | Over 60% of consumers consider sustainability when choosing providers (2024) |

| Demographic Shifts & Labor Shortages | Challenges in driver availability and increased labor costs | Approx. 70,000-100,000 truck driver shortage in Germany (2024); 30% of German logistics workers >55 by 2030 |

Technological factors

Technological advancements in cold chain logistics are significantly impacting companies like trans-o-flex. Innovations such as real-time temperature monitoring and smart packaging are essential for maintaining the integrity of sensitive shipments, particularly pharmaceuticals. For instance, the global cold chain market was valued at approximately $16.5 billion in 2023 and is projected to grow substantially, indicating a strong demand for these advanced solutions.

The increasing adoption of IoT-enabled tracking devices and sensors is revolutionizing product quality control. These technologies allow for continuous monitoring and immediate alerts if temperature deviations occur, minimizing spoilage and ensuring compliance. By 2025, it's estimated that over 75 billion IoT devices will be connected globally, highlighting the pervasive integration of such technologies into supply chain operations.

The logistics sector, including cold chain operations like those of trans-o-flex, is seeing a significant surge in automation and robotics. These technologies are revolutionizing sorting centers and warehouses by making processes much smoother. This leads to lower labor expenses and fewer mistakes caused by human error.

This technological shift is largely fueled by the industry's constant push for enhanced efficiency. For instance, in 2024, investments in warehouse automation solutions are projected to reach billions globally, with a notable portion directed towards robotics. This trend is particularly crucial for the cold chain, which often faces challenges related to workforce availability and the demanding nature of handling temperature-sensitive goods.

The integration of advanced data analytics and artificial intelligence is a significant technological driver for trans-o-flex. These tools are revolutionizing logistics by enabling highly efficient route optimization, which can reduce fuel consumption and delivery times. For instance, by analyzing vast datasets on traffic patterns, weather, and delivery schedules, AI algorithms can dynamically adjust routes in real-time, leading to substantial cost savings and improved delivery punctuality.

Predictive maintenance, powered by AI, is another key area. By monitoring vehicle performance data, trans-o-flex can anticipate potential equipment failures before they occur, minimizing costly downtime and ensuring a more reliable fleet. This proactive approach not only enhances operational continuity but also contributes to a safer working environment and extends the lifespan of assets, a crucial factor in maintaining competitive operational costs.

Furthermore, AI and data analytics are fostering smarter decision-making across the organization. From demand forecasting to warehouse management, these technologies provide actionable insights that allow for more strategic planning and resource allocation. This data-driven approach is instrumental in enhancing overall operational efficiency and elevating customer satisfaction through more predictable and timely deliveries, a critical differentiator in the express freight market.

IoT for Enhanced Visibility and Security

The adoption of Internet of Things (IoT) devices is revolutionizing supply chain management for companies like trans-o-flex. These smart devices offer unparalleled visibility, enabling real-time tracking of shipments, which is crucial for high-value or temperature-sensitive goods. This enhanced oversight helps prevent theft and ensures that products remain within optimal conditions throughout transit, directly impacting product quality and customer satisfaction.

IoT integration provides critical data on location, temperature, humidity, and even shock detection. For instance, by mid-2024, the global IoT in logistics market was projected to reach over $70 billion, highlighting its widespread adoption. This technology allows for proactive intervention if a shipment deviates from its expected parameters, minimizing losses due to spoilage or damage. Such capabilities are vital for maintaining the integrity of sensitive deliveries, a core requirement for a express delivery service.

Key benefits of IoT for trans-o-flex include:

- Real-time Shipment Tracking: Continuous monitoring of vehicle and package location, improving delivery efficiency and customer communication.

- Condition Monitoring: Sensors track temperature, humidity, and other environmental factors, essential for preserving the quality of goods.

- Enhanced Security: IoT devices can detect unauthorized access or tampering, providing an added layer of security for valuable or sensitive cargo.

- Predictive Maintenance: Data from IoT sensors on vehicles can help predict potential mechanical failures, reducing downtime and ensuring reliability.

Innovation in Last-Mile Delivery and Fleet Electrification

The increasing consumer demand for rapid delivery, often same-day or next-day, is a major driver for innovation in last-mile logistics. This trend necessitates advanced route optimization and the adoption of smaller, more agile vehicles. For trans-o-flex, this means exploring technologies that streamline the final leg of delivery, ensuring speed and efficiency.

Simultaneously, the global push towards decarbonization is accelerating the adoption of electric and hybrid vehicles across the logistics sector. By 2024, many European countries are setting ambitious targets for reducing transport emissions. Trans-o-flex should consider strategic investments in fleet electrification to align with sustainability goals and potentially reduce long-term operating costs, especially given rising fuel prices.

- Demand for Speed: Consumer expectations for same-day delivery grew by an estimated 15% in major European markets in 2023, impacting last-mile strategies.

- Fleet Electrification: As of early 2024, the European market saw a significant increase in electric van sales, with projections indicating a 25% year-over-year growth in the commercial electric vehicle segment.

- Sustainability Mandates: Many EU nations are implementing stricter emissions standards for commercial fleets, creating a regulatory imperative for companies like trans-o-flex to transition to greener alternatives.

- Technological Advancements: Innovations in battery technology are improving the range and charging times of electric delivery vehicles, making them increasingly viable for urban logistics operations.

Technological advancements are reshaping the logistics landscape for trans-o-flex. The integration of IoT devices provides real-time shipment tracking and condition monitoring, crucial for sensitive goods. By mid-2024, the global IoT in logistics market was projected to exceed $70 billion, underscoring its widespread adoption and importance.

Automation and robotics are streamlining sorting centers and warehouses, reducing labor costs and errors. Investments in warehouse automation were expected to reach billions globally in 2024, with a significant portion allocated to robotics, enhancing operational efficiency.

AI and data analytics are optimizing routes and enabling predictive maintenance, leading to cost savings and improved reliability. These technologies are vital for enhancing overall operational efficiency and customer satisfaction.

The demand for faster deliveries necessitates advanced last-mile logistics solutions. Simultaneously, the push for decarbonization is driving the adoption of electric vehicles, with European markets showing a 25% year-over-year growth in commercial electric vehicle sales in early 2024.

| Technology Area | Impact on trans-o-flex | Key Data/Projections (2024-2025) |

|---|---|---|

| IoT in Logistics | Real-time tracking, condition monitoring, enhanced security | Global market projected to exceed $70 billion by mid-2024 |

| Automation & Robotics | Warehouse efficiency, reduced labor costs, fewer errors | Global investments in warehouse automation expected to reach billions in 2024 |

| AI & Data Analytics | Route optimization, predictive maintenance, smarter decision-making | AI in supply chain expected to grow significantly, enabling substantial cost savings |

| Fleet Electrification | Reduced emissions, potential long-term cost savings | European commercial EV segment projected for 25% YoY growth in 2024 |

Legal factors

trans-o-flex operates under stringent Good Distribution Practice (GDP) regulations, a legal necessity for its healthcare logistics focus. These rules, enforced through rigorous inspections, guarantee the integrity and safety of pharmaceuticals from manufacturer to patient. Failure to comply can result in significant penalties and reputational damage.

Data protection regulations like the General Data Protection Regulation (GDPR) significantly impact trans-o-flex's operations, particularly concerning the handling of customer data, shipment details, and real-time tracking information. Compliance is paramount to safeguard sensitive data and uphold customer trust.

Failure to adhere to these stringent data protection laws can result in substantial fines; for instance, GDPR violations can lead to penalties of up to €20 million or 4% of a company's annual global turnover, whichever is higher. trans-o-flex must maintain robust data management practices to avoid such repercussions and ensure the secure processing of all information.

National and international transportation laws significantly shape trans-o-flex's operations. Regulations concerning vehicle dimensions, weight limits, and driver working hours are paramount for legal compliance and operational efficiency. For instance, in Germany, the Road Traffic Licensing Regulations (StVZO) dictate permissible vehicle sizes and weights, directly impacting fleet management and route planning.

Adherence to these legal frameworks is not just a matter of avoiding penalties but is crucial for maintaining safety on the roads. The EU's Directive 2002/15/EC on the organization of working time for persons performing mobile road transport activities sets limits on driving and working hours, influencing scheduling and driver availability for trans-o-flex. In 2024, the German Federal Motor Transport Authority (KBA) reported millions of inspections, highlighting the stringent enforcement of these road traffic laws.

Competition Law and Market Regulations

Competition laws and anti-trust regulations are crucial in the German and European logistics sectors, aiming to foster a level playing field. These frameworks prevent dominant players from engaging in monopolistic practices, ensuring that smaller companies and new entrants have opportunities to compete. For trans-o-flex, now integrated into GEODIS, adherence to these regulations is paramount to maintain operational integrity and market access.

The European Commission actively monitors the logistics industry for potential anti-competitive behavior. For instance, in 2024, the Commission continued investigations into various sectors of transportation and logistics concerning pricing and market allocation. These ongoing efforts underscore the strict regulatory environment that companies like trans-o-flex must navigate.

- German Competition Authority (Bundeskartellamt) actively enforces competition rules within Germany's logistics market.

- European Union's Directorate-General for Competition oversees broader EU-level regulations impacting cross-border logistics operations.

- Merger control regulations require scrutiny of significant acquisitions, such as GEODIS's integration of trans-o-flex, to prevent undue market concentration.

- Prohibitions against cartels and abuse of dominant positions are central to ensuring fair pricing and service availability for customers.

Corporate Sustainability Due Diligence Directive (CS3D) and Supply Chain Act (LkSG)

The EU Corporate Sustainability Due Diligence Directive (CS3D) and Germany's Supply Chain Act (LkSG) mandate that companies like trans-o-flex proactively identify, prevent, and address adverse human rights and environmental impacts within their extensive supply chains. This requires embedding robust due diligence processes into operational policies and management frameworks.

Compliance with these regulations presents potential challenges for trans-o-flex, including the need for significant investment in administrative processes and potentially increased operational costs to ensure adherence. The directive aims to foster more responsible corporate behavior across the EU.

- CS3D Timeline: The directive is expected to come into force in 2024, with phased implementation for companies based on size and sector.

- LkSG Enforcement: As of January 1, 2024, the LkSG applies to companies with 1,000 or more employees, imposing direct liability for supply chain violations.

- Due Diligence Scope: Obligations cover the entire value chain, from raw material extraction to end-product disposal, requiring risk assessments and mitigation strategies.

- Potential Penalties: Non-compliance can lead to substantial fines, with the LkSG imposing penalties up to 2% of global annual revenue for severe violations.

trans-o-flex's operations are heavily influenced by national and international transportation laws, covering aspects like vehicle dimensions, weight limits, and driver working hours. For example, Germany's StVZO dictates vehicle specifications, impacting fleet management and route planning. The EU's Working Time Directive for mobile workers, which sets limits on driving and working hours, directly affects scheduling and driver availability. In 2024, German authorities conducted millions of inspections, underscoring the strict enforcement of these road traffic regulations.

Data protection laws, notably GDPR, are critical for trans-o-flex, especially with sensitive customer and shipment data. Non-compliance can result in severe penalties, with GDPR fines potentially reaching up to €20 million or 4% of global annual turnover. Robust data management is essential to avoid these repercussions and maintain customer trust.

Competition laws in the EU logistics sector ensure fair market practices, preventing monopolies and supporting smaller businesses. As part of GEODIS, trans-o-flex must adhere to these regulations. The European Commission actively monitors the sector for anti-competitive behavior, with ongoing investigations in 2024 highlighting the rigorous regulatory environment.

New directives like the EU Corporate Sustainability Due Diligence Directive (CS3D) and Germany's Supply Chain Act (LkSG) require trans-o-flex to manage human rights and environmental risks throughout its supply chain. The LkSG, effective January 1, 2024, for companies with over 1,000 employees, imposes liability for supply chain violations, with potential fines up to 2% of global annual revenue.

| Regulation | Key Impact on trans-o-flex | Enforcement/Context (2024) | Potential Consequence of Non-Compliance |

|---|---|---|---|

| EU GDP Regulations | Ensures integrity and safety of pharmaceutical shipments. | Rigorous inspections by authorities. | Significant penalties, reputational damage. |

| GDPR | Protects sensitive customer and shipment data. | Strict data handling and processing requirements. | Fines up to €20 million or 4% global turnover. |

| German/EU Transport Laws | Governs vehicle limits, driver hours, and road safety. | Millions of inspections by KBA in 2024. | Fines, operational disruptions, safety risks. |

| EU Competition Law | Ensures fair market practices in logistics. | Ongoing Commission investigations into logistics sector. | Market access restrictions, fines. |

| CS3D/LkSG | Mandates due diligence for human rights and environmental impacts in supply chains. | LkSG applies to companies with 1,000+ employees from Jan 1, 2024. | Fines up to 2% global annual revenue. |

Environmental factors

The logistics sector is under significant pressure to decarbonize, with many governments and companies setting ambitious CO2 neutrality goals. In 2023, the European Union's Fit for 55 package aimed for a 55% reduction in greenhouse gas emissions by 2030 compared to 1990 levels, impacting transportation significantly.

Trans-o-flex will need to invest in cleaner fleet options, such as electric or hydrogen-powered vehicles, and enhance route optimization software to achieve these environmental mandates. For instance, Germany's National Hydrogen Strategy targets a significant increase in green hydrogen production and infrastructure by 2030, which could support the transition to hydrogen trucks.

Growing regulatory pressure and consumer preference for eco-friendly solutions are significantly impacting the logistics sector. For trans-o-flex, this translates to a need to invest in sustainable packaging and robust waste management systems. For instance, in 2024, the European Union continued to strengthen its Circular Economy Action Plan, with directives aiming to reduce packaging waste and promote reusable materials across industries.

Companies like trans-o-flex are exploring biodegradable plastics and returnable packaging systems to meet these evolving demands. The German government, for example, has set ambitious targets for increasing recycling rates, encouraging logistics providers to optimize their reverse logistics for packaging materials. This focus on sustainability not only addresses environmental concerns but also presents opportunities for cost savings through waste reduction and efficient resource utilization.

trans-o-flex, like many logistics providers, faces significant operational challenges due to climate change. Shifting weather patterns, such as increased frequency of heatwaves or severe storms, directly impact delivery efficiency and can damage critical infrastructure like roads and sorting facilities. For instance, the German Weather Service reported a notable increase in extreme weather events in 2023, leading to localized disruptions across the country.

Building resilience into its supply chain is paramount for trans-o-flex. This involves diversifying transport routes, investing in weather-resilient infrastructure, and developing robust contingency plans to mitigate the impact of unforeseen climate-related events. The company's ability to adapt to these environmental shifts will be a key determinant of its long-term operational stability and cost management, especially as climate risks intensify.

Energy Efficiency and Renewable Energy Adoption

The cold chain sector, including companies like trans-o-flex Schnell-Lieferdienst GmbH & Co. KG, is inherently energy-intensive due to refrigeration requirements. This drives a strong demand for more energy-efficient refrigeration systems. For instance, advancements in refrigeration technology in 2024 are focusing on variable speed compressors and improved insulation to reduce energy consumption by an estimated 15-20% compared to older models.

Furthermore, there's a significant push towards adopting renewable energy sources for both operational facilities and the logistics fleet. Many companies are exploring solar panel installations on warehouses and transitioning to electric or hybrid vehicles. By 2025, it's projected that at least 30% of new commercial vehicle fleets in Europe will incorporate electric or alternative fuel technologies, driven by emissions reduction targets.

- Energy Efficiency: Refrigeration systems are being upgraded with technologies that can reduce energy usage by up to 20%.

- Renewable Energy Adoption: Companies are increasingly investing in solar power for their facilities.

- Fleet Electrification: A substantial portion of new commercial vehicle acquisitions are expected to be electric or hybrid by 2025.

- Regulatory Compliance: Meeting stricter environmental regulations and consumer demand for sustainability are key drivers for these changes.

Noise and Local Pollution Regulations

Regulations concerning noise and local air pollution, particularly in urban centers, directly impact trans-o-flex's vehicle selection and delivery timing. Stricter environmental standards in densely populated areas may necessitate fleet upgrades and adjustments to operational strategies to ensure compliance.

For instance, many European cities are implementing low-emission zones (LEZs) and ultra-low emission zones (ULEZs) which restrict older, more polluting vehicles. In 2024, Germany continued to expand its LEZ network, with cities like Hamburg and Munich imposing stricter emission requirements for commercial vehicles. This could mean trans-o-flex needs to invest in electric or Euro 6 compliant vehicles for deliveries within these zones.

- Vehicle Emissions Standards: Adherence to evolving Euro emission standards (e.g., Euro 7, expected to be finalized in 2025) will be critical for fleet procurement.

- Urban Delivery Restrictions: Potential for time-of-day delivery windows or outright bans on certain vehicle types in city centers could affect delivery efficiency.

- Noise Abatement Technologies: Investment in quieter vehicles and potentially exploring off-peak delivery times to mitigate noise complaints will be important.

The logistics sector faces increasing pressure to reduce its environmental footprint, with a strong emphasis on decarbonization and achieving net-zero emissions. In 2023, the European Union's Fit for 55 package set a target of a 55% reduction in greenhouse gas emissions by 2030, directly impacting transportation operations.

Trans-o-flex must invest in cleaner fleet technologies, such as electric or hydrogen vehicles, and enhance route optimization to meet these mandates. Germany's National Hydrogen Strategy, aiming for increased green hydrogen production by 2030, offers a potential pathway for transitioning to hydrogen-powered trucks.

Climate change itself poses operational risks, with extreme weather events like heatwaves and storms potentially disrupting deliveries and damaging infrastructure. The German Weather Service noted a rise in such events in 2023, highlighting the need for resilience.

Companies are also focusing on sustainable packaging and waste management, driven by regulations like the EU's Circular Economy Action Plan, which aims to reduce packaging waste and promote reusable materials. This shift towards eco-friendly practices can also lead to cost savings through reduced waste and better resource utilization.

| Environmental Factor | Impact on Trans-o-flex | Supporting Data/Initiatives |

|---|---|---|

| Decarbonization Goals | Need for cleaner fleet and optimized routes | EU's Fit for 55 package (55% GHG reduction by 2030) |

| Climate Change Impacts | Risk of delivery disruptions and infrastructure damage | Increased extreme weather events reported in Germany (2023) |

| Circular Economy | Focus on sustainable packaging and waste reduction | EU Circular Economy Action Plan, German recycling rate targets |

| Energy Efficiency & Renewables | Demand for energy-efficient refrigeration and renewable energy sources | Advancements in refrigeration technology (15-20% energy reduction); 30% of new European commercial fleets to be electric/hybrid by 2025 |

| Urban Emissions & Noise | Fleet upgrades and adjusted delivery strategies for LEZs | Expansion of Low Emission Zones (LEZs) in German cities; potential Euro 7 standards (finalized 2025) |

PESTLE Analysis Data Sources

Our PESTLE Analysis for trans-o-flex Schnell-Lieferdienst GmbH & Co. KG is built on a foundation of official government publications, reputable industry associations, and leading economic and market research firms. We draw from current legislative updates, economic forecasts, and technological advancements to provide a comprehensive overview.